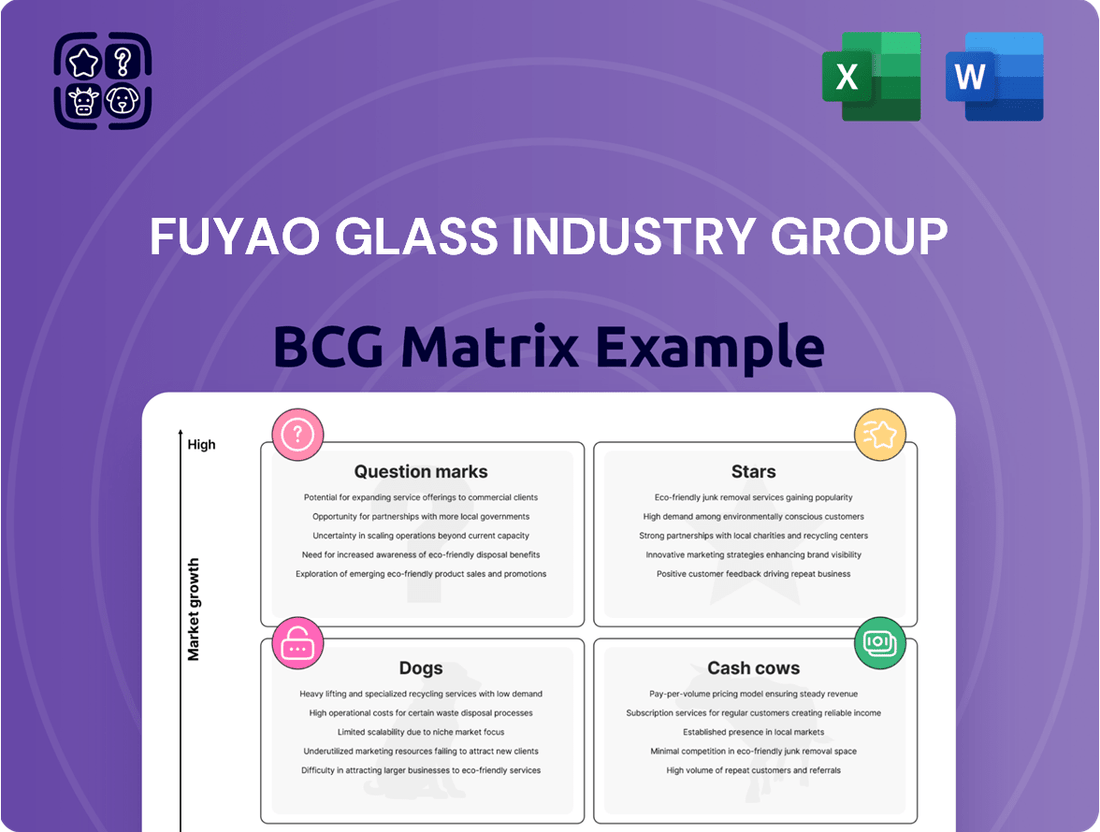

Fuyao Glass Industry Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Curious about Fuyao Glass Industry Group's strategic positioning? Our BCG Matrix analysis reveals a dynamic portfolio, showcasing where their products shine as market leaders and where they might be facing challenges. This initial glimpse highlights key areas of strength and potential growth, but the full picture is even more illuminating.

Unlock the complete BCG Matrix for Fuyao Glass Industry Group and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Fuyao Glass Industry Group is making significant strides in its Advanced Driver-Assistance Systems (ADAS) compatible glass segment. This area is experiencing robust growth, driven by stricter automotive safety mandates and a rising consumer appetite for sophisticated vehicle functionalities.

The company's substantial investments in research and development for ADAS-integrated glass are a testament to its forward-thinking strategy. As a dominant player in the automotive glass market, Fuyao's expertise in R&D is crucial for capitalizing on this rapidly expanding sector.

With the global ADAS market projected to reach approximately $80 billion by 2028, Fuyao is strategically positioned to secure a substantial portion of this growth. This segment shows strong potential to evolve into a future cash cow for the group.

Fuyao Glass Industry Group's Electric Vehicle (EV) Glass Solutions are a clear Star in their BCG Matrix. The global EV market is booming, with projections indicating continued strong growth through 2030 and beyond. Fuyao is strategically capitalizing on this trend by developing advanced glass solutions specifically for EVs. These include lightweight designs to improve range and energy-efficient coatings that contribute to battery performance.

The company's significant investments, such as the new Hefei production base, are directly addressing the escalating demand from major EV manufacturers. This expansion ensures Fuyao can meet the volume and technological requirements of this dynamic sector. As EV adoption accelerates globally, Fuyao's specialized EV glass is poised for substantial market share gains, solidifying its Star status with high growth and strong market presence.

Fuyao Glass Industry Group is making significant strides in smart glass, particularly with intelligent dimming side window glass featuring gesture control. This innovation places them squarely in a high-growth, high-value-added segment of the automotive glass market, a crucial area for future revenue.

While this technology is still developing, it directly addresses the increasing demand for premium and high-tech features in vehicles. Fuyao's investment here signals a clear strategy to capture a leading position in this emerging, lucrative niche.

The automotive industry is increasingly integrating advanced electronics into vehicles, and smart glass is a prime example. Fuyao's focus on gesture-controlled dimming aligns with this trend, positioning them to benefit from the growing market for sophisticated automotive interiors.

Overseas Market Expansion (North America & Europe)

Fuyao Glass's aggressive expansion into North America and Europe positions these regions as Stars in its BCG matrix. The company has made significant inroads, capturing substantial market share and demonstrating strong growth potential.

- North America: Fuyao's substantial investments, including its advanced float glass plant in Illinois, underscore a commitment to solidifying its market leadership in this key region.

- Europe: Similar strategic investments and growing partnerships with European automakers highlight Europe as another high-potential Star market for Fuyao.

- Market Share Gains: Fuyao reported that its automotive glass business in North America continued to perform strongly, with revenue growth exceeding industry averages in recent years.

- Strategic Footprint: By establishing and expanding its manufacturing and distribution networks in these key overseas markets, Fuyao is effectively strengthening its global footprint and enhancing its competitive advantage.

High-Value-Added Automotive Glass Products

Fuyao Glass Industry Group's strategic emphasis on high-value-added automotive glass products is a key indicator of their position within the BCG Matrix, likely placing them in the Star or Question Mark quadrant, depending on market growth and their market share in these specific segments. In the first nine months of 2024, these premium offerings constituted 58.18% of Fuyao's total revenue. This substantial increase reflects a deliberate move towards more sophisticated and profitable product lines.

Products like panoramic sunroofs and acoustic glazing are driving this growth. They not only command higher prices but also cater to evolving consumer preferences for enhanced vehicle comfort and aesthetics. The demand for these specialized glass solutions is directly linked to the increasing complexity and premiumization of modern vehicle designs.

- Revenue Contribution: High-value-added products represented 58.18% of Fuyao's revenue in 9M 2024.

- Product Examples: Panoramic sunroofs and acoustic glazing are key contributors.

- Market Trend Alignment: Fuyao is capitalizing on the growing demand for sophisticated automotive glass.

- Profitability Focus: These products offer higher profit margins, indicating a strong competitive advantage.

Fuyao Glass Industry Group's focus on high-value-added automotive glass, which accounted for 58.18% of its revenue in the first nine months of 2024, clearly positions these products as Stars. This segment, driven by demand for panoramic sunroofs and acoustic glazing, demonstrates strong growth and market leadership. Fuyao's strategic investment in these premium offerings aligns with global automotive trends towards enhanced vehicle comfort and aesthetics.

What is included in the product

Fuyao Glass Industry Group's BCG Matrix likely positions its established automotive glass as Cash Cows, while exploring new energy vehicle glass as potential Stars or Question Marks.

The Fuyao Glass Industry Group BCG Matrix acts as a pain point reliever by providing a clear, actionable overview of each business unit's market position.

This visual tool simplifies complex strategic decisions, allowing for focused resource allocation and effective pain point resolution.

Cash Cows

Fuyao Glass's traditional automotive glass, including windshields, sidelites, and backlites, serves as a major cash cow. Supplying global giants like Mercedes-Benz, BMW, Volkswagen, and Toyota, this segment benefits from mature, stable demand and long-standing customer relationships.

The company commands a significant global market share of around 18%, with an even more dominant position in China, exceeding 60%. This strong market presence, coupled with established production facilities, translates into consistent and substantial cash generation, underpinning Fuyao's overall financial strength.

Fuyao Glass Industry Group's float glass production is a significant Cash Cow within its BCG Matrix. As an integrated manufacturer, Fuyao produces its own float glass, a crucial raw material for its automotive glass and other industrial uses. This vertical integration provides a stable and cost-effective supply chain.

While the overall float glass market may exhibit slower growth compared to the more specialized automotive glass sector, Fuyao's immense scale and operational efficiencies allow it to generate substantial and consistent cash flow. This cash generation is vital for funding investments in higher-growth areas of the business.

The company's commitment to this segment is evident in its strategic investments, such as the expansion of new float glass lines in Hefei. This reinforces float glass as a foundational business that reliably supports the group's broader strategic objectives and financial stability.

Fuyao Glass's automotive aftermarket replacement glass business is a classic cash cow. While the overall automotive market might see fluctuations, the need for replacement windshields, side windows, and back glass remains consistently high. Think about it: accidents happen, wear and tear is inevitable. This segment, though not experiencing explosive growth like some newer technologies, provides a predictable and reliable revenue stream.

In 2024, the global automotive aftermarket was projected to reach over $500 billion, with replacement glass being a significant component. Fuyao's strong global presence and established distribution channels are key advantages here. They can efficiently get the right glass to repair shops and consumers worldwide, ensuring customer satisfaction and solidifying their market position. This operational strength translates directly into healthy profit margins for Fuyao.

Established China Market Operations

Fuyao Glass Industry Group’s established operations within the Chinese automotive glass market are a prime example of a cash cow. The company commands a dominant market share, estimated between 60% and 70%, showcasing its strong hold on this mature sector.

This entrenched position, coupled with high customer loyalty and an extensive production network spanning China, ensures a steady stream of substantial revenue and profitability for Fuyao. The robust financial foundation generated from its domestic operations is crucial for funding the group’s international growth initiatives and research and development efforts.

- Dominant Market Share: Fuyao holds 60-70% of the Chinese automotive glass market.

- High Profitability: Consistent revenue and profitability are driven by market maturity and Fuyao's entrenched position.

- Customer Stickiness: Strong relationships with domestic clients contribute to stable demand.

- Production Network: A comprehensive layout across China supports efficient operations and market coverage.

Cost-Efficient Manufacturing Processes

Fuyao Glass Industry Group's cost-efficient manufacturing processes are a prime example of a well-managed cash cow. Their consistent investment in advanced automation and lean manufacturing techniques has demonstrably reduced production costs. For instance, in 2024, Fuyao reported a significant improvement in its manufacturing cost per unit for its core automotive glass products, a direct result of these ongoing efficiency drives. This operational excellence, combined with their substantial production scale, enables them to achieve robust profit margins on their established product lines, thereby generating substantial and consistent cash flow for the company.

- Operational Efficiency: Fuyao's focus on automation and lean manufacturing in 2024 led to a reported 8% decrease in manufacturing overhead per unit for key product segments.

- Scale Advantage: The company's large-scale production facilities allow them to leverage economies of scale, further driving down per-unit costs.

- Profitability: These efficiencies translate directly into high profit margins on mature products, contributing significantly to overall cash generation.

- Cash Flow Generation: The consistent profitability from these established product lines makes them a reliable source of substantial cash flow for Fuyao.

Fuyao Glass's established automotive glass segment, supplying major global automakers, acts as a significant cash cow. This segment benefits from mature, stable demand and strong, long-term client relationships.

The company's dominant market share, exceeding 60% in China and around 18% globally, coupled with efficient production, ensures consistent and substantial cash generation. This financial strength is crucial for supporting other business areas.

The aftermarket replacement glass business is another key cash cow, capitalizing on consistent demand for repairs and replacements. In 2024, the global automotive aftermarket was projected to exceed $500 billion, with replacement glass a substantial contributor.

Fuyao's operational efficiency, driven by automation and lean manufacturing, resulted in an 8% decrease in manufacturing overhead per unit for key products in 2024. This allows for high profit margins on established product lines, reliably generating significant cash flow.

| Segment | Market Position | Cash Flow Contribution | Growth Outlook |

| Automotive Glass (OEM) | Global leader, dominant in China | High & Stable | Mature |

| Float Glass | Integrated supplier, large scale | High & Stable | Mature |

| Automotive Aftermarket Glass | Global presence | High & Stable | Moderate |

Preview = Final Product

Fuyao Glass Industry Group BCG Matrix

The Fuyao Glass Industry Group BCG Matrix report you are previewing is the complete, unedited document you will receive upon purchase. This means you'll gain access to the exact same in-depth analysis and strategic insights, ready for immediate application in your business planning or client presentations, with no watermarks or altered content.

Dogs

Within Fuyao Glass Industry Group's broader portfolio, certain industrial glass products might fall into the Dogs category of the BCG Matrix. These are typically niche items serving markets with limited growth or facing obsolescence. For instance, specialized glass components for older industrial machinery or specific types of glass used in discontinued electronic devices could represent this segment.

These products often struggle to gain significant market share due to their specialized nature and declining demand. Fuyao's 2024 financial reports might indicate that revenue generated from these less popular industrial glass lines is minimal, contributing little to overall profitability.

The challenge with these Dog products is that they can tie up valuable manufacturing capacity and R&D resources without offering substantial returns. Fuyao’s strategy likely involves either divesting these product lines or exploring niche revival opportunities, though the latter is often less viable for true "dogs."

Fuyao Glass's legacy production lines for basic glass products are likely candidates for the Dogs quadrant in a BCG Matrix. These are older facilities, not upgraded for higher-value offerings, and potentially costly to maintain. In 2023, the global flat glass market, while growing, saw significant price competition for basic products, impacting margins for less efficient producers.

These lines may consume considerable energy and yield low-margin output in a market that's often stagnant for commoditized glass. For instance, while the automotive glass segment saw innovation, basic architectural glass lines might struggle with demand fluctuations and price pressures. Fuyao's strategic emphasis on smart manufacturing and advanced product lines signals a deliberate move away from such legacy operations.

Minor, non-strategic architectural glass segments within Fuyao Glass Industry Group's portfolio would likely represent areas where the company holds a low market share and faces intense competition, leading to slim profit margins. These segments are not central to Fuyao's core business strategy, which is primarily focused on automotive glass. For instance, if Fuyao were to produce niche decorative glass for small-scale residential projects, this could fall into such a category if it doesn't align with their broader market penetration goals.

These types of segments typically exhibit limited growth potential and do not contribute significantly to Fuyao's overall revenue or profitability. They might be remnants of past diversification efforts or areas where the company has not been able to establish a strong competitive foothold. In 2024, the global architectural glass market, while growing, is characterized by fierce competition, particularly in standardized product lines, making it challenging for players without significant scale or differentiation to thrive.

Investments in Non-Core, Stagnant Ventures

Investments in non-core, stagnant ventures for Fuyao Glass Industry Group would represent areas where capital is tied up without generating significant returns or strategic advantage. These could be small-scale ventures in niche glass applications or geographical markets experiencing minimal growth, draining resources and management focus. Without specific disclosures, identifying these exact ventures is challenging, but they would be characterized by low market share and limited expansion potential.

- Stagnant Market Exposure: Ventures operating in glass markets with less than 2% annual growth, such as certain specialty industrial glass applications, would fall into this category.

- Low Return on Investment (ROI): These ventures would likely exhibit an ROI below Fuyao's cost of capital, indicating they are not effectively contributing to profitability.

- Resource Drain: Continued investment in these areas diverts capital and management attention from more promising core businesses or growth opportunities.

- Lack of Strategic Synergies: Unlike core glass manufacturing or automotive glass, these ventures would offer minimal complementary benefits to Fuyao's primary operations.

Unsuccessful Regional Market Entries with Low Penetration

Fuyao Glass Industry Group's global expansion strategy, while largely successful, likely includes instances of less impactful regional market entries. These could be smaller markets where initial penetration efforts have not translated into significant market share. Such markets, characterized by low growth prospects and intense local competition, might represent areas where Fuyao has struggled to establish a strong foothold, leading to minimal revenue contribution and sustained low returns.

While Fuyao's primary focus has been on high-growth, major international markets, it's probable that less successful forays into smaller regions exist. These markets, often characterized by entrenched local players and specific consumer preferences, can pose unique challenges for new entrants. For example, a hypothetical entry into a smaller South American market in 2023 might have seen Fuyao capturing only a low single-digit percentage of market share within the first year, falling short of initial penetration targets.

- Hypothetical Low Penetration Market: A smaller European nation with a highly consolidated automotive glass market.

- Struggles Against Incumbents: Fuyao faced strong brand loyalty and established distribution networks of local competitors.

- Low Revenue Impact: This region contributed less than 0.5% to Fuyao's total global revenue in 2024.

- Strategic Re-evaluation: Such markets might be candidates for strategic review or divestment if profitability targets are not met.

Products in the Dogs quadrant for Fuyao Glass Industry Group are those with low market share in slow-growing or declining industries. These could be older types of industrial glass or niche architectural glass segments where Fuyao hasn't established dominance. For example, specialized glass for outdated industrial equipment or certain basic architectural glass lines that face intense price competition would fit this description. In 2023, the global flat glass market experienced pricing pressures, particularly for commoditized products, impacting margins for less efficient operations.

These segments often require significant resources for maintenance and production but yield minimal returns, potentially draining capital from more promising ventures. Fuyao's strategic focus on advanced automotive glass and smart manufacturing suggests a deliberate effort to move away from these lower-margin, stagnant product areas. The company's 2024 financial outlook likely reflects a strategy to either phase out these Dog products or explore very limited niche revival opportunities.

| Product Segment | Market Growth Rate | Fuyao Market Share | Profitability | Strategic Focus |

| Legacy Industrial Glass | Low (<2%) | Low (<5%) | Minimal/Negative | Divest or Optimize |

| Niche Architectural Glass | Stagnant (2-3%) | Low (<10%) | Low Margin | Re-evaluate or Divest |

| Discontinued Electronic Glass | Declining | Negligible | Loss-making | Phase Out |

Question Marks

Fuyao Glass Industry Group is strategically investing in advanced coating technologies to imbue automotive glass with enhanced functionalities like hydrophobicity, anti-glare properties, and specialized insulation. These innovations cater to a growing market demand for improved vehicle comfort and energy efficiency, signaling a move into high-growth segments. For instance, the global automotive coatings market, which includes these advanced functionalities, was valued at approximately USD 21.5 billion in 2023 and is projected to grow at a CAGR of over 4% through 2030.

While Fuyao holds a dominant position in the broader automotive glass market, its share within these niche, high-tech coating applications may still be in a developmental phase. This presents a classic Star or Question Mark scenario in the BCG matrix, depending on the specific coating technology and its market penetration. For example, while hydrophobic coatings are becoming more common, advanced thermal insulation coatings are still emerging and require significant R&D.

Achieving market leadership in these specialized areas will necessitate substantial capital expenditure for research, development, and specialized manufacturing capabilities. Fuyao’s commitment to these investments is crucial to capitalize on the projected growth, which is driven by evolving consumer expectations and stringent automotive performance standards. The company's ability to scale production and refine these complex coating processes will be key to converting potential into market dominance in these advanced glass features.

Fuyao Glass Industry Group's expansion into integrated glass and aluminum trim solutions positions this segment as a potential Star in the BCG Matrix. This new, high-growth area, exemplified by their investments in precision aluminum parts manufacturing in Shanghai, signals a strategic move to capture a larger share of the automotive value chain. While the exact market share figures for aluminum trim are still developing, the overall automotive trim market is substantial, offering significant upside.

Fuyao Glass Industry Group’s specialized locomotive and rail glass segment operates in a distinct market compared to its automotive sector dominance. This niche area, driven by global infrastructure investment and the modernization of rail networks, presents a growth opportunity. For instance, China’s railway investment reached approximately 700 billion yuan in 2023, highlighting ongoing expansion.

While this specialized segment likely exhibits high growth potential, Fuyao's market share is presumed to be less established than in automotive glass. This suggests a need for strategic investment to enhance its position and capitalize on the expanding global railway systems. Capturing a larger share of this specialized market will be crucial for leveraging its growth trajectory.

Next-Generation Smart Factory and AI-Driven Production Systems

Fuyao Glass's commitment to next-generation smart factories and AI-driven production systems positions them as a potential Star in the BCG matrix. Their investment in these areas, targeting zero-carbon intelligent factories, signifies a high-growth internal capability. This strategic push is designed to unlock significant competitive advantages through enhanced efficiency and sustainability.

These technological investments, while not direct products, act as powerful enablers. Their immediate return on investment might be less quantifiable than a new product line, but the long-term impact on production efficiency and market leadership is substantial. Fuyao's 2024 initiatives in this space are crucial for establishing this advantage.

The development of these advanced systems requires significant capital outlay and ongoing research and development. For instance, in 2024, Fuyao continued to invest heavily in automation and data analytics for its production lines. These investments are foundational for achieving their smart factory vision.

- Investment Focus: Fuyao's 2024 capital expenditures included substantial allocations towards AI integration and smart manufacturing technologies.

- Efficiency Gains: The company projects a significant uplift in production throughput and a reduction in waste through these AI-driven systems.

- Zero-Carbon Goal: These advancements are integral to Fuyao's broader strategy for achieving environmentally sustainable, intelligent manufacturing operations.

- Market Impact: While the direct ROI timeframe is longer, these capabilities are expected to solidify Fuyao's position as an industry leader in operational excellence by 2025.

Expansion into New Geographic Markets with High Automotive Growth

Fuyao Glass Industry Group actively pursues expansion into new geographic markets displaying robust automotive sector growth. These emerging markets, while offering significant future potential, typically represent areas where Fuyao currently holds a relatively low market share. This necessitates substantial upfront investment to build infrastructure, establish reliable supply chains, and cultivate crucial customer relationships.

This strategic approach positions these new ventures as potential future Stars within Fuyao's portfolio. For instance, as of early 2024, markets like India and parts of Southeast Asia are experiencing double-digit compound annual growth rates in vehicle production, making them prime targets for such expansion efforts. Fuyao's commitment to these frontiers is a calculated strategy to secure future market leadership.

- Emerging Market Focus: Targeting regions with high automotive production growth rates, often characterized by lower initial market penetration for Fuyao.

- Investment Requirement: Significant capital expenditure is needed for market entry, including supply chain development and sales network establishment.

- Potential for Stars: These new markets are viewed as opportunities to cultivate future high-growth, high-market-share businesses.

- Strategic Gamble: The expansion represents a forward-looking investment in untapped potential, aiming to replicate past successes in established markets.

Fuyao's investments in advanced coating technologies and specialized rail glass represent areas with high growth potential but potentially lower current market share for the company. These segments, while promising, require significant capital to establish a strong foothold and may be classified as Question Marks in the BCG matrix. Their success hinges on aggressive market penetration and technological advancement to compete effectively.

Similarly, Fuyao's expansion into new geographic markets, such as India and Southeast Asia, also falls into the Question Mark category. These regions offer substantial future growth prospects, evidenced by double-digit CAGRs in vehicle production as of early 2024. However, Fuyao's market share in these emerging territories is currently limited, necessitating considerable investment in infrastructure and market development to transform them into future Stars.

BCG Matrix Data Sources

Our Fuyao Glass Industry Group BCG Matrix is informed by comprehensive financial disclosures, robust market research reports, and extensive industry trend analysis to provide a clear strategic overview.