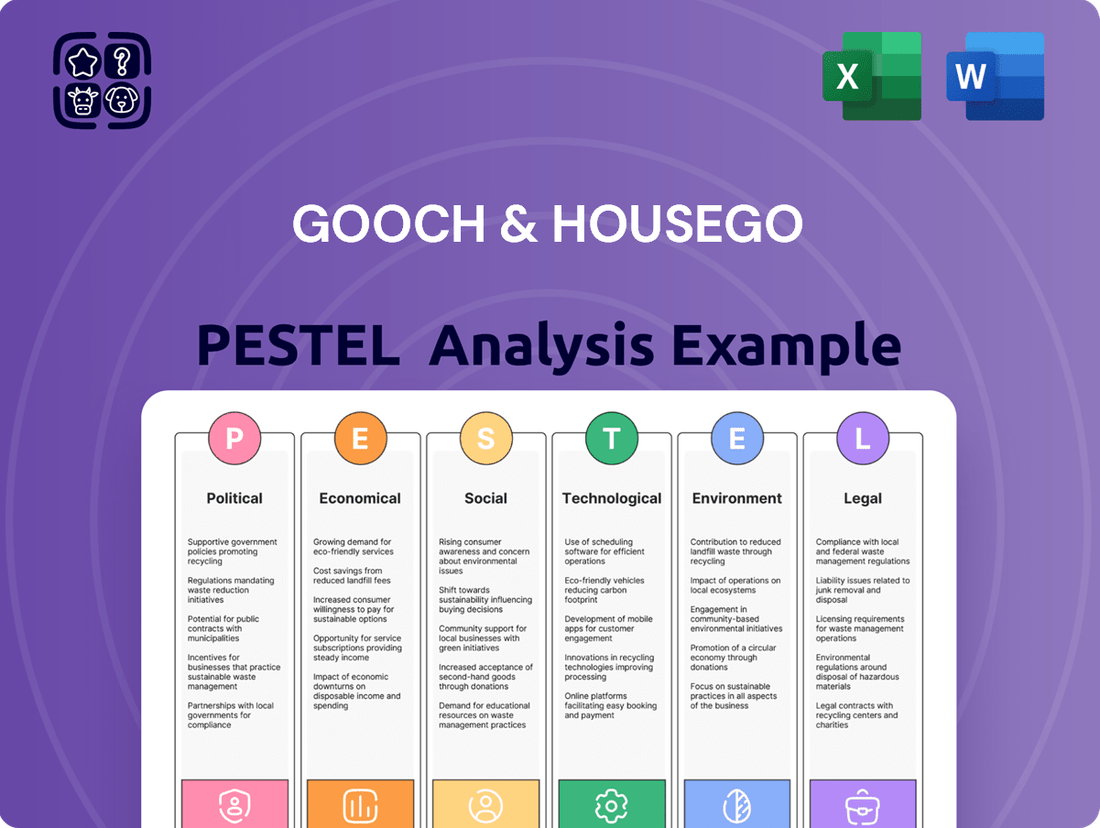

Gooch & Housego PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gooch & Housego Bundle

Navigate the complex external environment shaping Gooch & Housego's future with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that could impact their operations and strategic direction. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government R&D funding is a crucial lever for Gooch & Housego, particularly in the photonics sector. The UK government's commitment to new ten-year R&D budgets aims to offer researchers and industry long-term financial certainty, a move designed to stimulate private investment in cutting-edge technologies. This consistent support is vital for companies like Gooch & Housego, which operate in innovation-intensive fields.

The UK photonics industry has directly benefited from government innovation strategies, as evidenced by its resilience during global economic turbulence. The UK Photonics Leadership Group has noted that these strategic initiatives have been instrumental in helping the sector navigate challenging periods, underscoring the direct impact of government policy on industry stability and growth.

Changes in global trade policies, such as shifting tariff structures from major economies like the United States and China, directly impact Gooch & Housego's operational costs. For instance, increased tariffs on optical components or advanced manufacturing equipment could raise raw material expenses, affecting profit margins.

Tariffs can also disrupt established supply chains, forcing companies like Gooch & Housego to re-evaluate sourcing strategies and potentially relocate production to mitigate increased costs. This reassessment is crucial for maintaining competitive pricing in international markets.

Government spending and policy in the aerospace and defense sectors are crucial for Gooch & Housego, as their specialized optical components are vital for advanced defense systems. Increased defense budgets, particularly in major economies, directly translate to higher demand for the sophisticated technologies G&H provides. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 highlights continued investment in next-generation fighter jets and intelligence, surveillance, and reconnaissance (ISR) platforms, areas where G&H's products are essential.

The global aerospace and defense market is indeed on an upward trajectory. Projections for 2024 and 2025 indicate robust growth, fueled by modernization efforts and a renewed focus on national security worldwide. This expansion is particularly strong in areas like advanced communication systems, satellite technology, and precision navigation, all of which rely heavily on high-performance optical solutions like those offered by Gooch & Housego. The market is expected to reach over $1.4 trillion by 2025, presenting significant opportunities for companies like G&H.

Geopolitical Stability and Conflicts

Global geopolitical stability and regional conflicts present significant execution risks for companies like Gooch & Housego, which operates globally. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, which intensified in 2024, can lead to supply chain disruptions and affect the availability of critical components. This instability can also impact international trade routes and influence foreign direct investment in high-tech manufacturing sectors where Gooch & Housego is active.

These uncertainties can translate into tangible financial impacts. In 2024, many technology and manufacturing firms reported increased logistics costs and delays due to regional conflicts, impacting their profit margins. For Gooch & Housego, this could mean higher costs for raw materials or components sourced from affected regions, as well as potential delays in delivering finished products to international customers.

- Supply Chain Volatility: Geopolitical events in 2024, such as trade disputes and regional conflicts, have demonstrated a heightened risk of supply chain disruptions, potentially impacting Gooch & Housego's access to essential materials and components.

- Trade Policy Uncertainty: Shifting trade policies and tariffs, often a byproduct of geopolitical tensions, can increase the cost of international trade and affect Gooch & Housego's global market access and competitiveness.

- Investment Climate: Heightened geopolitical risks can deter investment in new manufacturing facilities or R&D projects in certain regions, influencing Gooch & Housego's strategic expansion and long-term growth plans.

Export Controls and Regulations

Export controls on advanced optical technologies, particularly those with potential defense applications, directly influence Gooch & Housego's global reach. These regulations, often driven by national security interests and international treaties, can restrict market access and impact sales volumes. For instance, in 2023, the US Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce stringent export controls on items deemed critical to national security, which could encompass certain high-precision optical components manufactured by companies like Gooch & Housego.

These evolving regulations mean Gooch & Housego must navigate a complex web of compliance to serve its international clientele effectively. Failure to adhere to these rules can result in significant penalties, including fines and restrictions on future trade. The company's ability to adapt its supply chain and sales strategies to comply with varying national and international export regimes is crucial for maintaining its competitive position in the global market.

- Impact on Market Access: Export controls can limit the company's ability to sell its products in certain strategic markets.

- Compliance Costs: Adhering to diverse and changing export regulations incurs significant administrative and legal expenses.

- Geopolitical Influence: International relations and national security concerns directly shape the scope and enforcement of these controls.

Government R&D funding and innovation strategies are pivotal for Gooch & Housego's growth in the photonics sector. The UK's commitment to long-term R&D budgets provides financial certainty, encouraging private investment in advanced technologies. This consistent support is vital for innovation-intensive fields like photonics, as demonstrated by the sector's resilience during economic downturns due to strategic government initiatives.

Government spending in aerospace and defense directly fuels demand for Gooch & Housego's specialized optical components. For instance, the U.S. Department of Defense's fiscal year 2025 budget request shows continued investment in advanced platforms, where G&H's products are essential. The global aerospace and defense market is projected to exceed $1.4 trillion by 2025, driven by modernization and national security, presenting significant opportunities for companies like G&H.

Geopolitical instability and regional conflicts pose execution risks, impacting Gooch & Housego's global operations. Tensions in Eastern Europe and the Middle East in 2024 led to supply chain disruptions and increased logistics costs for many tech firms, affecting profit margins. These uncertainties can hinder access to critical components and delay product delivery, as seen with increased shipping costs reported by manufacturers in 2024.

Export controls on advanced optical technologies, driven by national security, directly affect Gooch & Housego's market access. Regulations enforced in 2023, such as those by the US Bureau of Industry and Security, can restrict sales of high-precision components. Navigating these evolving rules incurs significant compliance costs and requires strategic adaptation of supply chains and sales strategies to maintain competitiveness.

What is included in the product

This Gooch & Housego PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting the company's operations and strategic decisions.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and mitigate risks in the dynamic global market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Gooch & Housego's external environment to inform strategic decisions.

Economic factors

The photonics market's robust expansion is a key economic driver for Gooch & Housego. This sector is booming due to the increasing need for faster data transmission, sophisticated medical imaging technologies, and widespread automation across industries.

With the global photonics market valued in the trillions and showing consistent upward projections, it presents a fertile ground for G&H's niche offerings. For instance, the compound annual growth rate (CAGR) for the global photonics market was estimated to be around 6-7% in the early 2020s, with projections suggesting continued strong growth through 2025 and beyond, reaching hundreds of billions in value.

Investment in industrial and scientific sectors, particularly in research and development, directly fuels demand for Gooch & Housego's specialized optical components. For example, global R&D spending reached an estimated $2.5 trillion in 2024, with a significant portion allocated to advanced manufacturing and scientific instrumentation.

As industries increasingly integrate sophisticated photonics into processes like advanced laser manufacturing and high-precision optical metrology, the market for Gooch & Housego's high-performance optical solutions remains strong. The industrial laser market alone was valued at over $15 billion in 2023 and is projected to grow substantially in the coming years.

Currency exchange rate fluctuations present a significant economic factor for Gooch & Housego, a UK-based entity with a global footprint. As of early 2024, the GBP has experienced notable volatility against major currencies like the USD and EUR. This volatility directly impacts the value of overseas sales when translated back into Pounds Sterling, potentially affecting reported revenues and profitability.

Managing foreign exchange risk is therefore paramount for Gooch & Housego. For instance, a stronger Pound can make their products more expensive for international buyers, potentially dampening demand, while a weaker Pound can increase the cost of imported components. The company's hedging strategies, a common practice in 2024, are critical for mitigating these unpredictable swings and ensuring stable financial performance.

Inflation and Cost of Raw Materials

Rising global inflation and the escalating cost of raw materials present a significant challenge for Gooch & Housego. The company's reliance on specialized optical materials means that fluctuations in these input prices directly impact production expenses. For instance, reports from early 2024 indicated persistent inflationary pressures across key economies, leading to increased costs for many industrial inputs.

Effectively managing these rising costs is crucial for Gooch & Housego to protect its profit margins and maintain its competitive pricing. The company must employ robust supply chain management strategies and explore potential hedging mechanisms to mitigate the impact of volatile raw material expenses.

- Inflationary pressures in 2024 have led to higher costs for many industrial commodities.

- Specialized optical materials are particularly susceptible to price volatility.

- Effective cost management is vital for Gooch & Housego's profitability and market competitiveness.

Economic Cycles and Industry-Specific Demand

Gooch & Housego's financial health is closely tied to the ebb and flow of global economic cycles. When the economy is booming, businesses tend to invest more, leading to increased demand for Gooch & Housego's specialized optical components across various sectors.

However, the company's diversified customer base provides a degree of resilience. For instance, even if industrial manufacturing experiences a downturn, robust demand from the medical sector, particularly in areas like advanced diagnostics and surgical equipment, can help stabilize revenue. Similarly, the aerospace and defense industries, often characterized by long-term projects and consistent government spending, can offer a counterbalance to more cyclical markets.

- Aerospace & Defense Growth: The global aerospace and defense market was projected to reach approximately $2.5 trillion in 2024, with continued investment in advanced technologies benefiting companies like Gooch & Housego.

- Medical Sector Expansion: The medical diagnostics market alone is anticipated to grow significantly, with some projections indicating a compound annual growth rate (CAGR) of over 7% through 2025, driven by demand for sophisticated imaging and analytical tools.

- Industrial Sector Volatility: While industrial markets can be sensitive to economic slowdowns, specific segments like semiconductor manufacturing continue to see investment, supporting demand for precision optics.

The global economic landscape significantly influences Gooch & Housego's performance. Persistent inflation in 2024 increased raw material costs, directly impacting production expenses for specialized optical components. Currency fluctuations, particularly for the GBP against the USD and EUR in early 2024, also affect overseas sales values and import costs, necessitating active risk management through hedging strategies.

| Economic Factor | Impact on Gooch & Housego | Data Point (2024/2025 Projections) |

|---|---|---|

| Global Photonics Market Growth | Drives demand for G&H's specialized optical components. | Projected CAGR of 6-7% through 2025. |

| R&D Spending | Fuels demand for advanced optical solutions. | Global R&D spending estimated at $2.5 trillion in 2024. |

| Industrial Laser Market | Key segment for high-performance optics. | Valued over $15 billion in 2023, with substantial projected growth. |

| Inflation & Raw Material Costs | Increases production expenses, impacting margins. | Persistent inflationary pressures observed across key economies in early 2024. |

| Currency Volatility (GBP) | Affects international sales value and import costs. | GBP experienced notable volatility against USD and EUR in early 2024. |

Same Document Delivered

Gooch & Housego PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Gooch & Housego PESTLE analysis provides a comprehensive overview of the external factors impacting the company, covering political, economic, social, technological, legal, and environmental influences. You'll gain valuable insights into the strategic landscape for Gooch & Housego.

Sociological factors

The global demand for advanced healthcare solutions, encompassing minimally invasive treatments and cutting-edge diagnostic tools, directly fuels the market for Gooch & Housego's specialized biophotonics and medical-grade optical components. This trend is particularly evident as healthcare systems worldwide invest in technologies that offer greater precision and patient comfort.

The escalating global burden of chronic diseases, such as cardiovascular conditions and cancer, further intensifies the need for sophisticated medical technologies. For instance, the World Health Organization reported in 2023 that non-communicable diseases account for an estimated 74% of all deaths globally, underscoring the persistent demand for innovative diagnostic and therapeutic equipment that Gooch & Housego's products can support.

Gooch & Housego's success hinges on access to a highly skilled workforce, particularly in photonics, optical engineering, and precision manufacturing. These specialized fields require deep technical expertise, making talent availability a critical factor.

The global competition for STEM talent remains intense. For instance, in 2024, the UK government continued to focus on attracting international talent through initiatives like the Global Talent visa, aiming to bolster sectors like advanced manufacturing and technology, which directly benefits companies like Gooch & Housego.

Global safety and security concerns are on the rise, directly boosting the demand for advanced photonics solutions, a key area for Gooch & Housego. The defense and security sectors, in particular, are investing heavily in technologies that offer enhanced capabilities. For instance, the global defense market was valued at approximately $2.25 trillion in 2023 and is projected to grow, with a significant portion allocated to advanced sensing and surveillance technologies.

Photonics technologies are highly sought after for security applications due to their inherent reliability and precision. These attributes are crucial for systems requiring accurate threat detection and secure communication. The market for optical sensors in defense, a segment where Gooch & Housego operates, is expected to see substantial growth, driven by advancements in areas like counter-drone systems and border security.

Consumer Electronics and Connectivity Trends

The insatiable consumer appetite for cutting-edge electronics, from the latest smartphones to immersive AR/VR headsets, directly fuels demand for Gooch & Housego's sophisticated optical components. The widespread adoption of 5G networks, which saw global subscriptions surpass 1.5 billion by early 2024, underscores the critical need for the miniaturized and highly efficient photonic solutions that the company provides.

This trend is further amplified by the increasing integration of advanced optical technologies into everyday devices, creating a robust market for Gooch & Housego's products. For instance, the augmented reality market alone was projected to reach over $80 billion by 2025, indicating substantial growth opportunities driven by consumer electronics innovation.

Key drivers include:

- Increasing smartphone sophistication: New models consistently incorporate more advanced camera systems and display technologies requiring high-performance optics.

- Growth in AR/VR adoption: Consumer interest in virtual and augmented reality experiences is expanding, pushing demand for specialized optical components.

- 5G network expansion: The rollout of 5G infrastructure necessitates advanced optical solutions for data transmission and processing.

- Demand for connected devices: The Internet of Things (IoT) ecosystem relies heavily on efficient data transfer, where optical technologies play a vital role.

Ethical Considerations in AI and Advanced Technologies

As photonics increasingly merges with AI and advanced technologies, ethical questions surrounding data privacy and the societal impact of these innovations become paramount. Gooch & Housego, operating in this space, must navigate these evolving societal expectations.

For instance, the growing use of AI in data analysis, a field where photonics plays a role, raises concerns about how personal data is collected, used, and protected. Companies like Gooch & Housego may face scrutiny over the ethical implications of their technology's contribution to data-driven systems.

- Data Privacy: With photonics enabling advanced sensors and imaging, ensuring robust data privacy measures in AI applications is critical. This is particularly relevant as global regulations like GDPR and CCPA continue to shape data handling practices.

- Autonomous Systems: The integration of photonics with AI can lead to more sophisticated autonomous systems. Ethical frameworks for accountability and decision-making in these systems are still under development, impacting technology providers.

- Societal Impact: The broader societal implications of advanced technologies, including job displacement and algorithmic bias, are increasingly debated. Companies involved in developing these technologies, such as Gooch & Housego, are expected to consider their role in mitigating negative impacts.

Societal shifts, such as the growing emphasis on health and well-being, directly influence the demand for Gooch & Housego's precision optical components used in medical devices. As global populations age and become more health-conscious, the market for advanced diagnostics and treatments, which rely on sophisticated optics, continues to expand. The increasing integration of technology into daily life also shapes consumer expectations for performance and innovation in electronic devices, benefiting companies like Gooch & Housego that supply critical optical elements.

Technological factors

Significant advancements in silicon photonics and integrated photonics are a major driver for market expansion. These technologies are enabling much faster data transfer speeds and leading to more compact, energy-efficient electronic devices. For instance, the global silicon photonics market was valued at approximately $1.4 billion in 2023 and is projected to reach over $10 billion by 2030, showcasing robust growth.

Gooch & Housego's deep expertise in precision optics is a key advantage here. This positions the company to effectively leverage these technological innovations. Their capabilities are particularly well-suited for critical applications within data centers, the rapidly evolving telecommunications sector, and the demanding field of high-performance computing, all areas experiencing substantial growth and requiring advanced optical solutions.

The burgeoning field of quantum photonics and quantum computing represents a significant opportunity for Gooch & Housego. Their expertise in precisely manipulating light is fundamental to the development of these advanced technologies. For instance, the global quantum computing market was valued at approximately $1.5 billion in 2023 and is projected to reach over $13 billion by 2030, indicating substantial growth potential.

Government and industry backing is a key driver in this sector. In 2024, the US National Quantum Initiative Act continues to fuel research and development, with significant funding allocated to quantum science. This robust investment ecosystem directly benefits companies like Gooch & Housego, whose components are essential for building the infrastructure required for quantum advancements.

Continuous innovation in optical coatings and materials directly benefits companies like Gooch & Housego by improving the performance and durability of their optical components. These advancements are vital for sectors demanding high reliability.

For instance, the development of advanced anti-reflective coatings and new broadband coatings is critical for meeting the stringent requirements in aerospace and medical imaging. These technologies enable clearer signals and more precise measurements, directly impacting the utility of optical systems.

The market for advanced optical coatings is projected for significant growth, with some estimates pointing to a compound annual growth rate of over 7% through 2028. This expansion is driven by increasing demand in telecommunications, defense, and consumer electronics, all areas where Gooch & Housego operates.

Miniaturization and IoT Integration

The relentless drive for smaller, more powerful devices is a significant technological tailwind for Gooch & Housego. As components shrink, the demand for highly precise photonic solutions capable of fitting into these compact designs escalates. This trend directly benefits companies like Gooch & Housego, which specialize in advanced optical technologies.

The expansion of the Internet of Things (IoT) is another key factor. Photonics are increasingly crucial for enabling the seamless data collection and communication that underpins IoT. Gooch & Housego's expertise in developing compact and efficient photonic sensors and components positions them well to capitalize on this growth. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.7 trillion by 2028, demonstrating a substantial opportunity for component suppliers.

- Miniaturization: Drives demand for smaller, high-performance photonic components.

- IoT Integration: Photonics are essential for data processing and communication in IoT devices.

- Market Growth: The IoT market's expansion offers significant opportunities for photonic solution providers.

Additive Manufacturing and Laser Technologies

The growing use of laser technologies in manufacturing, including laser cutting, 3D printing, and advanced optical inspection, directly boosts demand for Gooch & Housego's precision optics. These advanced manufacturing processes, often referred to as additive manufacturing, rely heavily on the precise control and manipulation of light. For example, the global 3D printing market was valued at approximately $17.8 billion in 2023 and is projected to reach $60.9 billion by 2030, indicating a significant expansion in sectors that utilize laser-based additive manufacturing.

Photonics, the science of light, is at the core of these advancements, offering superior accuracy and energy efficiency. Gooch & Housego's expertise in designing and manufacturing complex optical components is therefore crucial for enabling these high-precision industrial applications. The demand for photonics solutions is further amplified as industries seek to improve manufacturing quality and reduce material waste through these sophisticated laser-driven techniques.

Key areas driving this demand include:

- Industrial Laser Cutting and Welding: Requiring high-quality optics for beam delivery and shaping.

- Additive Manufacturing (3D Printing): Especially in metal printing, where precise laser control is paramount.

- Optical Inspection and Metrology: Utilizing lasers for detailed quality control and measurement in production lines.

- Semiconductor Manufacturing: Where extreme precision in lithography, often laser-based, is essential.

Technological advancements, particularly in silicon photonics and quantum computing, are creating significant growth opportunities for Gooch & Housego. The increasing demand for miniaturized and high-performance optical components, driven by the expansion of the Internet of Things (IoT) and advanced manufacturing processes like 3D printing, directly benefits the company's expertise in precision optics.

The global silicon photonics market is expected to exceed $10 billion by 2030, up from approximately $1.4 billion in 2023. Similarly, the quantum computing market, valued at about $1.5 billion in 2023, is projected to reach over $13 billion by 2030. These figures underscore the substantial market potential for companies like Gooch & Housego that provide essential optical solutions for these burgeoning fields.

The company's capabilities in advanced optical coatings are also crucial, with the market for these coatings projected for over 7% compound annual growth through 2028. This growth is fueled by demand in telecommunications, defense, and consumer electronics, all sectors where Gooch & Housego operates and where enhanced optical performance is critical.

| Technology Area | Market Value (2023 est.) | Projected Market Value (2028/2030 est.) | Growth Driver for Gooch & Housego |

|---|---|---|---|

| Silicon Photonics | $1.4 billion | >$10 billion (by 2030) | Enabling faster data transfer and compact devices |

| Quantum Computing | $1.5 billion | >$13 billion (by 2030) | Fundamental to quantum technology development |

| Advanced Optical Coatings | N/A | >7% CAGR (through 2028) | Improving component performance and reliability |

| Additive Manufacturing (3D Printing) | $17.8 billion | $60.9 billion (by 2030) | Precision optics for laser-based manufacturing |

Legal factors

Protecting its innovations through patents and trade secrets is vital for Gooch & Housego's edge in the competitive photonics sector. For instance, as of early 2024, the company holds a robust portfolio of patents covering its specialized fiber optic components and acousto-optic devices, safeguarding its technological advancements.

Evolving intellectual property legislation, particularly concerning AI-generated inventions and international patent enforcement, presents both opportunities and challenges. The increasing complexity of cross-border IP disputes means Gooch & Housego must remain vigilant in adapting its legal strategies to protect its global market position.

Gooch & Housego operates under stringent product safety and quality regulations, especially critical in its key markets like medical, aerospace, and defense. For instance, in the medical device sector, adherence to FDA regulations in the US and similar bodies globally is non-negotiable for market entry and continued sales. Failure to meet these standards can lead to product recalls and significant financial penalties, impacting Gooch & Housego's revenue streams and brand reputation.

Compliance with these rigorous standards is not merely a legal obligation but a fundamental requirement for maintaining customer trust and securing market access. In the aerospace industry, for example, certifications like AS9100 are vital, and in 2023, the global aerospace market was valued at over $800 billion, highlighting the immense opportunity but also the high stakes involved in meeting quality benchmarks.

Gooch & Housego's operations are significantly influenced by international trade laws and agreements, particularly in the UK, USA, and China, where it maintains manufacturing facilities. Adherence to varying customs regulations and trade pacts is crucial for seamless supply chain management and market access. For instance, the UK's trade relationship with the EU post-Brexit, and ongoing US-China trade dynamics, directly affect import/export costs and product movement.

Changes in these frameworks, such as the introduction or modification of tariffs, can create substantial volatility. For example, in early 2024, discussions around potential new tariffs on certain manufactured goods between major economies could necessitate adjustments in Gooch & Housego's sourcing and sales strategies, impacting overall profitability. The company must remain agile to navigate these evolving legal landscapes.

Data Protection and Privacy Laws

Gooch & Housego's operations, particularly those involving photonics in data-intensive applications, necessitate strict adherence to evolving data protection and privacy regulations like the GDPR. While the company doesn't directly process end-user data, its components are integral to systems that do, making compliance a critical consideration. The global data privacy market was valued at approximately $22.8 billion in 2023 and is projected to reach $60.9 billion by 2030, highlighting the growing importance of this regulatory landscape.

The increasing digitalization across industries, from telecommunications to healthcare, amplifies the need for robust data security within the supply chain. Gooch & Housego's photonics solutions, enabling high-speed data transmission and processing, must align with these stringent data handling requirements. Failure to comply can lead to significant financial penalties and reputational damage, impacting market access and customer trust. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- Regulatory Scrutiny: Increased focus on data privacy compliance for companies involved in technology and data infrastructure.

- Supply Chain Responsibility: Ensuring components enable systems that meet data protection standards is crucial for market acceptance.

- Global Compliance Landscape: Navigating varying data privacy laws across different operating regions presents a complex challenge.

- Reputational Risk: Data breaches or non-compliance in systems utilizing their technology could negatively impact Gooch & Housego's brand.

Export Control Regulations for Dual-Use Technologies

Gooch & Housego operates within a complex web of legal frameworks governing dual-use technologies, essential for its aerospace and defense sector engagement. Compliance with these export controls, such as those managed by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) and similar international bodies, is paramount. These regulations dictate the conditions under which advanced optical components and systems, potentially usable for both civilian and military purposes, can be exported, ensuring responsible international trade and preventing legal penalties. For instance, the Wassenaar Arrangement, a multilateral export control regime, aims to contribute to regional and international security and stability by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies. Failure to adhere can result in significant fines and reputational damage.

Key aspects of these legal factors include:

- Export Licensing Requirements: Companies like Gooch & Housego must navigate intricate licensing processes for exporting sensitive technologies, often requiring specific approvals for each transaction.

- End-User Controls: Regulations often mandate verification of the end-user and end-use of exported items to prevent diversion to unauthorized parties or applications.

- International Treaties and Agreements: Adherence to multilateral agreements, such as the Wassenaar Arrangement, influences global trade practices for dual-use items.

- Sanctions and Embargoes: Compliance with national and international sanctions regimes is critical to avoid trading with restricted entities or countries.

Gooch & Housego's patent portfolio, protecting its core photonics innovations, is a significant legal asset. For instance, in early 2024, the company held numerous patents covering specialized fiber optics and acousto-optic devices, crucial for maintaining its competitive edge. The evolving landscape of intellectual property law, especially concerning international enforcement and new technologies, requires continuous adaptation of its legal strategies.

Stringent product safety and quality regulations are paramount, particularly in the medical, aerospace, and defense sectors. Compliance with bodies like the FDA in the US is non-negotiable, with the global aerospace market exceeding $800 billion in 2023, underscoring the high stakes for quality adherence. Adherence to standards like AS9100 in aerospace is vital for market access and customer trust.

International trade laws significantly impact Gooch & Housego's global operations, with UK, US, and China being key markets. Navigating customs regulations and trade pacts, such as post-Brexit EU trade relations and US-China trade dynamics, is essential for supply chain efficiency. Potential tariff changes in early 2024 could necessitate strategic adjustments in sourcing and sales to mitigate profit impacts.

Data protection and privacy laws, including GDPR, are increasingly relevant as Gooch & Housego's components are used in data-intensive applications. While not directly handling end-user data, its technology must enable systems that comply, given the global data privacy market's projected growth from $22.8 billion in 2023 to $60.9 billion by 2030. Non-compliance can lead to substantial fines, potentially up to 4% of global annual revenue or €20 million.

Compliance with export controls for dual-use technologies is critical for Gooch & Housego's aerospace and defense business. Regulations from bodies like the U.S. Bureau of Industry and Security (BIS) and international agreements like the Wassenaar Arrangement govern the export of advanced optical components. Failure to comply can result in severe penalties and reputational damage.

| Legal Factor | Impact on Gooch & Housego | Key Regulations/Examples | Market Relevance (2023-2024 Data) |

|---|---|---|---|

| Intellectual Property | Protects technological innovation, maintains competitive advantage. | Patents for fiber optics, acousto-optics; evolving IP laws. | Crucial for differentiation in a high-tech sector. |

| Product Safety & Quality | Ensures market access, builds customer trust, avoids penalties. | FDA regulations (medical), AS9100 (aerospace). | Global aerospace market >$800 billion; medical device sector vital. |

| International Trade Laws | Facilitates global supply chains and market access, impacts costs. | Brexit trade impact, US-China trade dynamics, tariffs. | Affects import/export costs and product movement. |

| Data Protection & Privacy | Ensures compliance for components in data-handling systems. | GDPR, data privacy market projected to reach $60.9B by 2030. | Critical for components enabling high-speed data transmission. |

| Export Controls (Dual-Use) | Governs trade of sensitive technologies, prevents misuse. | Wassenaar Arrangement, U.S. BIS regulations. | Essential for aerospace and defense sector engagement. |

Environmental factors

Gooch & Housego's manufacturing operations are subject to scrutiny regarding energy consumption, a critical factor given the global push for sustainability and the volatility of energy prices. The company's photonics technologies, however, offer a significant advantage, as many of their products inherently contribute to energy efficiency in downstream applications, aligning with environmental objectives.

The drive for reduced carbon footprints is intensifying, with many nations setting ambitious net-zero targets. For instance, the UK government aims for a 68% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. This regulatory environment underscores the importance of Gooch & Housego's energy-efficient product portfolio.

Gooch & Housego's manufacturing processes are directly affected by evolving waste management and recycling regulations, particularly concerning packaging and electronic waste. Compliance with these rules, which are tightening globally, influences operational costs and supply chain logistics. For instance, the UK's Extended Producer Responsibility (EPR) scheme for packaging, which came into full effect in 2024, places greater financial and operational burdens on producers to manage the end-of-life of their products.

Gooch & Housego faces increasing pressure to ensure sustainability across its entire supply chain. This means scrutinizing raw material sourcing and manufacturing processes to align with ethical and environmental standards. For instance, in 2024, many companies in the advanced materials sector are actively seeking suppliers with certifications for responsible sourcing and reduced carbon emissions, a trend likely to impact Gooch & Housego's supplier selection criteria.

Carbon Emissions and Climate Change Policies

Policies focused on reducing carbon emissions, like carbon pricing or border adjustments, could directly affect Gooch & Housego's operational expenses and how competitive they are in the market. For instance, if a carbon tax is implemented in a key market, the cost of energy and raw materials might rise, impacting their bottom line.

Gooch & Housego will likely need to assess its own carbon footprint and actively seek ways to decarbonize its operations to stay ahead of regulatory changes and meet evolving stakeholder expectations. This could involve investing in more energy-efficient technologies or exploring renewable energy sources for their manufacturing processes.

The company's ability to adapt to these environmental shifts will be crucial. For example, the UK government's net-zero by 2050 target, and similar global initiatives, signal a long-term trend towards stricter environmental regulations that will shape the industrial landscape for years to come.

- Impact on Costs: Increased energy prices or carbon taxes could raise manufacturing costs for Gooch & Housego.

- Market Competitiveness: Companies with lower carbon footprints may gain a competitive advantage as markets increasingly favor sustainable products.

- Decarbonization Strategies: Exploring renewable energy, improving energy efficiency, and optimizing supply chains are key areas for Gooch & Housego to consider.

Resource Scarcity and Raw Material Sourcing

The availability and sustainable sourcing of critical raw materials, such as rare earth elements essential for advanced optical coatings, present significant environmental and supply chain challenges for Gooch & Housego. Geopolitical factors and increasing global demand can lead to price volatility and limited access, impacting production costs and timelines. For instance, disruptions in the supply of specific rare earth minerals, crucial for high-performance optics, could directly affect Gooch & Housego's ability to meet demand in 2024 and 2025.

To navigate these risks, Gooch & Housego must prioritize resource efficiency and explore the development or adoption of alternative materials. This proactive approach can mitigate the environmental footprint associated with extraction and processing. The company's commitment to sustainability in sourcing is becoming increasingly important for maintaining its market position and meeting the expectations of environmentally conscious clients.

- Supply Chain Vulnerability: Reliance on specific geographical regions for key minerals like silicon carbide or specialized glass precursors creates inherent supply chain risks.

- Environmental Impact of Extraction: The mining and processing of raw materials often carry significant environmental consequences, including habitat destruction and water pollution, which Gooch & Housego must consider in its supplier selection.

- Material Innovation: Investing in research for alternative, more readily available, or sustainably sourced materials for optical components can reduce dependency and future cost pressures.

- Circular Economy Principles: Implementing strategies for material reuse and recycling within the manufacturing process can further enhance resource efficiency and reduce waste.

Gooch & Housego's operations are significantly impacted by environmental regulations and global sustainability trends, influencing everything from energy consumption to waste management. The company's photonics technologies can offer an advantage by contributing to energy efficiency in downstream applications, aligning with growing environmental objectives and regulatory pressures like the UK's net-zero targets. For instance, the UK government's aim for a 68% reduction in greenhouse gas emissions by 2030 highlights the importance of energy-efficient product portfolios.

The company faces increasing scrutiny regarding its supply chain's environmental footprint, including the sourcing of critical raw materials. For example, the availability and sustainable extraction of rare earth elements, vital for advanced optical coatings, can lead to price volatility and supply chain risks, directly affecting production costs and timelines for 2024 and 2025. Adopting circular economy principles and exploring alternative materials are key strategies to mitigate these environmental and supply chain challenges.

| Environmental Factor | Impact on Gooch & Housego | Examples/Data (2024/2025) |

|---|---|---|

| Energy Consumption & Efficiency | Rising energy costs and carbon pricing can increase operational expenses. | Global energy prices saw fluctuations in 2024. The EU's Emissions Trading System (ETS) continues to drive up the cost of carbon. |

| Waste Management & Recycling | Stricter regulations on waste and packaging increase compliance costs. | The UK's Extended Producer Responsibility (EPR) scheme for packaging, fully effective in 2024, places greater financial burden on producers. |

| Raw Material Sourcing | Dependence on specific minerals creates supply chain vulnerabilities and price volatility. | Demand for rare earth elements, crucial for optics, remained high in 2024, impacting availability and cost. |

| Carbon Footprint Reduction | Pressure to decarbonize operations to meet regulatory targets and stakeholder expectations. | Many companies are setting science-based targets for emissions reduction, aiming for significant cuts by 2030. |

PESTLE Analysis Data Sources

Our Gooch & Housego PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.