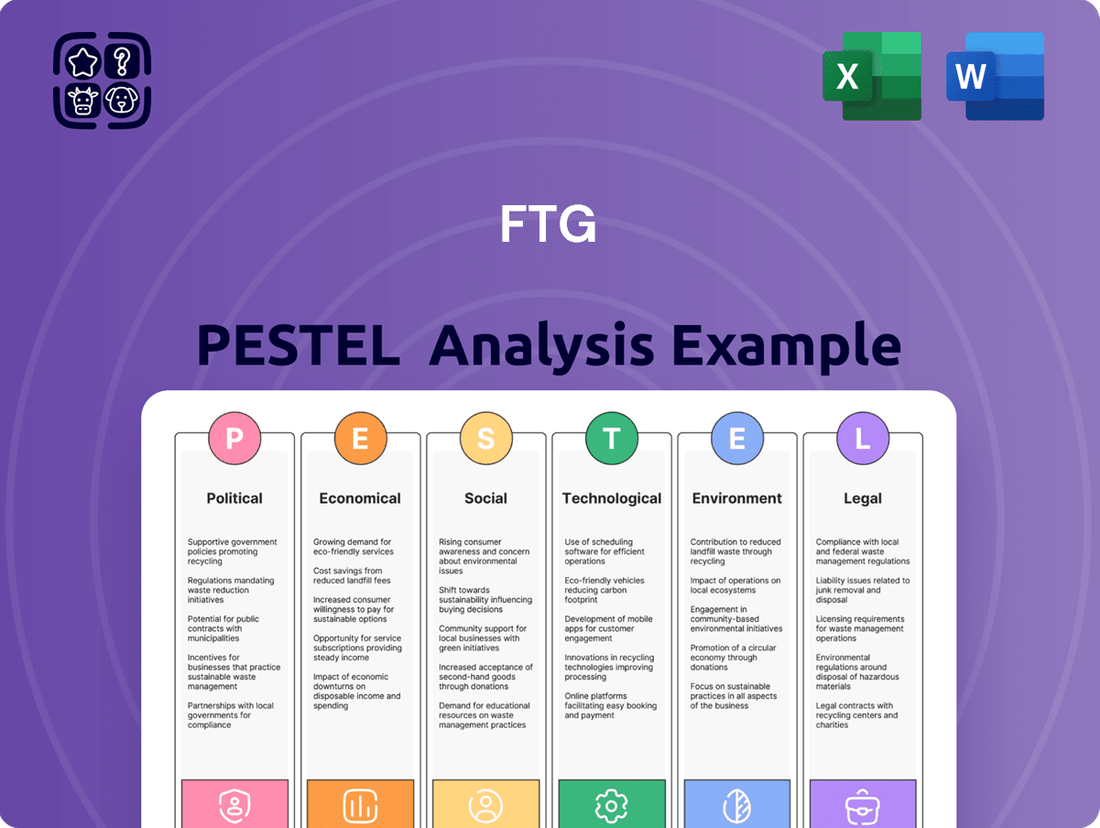

FTG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTG Bundle

Unlock the critical external factors shaping FTG's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and leverage this knowledge to refine your strategy. Download the full report for actionable insights and a competitive advantage.

Political factors

Government defense spending is a pivotal political factor for FTG, given its substantial operations within the aerospace and defense industries. Global defense budgets are on the rise, with the US Department of Defense's budget for fiscal year 2025 projected to reach $886 billion, a significant increase. European nations are also boosting their defense investments, with many NATO members aiming to meet or exceed the 2% of GDP defense spending target, directly impacting demand for FTG's specialized circuit boards and assemblies.

Global trade policies and tariffs significantly influence FTG's operational costs and supply chain stability. For instance, the ongoing trade tensions between major economies, particularly the US and China, have led to increased tariffs on various goods, including electronic components and raw materials like rare earth metals. This directly impacts FTG's production expenses, potentially reducing its competitive edge in the market.

In 2024, the International Monetary Fund (IMF) projected that global trade growth would slow, partly due to these protectionist measures. FTG's strategic response, such as exploring new manufacturing hubs like a potential facility in India, is a direct effort to diversify its sourcing and mitigate the risks associated with geopolitical trade disputes and their associated tariff escalations.

Geopolitical instability, such as ongoing conflicts in Eastern Europe and the Middle East, significantly boosts demand for advanced defense systems. This trend directly benefits FTG's Aerospace and Defense segments, as nations prioritize military modernization. For instance, global defense spending was projected to reach $2.4 trillion in 2024, a notable increase driven by these very tensions.

Heightened international tensions also compel countries to bolster their military capabilities, leading to greater demand for FTG's specialized electronic products. This includes advanced radar systems, secure communication equipment, and electronic warfare solutions. The global market for electronic warfare systems alone was estimated to be around $20 billion in 2023 and is expected to grow substantially.

Government Regulations and Compliance

FTG's position as a supplier in the aerospace and defense sectors necessitates strict adherence to government regulations. This includes evolving cybersecurity mandates like CMMC 2.0, which is critical for maintaining eligibility for defense contracts. Failure to comply can result in significant penalties and loss of business opportunities.

The U.S. Department of Defense's Cybersecurity Maturity Model Certification (CMMC) program is progressively rolling out, with many prime contractors now requiring CMMC Level 2 compliance from their suppliers by early 2025. This means FTG must invest in robust cybersecurity infrastructure and processes to meet these evolving standards, impacting operational costs and strategic planning.

- CMMC 2.0 Implementation: The U.S. DoD aims to have a significant portion of its solicitations requiring CMMC compliance by the end of 2025, impacting thousands of suppliers.

- Cybersecurity Investment: Companies like FTG are projected to spend billions collectively on achieving and maintaining CMMC compliance, reflecting the high stakes involved.

- Contractual Requirements: Many new defense contracts issued in 2024 and expected through 2025 explicitly list CMMC Level 2 as a prerequisite for bidding.

Government Funding and Incentives

Government funding and investment support schemes, particularly those targeting the electronics and electrical appliance sectors, present significant opportunities for FTG. These initiatives can directly translate into capital inflows for PCB production and related supply chains, alleviating financial pressures and fostering growth.

For instance, in 2024, various nations continued to roll out programs designed to onshore critical manufacturing, including semiconductors and their components. These often include tax credits, grants, and low-interest loans. FTG could leverage these to reduce the cost of new equipment or expand existing facilities.

- Government Investment: Programs like the U.S. CHIPS and Science Act, with its $52.7 billion in funding, aim to boost domestic semiconductor manufacturing, indirectly benefiting PCB suppliers.

- Incentive Impact: Such incentives can lower the barrier to entry for advanced manufacturing technologies, making it more feasible for FTG to invest in cutting-edge PCB production.

- Supply Chain Resilience: Government focus on supply chain resilience encourages investment in domestic production, creating a more stable and predictable market for FTG.

- R&D Support: Funding for research and development can help FTG innovate in areas like advanced materials and miniaturization for PCBs.

Government defense spending is a major driver for FTG, with global defense budgets projected to exceed $2.4 trillion in 2024, fueling demand for advanced electronics. Trade policies and geopolitical tensions, like those impacting global trade growth in 2024, necessitate strategic diversification for supply chain stability. Strict adherence to evolving cybersecurity regulations, such as CMMC 2.0, is crucial for defense contract eligibility, with significant compliance investments anticipated by 2025.

What is included in the product

The FTG PESTLE Analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the business landscape, providing a comprehensive understanding of external influences.

Provides a structured framework to identify and mitigate potential external threats, thereby reducing uncertainty and anxiety around future business challenges.

Economic factors

Global economic growth is a significant driver for industries like telecommunications, aerospace, and defense, which are key markets for FTG. A robust global economy, especially in consumer electronics, automotive, and healthcare, translates to higher demand for printed circuit boards.

The International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a stable but moderate expansion. This recovery supports increased consumer spending and business investment, directly benefiting sectors reliant on advanced electronics.

The electronics industry, a crucial sector for FTG, continues to grapple with supply chain volatility. For instance, the price of copper, a vital component in PCB manufacturing, saw significant fluctuations throughout 2024, impacting production costs. Potential shortages of semiconductors, exacerbated by geopolitical tensions and increased demand, also pose a risk to FTG's manufacturing timelines and overall output capacity.

Currency exchange rates significantly influence FTG's financial performance as a global manufacturer. Fluctuations between the Canadian Dollar (CAD), US Dollar (USD), and Chinese Yuan (CNY) directly impact the reported value of international sales and the cost of imported materials. For instance, a strengthening USD against the CAD could boost FTG's reported USD-denominated revenues when translated back into CAD, but it would also increase the cost of sourcing components from Canada for its US operations.

The Bank of Canada's benchmark interest rate, which influences the CAD, and the US Federal Reserve's policy rate, affecting the USD, are key drivers of these exchange rates. As of early 2024, the CAD has shown some volatility against the USD, trading in a range that can impact import costs for FTG's Canadian facilities and export competitiveness from its US base. Similarly, the CNY's managed float against major currencies is crucial for FTG's manufacturing costs and sales in China.

FTG's expansion into India introduces the Indian Rupee (INR) into this complex equation. Managing currency risk across CAD, USD, CNY, and INR requires robust hedging strategies to mitigate the impact of adverse movements on profitability and cash flow. For example, if the INR depreciates significantly against the USD, FTG's Indian-sourced components would become cheaper in USD terms, but the value of sales made in INR would decrease when converted to USD or CAD.

Industry Specific Market Growth

The printed circuit board (PCB) market is poised for substantial expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 4.5% through 2028, reaching an estimated $100 billion. This growth is largely propelled by the escalating demand for smaller, more powerful, and flexible PCBs essential for consumer electronics, automotive systems, and telecommunications infrastructure.

The aerospace and defense electronics sector is also demonstrating vigorous growth, with market forecasts suggesting a CAGR of around 5.2% for the period up to 2027, potentially exceeding $100 billion. This upward trend is directly linked to global defense modernization initiatives and the increasing need for sophisticated electronic systems in aircraft, surveillance, and communication technologies.

- PCB Market Growth: Projected CAGR of 4.5% through 2028, reaching an estimated $100 billion.

- Key Drivers for PCBs: Demand for miniaturization, higher performance, and flexible designs.

- Aerospace & Defense Electronics Growth: Forecasted CAGR of 5.2% up to 2027, exceeding $100 billion.

- Drivers for Aerospace & Defense: Modernization efforts and advanced system requirements.

Investment and Capital Deployment

FTG's investment strategy centers on expanding its operational footprint and enhancing capabilities. In 2024, the company allocated a significant portion of its capital towards strategic investments in existing facilities, aiming to boost efficiency and output. This focus on organic growth is complemented by targeted acquisitions designed to broaden market access and integrate new technologies.

The company's capital deployment is directly linked to its growth trajectory and shareholder value creation. For instance, the ongoing development of its new facility in Hyderabad, India, represents a substantial capital commitment expected to unlock new market opportunities and contribute significantly to revenue streams by late 2025. This expansion is a key element in FTG's plan to increase its global market presence.

- Strategic Investments: FTG continues to invest in upgrading and expanding its existing manufacturing and distribution sites to meet growing demand.

- Acquisition Strategy: The company actively evaluates acquisition targets that align with its long-term strategic goals, focusing on synergistic opportunities.

- New Facility Development: The Hyderabad facility, slated for partial operation by early 2025, is a major capital expenditure aimed at capturing market share in a high-growth region.

- Capital Allocation: FTG prioritizes capital deployment towards projects with the highest potential for return on investment and sustainable growth.

Economic factors significantly shape FTG's operating environment, influencing demand for its products and the cost of doing business. Global economic expansion directly correlates with increased demand for electronics, benefiting FTG's core markets like consumer electronics and automotive. However, supply chain disruptions and currency fluctuations remain key challenges that require careful management.

The IMF's projection of 3.2% global growth for 2024, a slight increase from 2023, signals a steady economic climate that supports consumer spending and business investment. This moderate growth is beneficial for industries that rely on advanced electronic components, such as those manufactured by FTG.

The electronics sector, particularly PCBs, is experiencing robust growth, with a projected CAGR of 4.5% through 2028, reaching $100 billion. Similarly, aerospace and defense electronics are set for a CAGR of 5.2% up to 2027. These trends highlight strong market demand for FTG's capabilities.

FTG's strategic capital investments, including the development of its Hyderabad facility, underscore its commitment to growth and market expansion. The company's focus on organic expansion, coupled with potential acquisitions, positions it to capitalize on these favorable market dynamics and enhance shareholder value.

Same Document Delivered

FTG PESTLE Analysis

The preview you see here is the exact FTG PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, providing a comprehensive overview of political, economic, social, technological, legal, and environmental factors. You can trust that what you're previewing is the complete and ready-to-use file.

Sociological factors

The electronics and aerospace sectors are grappling with a shortage of skilled labor, especially engineers and technicians, a trend projected to continue through 2025. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 5% growth in aerospace engineers’ employment, yet many companies report difficulty filling these specialized roles.

These labor gaps directly constrain production capacity and hinder growth initiatives. Companies are responding by increasing investment in internal training programs and more aggressive talent acquisition strategies to bridge these critical skill deficits.

Consumers increasingly prefer compact, lightweight electronics, pushing manufacturers towards smaller, more powerful components. This demand directly impacts PCB technology, favoring advanced solutions like High-Density Interconnect (HDI) and flexible circuit boards to meet these shrinking size requirements. For instance, the global market for flexible PCBs was valued at approximately $15.7 billion in 2023 and is projected to reach over $28 billion by 2030, highlighting this significant trend.

The aerospace and defense industries are experiencing a significant sociological push for modernization, driving demand for upgraded systems. This trend is fueled by the need to integrate advanced electronics into existing fleets, ensuring operational relevance and enhanced capabilities. For instance, the U.S. Air Force's fleet recapitalization efforts, including upgrades to the B-52 bomber and F-15 fighter jets, underscore this commitment to modernization, creating sustained demand for components like those FTG provides.

Global Connectivity and IoT Expansion

The increasing adoption of the Internet of Things (IoT) and the rollout of 5G networks are significantly boosting the demand for advanced Printed Circuit Boards (PCBs). This societal trend towards hyper-connectivity fuels the need for specialized, high-performance PCBs capable of handling complex data and seamless communication.

By 2025, the global IoT market is projected to reach over $1.5 trillion, with a substantial portion of this growth driven by smart devices and infrastructure requiring sophisticated PCB solutions. This expansion is directly linked to how society integrates technology into daily life, from smart homes to industrial automation.

- IoT Market Growth: The global IoT market is expected to surpass $1.5 trillion by 2025.

- 5G Impact: 5G deployment is accelerating the need for PCBs that support higher frequencies and data speeds.

- Societal Shift: A growing preference for smart, connected technologies is a primary driver for PCB innovation.

- Demand for Advanced PCBs: This societal shift translates into increased demand for specialized and high-performance PCBs.

Public Perception and Corporate Social Responsibility

Public perception significantly influences corporate behavior, especially concerning environmental impact. Growing public awareness in 2024 and 2025 is increasingly pressuring manufacturers, including those in FTG's sector, to adopt sustainable and greener production methods. This shift is driven by a desire for ethical consumption and a concern for the planet's future.

FTG's proactive commitment to sustainability in its manufacturing processes can directly enhance its public image. Companies demonstrating genuine environmental stewardship often find themselves appealing more strongly to environmentally conscious consumers, investors, and other stakeholders. For instance, a 2024 survey indicated that over 60% of consumers are more likely to purchase from brands with strong sustainability credentials.

- Growing Demand for Sustainable Products: Consumers are increasingly seeking products with minimal environmental footprints, influencing purchasing decisions.

- Investor Scrutiny on ESG: Environmental, Social, and Governance (ESG) factors are becoming critical for investment decisions, with many funds prioritizing sustainable companies.

- Brand Reputation and Loyalty: A positive public perception built on CSR initiatives can foster stronger brand loyalty and differentiate FTG in a competitive market.

- Regulatory Anticipation: Proactive adoption of sustainable practices can position FTG favorably for future environmental regulations, potentially reducing compliance costs.

Societal trends are significantly shaping the electronics and aerospace industries. The demand for smaller, more powerful electronics, driven by consumer preference, is pushing advancements in PCB technology, with the flexible PCB market projected to exceed $28 billion by 2030. Furthermore, a societal push for modernization in aerospace necessitates upgraded systems, creating sustained demand for advanced components.

Technological factors

The ongoing push for smaller, more powerful electronic gadgets is directly fueling the demand for High-Density Interconnect (HDI) Printed Circuit Boards (PCBs). These specialized boards are crucial because they pack more electrical pathways into a much tighter space, which is essential for the advanced functionality we expect from modern devices.

This trend is particularly evident in consumer electronics. For instance, the smartphone market, a major driver of HDI PCB adoption, saw global shipments reach approximately 1.2 billion units in 2024, according to industry analysts. The ability of HDI PCBs to support finer trace widths and smaller vias allows manufacturers to create thinner and lighter devices without sacrificing performance.

Beyond smartphones, HDI PCBs are becoming indispensable in other sectors. In the medical field, their use in wearable health monitors and advanced diagnostic equipment is growing, enabling more sophisticated patient tracking and data analysis. The market for medical electronic devices, heavily reliant on miniaturized components like HDI PCBs, was projected to reach over $100 billion globally by the end of 2024.

The market for flexible printed circuit boards (PCBs) is experiencing significant growth, projected to reach approximately $9.5 billion by 2027, up from $6.8 billion in 2022, according to industry reports. This expansion is fueled by the escalating demand for sophisticated electronics in wearable technology, medical devices, and advanced automotive systems, where space and flexibility are paramount.

Rigid-flex PCBs, a hybrid solution combining the benefits of rigid and flexible circuits, are also gaining traction. Their ability to reduce component count and eliminate cumbersome wire harnesses makes them particularly attractive for applications requiring high reliability and complex routing, such as in advanced driver-assistance systems (ADAS) within the automotive sector.

Artificial intelligence (AI) and machine learning are revolutionizing PCB manufacturing, boosting precision and efficiency. This integration is driving enhanced automation across production lines, allowing for more complex designs and faster turnaround times.

Smart factories, powered by the Internet of Things (IoT), are key to this transformation. They enable real-time monitoring of equipment and processes, facilitating predictive maintenance and significantly increasing overall throughput. For instance, by mid-2024, many leading PCB manufacturers reported a 15-20% increase in production efficiency due to AI-driven quality control and automated assembly.

Advanced Materials Development

The development of advanced materials is significantly reshaping Printed Circuit Board (PCB) manufacturing. Innovations like high-performance substrates and conductive inks are enabling PCBs with superior thermal management and electrical conductivity. This progress is crucial as demand for sophisticated electronics, from AI hardware to advanced automotive systems, continues to surge. For instance, the global PCB market was valued at approximately $75 billion in 2023 and is projected to grow, with advanced materials being a key enabler of this expansion.

These new materials are not only enhancing performance but also facilitating new manufacturing methods. Additive manufacturing, for example, becomes more viable with materials designed for 3D printing, allowing for more complex and customized PCB designs. Furthermore, there's a growing emphasis on sustainability, with advanced materials contributing to more environmentally friendly production processes, such as reduced waste and the use of less hazardous chemicals. The drive towards greener manufacturing is a significant trend, with companies actively seeking materials that align with ESG (Environmental, Social, and Governance) goals.

- Enhanced Performance: Advanced materials provide better thermal dissipation and electrical signal integrity, crucial for high-frequency and high-power applications.

- Additive Manufacturing Enablement: Materials are being developed specifically for 3D printing PCBs, opening doors for intricate designs and on-demand production.

- Sustainability Focus: Innovations include biodegradable substrates and lead-free conductive inks, reducing the environmental footprint of PCB production.

- Market Growth Driver: The adoption of these materials is directly supporting the projected growth in the PCB market, estimated to reach over $90 billion by 2028.

5G and High-Speed Communication Technologies

The ongoing global deployment of 5G networks and the broader expansion of high-speed data services are creating substantial demand for advanced Printed Circuit Boards (PCBs). These PCBs must be engineered to effectively manage high-frequency signals and accommodate significantly increased bandwidth, directly impacting the telecommunications industry. This technological shift necessitates specialized PCBs for critical infrastructure components like base stations.

The telecommunications sector is a primary beneficiary and driver of this trend. As of early 2024, 5G network coverage continues to expand, with many regions reporting substantial growth in 5G subscriptions. For instance, global 5G connections were projected to surpass 1.5 billion by the end of 2024, a significant leap from previous years, underscoring the urgency for advanced PCB manufacturing capabilities.

- Increased Demand for High-Frequency PCBs: The need for PCBs that can reliably handle signals in the gigahertz range is paramount for 5G infrastructure.

- Impact on Telecom Infrastructure: Base stations, routers, and other network equipment require specialized, high-performance PCBs to support 5G’s speed and capacity.

- Market Growth in Advanced PCBs: The global market for advanced PCBs, driven by 5G and other high-tech applications, is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of over 7% through 2028.

- Investment in R&D: PCB manufacturers are investing heavily in research and development to create materials and designs that meet the stringent requirements of next-generation communication technologies.

Technological advancements are a primary driver for the Printed Circuit Board (PCB) industry, pushing innovation in miniaturization, performance, and manufacturing processes. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into smart factories is enhancing production precision and efficiency, with many manufacturers reporting significant output increases by mid-2024 due to AI-driven quality control.

The development of advanced materials, such as high-performance substrates and conductive inks, is enabling PCBs with superior thermal and electrical properties, crucial for demanding applications like AI hardware and automotive systems. This trend supports the projected growth of the global PCB market, which was valued at approximately $75 billion in 2023 and is expected to expand further.

Furthermore, the ongoing global deployment of 5G networks is creating substantial demand for advanced, high-frequency PCBs. This is driving investment in research and development for next-generation communication technologies, with the advanced PCB market projected to achieve a CAGR exceeding 7% through 2028.

| Technology Trend | Impact on PCBs | Relevant Data/Projection |

|---|---|---|

| AI & IoT in Manufacturing | Increased precision, efficiency, automation | 15-20% efficiency increase reported by manufacturers (mid-2024) |

| Advanced Materials | Enhanced thermal/electrical performance, new manufacturing methods | Global PCB market ~ $75 billion (2023), growth driven by materials |

| 5G Network Deployment | Demand for high-frequency, high-bandwidth PCBs | Advanced PCB market CAGR > 7% through 2028 |

Legal factors

Environmental regulations, particularly concerning hazardous substances like lead and brominated flame retardants, significantly influence Printed Circuit Board (PCB) manufacturing. Compliance with these rules, including e-waste disposal mandates, requires substantial investment in cleaner production technologies and sustainable material sourcing.

For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive, updated in 2022, continues to drive the adoption of lead-free solders and alternative flame retardants in electronics, impacting global supply chains. Failure to adhere can result in hefty fines and market access restrictions, making proactive environmental management a critical operational factor for companies like FTG.

FTG, as a global player in aerospace and defense, navigates a complex web of import/export regulations and trade controls. These rules govern the movement of sensitive technologies and finished products, directly impacting supply chain efficiency and market access. For instance, the US International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) impose strict requirements on defense articles and dual-use technologies, with potential penalties for non-compliance. In 2024, global trade tensions and evolving national security concerns continue to reshape these controls, requiring FTG to maintain robust compliance programs to avoid disruptions.

Protecting intellectual property, like the unique designs and manufacturing processes for FTG's high-reliability PCBs and aerospace assemblies, is absolutely vital for maintaining its edge in the market. This is where robust legal frameworks come into play.

Patents, trademarks, and trade secrets form the bedrock of this protection, acting as legal shields for FTG's innovations. For instance, in 2024, the global intellectual property market saw significant growth, with patent filings alone reaching new heights, underscoring the increasing importance of safeguarding technological advancements.

Product Liability and Safety Standards

FTG's commitment to producing high-reliability circuit boards for sectors like aerospace and defense means navigating a complex web of product liability laws and safety standards. Failure to meet these rigorous requirements, such as those mandated by the FAA for aviation components or DoD standards for defense systems, can result in severe legal penalties, including substantial fines and costly lawsuits. For instance, in 2024, a major electronics supplier faced a $50 million lawsuit over faulty components in a defense contract, highlighting the financial risks of non-compliance.

Adherence to these regulations is not just about avoiding legal trouble; it's fundamental to maintaining FTG's reputation for quality and reliability in critical industries. The company must ensure its manufacturing processes and product designs align with established safety protocols, such as ISO 9001 and specific industry certifications. A breach of these standards could lead to contract terminations and a loss of trust among key clients, impacting future business opportunities significantly.

- Regulatory Compliance: FTG must comply with global product safety regulations, such as those enforced by the European Union's CE marking directives for electronic components, ensuring products meet health, safety, and environmental protection standards.

- Liability Exposure: In 2023, the global product liability market experienced a notable increase in claims, particularly in the technology and manufacturing sectors, underscoring the financial risks associated with product defects.

- Industry Standards: For aerospace and defense, adherence to standards like AS9100 is critical, with audits and certifications playing a key role in demonstrating FTG's commitment to quality and safety.

- Reputational Impact: A single product failure linked to a safety lapse could severely damage FTG's brand, potentially costing millions in lost revenue and requiring extensive public relations efforts to rebuild trust.

Labor Laws and Employment Regulations

FTG's global footprint necessitates adherence to a complex web of international labor laws and employment regulations. These vary significantly by country, impacting everything from minimum wage requirements and working hour limits to employee benefits and termination procedures. For instance, in 2024, the average minimum wage across OECD countries saw an increase, a trend FTG must monitor closely in its operational regions.

Navigating these diverse legal landscapes is critical for smooth operations and risk mitigation. FTG must ensure compliance with regulations concerning collective bargaining, workplace safety, and anti-discrimination laws. The potential for labor disputes, such as the strike experienced at its Aerospace Toronto facility in early 2025, highlights the tangible impact of employment regulations on productivity and financial performance.

- Compliance Costs: FTG incurs costs related to legal counsel, HR compliance training, and potential fines for non-adherence to labor laws.

- Workforce Relations: Strict adherence to regulations fosters better employee relations and can mitigate the risk of costly labor disputes.

- Talent Acquisition: Understanding and complying with local employment laws is crucial for attracting and retaining a skilled workforce in different markets.

- Operational Disruption: Failure to comply with labor laws can lead to strikes, work stoppages, and significant financial losses, as seen with the Toronto facility incident.

FTG's operations are heavily shaped by intellectual property laws, safeguarding its innovations in high-reliability PCBs and aerospace assemblies. Patents, trademarks, and trade secrets are crucial legal tools, with global patent filings in 2024 showing a significant upward trend, emphasizing the value of protecting technological advancements.

Product liability laws and stringent safety standards, such as those from the FAA and DoD, pose significant legal risks. A 2024 lawsuit against an electronics supplier for faulty defense contract components, resulting in a $50 million claim, illustrates the financial repercussions of non-compliance. Adherence to standards like AS9100 is vital for maintaining client trust and avoiding contract terminations.

| Legal Factor | Impact on FTG | 2024/2025 Data/Trend |

|---|---|---|

| Intellectual Property Protection | Safeguards proprietary designs and manufacturing processes; maintains competitive advantage. | Global patent filings increased in 2024, indicating heightened IP value. |

| Product Liability & Safety Standards | Mitigates risk of lawsuits and fines for defective products in critical sectors. | A 2024 lawsuit involved a $50 million claim for faulty defense components. Adherence to AS9100 is critical. |

| International Trade & Export Controls | Ensures compliance with regulations like ITAR/EAR, affecting supply chain and market access. | Evolving national security concerns in 2024 are reshaping global trade controls. |

| Labor Laws & Employment Regulations | Governs workforce management, impacting operational costs and stability. | Minimum wages in OECD countries saw increases in 2024; a labor dispute at FTG's Toronto facility occurred in early 2025. |

Environmental factors

Traditional Printed Circuit Board (PCB) manufacturing, a core process for companies like FTG, historically relies on materials such as lead and brominated flame retardants. These substances are classified as hazardous, and their use results in the generation of substantial waste streams that require careful management.

FTG, like many in the electronics manufacturing sector, confronts the critical challenge of effectively managing and actively reducing its hazardous waste output. This is essential not only for adhering to increasingly stringent environmental regulations globally but also for minimizing the company's ecological footprint and potential liabilities.

For instance, in 2024, the global electronics waste (e-waste) generation reached an estimated 62 million metric tons, with a significant portion stemming from manufacturing processes. FTG's commitment to sustainable practices means investing in cleaner production technologies and robust waste treatment solutions to mitigate these environmental impacts and ensure regulatory compliance.

PCB fabrication is notoriously energy-intensive, with significant implications for a company's carbon footprint. For instance, the etching and plating processes alone can consume substantial amounts of electricity. FTG must prioritize adopting more energy-efficient manufacturing techniques to mitigate these environmental impacts.

In 2024, the global electronics manufacturing sector faced increasing scrutiny regarding its energy consumption and associated greenhouse gas emissions. Reports indicate that the semiconductor and PCB industries are among the higher energy-consuming sectors. FTG's commitment to sustainability necessitates exploring renewable energy integration, such as solar or wind power, to reduce reliance on fossil fuels and align with evolving environmental regulations and stakeholder expectations for 2025.

The electronics industry's heavy reliance on finite resources like copper, gold, and critical rare earth elements for Printed Circuit Board (PCB) manufacturing presents significant long-term supply chain risks. For instance, global copper reserves are estimated to be around 870 million tonnes, but demand continues to rise, impacting price stability and availability. FTG must proactively investigate and integrate more sustainable material alternatives and implement rigorous responsible sourcing policies to mitigate these environmental and economic vulnerabilities.

E-waste Management and Recycling

The escalating global concern surrounding electronic waste, or e-waste, is compelling Printed Circuit Board (PCB) manufacturers to implement more robust recycling programs and embrace circular economy principles. This trend is driven by increasing regulatory scrutiny and consumer demand for sustainable practices.

Key aspects include designing PCBs for easier disassembly and improving the recovery rates of valuable materials, such as gold, silver, and copper, from discarded electronics. This not only mitigates environmental impact but also presents a significant economic opportunity.

For instance, the global e-waste generated reached an estimated 62 million metric tons in 2020, with projections indicating a rise to 74 million metric tons by 2030. The value of raw materials contained within this waste stream is also substantial, estimated to be around $57 billion annually.

- Growing E-waste Volume: Global e-waste is projected to reach 74 million metric tons by 2030, up from 62 million metric tons in 2020.

- Economic Value of Recovery: The raw materials recoverable from e-waste are valued at approximately $57 billion per year.

- Circular Economy Focus: PCB manufacturers are increasingly adopting design-for-disassembly and material recovery strategies.

- Regulatory Pressure: Stricter environmental regulations worldwide are pushing for enhanced e-waste management and recycling initiatives.

Water and Air Pollution

The electronics manufacturing sector, including printed circuit board (PCB) production, often relies on chemical treatments like etching and cleaning agents. These processes can release volatile organic compounds (VOCs) into the air and discharge wastewater containing heavy metals and solvents, posing significant environmental risks. For instance, in 2023, the global electronics industry generated an estimated 5.1 million tonnes of e-waste, a portion of which is directly attributable to manufacturing byproducts.

FTG must actively manage its environmental impact by carefully selecting and utilizing these chemical agents. This involves a dual approach: optimizing the use of current agents to minimize waste and emissions, and concurrently investing in research and development for more sustainable, less toxic alternatives. The goal is to achieve production efficiency without compromising environmental stewardship.

Furthermore, robust wastewater treatment is crucial. Advanced filtration and chemical precipitation methods can remove pollutants before discharge, ensuring compliance with increasingly stringent environmental regulations. Many regions, such as the European Union under the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, are pushing for stricter controls on hazardous substances in manufacturing processes.

Key considerations for FTG in managing water and air pollution from chemical treatments include:

- Evaluating the environmental impact of all chemical inputs in PCB manufacturing.

- Investing in R&D for biodegradable or less hazardous etching and cleaning solutions.

- Implementing state-of-the-art wastewater treatment technologies to meet or exceed regulatory standards.

- Monitoring and reporting air emissions to ensure compliance and identify areas for improvement.

Environmental factors significantly shape the PCB manufacturing landscape for companies like FTG. The industry's historical reliance on hazardous materials such as lead and brominated flame retardants creates substantial waste streams requiring diligent management. FTG, like its peers, faces pressure to reduce its ecological footprint and comply with evolving global regulations. The sheer volume of e-waste, projected to reach 74 million metric tons by 2030, underscores the need for sustainable practices and resource recovery.

Energy consumption is another critical environmental consideration. PCB fabrication processes, particularly etching and plating, are energy-intensive, contributing to the sector's carbon footprint. Reports from 2024 highlighted the electronics manufacturing sector's significant energy use. FTG must prioritize energy efficiency and explore renewable energy sources to meet environmental targets for 2025 and beyond.

The sourcing of finite resources like copper and rare earth elements presents long-term supply chain risks. With global copper reserves estimated at 870 million tonnes and rising demand, price volatility is a concern. FTG's strategy must include responsible sourcing and the exploration of more sustainable material alternatives to mitigate these environmental and economic vulnerabilities.

Chemical treatments in PCB manufacturing, including etching and cleaning agents, pose risks of air and water pollution. The generation of volatile organic compounds (VOCs) and wastewater containing heavy metals necessitates careful chemical management and advanced treatment solutions. FTG's commitment to environmental stewardship requires optimizing chemical use and investing in less toxic alternatives, aligning with regulations like the EU's REACH.

| Environmental Factor | Impact on PCB Manufacturing | FTG's Considerations/Actions | Relevant Data (2024/2025 Focus) |

| Hazardous Materials & Waste | Generation of hazardous waste streams, regulatory compliance burden | Reduce hazardous material use, invest in cleaner technologies, robust waste treatment | Global e-waste projected to reach 74 million metric tons by 2030 (up from 62 million in 2020) |

| Energy Consumption | High electricity usage, carbon footprint | Adopt energy-efficient techniques, explore renewable energy integration (solar, wind) | Electronics manufacturing identified as high energy-consuming sector |

| Resource Depletion | Supply chain risks, price volatility for critical materials | Investigate sustainable material alternatives, implement responsible sourcing policies | Global copper reserves ~870 million tonnes; rising demand impacts availability |

| Chemical Pollution (Air & Water) | VOC emissions, wastewater contamination (heavy metals, solvents) | Optimize chemical usage, R&D for less toxic alternatives, advanced wastewater treatment | EU REACH regulation driving stricter controls on hazardous substances |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government statistics, international economic organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors influencing your business.