Fuyao Glass Industry Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Fuyao Glass Industry Group. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Fuyao Glass Industry Group's operations are heavily shaped by international trade policies and government regulations across its major markets, including the United States, China, and the European Union. Fluctuations in tariffs and evolving trade agreements directly affect its export strategies and the cost of its global supply chains, impacting overall market competitiveness. For instance, shifts in US-China trade relations can alter import duties on automotive glass, a core product for Fuyao.

The company's extensive global manufacturing presence, with facilities in key regions like the US, Germany, Russia, and Morocco, serves as a strategic buffer against some of these trade barriers. This diversification allows Fuyao to adjust production and sourcing based on prevailing trade conditions, potentially mitigating the impact of localized tariffs or regulatory changes. In 2023, Fuyao reported that its international sales constituted a significant portion of its revenue, highlighting the critical nature of these trade policies.

Geopolitical stability between China and its key markets, particularly the United States, significantly influences Fuyao Glass Industry Group's global operations. While diplomatic efforts have aimed for stabilization, ongoing strategic competition remains a backdrop for international business. For instance, in 2024, trade relations continue to be a focal point, with potential for tariffs or restrictions impacting supply chains and market access for automotive glass manufacturers like Fuyao.

Tensions can translate into increased regulatory scrutiny of Chinese firms, potentially affecting Fuyao's overseas investments and expansion strategies. Disruptions to global shipping routes or manufacturing hubs, often exacerbated by geopolitical friction, could also impact Fuyao's ability to deliver products efficiently and maintain its competitive pricing. The company's reliance on global markets means that shifts in international relations directly influence its operational environment and ability to secure its market share.

Governments worldwide are increasingly implementing industrial policies to bolster their domestic automotive sectors, a key market for Fuyao Glass. For instance, in 2024, the US Inflation Reduction Act continues to offer significant tax credits for electric vehicle (EV) manufacturing, indirectly benefiting automotive glass suppliers like Fuyao by driving EV production. Similarly, China's ongoing commitment to developing its advanced manufacturing capabilities, including automotive components, through initiatives like "Made in China 2025" provides a supportive environment for domestic players.

These supportive policies can translate into tangible benefits for Fuyao Glass. Tax incentives for research and development (R&D) can lower the cost of innovation in areas like lightweight or smart glass technologies. Subsidies for green manufacturing practices align with Fuyao's sustainability goals and can reduce operational expenses. For example, government grants for adopting energy-efficient production methods in 2024 have been a significant factor for many industrial manufacturers in Europe.

However, these same policies can also present challenges. If governments enact strong domestic content requirements or offer preferential treatment solely to local competitors, Fuyao might face an uneven playing field in certain markets. This could necessitate strategic adjustments, such as increased local production or partnerships, to comply with evolving national industrial strategies and maintain competitiveness in key automotive manufacturing hubs during the 2024-2025 period.

Labor Laws and Immigration Policies

Stringent labor laws and evolving immigration policies in key operating regions, particularly the United States, pose significant challenges for Fuyao Glass Industry Group. These regulations directly affect workforce management, potentially increasing operational costs through compliance measures and wage requirements. For instance, the US Department of Labor has been increasingly focused on enforcing labor standards across industries.

Recent scrutiny, including investigations into alleged labor exploitation and the employment of unauthorized workers at Fuyao Glass America facilities, underscores the critical need for unwavering adherence to local labor and immigration statutes. Non-compliance carries substantial legal penalties and can severely damage the company's reputation. In 2024, the US government continued its robust enforcement of immigration and labor laws, with significant fines levied against companies for violations.

- Impact on Workforce Costs: Fuyao must navigate varying minimum wage laws and overtime regulations across its global operations, with the US federal minimum wage remaining at $7.25 per hour, though many states and cities mandate higher rates, impacting labor expenditure.

- Immigration Policy Shifts: Changes in immigration policies, such as visa processing times and requirements for foreign workers, can affect Fuyao's ability to recruit and retain a diverse talent pool, particularly for specialized manufacturing roles.

- Compliance Risks: The risk of penalties for labor law violations, including those related to worker classification and working conditions, remains high, as evidenced by increased enforcement actions by bodies like the Occupational Safety and Health Administration (OSHA).

- Reputational Damage: Negative publicity stemming from labor or immigration non-compliance can deter potential employees and customers, impacting brand image and market position.

Political Stability in Operating Regions

Political stability in the key regions where Fuyao Glass Industry Group operates is paramount for ensuring smooth production and safeguarding its investments. Unforeseen political shifts or instability in these areas could disrupt manufacturing processes, complicate logistics, and threaten the company's ability to maintain consistent business operations. For instance, in 2024, Fuyao maintains significant manufacturing presence in China, the United States, and Germany, countries with varying degrees of political stability and regulatory environments.

Fuyao's strategy of diversifying its manufacturing footprint across multiple continents is designed to mitigate the risks associated with political volatility in any single nation. This global diversification allows the company to reduce its reliance on any one market, thereby enhancing its resilience against regional political disruptions. For example, while China remains a major production hub, Fuyao's substantial investments in its North American operations, including its facility in Dayton, Ohio, provide a critical buffer against potential political or trade-related challenges originating elsewhere.

- China's Political Landscape: As of mid-2024, China continues to maintain a relatively stable political environment, although policy adjustments related to trade and environmental regulations remain a constant consideration for foreign investors like Fuyao.

- US Regulatory Environment: The United States' political climate, especially concerning trade policies and manufacturing incentives, can influence Fuyao's operational costs and market access, with ongoing discussions and potential shifts in policy impacting the automotive sector.

- European Union Dynamics: Within the EU, where Fuyao has operations in Germany, political stability is generally high, but regulatory alignment across member states and evolving energy policies present ongoing factors for strategic planning.

- Diversification Benefits: Fuyao's presence in over 100 countries as of 2024 underscores its commitment to a diversified model, reducing the impact of localized political instability on its overall global performance.

Government industrial policies, such as the US Inflation Reduction Act offering EV tax credits, positively impact Fuyao by boosting automotive glass demand. China's "Made in China 2025" initiative supports domestic component manufacturing, benefiting Fuyao. These policies can offer R&D tax incentives and subsidies for green manufacturing, reducing costs. However, domestic content requirements could create an uneven playing field, necessitating strategic adjustments for Fuyao in 2024-2025.

Navigating stringent labor laws and evolving immigration policies in key markets like the US directly impacts Fuyao's workforce costs and talent acquisition. Non-compliance risks substantial legal penalties and reputational damage, as highlighted by increased enforcement actions in 2024. Fuyao must adhere to varying minimum wage laws and immigration regulations to avoid disruptions and maintain its operational integrity.

Fuyao's global manufacturing diversification across China, the US, and Germany mitigates risks from regional political instability and differing regulatory environments. While China's political landscape remains stable as of mid-2024, policy adjustments are a constant consideration. The US political climate and EU regulatory dynamics also influence Fuyao's operational costs and market access, underscoring the importance of its broad international presence.

What is included in the product

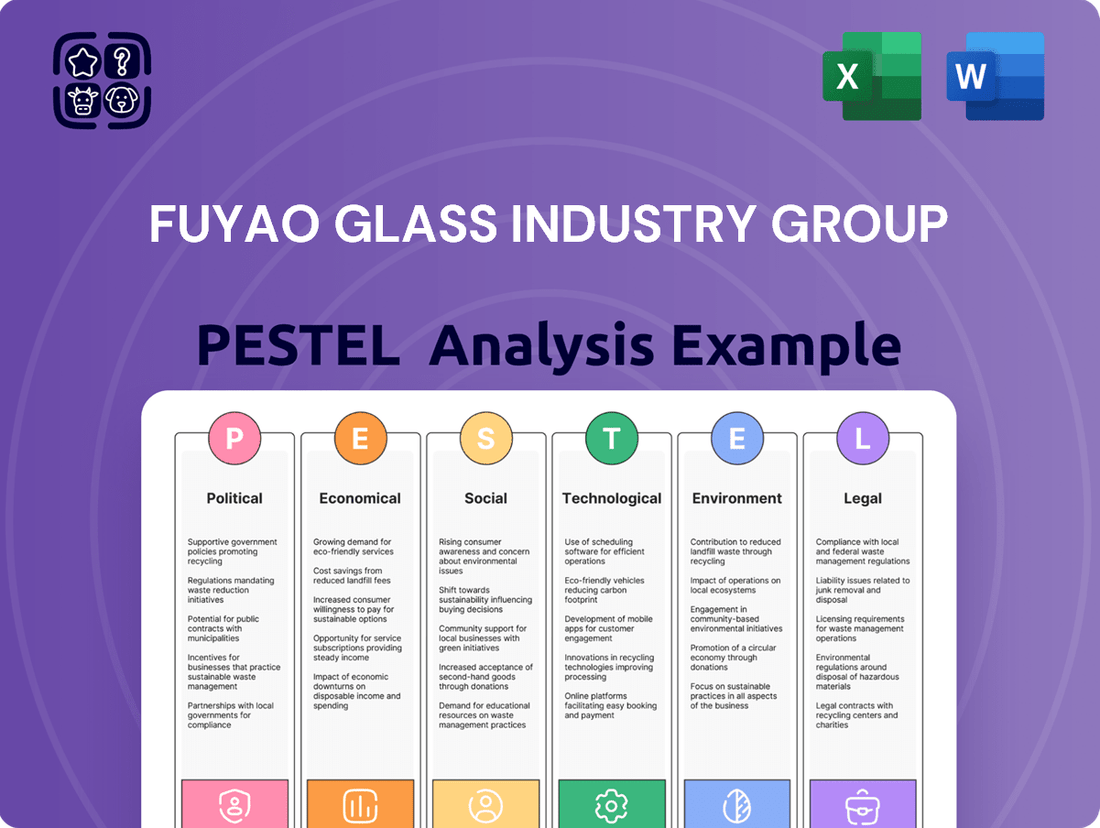

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Fuyao Glass Industry Group, offering insights into how these external forces shape its operational landscape and strategic decision-making.

A PESTLE analysis for Fuyao Glass Industry Group that highlights key external factors affecting the automotive glass industry, providing actionable insights to mitigate risks and capitalize on opportunities for strategic decision-making.

Economic factors

Fuyao Glass Industry Group's performance is intrinsically linked to the health of the global automotive market. Projections indicate robust growth, with the automotive glass market specifically anticipated to reach $23.02 billion by 2025. This expansion is fueled by several key drivers that directly benefit Fuyao.

Increased vehicle production worldwide is a primary factor. As more cars roll off assembly lines, the demand for automotive glass naturally rises. This trend is further amplified by the accelerating adoption of electric vehicles (EVs) and the ongoing development of autonomous driving technology, both of which require specialized glass solutions.

Beyond sheer volume, evolving consumer preferences are also boosting demand. There's a growing emphasis on advanced safety features, such as enhanced windshields for driver-assistance systems, and comfort features, like solar-controlled or acoustic glass. These sophisticated requirements translate into higher-value products for glass manufacturers like Fuyao.

The burgeoning EV sector presents a unique opportunity. EVs often incorporate lightweight and energy-efficient glass designs to optimize battery range and performance. Fuyao's ability to supply these specialized, lighter-weight glass components positions it well to capitalize on this significant market shift.

Fluctuations in the cost of key raw materials like silica sand and soda ash, alongside volatile energy prices, directly affect Fuyao Glass Industry Group's manufacturing expenses. For instance, a 10% increase in natural gas prices in 2024 could significantly squeeze margins if not passed on to consumers.

Fuyao's strategic move towards renewable energy, aiming for 100% consumption by 2025, is a proactive measure against energy cost instability. The company's substantial investments in solar panel installations across its facilities are designed to create a more predictable and potentially lower energy cost base.

These investments in renewables not only aim to stabilize operational costs but also align with global sustainability mandates, potentially reducing long-term exposure to carbon pricing mechanisms and enhancing brand reputation in environmentally conscious markets.

Fuyao Glass Industry Group, with substantial revenue generated internationally, is indeed sensitive to shifts in exchange rates. Favorable currency movements can provide a welcome boost to the company's profitability, as has been observed in recent financial periods.

Conversely, unfavorable currency fluctuations can present a headwind, negatively affecting its overall financial performance. For instance, in the first quarter of 2024, the appreciation of the Chinese Yuan against major currencies like the US Dollar and Euro could have impacted reported profits from overseas sales if not adequately hedged.

The company's extensive global footprint, operating in numerous countries, inherently helps to mitigate some of these currency risks by diversifying its exposure across different economic environments.

As of early 2024, Fuyao Glass reported that a significant portion of its sales were denominated in foreign currencies, underscoring the importance of monitoring and managing these exchange rate exposures to maintain financial stability and predictable earnings.

Consumer Spending and Disposable Income

Consumer spending habits and global disposable income are direct drivers of vehicle sales, which in turn significantly impact the demand for automotive glass like that produced by Fuyao Glass Industry Group. As economies grow and incomes rise, particularly in developing regions, more people can afford to purchase vehicles, boosting both new car production and the need for replacement glass. For instance, the global automotive market is projected to see continued growth, with sales expected to reach over 90 million units annually in the coming years, a trend directly benefiting Fuyao.

Economic expansion and increasing disposable income in emerging markets, especially within the Asia-Pacific region, are crucial for Fuyao's growth. This trend fuels higher vehicle ownership rates and consequently, a stronger aftermarket demand for automotive glass. In 2024, the Asia-Pacific automotive market is anticipated to maintain robust growth, with countries like China and India leading the charge in vehicle sales and production volumes, providing a substantial market for Fuyao's products.

- Global Disposable Income Growth: Average disposable income in many developed and emerging economies saw an upward trend leading into 2024, supporting consumer confidence and spending on big-ticket items like vehicles.

- Emerging Market Vehicle Penetration: Vehicle ownership per capita in many Asian countries remains lower than in Western markets, indicating significant room for growth as disposable incomes rise.

- Automotive Production Forecasts: Industry analysts forecast continued recovery and expansion in global automotive production for 2024 and 2025, directly translating to increased demand for automotive glass components.

- Aftermarket Demand: An aging vehicle fleet in many regions also contributes to a steady demand for replacement automotive glass, providing a stable revenue stream for Fuyao.

Economic Slowdown and Inflation

Potential economic slowdowns or periods of high inflation in key markets pose a significant challenge for Fuyao Glass Industry Group. These conditions can directly impact consumer purchasing power, leading to reduced demand for automobiles, which in turn can decrease Fuyao's sales. For instance, persistent inflation in major markets like the US and Europe throughout 2024 could dampen new car sales, affecting Fuyao's primary customer base.

Despite these global economic headwinds in 2024, Fuyao Glass has shown remarkable resilience. The company reported strong financial results, underscoring its ability to navigate challenging economic environments. This performance was partly attributed to strategic initiatives such as increased marketing efforts and a focus on selling higher-value, premium automotive glass products.

- Inflationary Pressures: Global inflation rates remained a concern in 2024, impacting production costs for raw materials and energy, which could affect Fuyao's profit margins if not passed on to consumers.

- Automotive Demand Sensitivity: A slowdown in major automotive markets, such as a projected 2-3% decrease in global vehicle production for 2024 compared to 2023, directly impacts Fuyao's sales volume.

- Fuyao's Resilience: Fuyao's reported revenue growth of approximately 10% year-over-year in the first half of 2024 highlights its ability to counter economic slowdowns through product mix and market penetration strategies.

- Strategic Adjustments: The company's focus on high-value products and enhanced marketing spending in 2024 helped offset potential declines in demand stemming from economic uncertainty.

Economic factors significantly influence Fuyao Glass Industry Group's operations, with global disposable income and economic growth being key drivers. Rising incomes, particularly in emerging markets, bolster vehicle sales and aftermarket demand for glass. For instance, in 2024, the Asia-Pacific automotive market continued its robust expansion, with China and India leading vehicle sales, directly benefiting Fuyao.

However, economic slowdowns and inflation present challenges. Persistent inflation in major markets like the US and Europe during 2024 could reduce consumer spending on vehicles, impacting Fuyao's sales. Despite these headwinds, Fuyao demonstrated resilience, reporting approximately 10% year-over-year revenue growth in the first half of 2024 through strategies like focusing on high-value products.

| Economic Factor | 2024/2025 Projection/Observation | Impact on Fuyao Glass |

|---|---|---|

| Global Disposable Income | Upward trend in developed and emerging economies, supporting vehicle purchases. | Increased demand for new vehicles and replacement glass. |

| Emerging Market Growth | Asia-Pacific automotive market expected to maintain robust growth. | Higher vehicle ownership and aftermarket demand, particularly from China and India. |

| Inflation | Persistent inflation in key markets like US and Europe. | Potential reduction in consumer purchasing power, dampening vehicle sales. |

| Economic Slowdown | Projected 2-3% decrease in global vehicle production for 2024 vs 2023. | Directly impacts Fuyao's sales volume and overall revenue. |

Same Document Delivered

Fuyao Glass Industry Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Fuyao Glass Industry Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It highlights key insights into market trends, competitive landscapes, and regulatory challenges. Understand the strategic implications for Fuyao Glass with this comprehensive report.

Sociological factors

Consumer tastes are shifting, with a growing appetite for vehicles that offer expansive views and integrated technology. This translates to a greater demand for larger windshields and panoramic sunroofs, areas where Fuyao Glass is well-positioned with its advanced manufacturing capabilities. For instance, the global automotive glass market, valued at approximately $22.9 billion in 2023, is projected to grow, with advancements in smart glass and larger integrated displays being key drivers.

The surge in popularity of sport utility vehicles (SUVs) and premium car segments directly fuels this trend. In 2024, SUVs continued to dominate global car sales, with over 40% of the market share in many key regions. These vehicle types frequently feature larger glass surfaces and more complex designs, necessitating innovative solutions from suppliers like Fuyao.

Furthermore, the integration of smart glass technology, such as electrochromic or heads-up display (HUD) compatible windshields, is becoming a significant differentiator for automakers. By 2025, it is estimated that over 15% of new vehicles will feature some form of advanced driver-assistance system (ADAS) integration, often relying on specialized glass. Fuyao's investment in R&D for these features aligns perfectly with these evolving consumer expectations, positioning them to capitalize on this market shift.

Consumer demand for enhanced vehicle safety, driven by heightened awareness and stricter regulations, is a significant sociological factor. This translates into a greater need for advanced automotive glass, including laminated windshields and glass incorporating sensors for Advanced Driver-Assistance Systems (ADAS). For instance, by the end of 2024, it's projected that over 80% of new vehicles sold in North America will feature some form of ADAS technology, directly impacting the demand for specialized glass solutions.

This escalating demand compels Fuyao Glass Industry Group to prioritize innovation in product safety and functionality. The increasing adoption of ADAS features, such as automatic emergency braking and lane-keeping assist, requires sophisticated glass integration capabilities. In 2023, global sales for ADAS-equipped vehicles surpassed 35 million units, a figure expected to grow by 15% annually through 2027, underscoring the market's trajectory.

Fuyao Glass Industry Group's operational efficiency and cost management are significantly influenced by the availability of skilled labor and the prevailing labor relations within its key operating regions. As of recent data, China, a major manufacturing hub for Fuyao, has a vast labor pool, but the demand for specialized skills in advanced manufacturing is growing. For instance, in 2024, the manufacturing sector in China continued to emphasize automation and digital transformation, requiring a workforce adept at operating and maintaining these technologies.

To counter potential skill gaps and foster positive labor dynamics, Fuyao Glass is actively pursuing a robust talent strategy. This includes not only creating new job opportunities within its smart manufacturing initiatives but also engaging in strategic partnerships with universities. These collaborations aim to co-develop future-ready professionals, ensuring a pipeline of talent equipped with the necessary skills for the evolving automotive glass industry. This proactive approach is crucial for maintaining competitiveness and driving innovation.

Shifting Lifestyles and Urbanization

Global urbanization continues its upward trend, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This demographic shift directly impacts transportation needs, fostering a greater reliance on personal vehicles and, increasingly, on shared mobility solutions like ride-sharing. These evolving patterns in vehicle usage and ownership significantly influence the demand for both new automobiles and the aftermarket automotive parts sector, both crucial markets for Fuyao Glass Industry Group.

The rise of ride-sharing and subscription-based car services, particularly prominent in major metropolitan hubs, alters traditional car ownership models. For instance, in 2024, ride-sharing services facilitated billions of trips globally. This shift can lead to increased vehicle mileage and potentially faster wear and tear on components, indirectly boosting the automotive aftermarket, which is a key area for Fuyao's replacement glass business. Furthermore, evolving urban lifestyles often prioritize convenience and efficiency, shaping consumer preferences for vehicle features and types.

- Urban Population Growth: Expected to reach 68% by 2050, up from approximately 57% in 2023.

- Ride-Sharing Impact: Billions of trips facilitated annually globally, increasing vehicle utilization.

- Aftermarket Demand: Changing usage patterns can accelerate component replacement needs.

- Consumer Preferences: Lifestyles influence demand for specific vehicle types and features.

Corporate Social Responsibility and Brand Image

Societal expectations for robust corporate social responsibility (CSR) and ethical business practices significantly shape Fuyao Glass Industry Group's brand image and, consequently, consumer trust. Public scrutiny is high, and any perceived misstep can have lasting repercussions. For instance, in 2023, global consumer spending on ethically sourced products continued its upward trend, with reports indicating a significant portion of consumers willing to pay a premium for sustainable goods, directly impacting brand perception.

Allegations of labor exploitation, even when potentially linked to third-party contractors, can severely damage Fuyao's reputation. Such incidents, if not swiftly and transparently addressed, erode public confidence and can lead to boycotts or negative media coverage. A 2024 study by a leading consumer advocacy group found that 65% of consumers actively avoid brands with documented labor practice issues, regardless of direct employment status.

Fuyao's commitment to Environmental, Social, and Governance (ESG) principles and transparent governance is therefore paramount for cultivating and maintaining a positive public perception. By actively demonstrating adherence to these standards, Fuyao can mitigate reputational risks and build stronger stakeholder relationships. In their 2024 sustainability report, Fuyao highlighted a 15% reduction in waste generation and investments in employee training programs, aiming to bolster their ESG credentials.

- Brand Image Impact: Societal demand for ethical operations directly influences consumer trust and purchasing decisions, making CSR a critical business driver.

- Reputational Risk: Even indirect associations with labor exploitation can trigger significant negative publicity and consumer backlash, as evidenced by market research from 2024.

- ESG Importance: Fuyao's proactive embrace of ESG principles and transparent governance is essential for safeguarding and enhancing its public standing.

- Data-Driven Trust: Demonstrating tangible improvements, such as Fuyao's reported 2024 waste reduction efforts, reinforces credibility and builds investor and consumer confidence.

Societal expectations for enhanced vehicle safety are a major driver for Fuyao Glass. Consumers are increasingly prioritizing vehicles equipped with Advanced Driver-Assistance Systems (ADAS), which require specialized glass integration. By 2024, over 80% of new vehicles in North America were projected to include some form of ADAS, directly boosting demand for Fuyao's advanced glass solutions.

The growing trend of urbanization, with nearly 70% of the global population expected to live in urban areas by 2050, also impacts Fuyao. This demographic shift increases reliance on personal and shared mobility, influencing demand for both new vehicles and aftermarket parts, including replacement glass. Ride-sharing services alone facilitated billions of trips globally in 2024, increasing vehicle utilization and potential aftermarket needs.

Furthermore, evolving consumer preferences are leaning towards vehicles with larger glass surfaces, such as panoramic sunroofs and expansive windshields, driven by a desire for more immersive and technologically integrated driving experiences. The global automotive glass market, valued at approximately $22.9 billion in 2023, is set to grow, with these consumer tastes being a key catalyst.

Corporate social responsibility and ethical labor practices are critical for Fuyao's brand image. Public scrutiny means that any association with labor issues, even indirect, can severely damage reputation. A 2024 study indicated that 65% of consumers avoid brands with documented labor practice problems. Fuyao's commitment to ESG principles, demonstrated by initiatives like their reported 15% waste reduction in 2024, is vital for building trust.

Technological factors

The automotive sector's embrace of smart glass is accelerating, with innovations like electrochromic and augmented reality (AR) windshields becoming key features for improved safety and driver experience. Fuyao Glass Industry Group's commitment to research and development, including advanced B-pillar technologies and materials that reduce weight and boost energy efficiency, strategically places them to benefit from this significant market shift.

Fuyao Glass Industry Group is actively embracing Industry 4.0 principles, integrating automated manufacturing and intelligent processes to boost operational efficiency and product consistency. This strategic shift involves significant investment in smart factory technologies, including the Internet of Things (IoT) and advanced data analytics, to fine-tune production workflows.

By leveraging big data, Fuyao aims to reduce manufacturing costs and elevate the quality of its automotive glass products, a critical factor in the competitive global market. These technological advancements are not just about machinery; they also contribute to creating more skilled, high-value jobs within the company's operations.

For instance, in 2024, Fuyao reported a substantial increase in its investment in R&D and automation, with a particular focus on smart manufacturing initiatives. This commitment is expected to yield a projected 15% improvement in production line efficiency by the end of 2025, driven by real-time data monitoring and predictive maintenance.

The automotive industry's increasing focus on fuel efficiency and lower emissions is a significant technological driver. This trend directly impacts glass manufacturers like Fuyao Glass, pushing for the development of lightweight and eco-friendly materials. Manufacturers are aiming to reduce overall vehicle weight to meet stringent regulatory targets.

Fuyao's innovation in lightweight automotive glass plays a crucial role here. Their advanced glass solutions can potentially decrease vehicle weight by as much as 20%. This reduction in mass directly translates to improved fuel economy, a key selling point for consumers and a critical factor for automakers navigating environmental regulations.

For instance, by 2025, the U.S. Environmental Protection Agency (EPA) is targeting fleet-wide average fuel economy standards that encourage such material innovations. Fuyao's commitment to developing these lighter, yet durable, glass products positions them favorably to meet these evolving demands and support the automotive sector's sustainability goals.

Integration with Advanced Driver-Assistance Systems (ADAS)

Modern vehicles are increasingly equipped with Advanced Driver-Assistance Systems (ADAS), a trend that directly impacts automotive glass manufacturers like Fuyao Glass Industry Group. These sophisticated systems, which include features like adaptive cruise control, lane keeping assist, and automatic emergency braking, rely on specialized glass that integrates sensors and cameras. Fuyao must therefore produce high-precision glass that is not only structurally sound but also compatible with these complex electronic components, ensuring the accurate functioning of ADAS technologies.

The integration of ADAS necessitates advancements in glass manufacturing to accommodate embedded sensors, heating elements for camera clarity, and precise calibration requirements. For instance, windshields are now critical components for forward-facing cameras, demanding exceptionally flat surfaces and accurate optical properties. Fuyao's ability to meet these stringent technical specifications is crucial for the seamless operation of features like remote calibration, which allows for recalibration of ADAS sensors without requiring a visit to a specialized workshop, a growing consumer expectation.

- ADAS Market Growth: The global ADAS market was valued at approximately USD 30 billion in 2023 and is projected to reach over USD 70 billion by 2030, indicating a significant demand for compatible automotive glass.

- Sensor Integration: Windshields for ADAS-equipped vehicles often feature integrated sensor housings, requiring specialized manufacturing processes to ensure durability and precise alignment.

- Calibration Accuracy: The accuracy of ADAS functions is directly linked to the optical quality and flatness of the glass, with deviations potentially leading to system malfunctions.

- Fuyao's Investment: Fuyao has been investing in advanced manufacturing capabilities to produce laminated glass with integrated functionalities for ADAS, positioning itself to capture this growing market segment.

Research and Development Investment

Fuyao Glass Industry Group's commitment to research and development is crucial for staying ahead in the dynamic automotive glass sector. In 2023, the company channeled approximately 10% of its revenue into R&D initiatives. This investment is strategically directed towards pioneering new glass technologies and enhancing existing product lines to align with evolving automotive trends and consumer expectations.

The focus of Fuyao's R&D efforts in 2023 included:

- Development of lighter-weight glass solutions to improve vehicle fuel efficiency.

- Advancements in smart glass technology, incorporating features like variable tinting and integrated displays.

- Research into enhanced safety features, such as improved impact resistance and crack propagation control.

- Exploration of sustainable manufacturing processes and materials to reduce environmental impact.

Fuyao Glass is significantly investing in advanced manufacturing techniques aligned with Industry 4.0, aiming to boost efficiency and product quality through smart factory technologies like IoT and data analytics. The company's 2024 R&D investment, a substantial portion of revenue, focuses on smart manufacturing, targeting a 15% production efficiency gain by the end of 2025 through real-time monitoring and predictive maintenance.

The automotive industry's push for fuel efficiency and reduced emissions directly drives demand for Fuyao's lightweight glass solutions, potentially cutting vehicle weight by up to 20%. This innovation is critical for meeting stringent environmental regulations, such as those targeted by the EPA for 2025, enhancing vehicle fuel economy. Fuyao's strategic development of these lighter, durable materials positions them to meet evolving automotive sector demands for sustainability.

Fuyao is actively developing glass technologies that integrate with Advanced Driver-Assistance Systems (ADAS), which are becoming standard in modern vehicles. This requires high-precision glass manufacturing to accommodate sensors and cameras, ensuring the accurate functionality of features like adaptive cruise control and lane keeping assist. The global ADAS market's rapid growth, projected to exceed USD 70 billion by 2030, underscores the importance of Fuyao's investment in specialized glass production for this segment.

Legal factors

Fuyao Glass Industry Group navigates a complex international trade landscape, demanding strict adherence to import/export regulations, customs duties, and anti-dumping laws across its global operations. For instance, in 2023, the automotive glass sector faced increased scrutiny regarding trade practices, potentially impacting tariffs on components sourced from different regions. Failure to comply can lead to substantial financial penalties, trade embargoes, and severe reputational damage, as seen with other manufacturers facing sanctions in recent years.

Fuyao Glass Industry Group must strictly adhere to labor and employment laws in every country it operates. This includes compliance with minimum wage regulations, ensuring safe and fair working conditions, and verifying employment eligibility for all staff. Failure to do so can lead to significant legal penalties and damage to the company's reputation.

In the United States, recent federal investigations into Fuyao Glass America highlighted the risks associated with non-compliance. These investigations, focusing on allegations of labor exploitation and the employment of unauthorized workers, demonstrate the serious repercussions that can arise from lax adherence to labor laws. Such scrutiny can result in substantial fines and ongoing legal battles.

Fuyao Glass Industry Group operates under stringent product safety and quality regulations within the automotive sector. This demands extensive testing and certification for all its glass components, a crucial step to ensure compliance across global markets.

Failure to meet these exacting standards, such as those set by regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) in the US or European Union directives, can lead to costly product recalls and significant liabilities. For instance, in 2023, automotive recalls in the US alone impacted millions of vehicles, highlighting the financial and reputational risks associated with quality lapses.

Maintaining a reputation for high-quality, safe products is paramount for Fuyao. This commitment is not just about avoiding penalties but also about securing and retaining long-term contracts with major automakers who prioritize reliability and adherence to safety protocols.

Environmental Protection Laws and Regulations

Fuyao Glass Industry Group must diligently adhere to a complex web of environmental protection laws and regulations. These legal mandates cover critical areas such as air and water emissions standards, responsible waste management practices, and stringent pollution control measures. Failure to comply can result in significant fines and operational disruptions.

These legal obligations directly shape Fuyao's environmental strategy. For instance, the group's commitment to reducing carbon emissions, aiming for a significant reduction by 2030, is heavily influenced by evolving climate change legislation and international agreements. Similarly, efforts to increase recycling rates are driven by waste diversion mandates and the growing legal emphasis on circular economy principles.

- Emissions Standards: Fuyao must meet increasingly strict limits on greenhouse gases and other pollutants released from its manufacturing facilities, a trend expected to intensify through 2025.

- Waste Management: Regulations governing the disposal and recycling of industrial waste, including glass byproducts and chemicals, are a key legal consideration for Fuyao's operations.

- Pollution Control: Compliance with laws designed to prevent water contamination and manage hazardous materials is paramount to avoiding legal penalties and reputational damage.

- Sustainability Reporting: Growing legal requirements for transparent environmental, social, and governance (ESG) reporting mean Fuyao must accurately track and disclose its environmental performance.

Intellectual Property Rights Protection

Fuyao Glass Industry Group's commitment to safeguarding its intellectual property (IP) is paramount, especially considering substantial investments in innovative glass technologies. The company’s legal strategy must navigate patent, trademark, and trade secret laws to foster innovation while avoiding infringement on competitors' IP. In 2023, Fuyao reported significant R&D expenditure, underscoring the importance of IP protection to its competitive edge.

Legal frameworks governing IP directly influence Fuyao's ability to commercialize new products and maintain market exclusivity. Robust patent protection allows the company to recoup R&D costs and deter imitation, a critical factor in the highly competitive automotive and construction glass sectors. For instance, Fuyao actively manages a portfolio of patents related to advanced automotive glass features, contributing to its market leadership.

- Patent Protection: Fuyao holds numerous patents globally for its specialized glass manufacturing processes and product innovations, crucial for maintaining technological superiority.

- Trademark Enforcement: Protecting its brand identity, including logos and product names, is vital for market recognition and preventing counterfeit goods.

- Trade Secret Management: Safeguarding proprietary manufacturing techniques and formulas is essential to prevent competitors from gaining an unfair advantage.

- Global IP Landscape: Navigating diverse international IP laws is a continuous challenge and requires significant legal resources to ensure compliance and enforce rights across different jurisdictions.

Fuyao Glass Industry Group faces significant legal obligations concerning international trade, requiring adherence to import/export rules and anti-dumping laws, which can impact component sourcing and tariffs, as seen with increased scrutiny in the automotive glass sector in 2023.

Compliance with labor laws, including minimum wage and safe working conditions, is critical, with past US investigations into Fuyao Glass America highlighting severe repercussions of non-compliance, such as substantial fines.

Navigating product safety and quality regulations, like those from NHTSA, is essential, as evidenced by millions of vehicles affected by US automotive recalls in 2023, underscoring the financial risks of quality lapses.

Environmental laws dictate Fuyao's strategy, with evolving climate legislation influencing carbon emission reduction goals and waste diversion mandates driving recycling efforts.

Environmental factors

The intensifying global commitment to combating climate change and achieving carbon neutrality places considerable pressure on industrial manufacturers such as Fuyao Glass Industry Group. This necessitates a proactive approach to minimizing their environmental impact.

Fuyao has responded by establishing concrete environmental objectives. The company is working towards a 20% reduction in carbon emissions per unit of production by the close of 2024. Furthermore, Fuyao has set an ambitious goal to achieve 100% renewable energy consumption by 2025, a target supported by substantial investments in solar panel installations across its facilities.

Fuyao Glass Industry Group recognizes the paramount importance of robust waste management and recycling in the glass manufacturing sector. The company has actively implemented comprehensive waste recycling programs, demonstrating a strong commitment to environmental stewardship.

These initiatives have yielded impressive results, with Fuyao achieving a recycling rate of over 50% for its production waste on an annual basis. This commitment extends to future goals, as the company has set an ambitious target to increase raw material recycling to a remarkable 85% by the year 2025.

Water scarcity and pollution are significant environmental considerations for manufacturers like Fuyao Glass. The company acknowledges the need for responsible water management and robust pollution control. Fuyao has stated its commitment to maintaining good water quality and actively works to reduce its overall water consumption across its operations. This focus also extends to the responsible use of chemicals to prevent any potential pollution.

Sustainable Sourcing of Raw Materials

The environmental impact of raw material extraction, particularly for silica sand, a key component in glass manufacturing, is a growing concern for global industries. Fuyao Glass Industry Group's integrated production model, which spans from raw material procurement to finished automotive glass, necessitates a strong focus on sustainable sourcing to mitigate environmental degradation and secure a reliable supply chain. This commitment is crucial for maintaining operational continuity and adhering to evolving environmental regulations.

Fuyao's approach to sustainable sourcing involves careful selection of suppliers and engagement in practices that minimize ecological disruption. For instance, the company's vertical integration means it has greater control over the environmental footprint of its raw material inputs. By prioritizing responsible extraction and processing methods, Fuyao aims to reduce waste and conserve natural resources. This proactive stance is becoming increasingly important as global supply chains face scrutiny regarding their environmental impact.

The industry is witnessing a shift towards more circular economy principles, encouraging the reuse and recycling of materials. Fuyao's commitment to sustainability extends to exploring innovative ways to incorporate recycled glass cullet into its production processes, further reducing the demand for virgin raw materials. This strategy not only benefits the environment but also offers potential cost efficiencies.

In 2023, the global glass industry faced increased pressure to adopt greener manufacturing practices. Fuyao's efforts in sustainable sourcing are aligned with this trend, aiming to reduce its carbon footprint and enhance its reputation as an environmentally conscious manufacturer. The company's long-term strategy emphasizes the importance of balancing economic growth with ecological responsibility, particularly in its upstream operations.

Key aspects of Fuyao's sustainable sourcing initiatives include:

- Supplier Audits: Implementing rigorous environmental and social audits for raw material suppliers.

- Resource Efficiency: Optimizing the use of water and energy during extraction and processing.

- Waste Reduction: Minimizing waste generation throughout the raw material supply chain.

- Circular Economy Integration: Increasing the use of recycled materials, such as glass cullet, in production.

Energy Efficiency and Renewable Energy Adoption

Fuyao Glass Industry Group is actively addressing the environmental push towards energy efficiency and renewable energy. Their focus on reducing electrical consumption and improving compressor efficiency in 2024-2025 directly aligns with global sustainability trends, aiming to cut operational costs while minimizing their carbon footprint.

Investing in solar power represents a significant step in their renewable energy adoption strategy. For instance, by the end of 2024, Fuyao aimed to have installed a substantial capacity of solar panels across its manufacturing facilities, aiming to generate a notable percentage of their electricity needs from this clean source. This not only bolsters their environmental credentials but also offers long-term economic benefits through reduced reliance on grid electricity.

These initiatives are critical as regulatory bodies and consumer preferences increasingly favor companies with strong environmental, social, and governance (ESG) performance. Fuyao's proactive approach positions them favorably in a market where sustainability is becoming a key differentiator.

- Energy Efficiency Initiatives: Fuyao's commitment to reducing electrical consumption and enhancing compressor efficiency is a core part of their 2024-2025 environmental strategy.

- Renewable Energy Investment: The company is actively investing in solar power generation, aiming to integrate clean energy sources into its operational framework.

- Cost Savings and Sustainability: By adopting these greener practices, Fuyao expects to achieve significant operational cost savings and contribute to overall environmental sustainability.

- Market Alignment: These environmental actions are crucial for aligning with evolving market demands and regulatory expectations for corporate ESG responsibility.

Fuyao Glass Industry Group is actively responding to global environmental pressures by setting ambitious targets for carbon emission reduction and renewable energy adoption. The company aims for a 20% decrease in carbon emissions per production unit by the end of 2024 and plans to achieve 100% renewable energy consumption by 2025, backed by significant solar power investments.

Waste management is a key focus, with Fuyao implementing comprehensive recycling programs that resulted in over 50% production waste recycling in the past year. They are targeting an impressive 85% raw material recycling rate by 2025.

Water management and pollution control are also priorities, with Fuyao committed to responsible water usage and reducing consumption, alongside careful chemical management to prevent pollution.

Sustainable sourcing of raw materials, like silica sand, is crucial for Fuyao's integrated model, driving efforts to minimize ecological impact and ensure supply chain resilience. This includes supplier audits, resource efficiency, waste reduction, and circular economy integration.

| Environmental Initiative | Target Year | Current Status/Progress | Key Metric |

| Carbon Emission Reduction | 2024 | On track to achieve | 20% reduction per unit of production |

| Renewable Energy Consumption | 2025 | Significant investment in solar | 100% renewable energy |

| Production Waste Recycling | Ongoing | Achieved | Over 50% annual recycling rate |

| Raw Material Recycling | 2025 | Targeted | 85% recycling rate |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fuyao Glass Industry Group is built on comprehensive data from leading economic databases, official government publications detailing regulatory landscapes, and reputable industry-specific market research reports. These sources ensure a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors influencing the group.