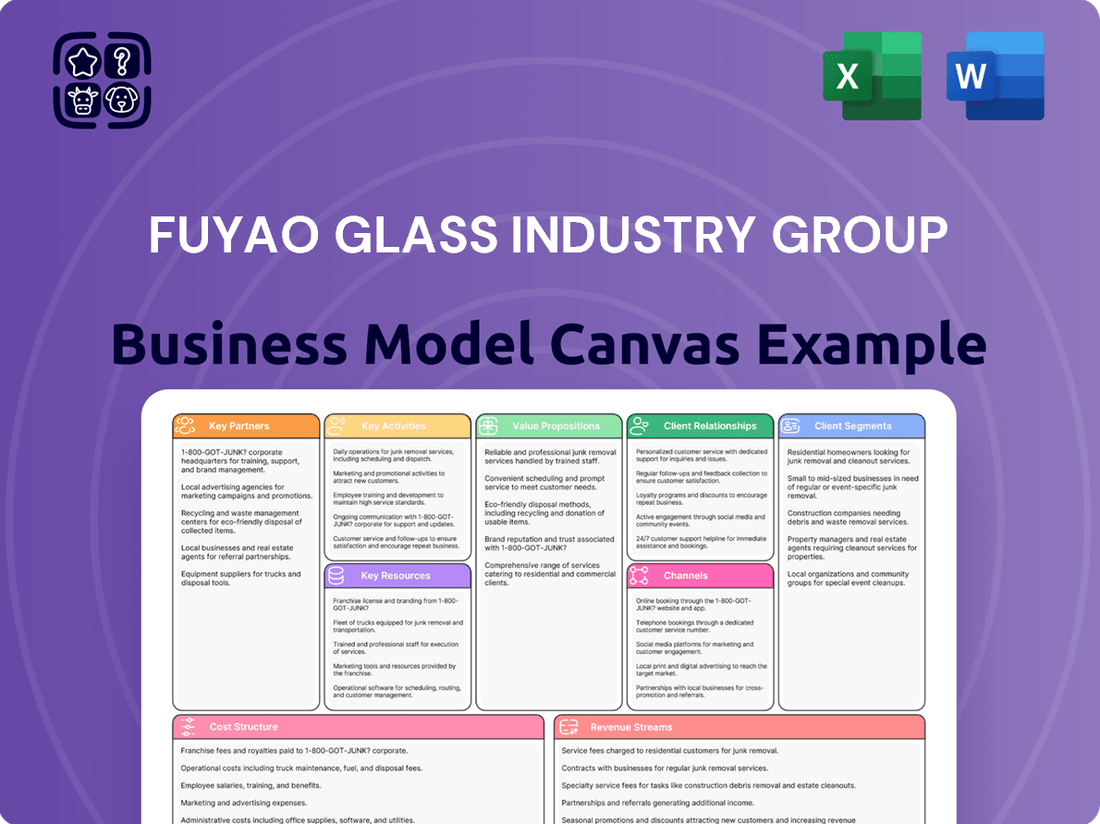

Fuyao Glass Industry Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Unlock the full strategic blueprint behind Fuyao Glass Industry Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Fuyao Glass Industry Group’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Fuyao Glass Industry Group operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Fuyao Glass Industry Group’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Fuyao Glass Industry Group. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Fuyao Glass Industry Group's key partnerships are with leading global automotive original equipment manufacturers (OEMs). These include prestigious brands such as Mercedes-Benz, BMW, Volkswagen, Toyota, Audi, General Motors, and Tesla, reflecting Fuyao's status as a critical supplier. These relationships are foundational to Fuyao's ability to provide high-quality automotive glass for new vehicle assembly lines.

The company actively cultivates these OEM relationships by developing detailed customer service operation manuals. This standardization of processes is designed to ensure consistent quality and elevate customer satisfaction across its major automotive partners. In 2023, Fuyao's revenue from the automotive sector was a significant portion of its total sales, underscoring the importance of these OEM collaborations.

Fuyao Glass Industry Group strategically partners with suppliers of crucial raw materials, including float glass and polyvinyl butyral (PVB). These partnerships are vital for maintaining the high quality and consistent production of their automotive and architectural glass products.

To ensure a stable supply chain and competitive pricing, Fuyao operates dedicated procurement departments within its international subsidiaries. This localized sourcing strategy allows them to tap into regional markets and respond effectively to demand fluctuations.

The company places a strong emphasis on supplier quality and reliability, conducting regular onsite reviews. These assessments help guarantee that raw materials meet Fuyao's stringent specifications and that deliveries are consistently on schedule, supporting efficient manufacturing operations.

Fuyao Glass Industry Group actively collaborates with research institutions and technology companies to drive innovation in advanced glass solutions. These partnerships are crucial for developing cutting-edge products such as lightweight, energy-efficient, smart dimming, and Heads-Up Display (HUD) glass, catering to evolving automotive and architectural demands.

With dedicated R&D centers strategically located in the U.S. and Germany, Fuyao leverages these facilities for intensive research and development efforts. The company also engages in collaborative co-development programs with universities, fostering a synergistic approach to technological advancement and knowledge sharing.

Logistics and Distribution Partners

Fuyao Glass leverages a critical network of logistics and distribution partners to ensure its global supply chain operates seamlessly. These relationships are fundamental for the prompt and economical delivery of automotive glass from its numerous manufacturing facilities to car makers’ assembly lines and the aftermarket sector across the globe. For instance, in 2024, Fuyao continued to optimize its shipping routes, a key factor in maintaining its competitive edge in a market where delivery speed directly impacts automotive production schedules.

The company's expansive distribution infrastructure is designed to significantly shorten lead times, a crucial advantage in the fast-paced automotive industry. This efficiency translates into better inventory management for Fuyao’s clients and reduces the risk of production stoppages due to parts shortages. Fuyao’s commitment to reliable logistics was evident in its 2024 performance, where it successfully navigated complex international shipping challenges, maintaining a high on-time delivery rate for its key automotive clients.

- Global Reach: Fuyao's logistics partners enable distribution across North America, Europe, and Asia, supporting its status as a leading automotive glass supplier.

- Cost Efficiency: Collaborations with freight forwarders and shipping companies are vital for managing transportation costs, particularly with fluctuating fuel prices impacting global trade in 2024.

- Reduced Lead Times: An optimized distribution network directly contributes to Fuyao’s ability to meet just-in-time delivery requirements for major automotive manufacturers.

Strategic Acquisition and Joint Venture Partners

Fuyao Glass Industry Group actively pursues strategic acquisitions and joint ventures to enhance its operational capabilities and broaden its market presence. A prime example is its significant acquisition of PPG Industries' automotive glass business, a move that substantially bolstered its global footprint and technological expertise.

These strategic alliances enable Fuyao to pursue vertical integration, securing key components and processes within its supply chain, or to diversify into complementary product areas such as aluminum trim. For instance, by integrating advanced manufacturing technologies acquired through partnerships, Fuyao can offer more sophisticated automotive glass solutions. This strategy directly strengthens its competitive standing in the automotive sector.

- Strategic Acquisitions: Past acquisitions, like the notable purchase of PPG's automotive glass operations, have been pivotal in expanding Fuyao's global reach and technological portfolio.

- Joint Ventures: Collaborations with other industry leaders allow for shared risk and accelerated market entry into new geographic regions or product segments.

- Vertical Integration: Partnerships facilitate the integration of upstream or downstream processes, such as securing raw material supply or developing advanced glass coatings.

- Product Line Expansion: Ventures into new product categories, like aluminum trim, diversify revenue streams and offer a more comprehensive solution to automotive manufacturers.

Fuyao Glass Industry Group's key partnerships extend to research institutions and technology firms, driving innovation in advanced glass solutions like smart dimming and HUD glass. These collaborations are crucial for developing next-generation products that meet evolving automotive and architectural demands.

The company's commitment to R&D is evident in its dedicated centers in the U.S. and Germany, complemented by university partnerships for synergistic technological advancement. These alliances enable Fuyao to stay at the forefront of glass technology, responding to market trends such as the increasing demand for lightweight and energy-efficient materials.

| Strategic Alliance Type | Focus Area | Impact on Fuyao |

| Research Institutions | Advanced Glass Solutions (e.g., HUD, Smart Dimming) | Product Innovation, Technological Edge |

| Technology Companies | New Material Development, Manufacturing Processes | Enhanced Product Performance, Operational Efficiency |

| Universities | Co-development Programs, Knowledge Sharing | Talent Acquisition, Cutting-edge Research Integration |

What is included in the product

Fuyao Glass Industry Group leverages a vertically integrated business model, focusing on mass production of automotive and architectural glass to a global customer base through direct sales and strategic partnerships.

This model emphasizes cost leadership and scale, supported by strong manufacturing capabilities and efficient supply chain management to deliver value to automotive OEMs and construction sectors.

Fuyao Glass Industry Group's Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of its complex operations, streamlining understanding for stakeholders and facilitating quick identification of strategic advantages.

Activities

Fuyao Glass Industry Group dedicates substantial resources to research and development, a cornerstone of its business model. In 2024, the company continued its strong commitment to advancing glass technologies, focusing on areas like lightweighting for improved vehicle efficiency and the development of smart glass for enhanced user experience.

This persistent investment in R&D is vital for Fuyao to stay ahead in the rapidly changing automotive sector, especially with the rise of electric and autonomous vehicles, which require specialized glass solutions. For instance, the demand for advanced functionalities like integrated sensors and displays in vehicle glass is a key driver for their innovation efforts.

Fuyao’s R&D pipeline is geared towards future mobility needs, encompassing everything from enhanced durability and safety features to integrated connectivity solutions within automotive glass. This proactive approach ensures they can meet the stringent requirements of global automakers for next-generation vehicles.

Fuyao Glass Industry Group's manufacturing and production activities are central to its business, focusing on the high-volume creation of automotive and architectural glass. This involves leveraging advanced automation and sophisticated lean manufacturing principles across its extensive global network of production facilities.

In 2024, Fuyao continued to emphasize operational efficiency, with its numerous modern plants strategically positioned worldwide to ensure consistent and substantial output. The company's commitment to advanced technology in its manufacturing processes allows for the production of high-quality glass products that meet stringent industry standards, supporting its position as a leading global supplier.

Fuyao Glass Industry Group’s key activity of quality control and assurance is paramount. They implement stringent measures, aligning with global benchmarks like ISO 9001 and IATF 16949, to guarantee product dependability and foster customer contentment. This dedication ensures their automotive glass meets the exacting standards of global manufacturers.

A significant outcome of this focus is a reduction in product defects, a crucial metric in the automotive supply chain. Fuyao’s commitment to excellence directly contributes to maintaining a high customer satisfaction rate, a testament to their reliable manufacturing processes. For instance, in 2023, Fuyao maintained a customer complaint rate below 0.05%, underscoring their effectiveness.

Global Sales and Distribution

Fuyao Glass manages a vast global sales and distribution network, a crucial activity for serving automotive original equipment manufacturers (OEMs) and aftermarket customers across the globe. This involves direct sales engagement with key clients and the intricate management of complex supply chains to ensure products reach their destinations efficiently.

Ensuring timely delivery across diverse geographical regions is paramount. This operational excellence underpins Fuyao's ability to maintain strong relationships with its automotive partners. For instance, in 2024, Fuyao continued to strengthen its presence in key markets by expanding its logistics capabilities, a move designed to reduce lead times and enhance customer satisfaction.

- Global OEM Relationships: Maintaining and expanding relationships with major automotive manufacturers worldwide, ensuring a steady demand for its products.

- Aftermarket Network Management: Developing and managing a robust network for supplying replacement glass to the automotive aftermarket sector, catering to a broader customer base.

- Supply Chain Optimization: Continuously improving logistics and supply chain operations to guarantee timely and cost-effective delivery of products to all global markets.

- Regional Distribution Hubs: Establishing and operating strategic distribution centers in key regions to facilitate efficient product flow and local market responsiveness.

Supply Chain Management

Fuyao Glass Industry Group’s supply chain management is central to its cost control and operational efficiency. This involves meticulously overseeing everything from acquiring raw materials like silica sand and soda ash to getting the final automotive glass products to customers worldwide. In 2023, the company's commitment to optimizing logistics contributed to its reported revenue of RMB 27.57 billion.

Key activities include rigorous supplier evaluation and negotiation to secure favorable terms for essential inputs, ensuring quality and competitive pricing. For instance, Fuyao Glass operates multiple production bases globally, necessitating sophisticated logistics to manage inventory and timely deliveries across different regions.

- Supplier Relationship Management: Building strong relationships with reliable suppliers of raw materials and components.

- Logistics and Distribution: Optimizing transportation routes and warehousing for efficient global delivery.

- Inventory Management: Maintaining appropriate stock levels to meet demand without incurring excessive holding costs.

- Quality Control: Ensuring that all sourced materials meet stringent quality standards.

Fuyao's key activities revolve around advanced research and development for next-generation glass, efficient high-volume manufacturing leveraging automation, and stringent quality control to meet global automotive standards. These are supported by a robust global sales and distribution network and optimized supply chain management.

| Key Activity | Description | 2023/2024 Impact/Data |

| Research & Development | Innovating glass technologies for automotive (lightweighting, smart glass) and architectural applications. | Focus on advanced functionalities for EVs and autonomous vehicles. |

| Manufacturing & Production | High-volume production of automotive and architectural glass using automation and lean principles. | Global network of modern plants ensuring efficient, high-quality output. |

| Quality Control | Implementing stringent measures (ISO 9001, IATF 16949) to ensure product dependability. | Maintained customer complaint rate below 0.05% in 2023. |

| Sales & Distribution | Managing global network for OEMs and aftermarket, ensuring timely delivery. | Expanded logistics capabilities in 2024 to reduce lead times. |

| Supply Chain Management | Overseeing raw material sourcing to final delivery, focusing on cost control. | Contributed to RMB 27.57 billion revenue in 2023 through optimized logistics. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Fuyao Glass Industry Group you are currently previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the comprehensive analysis you'll obtain. When you complete your order, you'll gain full access to this same detailed framework, ready for your strategic review and application.

Resources

Fuyao Glass operates cutting-edge manufacturing facilities worldwide, featuring extensive automation and smart production systems. These advanced plants are the backbone of their high-volume, premium-quality glass output, essential for meeting global automotive and architectural demands.

The group's investment in sophisticated technology, including robotic assembly and AI-driven quality control, allows for the efficient production of complex, specialized glass components. For instance, their 2023 revenue reached over 29.5 billion RMB, underscoring the scale and success driven by these technological capabilities.

These state-of-the-art facilities are not just about volume; they are crucial for Fuyao's innovation in developing advanced products like heated windshields and panoramic sunroofs, directly supporting their key partners in the automotive sector.

Fuyao Glass boasts a robust intellectual property portfolio, with a significant concentration of patents in cutting-edge areas such as autonomous vehicle glass, advanced computer vision integration, and specialized functionalities like heads-up displays and smart glass. This strong patent foundation is a core resource, protecting their innovative advancements and providing a competitive edge.

The company's commitment to research and development is evident in its network of R&D centers and its highly skilled engineering workforce. These centers are crucial for fostering continuous innovation, enabling Fuyao to develop differentiated products that meet evolving industry demands. For example, their investment in R&D supports the creation of lighter, stronger, and more technologically integrated glass solutions.

Fuyao Glass Industry Group's success hinges on its highly skilled workforce, encompassing engineers, technicians, and a seasoned management team. This expertise is critical for the complex processes of specialized glass manufacturing, cutting-edge research and development, and managing extensive global operations. In 2023, Fuyao continued its commitment to talent development, with significant investment allocated to employee training programs designed to instill stringent production standards directly into the workforce's skill sets.

Global Distribution Network and Customer Relationships

Fuyao Glass Industry Group's extensive global distribution network is a cornerstone of its business model. This network, built over decades, allows for efficient delivery of automotive glass to manufacturers across continents, ensuring Fuyao's products reach their markets seamlessly. This logistical prowess is a significant competitive advantage, enabling consistent supply and responsiveness to client needs.

Long-standing relationships with major automotive original equipment manufacturers (OEMs) worldwide are another vital intangible asset. These partnerships are cultivated through reliability, quality, and a deep understanding of OEM requirements. For instance, Fuyao is a key supplier to numerous global automotive giants, reflecting the trust and dependency built over years of collaboration. This ensures a steady stream of orders and provides valuable insights into future product development trends within the automotive sector.

The impact of this network and these relationships is evident in Fuyao's market penetration and consistent demand. As of the first half of 2024, Fuyao continued to solidify its position as a leading automotive glass supplier, with its global footprint enabling it to serve diverse and evolving automotive markets effectively. The company's ability to maintain strong ties with OEMs directly translates into predictable revenue streams and a stable demand base for its comprehensive range of automotive glass solutions.

- Global Reach: Fuyao operates manufacturing facilities and distribution centers in key automotive manufacturing hubs across North America, Europe, and Asia, enabling localized production and support for global OEMs.

- OEM Partnerships: Fuyao is a Tier 1 supplier to virtually every major automotive manufacturer globally, a testament to its product quality and supply chain reliability.

- Market Penetration: The established network facilitates deep penetration into both mature and emerging automotive markets, securing significant market share for Fuyao's automotive glass products.

- Demand Stability: These enduring relationships and widespread distribution channels contribute to a consistent and robust demand for Fuyao's offerings, mitigating the impact of regional market fluctuations.

Financial Capital

Fuyao Glass Industry Group's financial capital is a critical resource enabling its extensive global operations. This substantial financial backing is essential for financing large-scale manufacturing, investing in cutting-edge research and development, and funding significant capital expenditures for new plants and technology upgrades. Strategic acquisitions, which are key to expanding market reach and product portfolios, also heavily rely on robust financial resources.

Fuyao's financial strength is clearly demonstrated by its performance in 2024. The company reported robust revenue figures and healthy net profit margins, highlighting its financial stability and capacity to support its ambitious growth strategies. This strong financial footing allows Fuyao to navigate market fluctuations and pursue long-term investments.

- Revenue Growth: Fuyao Glass reported a significant year-over-year revenue increase in early 2024, driven by strong demand in the automotive sector.

- Profitability: The company maintained healthy profit margins throughout 2024, indicating efficient cost management and strong pricing power.

- Investment Capacity: Fuyao’s substantial cash flow from operations in 2024 provided ample capital for planned R&D and expansion projects.

- Debt Management: The group maintained a healthy debt-to-equity ratio in 2024, showcasing prudent financial management and access to diverse funding sources.

Fuyao Glass Industry Group's key resources are its advanced manufacturing facilities, extensive intellectual property, skilled workforce, global distribution network, strong OEM partnerships, and substantial financial capital. These elements collectively underpin its market leadership and competitive advantage in the automotive and architectural glass sectors.

The group's manufacturing prowess is supported by significant investments in automation and smart production systems. Its intellectual property portfolio protects innovations in areas like autonomous vehicle glass. A highly skilled workforce, from engineers to management, drives both production and R&D efforts. Fuyao's global reach, built on decades of strong OEM relationships, ensures consistent demand and market penetration.

Financially, Fuyao Glass demonstrated robust performance in early 2024, with notable revenue growth and maintained profitability. This financial strength allows for continued investment in R&D, expansion projects, and strategic acquisitions, reinforcing its position as a leading global glass manufacturer.

| Key Resource | Description | Supporting Data (2023/Early 2024) |

|---|---|---|

| Manufacturing Facilities | Cutting-edge, automated, and smart production systems globally. | 2023 Revenue: Over 29.5 billion RMB; Investment in advanced technology. |

| Intellectual Property | Patents in autonomous vehicle glass, computer vision, smart glass. | Focus on R&D for advanced glass solutions. |

| Skilled Workforce | Engineers, technicians, and experienced management; investment in training. | Significant allocation to employee training in 2023 for production standards. |

| Global Distribution & OEM Partnerships | Extensive network reaching key automotive hubs; Tier 1 supplier to major OEMs. | Strong market penetration in mature and emerging automotive markets; predictable revenue streams. |

| Financial Capital | Substantial backing for global operations, R&D, and expansion. | Robust revenue growth and healthy profit margins reported in early 2024; prudent debt management. |

Value Propositions

Fuyao Glass Industry Group delivers automotive glass that excels in quality and resilience, incorporating cutting-edge technologies. This includes features like heads-up display integration, dimmable glass, and lightweight construction, all designed to elevate vehicle performance and driver experience.

These advanced solutions directly benefit major Original Equipment Manufacturers (OEMs) by contributing to enhanced vehicle safety, improved fuel efficiency through lighter materials, and a more sophisticated user interface. For instance, the growing demand for advanced driver-assistance systems (ADAS) necessitates sophisticated glass integration, a key area for Fuyao.

In 2024, the global automotive glass market is projected to continue its growth, driven by increased vehicle production and the adoption of new automotive technologies. Fuyao's commitment to innovation positions it to capture a significant share of this expanding market, particularly as electric vehicles and autonomous driving features become more prevalent, requiring specialized glass functionalities.

Fuyao Glass Industry Group, as the world's largest automotive glass manufacturer, provides exceptional supply chain reliability. This is crucial for global automakers who depend on consistent, high-volume production. In 2023, Fuyao reported revenue of ¥27.3 billion (approximately $3.8 billion USD), underscoring its massive operational scale and ability to serve major clients.

The company's extensive global network of production facilities, spanning across Asia, Europe, and North America, ensures that automakers receive their glass components with reduced lead times. This geographical diversification is a key factor in mitigating supply chain disruptions, a critical concern for the automotive industry which saw production volumes rebound significantly in 2024, with global light vehicle production projected to reach over 90 million units.

Fuyao Glass achieves remarkable cost efficiencies through its extensive use of advanced automation and lean manufacturing processes. This operational excellence, combined with a strategy of vertical integration, particularly its self-supply of float glass, significantly lowers production expenses. For instance, in 2023, Fuyao reported a gross profit margin of 27.1%, demonstrating its ability to manage costs effectively.

This cost advantage translates directly into competitive pricing for its automotive glass products. By offering high-quality glass at attractive price points, Fuyao provides substantial economic benefits to its Original Equipment Manufacturer (OEM) customers. This pricing strategy has been a key factor in securing long-term supply agreements with major global automakers.

Customized Design and R&D Collaboration

Fuyao Glass Industry Group excels in providing highly customized automotive glass solutions, working hand-in-hand with manufacturers from the initial design stages. This deep collaboration ensures that each glass component precisely meets specific vehicle model requirements and aesthetic demands, fostering unique integrations.

This customer-centric R&D approach allows Fuyao to develop innovative glass features tailored to individual client needs. For instance, their partnerships often result in advanced functionalities like integrated antennas, heating elements, or sensor housings, directly embedded into the glass structure.

In 2024, Fuyao’s commitment to customized design was evident in its ongoing collaborations with major automotive OEMs. These partnerships are crucial for developing next-generation vehicle features, including advanced driver-assistance systems (ADAS) integration which requires precise glass specifications.

The benefits of this collaborative model are significant:

- Enhanced Vehicle Integration: Custom-designed glass fits seamlessly into vehicle architectures.

- Innovation & Differentiation: Fuyao helps clients create unique vehicle features through advanced glass technology.

- Reduced Development Cycles: Early R&D collaboration streamlines the integration of glass components into new models.

- Meeting Evolving Market Demands: Fuyao’s flexibility supports the industry's push for lighter, smarter, and more integrated automotive glass.

Commitment to Sustainability and Environmental Responsibility

Fuyao Glass Industry Group is deeply committed to sustainability, integrating eco-friendly manufacturing processes that minimize environmental impact. This dedication is evident in their ambitious carbon emission reduction targets and robust waste recycling initiatives, which are crucial for meeting evolving global environmental standards. For instance, in 2024, the company continued to invest in technologies aimed at reducing energy consumption per unit of production, a key metric in their sustainability reporting.

This strong environmental focus is a significant draw for automotive manufacturers who are increasingly prioritizing suppliers with verifiable green credentials. By adhering to and often exceeding international environmental benchmarks, Fuyao positions itself as a preferred partner for leading car brands seeking to enhance their own sustainability portfolios. This commitment directly supports their value proposition by ensuring compliance and fostering positive brand association in a market that values corporate responsibility.

Key aspects of Fuyao's sustainability commitment include:

Implementation of advanced energy-efficient technologies in production facilities.

Setting and tracking progress against specific carbon emission reduction goals.

Operating comprehensive waste recycling and material reuse programs across their operations.

Alignment with international environmental regulations and certifications.

Fuyao Glass Industry Group offers superior automotive glass with advanced features like HUD integration and lightweight design, enhancing vehicle performance and driver experience. Their commitment to quality and innovation is a core value for automotive manufacturers.

The company provides exceptional supply chain reliability as the world's largest automotive glass manufacturer, a critical factor for global automakers. In 2023, Fuyao reported revenue of ¥27.3 billion, underscoring their operational scale.

Fuyao Glass delivers cost efficiencies through automation and vertical integration, offering competitive pricing for high-quality products. This cost advantage is key to securing long-term supply agreements with major global automakers.

Fuyao excels in customized solutions, collaborating with manufacturers on unique glass features and advanced functionalities. This customer-centric approach streamlines development and meets evolving market demands for integrated automotive glass.

Fuyao Glass Industry Group is committed to sustainability, integrating eco-friendly processes and setting carbon emission reduction targets. This aligns with the growing demand from automakers for suppliers with strong environmental credentials.

| Value Proposition | Key Features | Customer Benefit | 2023 Data/2024 Outlook |

|---|---|---|---|

| Superior Quality & Innovation | HUD integration, dimmable glass, lightweight construction | Enhanced vehicle performance, driver experience, safety | Global automotive glass market growth driven by new tech |

| Supply Chain Reliability | World's largest manufacturer, global production network | Consistent, high-volume supply, reduced lead times | ¥27.3 billion revenue (2023); Global light vehicle production >90 million units (2024 projection) |

| Cost Efficiency & Competitive Pricing | Automation, vertical integration (float glass), lean manufacturing | Substantial economic benefits for OEMs | 27.1% gross profit margin (2023) |

| Customized Solutions & Collaboration | Co-development of unique glass features, integrated tech | Seamless vehicle integration, innovation, differentiation | Ongoing collaborations for next-gen vehicle features (ADAS) |

| Sustainability Commitment | Eco-friendly processes, carbon reduction targets, recycling | Preferred partner for brands valuing green credentials, regulatory compliance | Investment in energy-efficient technologies (2024) |

Customer Relationships

Fuyao Glass Industry Group cultivates enduring ties with its key Original Equipment Manufacturer (OEM) clients by assigning specialized account management teams. These teams focus on fostering trust and ensuring consistent collaboration, leading to relationships that frequently endure for twenty years or more.

This dedicated approach underlines Fuyao's commitment to long-term partnerships, moving beyond transactional exchanges to build genuine alliances. For instance, in 2023, Fuyao reported that over 80% of its revenue came from repeat customers, a testament to the success of its relationship-building strategy.

Fuyao Glass Industry Group provides robust technical support, working closely with automakers to ensure seamless integration of its glass products into vehicle designs. This collaborative approach extends to joint research and development efforts, allowing for the customization of glass to meet precise performance specifications, such as enhanced acoustic insulation or improved thermal efficiency.

In 2024, Fuyao Glass continued to invest heavily in R&D, with reported expenditures aimed at developing next-generation automotive glass technologies. This commitment to innovation, often in partnership with leading automotive manufacturers, helps solidify its position as a key supplier by addressing evolving demands for lightweight, durable, and technologically advanced glass solutions.

Fuyao Glass Industry Group prioritizes exceptional customer relationships through robust service and quality assurance programs. They maintain quick response times and implement stringent quality control across all operations, ensuring a high standard for their automotive glass products.

To further enhance client satisfaction, Fuyao develops detailed customer service operation manuals specifically for their major Original Equipment Manufacturer (OEM) partners. This proactive approach allows for prompt issue resolution and a consistently positive customer experience.

In 2024, Fuyao reported a significant emphasis on these customer-centric initiatives, with investments aimed at refining service delivery and quality assurance protocols. This dedication is reflected in their ongoing efforts to meet and exceed the evolving demands of the global automotive industry.

Supplier-Customer Integration

Fuyao Glass integrates deeply into its customers' supply chains by strategically placing production facilities near key clients. This proximity is crucial for operational efficiency. For instance, Fuyao's global presence, with manufacturing plants in China, the United States, and Europe, allows for localized production to serve major automotive manufacturers directly.

This close integration yields significant benefits. By minimizing transportation distances, Fuyao effectively reduces logistics expenses and ensures prompt delivery of its glass products and related services. This operational synergy fosters robust and reliable relationships with its customer base, a cornerstone of its business model.

- Geographical Proximity: Production sites are strategically located near major automotive manufacturers, reducing transit times and costs.

- Supply Chain Integration: Fuyao becomes an integral part of the customer's production process, enabling just-in-time delivery.

- Cost Reduction: Lower logistics expenses directly contribute to competitive pricing and improved profitability.

- Enhanced Service Delivery: Timely delivery and responsive service strengthen customer loyalty and operational partnerships.

Aftermarket Support

Fuyao Glass Industry Group extends its reach beyond original equipment manufacturer (OEM) supply by actively engaging with the automotive aftermarket. This strategic move allows Fuyao to cater to a broader customer segment, including independent repair shops and individual vehicle owners seeking replacement glass. By offering a comprehensive range of replacement parts and associated services, Fuyao cultivates sustained relationships with its customer base long after the initial vehicle sale.

This aftermarket presence is crucial for Fuyao's customer retention and revenue diversification. It ensures a consistent demand for their products and services, even as new vehicle sales fluctuate. In 2024, the global automotive aftermarket was projected to reach significant figures, with replacement glass being a substantial component, highlighting the economic importance of this sector for companies like Fuyao.

- Aftermarket Reach Fuyao supplies replacement automotive glass, serving independent repair networks and end-customers.

- Customer Engagement This segment fosters ongoing relationships with vehicle owners and the repair industry.

- Market Size (2024 Projection) The global automotive aftermarket, including glass replacement, represented a multi-billion dollar market opportunity.

- Revenue Diversification Aftermarket sales provide a stable revenue stream independent of new vehicle production cycles.

Fuyao Glass Industry Group fosters deep customer relationships through dedicated account management and proactive technical support, often leading to partnerships lasting two decades or more. Its commitment to collaborative R&D ensures glass solutions are precisely tailored to automotive manufacturers' evolving needs, a strategy reinforced by significant 2024 R&D investments in next-generation technologies.

By strategically locating production facilities near key clients and integrating into their supply chains, Fuyao ensures efficient, just-in-time delivery, reducing logistics costs and bolstering reliability. This operational synergy, coupled with a strong aftermarket presence serving repair shops and vehicle owners, diversifies revenue and sustains customer engagement beyond initial vehicle sales.

| Customer Relationship Aspect | Description | Key Impact | 2023/2024 Data Point |

| OEM Account Management | Specialized teams dedicated to long-term OEM partnerships. | High customer retention and trust. | Over 80% of 2023 revenue from repeat customers. |

| Technical & R&D Collaboration | Joint development for customized glass solutions. | Meeting precise performance needs and driving innovation. | Continued heavy investment in R&D for advanced glass in 2024. |

| Supply Chain Proximity | Global manufacturing sites near key automotive hubs. | Reduced logistics costs and prompt delivery. | Facilities across China, US, and Europe serving localized needs. |

| Aftermarket Engagement | Supplying replacement glass to repair networks and owners. | Revenue diversification and sustained customer lifecycle engagement. | Targeting the significant global automotive aftermarket in 2024. |

Channels

Fuyao Glass Industry Group’s primary sales channel involves direct engagement with major global automotive original equipment manufacturers (OEMs). This direct approach allows for the negotiation of terms, the establishment of long-term supply agreements, and the seamless integration of Fuyao's products into new vehicle production lines. For instance, in 2023, Fuyao reported that approximately 70% of its revenue stemmed from supplying automotive glass to OEMs, highlighting the critical importance of this channel.

Fuyao Glass Industry Group operates a robust global manufacturing and distribution network. This network includes state-of-the-art production facilities and strategically positioned distribution centers throughout China, the United States, Europe, and other key international markets.

These strategically located hubs are crucial for optimizing logistics and ensuring prompt delivery of automotive glass products to a broad customer base worldwide. The company’s commitment to an extensive global footprint enhances its ability to serve diverse market demands efficiently.

In 2024, Fuyao continued to expand its international presence, with a significant portion of its revenue generated from overseas markets. For instance, its North American operations are a substantial contributor, reflecting the importance of its U.S. manufacturing and distribution capabilities.

The group’s efficient supply chain management, supported by these numerous hubs, allows for a competitive edge in the global automotive aftermarket and OEM sectors. This integrated approach to manufacturing and distribution is a cornerstone of Fuyao’s business model, ensuring consistent product availability and customer satisfaction across all operating regions.

Fuyao Glass Industry Group leverages extensive aftermarket distribution networks to ensure its replacement automotive glass is readily available. These channels primarily consist of independent distributors and large repair shop chains, reaching both professional installers and, in some cases, directly to consumers seeking repairs.

This multi-faceted approach guarantees that Fuyao's products are accessible for the ongoing maintenance and repair needs of vehicles worldwide. By working with established partners, Fuyao benefits from their existing customer bases and logistical capabilities, streamlining product delivery and market penetration.

In 2024, the global automotive aftermarket was projected to reach hundreds of billions of dollars, a significant portion of which is driven by replacement parts like automotive glass, highlighting the critical importance of efficient distribution for companies like Fuyao.

Online Presence and Investor Relations Portals

Fuyao Glass Industry Group leverages its official website and dedicated investor relations portals as crucial informational channels. While not a direct sales avenue for bulk glass, these platforms are vital for transparent communication with stakeholders, including individual investors, financial professionals, and academic researchers. They provide access to essential company data, periodic reports, and updates, fostering an informed stakeholder base.

These digital presences are key to building trust and facilitating engagement. For instance, in 2023, Fuyao Glass reported revenues of RMB 27.1 billion, with detailed financial statements and annual reports readily available on these portals. This accessibility is critical for financial analysts and strategists seeking to perform valuations, such as discounted cash flow (DCF) analyses, and understand the company's performance.

- Website as Information Hub: Fuyao's official website serves as a central repository for corporate information, product details, and news releases, crucial for market analysis.

- Investor Relations Portals: These platforms provide direct access to financial reports, shareholder information, and corporate governance documents, vital for investors and financial professionals.

- Transparency and Trust: By offering comprehensive and easily accessible data, Fuyao enhances transparency, building trust with its diverse stakeholder groups.

- Stakeholder Engagement: These channels facilitate communication, enabling investors and other interested parties to stay updated on the company's strategic direction and financial health.

Industry Trade Shows and Conferences

Fuyao Glass Industry Group actively participates in key industry events like the Automotive Aftermarket Products Expo (AAPEX) and the China International Glass Industrial Technical Exhibition. These platforms are crucial for unveiling their latest advancements in automotive glass technology, such as enhanced acoustic and lightweight solutions. In 2024, Fuyao's presence at these shows aimed to solidify partnerships and attract new business by demonstrating their commitment to innovation and quality.

These trade shows are vital for lead generation, enabling Fuyao to connect directly with potential automotive manufacturers, Tier 1 suppliers, and distributors. The company uses these opportunities to foster relationships and understand emerging market demands. For instance, their exhibits often highlight advanced driver-assistance systems (ADAS) compatible glass, a growing segment in the automotive industry.

Fuyao's brand leadership is reinforced by showcasing their comprehensive product portfolio and technological capabilities. Their consistent participation in these high-profile events signals stability and expertise to industry peers and customers alike. This strategy directly contributes to market visibility and strengthens their competitive positioning globally.

- Product Showcase: Displaying new automotive glass innovations and technologies.

- Networking Opportunities: Connecting with potential clients, partners, and industry influencers.

- Brand Reinforcement: Demonstrating market leadership and commitment to quality.

- Lead Generation: Identifying and cultivating new business opportunities.

- Market Intelligence: Gathering insights into industry trends and customer needs.

Fuyao Glass Industry Group's channels are multi-faceted, focusing on direct OEM supply, extensive aftermarket distribution, and digital engagement. This comprehensive approach ensures broad market coverage and robust stakeholder communication.

The company's direct sales to automotive OEMs remain its cornerstone, accounting for a significant majority of its revenue, as seen in 2023 where approximately 70% of sales came from this channel. This direct engagement allows for tailored solutions and long-term supply agreements, integrating Fuyao's products directly into new vehicle manufacturing processes. Its global manufacturing and distribution network, with hubs in China, the US, and Europe, supports timely delivery to these critical clients. In 2024, international markets, particularly North America, continued to be substantial revenue generators, underscoring the importance of this distributed infrastructure.

Fuyao also maintains a strong presence in the aftermarket through a wide network of independent distributors and repair chains, ensuring its replacement glass is readily available. This channel is vital given the size of the global automotive aftermarket, projected to be in the hundreds of billions of dollars in 2024. Complementing these physical channels, Fuyao utilizes its official website and investor relations portals for transparent communication, providing essential data for financial analysis and stakeholder engagement. Participation in industry events like AAPEX further bolsters its market visibility, showcasing technological advancements and fostering new business relationships.

| Channel | Primary Focus | Key Activities/Benefits | 2023/2024 Data Point |

| Direct OEM Sales | New Vehicle Manufacturing | Long-term agreements, product integration, direct negotiation | Approx. 70% of 2023 revenue from OEMs |

| Aftermarket Distribution | Vehicle Repair & Maintenance | Independent distributors, repair chains, product accessibility | Global aftermarket projected in hundreds of billions (2024) |

| Digital Channels (Website/IR) | Stakeholder Communication & Information | Financial reports, corporate data, transparency, trust building | RMB 27.1 billion in 2023 revenue detailed on portals |

| Industry Events | Brand Building & Lead Generation | Product showcases, networking, market intelligence, partnerships | Active participation in AAPEX and China International Glass Exhibition (2024) |

Customer Segments

Fuyao Glass Industry Group's primary customer base consists of major global automotive Original Equipment Manufacturers (OEMs). This segment includes industry titans like Volkswagen, Toyota, General Motors, and Tesla, who rely on Fuyao for the high-volume, high-quality, and technologically sophisticated glass needed for new vehicle production.

These OEMs demand advanced features such as integrated sensors, acoustic insulation, and lightweight materials, which Fuyao consistently delivers. For instance, in 2023, the global automotive market saw over 78 million new vehicles produced, with Fuyao securing significant supply contracts across many of these manufacturers.

Fuyao's ability to meet stringent OEM specifications for safety, durability, and aesthetics, including advanced driver-assistance systems (ADAS) integration, solidifies its position as a critical partner. This segment represents the bulk of Fuyao's revenue, demonstrating the group's deep integration into the global automotive supply chain.

Electric vehicle (EV) manufacturers represent a crucial and rapidly expanding customer segment for Fuyao Glass. These OEMs require advanced glass solutions that are not only lightweight and energy-efficient to maximize EV range but also incorporate smart features to enhance the user experience. Fuyao's strategic focus on this area is evident in its development of specialized products like panoramic sunroofs, designed to meet the unique aesthetic and functional demands of electric vehicle design.

Fuyao Glass extends its expertise beyond vehicles to cater to a broad spectrum of industrial applications. This encompasses manufacturers of household appliances, where durable and aesthetically pleasing glass is crucial, and the construction sector, requiring specialized glass for buildings and infrastructure.

Further segmentation within industrial users includes producers of electronic devices and specialized equipment needing precise glass components. In 2023, the industrial glass market saw significant growth, with global demand driven by these diverse manufacturing sectors, reflecting a robust need for Fuyao's specialized offerings.

Automotive Aftermarket Distributors and Retailers

Fuyao Glass Industry Group serves a critical customer segment comprising automotive aftermarket distributors and retailers. These businesses are the backbone of vehicle repair and maintenance, stocking and selling replacement automotive glass. Fuyao’s extensive product line, encompassing both standard and specialized glass, directly addresses the diverse needs of this segment, ensuring availability for a wide array of vehicle makes and models.

The aftermarket demand for automotive glass remains robust. For example, in 2024, the global automotive aftermarket sector, which includes glass replacement, is projected to continue its growth trajectory, driven by an aging vehicle population and increased mileage. Fuyao's ability to supply high-quality, reliable glass products makes them an indispensable partner for these distributors and retailers.

- Key Value Proposition: Fuyao offers a comprehensive catalog of replacement automotive glass, including windshields, side windows, and rear windows, often meeting or exceeding original equipment manufacturer (OEM) specifications.

- Distribution Channels: They partner with national and regional distributors, as well as independent repair shops and large retail chains, to ensure broad market reach.

- Market Focus: This segment caters to the ongoing need for vehicle upkeep and repair, representing a stable and significant revenue stream for Fuyao.

- Data Point: The automotive glass replacement market alone is a multi-billion dollar industry, with significant portions of sales occurring through these aftermarket channels.

Specialized Industrial Clients

Fuyao Glass Industry Group serves specialized industrial clients who demand unique, high-tech glass applications. This niche segment moves beyond standard automotive or architectural glass, focusing on sectors with highly specific technical requirements, such as advanced transportation or specialized manufacturing equipment. For instance, Fuyao's research and development prowess enables them to engineer glass solutions for applications like high-speed rail windows, which require specific thermal, acoustic, and impact resistance properties.

These clients often collaborate closely with Fuyao's technical teams to co-develop custom glass formulations and designs. This partnership approach leverages Fuyao's extensive R&D capabilities, demonstrated by their consistent investment in innovation. In 2024, Fuyao continued to allocate significant resources towards developing next-generation glass technologies, including those with enhanced durability and specialized functionalities for emerging industries.

- Customization Expertise Fuyao excels in tailoring glass for specific industrial needs, moving beyond mass production.

- R&D Driven Solutions The company's commitment to research allows it to engineer advanced glass for demanding sectors like rail.

- High-Tech Applications Serving clients in areas requiring specialized performance characteristics, such as extreme temperature resistance or advanced optical properties.

- Collaborative Development Working directly with clients to create bespoke glass products that meet stringent technical specifications.

Fuyao Glass Industry Group's customer base is diverse, primarily centered around global Original Equipment Manufacturers (OEMs) in the automotive sector, including major players like Volkswagen and Toyota. This segment demands high-volume, technologically advanced glass for new vehicle production, with Fuyao consistently meeting stringent specifications for safety and integrated features.

A significant and growing segment for Fuyao is electric vehicle (EV) manufacturers, who require lightweight, energy-efficient, and smart glass solutions. Beyond automotive, Fuyao also serves industrial clients in household appliances and construction, alongside specialized industrial users needing custom, high-tech glass for applications like high-speed rail.

The automotive aftermarket is another key segment, with distributors and retailers relying on Fuyao for replacement glass to meet the ongoing needs of vehicle repair and maintenance. This segment benefits from Fuyao's extensive product catalog and commitment to quality, ensuring broad availability for a wide range of vehicles.

Cost Structure

Raw material expenses represent a substantial component of Fuyao Glass Industry Group's cost structure, with float glass and polyvinyl butyral (PVB) being the primary inputs.

The cost of these essential materials is sensitive to global commodity market dynamics; for instance, natural gas prices, crucial for float glass manufacturing, and soda ash costs can significantly influence overall production expenses.

In 2024, the volatility in energy markets, including natural gas, directly translated into higher raw material procurement costs for Fuyao, impacting their margins.

For example, a noticeable uptick in global energy prices during the first half of 2024 led to an estimated 5-7% increase in the cost of float glass for Fuyao compared to the previous year.

Manufacturing and production costs are a significant part of Fuyao Glass Industry Group's operations. These include the wages for their large workforce, the substantial energy needed to power their extensive facilities, and other direct factory expenses. For instance, in 2023, Fuyao reported that its cost of sales, which includes these manufacturing expenses, was RMB 27.7 billion.

Fuyao actively works to manage these expenditures. A key strategy is the ongoing investment in automation and the adoption of lean manufacturing principles. These initiatives are designed to streamline processes, reduce waste, and ultimately keep these essential production costs in check. This focus on efficiency is crucial for maintaining competitiveness in the global automotive glass market.

Research and Development (R&D) is a significant component of Fuyao Glass Industry Group's cost structure, crucial for maintaining its competitive edge. This investment fuels the development of new technologies and innovative products, ensuring the company remains at the forefront of the automotive glass industry. In 2023, Fuyao Glass demonstrated its dedication to innovation by allocating approximately 10% of its annual revenue specifically to R&D activities.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Fuyao Glass Industry Group encompass a broad range of operational costs. These include marketing and sales efforts to reach global markets, salaries for administrative staff, and general overhead like office supplies and utilities essential for managing their worldwide business.

Fuyao Glass has actively pursued strategies to streamline these costs. For instance, in 2023, the company focused on optimizing its sales network and administrative structures to enhance efficiency and reduce expenditure. This proactive approach aims to improve profitability by controlling indirect operational spending.

- Sales and Marketing: Costs associated with promoting Fuyao's automotive and architectural glass products globally.

- Administrative Salaries: Compensation for management, HR, finance, and other support staff.

- Office Expenses: Rent, utilities, supplies, and IT infrastructure for Fuyao's corporate offices worldwide.

- Overhead Costs: Other indirect expenses necessary for smooth global operations and compliance.

Capital Expenditure (CapEx)

Fuyao Glass Industry Group's capital expenditure is substantial, reflecting the capital-intensive nature of automotive glass manufacturing. Significant investments are necessary for establishing new production facilities, expanding current operations, and continuously upgrading machinery and technology to maintain a competitive edge. These expenditures are crucial for scaling production and incorporating advanced manufacturing processes.

In recent years, Fuyao has committed billions of dollars to new plant construction and capacity enhancements. These investments include major projects in both China and the United States, demonstrating a strategic global expansion. For instance, their North American operations have seen considerable CapEx to bolster local production capabilities and better serve major automotive clients.

- New Plant Construction: Fuyao frequently invests in building entirely new manufacturing sites to increase overall production capacity and enter new geographical markets.

- Facility Expansion: Existing plants are regularly expanded to accommodate higher production volumes and integrate new product lines or technologies.

- Machinery and Technology Upgrades: Continuous investment in state-of-the-art machinery, automation, and advanced manufacturing technologies is essential for efficiency and quality improvement.

- Global Investment: Recent CapEx figures highlight significant outlays for projects in key markets, such as the substantial investments made in their U.S. facilities to support North American automotive production.

Fuyao's cost structure is dominated by raw materials like float glass and PVB, with their costs influenced by global commodity markets, particularly energy prices. Manufacturing and production expenses, including labor and energy, are also substantial. These costs were reflected in their 2023 cost of sales, which reached RMB 27.7 billion.

Investment in R&D is a significant cost, with Fuyao allocating about 10% of its revenue to innovation, as seen in 2023. Selling, General, and Administrative (SG&A) expenses cover global marketing, salaries, and overhead, with efforts made to streamline these in 2023.

| Cost Category | Key Components | 2023 Impact (Illustrative) | 2024 Trend (Illustrative) |

|---|---|---|---|

| Raw Materials | Float Glass, PVB | RMB 10-12 billion (estimated) | Increased by 5-7% due to energy costs |

| Manufacturing & Production | Labor, Energy, Factory Overhead | RMB 15-17 billion (estimated) | Managed through automation |

| R&D | New Technology Development | ~10% of Revenue (approx. RMB 2.5-3 billion) | Continued investment |

| SG&A | Sales, Marketing, Admin Salaries, Office Expenses | RMB 4-5 billion (estimated) | Focus on optimization |

Revenue Streams

Fuyao Glass's primary revenue driver is the sale of automotive glass to Original Equipment Manufacturers (OEMs), making up around 85% of its total income. This significant portion comes from supplying essential components like windshields, sidelites, backlites, and sunroofs for new vehicles being manufactured globally.

The company offers a diverse range of products within this OEM segment, catering to both standard automotive needs and more advanced, high-value-added glass solutions. Examples include sophisticated intelligent panoramic sunroof glass and specialized glass for Heads-Up Displays (HUDs), which enhance vehicle functionality and appeal.

Fuyao Glass Industry Group primarily generates revenue through the sale of float glass products. While a significant portion of this float glass is utilized internally for its automotive glass manufacturing operations, the company also strategically sells a portion to external customers.

This external sales channel contributes to Fuyao's overall revenue stream, diversifying its income sources beyond its core automotive glass business. For instance, in the first half of 2024, Fuyao reported total revenue of RMB 12.5 billion, with float glass sales forming a foundational element of this financial performance.

Fuyao Glass Industry Group generates revenue through the sale of industrial glass products, extending its reach beyond the automotive industry. This segment, while smaller, contributes to a more robust and diversified revenue stream for the company. For instance, in 2023, Fuyao's non-automotive glass revenue demonstrated steady growth, indicating the increasing importance of these industrial applications in their overall financial performance.

Aftermarket Automotive Glass Sales

Fuyao Glass Industry Group generates significant revenue by selling replacement automotive glass directly into the aftermarket. This segment caters to a broad network of distributors and auto repair shops, ensuring Fuyao's glass is readily available for vehicles needing replacements beyond the original equipment manufacturer (OEM) stage.

This aftermarket sales strategy solidifies Fuyao's position throughout the entire lifecycle of automotive glass, from initial installation to subsequent repairs. By capturing this crucial segment, the company diversifies its income sources and strengthens its market penetration.

In 2024, the global automotive aftermarket was valued at approximately $460 billion, showcasing the immense opportunity for glass manufacturers like Fuyao. Specifically, the automotive glass replacement market within this sector is a substantial contributor.

- Aftermarket Sales: Revenue derived from selling replacement automotive glass to independent distributors and repair chains.

- Market Reach: Ensures Fuyao's products are accessible for post-manufacturing vehicle repairs and upgrades.

- Lifecycle Presence: Captures value across the entire lifespan of automotive glass in vehicles.

- Diversification: Provides a stable revenue stream independent of new vehicle production volumes.

Sales of Other Glass-Related Products and Services

Fuyao Glass Industry Group diversifies its revenue beyond automotive and architectural glass by selling specialized products and services. This includes aluminum trim parts, showcasing an expansion into integrated solutions for its clientele. This strategic move into related, yet distinct, product lines supports the company's long-term sustainable growth trajectory.

This diversification strategy is crucial for Fuyao. For instance, in 2023, the company reported significant revenue contributions from its non-automotive glass segments, indicating the growing importance of these "other" revenue streams. This broader offering allows Fuyao to capture more value across the supply chain and cater to a wider range of customer needs, reinforcing its market position.

- Diversified Product Portfolio: Revenue generated from specialized glass products beyond core automotive and architectural applications.

- Integrated Solutions: Sales of complementary items like aluminum trim parts, offering customers a more comprehensive package.

- Market Expansion: Extending product boundaries to tap into new market segments and customer demands.

- Sustainable Growth Driver: This diversified approach contributes to the company's overall resilience and long-term financial health, as seen in the increasing share of non-automotive revenue in recent financial reports.

Fuyao Glass's revenue streams are primarily anchored in the automotive sector, with a significant portion derived from supplying glass to Original Equipment Manufacturers (OEMs). Complementing this, the company also generates substantial income from the automotive aftermarket, providing replacement glass for a vast array of vehicles. Beyond automotive, Fuyao benefits from selling float glass and other industrial glass products, diversifying its income and reducing reliance on any single market segment.

| Revenue Stream | Description | 2023/2024 Data Point |

| Automotive OEM Glass Sales | Supplying new glass components (windshields, sunroofs, etc.) to car manufacturers. | Accounted for approximately 85% of total income in recent periods. |

| Automotive Aftermarket Sales | Selling replacement glass to distributors and repair shops for vehicles post-production. | The global automotive aftermarket was valued around $460 billion in 2024, a significant opportunity for glass replacement. |

| Float Glass Sales | Selling raw float glass, some of which is used internally and some sold externally. | Contributed to Fuyao's total revenue of RMB 12.5 billion in the first half of 2024. |

| Industrial & Specialized Glass Sales | Revenue from non-automotive glass applications and complementary products like aluminum trim. | Non-automotive segments showed steady growth in 2023, indicating increasing importance. |

Business Model Canvas Data Sources

The Fuyao Glass Industry Group Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research, and competitive analysis. This multi-faceted approach ensures each component accurately reflects operational realities and strategic goals.