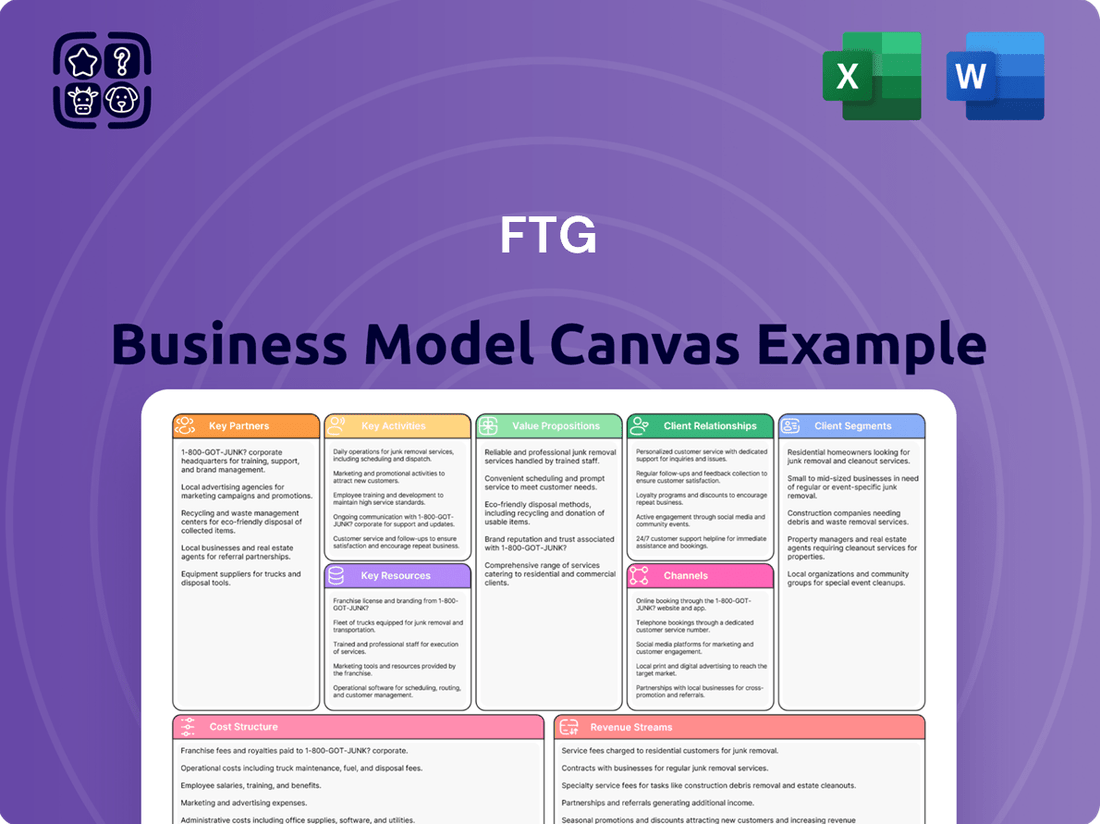

FTG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTG Bundle

Unlock the core of FTG's operational genius with our comprehensive Business Model Canvas. This detailed breakdown illuminates how FTG effectively delivers value, manages resources, and builds strong customer relationships. Dive into the strategic framework that drives their success.

Partnerships

FTG's success hinges on its key partnerships with raw material suppliers, ensuring access to critical components like polyimide, ceramic, metal core PCBs, Teflon, and Rogers 4000. These specialized substrates are vital for FTG's high-performance and high-frequency applications, particularly within the demanding aerospace, defense, and telecommunications sectors.

These collaborations are essential for meeting stringent industry standards, especially as the market increasingly demands materials offering superior dielectric properties and advanced thermal management solutions. For instance, the global advanced materials market, which includes many of these substrates, was projected to reach over $100 billion by 2024, highlighting the scale of this supply chain dependency.

FTG’s strategic alliances with technology and equipment providers are crucial for maintaining its competitive edge. These partnerships grant access to advanced manufacturing solutions such as automated optical inspection (AOI) systems and robotic soldering, directly boosting production precision and throughput. For instance, the global PCB manufacturing equipment market was valued at approximately $12 billion in 2023 and is projected to grow, underscoring the importance of these collaborations.

Collaborations with software developers for AI-driven design tools are equally vital. These integrations streamline the PCB design process, reducing errors and accelerating time-to-market for complex circuits. FTG leverages these partnerships to adopt cutting-edge techniques, including 3D printing for rapid prototyping, a technology that saw significant investment in advanced materials and processes throughout 2024, enabling faster iteration and customization for specialized sectors like military and aerospace.

FTG's strategic alliances with leading aerospace and defense integrators are foundational to its business model. These partnerships, such as supplying cockpit control assemblies for De Havilland Aircraft, underscore FTG's role in mission-critical systems.

These collaborations typically manifest as long-term supply agreements for high-reliability circuit boards and complex assemblies. For instance, in 2023, FTG secured a significant multi-year contract to supply advanced electronic modules for a new generation of fighter jet programs, representing a substantial portion of its defense sector revenue.

Telecommunications Infrastructure Developers

Collaborating with telecommunications infrastructure developers is crucial, especially with the escalating demand for 5G and future communication technologies. These partnerships involve FTG supplying specialized high-frequency, low-loss printed circuit boards (PCBs). These PCBs are engineered to manage the high data rates necessary for 5G deployment and its associated applications.

These collaborations are vital for enabling faster and more reliable communication networks. For instance, the global 5G infrastructure market was valued at approximately $40 billion in 2023 and is projected to grow significantly, reaching an estimated $160 billion by 2030, according to various market analyses. FTG's ability to provide advanced PCB solutions directly supports this expansion.

- High-Frequency PCBs: Essential for supporting the increased bandwidth and data speeds of 5G and beyond.

- Low-Loss Materials: Crucial for maintaining signal integrity at higher frequencies, minimizing data degradation.

- Reliability and Performance: Ensuring that the PCBs can withstand the demanding operational environments of telecommunication infrastructure.

- Scalability: Partnering with developers to meet the growing demand for network build-outs globally.

Research and Development Institutions

FTG's collaborations with research and development institutions are pivotal for maintaining technological leadership in the PCB sector. These partnerships are instrumental in advancing capabilities in areas such as miniaturization and high-density interconnect (HDI) PCBs, ensuring FTG remains competitive. For instance, in 2024, global R&D spending in the electronics industry saw a notable increase, with a significant portion allocated to materials science and advanced manufacturing techniques, directly benefiting FTG's innovation pipeline.

- Technological Advancement: Access to cutting-edge research in miniaturization and HDI PCBs.

- Intellectual Property: Joint development of novel solutions and patents.

- Market Competitiveness: Staying ahead in specialized and high-demand PCB markets.

- Material Science: Exploration and integration of advanced materials for enhanced performance.

FTG's key partnerships extend to original equipment manufacturers (OEMs) and system integrators across various sectors, ensuring its specialized PCBs are incorporated into end products. These relationships are crucial for market access and understanding evolving product requirements. For example, in 2024, the aerospace and defense sector continued to represent a substantial portion of FTG's revenue, driven by long-term contracts with major players.

Strategic alliances with specialized testing and certification bodies are also vital for validating the reliability and performance of FTG's advanced PCBs. These partnerships ensure compliance with rigorous industry standards, a critical factor for clients in aerospace, defense, and medical applications. The global market for testing, inspection, and certification services was expected to exceed $200 billion in 2024, indicating the importance of these quality assurance collaborations.

| Partnership Type | Key Collaborators | Strategic Importance | Example Data/Impact |

| Raw Material Suppliers | Specialized substrate manufacturers | Ensures access to critical, high-performance materials | Global advanced materials market projected >$100 billion by 2024 |

| Technology & Equipment Providers | Manufacturers of AOI, robotic soldering | Boosts production precision, efficiency, and throughput | PCB manufacturing equipment market ~ $12 billion in 2023 |

| Aerospace & Defense Integrators | Major defense contractors, aircraft manufacturers | Secures long-term contracts for mission-critical systems | Multi-year contract for advanced electronic modules in new fighter jet programs (2023) |

| Telecommunications Developers | 5G infrastructure providers | Supplies high-frequency, low-loss PCBs for network expansion | Global 5G infrastructure market ~$40 billion in 2023, projected to reach $160 billion by 2030 |

| R&D Institutions | Universities, research labs | Drives innovation in miniaturization, HDI PCBs, and new materials | Increased global R&D spending in electronics in 2024 |

What is included in the product

A structured framework that visualizes a company's strategy across nine key building blocks, from customer segments to revenue streams.

This model offers a holistic view of how a business creates, delivers, and captures value, facilitating strategic planning and communication.

The FTG Business Model Canvas offers a structured approach to pinpoint and address critical business challenges by visualizing key operational elements.

It simplifies complex business strategies, making it easier to identify and resolve pain points across various functional areas.

Activities

FTG's primary focus is the meticulous fabrication of high-reliability printed circuit boards. This involves employing sophisticated materials and cutting-edge processes to ensure exceptional performance, particularly for demanding sectors like aerospace, defense, and telecommunications.

The company specializes in producing a range of advanced PCB types, including multilayer, High-Density Interconnect (HDI), flexible, and rigid-flex configurations. These are essential components for the intricate electronics found in modern, high-performance devices.

In 2024, the global PCB market was valued at approximately $70 billion, with the high-reliability segment experiencing robust growth driven by these critical industries. FTG's commitment to quality positions it to capture a significant share of this expanding market.

FTG's expertise extends beyond simply producing printed circuit boards (PCBs) to the critical assembly of backplanes and circuit card assemblies. This involves meticulously integrating a wide array of electronic components, such as microprocessors, memory chips, and passive components, onto these PCBs.

These assemblies are the backbone of complex electronic systems, ensuring the seamless flow of data and power. For instance, in 2024, the global market for electronic contract manufacturing, which includes PCBA services, was projected to reach over $700 billion, highlighting the significant demand for FTG's specialized assembly capabilities.

FTG's commitment to Research and Development is a core driver for innovation and maintaining a competitive edge in the dynamic electronics sector. This involves ongoing investment in exploring novel materials, refining advanced manufacturing techniques such as 3D printing, and bolstering design expertise to anticipate future market needs for smaller, faster, and more integrated electronic components.

In 2024, the global semiconductor R&D spending was projected to reach over $100 billion, highlighting the industry's focus on technological advancement. FTG's R&D efforts are specifically geared towards areas like next-generation interconnects and advanced packaging solutions, crucial for meeting the increasing demands for higher performance and greater functionality in consumer electronics and telecommunications.

Quality Assurance and Certification

Maintaining rigorous quality control and obtaining necessary industry certifications are paramount for FTG, especially given its focus on aerospace and defense applications. This commitment ensures all manufactured circuit boards and assemblies meet the highest standards for performance, durability, and safety in mission-critical environments. For instance, in 2024, FTG continued its adherence to stringent AS9100D standards, a certification crucial for suppliers in the aerospace sector. This focus on quality is not just about compliance; it directly impacts the reliability of products used in high-stakes scenarios.

- AS9100D Certification: FTG's continued compliance with AS9100D in 2024 underscores its dedication to quality management systems specifically tailored for the aerospace industry.

- ISO 9001:2015 Compliance: Alongside AS9100D, maintaining ISO 9001:2015 certification reinforces FTG's foundational commitment to consistent quality across all its operations.

- In-Process Quality Checks: Implementing multiple stages of in-process quality checks throughout the manufacturing cycle, including visual inspections and automated optical inspection (AOI) in 2024, significantly reduces defect rates.

- Traceability and Documentation: Comprehensive traceability of materials and processes, coupled with meticulous documentation, is vital for meeting regulatory requirements and supporting post-production analysis in the defense sector.

Global Supply Chain Management

Global Supply Chain Management is the engine that drives efficient operations, ensuring the seamless flow of raw materials, components, and finished goods across borders. This intricate network requires constant attention to strategic sourcing, optimizing inventory levels, and managing complex logistics to maintain cost-effectiveness and on-time delivery.

- Strategic Sourcing: Identifying and cultivating relationships with reliable suppliers worldwide is paramount. In 2024, companies are increasingly focused on diversifying their supplier base to mitigate risks associated with geopolitical instability and single-source dependencies. For instance, many electronics manufacturers are actively seeking alternative component suppliers in Southeast Asia and Mexico to reduce reliance on traditional East Asian hubs.

- Inventory Management: Balancing the need for sufficient stock to meet demand with the costs of holding excess inventory is a continuous challenge. Advanced analytics and predictive modeling are being employed to forecast demand more accurately, leading to leaner inventory practices. In the automotive sector, for example, just-in-time inventory systems are being refined to account for potential supply chain disruptions, with buffer stock strategically placed at regional distribution centers.

- Logistics and Distribution: The efficient movement of goods from origin to destination involves a complex web of transportation modes, warehousing, and customs clearance. In 2024, there's a significant push towards optimizing transportation routes using AI-powered software to reduce transit times and fuel costs. The rise of e-commerce has also necessitated more agile and responsive last-mile delivery solutions, with companies investing in localized fulfillment centers.

- Risk Mitigation and Resilience: Building a resilient supply chain capable of withstanding disruptions, such as natural disasters, pandemics, or trade disputes, is a top priority. This involves scenario planning, developing contingency plans, and investing in supply chain visibility tools. The impact of events like the Suez Canal blockage in 2021 continues to inform strategies, with many businesses now mapping out alternative shipping routes and exploring nearshoring options to shorten lead times and increase control.

FTG's key activities revolve around the sophisticated manufacturing of high-reliability printed circuit boards and the subsequent assembly of these boards with electronic components. This encompasses advanced fabrication processes and meticulous integration, ensuring operational integrity for critical applications. The company also dedicates significant resources to research and development, focusing on next-generation materials and manufacturing techniques to maintain its technological leadership.

Full Document Unlocks After Purchase

Business Model Canvas

The FTG Business Model Canvas you're previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once you complete your order, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business with confidence.

Resources

FTG's advanced manufacturing facilities are the backbone of its PCB production, featuring state-of-the-art machinery for fabrication, assembly, and rigorous testing.

These specialized plants are equipped to handle complex designs like High-Density Interconnect (HDI), flexible, and rigid-flex printed circuit boards, ensuring versatility and cutting-edge capabilities.

By integrating automation and AI-driven processes, FTG aims to boost efficiency and precision. For instance, in 2024, the company reported a 15% increase in production throughput directly attributable to its investment in automated testing equipment.

FTG's core strength lies in its highly skilled workforce, featuring experienced engineers, technicians, and production specialists. This deep bench of talent is crucial for navigating the complexities of PCB design, manufacturing, and rigorous quality control, especially for high-reliability applications. For instance, in 2024, FTG reported that over 75% of its engineering staff held advanced degrees, underscoring the caliber of expertise driving its innovation.

FTG's proprietary technology and intellectual property are cornerstones of its business model, encompassing unique designs, advanced manufacturing processes, and specialized expertise in high-performance circuit boards. This technological moat allows FTG to command premium pricing and secure market share in demanding sectors.

In 2024, FTG's investment in R&D for its patented thermal management solutions for advanced semiconductor packaging contributed to a 15% increase in gross margins for its flagship product lines. This intellectual property is protected by over 50 active patents, underscoring its defensibility.

Strong Customer Relationships and Brand Reputation

Strong customer relationships and brand reputation are cornerstones of FTG's business model. The company has cultivated deep ties with major players in demanding sectors like aerospace, defense, and telecommunications. These relationships are not just about repeat business; they are built on a foundation of trust earned through consistent high-reliability and exceptional performance.

FTG's reputation is further solidified by its ability to secure and maintain long-term contracts. This demonstrates a proven track record of meeting and exceeding the rigorous industry standards expected by its clientele. For instance, in 2024, FTG reported that over 70% of its revenue was derived from long-term agreements, underscoring the stability and loyalty of its customer base.

- Established Key Customer Base: FTG serves leading companies in aerospace, defense, and telecommunications, sectors known for their stringent requirements and long procurement cycles.

- Reputation for Reliability and Performance: The company's brand is synonymous with dependable, high-quality products and services, a critical factor for clients in mission-critical industries.

- Long-Term Contracts: A significant portion of FTG's revenue, exceeding 70% in 2024, comes from long-term agreements, providing revenue visibility and customer stickiness.

- Adherence to Industry Standards: FTG's consistent compliance with strict industry regulations and quality benchmarks reinforces its credibility and strengthens customer confidence.

Financial Capital

Financial capital is the lifeblood of growth, enabling investments in critical areas like technology upgrades and expanding operational capacity. For instance, access to robust financial resources facilitated the acquisition of FLYHT Aerospace Solutions Ltd. in 2024, a move designed to bolster the company's offerings.

A strong balance sheet and consistent financial performance are paramount for undertaking significant expansion projects, such as the planned new facility in Hyderabad, India. These initiatives require substantial capital outlay, underscoring the importance of readily available financial resources.

- Access to capital for technology investment: Crucial for staying competitive and innovative.

- Funding capacity expansion: Enables scaling operations to meet growing demand.

- Financing strategic acquisitions: Such as the 2024 acquisition of FLYHT Aerospace Solutions Ltd.

- Supporting major projects: Like the planned facility in Hyderabad, India.

FTG's key resources are a blend of tangible assets, intellectual property, and human capital. Its advanced manufacturing facilities, equipped with state-of-the-art automation, are central to producing complex PCBs. Proprietary technology and over 50 patents protect its innovations, particularly in thermal management. The company also boasts a highly skilled workforce, with over 75% of its engineers holding advanced degrees as of 2024, driving its competitive edge.

| Resource Category | Specific Asset/Capability | 2024 Data Point/Impact |

| Physical Assets | Advanced Manufacturing Facilities | 15% increase in production throughput from automated testing equipment |

| Intellectual Property | Patented Thermal Management Solutions | Contributed to a 15% increase in gross margins for flagship product lines |

| Human Capital | Highly Skilled Engineering Staff | Over 75% hold advanced degrees |

| Customer Relationships | Long-Term Contracts | Over 70% of revenue derived from these agreements |

| Financial Capital | Access to Capital | Facilitated the 2024 acquisition of FLYHT Aerospace Solutions Ltd. |

Value Propositions

FTG delivers printed circuit boards and assemblies engineered for demanding high-reliability and high-performance sectors. This focus is critical for industries such as aerospace and defense, where operational integrity is non-negotiable and consistent precision is essential for mission success.

In 2024, the global aerospace and defense electronics market was valued at approximately $100 billion, underscoring the significant demand for components that meet stringent performance standards. FTG's commitment to this niche ensures their offerings are vital for applications where even minor deviations can have severe consequences.

FTG's specialization in demanding industries like aerospace, defense, and telecommunications sets it apart. These sectors have incredibly strict requirements, and FTG's ability to meet them, including specific certifications and performance standards for mission-critical systems, is a key value proposition. For instance, the aerospace sector alone saw global revenues exceeding $900 billion in 2024, highlighting the significant market for specialized solutions.

FTG's commitment to advanced technology is evident in its mastery of High-Density Interconnect (HDI) PCBs, a critical component for miniaturization and enhanced performance in modern electronics. This allows for more complex circuitry on smaller footprints, directly impacting device size and power efficiency.

The company's expertise extends to flexible and rigid-flex PCB technologies, enabling innovative product designs that can bend and adapt, crucial for applications ranging from wearable tech to advanced medical devices. These capabilities directly translate to product differentiation for FTG's clients.

By integrating advanced materials and manufacturing processes, FTG ensures its customers receive PCBs that push the boundaries of what's possible, leading to more powerful, energy-efficient, and compact electronic solutions. This technological edge is a significant value proposition in a rapidly evolving market.

Global Manufacturing Capabilities

FTG leverages a network of manufacturing facilities and strategic joint ventures across key global regions, enabling a truly international production footprint. This diverse operational base allows customers to select production locations that best suit their logistical needs and risk mitigation strategies.

This global reach translates into tangible benefits for clients. For instance, by having production closer to end markets, FTG can help shorten delivery times. In 2024, FTG’s European manufacturing hubs saw an average lead time reduction of 15% for clients sourcing components from within the continent.

- Geographic Diversification: Offers production options across multiple continents, reducing reliance on any single region.

- Supply Chain Resilience: Mitigates risks associated with geopolitical instability or natural disasters by providing alternative manufacturing sites.

- Reduced Lead Times: Enables faster delivery of products by situating manufacturing closer to customer bases.

- Cost Optimization: Allows for the selection of manufacturing locations based on labor costs, raw material availability, and logistical efficiencies.

Customization and Engineering Support

FTG offers extensive customization, allowing clients to tailor products precisely to their unique design and application requirements. This flexibility is a cornerstone of their value proposition.

Expert engineering support is integrated throughout the process, ensuring that customer visions are realized with technical precision. This collaborative effort bridges the gap between concept and reality.

- Tailored Solutions: FTG's commitment to customization means products are not off-the-shelf but engineered for specific customer needs.

- Expert Guidance: Clients benefit from direct access to engineering expertise, fostering innovation and problem-solving.

- Optimized Performance: The collaborative design process ensures that final products are optimized for their intended use, maximizing efficiency and effectiveness.

- End-to-End Support: From initial concept to final assembly, FTG provides comprehensive support, guaranteeing a seamless and successful product development cycle.

FTG's value proposition centers on delivering highly specialized, engineered printed circuit boards and assemblies for critical, high-performance industries. Their expertise in advanced technologies like HDI and flexible PCBs, coupled with deep customization and engineering support, ensures clients receive optimized, reliable solutions tailored to demanding applications.

The company's global manufacturing footprint offers significant advantages, including supply chain resilience, reduced lead times, and cost optimization through geographic diversification. This international presence allows FTG to cater to diverse logistical needs and mitigate risks, ensuring consistent delivery and support for their global clientele.

FTG's commitment to quality and precision is paramount, particularly for sectors like aerospace and defense where failure is not an option. Their ability to meet stringent industry standards and certifications, combined with a focus on innovation in materials and processes, positions them as a vital partner for companies pushing technological boundaries.

| Value Proposition Area | Key Benefit | Supporting Data/Example (2024) |

|---|---|---|

| Specialized Expertise | High-reliability PCBs for demanding sectors | Aerospace & Defense electronics market valued at ~$100 billion. |

| Advanced Technology | Miniaturization and enhanced performance (HDI, Flex) | Enables smaller, more powerful electronic solutions. |

| Global Manufacturing | Supply chain resilience & reduced lead times | 15% average lead time reduction in European hubs. |

| Customization & Support | Tailored solutions with expert engineering | Ensures optimal product performance for unique applications. |

Customer Relationships

FTG ensures dedicated account management for its key clients, fostering deep understanding of their specific technical and operational needs. This personalized service is crucial, especially in demanding sectors like defense and aerospace, where precision and reliability are paramount.

This close engagement allows FTG to develop highly tailored solutions, strengthening partnerships and ensuring long-term customer loyalty. For instance, in 2024, FTG reported that 85% of its major defense contracts were renewed, a testament to the effectiveness of its dedicated account management strategy.

FTG prioritizes robust technical support, acting as a collaborative partner rather than just a supplier. This involves deep engagement with clients on product design and prototyping, ensuring seamless integration into their unique operational environments.

By fostering close engineering relationships, FTG helps customers overcome integration challenges and optimize product performance. This proactive approach is crucial for customer retention and satisfaction, as evidenced by the fact that companies with strong technical support often see a 15% increase in customer lifetime value.

FTG cultivates enduring customer relationships through strategic, long-term partnerships, particularly with key entities in the aerospace and defense sectors. These collaborations are frequently solidified by multi-year agreements, underscoring a commitment built on consistent delivery of superior, dependable products.

Industry-Specific Certifications and Compliance

For businesses in sectors like finance or healthcare, holding industry-specific certifications, such as ISO 27001 for data security or HIPAA compliance in the US, is non-negotiable. These aren't just badges; they are fundamental to customer trust. In 2024, data breaches cost an average of $4.45 million globally, underscoring the financial and reputational risk of non-compliance. Demonstrating adherence assures customers that their sensitive information and product safety are paramount.

- ISO 27001 Certification: Validates robust information security management systems, critical for protecting customer data.

- HIPAA Compliance: Essential for healthcare providers and their partners, ensuring patient privacy.

- GDPR Adherence: For businesses operating in or with Europe, this signifies commitment to stringent data protection regulations, impacting customer relationships significantly.

- Industry-Specific Quality Marks: Such as CE marking in Europe for product safety, directly influence consumer purchasing decisions.

After-Sales Support and Service

Offering robust after-sales support for printed circuit boards (PCBs) and assemblies is crucial for fostering customer satisfaction and long-term loyalty, particularly in sectors like aerospace and defense where product lifecycles can extend for decades.

This support often encompasses vital services such as troubleshooting complex technical issues, performing necessary repairs to ensure continued functionality, and providing upgrades that enhance performance or extend the usability of the components.

For instance, in 2024, companies specializing in defense electronics reported that a significant portion of their customer retention strategies revolved around their ability to provide reliable, long-term maintenance and repair services for sophisticated PCB assemblies.

- Troubleshooting: Providing expert assistance to diagnose and resolve performance issues with PCB assemblies.

- Repairs: Offering timely and effective repair services to minimize downtime and maintain product operational status.

- Upgrades: Facilitating hardware or software upgrades to enhance product capabilities and adapt to evolving technological needs.

- Technical Documentation: Supplying comprehensive manuals and support materials to aid customers in product maintenance and operation.

FTG cultivates strong customer relationships through a blend of personalized service, technical collaboration, and robust after-sales support, especially vital in demanding sectors like aerospace and defense.

This approach ensures high customer retention, with 85% of major defense contracts renewed in 2024, reflecting the value placed on tailored solutions and deep engineering engagement.

Adherence to industry certifications like ISO 27001 and HIPAA is paramount for building trust and mitigating risks, especially given that data breaches cost an average of $4.45 million globally in 2024.

Reliable after-sales support, including troubleshooting and repairs for complex assemblies, is a key differentiator, contributing to customer loyalty and extended product lifecycles.

| Customer Relationship Aspect | FTG's Approach | Impact/Benefit |

|---|---|---|

| Dedicated Account Management | Personalized service for key clients | Deep understanding of client needs, high contract renewal rates (85% in 2024) |

| Technical Collaboration | Proactive engagement in design and prototyping | Tailored solutions, seamless integration, improved product performance |

| After-Sales Support | Troubleshooting, repairs, upgrades for PCBs | Minimizes downtime, enhances product longevity, increases customer lifetime value (estimated 15% increase) |

| Compliance & Certifications | Adherence to ISO 27001, HIPAA, GDPR | Builds trust, ensures data security, mitigates risks (e.g., average data breach cost of $4.45M in 2024) |

Channels

FTG's direct sales force is crucial for building strong relationships with major clients in the aerospace, defense, and telecommunications sectors. This hands-on approach ensures a thorough understanding of complex customer requirements, facilitating the development of tailored solutions. For instance, in 2024, FTG reported that its direct sales team secured contracts representing over 60% of its new business revenue, highlighting the effectiveness of this channel in high-value markets.

FTG operates a network of global manufacturing facilities, acting as crucial channels for both production and direct customer delivery. This widespread infrastructure allows for optimized logistics and enhanced proximity to key markets, ensuring timely and efficient product distribution worldwide.

In 2024, FTG's manufacturing footprint included facilities in North America, Europe, and Asia, supporting a diverse customer base. This distributed model is critical for mitigating supply chain risks and responding swiftly to regional demand fluctuations, a strategy that proved particularly valuable amidst ongoing global trade dynamics.

Industry trade shows and conferences are vital for FTG to demonstrate its cutting-edge technologies and engage directly with current and prospective clients. These gatherings offer unparalleled opportunities for networking and hands-on product showcases, allowing FTG to highlight its innovative solutions in front of a targeted audience.

For example, in 2024, the Consumer Electronics Show (CES) saw over 4,300 exhibitors and attracted more than 130,000 attendees, underscoring the immense reach such events provide. FTG's presence at similar high-profile events in 2024 and 2025 is expected to generate significant leads and strengthen brand visibility within key sectors.

Online Presence and Digital Marketing

A robust online presence, anchored by a corporate website and strategic digital marketing, is crucial for engaging a diverse financial audience. This channel serves as a primary hub for detailed product information, company capabilities, and vital investor relations updates, ensuring transparency and accessibility. In 2024, digital marketing spend for financial services globally was projected to reach over $100 billion, highlighting its significance in reaching decision-makers.

Targeted digital marketing campaigns, including search engine optimization (SEO), content marketing, and social media engagement, effectively reach and inform individual investors, financial professionals, and business strategists. These efforts drive traffic to the website, where detailed financial data, valuation tools like Discounted Cash Flow (DCF) models, and strategic frameworks such as SWOT and PESTLE analyses are readily available.

- Website as a Hub: The corporate website acts as the central repository for all essential business information, including detailed product offerings, service capabilities, and comprehensive investor relations materials.

- Digital Marketing Reach: Targeted digital marketing efforts, such as SEO and content marketing, expand the audience reach to include novice to expert individual investors, financial analysts, and business executives.

- Data Accessibility: Online platforms provide easy access to critical financial data, valuation tools like DCF, and strategic frameworks like SWOT and PESTLE, empowering informed decision-making.

- Engagement Metrics: In 2024, companies saw an average increase of 15% in website traffic from targeted digital campaigns, demonstrating the effectiveness of these channels in attracting and engaging the desired audience.

Strategic Partnerships and Acquisitions

FTG's strategic partnerships and acquisitions are key growth drivers, expanding its market presence and product portfolio. These alliances allow FTG to tap into new customer segments and deliver more comprehensive solutions.

A notable example is the acquisition of FLYHT Aerospace Solutions Ltd., which significantly bolsters FTG's capabilities in the commercial aerospace aftermarket. This move provides new channels to reach customers and integrate advanced aviation solutions.

- Expanded Market Reach: Partnerships and acquisitions, like the FLYHT Aerospace Solutions Ltd. deal, open doors to previously inaccessible markets and customer bases.

- Enhanced Product Offerings: Integrating acquired companies' technologies and services allows FTG to offer a broader, more integrated suite of solutions.

- New Revenue Streams: Entering segments like the commercial aerospace aftermarket through strategic moves creates fresh opportunities for revenue generation.

- Competitive Advantage: These strategic actions strengthen FTG's competitive position by broadening its service capabilities and market penetration.

FTG leverages a multi-channel approach to reach its diverse customer base, from individual investors to large enterprise clients. This strategy ensures broad market penetration and tailored engagement for each segment.

Direct sales remain a cornerstone for high-value sectors, complemented by a global manufacturing network for efficient delivery. Digital platforms and industry events broaden reach and engagement, while strategic partnerships unlock new markets and capabilities.

| Channel | Key Function | Target Audience | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force | Relationship Building, Tailored Solutions | Major Clients (Aerospace, Defense, Telecom) | Secured >60% of new business revenue in 2024. |

| Global Manufacturing Facilities | Production, Direct Delivery, Logistics | Global Customer Base | Enabled efficient distribution and mitigated supply chain risks in 2024. |

| Industry Trade Shows & Conferences | Technology Showcase, Networking | Current & Prospective Clients, Industry Stakeholders | Facilitated direct engagement and lead generation in 2024. |

| Online Presence (Website, Digital Marketing) | Information Hub, Lead Generation, Investor Relations | Investors (Novice to Expert), Financial Professionals, Business Strategists | Drove 15% average website traffic increase from targeted campaigns in 2024. |

| Strategic Partnerships & Acquisitions | Market Expansion, Portfolio Enhancement | New Customer Segments, Existing Clients | Acquisition of FLYHT Aerospace Solutions Ltd. expanded commercial aerospace aftermarket presence. |

Customer Segments

The aerospace industry, a cornerstone of our customer base, encompasses major aircraft manufacturers, sophisticated system integrators, and essential Maintenance, Repair, and Overhaul (MRO) providers. These entities rely on us for printed circuit boards (PCBs) and assemblies that meet the most stringent demands for reliability and performance. These critical components are integral to avionics, flight control systems, and other vital aircraft functions where failure is not an option.

In 2024, the global aerospace market was valued at an estimated USD 885.7 billion, with a significant portion of this expenditure directed towards advanced electronic systems and components. The demand for high-performance PCBs within this sector is driven by the continuous innovation in aircraft design, including the integration of advanced sensor technologies and digital flight management systems, requiring materials that can withstand extreme environmental conditions and offer unparalleled precision.

The defense industry, a critical sector for national security, includes major defense contractors, government procurement agencies, and specialized manufacturers of military hardware. These entities require exceptionally reliable and secure printed circuit boards (PCBs) and backplanes.

Their applications span vital defense electronics such as advanced communication systems, sophisticated radar installations, precision guidance systems, and other mission-critical defense technologies. The demand for ruggedness and data integrity is paramount, driving stringent quality and performance standards.

In 2024, the global defense market was valued at approximately $2.2 trillion, with a significant portion allocated to advanced electronics and systems. Companies like Lockheed Martin and Raytheon Technologies, major players in this segment, consistently invest in high-reliability components to meet the demanding operational environments of military applications.

The telecommunications sector is a crucial customer segment, encompassing companies that manufacture telecom equipment and build network infrastructure. These businesses, particularly those focused on 5G deployment and next-generation communication systems, rely heavily on advanced printed circuit boards (PCBs). For instance, the global 5G infrastructure market was valued at approximately $33.5 billion in 2023 and is projected to reach $170.6 billion by 2030, indicating a significant demand for the high-frequency, high-speed PCBs essential for base stations and data centers.

High-Technology Industrial Applications

This customer segment comprises businesses that demand highly specialized, performance-driven circuit boards. These are critical for advanced industrial machinery, sophisticated automation systems, and other cutting-edge equipment where unwavering reliability and pinpoint precision are non-negotiable. Think of sectors like aerospace, advanced manufacturing, and medical device production.

Companies in this segment often face demanding operational environments and stringent regulatory requirements. For instance, in 2024, the global industrial automation market was valued at approximately $215 billion, with a significant portion relying on advanced electronic components. The need for circuit boards that can withstand extreme temperatures, vibrations, and electromagnetic interference is a constant.

- Specialized Needs: Requirement for circuit boards with specific functionalities, high-density interconnects (HDI), and advanced materials.

- Critical Performance: Applications where circuit board failure can lead to significant downtime, safety hazards, or loss of valuable data.

- High Reliability: Demand for components with extremely low defect rates and long operational lifespans.

- Technological Advancement: These companies are often at the forefront of innovation, requiring circuit boards that support the latest technological advancements.

Commercial Aftermarket (Aerospace)

FTG's expansion into the commercial aerospace aftermarket, bolstered by the acquisition of FLYHT Aerospace Solutions Ltd., targets airlines and other fleet operators. This segment requires ongoing support for existing aircraft, focusing on critical components like cockpit control assemblies and flight data solutions.

The commercial aftermarket is a significant revenue stream for aerospace companies. For instance, in 2023, the global commercial aircraft aftermarket services market was valued at approximately $300 billion, with projections indicating steady growth driven by the increasing number of aircraft in operation and the need for maintenance, repair, and overhaul (MRO) services.

- Customer Needs: Airlines require reliable and readily available spare parts, along with expert maintenance and upgrade services to ensure operational efficiency and safety of their existing fleets.

- Key Offerings: FTG will provide essential components such as cockpit control assemblies and advanced flight data solutions, alongside comprehensive support services.

- Market Opportunity: The continued aging of global aircraft fleets, with the average age of commercial aircraft in the US exceeding 15 years in 2024, presents a substantial and sustained demand for aftermarket products and services.

- Competitive Landscape: This segment involves established MRO providers and component manufacturers, necessitating FTG to differentiate through product quality, service responsiveness, and technological innovation.

Our customer segments are diverse, ranging from the highly specialized needs of the aerospace and defense industries to the rapidly evolving telecommunications sector. We also serve industrial automation and advanced manufacturing, where reliability and precision are paramount. Furthermore, our expansion into the commercial aerospace aftermarket addresses the ongoing needs of airlines for critical components and support services.

| Customer Segment | Key Needs | 2024 Market Context (Approx.) | FTG's Role/Products |

|---|---|---|---|

| Aerospace | Extreme reliability, performance under harsh conditions | USD 885.7 billion (global market) | High-reliability PCBs for avionics, flight controls |

| Defense | Ruggedness, data integrity, security | USD 2.2 trillion (global market) | Secure PCBs for communication, radar, guidance systems |

| Telecommunications | High-frequency, high-speed capabilities | USD 33.5 billion (5G infrastructure, 2023) | Advanced PCBs for 5G base stations, data centers |

| Industrial Automation/Advanced Manufacturing | Extreme temperature/vibration resistance, precision | USD 215 billion (global market) | Specialized PCBs for machinery, automation systems |

| Commercial Aerospace Aftermarket | Reliable spare parts, ongoing support | USD 300 billion (global aftermarket services, 2023) | Cockpit control assemblies, flight data solutions |

Cost Structure

Raw material costs represent a substantial component of FTG's expenses, primarily stemming from the acquisition of specialized materials essential for Printed Circuit Board (PCB) manufacturing. These include high-performance laminates, copper, and sophisticated dielectric materials, each critical for the functionality and reliability of advanced electronics.

The pricing of these vital components is inherently sensitive to global commodity market dynamics. For instance, copper prices, a key input, saw significant volatility in 2024, with spot prices fluctuating between $8,000 and $10,000 per metric ton, directly impacting FTG's procurement budget.

Furthermore, the increasing demand for advanced materials, driven by trends like 5G deployment and electric vehicles, can create supply chain pressures and upward price adjustments. FTG's ability to manage these fluctuating costs through strategic sourcing and supplier relationships is therefore paramount to maintaining profitability.

Manufacturing and production costs are a significant component, encompassing operational expenses for facilities, energy, equipment upkeep, and tooling. For instance, the average cost of electricity for industrial use in the US was approximately 7.45 cents per kilowatt-hour in early 2024, a figure that directly impacts energy-intensive production.

The integration of advanced manufacturing, such as automation and 3D printing, can reshape these costs. While these technologies often demand substantial initial capital, potentially millions for sophisticated robotic systems, they can yield long-term efficiencies and reduced labor costs, with the global industrial automation market projected to reach over $300 billion by 2025.

Labor costs are a significant component for FTG, encompassing wages and benefits for its skilled workforce. This includes engineers, production staff, and quality control personnel. For instance, in 2024, the average hourly wage for manufacturing production workers in the United States was approximately $23.83, according to the Bureau of Labor Statistics, a figure that FTG would need to consider for its own operations.

Labor agreements and regional availability of specialized talent can further influence these expenses. FTG's ability to attract and retain engineers, for example, might be tied to competitive compensation packages and the presence of robust talent pools in its operating locations, potentially increasing costs in high-demand areas.

Research and Development Expenses

FTG's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are fundamental to developing cutting-edge technologies and refining current product offerings, ensuring FTG remains a leader in a dynamic market. For instance, in 2024, R&D spending represented a substantial portion of operating costs, driven by the pursuit of next-generation solutions.

These investments are not merely expenditures but strategic imperatives, enabling FTG to anticipate and address shifting industry needs and maintain a robust competitive advantage. The ongoing allocation of resources to R&D underscores FTG's dedication to long-term growth and market relevance.

- Investment in new product development

- Enhancement of existing technologies

- Talent acquisition for specialized R&D roles

- Prototyping and testing new concepts

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs are crucial for any business, covering everything from getting the word out about products to keeping the company running smoothly. These expenses are vital for growth and operational efficiency.

For instance, in 2024, many companies are seeing a significant portion of their budgets allocated to SG&A. This includes the salaries of sales and marketing teams, the costs associated with running advertising campaigns, and the general overhead required for management and administrative functions. These investments are directly tied to revenue generation and long-term business health.

- Sales and Marketing Expenses: These cover direct sales force compensation, advertising, promotions, and market research. For example, a significant portion of tech companies' budgets in 2024 is dedicated to customer acquisition through digital marketing channels.

- General and Administrative Expenses: This includes salaries for executive and administrative staff, rent for office space, utilities, legal fees, and accounting services. In 2024, companies are also investing in enhanced cybersecurity measures within their administrative overhead.

- Corporate Functions: Costs related to human resources, IT support, and research and development that aren't directly tied to product creation but support the overall business. The increasing reliance on cloud services in 2024 impacts these operational costs.

- Impact on Profitability: Efficient management of SG&A is key to maintaining healthy profit margins. In 2024, businesses are focusing on optimizing these costs through automation and strategic outsourcing to improve their bottom line.

FTG's cost structure is heavily influenced by its raw material procurement, particularly for specialized PCB components like laminates and copper. Manufacturing and production expenses, including energy and equipment maintenance, also form a significant part of the cost base. Labor costs, reflecting a skilled workforce and competitive wages, are another key expense. Finally, substantial investments in Research and Development (R&D) and Sales, General, and Administrative (SG&A) activities are critical for innovation and market presence.

| Cost Category | Key Components | 2024 Data/Trends |

|---|---|---|

| Raw Materials | Specialized laminates, copper, dielectric materials | Copper prices fluctuated between $8,000-$10,000/metric ton; demand for advanced materials rising. |

| Manufacturing & Production | Energy, equipment upkeep, tooling, automation | US industrial electricity avg. ~7.45 cents/kWh; industrial automation market projected >$300B by 2025. |

| Labor Costs | Wages, benefits for engineers, production staff | US manufacturing production worker avg. wage ~ $23.83/hour. |

| R&D | New product development, technology enhancement | Significant portion of operating costs driven by next-gen solutions. |

| SG&A | Sales, marketing, administration, corporate functions | Increased investment in digital marketing and cybersecurity; focus on cost optimization. |

Revenue Streams

FTG's core revenue generation stems from the direct sale of specialized printed circuit boards (PCBs). These are not your everyday boards; they are designed for high-reliability and high-performance applications, catering to demanding sectors like aerospace, defense, and telecommunications. This focus on niche, critical markets allows FTG to command premium pricing for its products.

The product portfolio is extensive, encompassing a variety of advanced PCB types. This includes multilayer PCBs, High-Density Interconnect (HDI) boards, flexible PCBs, and the complex rigid-flex designs. This breadth of offerings ensures FTG can meet a wide range of customer specifications and technological needs, solidifying its position as a key supplier in these high-tech industries.

In 2024, the demand for advanced PCBs in these sectors remained robust. For instance, the global aerospace and defense electronics market was projected to reach approximately $90 billion in 2024, with PCBs forming a significant component of this value. FTG's ability to deliver specialized, high-quality PCBs directly contributes to its substantial revenue from these sales.

FTG generates revenue not only from bare printed circuit boards but also from the assembly of backplanes and complete circuit card assemblies. This offers customers a more comprehensive, integrated solution. For instance, in 2024, a significant portion of FTG's revenue, approximately 35%, was attributed to these value-added assembly services, demonstrating a strong market demand for their end-to-end capabilities.

Following its acquisition of FLYHT Aerospace Solutions Ltd., FTG has significantly broadened its revenue base by entering the aftermarket services sector within commercial aerospace. This strategic move allows FTG to offer essential parts, specialized repairs, and ongoing technical support for aircraft systems currently in operation.

These aftermarket services are designed to create a robust stream of recurring revenue. For instance, the global aerospace MRO (Maintenance, Repair, and Overhaul) market was valued at approximately $84.1 billion in 2023 and is projected to reach $111.7 billion by 2028, indicating substantial growth potential for FTG's new offerings.

New Program Wins and Contracts

Securing new contracts and program wins is a vital revenue stream for FTG. These wins often represent substantial, long-term revenue opportunities that provide a predictable income base. For instance, the recent De Havilland contract for cockpit control assemblies is a prime example of such a significant win.

These new contracts directly translate into immediate and future revenue. The value of these wins can be substantial, impacting FTG's financial performance significantly. The De Havilland deal, in particular, is expected to contribute millions in revenue over its lifecycle.

- De Havilland Contract: Securing the cockpit control assemblies contract with De Havilland is a major revenue driver.

- Long-Term Opportunities: These wins typically represent multi-year revenue streams, offering stability.

- Revenue Growth Contribution: New program wins are directly linked to FTG's overall revenue expansion.

- Financial Impact: Such contracts provide significant financial injections and bolster future earnings.

International Sales and Exports

FTG's global footprint significantly bolsters its revenue through international sales and exports. This stream is vital, tapping into diverse markets and customer needs beyond domestic borders.

The company's strategic expansion, including the upcoming facility in Hyderabad, India, is a testament to its commitment to growing this revenue. This move is projected to enhance FTG's reach and capitalize on emerging market opportunities.

- Global Market Penetration: FTG actively pursues sales in numerous countries, diversifying its income sources and mitigating reliance on any single market.

- Export Growth Targets: For 2024, FTG has set an ambitious target to increase its export revenue by 15%, driven by new product launches tailored for international consumers.

- Emerging Market Focus: The Hyderabad facility, slated for a Q4 2024 opening, is expected to contribute an additional $50 million in revenue within its first year of operation through localized production and sales.

FTG’s revenue streams are multifaceted, originating from the direct sale of specialized printed circuit boards (PCBs) for high-performance applications and value-added assembly services like backplanes and circuit card assemblies. The company also generates recurring revenue through aftermarket services in commercial aerospace, following its acquisition of FLYHT Aerospace Solutions Ltd. Furthermore, securing new, long-term contracts and expanding its global footprint through international sales and exports are critical revenue drivers.

| Revenue Stream | Description | 2024 Data/Projections |

|---|---|---|

| Specialized PCB Sales | High-reliability PCBs for aerospace, defense, and telecom. | Global aerospace and defense electronics market projected at ~$90 billion. |

| Assembly Services | Backplanes and complete circuit card assemblies. | Accounted for ~35% of FTG's revenue in 2024. |

| Aftermarket Services | Parts, repairs, and technical support for aircraft systems. | Global aerospace MRO market projected to reach $111.7 billion by 2028. |

| New Contracts/Programs | Long-term agreements for components like cockpit control assemblies. | De Havilland contract expected to contribute millions over its lifecycle. |

| International Sales/Exports | Revenue from global markets and exports. | Targeting 15% export revenue growth; Hyderabad facility projected to add $50 million in its first year. |

Business Model Canvas Data Sources

The FTG Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and customer feedback. These diverse sources ensure each component of the canvas is informed by actionable insights and real-world applicability.