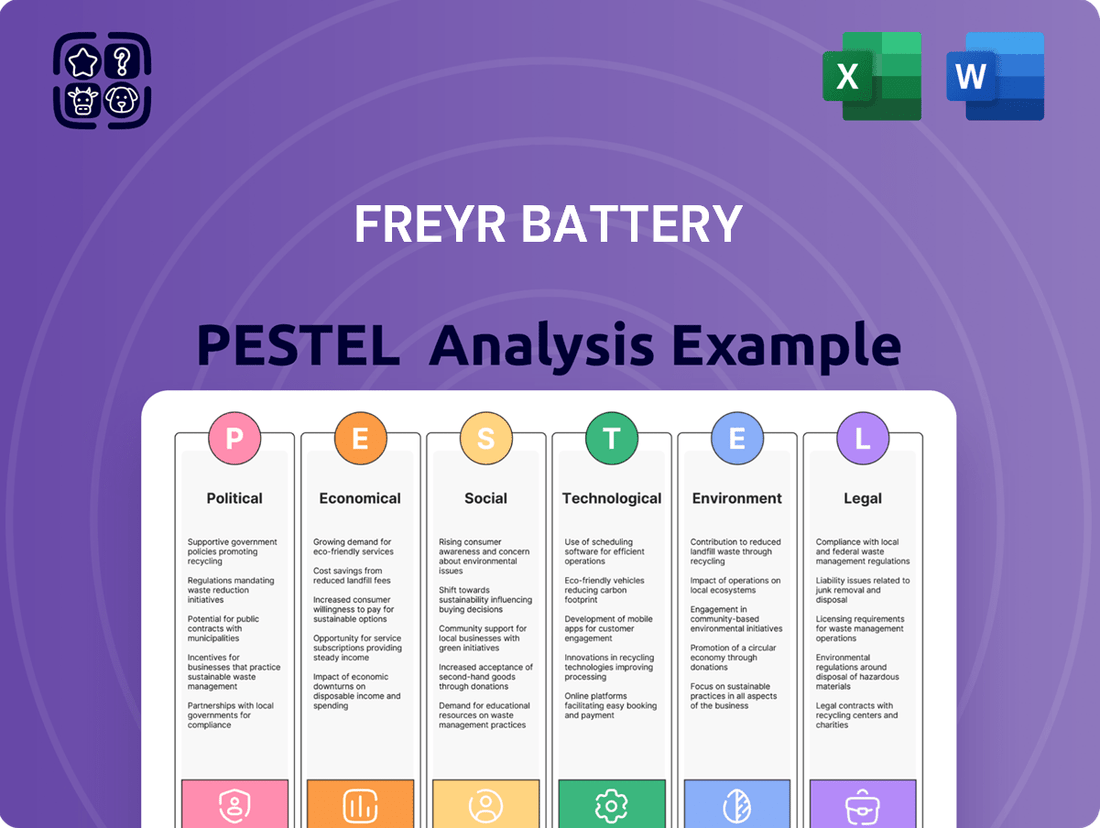

FREYR Battery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

Navigate the evolving landscape of battery technology with our comprehensive PESTLE analysis of FREYR Battery. Understand the critical political, economic, social, technological, legal, and environmental factors influencing their growth and market position. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Unlock actionable intelligence on FREYR Battery's external environment. This PESTLE analysis dives deep into the forces shaping their future, from government incentives for green energy to supply chain disruptions. Download the full report now to gain a decisive competitive advantage.

Political factors

Governments worldwide, especially in Europe, are actively promoting domestic battery manufacturing through supportive policies and financial incentives. This political push is crucial for building resilient supply chains and achieving clean energy goals.

FREYR Battery has directly benefited from this trend, securing a significant €100 million grant from the EU's Innovation Fund for its Giga Arctic facility. This substantial funding underscores a clear political commitment to advancing battery technology and bolstering regional energy independence.

Discrepancies in government support significantly shape investment strategies for companies like FREYR Battery. The U.S. Inflation Reduction Act (IRA), for instance, offers substantial incentives that have directly influenced FREYR's capital allocation decisions.

As a result of the IRA's attractive subsidies, FREYR Battery has notably scaled back its investment plans for the Giga Arctic project in Norway. The company is now prioritizing the development of its Giga America facility in Georgia, USA, demonstrating how competitive international policy environments can redirect global capital flows.

This strategic shift underscores the critical role of policy in the battery manufacturing sector. European subsidy schemes have, to date, not matched the financial advantages presented by the IRA, creating a clear incentive for companies to favor U.S. locations for new battery production facilities.

The March 2024 Memorandum of Understanding between the EU and Norway solidifies a strategic partnership focused on sustainable raw materials and battery value chains. This agreement is a significant development for companies like FREYR Battery, potentially unlocking opportunities for joint investment and R&D collaboration.

This partnership emphasizes adherence to high ESG standards, which aligns with the growing demand for responsible sourcing and production in the battery sector. It also signals a commitment to mobilizing financial instruments, which could provide crucial support for FREYR's expansion and supply chain integration within Europe, offering a more stable operational environment.

Political Stability and Investment Climate in Norway

Norway's robust political stability, underpinned by strong property rights and an efficient legal framework, significantly enhances its appeal for foreign direct investment, including large-scale industrial ventures like FREYR Battery. This stable environment is a critical factor for companies undertaking long-term capital-intensive projects.

The Norwegian government actively fosters foreign investment, evidenced by its efforts to harmonize legislation with EU standards. This alignment facilitates the free movement of capital, personnel, services, and goods across the European Economic Area, creating a more predictable and accessible market for businesses operating within it.

- Political Stability: Norway consistently ranks high in global political stability indices, offering a secure operating environment.

- Legal Framework: Strong protection of property rights and an effective legal system minimize investment risks.

- EU Alignment: Norway's adherence to EU standards within the EEA promotes open market access and regulatory predictability.

Evolving Regulatory Landscape in Europe

Europe's regulatory environment is undergoing a significant transformation for battery manufacturers like FREYR, primarily driven by the new EU Battery Regulation. This regulation, which started its phased implementation in February 2024 and will be fully effective by August 2025, aims to boost battery sustainability and foster a circular economy.

Key aspects of this regulation include mandatory CO₂ footprint reporting, increased battery collection targets, and new labeling standards designed to enhance transparency and environmental responsibility. FREYR must proactively adjust its production processes and supply chain management to meet these increasingly rigorous and harmonized EU-wide requirements.

- EU Battery Regulation: Phased in from February 2024, fully applicable by August 2025.

- Sustainability Focus: Mandatory CO₂ disclosure and stricter collection quotas are central.

- Circular Economy: New labeling requirements promote battery reuse and recycling.

- Compliance Adaptation: FREYR must continuously evolve operations to meet stringent standards.

Government policies significantly influence FREYR Battery's strategic direction, with the U.S. Inflation Reduction Act (IRA) offering substantial incentives that have reshaped investment priorities. This has led FREYR to scale back Norwegian investments in favor of its Giga America facility in Georgia, USA, highlighting the impact of competitive international policy environments on capital flows.

The EU's commitment to domestic battery production is evident through initiatives like the €100 million grant from the EU's Innovation Fund for FREYR's Giga Arctic project. Furthermore, a March 2024 Memorandum of Understanding between the EU and Norway aims to bolster sustainable raw materials and battery value chains, potentially fostering collaboration and investment.

The EU Battery Regulation, phased in from February 2024 and fully effective by August 2025, mandates CO₂ footprint reporting and increased battery collection targets, pushing companies like FREYR to adapt production and supply chain management for enhanced sustainability and transparency.

| Policy/Regulation | Effective Date | Impact on FREYR Battery |

|---|---|---|

| U.S. Inflation Reduction Act (IRA) | August 2022 | Redirected investment towards U.S. facilities (Giga America). |

| EU Innovation Fund Grant | Announced 2023 | Provided €100 million for Giga Arctic (Norway). |

| EU-Norway MoU | March 2024 | Potential for joint investment and R&D in sustainable battery value chains. |

| EU Battery Regulation | Feb 2024 (phased), Aug 2025 (full) | Requires adaptation for CO₂ reporting, collection targets, and labeling. |

What is included in the product

This FREYR Battery PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides actionable insights into market dynamics and regulatory landscapes, empowering stakeholders to identify opportunities and mitigate risks.

This FREYR Battery PESTLE Analysis acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during meetings and presentations to proactively address potential market challenges.

Economic factors

The global demand for batteries, particularly for electric vehicles (EVs) and energy storage, is on a steep upward trajectory. Projections suggest a remarkable 14-fold increase in worldwide battery demand by 2030, highlighting a massive growth opportunity.

The European Union is poised to be a significant driver of this demand, largely due to its aggressive push for transport electrification. This burgeoning market directly translates into a robust and expanding customer base for FREYR Battery's offerings.

FREYR Battery, like many manufacturers, is navigating a landscape of persistent elevated input costs. Despite some easing of inflation, the price of raw materials, components, and labor remains a significant challenge. For instance, in early 2024, while headline inflation figures showed moderation, the cost of key battery materials like lithium and cobalt, though volatile, continued to present cost pressures for producers.

These ongoing cost increases directly impact FREYR's profitability. The necessity to absorb these higher expenses or pass them on to customers is a delicate balancing act. Passing costs could affect the price competitiveness of FREYR's battery solutions, particularly those marketed with a 'green premium', potentially slowing adoption rates.

Effectively managing these cost pressures is therefore paramount to FREYR's financial health and its ability to scale operations. Strategies for cost mitigation, supply chain resilience, and efficient production are critical for maintaining margins and market position in 2024 and beyond.

Scaling battery manufacturing demands substantial capital, making access to funding a critical determinant of success for FREYR Battery. The company's strategic focus under its new leadership is on securing financeable projects, a move that directly addresses this economic factor.

FREYR Battery is actively pursuing various funding avenues, including significant applications for loans from governmental bodies such as the U.S. Department of Energy. For instance, in late 2023, the company announced it was a recipient of a conditional commitment for a loan of up to $750 million from the U.S. Department of Energy’s Advanced Technology Vehicles Manufacturing (ATVM) loan program, aimed at its Georgia facility.

The terms and availability of this financing are paramount to FREYR's expansion strategy, particularly for its planned facilities in Norway and the United States. These capital-intensive projects require robust financial backing to move from development to full-scale production, underscoring the economic importance of capital access.

Raw Material Price Volatility

The prices of critical battery materials like lithium, cobalt, and nickel have seen sustained high levels and remain prone to significant swings. For instance, lithium carbonate prices, a key component, have experienced considerable volatility, with some reports indicating significant price increases in late 2023 and early 2024 following a period of decline.

Sourcing these essential materials, particularly from operations adhering to stringent low-emission standards, often translates to elevated procurement costs for companies like FREYR. This focus on sustainable sourcing, while environmentally responsible, can add a premium to the overall expense of raw materials.

These fluctuations in commodity prices directly influence FREYR's manufacturing expenses and, consequently, its overall profitability. For example, a sharp rise in nickel prices, which are crucial for many battery chemistries, could compress FREYR's profit margins if not effectively managed through hedging or price adjustments.

- Lithium Carbonate Price Trends: Prices have shown marked volatility, with significant upward movements observed in late 2023 and early 2024 after earlier declines.

- Cobalt and Nickel Market Dynamics: These metals, vital for battery cathodes, are subject to geopolitical factors and supply chain disruptions, impacting their price stability.

- Impact on Production Costs: Volatile raw material prices directly affect FREYR's cost of goods sold, potentially influencing pricing strategies and competitive positioning.

- Sustainable Sourcing Premiums: The drive for ethically and environmentally sourced materials can add a cost premium, further contributing to price volatility for battery manufacturers.

Company Financial Performance and Revenue Generation

FREYR Battery's financial performance in the current pre-revenue phase is characterized by significant investment in its gigafactory development. For the second quarter of 2024, the company reported a net loss of $(27.0) million. This is typical for companies in this stage of scaling up production capacity.

The company's primary financial objective is to transition to revenue generation and achieve positive EBITDA as early as 2025. This milestone is crucial for validating its business model and securing the necessary capital for continued expansion. The current trailing twelve-month revenue for 2024 stands at $2.94 million, indicating early-stage commercial activity.

- Net Loss (Q2 2024): $(27.0) million

- Revenue Target: Achieve first revenues and positive EBITDA in 2025

- Trailing Twelve-Month Revenue (2024): $2.94 million

The global battery market is expanding rapidly, driven by EV adoption and energy storage needs, with demand projected to surge significantly by 2030. Europe's commitment to electrification is a key growth driver for companies like FREYR Battery.

Despite moderating inflation, FREYR faces persistent high input costs for raw materials, components, and labor, impacting profitability and requiring careful pricing strategies to maintain competitiveness.

Securing substantial capital is vital for FREYR's gigafactory expansion, with the company actively pursuing government funding, such as a conditional $750 million loan from the U.S. Department of Energy for its Georgia facility.

Fluctuations in critical battery material prices, including lithium, cobalt, and nickel, directly affect FREYR's manufacturing expenses and profit margins, necessitating robust cost management and sourcing strategies.

| Economic Factor | Data Point | Impact on FREYR Battery |

|---|---|---|

| Global Battery Demand | Projected 14-fold increase by 2030 | Significant growth opportunity for FREYR's products. |

| Input Costs | Persistent elevated levels for raw materials, components, labor (early 2024) | Pressures profitability, requires careful pricing to maintain competitiveness. |

| Capital Access | Conditional $750M DOE loan commitment (late 2023) | Crucial for financing gigafactory expansion, supports strategic growth. |

| Commodity Prices | Volatility in lithium, cobalt, nickel prices (late 2023/early 2024) | Directly influences manufacturing expenses and profit margins. |

What You See Is What You Get

FREYR Battery PESTLE Analysis

The preview shown here is the exact FREYR Battery PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting FREYR Battery's operations and market position. You'll gain deep insights into the strategic landscape shaping the future of battery manufacturing.

Sociological factors

Societal values are increasingly prioritizing environmental consciousness, leading to a strong preference for sustainable transportation options. This shift is directly fueling a surge in electric vehicle (EV) adoption across major markets.

Government policies are a significant catalyst, with Norway aiming to cease sales of new fossil fuel cars by 2025 and the European Union setting a similar target for 2035. These ambitious timelines underscore a clear societal and political commitment to electrification.

This growing consumer demand for EVs translates into a robust market for advanced battery technologies. For instance, in 2023, EV sales in Europe exceeded 1.7 million units, representing a substantial year-over-year increase and highlighting the critical need for reliable battery manufacturers like FREYR.

The burgeoning battery manufacturing industry, including players like FREYR Battery, faces a significant hurdle in workforce availability and skill development. Labor shortages are a persistent issue throughout the entire battery value chain, potentially causing production delays and driving up operational expenses. For instance, reports in early 2024 highlighted a growing deficit in skilled technicians and engineers specifically for advanced manufacturing roles.

Addressing this, there's a strong emphasis on creating high-quality employment opportunities and bolstering workforce expertise, particularly in raw materials sourcing and battery production. Initiatives like the EU-Norway partnership, launched in late 2023, aim to bridge these skill gaps through targeted training and development programs, recognizing the crucial role a capable workforce plays in the sector's expansion.

Public awareness of environmental issues is soaring, driving a significant demand for sustainable products. This trend is particularly strong in the clean energy sector, where consumers are increasingly willing to pay more for products with a lower carbon footprint. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions, and a notable portion are willing to pay a premium for eco-friendly options.

FREYR Battery's commitment to producing low-carbon battery cells directly taps into this growing societal value. By emphasizing its sustainable manufacturing processes, FREYR can cultivate a strong brand reputation and attract environmentally conscious customers. This alignment with public sentiment is crucial for market appeal, especially as governments and corporations globally set ambitious sustainability targets for 2025 and beyond.

Corporate Social Responsibility in Supply Chains

Societal expectations are increasingly pushing companies like FREYR Battery to ensure ethical practices throughout their entire supply chain, especially concerning raw material sourcing. New regulations, such as the EU Battery Regulation, are formalizing these demands, requiring stringent adherence to human rights and environmental standards. This means FREYR must actively demonstrate robust due diligence in how it procures critical battery materials.

FREYR's commitment to Corporate Social Responsibility (CSR) in its supply chain is crucial for meeting evolving stakeholder demands. For instance, the EU Battery Regulation, which came into full effect in 2024, mandates detailed due diligence for battery manufacturers regarding the sourcing of critical raw materials like cobalt and lithium. Companies are expected to identify, prevent, and mitigate adverse impacts on human rights and the environment. FREYR's strategy must clearly articulate how it will achieve compliance, potentially through supplier audits and certifications.

- EU Battery Regulation (2024): Mandates due diligence for critical raw materials, impacting sourcing strategies.

- Human Rights Due Diligence: Companies must ensure materials are extracted and traded ethically, free from forced labor or child labor.

- Environmental Standards: Sourcing must comply with international environmental protocols to minimize ecological impact.

- Supply Chain Transparency: Increased demand for visibility into the origins and processing of battery components.

Shift Towards Energy Storage Solutions

Societal shifts are significantly boosting the demand for energy storage. Beyond electric vehicles, the increasing adoption of renewable energy sources like solar and wind power necessitates robust stationary storage to ensure grid stability and reliability. This trend is creating a substantial market for battery solutions like FREYR Battery's, catering to a fundamental need for a more sustainable and consistent energy supply.

The global energy storage market is experiencing rapid expansion. Projections indicate the market could reach hundreds of billions of dollars in the coming years, driven by these societal demands. For instance, the stationary storage segment alone is expected to see substantial growth, with some analysts forecasting it to outpace the automotive sector in investment by 2030.

- Growing Renewable Integration: As grids incorporate more intermittent renewables, the need for batteries to balance supply and demand becomes critical.

- Grid Modernization: Investments in upgrading aging electricity infrastructure often include significant allocations for energy storage.

- Energy Security Concerns: Public and governmental focus on energy independence and resilience further fuels the demand for localized storage solutions.

- Consumer Demand for Sustainability: An increasing awareness of climate change is driving consumer preference for products and services that support a greener future, including renewable energy and storage.

Societal values are increasingly prioritizing environmental consciousness, directly fueling a surge in electric vehicle (EV) adoption. This growing consumer demand for EVs translates into a robust market for advanced battery technologies, with European EV sales exceeding 1.7 million units in 2023.

The burgeoning battery manufacturing industry, including players like FREYR Battery, faces a significant hurdle in workforce availability and skill development, with reports in early 2024 highlighting a growing deficit in skilled technicians and engineers.

Public awareness of environmental issues is soaring, driving a significant demand for sustainable products, with a 2024 survey indicating that over 60% of consumers consider sustainability a key factor in their purchasing decisions.

Societal expectations are increasingly pushing companies like FREYR Battery to ensure ethical practices throughout their supply chain, especially concerning raw material sourcing, a demand formalized by the EU Battery Regulation in 2024.

Societal shifts are significantly boosting the demand for energy storage, with the global energy storage market experiencing rapid expansion driven by renewable energy integration and grid modernization efforts.

Technological factors

FREYR Battery's core technological advantage lies in its adoption of the 24M SemiSolid™ battery cell technology. This platform is designed to streamline manufacturing, boost efficiency, and lower resource usage compared to traditional methods.

The company's progress in industrializing this advanced technology is evident in recent achievements at its Customer Qualification Plant (CQP). During the first half of 2024, FREYR successfully conducted automated casting trials and produced unit cells, signaling a significant step towards commercialization.

The push for cost-effective, large-scale battery manufacturing means gigafactories absolutely need advanced automation. FREYR is making this a priority, aiming for fully automated production lines to boost both efficiency and how much they can produce. This commitment is clear from their successful automated production tests at the Customer Qualification Plant (CQP).

This strategic focus on cutting-edge manufacturing is crucial for FREYR to reach its ambitious GWh production targets. By embracing automation, FREYR is positioning itself to compete effectively in the rapidly growing electric vehicle and energy storage markets, where production volume and cost are paramount.

The battery industry is a hotbed of innovation, with companies worldwide filing patents at an accelerated pace for next-generation technologies like solid-state and lithium-sulfur batteries. This rapid advancement means continuous R&D investment is crucial for staying ahead.

FREYR's competitive standing hinges on its commitment to ongoing research and development, alongside its ability to effectively incorporate these emerging innovations into its production lines. The pace of battery technology development is a key technological factor influencing FREYR's market position.

Digitalization and Battery Passport Implementation

The EU Battery Regulation, set to take effect in February 2027, will mandate a digital battery passport. This passport, accessible via QR codes, will detail a battery's carbon footprint, material sourcing, and projected lifespan, demanding advanced data management and traceability solutions. This push towards digitalization significantly influences manufacturing operations and enhances supply chain transparency.

FREYR Battery, like other industry players, must integrate robust systems to comply with these new data requirements. The ability to accurately track and report on a battery's lifecycle is becoming a critical competitive differentiator, especially as consumers and regulators increasingly prioritize sustainability and ethical sourcing. For instance, the demand for transparency in cobalt sourcing, a key component in many batteries, is on the rise, with reports indicating that by 2025, over 70% of battery manufacturers will be prioritizing traceable materials.

- Digital Passport Mandate: EU Battery Regulation requires digital passports from February 2027, detailing carbon footprint, material origin, and lifetime.

- Data Management Needs: Implementation necessitates sophisticated data management and traceability systems for compliance.

- Supply Chain Impact: Digitalization drives greater transparency across manufacturing processes and the entire supply chain.

- Market Expectation: Increasing consumer and regulatory focus on sustainability and ethical sourcing will make compliance a competitive advantage.

Balancing Cost and Performance in Battery Design

Technological advancements in battery design are crucial for FREYR, as they directly impact cost and performance. The ongoing push for higher energy density and faster charging speeds necessitates continuous innovation. For instance, the increasing adoption of Lithium Iron Phosphate (LFP) batteries, known for their lower cost and improved safety, is a key trend. LFP battery prices saw a significant drop in 2023, making them more competitive in the market.

However, the industry is also investing in next-generation chemistries and materials to push performance boundaries. Incorporating silicon into anodes, for example, promises to boost energy density, allowing batteries to store more power in the same volume. This could be vital for applications demanding extended range or longer operational times. By 2025, the global battery market is projected to reach over $200 billion, highlighting the immense growth potential driven by these technological shifts.

- LFP Battery Cost Reduction: LFP battery pack prices fell by approximately 20% in 2023 compared to 2022, driven by material cost decreases and manufacturing scale.

- Energy Density Improvements: Research into silicon-anode technology aims to increase energy density by 15-20% over traditional graphite anodes.

- Charging Speed Advancements: Ultra-fast charging technologies are being developed, with some aiming for an 80% charge in under 15 minutes.

- Market Growth Projection: The global battery market is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030.

FREYR's reliance on the 24M SemiSolid™ technology positions it at the forefront of manufacturing innovation, aiming for reduced costs and enhanced efficiency. The successful automated casting trials and unit cell production at their Customer Qualification Plant (CQP) in early 2024 underscore this technological commitment.

The company's strategic focus on automation is critical for achieving its ambitious GWh production targets. This drive for efficiency is essential to remain competitive in the rapidly expanding electric vehicle and energy storage sectors, where scale and cost are paramount.

The battery industry's rapid pace of innovation, with significant patent filings for next-generation technologies, necessitates FREYR's continuous R&D investment. Their ability to integrate these advancements will be key to maintaining a strong market position.

Compliance with the upcoming EU Battery Regulation, mandating digital passports by February 2027, requires sophisticated data management. This regulation emphasizes transparency in carbon footprint and material sourcing, making traceability a significant competitive factor.

Legal factors

The EU Battery Regulation (2023/1542), which started applying in February 2024 and will be fully implemented by August 2025, places significant legal requirements on battery producers like FREYR Battery. This regulation mandates that by February 2025, companies must declare the carbon footprint of their batteries, a crucial step for market access in the EU.

Furthermore, the regulation introduces minimum recycled content requirements starting in 2028 and sets ambitious collection and recycling targets for different battery chemistries. FREYR Battery's ability to meet these evolving legal obligations is critical for its European operations and supply chain integrity.

Global trade policies, including tariffs and trade agreements, significantly influence the cost and logistics of sourcing raw materials and exporting batteries. For FREYR Battery, understanding and adapting to these evolving trade landscapes is crucial for maintaining competitive pricing and ensuring a stable supply chain. For instance, the U.S. imposed tariffs on certain goods from China, which can directly impact the cost of components or finished products if FREYR sources or sells in those markets.

Recent tariff increases on imports, such as those impacting goods from China, can escalate manufacturing input costs and create uncertainty in supply chain stability. Navigating these complex international trade dynamics is essential for FREYR to optimize its global operations and mitigate potential financial impacts. The company must stay abreast of changes in trade regulations to ensure efficient and cost-effective production and distribution.

Protecting intellectual property (IP) is paramount in the fast-paced battery industry. Patents safeguard innovations in battery materials and production methods, with a notable surge in patent filings within the battery sector. For instance, in 2023, patent applications related to battery technologies saw a significant uptick, reflecting intense R&D activity.

While patents offer robust protection, emerging regulations, such as the EU Battery Regulation's emphasis on transparency through initiatives like the digital battery passport, require companies like FREYR Battery to meticulously manage their trade secrets alongside patent strategies to ensure compliance and competitive advantage.

Norwegian Foreign Direct Investment Regulations

Norway's legal framework generally encourages foreign direct investment, with the Norwegian Industrial Licensing Act serving as a key piece of legislation. This act, while welcoming to foreign capital, incorporates screening mechanisms designed to safeguard national interests and critical infrastructure, ensuring investments align with strategic national priorities.

Anticipated changes to Norway's foreign direct investment screening system are on the horizon, potentially introducing significant shifts in how foreign investments are assessed and approved. These proposed amendments could impact the due diligence processes and the types of investments that receive closer scrutiny.

- Norwegian Industrial Licensing Act: Governs foreign investment, balancing openness with national interest protection.

- FDI Screening Mechanisms: Exist to review investments impacting national security and critical infrastructure.

- Proposed Amendments: Expected to update and potentially strengthen the FDI screening process, requiring careful monitoring by investors.

- Impact on FREYR Battery: Changes could influence the ease or conditions of FREYR Battery's foreign investment activities in Norway.

Labor and Employment Laws

FREYR Battery, as a significant manufacturer, operates under stringent Norwegian and international labor and employment laws. These regulations dictate fair employment practices, working conditions, and employee rights. For instance, in 2024, Norway's labor market saw a continued emphasis on worker protections, with ongoing dialogues about collective bargaining agreements and workplace safety standards, directly impacting companies like FREYR.

Decisions concerning workforce adjustments, particularly in light of project changes such as potential scale-downs at facilities like Giga Arctic, require meticulous adherence to legal frameworks. This includes strict compliance with laws governing employee terminations, severance packages, and mandatory consultation processes with employee representatives. Failure to comply can lead to significant legal penalties and reputational damage.

Key legal considerations for FREYR Battery in labor and employment include:

- Compliance with Norwegian Working Environment Act: Ensuring adherence to regulations on working hours, leave, health, and safety.

- Employee Termination Procedures: Following legal requirements for notice periods, severance pay, and consultation for any workforce reductions.

- Collective Bargaining Agreements: Engaging with unions and adhering to terms stipulated in collective agreements, which are common in Norway's industrial sector.

- International Labor Standards: For any operations or partnerships outside Norway, ensuring alignment with relevant international labor conventions and standards.

The EU Battery Regulation, fully effective by August 2025, mandates carbon footprint declarations by February 2025 and introduces recycling targets, directly impacting FREYR's market access and operational compliance in Europe. Global trade policies, including U.S. tariffs on Chinese goods, can escalate input costs and supply chain risks for FREYR. Intellectual property protection remains vital, with a notable surge in battery technology patent filings in 2023, necessitating careful management of trade secrets alongside patents for compliance with transparency initiatives like the digital battery passport.

| Legal Factor | Key Regulation/Policy | Impact on FREYR Battery | 2024/2025 Relevance |

|---|---|---|---|

| EU Battery Regulation | Regulation (EU) 2023/1542 | Market access, carbon footprint declaration, recycling targets | Declaration due Feb 2025, full implementation Aug 2025 |

| International Trade | U.S. Tariffs on Chinese Goods | Increased input costs, supply chain uncertainty | Ongoing impact on sourcing and export strategies |

| Intellectual Property | Patent filings, Digital Battery Passport | Protection of innovation, compliance requirements | Surge in patent filings in 2023, passport implementation ongoing |

| Foreign Direct Investment (Norway) | Norwegian Industrial Licensing Act | Investment screening, national interest protection | Anticipated amendments to screening mechanisms |

| Labor & Employment | Norwegian Working Environment Act | Worker protections, safety standards, termination procedures | Continued emphasis on worker protections in 2024 |

Environmental factors

FREYR Battery is deeply committed to manufacturing battery cells with a minimal carbon footprint, directly supporting the global push to reduce emissions in energy and transport. This focus is not just an ethical stance but a strategic alignment with evolving regulatory landscapes.

The EU Battery Regulation, set to take effect in February 2025, will require detailed carbon footprint declarations for electric vehicle batteries. This means companies like FREYR must meticulously track and report their environmental impact, with future regulations promising even stricter emission limits, incentivizing cleaner production processes and more sustainable supply chains across the board.

FREYR Battery's strategy hinges on Norway's abundant renewable energy, primarily hydropower, to power its manufacturing. This approach is crucial for minimizing the carbon footprint of its battery production, offering a distinct competitive edge and aligning with global climate objectives. The consistent availability of clean energy is a cornerstone of FREYR's environmental credentials.

The new EU Battery Regulation, effective from 2024, mandates ambitious recycling targets and champions circular economy principles for batteries. This includes raising collection rates for portable and light vehicle batteries and setting minimum recovery rates for critical materials such as lithium, nickel, and cobalt by the end of 2027, with initial targets for lithium recovery at 50% by 2027, rising to 80% by 2031.

FREYR Battery must proactively embed these stringent recycling and resource recovery mandates into its product lifecycle management strategies. For instance, by 2030, the regulation aims for 95% of cobalt, nickel, and copper to be recovered, directly impacting how FREYR sources and manages its raw materials and end-of-life battery products.

Sustainable Sourcing of Raw Materials

Environmental factors are increasingly shaping how companies like FREYR Battery approach raw material sourcing. There's a growing demand for these materials to be obtained sustainably and ethically. This means looking beyond just cost and availability to consider the environmental impact of extraction and the social conditions of the workers involved.

The European Union is placing significant emphasis on this, with the EU Battery Regulation set to introduce obligations for supply chain due diligence starting in August 2025. This regulation will require battery manufacturers to demonstrate that critical raw materials used in their products have been extracted and traded in line with both environmental and social standards. This proactive regulatory environment means FREYR Battery must build robust systems to track and verify the origin and production methods of its key materials.

Key considerations for FREYR Battery regarding sustainable sourcing include:

- Compliance with the EU Battery Regulation: Ensuring all critical raw materials sourced meet the due diligence requirements from August 2025, covering environmental protection and human rights.

- Traceability of Supply Chains: Implementing systems to trace raw materials like lithium, cobalt, and nickel back to their origin, verifying responsible extraction practices.

- Partnerships with Ethical Suppliers: Collaborating with suppliers who demonstrate strong environmental management systems and fair labor practices, potentially leading to audits and certifications.

- Minimizing Environmental Footprint: Exploring opportunities to source materials with lower carbon footprints or those derived from recycled content, aligning with circular economy principles.

Climate Change Policies and Market Demand

Global climate change policies, including the Paris Agreement and national net-zero emission targets, are significantly accelerating the shift away from fossil fuels. This regulatory momentum directly fuels the demand for electric vehicles (EVs) and advanced energy storage systems, creating a robust market for companies like FREYR Battery. For instance, by the end of 2023, the global EV market share reached approximately 15%, a substantial increase from previous years, demonstrating the tangible impact of these policies.

This regulatory push, combined with increasing consumer awareness regarding environmental sustainability, cultivates a highly favorable market landscape for FREYR's clean battery technology. The company is well-positioned to capitalize on this trend, as evidenced by its commitment to producing batteries using greener manufacturing processes. The International Energy Agency (IEA) projected in its 2024 outlook that global renewable energy capacity additions would continue to grow, further underpinning the need for energy storage solutions.

- Growing EV Adoption: Global EV sales surpassed 13 million units in 2023, a testament to the effectiveness of supportive climate policies.

- Energy Storage Demand: The global energy storage market is projected to reach over $1 trillion by 2030, driven by renewable energy integration.

- Policy Support: Government incentives and mandates for clean energy technologies are a key driver for battery manufacturers like FREYR.

Environmental regulations are a significant driver for FREYR Battery, particularly the EU Battery Regulation set to impact operations from February 2025. This regulation mandates carbon footprint declarations for EV batteries and introduces ambitious recycling targets, requiring FREYR to embed circular economy principles into its lifecycle management, with specific material recovery rates for lithium and cobalt due by 2027 and 2030 respectively.

FREYR's strategic advantage is amplified by Norway's abundant renewable energy, primarily hydropower, which underpins its low-carbon manufacturing approach. This reliance on clean energy aligns with global climate objectives and provides a competitive edge in a market increasingly scrutinized for its environmental impact, with the IEA projecting continued growth in renewable energy capacity additions through 2024.

The demand for sustainably and ethically sourced raw materials is escalating, with the EU's supply chain due diligence obligations commencing in August 2025. FREYR must therefore implement robust systems for traceability and verification of critical materials like lithium, cobalt, and nickel, ensuring compliance with environmental and social standards to meet regulatory and market expectations.

Global climate policies are accelerating the transition to EVs and energy storage, creating substantial market opportunities for FREYR. By the end of 2023, global EV market share reached approximately 15%, a clear indicator of policy effectiveness, and the energy storage market is projected to exceed $1 trillion by 2030, underscoring the critical role of battery manufacturers.

PESTLE Analysis Data Sources

Our PESTLE analysis for FREYR Battery is built on a foundation of robust data, drawing from official government publications, reputable industry associations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the battery industry.