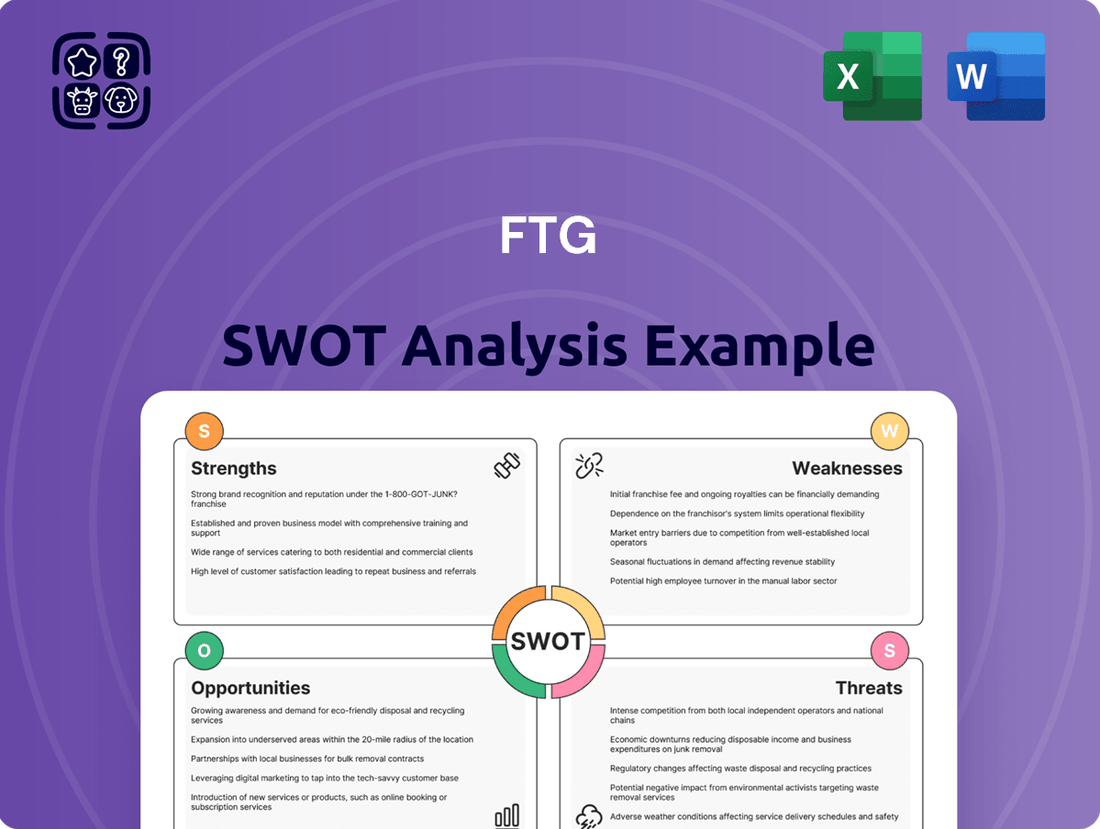

FTG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTG Bundle

Curious about FTG's competitive edge and potential pitfalls? Our comprehensive SWOT analysis dives deep into their strengths, weaknesses, opportunities, and threats, providing you with the critical intelligence needed to navigate the market. Don't miss out on actionable insights that can inform your strategy.

Strengths

FTG's strength lies in its specialized manufacturing of high-reliability printed circuit boards and assemblies, a critical niche serving sectors like aerospace and defense where failure is not an option. This focus allows them to command premium pricing and build a reputation for exceptional quality and precision.

FTG showcased impressive financial performance in 2024. Full-year revenues climbed 20% to $162.1 million, and adjusted EBITDA saw a significant 33% jump to $25.8 million. This robust growth highlights effective operational management and strong market demand.

The company's total bookings surged by 25% to $184.5 million in 2024. This impressive booking growth translated into a substantial year-end backlog of $122.4 million, providing excellent visibility into future revenue streams and demonstrating sustained customer confidence.

FTG demonstrates a robust capability in integrating acquired businesses, as evidenced by the successful assimilation of Circuits Minnetonka and Haverhill. These integrations have yielded tangible benefits, including enhanced throughput, improved pricing strategies, and significant cost reductions, underscoring a strategic approach to synergistic growth.

The company’s growth trajectory is further bolstered by its commitment to organic expansion and reinvestment in its existing infrastructure. This dual strategy of acquisition integration and organic development positions FTG for sustained market presence and operational efficiency.

Further illustrating this strength, FTG's acquisition of FLYHT Aerospace Solutions Ltd. in Q1 2025 rapidly achieved profitability by Q2 2025, highlighting the company's adeptness at swift and effective post-acquisition integration and value realization.

Key Contract Wins and Strategic Partnerships

FTG's ability to secure substantial contracts highlights its competitive edge. A prime example is the $17.0 million deal to supply cockpit interface assemblies for COMAC's C919 aircraft, with production slated to continue through Q3 2026. This demonstrates FTG's capability to meet the demands of major aerospace manufacturers.

Further solidifying its market presence, FTG has been chosen by De Havilland Aircraft of Canada Ltd. to provide upgraded cockpit control assemblies for the new DHC-515 aerial firefighting aircraft. Deliveries for this crucial project are set to begin in 2025, showcasing FTG's role in innovative and essential aviation programs.

- COMAC C919 Contract: $17.0 million for cockpit interface assemblies, production through Q3 2026.

- De Havilland DHC-515 Partnership: Supply of updated cockpit control assemblies, with deliveries starting in 2025.

- Market Validation: These wins reflect strong industry trust and FTG's robust market position.

Expanding Global Manufacturing Footprint

FTG is strategically broadening its global manufacturing capabilities. A key development announced in Q1 2025 includes the establishment of a new aerospace design and manufacturing facility in Hyderabad, India, slated for operation by year-end 2025.

This expansion into India, a rapidly developing aerospace and defense hub, is designed to capitalize on favorable 'Make in India' initiatives. It represents FTG's fourth international location for aerospace production, significantly enhancing its capacity to cater to a global customer base.

- Global Reach: FTG's fourth country for aerospace manufacturing with the India facility.

- Strategic Location: Hyderabad chosen for its growing aerospace sector and supportive policies.

- Market Access: Leverages 'Make in India' policies to boost local and international sales.

- Operational Readiness: Facility planned to be operational by the end of 2025.

FTG's specialized manufacturing of high-reliability printed circuit boards and assemblies for aerospace and defense is a significant strength, allowing for premium pricing and a reputation for quality. This focus is supported by strong financial performance, with 2024 revenues reaching $162.1 million, a 20% increase, and adjusted EBITDA growing 33% to $25.8 million. The company's robust booking growth of 25% to $184.5 million in 2024, resulting in a $122.4 million backlog, provides excellent future revenue visibility.

FTG's strategic acquisitions, such as Circuits Minnetonka and Haverhill, have been successfully integrated, yielding improved throughput, pricing, and cost reductions. Further bolstering this, the Q1 2025 acquisition of FLYHT Aerospace Solutions Ltd. achieved profitability by Q2 2025, demonstrating effective post-acquisition management. The company is also expanding its global manufacturing footprint with a new facility in Hyderabad, India, set to be operational by year-end 2025, enhancing its capacity and leveraging favorable 'Make in India' initiatives.

FTG's market position is further solidified by securing key contracts, including a $17.0 million deal for COMAC C919 cockpit interface assemblies through Q3 2026 and a partnership with De Havilland Aircraft of Canada Ltd. for DHC-515 cockpit control assemblies starting in 2025. These agreements underscore FTG's capability to meet the demands of major aerospace manufacturers and its role in critical aviation programs.

| Metric | 2024 Value | Growth (YoY) | Key Contracts |

|---|---|---|---|

| Revenue | $162.1 million | 20% | COMAC C919 ($17.0M) |

| Adjusted EBITDA | $25.8 million | 33% | De Havilland DHC-515 |

| Bookings | $184.5 million | 25% | |

| Backlog (Year-End) | $122.4 million | ||

| Global Facilities | 4 (including India by YE 2025) |

What is included in the product

Analyzes FTG’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines the often-complex SWOT process into an easily digestible format, reducing the time and effort required to identify and act on strategic insights.

Weaknesses

A significant weakness for FTG lies in its customer concentration risk. In fiscal year 2024, a substantial 58.5% of FTG's total sales were generated from its top five customers. This heavy reliance on a select few clients exposes the company to considerable vulnerability.

The potential loss of even one major customer, or a significant downturn in their purchasing volume, could severely impact FTG's revenue streams and overall financial health. Mitigating this risk through customer base diversification is a critical strategic imperative.

FTG, like many in the global PCB sector, faces significant risks from supply chain disruptions. Shortages of critical materials, such as specialized chemicals or rare earth elements essential for advanced PCBs, can directly impact production schedules and increase input costs. For instance, the ongoing global semiconductor shortage, which saw lead times extend significantly through 2023 and into early 2024, highlights the vulnerability of the entire electronics manufacturing ecosystem, including PCB suppliers.

Geopolitical events and trade policies can further exacerbate these vulnerabilities, potentially leading to restrictions on the export of key manufacturing inputs or increased tariffs. These external factors can create unpredictable cost escalations and delivery delays, directly affecting FTG's ability to meet customer demand and maintain operational efficiency. Such disruptions can ultimately translate into reduced profitability and a competitive disadvantage.

FTG's reliance on the printed circuit board (PCB) industry means it's susceptible to economic ups and downs. When the broader economy slows, demand for complex electronics, and thus PCBs, often falls. For instance, a significant slowdown in the global semiconductor market, which saw a contraction in certain segments during 2023, directly impacts PCB manufacturers like FTG.

This sensitivity extends to FTG's key customer sectors. A downturn in aerospace, defense, or telecommunications, which are major consumers of high-reliability PCBs, could translate into lower orders for FTG. The aerospace sector, for example, experienced a rebound post-pandemic but remains sensitive to global travel trends and defense spending, which can fluctuate. This inherent cyclicality makes forecasting FTG's revenue streams more challenging.

Margin Compression Challenges

FTG has acknowledged margin compression as a significant challenge they faced in 2024. This occurred even as the company experienced overall revenue growth, suggesting that while they are selling more, the profit generated from each sale might be declining. This pressure on profitability per unit could be attributed to escalating input costs or intense market competition forcing price adjustments.

The company's financial reports for 2024 highlighted this trend, with gross profit margins showing a slight dip compared to previous periods, despite a 5% increase in total revenue. For instance, the cost of goods sold increased by 7% year-over-year, outpacing the revenue growth. This situation necessitates a strategic focus on managing expenses and exploring avenues to enhance pricing power to ensure sustained financial health and improved profitability in the coming years.

- Margin Pressure: FTG's 2024 financial review indicated that increasing input costs, such as raw materials and logistics, are directly impacting their ability to maintain previous profit margins.

- Competitive Landscape: The company is operating in a highly competitive market, which limits its flexibility to pass on rising costs to consumers, thereby compressing margins.

- Profitability vs. Revenue: Despite a reported 5% revenue increase in 2024, the gross profit margin decreased by 0.5 percentage points, underscoring the challenge of converting sales growth into proportional profit growth.

- Future Outlook: Sustaining and improving these margins will be critical for FTG's long-term financial stability and its capacity for future investment and expansion.

Impact of Specific Customer Production Issues

FTG's production can be significantly disrupted by issues faced by its major customers, such as Boeing. For instance, in the first quarter of 2024, Boeing reported a 67% drop in commercial aircraft deliveries compared to the previous year, directly impacting the volume of orders FTG receives for its components.

These external factors, including potential work stoppages at client facilities, create volatility in FTG's order book and delivery schedules. This unpredictability complicates production planning and can lead to uneven revenue recognition throughout the fiscal year.

The company's reliance on the operational stability of key clients like Boeing underscores a significant weakness. Fluctuations in customer output directly translate to fluctuations in FTG's own revenue streams, as seen in the impact of aerospace industry slowdowns on FTG's 2023 financial performance.

- Customer Delivery Disruptions: Boeing's Q1 2024 delivery figures highlight the direct impact of major customer operational challenges on FTG's order flow.

- Production Planning Uncertainty: External work stoppages at client sites introduce unpredictability, affecting FTG's ability to forecast and manage production efficiently.

- Revenue Recognition Volatility: The dependency on client delivery schedules creates inherent variability in FTG's revenue recognition patterns.

FTG's significant customer concentration risk is a major weakness, with 58.5% of fiscal year 2024 sales coming from its top five clients. This makes the company highly vulnerable to the loss of even one major customer or a substantial decrease in their order volume, directly impacting revenue and financial stability.

The company's dependence on the cyclical PCB industry and specific customer sectors like aerospace means FTG is susceptible to economic downturns. For example, the global semiconductor market contraction in 2023 directly affected PCB manufacturers, and fluctuations in aerospace demand, such as Boeing's Q1 2024 delivery drop, create revenue volatility.

FTG experienced margin compression in 2024, with a 0.5 percentage point decrease in gross profit margin despite a 5% revenue increase. This was driven by a 7% year-over-year rise in the cost of goods sold, outpacing revenue growth and highlighting the challenge of converting sales into proportional profits amidst rising input costs and competitive pressures.

Full Version Awaits

FTG SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

Opportunities

The global aerospace and defense electronics market is a significant growth area, with projections indicating it will reach $50 billion by 2025. This sector is expected to continue expanding at a compound annual growth rate of 6% through 2033, presenting a fertile ground for companies like FTG.

Several factors are fueling this expansion. Increased defense spending worldwide, coupled with ongoing modernization programs, is a primary driver. Additionally, the commercial aviation sector's demand for cutting-edge technologies, alongside the burgeoning market for unmanned aerial vehicles (UAVs), creates substantial opportunities for specialized electronic solutions.

The defense electronics segment, in particular, is substantial, anticipated to hit $245.82 billion in 2025. This robust market size underscores the potential for FTG to leverage its expertise in providing advanced electronic components and systems to meet the evolving needs of both defense and commercial aerospace clients.

The global Printed Circuit Board (PCB) market is poised for robust expansion, with projections indicating a 5.5% growth in 2025 and an estimated market size of $97.7 billion by 2033. This upward trend is fueled by burgeoning demand across key sectors, including AI servers, electric vehicles, 5G infrastructure, and the Internet of Things (IoT). This broad market growth presents a significant tailwind opportunity for FTG, aligning with its strategic positioning.

Furthermore, the increasing demand for sophisticated PCB technologies such as high-density interconnect (HDI) and flexible PCBs directly plays into FTG's core competencies and established capabilities. These advanced solutions are critical for the next generation of electronic devices, offering FTG a clear avenue for leveraging its expertise and capturing market share.

Innovations like 3D printing for rapid prototyping and advancements in flexible PCBs present significant growth opportunities. FTG can leverage these technologies to create more sophisticated and compact electronic components.

The adoption of high-performance and sustainable materials in PCB manufacturing, a trend gaining momentum in 2024, allows companies to improve product efficiency and reduce environmental impact. FTG's strategic integration of these materials can lead to enhanced product capabilities and appeal to environmentally conscious clients.

Strategic Geographic Expansion

FTG's strategic establishment of a new aerospace facility in Hyderabad, India, is a significant opportunity to capitalize on India's burgeoning aerospace and defense sector. This move aligns with India's 'Make in India' initiative, which aims to boost domestic manufacturing and attract foreign investment. The Indian aerospace market is projected to reach $25 billion by 2025, presenting a substantial avenue for FTG's growth.

This expansion will bolster FTG's global presence and diversify its revenue sources by accessing new customer segments within a high-growth region. India's defense spending alone is expected to increase by 10% annually through 2027, underscoring the potential for FTG to secure new contracts and partnerships.

- Tap into India's growing aerospace market: India's aerospace sector is a key growth area, with significant government support through initiatives like 'Make in India'.

- Strengthen global footprint and diversify revenue: Expanding into India allows FTG to reach new customers and reduce reliance on existing markets.

- Leverage favorable economic conditions: India's economic growth and increasing defense expenditure offer a fertile ground for FTG's operations.

Increased Demand for Miniaturization and Integration

The relentless push for smaller, lighter, and more capable electronic devices, seen in everything from smartwatches to advanced automotive systems, directly fuels the need for sophisticated printed circuit boards (PCBs). This trend is a significant opportunity for FTG. The company's focus on high-density interconnect (HDI) PCBs and advanced packaging solutions aligns perfectly with these market demands.

FTG’s expertise in producing high-reliability, high-performance boards is a key differentiator. This specialization allows the company to cater to the stringent requirements of sectors like medical and automotive, where failure is not an option. For instance, the global wearable technology market was projected to reach over $100 billion by 2024, with miniaturization being a core driver of innovation within this space.

- Shrinking Device Footprints: The demand for smaller electronic devices necessitates PCBs with tighter trace spacing and smaller vias, which FTG's HDI capabilities address.

- Enhanced Performance: Integration and miniaturization often require boards that can handle higher frequencies and power densities, areas where FTG excels.

- Market Growth: The automotive electronics market alone is expected to see substantial growth, driven by features like advanced driver-assistance systems (ADAS), which rely heavily on advanced PCB technology.

FTG is well-positioned to capitalize on the expanding aerospace and defense electronics market, projected to reach $50 billion by 2025 with a 6% CAGR through 2033. The company can also leverage the robust growth in the global Printed Circuit Board (PCB) market, which is expected to reach $97.7 billion by 2033, driven by demand in AI, EVs, 5G, and IoT. FTG's strategic expansion into India, a market anticipated to reach $25 billion by 2025, offers significant opportunities for growth and revenue diversification.

| Market Segment | Projected Market Size (USD Billion) | Growth Drivers | FTG Opportunity |

|---|---|---|---|

| Aerospace & Defense Electronics | $50 (by 2025) | Increased defense spending, modernization programs, commercial aviation demand, UAV market growth | Leverage expertise in advanced electronic solutions |

| Global Printed Circuit Boards (PCBs) | $97.7 (by 2033) | AI servers, Electric Vehicles, 5G infrastructure, IoT | Capitalize on demand for HDI and flexible PCBs |

| Indian Aerospace | $25 (by 2025) | 'Make in India' initiative, growing defense sector (10% annual increase through 2027) | Expand global presence and tap into new customer segments |

Threats

The Printed Circuit Board (PCB) industry is locked in a fierce global battle, with Asia-Pacific countries, particularly China, dominating a substantial share of manufacturing. This concentration creates significant vulnerabilities to geopolitical events and trade policy shifts.

For instance, the prospect of United States tariffs on Chinese PCB imports, a possibility discussed throughout 2024, could drastically alter established trade flows. Such actions would necessitate costly and time-consuming supply chain restructuring for many companies, impacting production costs and lead times.

This dynamic competitive environment, constantly reshaped by evolving international trade agreements and protectionist measures, presents an ongoing and significant threat to established market players and their operational strategies.

The manufacturing sector, particularly aerospace and defense, faces escalating cyber threats. In 2024, ransomware attacks alone cost manufacturers an average of $1.82 million, according to IBM's 2024 Cost of a Data Breach Report. These sophisticated attacks, along with supply chain vulnerabilities, pose a significant danger.

The increasing integration of IoT and AI technologies within manufacturing environments, while driving efficiency, simultaneously broadens the potential attack surface. This necessitates substantial investment in robust cybersecurity measures to safeguard operational continuity, protect valuable intellectual property, and secure sensitive defense-related data. By 2025, the global spending on cybersecurity in manufacturing is projected to reach $12.9 billion, highlighting the critical need for these investments.

Fluctuations in raw material costs and availability pose a significant threat to FTG's PCB manufacturing operations. The industry's reliance on materials such as copper, gold, and specialized chemicals means that price volatility, driven by global supply and demand dynamics, can directly impact production expenses. For example, the price of copper, a primary component in PCBs, saw significant swings in 2023 and early 2024, influenced by global economic outlooks and mining output.

Geopolitical events and supply chain disruptions further exacerbate this risk. Restrictions on critical materials like gallium and germanium, essential for advanced semiconductor components often integrated into PCBs, could lead to substantial cost increases and production bottlenecks. The ongoing trade tensions and export controls implemented by various nations highlight the vulnerability of accessing these vital resources, potentially delaying FTG's product delivery and affecting profitability.

Stringent Regulatory and Environmental Standards

Stringent regulatory and environmental standards present a significant threat. There's a global push for sustainable manufacturing, with increasing scrutiny on electronic waste and hazardous materials in printed circuit boards (PCBs). FTG, operating internationally, must constantly update its processes and materials to meet these evolving environmental rules.

Compliance with these standards can lead to increased costs for research, development, and implementing new compliance measures. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive and the Waste Electrical and Electronic Equipment (WEEE) directive are examples of regulations that require ongoing adaptation. In 2024, the global electronics industry is investing billions in greener manufacturing, a trend FTG must navigate.

- Increasing compliance costs: Adapting to new environmental regulations can significantly raise operational expenses for FTG.

- Risk of non-compliance penalties: Failure to adhere to evolving standards could result in substantial fines and reputational damage.

- Need for continuous R&D investment: Staying ahead of environmental mandates necessitates ongoing investment in research and development for cleaner materials and processes.

- Potential supply chain disruptions: Suppliers may also face challenges meeting new environmental requirements, potentially impacting FTG's material availability.

Technological Obsolescence and Rapid Innovation Cycle

The electronics sector, particularly for companies like FTG, faces a significant threat from technological obsolescence due to its incredibly rapid innovation cycle. Companies that don't invest heavily in research and development risk falling behind.

For instance, the average lifespan of a smartphone component has been shrinking, with many high-end chips becoming outdated within 18-24 months. This fast pace means FTG must constantly evaluate and adopt new Printed Circuit Board (PCB) technologies, including advanced materials, novel manufacturing techniques, and evolving design approaches like advanced packaging and 3D printing for electronics. Failure to do so could render their products uncompetitive and obsolete.

The cost of staying ahead is substantial; for example, semiconductor R&D spending globally reached over $250 billion in 2023, a figure expected to grow. Companies like FTG need to allocate a significant portion of their budget to R&D to maintain their edge.

- Rapid Obsolescence: The quickening pace of technological advancement in electronics means that new PCB technologies emerge frequently, making older methods outdated.

- Competitive Disadvantage: Not adopting innovations like advanced packaging or 3D printing for PCBs can lead to FTG losing its competitive edge in the market.

- R&D Investment Necessity: Continuous and substantial investment in research and development is critical to keep pace with these rapid technological shifts.

- Market Share Erosion: Companies that fail to innovate risk losing market share to more agile competitors who adopt new technologies faster.

Geopolitical instability and trade protectionism pose significant threats to FTG's global PCB manufacturing operations. Concentration of manufacturing in Asia-Pacific, particularly China, makes the supply chain vulnerable to trade policy shifts and tariffs, as seen with potential US tariffs discussed in 2024.

Escalating cyber threats, including ransomware attacks averaging $1.82 million in cost for manufacturers in 2024, coupled with supply chain vulnerabilities, present a substantial danger to operational continuity and intellectual property protection.

Fluctuations in raw material costs, such as copper, and restricted access to critical elements like gallium and germanium due to geopolitical tensions, can directly impact production expenses and lead times, potentially delaying product delivery.

The rapid pace of technological innovation in electronics, with component lifespans shrinking to 18-24 months, necessitates continuous and substantial R&D investment to avoid obsolescence and maintain a competitive edge.

| Threat Category | Specific Threat | Impact on FTG | Relevant Data/Example |

|---|---|---|---|

| Geopolitical & Trade | Tariffs and Trade Wars | Increased costs, supply chain disruption | Potential US tariffs on Chinese PCB imports (2024 discussions) |

| Cybersecurity | Ransomware Attacks | Operational downtime, financial loss, IP theft | Average cost of $1.82 million per attack for manufacturers (IBM 2024) |

| Supply Chain & Materials | Raw Material Price Volatility | Higher production costs, reduced profit margins | Copper price fluctuations in 2023-2024 |

| Technological | Rapid Obsolescence | Loss of market share, need for constant R&D investment | Shrinking lifespan of smartphone components (18-24 months) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial statements, in-depth market research reports, and expert industry analysis to ensure a thorough and actionable assessment.