FREYR Battery Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

FREYR Battery's marketing mix is a carefully orchestrated symphony of innovation and strategic placement. Their cutting-edge battery technology forms the core of their product offering, while their pricing strategy aims to balance premium value with market accessibility. Discover how their distribution channels and promotional efforts create a compelling narrative for a sustainable energy future.

Want to truly understand FREYR Battery's market dominance? Dive into the full 4Ps Marketing Mix Analysis for an in-depth look at their product innovation, pricing architecture, channel strategy, and communication mix. This comprehensive, editable report is your key to unlocking actionable insights for your own business planning or academic research.

Product

FREYR Battery's product strategy centers on clean, next-generation battery cells designed for sustainability and cost-competitiveness. Their manufacturing approach targets a significantly lower carbon footprint compared to traditional methods, aiming to produce batteries with a lifecycle emission reduction of up to 90%.

The company's commitment to accelerating decarbonization is evident in its product's intended applications across global energy storage and transportation sectors. By focusing on scalable, high-volume production, FREYR aims to make these advanced battery solutions accessible and impactful in the fight against climate change.

FREYR Battery's 24M SemiSolid™ technology platform is a significant differentiator, simplifying battery manufacturing. This innovative process incorporates the electrolyte early on, bypassing the need for expensive and energy-consuming solvent recovery systems.

This integration is vital for FREYR's goal of achieving highly efficient and environmentally conscious battery production. For instance, in 2024, the company is focused on scaling this technology, aiming for significant cost reductions compared to traditional methods.

FREYR Battery's cell technology is strategically positioned for high-growth sectors like Energy Storage Systems (ESS) and commercial electric vehicles (EVs). This dual focus allows them to capitalize on the accelerating demand for clean energy solutions across different mobility and grid applications.

The company also has aspirations to enter the passenger EV market, aiming for a comprehensive presence in the electrification wave. This broad application strategy enables FREYR to cater to a wider spectrum of the clean energy transition, potentially diversifying revenue streams and market penetration.

For instance, the global ESS market is projected to reach $150 billion by 2030, according to some industry analyses, highlighting a significant opportunity for FREYR's products. Similarly, the commercial EV sector, including trucks and buses, is experiencing rapid adoption, with projections suggesting substantial growth in the coming years, further underscoring the relevance of FREYR's targeted applications.

Customer Qualification Plant (CQP) Output

The Customer Qualification Plant (CQP) in Mo i Rana, Norway, achieved a key objective by completing automated casting trials and unit cell production in the first half of 2024. This advancement allows FREYR Battery to produce functional, multi-layer battery sample cells, a crucial step for engaging potential customers and validating their technology.

This facility is instrumental for FREYR's technology development and validation efforts, providing tangible battery samples for customer evaluation and feedback. The successful trials at the CQP are a testament to FREYR's progress in scaling its manufacturing capabilities.

- Automated Casting Trials Completed: First half of 2024.

- Unit Cell Production Achieved: First half of 2024.

- Key Output: Functional, multi-layer battery sample cells for potential customers.

- Strategic Importance: Critical for technology development and validation.

Strategic Shift to Downstream Modules and Packs

FREYR Battery is strategically pivoting towards downstream modules and battery packs. This move is designed to capitalize on current market demands and speed up revenue generation by utilizing their existing battery cell production capabilities. This approach offers a more direct route to early income and positive cash flow.

This strategic shift allows FREYR to leverage its established cell manufacturing capacity without the immediate, large-scale capital outlays associated with full-scale battery production facilities. By focusing on modules and packs, the company can respond more agilely to customer needs and secure initial market traction.

- Accelerated Revenue: The focus on downstream products aims to generate revenue sooner than solely relying on large-scale cell production.

- Reduced Capital Intensity: Modules and packs require less upfront investment compared to building and operating Gigafactories.

- Market Responsiveness: This strategy allows FREYR to adapt more quickly to specific customer requirements for battery solutions.

- Cash Flow Generation: Early sales of modules and packs are expected to improve the company's cash flow position.

FREYR Battery's product strategy is anchored in its innovative 24M SemiSolid™ technology, which promises cleaner, more cost-effective battery cell production. This technology simplifies manufacturing and aims for a significantly lower carbon footprint, targeting up to a 90% lifecycle emission reduction. The company is focusing on producing functional battery sample cells from its Customer Qualification Plant (CQP) in Mo i Rana, Norway, with automated casting trials and unit cell production achieved in the first half of 2024. This allows for crucial customer engagement and technology validation, paving the way for future commercialization.

The company is strategically pivoting to downstream modules and battery packs to accelerate revenue generation and improve cash flow. This move leverages existing cell production capabilities while reducing the capital intensity associated with full-scale Gigafactory operations, allowing for greater market responsiveness and quicker income streams.

| Product Focus | Key Technology | Production Milestone (H1 2024) | Strategic Shift | Target Markets |

|---|---|---|---|---|

| Clean, next-generation battery cells | 24M SemiSolid™ | Automated casting trials & unit cell production | Downstream modules & packs | Energy Storage Systems (ESS), Commercial EVs |

| Sustainability & Cost-Competitiveness | Simplified manufacturing | Functional, multi-layer sample cells | Accelerated revenue & cash flow | Potential for Passenger EVs |

| Lifecycle Emission Reduction (up to 90%) | Early electrolyte integration | Customer validation | Reduced capital intensity | Global energy storage & transportation |

What is included in the product

This analysis delves into FREYR Battery's marketing mix, examining its innovative product offerings, competitive pricing strategies, strategic global placement, and targeted promotional efforts to understand its market positioning and competitive advantages.

It provides a comprehensive overview for stakeholders seeking to grasp FREYR Battery's marketing approach, highlighting how its product, price, place, and promotion elements are integrated for market success.

FREYR Battery's 4P marketing mix analysis pinpoints how their product, price, place, and promotion strategies directly address the industry's pain points by offering sustainable, cost-effective, and accessible battery solutions.

Place

FREYR Battery is strategically developing its production footprint in Norway, with Mo i Rana serving as a cornerstone. The company is establishing a significant production capacity here, encompassing its Customer Qualification Plant (CQP) and the ambitious Giga Arctic facility.

These Norwegian sites are meticulously selected to capitalize on the nation's abundant renewable energy resources, particularly hydropower, ensuring a foundation for sustainable battery manufacturing. This commitment to green energy is a key differentiator for FREYR.

The CQP in Mo i Rana is already operational, facilitating crucial technology development and process refinement. This facility is vital for FREYR's path to scaling its advanced battery production technologies.

FREYR Battery's Giga America project in Coweta County, Georgia, is a cornerstone of its U.S. expansion, aiming to solidify its presence in the North American battery market. This facility is designed to localize the battery supply chain, a critical move to serve the burgeoning demand for electric vehicles and energy storage solutions across the continent.

The Giga America plant is projected to have an initial production capacity of 11.4 GWh, with plans for a significant expansion to 34 GWh. This expansion is crucial for FREYR to capture a substantial share of the rapidly growing U.S. battery market, which is seeing increased government support and private investment through initiatives like the Inflation Reduction Act.

FREYR Battery is actively pursuing strategic European expansion, with a keen focus on a potential joint venture in Vaasa, Finland. This venture is earmarked for the industrial-scale production of LFP cathode active materials, a critical component for battery manufacturing.

The Finnish project has secured a significant grant from the European Union, underscoring its strategic importance in bolstering Europe's battery supply chain. This initiative is poised to establish a substantial domestic source for essential battery materials, reducing reliance on external suppliers.

Prioritizing U.S. Market Focus

FREYR Battery is sharpening its focus on the U.S. market for its commercialization efforts and securing crucial financing. While its Norwegian roots remain, the strategic pivot towards the United States is a clear indicator of where the company sees its near-term growth opportunities. This strategic alignment is heavily influenced by favorable policy environments.

The U.S. Inflation Reduction Act (IRA) of 2022 is a significant driver, offering substantial tax credits and incentives for domestic battery manufacturing and clean energy production. For FREYR, this translates into a more attractive financial landscape for its planned gigafactories. The company has actively pursued opportunities within the U.S., aiming to leverage these incentives to de-risk its expansion plans and accelerate production.

- U.S. Market Emphasis: FREYR is prioritizing the U.S. for commercialization and financing, building on its Norwegian base.

- IRA Impact: The Inflation Reduction Act provides significant financial incentives for U.S.-based battery manufacturing.

- Strategic Alignment: This focus aligns FREYR with key U.S. government policies promoting domestic clean energy production.

- Project Finance: The U.S. market's incentives are crucial for securing the financeable projects FREYR needs for expansion.

Direct Sales and Strategic Partnerships

FREYR Battery operates with a direct sales approach, focusing on business-to-business (B2B) engagements. This strategy allows for tailored solutions and strong relationships with major clients in the energy storage sector.

A prime example of this direct sales model is FREYR's binding sales agreement with Nidec Corporation, a significant player in the market. This agreement underscores FREYR's commitment to delivering its advanced battery solutions directly to key industrial partners.

Furthermore, FREYR actively cultivates strategic partnerships, including joint ventures, to enhance its market reach and offering. The collaboration with Nidec, for instance, extends beyond mere sales to encompass integrated downstream solutions, demonstrating a deeper strategic alignment.

- Direct Sales: Binding sales agreement with Nidec Corporation for energy storage solutions.

- Strategic Partnerships: Joint venture with Nidec to provide integrated downstream solutions.

FREYR Battery's production footprint is global, with key facilities in Norway and the United States. Its Norwegian operations, including the Customer Qualification Plant (CQP) and Giga Arctic in Mo i Rana, leverage abundant renewable energy. The company is also expanding into the U.S. with Giga America in Georgia, aiming for 11.4 GWh initial capacity, expandable to 34 GWh, to capitalize on IRA incentives.

FREYR is also exploring a joint venture in Vaasa, Finland, for LFP cathode active material production, supported by EU grants. This multi-location strategy allows FREYR to serve diverse markets and secure supply chains.

| Location | Facility Type | Planned Capacity (GWh) | Key Focus |

|---|---|---|---|

| Mo i Rana, Norway | Customer Qualification Plant (CQP) | N/A (Process Refinement) | Technology Development, Process Scaling |

| Mo i Rana, Norway | Giga Arctic | 29 | Industrial-scale Battery Production |

| Coweta County, Georgia, USA | Giga America | 11.4 (initial), 34 (expansion) | U.S. Market Expansion, IRA Benefits |

| Vaasa, Finland (Potential JV) | LFP Cathode Material Plant | N/A (Material Production) | European Supply Chain, EU Grant Support |

Preview the Actual Deliverable

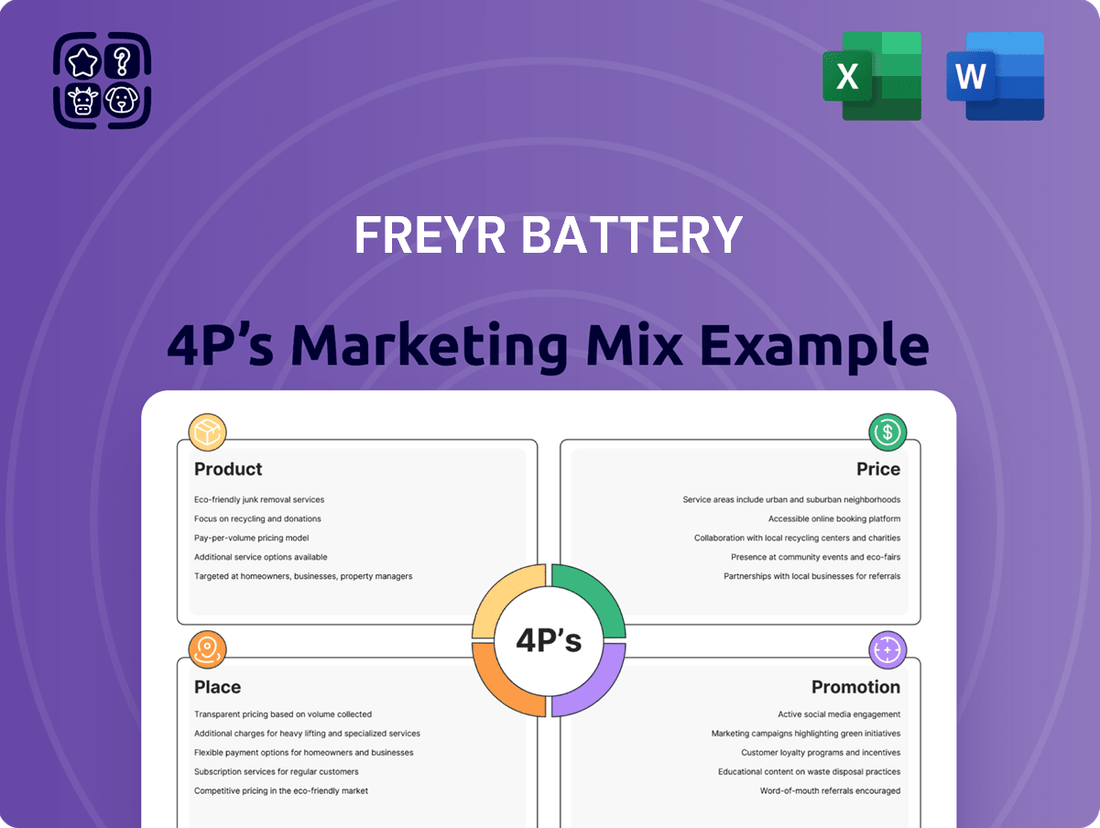

FREYR Battery 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive FREYR Battery 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies, offering a complete roadmap for understanding their market approach.

Promotion

FREYR Battery leverages its official website, particularly the dedicated Investor Relations section, as a cornerstone for transparent communication. This digital space acts as a vital conduit, delivering crucial information and timely material updates to a broad spectrum of stakeholders, including investors and the general public.

The Investor Relations hub functions as a centralized repository for both financial and operational disclosures. For instance, as of their Q1 2024 update, FREYR provided detailed financial statements and operational progress reports, accessible to all interested parties, underscoring their commitment to openness.

FREYR Battery consistently disseminates regular financial reports and press releases, offering stakeholders detailed insights into its operational and financial journey. These communications, including quarterly earnings, highlight key milestones and strategic developments. For instance, FREYR's Q1 2024 report, released in May 2024, detailed progress on its Giga Arctic facility and its ongoing efforts to secure key customer agreements, demonstrating a commitment to transparency and stakeholder engagement.

FREYR Battery maintains a robust presence on social media, utilizing platforms like X (formerly Twitter) and LinkedIn to connect with a wide audience, including investors and the general public. This active engagement is crucial for disseminating timely information.

These digital channels serve as key conduits for sharing company milestones, advancements in battery technology, and other critical updates, thereby broadening FREYR's reach and fostering investor confidence. For instance, as of early 2024, FREYR has been actively posting about its Giga Arctic project progress.

Emphasis on Sustainability and Decarbonization

FREYR Battery prominently features its dedication to sustainable, low-carbon battery cell production in its promotional efforts. This focus directly addresses the growing demand for environmentally responsible solutions within the energy and transportation sectors.

The company positions itself as a key enabler in the global transition towards decarbonization. By highlighting its contribution to cleaner energy and transportation, FREYR aims to resonate with investors, customers, and partners who prioritize sustainability.

- Commitment to Low-Carbon Production: FREYR emphasizes its manufacturing processes designed to minimize carbon footprint.

- Accelerating Decarbonization: The company actively promotes its role in facilitating the global shift away from fossil fuels in energy and transport.

- Targeting ESG-Conscious Markets: This messaging appeals to a growing segment of stakeholders prioritizing Environmental, Social, and Governance (ESG) factors.

Showcasing Technical and Operational Milestones

FREYR Battery actively highlights its technological advancements, such as the successful automated casting trials and the production of unit cells at its Customer Qualification Plant (CQP). These achievements underscore the company's growing technical and operational prowess.

These milestones are crucial for establishing FREYR as a reliable partner for battery manufacturing. The company's progress in 2024 and early 2025, including advancements in pilot production, reinforces its commitment to scaling its technology.

- Successful automated casting trials: Demonstrating advanced manufacturing capabilities.

- Unit cell production at CQP: Validating the company's production processes and product quality.

- Operational readiness: Showcasing the ability to move from development to commercial-scale manufacturing.

- Industry validation: Reinforcing FREYR's position as a key player in the battery sector.

FREYR Battery's promotional strategy centers on its digital presence, investor relations, and a strong emphasis on sustainability and technological advancement. The company uses its website and social media to disseminate financial reports, operational updates, and key milestones, ensuring transparency. Their messaging highlights a commitment to low-carbon battery production and its role in global decarbonization efforts, appealing to ESG-conscious stakeholders.

| Focus Area | Key Promotional Activities | Data/Evidence (as of Q1 2024/Early 2025) |

|---|---|---|

| Digital Presence & Transparency | Investor Relations website, social media (X, LinkedIn) | Regular financial reports, press releases, Giga Arctic progress updates |

| Sustainability Messaging | Highlighting low-carbon production processes | Positioning as enabler of global decarbonization in energy and transport |

| Technological Advancement | Showcasing CQP achievements | Successful automated casting trials, unit cell production |

Price

FREYR Battery is strategically positioning itself to be a cost leader in battery cell production. This is a crucial element of their marketing mix, ensuring their products are attractive to a wide range of customers. Their target is to achieve production costs that are competitive on a global scale.

A key pillar of this cost-competitiveness is FREYR's access to Norway's abundant and low-cost renewable energy. This significantly reduces operational expenses compared to regions reliant on fossil fuels. For instance, Norway's electricity prices have historically been among the lowest in Europe, a trend expected to continue, benefiting FREYR's energy-intensive manufacturing process.

Further bolstering their cost advantage is the adoption of the 24M SemiSolid™ production platform. This technology is designed for inherent manufacturing efficiencies, including reduced processing steps and material waste. FREYR anticipates this platform will enable them to scale production rapidly while maintaining a lean cost structure, potentially achieving production costs below $70 per kWh by 2025.

FREYR Battery positions its battery cells at a premium due to a compelling value proposition centered on superior performance and sustainability. Key attributes like higher energy density, extended lifespan, and enhanced safety directly translate to better customer outcomes and lower total cost of ownership, justifying a higher price point.

This premium is further supported by their commitment to a near-zero carbon footprint in manufacturing, a significant differentiator in the increasingly environmentally conscious battery market. As of early 2024, the demand for sustainable energy solutions is rapidly growing, with the global battery market projected to reach hundreds of billions of dollars in the coming years, creating a strong market for FREYR's differentiated offering.

FREYR Battery faces intense market competition, with significant overcapacity and declining prices, largely driven by Chinese producers. This challenging environment demands continuous strategic adaptation for sustained success.

The company's decision to temporarily halt cell production at its Norway facility underscores the need to navigate these competitive pressures effectively and ensure long-term operational viability.

Significant Revenue Potential from Offtake Agreements

FREYR Battery's marketing strategy is significantly bolstered by its offtake agreements, which represent a substantial revenue stream. The company has secured conditional offtake agreements and a long-term sales agreement covering approximately 130 GWh of cumulative capacity. These commitments translate into a projected revenue potential of $9 billion to $10 billion, highlighting robust market interest in FREYR's battery solutions.

A key component of this revenue potential is the binding sales agreement with Nidec. This agreement alone covers 38 GWh of battery cells from 2025 through 2030, with an estimated gross value exceeding $3 billion. Such secured orders provide a strong foundation for FREYR's financial projections and demonstrate concrete demand for their manufacturing output.

- Secured Capacity: Approximately 130 GWh in conditional and long-term sales agreements.

- Revenue Projection: Estimated between $9 billion and $10 billion.

- Nidec Agreement: A binding deal for 38 GWh from 2025-2030, valued over $3 billion.

Focus on Financial Discipline and Cash Flow

FREYR Battery is sharpening its focus on financial discipline to navigate the current economic landscape and speed up its journey toward profitability. This involves a concerted effort to reduce its cash burn rate.

The company is strategically shifting towards less capital-intensive ventures, like developing downstream battery modules and packs. This approach aims to generate revenue sooner and bolster its cash flow.

- Reduced Cash Burn: FREYR's commitment to financial discipline is key to managing its operational expenses and capital deployment effectively in 2024.

- Earlier Revenue Streams: By concentrating on downstream modules and packs, FREYR anticipates generating revenue in the near term, improving its cash generation cycle.

- Capital Efficiency: Pursuing less capital-intensive projects aligns with the company's strategy to optimize its use of resources while building its market presence.

FREYR Battery's pricing strategy balances cost leadership aspirations with a premium value proposition. While aiming for competitive production costs, potentially below $70 per kWh by 2025, the company also leverages its superior performance and sustainability credentials to justify a higher price point.

This dual approach allows FREYR to appeal to a broad market, from cost-sensitive buyers to those prioritizing environmental impact and product longevity. The secured offtake agreements, totaling approximately 130 GWh and valued between $9 billion and $10 billion, demonstrate market acceptance of their pricing structure.

The binding sales agreement with Nidec, covering 38 GWh from 2025-2030 and exceeding $3 billion in value, further validates FREYR's ability to command premium pricing for its advanced battery solutions.

4P's Marketing Mix Analysis Data Sources

Our FREYR Battery 4P's analysis is grounded in a comprehensive review of public company disclosures, including SEC filings and investor presentations, alongside industry-specific market research and competitor analysis.