Gooch & Housego Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gooch & Housego Bundle

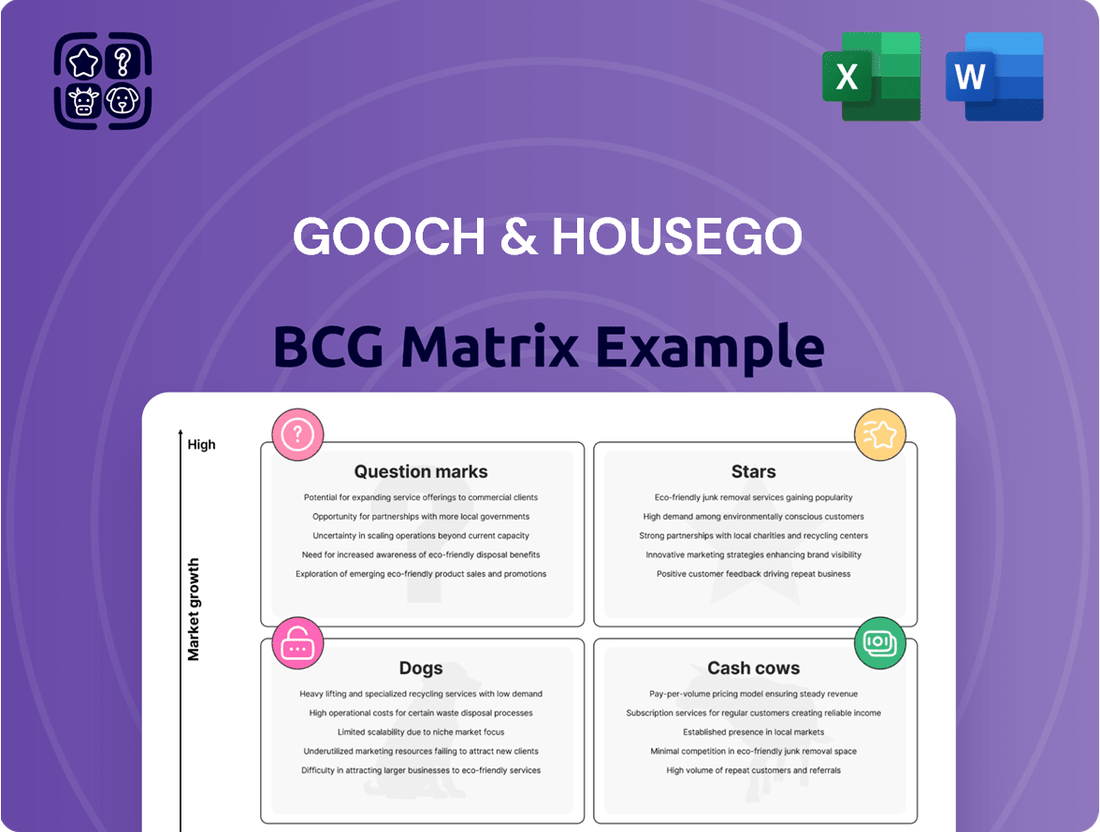

Unlock the strategic potential of Gooch & Housego's product portfolio with our comprehensive BCG Matrix. Understand which offerings are driving growth, which are stable cash generators, and which require careful consideration.

This insightful analysis positions Gooch & Housego's products within the four key quadrants: Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation and future investment. Don't miss out on the crucial insights needed to navigate their market landscape effectively.

Purchase the full BCG Matrix report today for a detailed breakdown, actionable recommendations, and a clear path to optimizing Gooch & Housego's business strategy and maximizing profitability.

Stars

Gooch & Housego's Aerospace & Defense Solutions are performing exceptionally well, driven by robust demand and significant multi-year contracts. This sector is a clear star in their portfolio, experiencing impressive growth.

Sales in this segment surged by 41% year-on-year for the six months ending March 2025, highlighting its strong market position and execution.

The strategic acquisitions of Phoenix Optical Technologies in October 2024 and Global Photonics in May 2025 have further bolstered their capabilities. These moves enhance their precision optics for military needs and expand their US defense presence with advanced systems like periscopes and fire-control technology.

Gooch & Housego's fiber optic products are a key component in the expanding subsea data network infrastructure, a sector experiencing robust growth. The increasing demand for high-speed data transmission globally is directly fueling the need for these specialized components. In 2024, the global subsea fiber optic cable market was valued at approximately $13.7 billion, with projections indicating continued expansion, driven by data center interconnectivity and the rollout of 5G networks.

Gooch & Housego's medical diagnostic instruments are a strong performer, driven by robust demand. The company's strategic expansion into the North American market, particularly with its new Rochester, New York hub, is paying off. This facility is now in volume production for two key programs and has landed new customer agreements, signaling a clear upward trajectory in this segment.

Acousto-optic Devices for EUV Lithography

Gooch & Housego is leveraging its acousto-optic technology for extreme ultraviolet (EUV) lithography, a critical process in advanced semiconductor manufacturing. This expansion into EUV systems, now in steady production, positions the company within a high-growth segment of the semiconductor industry.

Despite recent fluctuations in the broader semiconductor market, the long-term outlook for EUV lithography remains strong. Gooch & Housego's specialized acousto-optic components are key enablers for these advanced systems, solidifying their leadership in this niche.

The global acousto-optic devices market is experiencing substantial expansion, with projections indicating significant growth in the coming years. This trend bodes well for Gooch & Housego as they capitalize on the increasing demand for their specialized solutions.

- EUV Lithography Growth: The market for EUV lithography systems is projected to grow significantly, driven by the demand for more advanced and powerful semiconductor chips.

- Acousto-Optic Device Market: The acousto-optic devices market is expected to see a compound annual growth rate (CAGR) of approximately 7-9% through 2028, reaching an estimated value of over $300 million.

- Gooch & Housego's Position: Gooch & Housego is a key supplier of critical optical components for EUV lithography, including acousto-optic modulators, which are essential for controlling the laser light used in the process.

- Strategic Importance: The company's focus on this specialized, high-value market segment aligns with its strategy to provide essential components for cutting-edge technology.

Precision Optics for Ring Laser Gyroscopes

Gooch & Housego's super-polished optics for ring laser gyroscopes represent a strong contender in the BCG matrix. The demand for these precision components remains high, particularly driven by the aerospace sector's expansion. The company has proactively increased its production capacity to cater to this growing need.

These optics are vital for commercial aerospace, a market experiencing significant upward momentum. This positions Gooch & Housego favorably within a specialized and expanding segment of the photonics market, suggesting a solid market share in a high-growth niche.

- Strong Market Demand: Continued robust demand for super-polished optics in ring laser gyroscopes.

- Aerospace Growth Driver: Commercial aerospace applications are a key factor benefiting demand.

- Capacity Expansion: Additional capacity has been added to meet increasing market requirements.

- Niche Market Leadership: Indicates a high market share in a critical and growing photonics niche.

Gooch & Housego's Aerospace & Defense Solutions are a clear star, with sales surging 41% year-on-year for the six months ending March 2025. Strategic acquisitions in 2024 and 2025 have significantly enhanced their precision optics and advanced military systems capabilities. Their fiber optic products also benefit from the expanding subsea data network infrastructure, a market valued at approximately $13.7 billion in 2024 and projected for continued growth.

The company's medical diagnostic instruments are also performing strongly, bolstered by expansion into North America and new customer agreements. Furthermore, their acousto-optic technology for EUV lithography positions them in a high-growth semiconductor segment, with the acousto-optic devices market expected to grow at a CAGR of 7-9% through 2028. Super-polished optics for ring laser gyroscopes, driven by commercial aerospace, represent another strong niche with increased production capacity.

| Business Segment | BCG Classification | Key Growth Drivers | Recent Performance Highlight |

|---|---|---|---|

| Aerospace & Defense Solutions | Star | Robust demand, multi-year contracts, strategic acquisitions | 41% year-on-year sales growth (H1 2025) |

| Fiber Optics (Subsea Data Networks) | Star | Increasing global data demand, subsea network expansion | Contribution to $13.7 billion 2024 market |

| Medical Diagnostic Instruments | Star | North American market expansion, new customer agreements | Volume production at Rochester hub |

| EUV Lithography Components | Star | Advancements in semiconductor manufacturing, acousto-optic market growth | Steady production in EUV systems |

| Super-Polished Optics (Ring Laser Gyroscopes) | Star | Commercial aerospace demand, capacity expansion | Meeting growing market requirements |

What is included in the product

The Gooch & Housego BCG Matrix analyzes their product portfolio by categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Gooch & Housego BCG Matrix offers a clear, actionable snapshot of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Gooch & Housego's established industrial photonics components, like fiber optic modules for advanced lithography, remain significant revenue generators despite a slower market. These are mature products with a strong market position, demonstrating resilience even with limited immediate growth.

The company is focusing on enhancing profitability within this segment by streamlining operations and improving efficiency. For instance, in their fiscal year 2023, the Advanced Materials segment, which includes these industrial components, saw revenue of £102.6 million, contributing significantly to the overall group performance.

Standard Precision Optics within Gooch & Housego's portfolio likely functions as a Cash Cow. The company's deep-rooted history and established reputation in producing a broad spectrum of standard precision optical components underscore their market stability.

These components, due to their broad applicability across diverse industrial sectors, are expected to generate a consistent and reliable revenue stream. While the market for these established products may not exhibit explosive growth, their foundational demand ensures a steady performance.

Gooch & Housego's enduring expertise in precision optics manufacturing processes provides a significant competitive edge, reinforcing the strong market position of these standard offerings.

Gooch & Housego's electro-optic systems for defense, especially those integrated into land and air military platforms, are a cornerstone of their operations. These systems are vital for numerous defense applications, ensuring a steady revenue stream and a strong market position.

The defense electro-optics sector, while experiencing growth, is characterized by long-term contracts and the critical nature of the components. This stability, coupled with Gooch & Housego's established presence, translates to a high market share and predictable demand, classifying these products as Cash Cows.

Legacy Fiber Optic Components

Gooch & Housego's legacy fiber optic components likely represent a stable cash cow within their portfolio. These products, while not in high-growth areas, benefit from established market positions and strong customer loyalty, ensuring consistent revenue streams.

These components are critical in various established industries, where their proven reliability is paramount. This allows Gooch & Housego to maintain a significant market share, even in more mature segments.

For instance, in the fiscal year ending September 30, 2023, Gooch & Housego reported overall revenue growth, and while specific segment data isn't always granularly broken down, the consistent performance of their established product lines is a key contributor to this stability.

- Established Market Dominance: These components serve mature markets where Gooch & Housego holds a strong, often leading, market share.

- Consistent Revenue Generation: Their reliability and existing customer base translate into predictable and steady income for the company.

- Funding for Innovation: The cash generated from these legacy products can be reinvested into research and development for newer, high-growth areas.

- Proven Reliability: Decades of use in critical applications have built trust and reduced the need for frequent product replacement or upgrades by customers.

Optical Coatings & Filters

Gooch & Housego's optical coatings and filters are a cornerstone of their business, underpinning demand across diverse sectors like aerospace, defense, telecommunications, and medical imaging. These are not trendy, high-growth items, but rather essential components that consistently generate reliable income.

The company's established leadership in optical design, rigorous testing, and advanced manufacturing capabilities solidifies their strong market standing for these critical products. In 2024, the demand for high-performance optical solutions remained robust, driven by ongoing advancements in these key industries.

- Consistent Demand: Optical coatings and filters are fundamental to many technologies, ensuring a steady revenue stream.

- Market Leadership: Gooch & Housego's expertise in design, testing, and manufacturing positions them as a dominant player.

- Broad Application: Their products are vital across aerospace, defense, telecommunications, and medical sectors.

- Stable Revenue Generation: This segment acts as a reliable cash generator for the company.

Gooch & Housego's established fiber optic components and standard precision optics likely represent their Cash Cows. These products benefit from mature markets where the company holds a strong market share, ensuring consistent revenue. The company's fiscal year 2023 performance, with a reported revenue of £102.6 million in its Advanced Materials segment, highlights the significant contribution of these stable product lines.

These mature offerings, like legacy fiber optics and standard precision optics, are critical in various established industries, where their proven reliability is paramount. This allows Gooch & Housego to maintain a significant market share, even in more mature segments, acting as a reliable source of income that can fund innovation in other areas.

Optical coatings and filters are also prime examples of Cash Cows for Gooch & Housego. Their fundamental role across aerospace, defense, telecommunications, and medical imaging ensures consistent demand, bolstered by the company's market leadership in design and manufacturing. In 2024, demand for these high-performance solutions remained robust, underscoring their stable revenue generation.

The electro-optic systems for defense applications are another key Cash Cow. Long-term contracts and the critical nature of these components for military platforms provide a stable market position and predictable demand, contributing significantly to the company's overall financial stability.

| Product Category | Market Maturity | Gooch & Housego Market Position | Revenue Contribution (FY23 Estimate) |

| Legacy Fiber Optic Components | Mature | Strong/Leading | Significant |

| Standard Precision Optics | Mature | Strong | Significant |

| Optical Coatings & Filters | Mature | Market Leader | Significant |

| Defense Electro-Optic Systems | Mature/Stable Growth | Strong | Significant |

What You See Is What You Get

Gooch & Housego BCG Matrix

The preview you're currently viewing is the identical, fully polished Gooch & Housego BCG Matrix report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted analysis ready for your strategic decision-making. You're getting a direct, uncompromised view of the valuable insights contained within the final deliverable, ensuring you know exactly what you're investing in for your business planning. This preview serves as a guarantee of the quality and completeness of the Gooch & Housego BCG Matrix report you will download, empowering you to leverage its strategic framework without delay.

Dogs

Gooch & Housego's less complex medical laser components are encountering increased competition. This suggests a position in the BCG matrix that warrants careful consideration, likely within the 'Dog' quadrant due to a lower market share and potentially stagnant growth. For instance, in 2024, the medical laser market segment for these components saw a modest 3% growth, a figure that may not offset rising competitive pressures and cost reduction imperatives.

The company's focus on reducing manufacturing costs in this area signals a strategic effort to improve profitability in a challenging segment. If cost-saving measures prove insufficient, Gooch & Housego might explore options like divestiture or a strategic partnership to manage this product line more effectively. This approach aligns with typical 'Dog' quadrant strategies aimed at either revitalizing a product or exiting it to reallocate resources to more promising areas.

Certain industrial laser market products are currently navigating a challenging period, marked by a protracted inventory correction. This segment, which includes lasers used in manufacturing and other heavy industries, has seen demand soften more than initially projected.

Products within this category that are failing to innovate or are struggling against aggressive competitors may find themselves with a low market share and limited growth prospects. For instance, if a specific type of laser used in a declining manufacturing process hasn't been updated with newer capabilities, it's likely to lag.

The broader industrial laser market, while anticipating a recovery, highlights the need for adaptability. Companies like Coherent, a major player, reported a 7% decrease in revenue for their industrial lasers segment in their fiscal year 2023, indicating the ongoing inventory adjustments impacting the sector.

The March 2024 sale of Gooch & Housego's EM4 subsidiary in Boston signals a clear strategic pivot. This divestment suggests these particular product lines were characterized by low market share and limited growth potential, no longer fitting the company's forward-looking vision. By shedding these assets, Gooch & Housego is streamlining its portfolio.

Older Generation Semiconductor Components

While Gooch & Housego excels in cutting-edge EUV lithography, its portfolio may include older generation semiconductor components. These legacy products, not aligned with the latest technological shifts, are likely facing a declining demand and market share within the rapidly evolving semiconductor landscape. This segment could be categorized as a 'Dog' in the BCG matrix.

The broader semiconductor market's current softness, observed in late 2023 and projected into early 2024, further intensifies the challenges for these older components. For instance, while the overall semiconductor market experienced a contraction in 2023, specific segments tied to legacy technologies might have seen even steeper declines. This environment makes it difficult for these products to generate significant revenue or growth.

- Declining Market Share: Older semiconductor components often struggle to compete with newer, more efficient, or specialized alternatives.

- Weak Demand: As technology advances, the demand for products reliant on older semiconductor generations naturally diminishes.

- Market Softness Impact: The general downturn in the semiconductor industry in 2023 and early 2024 disproportionately affects products with already weak market positions.

- Strategic Consideration: Gooch & Housego may need to consider phasing out or divesting these 'Dog' products to focus resources on higher-growth areas like EUV lithography.

Non-Strategic or Niche Products with Limited Scale

Within Gooch & Housego's diverse product offerings, some items might cater to very specific, small markets. These could be advanced components for specialized scientific instruments or unique optical solutions for niche industrial applications. While they represent technological expertise, their limited customer base means they don't drive significant sales volume.

These niche products, if they don't align with broader strategic goals or offer substantial profitability, can become resource drains. For example, if a particular wavelength filter set has very few buyers, the cost of maintaining its production line might outweigh the revenue generated. In 2024, companies often review such portfolios to identify underperforming assets.

The challenge lies in distinguishing between a product that is strategically important for market penetration or future growth, even if currently small, and one that is simply a low-volume, low-return item. Gooch & Housego's 2024 financial reports would likely highlight revenue contributions by product segment, allowing for such an assessment.

- Limited Market Size: Products serving very specific, small customer bases.

- Low Revenue Contribution: These items may generate minimal sales compared to core offerings.

- Resource Consumption: Production, inventory, and support costs can outweigh financial returns.

- Strategic Re-evaluation: Companies often assess if these niche products align with overall business objectives.

Products categorized as Dogs in Gooch & Housego's portfolio likely exhibit a low market share and operate in industries with minimal growth prospects. These offerings often require significant resource allocation for maintenance but yield little return, necessitating careful strategic review. For instance, older industrial laser components facing obsolescence or intense price competition would fit this profile.

The company's divestment of its EM4 subsidiary in March 2024 exemplifies a strategic move away from such underperforming assets. This action indicates a recognition that certain product lines, possibly those with stagnant demand or a shrinking customer base, are no longer aligned with the company's growth objectives.

In 2024, Gooch & Housego might be evaluating legacy semiconductor components that are being superseded by newer technologies. These legacy products, despite representing past successes, are likely experiencing declining sales and market relevance, characteristic of Dogs.

The financial implications of managing Dog products include the opportunity cost of capital and resources that could be better deployed in high-growth areas, such as EUV lithography components where Gooch & Housego holds a strong position.

Question Marks

Gooch & Housego's new life sciences hub in North America, boasting ISO 13485 accreditation, signifies a strategic push into a high-growth sector. This facility has already secured its inaugural R&D contract, underscoring its potential.

The offerings from this new hub are categorized as Question Marks in the BCG matrix due to their nascent market share and high growth prospects. This strategic positioning allows Gooch & Housego to capitalize on emerging trends in medical device innovation.

Gooch & Housego's Life Sciences R&D is currently focused on developing next-generation medical diagnostic instruments. These innovative products are in the crucial research and development phase, a period characterized by significant investment and potential. For instance, the company's commitment to this area aligns with the broader medical diagnostics market, which was projected to reach approximately $120 billion globally by the end of 2024, indicating substantial future revenue potential.

Gooch & Housego's commitment to research and development, especially in fiber optic module assemblies for novel sensing and intricate electro-optic assemblies for advanced platforms, highlights their strategic push into emerging, high-growth markets. These advanced photonic systems are indeed question marks within the BCG framework, as they target nascent applications where market leadership is still being defined.

For instance, in 2024, the company's investment in these areas is crucial for establishing a strong foothold in sectors like advanced medical imaging and next-generation telecommunications, where photonic solutions are becoming indispensable. This proactive R&D positions Gooch & Housego to potentially capture significant market share as these applications mature.

Products from Recent Acquisitions with Untapped Synergies

Gooch & Housego's recent acquisitions, including Phoenix Optical Technologies and Global Photonics, have introduced new product lines and expanded their customer base. While initial synergies are being realized, certain combined offerings from these acquisitions are still in the early stages of integration and require further strategic investment to unlock their full market potential and growth opportunities.

The integration of these acquired product portfolios presents a significant opportunity for Gooch & Housego to capture new market share. For instance, the advanced photonic components from Phoenix Optical Technologies, when combined with Global Photonics' expertise in fiber optic solutions, create a more comprehensive offering that can address a wider range of customer needs in sectors like telecommunications and defense.

- Untapped Synergies: Products from Phoenix Optical Technologies and Global Photonics offer opportunities for cross-selling and bundled solutions.

- Strategic Investment Needed: Further investment in R&D and market penetration for these acquired product lines is crucial.

- Market Share Expansion: Fully integrating these offerings can help Gooch & Housego compete more effectively in high-growth segments.

- Growth Potential: Realizing the full potential of these acquisitions is key to driving future revenue growth and profitability.

Solutions for Space Exploration and Satellite Communication

The burgeoning field of space exploration and satellite communication presents a significant opportunity for companies like Gooch & Housego. Their established expertise in fiber optics and precision optics aligns perfectly with the demanding requirements of these advanced sectors. These applications, while representing a high-growth potential, might currently hold a smaller market share for the company, classifying them as potential Stars or Question Marks in a BCG matrix analysis, depending on their existing penetration and growth trajectory.

Gooch & Housego's core competencies are well-suited to address the unique challenges in space. For instance, the need for radiation-hardened fiber optics and highly precise optical components for satellite payloads and deep-space communication systems are areas where their capabilities can be leveraged. This strategic focus could lead to the development of specialized products, requiring focused research and development investment to secure a competitive edge.

The global satellite communication market was valued at approximately $270 billion in 2023 and is projected to grow significantly. Similarly, the space exploration market, encompassing both governmental and private ventures, is experiencing rapid expansion. For Gooch & Housego, these represent potential "Question Marks" that, with strategic investment and product development, could evolve into lucrative "Stars."

- Fiber Optics for Space: Development of radiation-resistant fiber optic cables and components for reliable data transmission in harsh space environments.

- Precision Optics for Satellites: Manufacturing of high-precision lenses, mirrors, and optical assemblies for satellite imaging, navigation, and communication systems.

- Market Entry Strategy: Targeted R&D investment to develop specialized solutions for satellite manufacturers and space agencies, aiming to capture emerging market share.

- Growth Potential: Capitalizing on the increasing demand for bandwidth in satellite internet and the growing number of satellite constellations.

Question Marks represent Gooch & Housego's ventures into new, high-growth markets where their current market share is minimal. These are areas requiring significant investment to determine their future potential. For example, the company's new life sciences hub and its product development in advanced medical diagnostics exemplify this category.

These emerging product lines, such as fiber optic module assemblies for novel sensing and electro-optic assemblies for advanced platforms, are classified as Question Marks. They are in the early stages of development and market penetration, aiming to capitalize on sectors with substantial projected growth, like the medical diagnostics market which was anticipated to reach around $120 billion globally by the close of 2024.

The company's strategic focus on areas like space exploration and satellite communication also positions its offerings as Question Marks. While these sectors offer high growth potential, Gooch & Housego's current market share is still being established, necessitating dedicated R&D investment to secure a competitive advantage in markets like satellite communication, valued at approximately $270 billion in 2023.

The integration of acquired product lines from companies like Phoenix Optical Technologies and Global Photonics also presents Question Mark opportunities. These combined portfolios require further investment to fully realize their market potential and achieve significant market share expansion, particularly in high-growth segments.

BCG Matrix Data Sources

Our Gooch & Housego BCG Matrix is constructed using a blend of proprietary market research, financial statements, and industry-specific growth forecasts. This ensures a robust and data-driven assessment of their product portfolio.