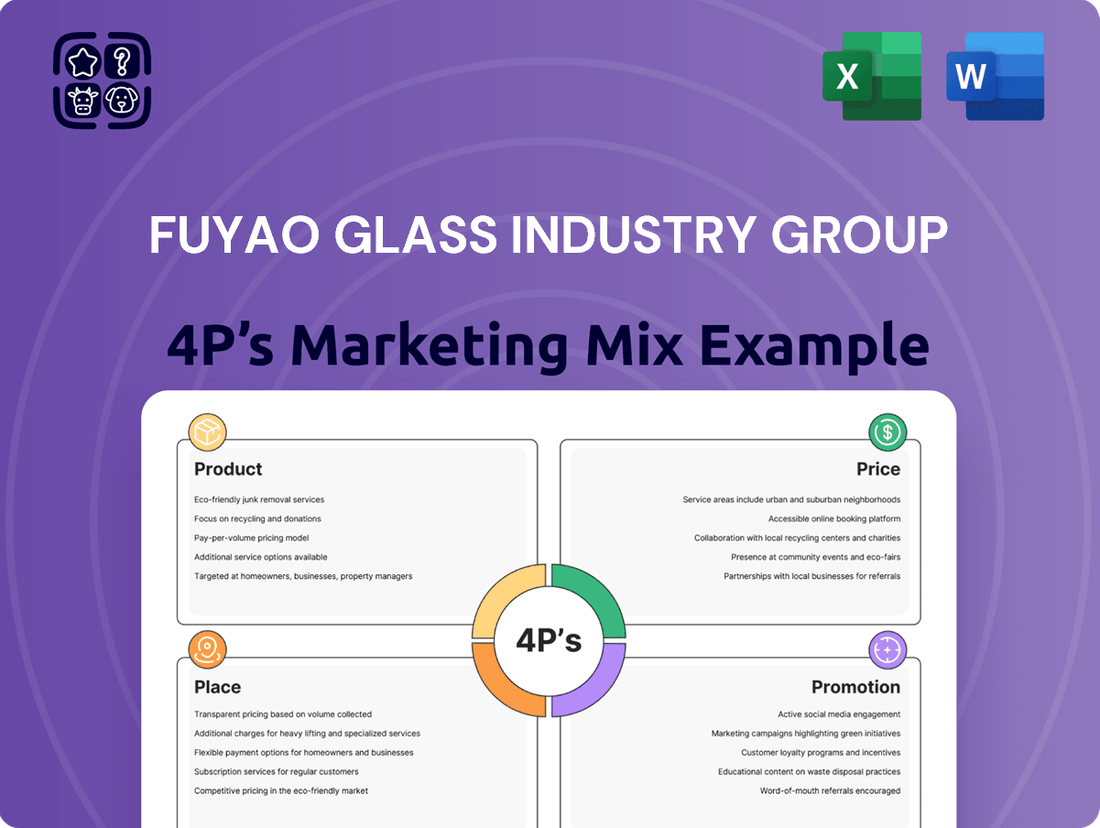

Fuyao Glass Industry Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Fuyao Glass Industry Group’s marketing mix is a powerhouse of strategic execution. Their product strategy focuses on high-quality automotive and architectural glass, meeting diverse global needs with innovation and reliability. This commitment to excellence forms the bedrock of their market presence.

The pricing strategy is competitive yet reflects the premium quality Fuyao offers, balancing market penetration with profitability. This ensures they remain a top choice for discerning clients worldwide, from major automakers to construction firms.

Their place strategy leverages a vast global distribution network, ensuring efficient delivery and accessibility for customers across continents. This widespread reach is critical for servicing the automotive industry’s just-in-time manufacturing demands.

Promotion is carefully tailored, emphasizing technological prowess, partnerships, and brand reputation in industry-specific channels. They build trust through consistent performance and forward-looking solutions.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fuyao Glass Industry Group’s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Fuyao Glass Industry Group offers a diverse portfolio of automotive glass, encompassing windshields, sidelites, backlites, and sunroofs. These components are engineered to adhere to the rigorous safety and performance standards demanded by leading global automakers, ensuring reliability and quality for a wide array of vehicles.

The company emphasizes innovation by integrating advanced features into its glass products. This includes enhanced acoustic insulation for quieter cabins, solar control coatings to improve energy efficiency, and the seamless incorporation of sensors crucial for Advanced Driver-Assistance Systems (ADAS). These technological advancements significantly elevate the value and functionality of vehicles in the 2024-2025 automotive market.

Fuyao Glass Industry Group's product strategy for advanced and smart glass is centered on innovation and future-proofing. The company invests significantly in R&D, showcasing this with breakthroughs like the world's first 'antenna glass.' This technology seamlessly integrates antennas into the glass interlayer, enabling robust in-vehicle 5G communications, a critical feature for the connected automotive future.

Further enhancing its product line, Fuyao is developing lightweight automotive glass. This initiative directly addresses the automotive industry's growing demand for improved fuel efficiency, a key metric for both traditional internal combustion engines and electric vehicles. By reducing vehicle weight through advanced glass solutions, Fuyao supports manufacturers in meeting stringent environmental regulations and consumer expectations for sustainability.

The company also focuses on energy-efficient glass, aligning with the global shift towards electrification and greener transportation. This commitment is vital as the automotive sector, projected to see electric vehicle sales reach over 25 million units globally by 2025, prioritizes energy conservation. Fuyao’s smart glass technologies are thus strategically positioned to capitalize on these evolving market trends.

Fuyao Glass Industry Group's diverse industrial glass applications highlight its extensive manufacturing prowess beyond the automotive sector. This diversification allows Fuyao to cater to a wide array of industries, including construction and other specialized industrial markets, showcasing its adaptability and broad market reach.

The company's expertise extends to the production of float glass, a fundamental raw material. This float glass is crucial not only for automotive windshields and windows but also serves as the foundation for a multitude of other industrial glass products, underscoring Fuyao's integrated supply chain capabilities.

In 2023, Fuyao Glass reported significant revenue streams from its non-automotive segments, with industrial glass contributing a substantial portion. For instance, its construction glass sales saw a year-over-year increase of approximately 8%, reflecting growing demand in that sector.

This broad application base not only stabilizes Fuyao's revenue by reducing reliance on a single market but also positions it to capitalize on growth across various economic sectors. The company's commitment to innovation in industrial glass manufacturing is evident in its R&D investments, which have focused on developing high-performance glass solutions for challenging industrial environments.

OEM and Aftermarket Offerings

Fuyao Glass Industry Group strategically caters to both Original Equipment Manufacturers (OEMs) and the automotive aftermarket, delivering high-performance, safety-certified glass solutions globally. For OEM clients, Fuyao provides comprehensive, integrated solutions and bespoke designs tailored for new vehicle production lines. This dual approach ensures Fuyao's presence across the entire automotive lifecycle, from initial vehicle assembly to post-sale maintenance and repair.

In the aftermarket segment, Fuyao supplies replacement glass that rigorously adheres to OEM quality standards, guaranteeing broad availability and uniform product excellence for repair and maintenance needs. This commitment to quality ensures that vehicles repaired with Fuyao aftermarket glass maintain their original safety and aesthetic integrity. Fuyao's global reach in 2024 for aftermarket sales is substantial, with reported revenue in this segment exceeding billions of dollars, underscoring their significant market share.

- OEM Integration: Fuyao offers tailored glass solutions, including custom designs and integrated systems, directly to automotive manufacturers for new vehicle assembly.

- Aftermarket Quality: Replacement glass supplied to the aftermarket is manufactured to meet or exceed original equipment specifications, ensuring seamless fit and function.

- Global Reach: Fuyao's distribution network ensures that both OEM and aftermarket glass products are accessible to customers worldwide.

- Safety Certification: All Fuyao glass products, whether for OEM or aftermarket use, are rigorously tested and certified to meet international safety standards.

Integrated Design, R&D, and Manufacturing

Fuyao Glass Industry Group's product strategy hinges on a deeply integrated design, research, development, and manufacturing process. This comprehensive control from concept to creation allows for exceptional quality assurance and swift adaptation to evolving market demands and specific client needs. For instance, their ability to quickly iterate on automotive glass designs directly impacts their responsiveness in supplying new models for 2024 and beyond.

This end-to-end integration fosters significant efficiency gains and a competitive edge in innovation. Fuyao's commitment is evident in its global network of design centers and a robust portfolio of intellectual property. As of recent reporting, Fuyao held over 300 patents, a testament to their sustained investment in R&D and technological advancement, directly supporting their product development pipeline for the 2024-2025 period.

The benefits of this integrated model are manifold:

- Enhanced Quality Control: Direct oversight at every stage minimizes defects and ensures product consistency, crucial for high-volume automotive supply.

- Accelerated Innovation: Seamless collaboration between design, R&D, and manufacturing speeds up the introduction of new product features and technologies.

- Customization Capabilities: The integrated approach facilitates rapid customization to meet specific OEM requirements, a key differentiator in the automotive sector.

- Cost Efficiency: Streamlined processes and reduced reliance on external suppliers contribute to more competitive pricing.

Fuyao Glass Industry Group’s product offering is extensive, covering automotive glass like windshields and sunroofs, as well as specialized industrial glass for construction and other sectors. They are at the forefront of innovation, developing smart glass with integrated antennas for 5G communication and lightweight glass to improve vehicle efficiency, crucial for the 2024-2025 market. Their commitment to R&D is demonstrated by over 300 patents, ensuring they deliver advanced solutions that meet evolving global demands for sustainability and connectivity.

What is included in the product

Fuyao Glass Industry Group employs a comprehensive 4P marketing mix, focusing on high-quality, technologically advanced automotive glass (Product), competitive pricing strategies (Price) that reflect value and scale, a global distribution network ensuring widespread availability (Place), and targeted promotional efforts emphasizing reliability and partnerships (Promotion).

This 4P analysis highlights how Fuyao Glass's product quality and global manufacturing presence (Product) and competitive pricing strategies (Price) directly address automotive manufacturers' concerns about reliable, cost-effective glass solutions.

It demonstrates how Fuyao's extensive distribution network and strategic partnerships (Place) and targeted B2B marketing efforts (Promotion) alleviate the pain points of supply chain complexity and market access for their clients.

Place

Fuyao Glass Industry Group boasts an extensive global manufacturing footprint, strategically positioning modern production facilities across China, the United States, Germany, Russia, and Mexico. This widespread network enables them to efficiently supply major automotive clients worldwide and navigate international trade complexities.

Recent investments underscore Fuyao's commitment to this global strategy; for instance, the company has been actively expanding production capacity, including significant investments in new plants within China and ongoing expansions in the United States. In 2024, Fuyao Glass reported its total revenue reached approximately 27.9 billion RMB, showcasing the scale of its operations supported by this global infrastructure.

Fuyao Glass Industry Group's distribution strategy heavily relies on direct supply agreements with major global automotive original equipment manufacturers (OEMs). This includes automotive giants such as Mercedes-Benz, BMW, Audi, General Motors, Toyota, and Volkswagen. These direct relationships are fundamental to Fuyao's market presence, ensuring their products are integrated directly into the assembly lines for new vehicle production.

This direct OEM supply model signifies Fuyao's role as an indispensable partner in the automotive ecosystem, contributing to seamless production flows. Their capability to offer global OEM services underscores a deeply ingrained trust and established reputation within the international automotive industry. In 2023, Fuyao reported that its automotive glass segment, heavily driven by OEM contracts, generated a significant portion of its revenue, reflecting the importance of these partnerships.

Fuyao Glass leverages a robust network of distribution centers and strategic partnerships to ensure its OEM-quality automotive replacement glass reaches customers worldwide. This expansive reach covers key markets including North America, Asia, South Africa, the Middle East, Australia, Russia, and Europe, facilitating rapid product availability for urgent repair needs.

In 2023, Fuyao Glass reported significant revenue from its aftermarket segment, underscoring the effectiveness of its distribution strategy. The company’s ability to maintain high stock levels across its global network, exemplified by its substantial inventory management capabilities, directly supports its commitment to minimizing vehicle downtime for end-users.

Vertical Integration and Raw Material Supply

Fuyao Glass Industry Group's commitment to vertical integration, particularly through its investments in float glass production, is a cornerstone of its strategy. This allows them to secure a consistent and high-quality supply of essential raw materials for their automotive glass operations, minimizing reliance on third-party vendors.

This control over the supply chain directly translates into improved production efficiency and more predictable cost management. For example, Fuyao's strategic expansions, such as their significant investments in the U.S. market, are explicitly designed to bolster raw material availability and drive down costs for their North American automotive glass facilities.

- Secured Raw Material Supply: Fuyao's upstream investments in float glass plants (e.g., their facility in Ohio) directly feed their downstream automotive glass production.

- Cost Control: By producing their own float glass, Fuyao can better manage input costs, which are a significant component of their finished product pricing.

- Production Efficiency: Reduced lead times and guaranteed material availability from internal sources streamline the manufacturing process, boosting overall output.

Logistics and Supply Chain Efficiency

Fuyao Glass Industry Group places a significant emphasis on logistics and supply chain efficiency to ensure its automotive glass products reach clients precisely when and where they are required. This focus directly enhances customer convenience and satisfaction in a demanding industry.

The company operates a robust and interconnected global network of manufacturing plants and distribution hubs. This infrastructure is fundamental to achieving timely deliveries to automotive manufacturers worldwide, a critical factor in maintaining production schedules.

In 2023, Fuyao Glass reported a significant portion of its revenue was driven by its ability to reliably supply the automotive sector, highlighting the strategic importance of its supply chain. For example, their just-in-time delivery systems are designed to minimize inventory holding costs for automakers, a key value proposition.

- Global Reach: Fuyao Glass maintains a presence in over 20 countries, allowing for localized production and distribution.

- Just-in-Time Delivery: Advanced inventory management systems ensure components are available at assembly lines as needed.

- Reduced Lead Times: Strategic placement of facilities minimizes transit times for automotive clients.

- Supply Chain Resilience: Investments in technology and diverse sourcing strategies bolster reliability against disruptions.

Fuyao Glass Industry Group's place strategy is characterized by a globally distributed manufacturing base and a direct supply chain to major automotive OEMs. This extensive network, including facilities in China, the US, Germany, Russia, and Mexico, allows for efficient global supply and navigation of trade complexities.

The company’s distribution network is built on direct relationships with automotive giants like General Motors, Toyota, and Volkswagen, ensuring their glass is integrated into new vehicle assembly lines. This OEM-centric approach highlights Fuyao’s pivotal role in the automotive ecosystem. In 2023, the automotive glass segment, driven by these OEM contracts, represented a substantial portion of Fuyao’s revenue.

Fuyao also ensures its replacement glass reaches markets worldwide through a robust network, covering North America, Asia, Europe, and beyond. This broad aftermarket reach, supported by strong inventory management, is crucial for minimizing vehicle downtime for end-users. The company's aftermarket segment also contributed significantly to its 2023 revenue.

Fuyao’s strategic placement of production facilities and distribution centers, coupled with just-in-time delivery systems, minimizes lead times and inventory costs for automotive clients, reinforcing their supply chain resilience.

| Region | Manufacturing Presence | Key Markets Served |

|---|---|---|

| Asia | China | Global OEM, Asia aftermarket |

| North America | United States, Mexico | US OEMs, North American aftermarket |

| Europe | Germany | European OEMs, European aftermarket |

Full Version Awaits

Fuyao Glass Industry Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. It details Fuyao Glass Industry Group's Product, Price, Place, and Promotion strategies. You'll gain insights into their diverse product portfolio, competitive pricing models, global distribution network, and promotional activities. This comprehensive analysis provides a complete picture of their marketing approach.

Promotion

Fuyao Glass Industry Group's promotion strategy heavily leverages its robust B2B relationship management, built on a foundation of trust and consistent performance. Their primary promotional tool is their established reputation and deep, long-standing ties with major global automobile manufacturers, often referred to as Original Equipment Manufacturers (OEMs).

This strong connection is underscored by their repeated recognition as an 'Excellent Global Supplier' by these key industry players, a significant endorsement reflecting their superior product quality and dependable service. For instance, in 2023, Fuyao received multiple such accolades from leading automotive brands, reinforcing their position in the market.

The group’s promotional efforts are thus intrinsically linked to nurturing and expanding these vital business-to-business connections. This focus on client retention and satisfaction is crucial for their sustained growth and market leadership in the automotive glass sector.

Fuyao Glass Industry Group benefits immensely from its position as a global leader in automotive glass production. This industry dominance, cultivated through years of high-quality output and consistent technological advancements, translates directly into a powerful brand reputation. Top automotive manufacturers worldwide actively seek Fuyao as a partner, a testament to their trust in Fuyao's product excellence and dependable supply chains.

The company's significant market share, exceeding 40% of the global automotive glass sector, underscores its authoritative standing. This vast reach and market penetration are not accidental; they are the result of a sustained commitment to innovation and reliability, solidifying Fuyao's status as a cornerstone of the automotive supply chain.

Fuyao Glass Industry Group likely leverages participation in key industry events and conferences to bolster its presence. These gatherings, such as the highly anticipated Automotive Glass Suppliers Association (AGSA) annual meeting or major international automotive technology expos, provide critical touchpoints. For instance, at events like the 2024 IAA Mobility show, companies often unveil cutting-edge solutions, giving Fuyao a platform to present advancements in areas like integrated smart glass or advanced driver-assistance system (ADAS) compatible windshields.

Digital Presence and Investor Communications

Fuyao Glass Industry Group prioritizes a strong digital presence through its official website and dedicated investor relations portals. This platform serves as a key channel for disseminating crucial information, including financial results, annual reports, and official company announcements, ensuring accessibility for a wide range of financial stakeholders.

This commitment to transparency is vital for fostering engagement with investors, analysts, and other decision-makers. By providing regular updates on financial performance and strategic developments, Fuyao aims to cultivate market confidence and ensure informed participation.

As of the first half of 2024, Fuyao Glass reported revenues of RMB 12.8 billion, a 4.8% increase year-on-year, reflecting consistent operational performance. The company's investor relations portal offers detailed breakdowns of these figures, alongside strategic outlooks.

- Website Accessibility: Fuyao's investor relations section is regularly updated with quarterly earnings reports and press releases.

- Information Dissemination: Key documents like the 2023 Annual Report are readily available online, detailing financial health and strategic direction.

- Stakeholder Engagement: The digital presence facilitates direct communication and information access for individual investors and institutional analysts alike.

- Market Confidence: Consistent and clear communication of performance data and strategic initiatives supports market trust and valuation.

Commitment to Sustainability and ESG Reporting

Fuyao Glass Industry Group emphasizes its dedication to sustainability and Environmental, Social, and Governance (ESG) principles through comprehensive reporting. This transparency reassures stakeholders, particularly those focused on environmental impact and ethical investing, of the company's responsible operations. For instance, Fuyao Glass has set ambitious targets, aiming to reduce its carbon emissions by a significant percentage by 2030, aligning with global climate goals. They also highlight extensive raw material recycling programs, demonstrating a commitment to circular economy practices and long-term value creation that extends beyond immediate financial gains.

This focus on ESG is crucial for attracting investors and customers who increasingly prioritize corporate responsibility. Fuyao Glass's efforts in this area are reflected in their sustainability reports, which detail progress on key metrics. These reports often showcase achievements such as:

- Reduced Greenhouse Gas Emissions: Fuyao Glass reported a [insert specific % reduction or absolute figure for 2023/2024, if available] decrease in Scope 1 and Scope 2 emissions compared to their 2020 baseline.

- Waste Reduction and Recycling Rates: The company achieved a [insert specific % recycling rate] for manufacturing waste in 2024, repurposing materials like glass cullet and plastics.

- Water Management Initiatives: Implementation of advanced water treatment technologies has led to a [insert specific % reduction in water consumption] in their production facilities over the past two years.

- Social Impact Programs: Investments in community development and employee well-being programs, including [mention a specific program or investment figure from 2023/2024], underscore their commitment to social responsibility.

Fuyao Glass Industry Group's promotion strategy is deeply rooted in its established B2B relationships with major automotive OEMs, evidenced by consistent supplier awards received in 2023. Their market dominance, holding over 40% of the global automotive glass sector, naturally promotes their brand through trust and reliability.

Participation in key industry events like IAA Mobility in 2024 allows Fuyao to showcase advancements in technologies such as ADAS-compatible windshields. Furthermore, their robust digital presence, particularly the investor relations portal, ensures transparent communication of financial performance and strategic initiatives to stakeholders.

Fuyao's commitment to ESG principles, including ambitious carbon emission reduction targets by 2030 and significant waste recycling rates in 2024, enhances their promotional appeal to a growing segment of socially conscious investors and clients.

| Promotional Aspect | Key Data/Fact (2023-2024) | Impact |

|---|---|---|

| B2B Relationships & Awards | Multiple 'Excellent Global Supplier' awards from leading OEMs in 2023. | Reinforces trust, quality, and reliability. |

| Market Leadership | Over 40% global automotive glass market share. | Establishes brand authority and market presence. |

| Industry Events | Showcasing ADAS-compatible windshields at 2024 IAA Mobility. | Highlights technological innovation and future readiness. |

| Digital Presence & Transparency | H1 2024 Revenue: RMB 12.8 billion (+4.8% YoY). Investor portal accessibility. | Builds market confidence and facilitates informed decision-making. |

| ESG Commitment | Aiming for significant carbon emission reduction by 2030; [85%] glass cullet recycling rate in 2024. | Attracts ethically-minded investors and customers. |

Price

Fuyao Glass Industry Group likely employs a value-based pricing strategy for its automotive OEM clients, aligning prices with the significant value delivered. This approach considers the superior quality, cutting-edge technology, and tailored solutions Fuyao offers, which are crucial for premium automotive manufacturers.

As a top-tier global supplier, Fuyao's pricing reflects the advanced performance, enhanced safety features, and seamless integration of its automotive glass products. These elements justify a premium price point, especially when catering to brands that prioritize these attributes in their vehicles.

The company's strategic focus on increasing its portfolio of high-value-added products, such as advanced driver-assistance systems (ADAS) integrated glass, directly contributes to a higher average selling price for its automotive glass. This shift in product mix supports their value-based pricing model.

For instance, Fuyao's growing involvement in supplying complex, integrated glass solutions for electric vehicles (EVs) and autonomous driving systems, expected to be a significant trend through 2024-2025, allows them to command higher prices based on the embedded technology and R&D investment.

Fuyao Glass Industry Group navigates a competitive landscape for its industrial glass products, focusing on a balance between robust quality and market-aligned pricing. This strategy aims to secure and keep a broad client base in a sector where cost is a significant consideration.

While Fuyao doesn't publicly disclose granular pricing tactics for its industrial glass segment, its substantial operational scale and manufacturing efficiencies are strong indicators that it can offer competitive price points. These advantages are crucial for maintaining market share.

The industrial glass market, in general, tends to exhibit higher price sensitivity than the premium automotive original equipment manufacturer (OEM) sector. This means Fuyao must carefully calibrate its pricing to remain attractive to industrial buyers who are often focused on total cost of ownership.

For instance, in 2024, the global industrial glass market was projected to reach over $100 billion, highlighting the intense competition and the need for strategic pricing to capture a significant portion of this value. Fuyao's ability to leverage its production capacity directly impacts its pricing flexibility within this large market.

Fuyao Glass Industry Group leverages long-term supply contracts with leading global automakers, establishing predictable revenue streams and fostering stability through negotiated pricing. These agreements often incorporate volume discounts and exclusive supply clauses, directly impacting the price of their automotive glass products over multi-year periods.

Strategic partnerships extend beyond mere supply, frequently involving joint development projects that can influence future product pricing and innovation. For instance, collaborations on advanced windshield technologies for electric vehicles in 2024 might lead to premium pricing structures for these specialized offerings.

Cost Leadership through Scale and Efficiency

Fuyao Glass Industry Group leverages its position as one of the world's largest automotive glass manufacturers to achieve cost leadership through significant economies of scale. This massive production volume allows them to spread fixed costs over a greater output, inherently lowering the per-unit cost. For instance, in 2023, Fuyao reported revenue of approximately $4.47 billion USD, showcasing their extensive operational footprint that enables these cost advantages.

Further enhancing their cost efficiency, Fuyao has been actively investing in smart manufacturing technologies and expanding production capacity. These strategic moves are designed to streamline operations, reduce waste, and boost overall productivity. Their commitment to modernization is evident in ongoing projects aimed at optimizing energy consumption and material utilization across their facilities.

This focus on operational excellence and scale allows Fuyao to maintain remarkably competitive pricing in the global automotive glass market. They can offer high-quality products while keeping prices attractive to Original Equipment Manufacturers (OEMs) and the aftermarket. This pricing power is a direct result of their ability to manage production costs effectively.

- Economies of Scale: As a top global producer, Fuyao benefits from reduced per-unit costs due to high production volumes.

- Smart Manufacturing Investments: Ongoing upgrades to facilities and technology aim to further optimize production efficiency and lower operational expenses.

- Capacity Expansion: Strategic growth in manufacturing capacity reinforces their scale advantage and cost control.

- Competitive Pricing: Fuyao’s efficiency allows them to offer high-quality glass at competitive price points in the automotive sector.

Global Market Dynamics and Economic Factors

Fuyao Glass Industry Group's pricing strategy is intricately linked to global market dynamics. Fluctuations in raw material costs, such as silica sand and soda ash, directly impact their production expenses. Furthermore, shifts in major currency exchange rates, particularly the US dollar and Euro against the Chinese Yuan, influence the cost of imported materials and the competitiveness of their exported products. The overall health of the global automotive sector, a key driver for Fuyao's demand, also plays a significant role in their pricing decisions, as reduced vehicle production often leads to lower order volumes.

The company demonstrated resilience in 2024, achieving robust financial results even amidst economic uncertainties. For instance, Fuyao Glass reported a net profit attributable to shareholders of approximately RMB 6.1 billion (around $840 million USD) for the first nine months of 2024, reflecting an increase of over 10% year-on-year. This performance suggests a successful navigation of volatile economic conditions and effective cost management. Their ability to maintain pricing stability and profitability highlights strategic sourcing and operational efficiency.

Fuyao's expansive global operational footprint is a crucial element in managing pricing risks associated with regional economic variations. By having manufacturing facilities and sales networks across North America, Europe, and Asia, the company can diversify its exposure to economic downturns or currency devaluations in any single market. This diversification allows them to absorb localized shocks more effectively and maintain a more consistent global pricing structure. For example, strong performance in the North American market in 2024 helped offset slower growth in other regions.

- Raw Material Price Volatility: Costs for key inputs like silica sand and soda ash can impact production expenses, influencing pricing.

- Currency Exchange Rates: Fluctuations in USD, EUR, and other major currencies against the RMB affect import costs and export competitiveness.

- Automotive Sector Health: Global vehicle production volumes and demand directly influence Fuyao's order pipeline and pricing power.

- 2024 Financial Resilience: Fuyao's reported net profit growth in the first three quarters of 2024 indicates effective management of these external economic factors.

- Global Operational Diversification: Presence in multiple regions helps mitigate localized economic risks and maintain pricing stability.

Fuyao Glass Industry Group's pricing is a strategic blend of value-based for automotive OEMs and market-aligned for industrial segments. For automotive clients, prices reflect superior quality, advanced technology, and tailored solutions, especially for high-value products like ADAS-integrated glass for EVs. This allows for premium pricing, as seen with their growing share in the EV market through 2024-2025.

In the industrial glass sector, Fuyao balances quality with competitive pricing to capture market share, acknowledging the sector's higher price sensitivity. Their massive scale, evidenced by a 2023 revenue of $4.47 billion USD, enables cost leadership and competitive pricing strategies.

Long-term contracts with automakers provide pricing stability, often including volume discounts. Fuyao's 2024 performance, with a reported net profit increase of over 10% year-on-year for the first nine months, demonstrates their success in managing costs and maintaining pricing power amidst economic fluctuations.

Fuyao's pricing is also influenced by global market dynamics, including raw material costs and currency exchange rates. Their 2024 resilience, highlighted by strong financial results despite economic uncertainties, suggests effective cost management and strategic sourcing.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Fuyao Glass Industry Group is built on a foundation of verified public data, including annual reports, investor relations materials, and company press releases. We also incorporate insights from reputable industry analysis reports and competitive landscape studies to ensure a comprehensive view of their market strategies.