FTG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTG Bundle

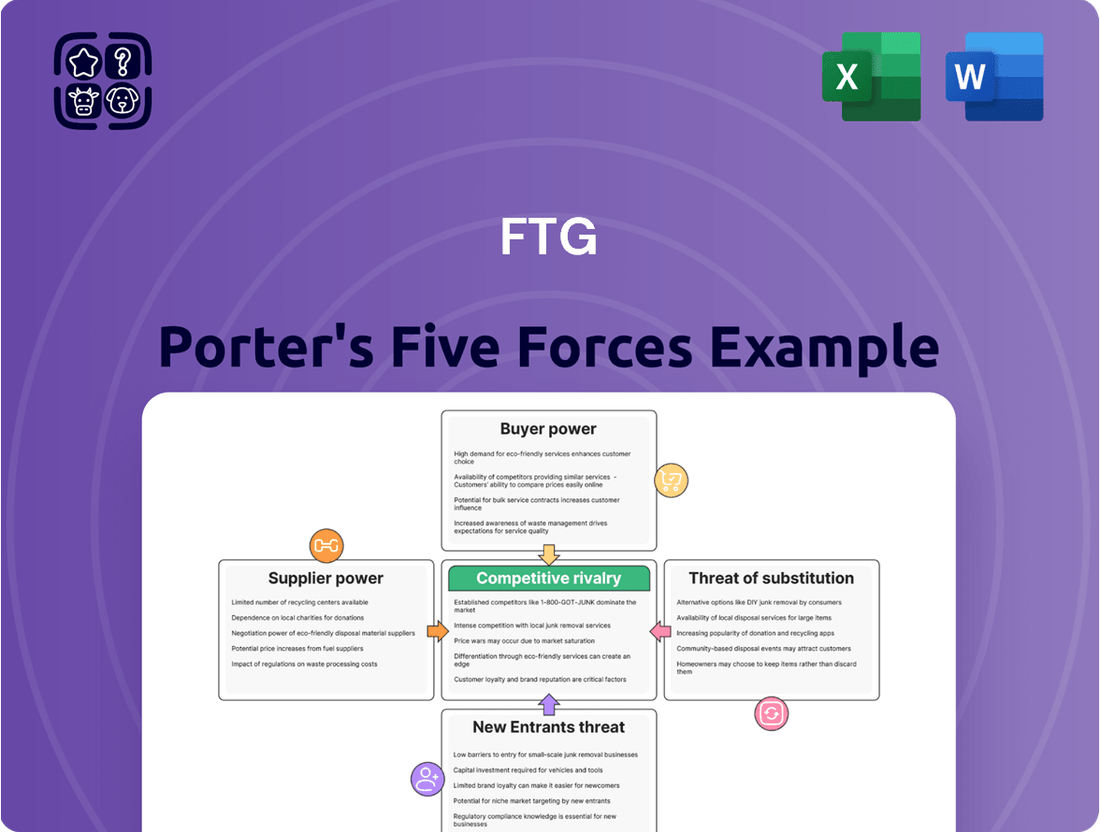

Porter's Five Forces Analysis offers a powerful lens to dissect FTG's competitive landscape. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning. This framework illuminates the underlying forces that shape profitability and market dynamics for FTG.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FTG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Printed Circuit Board (PCB) industry, including companies like FTG, often faces supplier concentration for essential materials such as copper foil, epoxy resins for laminates (like FR4), and specialized chemicals. This limited supplier base grants these providers considerable bargaining power.

For instance, in 2024, the global PCB market was valued at approximately $75 billion, with a significant portion of this value dependent on the consistent and timely supply of these core components. A disruption or price hike from even a few key suppliers can directly impact FTG's production costs and lead times.

This concentration is particularly acute for high-performance PCBs used in demanding sectors like aerospace and defense, where material specifications are stringent. Suppliers in these niches often have proprietary technologies or unique production capabilities, further solidifying their leverage over PCB manufacturers.

Suppliers offering advanced materials and components, like specialized integrated circuits or high-frequency laminates crucial for high-reliability circuit boards, wield significant bargaining power. FTG's focus on aerospace, defense, and telecommunications sectors necessitates these unique inputs, thereby restricting viable alternatives for FTG.

Switching suppliers for critical PCB materials or components presents significant hurdles for FTG, directly impacting their bargaining power. These costs aren't just financial; they involve the time and resources needed to qualify new materials, potentially re-engineer existing designs, and manage the inevitable disruptions to production schedules. This complexity inherently strengthens the hand of existing suppliers.

The aerospace and defense sectors, where FTG is a key player, impose particularly stringent certification requirements on materials and components. Meeting these rigorous standards for new suppliers is a lengthy and expensive process, further entrenching the switching costs for FTG and bolstering the bargaining power of established, certified suppliers.

Threat of Forward Integration by Suppliers

If key suppliers were to integrate forward into PCB manufacturing, they would directly compete with FTG, fundamentally altering the competitive landscape. This scenario, though less probable for suppliers of highly specialized raw materials, represents a significant escalation of their bargaining power.

This forward integration threat would allow suppliers to capture a larger portion of the value chain, potentially dictating terms and pricing to their former customers. For example, a supplier of advanced semiconductor materials could decide to manufacture the finished PCBs themselves, leveraging their material expertise and potentially offering a more integrated solution.

Consider the implications for a company like FTG:

- Increased Competition: Suppliers becoming direct rivals means FTG would face competition from entities with deep knowledge of their own supply chain inputs.

- Price Pressure: Integrated suppliers could use their control over raw materials to influence pricing on finished PCBs, squeezing FTG's margins.

- Supply Chain Disruption: A supplier's decision to integrate forward could also lead to disruptions in the availability of critical raw materials for FTG.

Importance of FTG to Supplier Revenue

FTG's substantial purchasing volume, especially for highly specialized components, can constitute a significant percentage of a supplier's overall revenue. For instance, in 2024, the automotive sector saw suppliers heavily reliant on major manufacturers, with some reporting that a single large client accounted for over 30% of their sales.

While FTG being a major customer could theoretically reduce supplier leverage, the current economic climate, marked by persistent supply chain disruptions and robust demand throughout 2024, has diminished this mitigating effect. Suppliers often find themselves with ample alternative buyers, lessening their dependence on any single client.

- Supplier Revenue Dependence: In 2024, many suppliers in critical industries reported that their top five customers represented an average of 60% of their revenue, highlighting concentrated customer bases.

- Specialized Inputs: For niche or proprietary components, FTG's purchasing volume might be the primary driver for a supplier's production, giving that supplier considerable sway.

- Mitigating Factors: While FTG's volume can be a negotiating tool, the broader market dynamics of 2024, characterized by high demand and limited supply for many key materials, have empowered suppliers across various sectors.

- Market Conditions: The ongoing strength in demand for many goods in 2024 means suppliers are less compelled to offer favorable terms to large buyers like FTG, as they can readily find other customers.

Suppliers of critical, specialized materials for the PCB industry, like those FTG relies on, often possess significant bargaining power due to limited alternatives and high switching costs for manufacturers. This power is amplified when suppliers have proprietary technologies or when the sectors FTG serves, such as aerospace and defense, demand highly specialized and certified components.

The concentration of suppliers for essential materials like copper foil and epoxy resins means that even a few key players can dictate terms, impacting FTG's production costs and lead times. For example, the global PCB market, valued around $75 billion in 2024, is heavily reliant on these core components, making disruptions or price increases from suppliers particularly impactful.

The threat of suppliers integrating forward into PCB manufacturing, though less common for raw material providers, presents an ultimate escalation of their power, potentially turning them into direct competitors. This scenario would allow them to control more of the value chain, influencing pricing and potentially disrupting supply for companies like FTG.

While FTG's substantial purchasing volume can be a negotiating advantage, market conditions in 2024, characterized by robust demand and supply chain constraints, have often empowered suppliers. Many suppliers reported that their top five customers accounted for a significant portion of their revenue, but the overall market dynamics have lessened their dependence on any single buyer.

What is included in the product

This analysis dissects the five competitive forces shaping FTG's industry, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly identify and quantify competitive threats, transforming complex market dynamics into actionable insights for strategic planning.

Customers Bargaining Power

The bargaining power of customers is significantly influenced by customer concentration and the volume of business they represent. For FTG, a key factor is the nature of its served industries, such as aerospace, defense, and telecommunications. These sectors are characterized by a limited number of very large clients, often major original equipment manufacturers (OEMs) or prime defense contractors.

These large customers frequently place substantial orders, representing a significant portion of FTG's revenue. For instance, a single major aerospace contract can be worth hundreds of millions, if not billions, of dollars. This high-volume purchasing power allows these clients to negotiate favorable terms, including pricing, delivery schedules, and product specifications, directly impacting FTG's profitability and operational flexibility.

Customers often face significant switching costs when changing PCB manufacturers, particularly due to the intricate requalification processes required, especially in sectors like aerospace and defense where reliability is paramount. For instance, a new supplier might need extensive testing and validation, which can take months and incur substantial expenses, thereby limiting a customer's immediate ability to switch.

Customer price sensitivity varies significantly across FTG's diverse client base. For instance, in the aerospace and defense industries, where product failure carries extreme consequences, customers tend to prioritize unwavering reliability and superior performance, making them less sensitive to price. Conversely, telecommunications clients often operate in highly competitive environments, leading them to be more attuned to pricing, which directly impacts FTG's pricing strategies and profit margins.

Availability of Alternative Suppliers

The availability of alternative suppliers significantly impacts FTG's bargaining power with its customers. While FTG focuses on high-reliability and high-performance printed circuit boards (PCBs), customers can often find alternative manufacturers, especially for less demanding applications or in regions with expanding PCB production capacity. The global PCB market is quite dynamic, with numerous manufacturers competing for business, which can empower customers to seek out different options if pricing or terms are not met.

For instance, while FTG might cater to specialized aerospace or medical device sectors, a customer needing standard PCBs could readily source them from a multitude of manufacturers worldwide. The global PCB market was valued at approximately $69 billion in 2023 and is projected to grow, indicating a broad competitive landscape. This broad availability means customers can switch suppliers if FTG's offerings don't align with their cost or performance expectations for certain product lines.

- Broad Market Availability: The global PCB market features numerous manufacturers, providing customers with a wide array of sourcing options, particularly for standard or less complex board requirements.

- Regional Competition: Growing manufacturing capabilities in various regions worldwide introduce more suppliers, increasing customer choice and potentially lowering switching costs.

- Price Sensitivity: For customers not requiring FTG's highest performance tiers, the availability of lower-cost alternatives from other suppliers can exert downward pressure on pricing.

Threat of Backward Integration by Customers

Large customers, particularly those with significant volume needs or highly specialized requirements, may possess the capability to bring printed circuit board (PCB) manufacturing in-house. This threat of backward integration is more pronounced for customers who have the necessary capital, technical expertise, and a consistent demand for PCBs. For instance, a major electronics manufacturer could invest in its own PCB fabrication facilities if the cost savings and control over proprietary designs outweigh the initial investment and ongoing operational complexities.

While the complete in-house production of complex, multi-layer PCBs remains a substantial undertaking, the mere *potential* for backward integration acts as a significant check on pricing power. This leverage allows large buyers to negotiate more aggressively on price and terms. In 2024, the global PCB market, valued at approximately $70 billion, saw intense competition, further amplifying customer bargaining power, especially among the top tier of buyers who represent a substantial portion of any manufacturer's revenue.

- Customer Capability: Large customers with substantial resources and technical know-how can explore bringing PCB manufacturing in-house.

- Proprietary Designs: The desire to protect sensitive or proprietary PCB designs can drive customers towards backward integration.

- Pricing Ceiling: The threat of customers producing their own PCBs limits the pricing flexibility for manufacturers like FTG.

- Market Dynamics: In a competitive market like the $70 billion global PCB industry in 2024, this threat is amplified, leading to more stringent price negotiations.

The bargaining power of customers is a critical factor for FTG, influenced by customer concentration and the volume of business they represent. FTG's primary clients in aerospace, defense, and telecommunications are often large OEMs or prime contractors who place substantial orders, giving them significant negotiation leverage on pricing and terms.

Switching costs for customers are generally high due to the rigorous requalification processes required for new PCB suppliers, especially in regulated sectors like aerospace and defense. This can limit immediate customer ability to switch, providing FTG with some pricing stability for these clients.

Customer price sensitivity varies; aerospace and defense clients prioritize reliability over cost, while telecommunications customers are more price-conscious due to competitive pressures. The global PCB market, valued at approximately $70 billion in 2024, offers numerous alternative suppliers, which can empower customers to seek better pricing, especially for less specialized PCB requirements.

The potential for large customers to bring PCB manufacturing in-house, particularly for standard components, acts as a ceiling on FTG's pricing power. This threat of backward integration is amplified in the competitive 2024 market, leading to more aggressive price negotiations from major buyers.

| Factor | Impact on FTG's Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Concentration & Volume | High | Major aerospace/defense clients represent significant revenue portions, enabling strong negotiation. |

| Switching Costs | Low to Moderate | High for specialized applications (aerospace/defense) due to requalification; lower for standard PCBs. |

| Price Sensitivity | Variable | Low in defense/aerospace; High in telecommunications. |

| Availability of Alternatives | Moderate to High | Broad global PCB market ($70 billion in 2024) offers many suppliers, especially for standard boards. |

| Threat of Backward Integration | Moderate | Potential for large clients to develop in-house manufacturing capabilities limits pricing flexibility. |

Preview the Actual Deliverable

FTG Porter's Five Forces Analysis

This preview showcases the complete FTG Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within an industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no hidden surprises or placeholder content.

Rivalry Among Competitors

The global Printed Circuit Board (PCB) market is characterized by its fragmentation, featuring a broad spectrum of companies from large, established multinational corporations to smaller, niche manufacturers. FTG specifically competes within the high-reliability and high-performance segment, where the sheer volume of competitors may be lower, but the intensity of competition is driven by advanced technological capabilities and innovation.

The Printed Circuit Board (PCB) market is seeing healthy expansion, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028, reaching an estimated value of $92.1 billion. This overall growth, particularly in sectors like aerospace and defense which are expected to grow at a CAGR of 5.2% in the same period, can ease competitive intensity. When the pie is getting bigger, there's less pressure for companies to aggressively fight for market share.

However, the PCB industry isn't monolithic. While specialized segments like aerospace offer a more moderate competitive landscape, the broader consumer electronics sector, a significant driver of general PCB demand, is characterized by intense rivalry. This segment often sees rapid product cycles and price sensitivity, leading to more aggressive competition among manufacturers vying for volume orders.

FTG's strategic focus on highly specialized, high-reliability circuit boards and backplanes for demanding sectors such as aerospace and defense creates a significant product differentiation. This specialization allows FTG to command premium pricing, as customers in these industries prioritize performance, durability, and stringent certifications over cost alone. For instance, in 2023, FTG reported that its specialized aerospace and defense segment contributed 45% of its total revenue, underscoring the market's willingness to pay for its unique capabilities.

Exit Barriers

High capital investment in manufacturing facilities and specialized equipment forms a significant barrier to exiting the Printed Circuit Board (PCB) industry. Companies that have invested heavily in advanced machinery and production lines face substantial costs if they decide to cease operations. This can trap firms in the market, even when profitability is low, as the alternative of liquidating assets and recouping capital may be unappealing.

These elevated exit barriers directly fuel competitive rivalry. Manufacturers may choose to continue producing at a loss rather than absorb the significant financial penalties associated with shutting down. For instance, a typical advanced PCB manufacturing plant can represent an investment of tens to hundreds of millions of dollars, making a complete shutdown a financially daunting prospect.

- High Capital Investment: Significant upfront costs for specialized machinery and facilities in PCB manufacturing.

- Asset Specificity: Equipment is often highly specialized and difficult to repurpose or sell at a favorable price.

- Operating Despite Losses: Companies may continue operations to avoid substantial exit costs, leading to prolonged price competition.

- Industry Trends: The global PCB market, valued at approximately $75 billion in 2023, sees companies hesitant to exit due to the sheer scale of their fixed assets.

Strategic Stakes

The competitive rivalry within the PCB and assembly sector is intense, as it forms the bedrock of FTG's strategic standing in vital markets like automotive and aerospace. Competitors recognize the critical nature of this business and are poised to vigorously protect their existing market positions.

This defense often manifests through aggressive strategies such as accelerated product innovation, forging key strategic alliances to enhance capabilities, and sometimes engaging in price-based competition to win or retain contracts. For example, in 2023, the global PCB market was valued at approximately $75 billion, with significant consolidation and strategic maneuvering among major players like TTM Technologies and Unimicron.

- High Stakes: FTG's core business in PCBs and assembly is fundamental to its strategic market presence, particularly in high-demand sectors.

- Aggressive Defense: Competitors are motivated to defend their market share through robust strategies.

- Key Competitive Tactics: These include rapid innovation, forming strategic partnerships, and potentially employing price competition.

- Market Dynamics: The substantial global PCB market value underscores the significant financial incentives for competitors to maintain or expand their share.

Competitive rivalry in the PCB market is a significant force, especially for companies like FTG operating in specialized segments. While overall market growth can temper this rivalry, certain sectors, like consumer electronics, remain highly competitive due to rapid product cycles and price sensitivity. FTG's focus on high-reliability products for aerospace and defense, where performance trumps price, helps mitigate direct competition from lower-end manufacturers, allowing for premium pricing and a more stable market position.

The intensity of competition is also shaped by the substantial barriers to exit within the PCB industry. High capital investments in specialized manufacturing equipment, often costing tens to hundreds of millions of dollars, make it financially challenging for companies to cease operations. This can lead to firms continuing to operate even at a loss, contributing to ongoing price pressures and a more aggressive competitive landscape.

| Competitive Factor | Description | Impact on FTG | Relevant 2023 Data |

| Market Fragmentation | Broad range of manufacturers from large multinationals to niche players. | FTG competes in a specialized segment with fewer, but technologically advanced, competitors. | Global PCB market valued at approx. $75 billion. |

| Product Differentiation | FTG's focus on high-reliability PCBs for aerospace and defense. | Allows premium pricing and reduces direct competition with mass-market producers. | FTG's specialized segment contributed 45% of revenue in 2023. |

| Exit Barriers | High capital investment in specialized PCB manufacturing facilities. | Can lead to companies operating at a loss, intensifying price competition. | Advanced PCB plant investments range from tens to hundreds of millions of dollars. |

| Competitive Tactics | Innovation, strategic alliances, and price competition. | FTG must continuously innovate and form partnerships to maintain its edge. | Major players like TTM Technologies and Unimicron actively engaged in strategic maneuvering in 2023. |

SSubstitutes Threaten

While printed circuit boards (PCBs) remain a cornerstone of electronic interconnection, the landscape is evolving. Emerging technologies such as the 3D printing of electronics, direct device embedding, and advanced packaging techniques present a potential long-term threat by offering alternative methods for creating interconnections. These innovations could provide novel form factors and higher levels of integration, potentially bypassing traditional PCB manufacturing processes.

The primary function of a printed circuit board (PCB) is to mechanically support and electrically connect electronic components. While direct substitutes for the entire PCB are scarce, advancements in chip design are creating functional equivalents. For instance, System-on-Chip (SoC) technology integrates multiple functions onto a single silicon die, potentially reducing the need for extensive external PCB interconnections and complex layouts.

Currently, for the high-reliability and performance demands of FTG's target markets, direct substitutes are not cost-effective. This means that while alternatives might exist, their price point or performance trade-offs make them unattractive compared to FTG's offerings.

However, this landscape could shift. If emerging technologies or alternative solutions significantly decrease in cost while still meeting or exceeding current performance benchmarks, the threat of substitutes for FTG would substantially increase. For instance, a breakthrough in lower-cost, high-efficiency materials could disrupt markets that currently rely on specialized, premium-priced components.

Performance and Reliability of Substitutes

In the aerospace and defense sectors, the performance and reliability of interconnection solutions are non-negotiable. Any potential substitute must adhere to extremely stringent military and aviation standards, a significant hurdle for emerging technologies. For instance, the failure rate for critical aerospace components is often measured in parts per billion, a benchmark that new interconnection methods must demonstrably meet or exceed.

The high cost associated with qualifying and certifying new technologies in this industry further deters substitutes. Companies like Boeing and Airbus invest millions in testing and validation for new materials and systems. This rigorous process, often taking years, creates a substantial barrier, making it difficult for alternative interconnection methods to gain traction against established, proven solutions.

The threat of substitutes in aerospace interconnections is therefore relatively low due to these demanding requirements. Consider the aerospace market for electrical connectors, valued at billions of dollars globally. Established players with decades of proven reliability, such as TE Connectivity and Amphenol, dominate this space. Their products are designed and tested to withstand extreme environmental conditions, including vibration, temperature fluctuations, and radiation, which are critical for aircraft and defense systems.

- Stringent Standards: Aerospace and defense demand unparalleled reliability, with failure rates often in the parts-per-billion range.

- High Qualification Costs: The expense and time required to certify new interconnection technologies act as a significant deterrent.

- Established Player Dominance: Companies with long track records of proven performance hold a strong market position, making it difficult for substitutes to enter.

- Environmental Resilience: Interconnection solutions must endure extreme conditions like vibration, temperature shifts, and radiation, a benchmark few new technologies can immediately meet.

Customer Acceptance of Substitutes

FTG's customers, especially those in heavily regulated industries, are generally slow to adopt new technologies. This is primarily because these sectors require extensive testing and certification processes before new solutions can be implemented. This inherent inertia significantly dampens the immediate threat posed by substitute products or services.

For instance, in the financial services sector, a key market for FTG, regulatory compliance mandates rigorous validation of any new software or platform. A 2024 survey of financial institutions revealed that the average time to approve and integrate a new technology solution can extend to 18-24 months, a substantial barrier for potential disruptors.

- Slow Adoption Rates: High regulatory hurdles in key FTG markets delay customer acceptance of substitutes.

- Extended Testing Cycles: Certification processes can take up to two years in regulated sectors.

- Customer Inertia: Established practices and the cost of switching further reduce the immediate threat from alternatives.

- Focus on Reliability: In critical applications, customers prioritize proven solutions over potentially unproven substitutes.

The threat of substitutes for FTG's interconnection solutions is currently low, primarily due to the stringent performance and reliability demands of its target markets, particularly aerospace and defense. Emerging technologies like 3D printed electronics or System-on-Chip (SoC) integration, while advancing, have not yet demonstrated the ability to meet these exacting standards cost-effectively. Furthermore, the high cost and lengthy certification processes required in these sectors create significant barriers to entry for alternative solutions.

Despite these hurdles, the long-term threat could increase if new technologies achieve comparable performance at a reduced cost. For example, if advanced packaging techniques mature to a point where they offer equivalent reliability and integration capabilities for a fraction of the price, they could begin to displace traditional PCB solutions in certain applications. This is particularly relevant as industries like consumer electronics continue to push for miniaturization and cost efficiencies.

| Factor | Current Threat Level | Potential Future Impact |

| Performance & Reliability Standards | Low | High if emerging tech meets standards |

| Cost-Effectiveness of Substitutes | Low | Moderate to High if costs decrease |

| Technological Maturity | Low | Moderate as new methods evolve |

| Regulatory & Qualification Costs | High Barrier | Remains a barrier, but can be overcome with time |

Entrants Threaten

Building a state-of-the-art PCB manufacturing plant demands immense upfront capital. Think millions of dollars for precision machinery, sterile cleanroom environments, and sophisticated quality control systems. For instance, a new, advanced PCB fabrication line can easily cost upwards of $50 million to $100 million, making it a formidable hurdle for newcomers.

The aerospace and defense sector presents significant barriers to entry due to rigorous regulatory and certification demands. For instance, achieving compliance with standards like AS9100 and International Traffic in Arms Regulations (ITAR) is a complex and time-consuming undertaking.

New companies must invest heavily in processes and documentation to meet these stringent requirements, often taking years to gain the necessary approvals. This lengthy and expensive path effectively deters many potential new competitors, thereby reducing the threat of new entrants.

Existing players like FTG benefit from significant economies of scale in producing complex printed circuit boards (PCBs), allowing them to spread fixed costs over a larger output and achieve lower per-unit production costs. For instance, in 2024, major PCB manufacturers reported average production volumes in the millions of units, a scale new entrants would find challenging to replicate quickly.

Furthermore, FTG has an established experience curve, meaning they've learned and optimized manufacturing processes over time, leading to increased efficiency and reduced waste. This accumulated knowledge translates into lower operating costs and higher quality, creating a substantial barrier for newcomers who lack this historical learning curve.

Access to Distribution Channels and Customer Relationships

Building robust relationships with key players in sectors like aerospace, defense, and telecommunications is a long-term endeavor, often requiring years of consistent performance and earned trust. Newcomers face a significant hurdle in replicating these deep-seated connections.

Penetrating established distribution channels and securing substantial contracts within these critical industries presents a formidable challenge for any new entrant. Existing suppliers have often cultivated decades-long partnerships, making it difficult for new companies to gain a foothold.

- Customer Loyalty: Incumbent firms benefit from high customer loyalty, making it expensive and time-consuming for new entrants to attract and retain clients.

- Supplier Agreements: Long-term, exclusive, or bundled supplier agreements can lock out new competitors from accessing essential components or distribution networks.

- Brand Reputation: Established brands in these sectors carry significant weight, and new entrants must invest heavily in building a comparable reputation for reliability and quality.

Proprietary Technology and Patents

While the fundamental processes for producing printed circuit boards (PCBs) are generally understood, the real competitive edge often lies in specialized techniques, unique material compositions, and intricate design know-how, particularly for high-performance applications. These elements can be protected through proprietary rights, creating a significant barrier for newcomers.

FTG's extensive history in the industry implies the accumulation of considerable proprietary knowledge and refined operational expertise. New entrants would face a substantial challenge in replicating or acquiring this deep-seated understanding, which is crucial for competing effectively in specialized PCB segments.

- Proprietary Knowledge: FTG likely possesses patented manufacturing processes and trade secrets for advanced PCB technologies.

- R&D Investment: Companies like FTG invest heavily in research and development to maintain a technological lead, making it costly for new entrants to catch up.

- High Entry Costs: The capital required to develop and implement proprietary technologies and secure necessary patents can be prohibitive for potential new competitors.

The threat of new entrants for a company like FTG, a specialized PCB manufacturer, is significantly mitigated by substantial capital requirements. Establishing a state-of-the-art manufacturing facility, complete with precision machinery and cleanroom environments, can easily cost tens of millions of dollars, a substantial barrier for any new player. Furthermore, the aerospace and defense sectors, key markets for FTG, impose rigorous regulatory and certification hurdles, such as AS9100 and ITAR compliance, which are time-consuming and expensive to navigate.

Existing players benefit from established economies of scale; for example, in 2024, major PCB manufacturers reported producing millions of units, a volume difficult for newcomers to match quickly. FTG's accumulated experience curve and deep-seated customer relationships, often built over decades in critical industries, create further barriers. New entrants would struggle to replicate the trust and access to distribution channels that incumbents possess.

Proprietary knowledge, including patented manufacturing processes and trade secrets for advanced PCB technologies, represents another significant deterrent. Companies like FTG invest heavily in R&D, making it costly for new entrants to achieve a comparable technological edge. Customer loyalty and long-term supplier agreements also lock in existing business, making it challenging for new competitors to gain market share.

| Barrier Type | Description | Example Impact on New Entrants | Relevance to FTG |

|---|---|---|---|

| Capital Requirements | High upfront investment for advanced manufacturing facilities. | Costing $50M-$100M+ for a single advanced PCB line. | Significant deterrent due to scale of investment needed. |

| Regulatory Hurdles | Compliance with industry-specific standards (e.g., AS9100, ITAR). | Requires years and substantial resources for certification. | Crucial for FTG's aerospace and defense clients. |

| Economies of Scale | Lower per-unit costs achieved through high-volume production. | New entrants struggle to match the cost-efficiency of established players producing millions of units annually (2024 data). | FTG leverages its production volume for competitive pricing. |

| Proprietary Knowledge | Patented technologies and trade secrets in specialized PCB manufacturing. | High R&D investment by incumbents makes replication costly. | FTG's expertise in advanced PCB segments creates a knowledge moat. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including company annual reports, investor presentations, and industry-specific trade publications. We also leverage data from reputable market research firms and government economic statistics to ensure a comprehensive understanding of the competitive landscape.