Gooch & Housego Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gooch & Housego Bundle

Gooch & Housego operates in a dynamic market shaped by intense rivalry and the looming threat of substitutes. Understanding the power of their suppliers and the influence of buyers is crucial for navigating this landscape.

The complete report reveals the real forces shaping Gooch & Housego’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gooch & Housego's position in the photonics industry suggests a potential for supplier concentration. This means that for specialized, high-precision components and raw materials essential to their operations, there might be only a few dominant suppliers available. In 2024, the photonics market continues to see consolidation, with key players often holding significant market share for niche technologies.

When suppliers are concentrated, they gain considerable bargaining power. This can translate into Gooch & Housego facing higher prices or less favorable payment terms, as their options for sourcing these critical inputs are limited. The company's dependence on these specific, technically advanced materials directly amplifies the leverage these concentrated suppliers possess.

Gooch & Housego's reliance on unique inputs significantly bolsters supplier bargaining power. For instance, the company's advanced acousto-optic and electro-optic devices often depend on highly specialized optical crystals and coatings that are not readily available from multiple sources.

Switching suppliers in the photonics industry, especially for companies like Gooch & Housego, can be a costly endeavor. These costs often include re-engineering components, re-tooling manufacturing equipment, and rigorous re-qualification procedures to guarantee the same level of precision and performance. For instance, in 2023, a significant portion of Gooch & Housego's cost of sales was related to raw materials and components, highlighting the importance of supplier relationships and the potential impact of switching.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power against Gooch & Housego. If a supplier possesses both the capability and the motivation to move into manufacturing products that directly rival Gooch & Housego's, it creates a potent competitive pressure. This scenario allows suppliers to capture more of the value chain, potentially dictating terms more forcefully.

While not a pervasive issue in highly specialized component manufacturing, the possibility of suppliers advancing into higher-value segments of the production process remains a strategic consideration. For instance, a supplier of advanced optical coatings might explore developing their own integrated optical systems, thereby directly competing with Gooch & Housego's finished products.

- Supplier Capability: Assessing if key suppliers possess the technical expertise and capital to develop competing product lines.

- Market Incentives: Evaluating if suppliers see greater profit potential in direct sales to end-customers rather than supplying Gooch & Housego.

- Industry Trends: Observing if there's a broader industry trend of component manufacturers moving up the value chain.

- Gooch & Housego's Dependence: Understanding the extent to which Gooch & Housego relies on specific suppliers for critical components, which can amplify supplier leverage if forward integration is a viable threat.

Importance of Gooch & Housego to Suppliers

The bargaining power of suppliers for Gooch & Housego is significantly influenced by how crucial Gooch & Housego's business is to those suppliers. If Gooch & Housego accounts for a substantial percentage of a supplier's total sales, that supplier will likely be more accommodating and less aggressive in demanding higher prices or unfavorable terms. This is because losing Gooch & Housego as a customer would represent a considerable revenue loss for them.

Conversely, if Gooch & Housego is a relatively small client for a large, diversified supplier, the supplier's bargaining power increases. In such scenarios, Gooch & Housego's business is not a major revenue driver for the supplier, meaning the supplier has less incentive to offer favorable terms to retain them. This dynamic can lead to higher input costs for Gooch & Housego.

For instance, consider a scenario where Gooch & Housego sources specialized optical components from a single, dominant manufacturer. If this manufacturer serves numerous industries and Gooch & Housego represents only a small fraction of their output, the supplier holds considerable leverage. In 2023, the global market for optical components was valued at approximately $75 billion, with specialized segments experiencing robust demand, potentially strengthening the position of key suppliers within those niches.

The specific nature of the components sourced also plays a role. If Gooch & Housego relies on highly specialized or proprietary materials that only a few suppliers can provide, those suppliers gain more bargaining power. This is especially true if the switching costs for Gooch & Housego to find an alternative supplier are high, perhaps due to qualification processes or integration challenges.

The bargaining power of suppliers to Gooch & Housego is considerable due to the specialized nature of photonics components. Suppliers of critical, high-precision materials often face limited competition, allowing them to command higher prices and dictate terms. In 2024, the photonics sector continues to see intense demand for advanced materials, reinforcing supplier leverage.

High switching costs for Gooch & Housego further strengthen supplier power. Re-engineering and re-qualifying specialized components can be prohibitively expensive, locking the company into existing supplier relationships. This dependence means suppliers can exert significant influence over pricing and availability, impacting Gooch & Housego's operational costs and efficiency.

The threat of forward integration by suppliers also looms, potentially allowing them to compete directly with Gooch & Housego. If suppliers can move up the value chain, they gain more control and can capture greater profit margins, increasing their bargaining position. This strategic consideration is vital for Gooch & Housego's long-term planning.

Gooch & Housego's customer importance to its suppliers is a key factor. If Gooch & Housego represents a small portion of a supplier's business, the supplier has less incentive to offer favorable terms. Conversely, if Gooch & Housego is a major client, the supplier is more likely to be accommodating, seeking to retain that significant revenue stream.

| Factor | Impact on Gooch & Housego | 2024 Context |

| Supplier Concentration | Limited sourcing options lead to higher input costs. | Consolidation in niche photonics markets continues. |

| Switching Costs | High expenses for re-qualification and integration. | Component qualification remains a lengthy, costly process. |

| Forward Integration Threat | Potential for direct competition from suppliers. | Suppliers increasingly explore higher-value segments. |

| Customer Importance | Leverage shifts based on revenue contribution. | Key suppliers may prioritize larger, consistent clients. |

What is included in the product

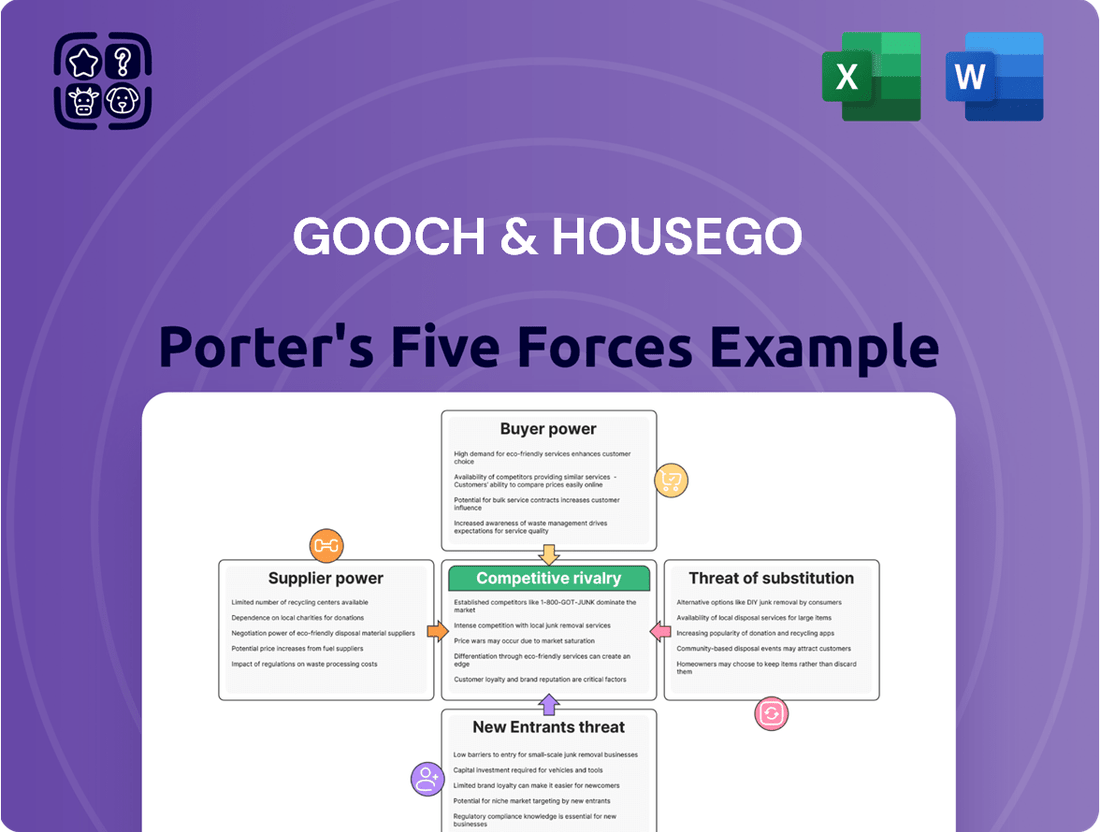

Gooch & Housego's Porter's Five Forces analysis reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its photonics market.

Gooch & Housego's Porter's Five Forces Analysis provides a streamlined, visual representation of competitive pressures, allowing for rapid identification of key threats and opportunities.

Customers Bargaining Power

Gooch & Housego's diverse customer base, spanning industrial, scientific, R&D, aerospace & defense, and medical sectors, generally dilutes individual customer bargaining power. However, the concentration of purchases within a few key customers or large, long-term programs, especially in the aerospace and defense sector, can significantly amplify their leverage.

For instance, the robust demand observed in the aerospace and defense market in 2024 means that major players within this segment, who often place substantial orders, can exert considerable influence over pricing and terms. This is a critical factor to consider when assessing Gooch & Housego's customer bargaining power.

For Gooch & Housego's customers, the cost of switching to a different supplier for specialized optical components and systems can be substantial. This is largely due to the high precision required and the extensive testing and integration processes involved, making a change a significant undertaking.

Gooch & Housego's deep expertise in manipulating and measuring light with extreme accuracy means their products are often integral to a customer's specific, demanding applications. This critical dependency can limit a customer's flexibility in sourcing from alternative providers.

In 2024, industries relying on advanced photonics, such as aerospace and defense or medical imaging, often face integration challenges that can cost millions to overcome when changing component suppliers, underscoring the high switching costs.

The availability of substitute products significantly impacts customer bargaining power for photonics companies like Gooch & Housego. If customers can easily find alternative technologies or solutions that perform a similar function, they are less reliant on Gooch & Housego's specific offerings. This can lead to increased price pressure and demands for better terms.

While Gooch & Housego focuses on specialized photonics, the broader photonics market is dynamic. Rapid technological advancements, particularly in areas like silicon photonics and miniaturization, could introduce new, potentially lower-cost substitutes for certain applications. For instance, the global silicon photonics market was valued at approximately $1.2 billion in 2023 and is projected to grow substantially, indicating a fertile ground for alternative solutions.

Customer Price Sensitivity

Customer price sensitivity for Gooch & Housego's components is a key factor. It hinges on how significant their parts are to a customer's total product cost and the customer's own standing in their respective markets. For instance, in industries like industrial lasers or semiconductor manufacturing, where demand has seen a slowdown, customers are likely to be more watchful of prices.

Conversely, in sectors such as aerospace and defense, where the components are vital for high-value, mission-critical applications, customers tend to exhibit lower price sensitivity. This is because the reliability and performance of Gooch & Housego's products are paramount, often outweighing minor cost differences.

- Price Sensitivity in Industrial Lasers: In 2024, the industrial laser market experienced a noticeable downturn, leading many manufacturers to scrutinize component costs more closely.

- Aerospace & Defense Demand: Gooch & Housego's presence in the aerospace and defense sector, a market segment that typically prioritizes performance and reliability over price, suggests a lower degree of customer price sensitivity in these areas.

- Semiconductor Market Trends: The semiconductor industry, while recovering in 2024, still saw some customers seeking cost efficiencies, potentially impacting price negotiations for certain components.

Threat of Backward Integration by Customers

Customers with substantial financial backing and technical expertise, especially major entities in aerospace, defense, and industrial markets, could explore producing their own photonics components. This potential for backward integration, though demanding and intricate for clients, would significantly enhance their negotiation power against Gooch & Housego.

For instance, a large defense contractor might invest in in-house manufacturing of specialized optical filters if the cost and complexity are outweighed by the strategic advantage of supply chain control and reduced reliance on external suppliers like Gooch & Housego. This capability directly impacts Gooch & Housego's pricing and service flexibility.

- Threat of Backward Integration: Customers with significant resources can potentially produce photonics components internally.

- Customer Leverage: This capability increases customers' bargaining power over Gooch & Housego.

- Strategic Consideration: Large players in aerospace, defense, and industrial sectors are most likely to consider this.

- Impact on Gooch & Housego: Threat of integration can influence pricing and market share.

The bargaining power of Gooch & Housego's customers is influenced by several factors, including the concentration of buyers, switching costs, and the availability of substitutes. While a diverse customer base generally weakens individual buyer power, large, key customers, particularly in sectors like aerospace and defense, can exert significant influence. This is amplified in 2024 by strong demand in these sectors, giving major buyers more leverage over pricing and terms.

High switching costs, stemming from the precision engineering and integration complexities of Gooch & Housego's specialized photonics products, limit customer ability to change suppliers. For example, in 2024, industries such as medical imaging faced integration challenges costing millions when switching component providers, reinforcing customer dependency.

The threat of backward integration, where large, well-funded customers might develop in-house photonics capabilities, also represents a potential increase in their bargaining power. This is more probable for major players in aerospace, defense, and industrial markets seeking greater supply chain control.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Buyer Concentration | High for key customers, low for diverse base | Strong demand in Aerospace & Defense amplifies power of major buyers. |

| Switching Costs | High due to technical complexity and integration | Millions in potential costs for integration challenges in sectors like medical imaging. |

| Availability of Substitutes | Moderate, depends on technological advancements | Growth in silicon photonics market ($1.2B in 2023) offers potential alternatives. |

| Price Sensitivity | Lower in critical applications (e.g., Aerospace), higher in slower markets (e.g., Industrial Lasers) | Industrial laser market downturn increased price scrutiny; Aerospace prioritizes performance. |

| Threat of Backward Integration | Potential for large, well-funded customers | Strategic advantage of supply chain control motivates consideration by major defense contractors. |

What You See Is What You Get

Gooch & Housego Porter's Five Forces Analysis

This preview displays the complete Gooch & Housego Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. This ensures you get a ready-to-use strategic tool without any hidden elements or placeholder content.

Rivalry Among Competitors

Gooch & Housego operates within the photonics technology sector, a field populated by a diverse array of specialized companies. This means the company isn't just facing a few similar players, but a broader spectrum of businesses vying for market share.

Key competitors include established names like TT Electronics and Solid State, alongside more niche photonics specialists such as Chromacity, NP Photonics, and Coherent Laser. This mix of broad electronic component manufacturers and highly focused photonics firms highlights the varied competitive pressures Gooch & Housego navigates.

The sheer number and differing specializations of these competitors contribute significantly to the intensity of rivalry in the photonics market, demanding constant innovation and strategic positioning from Gooch & Housego.

The photonics market is booming, with projections showing it reaching USD 2.01 trillion by 2030, growing at a 6.44% annual rate from 2025. This robust expansion offers ample room for companies, potentially easing direct conflict as demand outstrips supply in many areas.

Similarly, the electro-optics sector is on an upward trajectory, expected to hit US$17.21 billion by 2033, with a 5.20% compound annual growth rate starting in 2025. While overall market growth can dilute head-to-head competition, intense rivalry can still erupt for dominance within specialized, high-growth segments of these expanding industries.

Gooch & Housego's specialization in precision optical components and systems, encompassing acousto-optics, electro-optics, and fiber optics, offers a degree of product differentiation. This focus on high-precision light manipulation can lessen direct price competition by creating unique value propositions for customers. For example, in 2024, the advanced photonics market, where Gooch & Housego operates, saw continued demand for highly specialized components in areas like quantum computing and advanced sensing.

However, the competitive rivalry intensifies if other players can effectively match Gooch & Housego's precision or offer comparable integrated solutions. High switching costs, often associated with specialized optical systems that require significant integration and testing, can further influence rivalry. If customers face substantial costs or disruptions in changing suppliers, Gooch & Housego benefits from a more stable customer base, reducing the pressure from competitors.

Exit Barriers

High exit barriers in the photonics sector, including specialized machinery and significant capital outlays, can trap companies in a competitive landscape. For instance, the substantial investment in cleanroom facilities and advanced optical testing equipment, often costing millions, makes it difficult for firms to divest or repurpose these assets. This inflexibility means that even when market conditions deteriorate, companies might continue operating, leading to intensified competition as they fight to retain their customer base and market share rather than absorb sunk costs.

These elevated exit barriers can directly fuel competitive rivalry. When leaving the market is prohibitively expensive, firms are incentivized to engage in aggressive strategies to survive, even if it means lower profitability. This can manifest as price reductions to capture demand or increased marketing spend to hold onto customers, ultimately impacting the entire industry's financial health.

The persistence of companies in a challenging market due to high exit barriers can lead to:

- Price Wars: Companies may slash prices to gain or maintain market share, eroding profit margins across the board.

- Overcapacity: Continued production despite reduced demand can lead to excess inventory and further price pressure.

- Reduced Innovation Focus: Resources that could be directed towards R&D may instead be used for survival tactics, hindering long-term industry growth.

Strategic Commitments of Competitors

The strategic commitments made by competitors significantly intensify competitive rivalry within the photonics industry. Companies are actively investing in research and development, pursuing acquisitions to broaden their technological expertise and market reach, and expanding into new geographical territories. This aggressive posture means that players like Gooch & Housego face a dynamic landscape where rivals are continuously striving to gain a competitive edge.

Gooch & Housego’s own strategic actions, such as its acquisition of ITAR-compliant manufacturing capabilities in the United States, underscore the importance of these commitments. By strengthening its position in key markets, particularly in the aerospace and defense sector, Gooch & Housego demonstrates that it is responding to and participating in this high-stakes environment. This ongoing strategic maneuvering by all participants fuels the intensity of competition.

- Increased R&D Spending: Competitors are channeling substantial resources into innovation, aiming to develop next-generation photonic components and systems.

- Strategic Acquisitions: Companies are consolidating the industry through mergers and acquisitions to enhance product portfolios and expand market access.

- Market Expansion: Competitors are actively entering new geographic regions and vertical markets to diversify revenue streams and capture growth opportunities.

- Gooch & Housego's US Aerospace Acquisition: This move by Gooch & Housego to bolster its US presence, particularly in the defense sector, highlights the strategic importance of market positioning and capability enhancement in a competitive arena.

Competitive rivalry in the photonics sector is robust, driven by numerous specialized players and a high degree of product differentiation. While market growth can temper direct conflict, intense competition emerges in high-growth niches, as seen with advancements in quantum computing and advanced sensing in 2024. High switching costs and significant exit barriers, such as millions invested in specialized facilities, further lock companies into this competitive arena, often leading to price wars and reduced innovation focus as firms fight for survival.

| Factor | Description | Impact on Gooch & Housego |

|---|---|---|

| Number of Competitors | Diverse, including TT Electronics, Solid State, Chromacity, NP Photonics, Coherent Laser. | Requires constant innovation and strategic positioning. |

| Market Growth | Photonics projected to reach USD 2.01 trillion by 2030; Electro-optics to US$17.21 billion by 2033. | Can dilute direct conflict but intensifies rivalry in specialized segments. |

| Switching Costs | High due to integration and testing of specialized optical systems. | Can benefit Gooch & Housego by creating a more stable customer base. |

| Exit Barriers | High due to specialized machinery and capital outlays (e.g., cleanrooms). | Incentivizes aggressive strategies, potentially leading to price wars and overcapacity. |

| Strategic Commitments | Competitors invest heavily in R&D, acquisitions, and market expansion. | Gooch & Housego's US aerospace acquisition demonstrates active participation in this dynamic landscape. |

SSubstitutes Threaten

The threat of substitutes for Gooch & Housego's photonics products is moderate. While their core business relies on specialized optical components, alternative technologies can perform similar functions in certain applications. For instance, advancements in non-optical sensing, such as advanced radar or ultrasonic systems, could replace optical sensors in some industrial or automotive contexts, particularly where extreme precision is not the primary requirement.

The threat of substitutes for Gooch & Housego's photonics solutions hinges significantly on their price-performance trade-off. If alternative technologies can deliver comparable functionality at a substantially lower price point, customers, especially those in cost-sensitive industrial sectors, may be tempted to switch. For instance, while Gooch & Housego's advanced optical components offer high precision, a less sophisticated but cheaper alternative might suffice for certain applications, impacting demand.

Customer willingness to switch to substitutes hinges on how easily they can integrate new solutions, the perceived risks involved, and the tangible benefits of making a change. For instance, in highly regulated and safety-critical industries like aerospace and defense, or in the precision-demanding medical field, customers are inherently risk-averse. This makes them significantly less inclined to adopt substitutes that are unproven or lack the same level of precision and reliability as existing solutions.

Conversely, in less critical or more dynamic markets, the adoption of substitutes can occur much more rapidly. Consider the consumer electronics sector, where rapid technological advancements and evolving consumer preferences often drive quicker acceptance of new product categories or improved functionalities, even if they represent a departure from established norms. This willingness to embrace change is a key differentiator in how substitutes impact different industries.

Evolution of Digital Technologies

The relentless advancement of digital technologies presents a significant threat of substitutes for Gooch & Housego's traditional optical components. For instance, sophisticated software algorithms and computational imaging techniques are emerging that can manipulate or measure light, potentially bypassing the need for specialized physical optics in certain applications. While these digital solutions may not replace core components outright, they can certainly displace specific functionalities currently offered by Gooch & Housego's products.

The burgeoning Internet of Things (IoT) ecosystem is a prime example of this trend. The proliferation of IoT devices, particularly those requiring advanced sensing capabilities, is fueling demand for photonic sensors. In 2024, the global IoT market was valued at over $1.5 trillion, with a significant portion driven by the need for data acquisition through sensors. This growth highlights how digital advancements can create alternative pathways for light-based measurements, potentially impacting the market share of conventional optical solutions.

- Digital Manipulation: Advanced software can now perform light manipulation tasks previously requiring physical optical elements.

- Computational Imaging: Techniques like computational photography offer alternative methods for image capture and processing.

- IoT Sensor Demand: The growth of IoT, projected to reach an estimated $2.1 trillion by 2026, drives demand for photonic sensors, a key area where digital integration is crucial.

- Functional Displacement: While not always direct replacements, digital technologies can erode the market for specific optical component functionalities.

Emergence of New Materials or Manufacturing Processes

The emergence of novel materials and manufacturing processes poses a significant threat of substitution for Gooch & Housego. Innovations in areas like metamaterials or advanced semiconductor fabrication could yield components that fulfill similar functions to existing photonic products but via entirely new technological pathways. This could bypass the need for traditional optical components, directly impacting demand.

For instance, advancements in 3D printing of optical elements or the development of novel light-manipulating surfaces could offer alternative solutions to complex optical assemblies. The pace of material science and manufacturing innovation is rapid; for example, research into quantum dot displays continues to explore new ways to generate and control light, potentially offering substitutes for certain LED and laser applications that Gooch & Housego serves.

- Metamaterials: These engineered materials can manipulate electromagnetic waves in ways not possible with conventional optics, potentially creating substitutes for lenses and other optical components.

- Advanced Semiconductor Manufacturing: Innovations here could lead to integrated photonic circuits that perform complex optical functions on-chip, reducing reliance on discrete optical components.

- 3D Printing of Optics: This technology allows for the rapid prototyping and production of custom optical elements, potentially offering a more agile and cost-effective alternative for certain applications.

The threat of substitutes for Gooch & Housego's photonics products is generally moderate but varies by application. While specialized optical components are often critical, emerging digital technologies and alternative sensing methods can perform similar functions, especially where extreme precision isn't paramount. For example, advancements in computational imaging and non-optical sensing, like advanced radar, can displace specific functionalities. The global IoT market, valued at over $1.5 trillion in 2024, highlights how digital integration in sensing creates alternative pathways for light-based measurements.

| Technology Area | Potential Substitute | Impact on Gooch & Housego | Key Driver | Example Application |

|---|---|---|---|---|

| Digital Imaging | Computational Photography | Functional displacement for specific imaging tasks | Software advancements, processing power | Mobile phone cameras, industrial inspection |

| Sensing | Advanced Radar/Ultrasonic | Substitution in non-precision environments | Cost-effectiveness, robustness in certain conditions | Automotive parking sensors, industrial proximity sensing |

| Material Science | Metamaterials, 3D Printed Optics | Potential for new component designs bypassing traditional optics | Material innovation, advanced manufacturing | Novel lens designs, integrated optical systems |

Entrants Threaten

The photonics industry, particularly for high-precision components and complex systems, demands significant upfront capital for research and development, specialized manufacturing plants, and cutting-edge machinery. This substantial financial barrier inherently limits the number of new companies that can realistically enter the market, thereby reducing the threat of new entrants.

Gooch & Housego's strategic global manufacturing presence, with facilities located in the UK, USA, and China, underscores the extensive capital investment required to establish and maintain operations in this sector. For instance, setting up advanced cleanroom facilities and acquiring sophisticated optical fabrication equipment can easily run into tens of millions of dollars.

Gooch & Housego's significant investment in research, design, and engineering for precision optical components and systems translates into a substantial moat of proprietary technology. This deep technical expertise, cultivated over years, is not easily replicated by potential new entrants. For instance, their specialization in areas like acousto-optic devices and fiber optic components requires highly specialized knowledge and manufacturing capabilities that are difficult and time-consuming to acquire.

New companies face significant hurdles in securing access to established distribution channels, a critical factor for reaching Gooch & Housego's diverse customer base spanning industrial, scientific, R&D, aerospace & defense, and medical markets. Gooch & Housego's long-standing relationships, particularly with major defense contractors, create a formidable barrier to entry for newcomers seeking to penetrate these lucrative sectors.

Economies of Scale and Experience Curve

Existing players in the photonics industry, such as Gooch & Housego, leverage significant economies of scale. This means they can spread their fixed costs over a larger production volume, leading to lower per-unit costs. For instance, in 2023, Gooch & Housego reported revenues of £124.1 million, indicating a substantial operational base that new entrants would struggle to match from inception.

The experience curve further solidifies this advantage. As companies like Gooch & Housego have accumulated years of production and design experience, they've refined their processes, optimized material usage, and improved product yields. This accumulated learning translates into greater efficiency and lower operational expenses, creating a formidable barrier for newcomers attempting to compete on price without substantial upfront investment and time.

- Economies of Scale: Lower per-unit costs due to high production volumes.

- Experience Curve: Cost reductions achieved through accumulated learning in production and design.

- Cost Advantage: New entrants face difficulty matching established players' cost structures without significant initial losses.

- Operational Efficiency: Gooch & Housego's focus on operational efficiency enhances its competitive cost position.

Regulatory Hurdles and Certifications

Gooch & Housego operates in markets like aerospace, defense, and medical, which are heavily regulated. New companies entering these sectors must navigate complex approval processes and obtain specific certifications. For instance, in the aerospace industry, compliance with standards like AS9100 is often mandatory, a process that can take years and considerable financial outlay.

The significant time and capital investment required to achieve these certifications act as a substantial barrier. For example, achieving FDA clearance for medical devices, a sector Gooch & Housego serves, can cost hundreds of thousands to millions of dollars and involve extensive clinical trials. This financial and temporal commitment deters many potential new entrants.

- Aerospace & Defense: Compliance with AS9100 standards, often a prerequisite for supplying major defense contractors, involves rigorous quality management systems and can take 12-18 months to implement and certify.

- Medical Devices: Obtaining FDA 510(k) clearance for a new medical device can cost upwards of $100,000 and take 6-12 months, with higher-risk devices requiring even more extensive and costly pre-market approval processes.

- High Capital Investment: The need for specialized, high-precision manufacturing equipment and cleanroom facilities, particularly for medical and defense applications, adds another layer of significant upfront cost for any new player.

The threat of new entrants for Gooch & Housego is generally low due to high capital requirements for R&D, specialized manufacturing, and regulatory compliance. Established players benefit from economies of scale and experience curves, making it difficult for newcomers to compete on cost and efficiency. Furthermore, strong brand loyalty and established distribution channels, particularly in sensitive sectors like defense and medical, create significant barriers.

| Barrier Type | Description | Impact on New Entrants | Example for Gooch & Housego |

| Capital Requirements | High investment in R&D, specialized machinery, and facilities. | Deters new entrants due to substantial upfront costs. | Setting up advanced cleanroom facilities can cost tens of millions of dollars. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to match cost structures without comparable scale. | Gooch & Housego's 2023 revenue of £124.1 million indicates a large operational base. |

| Proprietary Technology & Expertise | Deep technical knowledge and unique manufacturing processes. | Difficult and time-consuming for new players to replicate. | Specialization in acousto-optic devices requires highly specialized knowledge. |

| Regulatory Hurdles | Complex approval processes and certifications in key markets. | Adds significant time and financial commitment for new entrants. | AS9100 certification for aerospace can take 12-18 months and substantial investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gooch & Housego draws from a comprehensive suite of data sources, including the company's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and data from financial information providers like Bloomberg and S&P Capital IQ to gain a thorough understanding of the competitive landscape.