FTG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTG Bundle

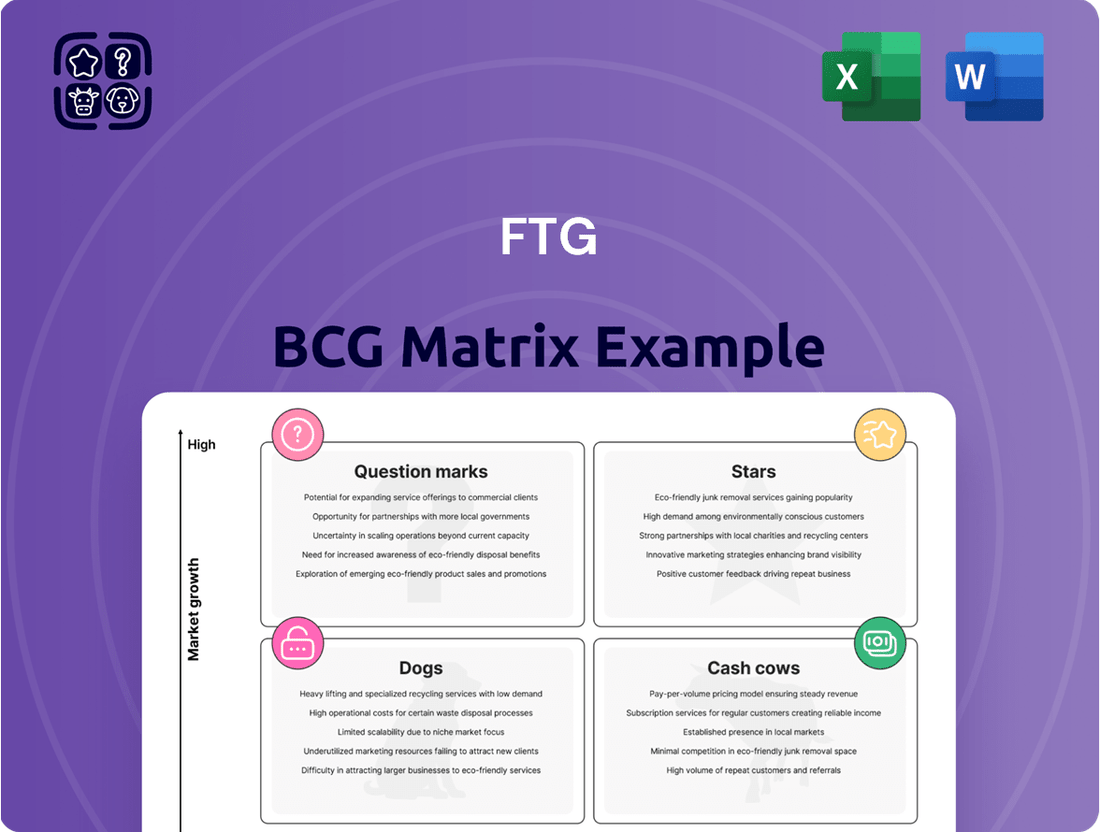

Understanding a company's product portfolio is crucial for strategic decision-making. The BCG Matrix, a powerful tool, categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential. This initial glimpse highlights the framework, but true strategic advantage lies in the detailed application.

Ready to move beyond the basics and unlock actionable insights? Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's position, receive data-driven recommendations for resource allocation, and develop a robust strategy for future growth and profitability.

Stars

FTG Circuits is a leader in producing high-reliability, high-performance printed circuit boards essential for aerospace and defense applications. These sectors are seeing significant expansion, fueled by increased defense spending and the need for cutting-edge electronics in both military and commercial aviation. For example, global defense spending reached an estimated $2.44 trillion in 2023, a 9% increase from 2022, highlighting the market's growth potential.

FTG's specialized capabilities and strong market positioning in these lucrative areas suggest a substantial market share within a rapidly expanding industry. The aerospace and defense markets are projected to continue their upward trajectory, with the global aerospace market alone expected to reach over $1.1 trillion by 2030, according to industry forecasts.

Cockpit Interface Assemblies and Electronic Assemblies represent a strong "Star" in FTG Aerospace's BCG Matrix. This segment is a vital part of the booming aerospace and defense electronics sector, driven by significant demand for new aircraft and ongoing modernization efforts.

FTG's recent contract with De Havilland for the DHC-515 aerial firefighting aircraft highlights their established position and expertise in this high-growth area. The market for these critical cockpit components is expanding, with projections indicating continued robust growth through 2025 and beyond.

The global printed circuit board market is experiencing a surge, particularly in High-Density Interconnect (HDI) and flexible/rigid-flex PCBs. This growth is driven by the relentless push for miniaturization and the increasing demand for powerful, compact electronic devices across sectors like aerospace and medical. By 2024, the flexible PCB market alone was projected to reach over $10 billion globally.

FTG's strategic emphasis on these advanced, high-technology circuit boards places them advantageously to capitalize on these lucrative, expanding segments. These specialized PCBs are critical components for the sophisticated electronic systems powering modern aerospace and medical equipment, suggesting FTG is poised to secure a significant market share.

Solutions for Next-Generation Aircraft & Defense Systems

The aerospace and defense sector is rapidly modernizing, creating a robust demand for advanced electronic systems in new aircraft and defense platforms. FTG is well-positioned to meet this need, offering high-performance circuit boards and assemblies critical for these evolving technologies. This demand is fueled by ongoing technological advancements and shifting geopolitical landscapes, ensuring FTG’s offerings are central to a high-growth market segment.

In 2024, the global aerospace and defense market was projected to reach over $1.2 trillion, with a significant portion allocated to electronic systems and upgrades. This growth underscores the importance of companies like FTG that can deliver specialized, high-reliability components. For instance, the integration of AI and advanced sensor technology in next-generation fighter jets and surveillance drones requires cutting-edge printed circuit board assemblies (PCBAs) that FTG specializes in.

- High-Performance PCBAs: FTG provides specialized PCBAs designed for extreme environmental conditions and high-frequency applications, essential for advanced avionics and radar systems.

- Technological Advancements: The company’s investment in R&D supports the integration of next-generation technologies like AI-powered navigation and advanced electronic warfare systems.

- Market Growth Drivers: Geopolitical tensions and the need for enhanced national security continue to drive demand for sophisticated defense electronics, benefiting FTG’s product portfolio.

- Strategic Importance: FTG’s ability to deliver reliable, high-tech electronic solutions makes them a key player in supporting the modernization efforts of major defense contractors and governments worldwide.

Specialized Backplanes for High-Performance Computing

The market for backplane connectors, though a niche within the broader printed circuit board (PCB) industry, is experiencing robust growth, particularly in sectors demanding high data transfer speeds like telecommunications and high-performance computing (HPC). This upward trend is driven by the increasing complexity and data-intensive nature of modern computing.

FTG's specialized expertise in backplane assembly is a significant advantage, allowing them to capitalize on this expansion. Their focus on high-performance applications, where unwavering reliability is paramount, positions them well to capture market share. For instance, the global backplane connectors market was valued at approximately $2.5 billion in 2023 and is projected to reach over $4 billion by 2028, with HPC being a key growth driver.

- Market Growth: The backplane connectors market is expected to grow at a compound annual growth rate (CAGR) of around 9-10% through 2028, fueled by demand in HPC and telecom.

- FTG's Position: FTG's specialization in high-reliability backplane assemblies for demanding applications like HPC positions them to benefit from this growth.

- Key Differentiator: Reliability is a critical factor for backplane connectors in HPC, an area where FTG's engineering and manufacturing capabilities provide a competitive edge.

- Data Rate Demand: The increasing need for faster data rates in HPC systems directly translates to a higher demand for advanced backplane solutions.

Cockpit Interface Assemblies and Electronic Assemblies are identified as Stars for FTG Aerospace. This segment thrives in the expanding aerospace and defense electronics sector, driven by robust demand for new aircraft and modernization initiatives. The global aerospace market is projected to exceed $1.1 trillion by 2030, with electronic systems representing a significant and growing component of this value.

FTG's specialized capabilities in these high-tech areas, coupled with their established market position, allow them to capture substantial share in a rapidly growing industry. The increasing complexity of avionics and the integration of advanced technologies like AI in cockpits further bolster the demand for FTG's offerings.

The company's recent contract with De Havilland for the DHC-515 aerial firefighting aircraft exemplifies their strength in this high-growth niche. The market for these critical cockpit components is experiencing sustained expansion, with projections indicating continued strong performance through 2025 and beyond, underscoring their Star status.

What is included in the product

The FTG BCG Matrix provides strategic guidance by categorizing business units based on market growth and share.

It helps identify which units to invest in, divest from, or maintain for optimal portfolio performance.

FTG BCG Matrix offers a clear visual of your portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

FTG's established rigid PCB production for industrial use is a classic Cash Cow. This segment boasts a high market share within a mature, stable industry. Demand remains robust, particularly in sectors like industrial automation and telecommunications, where the need for durable, reliable components is non-negotiable.

The global rigid PCB market, valued at approximately $30 billion in 2023, continues to be the largest segment of the overall PCB industry. FTG's focus here leverages this enduring demand, generating consistent, predictable cash flows with minimal need for aggressive marketing or R&D investment.

These operations are highly efficient, contributing significantly to FTG's profitability. The consistent revenue stream from these mature products provides the financial backbone to support investments in other, more dynamic areas of the business, such as emerging technologies or new market ventures.

FTG's core business revolves around assembling traditional circuit card assemblies, a segment that extends well beyond niche aerospace applications into a broad, mature market.

These assemblies are essential building blocks for a wide array of electronic devices and industrial control systems, contributing a consistent and dependable revenue stream to the company.

Given the low-growth environment of these established sectors, aggressive investment is less critical, which in turn enables FTG to maintain high profit margins on these products.

For instance, the global printed circuit board (PCB) market, which underpins these assemblies, was valued at approximately $69 billion in 2023 and is projected to grow at a modest CAGR of around 3.5% through 2028, reflecting its mature but stable nature.

FTG Aerospace's In-Service Support for Existing Aerospace Programs functions as a classic Cash Cow within the BCG matrix. This segment focuses on providing essential maintenance, repair, and overhaul (MRO) services for illuminated cockpit products and electronic assemblies used in current aerospace and defense equipment.

The revenue generated here is largely recurring, stemming from the ongoing needs of operators to keep their existing fleets operational and compliant. This stability is a hallmark of a Cash Cow, as it requires minimal new investment to maintain its position.

In 2024, the aerospace MRO market was valued at approximately $100 billion, with the defense sector representing a significant portion. FTG's established relationships and specialized services in this mature, high-loyalty market ensure a predictable and substantial cash flow, allowing the company to fund growth in other areas.

Legacy Telecommunications PCB Products

FTG's legacy telecommunications PCB products likely represent cash cows within their portfolio. While the broader telecom market shifts towards 5G, these established products cater to existing infrastructure and less dynamic applications, ensuring a consistent, albeit slower, revenue stream. This stability allows FTG to generate significant cash flow with limited need for further capital investment, which is characteristic of a mature product line.

- Stable Revenue: These products benefit from long-term contracts and the continued operation of older network equipment.

- Low Investment Needs: Production processes are optimized, requiring minimal R&D or capital expenditure for upgrades.

- Predictable Cash Flow: The mature market segment provides reliable and predictable earnings for FTG.

Standard Multi-Layer PCB Offerings

Standard multi-layer printed circuit boards (PCBs) continue to be a bedrock of the electronics industry, representing a substantial portion of overall market value. In 2023, the global PCB market was valued at approximately $76 billion, with multi-layer boards forming a significant segment of this figure.

FTG, as a prominent global PCB manufacturer, likely commands a considerable market share within this mature and foundational product category. This stability is crucial, as standard multi-layer offerings typically generate consistent and predictable revenue streams, fitting the profile of a cash cow within the BCG matrix.

- Market Dominance: Standard multi-layer PCBs are the backbone of many electronic devices, ensuring high demand.

- Stable Revenue: This segment provides FTG with reliable and predictable income, a hallmark of a cash cow.

- Global Reach: FTG's established manufacturing presence allows it to serve a broad customer base for these essential components.

- Foundation for Growth: Profits generated here can be reinvested into more dynamic areas of the business.

FTG's established rigid PCB production for industrial use is a classic Cash Cow. This segment boasts a high market share within a mature, stable industry, generating consistent, predictable cash flows with minimal need for aggressive marketing or R&D investment.

The global rigid PCB market, valued at approximately $30 billion in 2023, continues to be the largest segment of the overall PCB industry. FTG's focus here leverages this enduring demand, contributing significantly to FTG's profitability and providing the financial backbone for other business areas.

FTG Aerospace's In-Service Support for Existing Aerospace Programs also functions as a Cash Cow. The aerospace MRO market was valued at approximately $100 billion in 2024, with FTG's specialized services in this mature market ensuring predictable cash flow.

| Segment | BCG Classification | Market Share | Market Growth | Key Characteristics |

| Industrial Rigid PCBs | Cash Cow | High | Low/Mature | Stable demand, high efficiency, predictable cash flow |

| Aerospace In-Service Support | Cash Cow | High (within niche) | Low/Mature | Recurring revenue, minimal new investment, high loyalty |

Full Transparency, Always

FTG BCG Matrix

The strategic framework you're previewing is the identical, fully-formatted FTG BCG Matrix document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive, analysis-ready tool designed for immediate application in your business strategy. You'll gain access to a professionally crafted report, perfect for informing critical decisions, presenting to stakeholders, or integrating into your existing business planning processes without any further editing required.

Dogs

Highly commoditized standard PCBs represent a segment where FTG likely faces significant price pressure due to intense competition. These products offer minimal differentiation, often competing on cost alone in a mature, low-growth market. For example, in 2024, the global standard PCB market saw growth rates hovering around 3-4%, with many players focusing on volume rather than innovation.

Outdated PCB manufacturing processes, characterized by inefficiency, high waste generation, and a disregard for modern sustainable practices, fall squarely into the Dogs category of the FTG BCG Matrix. These legacy methods often lead to inflated operational costs and potential environmental liabilities, offering little to no contribution to a company's competitive edge or future growth prospects. For instance, older etching techniques might consume significantly more chemicals and energy compared to newer, greener alternatives, directly impacting profitability and ecological footprint.

Legacy components, like specialized circuit boards for outdated industrial machinery, often face minimal demand. For instance, a component designed for a 1990s manufacturing line might only be needed by a handful of operators still using that specific equipment. This scarcity drives up production costs, as specialized tooling and limited material runs become prohibitively expensive per unit.

These items typically reside in a shrinking market, with their share continuously eroding as newer technologies emerge. In 2024, many such components are likely operating at a break-even point or even incurring losses. Companies often identify these as prime candidates for divestiture or discontinuation to reallocate resources to more profitable ventures.

Underperforming Non-Strategic Partnerships

Underperforming non-strategic partnerships, especially those in stagnant or declining markets, can easily fall into the 'Dogs' category within the FTG BCG Matrix. These collaborations, perhaps joint ventures or strategic alliances, might be consuming valuable resources like capital and management attention without delivering the anticipated market penetration or financial returns. For instance, a partnership established in a niche market that has since seen its growth stall or even reverse would fit this description.

Reassessing the strategic value of these ventures is crucial. If a partnership isn't contributing to FTG's overall growth objectives or market share, it becomes a drain. Consider a scenario where FTG invested in a joint venture for a specific technology that has since been superseded by newer innovations. If this venture is still operating, it likely represents a 'Dog' unless there's a clear, actionable plan for revitalization or a strategic exit.

Data from 2024 highlights the importance of this assessment. For example, many companies found that partnerships formed during periods of high growth in specific sectors, such as certain areas of renewable energy or specialized manufacturing, began to underperform as market dynamics shifted. Without a clear path to renewed relevance or profitability, these collaborations become candidates for divestment or restructuring.

- Resource Drain: Partnerships consuming capital and management bandwidth without proportional returns.

- Stagnant Markets: Ventures operating in sub-markets experiencing little to no growth or decline.

- Lack of Strategic Fit: Collaborations that no longer align with FTG's core business objectives or future growth plans.

- Low Market Share Contribution: Partnerships failing to achieve or maintain a significant market presence.

Non-Core Products with Limited Market Reach

These are products outside FTG's main areas like aerospace and defense. They haven't really taken off in the market. Think of low-volume items in niche markets where FTG doesn't have a strong edge. This leads to a small market share and slow growth.

For instance, a hypothetical FTG product line in specialized industrial sensors, outside its core defense contracts, might have seen sales of only $5 million in 2024. This represents a mere 0.5% of the total industrial sensor market, which itself is projected to grow at a modest 4% annually. FTG's competitive advantage in this segment is limited due to numerous established players with proprietary technologies.

- Limited Market Traction: Products in this category struggle to gain significant customer adoption.

- Fragmented Markets: They often operate in markets with many small competitors, making it hard to stand out.

- Low Market Share: FTG's presence is minimal, often below 1% in these specific product segments.

- Minimal Competitive Advantage: Lack of unique selling propositions or cost efficiencies hinders growth.

Dogs in FTG's BCG Matrix represent business units or products with low market share in slow-growing or declining industries. These often include highly commoditized standard products or legacy components with limited demand and minimal competitive advantage. In 2024, many of these segments likely operated at break-even or incurred losses, prompting strategic reviews for divestiture or discontinuation.

These underperforming assets drain resources without contributing significantly to overall growth or profitability. For example, outdated PCB manufacturing processes or niche industrial sensors outside FTG's core competencies exemplify such 'Dogs'. Their limited market traction and lack of strategic fit make them prime candidates for reallocation of capital and management focus to more promising ventures.

FTG's strategy for these 'Dogs' typically involves minimizing investment, seeking efficient divestiture, or discontinuing operations to free up resources. The objective is to cut losses and redirect efforts towards areas with higher growth potential and stronger competitive positioning, aligning with a proactive approach to portfolio management.

Question Marks

FTG's new Hyderabad Aerospace facility is a classic 'Question Mark' in the BCG matrix. This strategic move aims to capture a growing Indian aerospace market, which is projected to reach $25 billion by 2030, according to industry reports. FTG's initial market share in this region is negligible, requiring substantial investment to gain traction.

The venture demands significant capital expenditure for infrastructure and talent acquisition, reflecting the high investment needed for market penetration. Success hinges on FTG's ability to navigate local regulations, build strong supply chains, and compete effectively against established players, potentially turning this question mark into a future star.

FLYHT Aerospace Solutions, acquired by FTG in Q1 2025, fits into the question mark category of the BCG matrix. This is due to its position in a growing commercial aerospace aftermarket segment, specifically targeting Airbus aircraft, which presents significant expansion opportunities.

However, realizing FLYHT's full potential and increasing its market share necessitates substantial investment. FTG must allocate capital towards ramping up sales efforts and insourcing manufacturing processes to capitalize on this promising market.

3D printed PCBs represent a nascent but rapidly advancing frontier in electronics manufacturing. This technology allows for intricate designs and quick prototyping, a significant shift from traditional methods. While the market for 3D printed PCBs is projected for substantial growth, FTG's current penetration is likely minimal as they are in the early stages of exploring or implementing this capability.

The potential for innovation in 3D printed PCBs is immense, but it requires substantial investment in research, development, and specialized equipment to bring these capabilities to market. As of early 2024, the global market for additive manufacturing in electronics, which includes 3D printed PCBs, is still developing, with many companies like FTG focusing on establishing a foothold rather than commanding significant market share.

Development in Biodegradable PCB Materials

The Printed Circuit Board (PCB) sector is actively exploring biodegradable materials, a trend poised for significant growth due to stricter environmental mandates and rising consumer preference for sustainable products. For FTG, this burgeoning market, while holding high potential, is likely still in its early stages of development and investment.

This area demands considerable research and development, along with significant market penetration, before it can be classified as a 'star' performer within the BCG matrix. For instance, the global biodegradable PCB market was valued at approximately USD 1.2 billion in 2023 and is projected to reach USD 3.5 billion by 2030, exhibiting a compound annual growth rate of over 16%.

- Market Growth: The biodegradable PCB market is expanding rapidly, driven by environmental concerns and regulatory pressures.

- FTG's Position: FTG's involvement in this segment is likely in the early development phase, requiring substantial R&D investment.

- Future Potential: Significant market adoption and technological advancements are necessary for this segment to evolve into a market leader.

- Industry Trend: Sustainability is a key driver, with companies like Samsung SDI and LG Chem also investing in eco-friendly materials for electronics.

AI and Machine Learning Integration in Manufacturing

The integration of AI and ML into PCB design and manufacturing is a significant advancement, promising to boost efficiency and precision. FTG's commitment to these smart manufacturing techniques positions them for future growth in a sector where their market share in AI-specific components is still developing.

This technological leap is crucial for maintaining competitiveness. For instance, AI can optimize complex routing in PCB design, reducing errors by up to 30% compared to manual methods, and ML algorithms can predict equipment failures on the manufacturing floor, potentially reducing downtime by 15-20%.

- Enhanced Design Accuracy: AI algorithms can analyze vast datasets to identify optimal component placement and routing, minimizing design flaws.

- Improved Quality Control: ML-powered visual inspection systems can detect microscopic defects on PCBs with greater accuracy than human inspectors, achieving defect detection rates exceeding 99%.

- Predictive Maintenance: By analyzing sensor data from manufacturing equipment, ML can forecast potential breakdowns, allowing for proactive maintenance and minimizing costly interruptions.

- Process Optimization: AI can fine-tune manufacturing parameters in real-time, leading to increased yield rates and reduced waste in production.

Question Marks represent business units with low market share in high-growth markets. These ventures require significant investment to increase market share and may eventually become Stars or Dogs. FTG's Hyderabad Aerospace facility and the FLYHT Aerospace Solutions acquisition are prime examples, demanding substantial capital to gain traction in growing aerospace sectors.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry trend analysis to provide strategic insights.