FREYR Battery Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

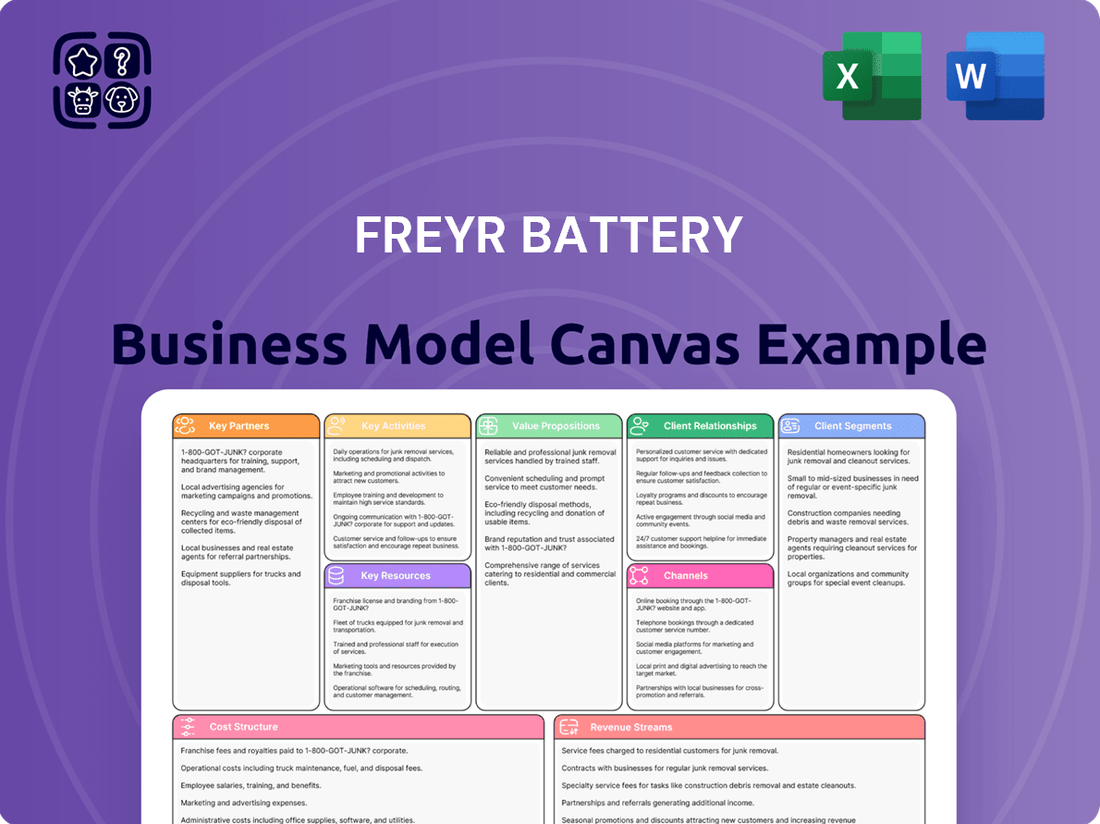

Discover the core components of FREYR Battery's innovative business model. This Business Model Canvas unpacks their customer relationships, key resources, and revenue streams, offering a clear view of their path to market leadership in sustainable battery solutions.

Unlock the full strategic blueprint behind FREYR Battery's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

FREYR Battery's strategic alliances with technology providers are fundamental to its manufacturing approach. A prime example is the licensing agreement with 24M Technologies, Inc., which grants FREYR access to their groundbreaking SemiSolid™ platform. This partnership is designed to streamline battery production, significantly lowering manufacturing expenses and paving the way for more efficient operations.

This collaboration with 24M Technologies is not just about licensing; it's about integrating advanced manufacturing processes. FREYR aims to leverage this technology to produce next-generation battery cells, enhancing both performance and cost-effectiveness. The SemiSolid™ platform, for instance, allows for a simplified manufacturing flow, reducing the number of steps and equipment needed compared to traditional methods.

As of early 2024, FREYR is actively working to establish its first Gigafactory in Mo i Rana, Norway, which will utilize this 24M technology. The company has also secured significant funding, including a substantial investment from the U.S. Department of Energy, underscoring the perceived value and potential of its technological partnerships in advancing battery manufacturing capabilities.

FREYR Battery prioritizes building strong relationships with raw material suppliers to create resilient and responsible supply chains. This focus is crucial for securing essential components for their battery manufacturing processes.

The company actively explores partnerships with major players like Glencore Plc. These collaborations aim to guarantee the ethical and sustainable sourcing of vital raw materials, such as nickel and cobalt, which are fundamental to battery production.

By engaging with suppliers committed to responsible practices, FREYR aims to foster a circular economy for battery production. This approach emphasizes material recovery and reuse, reducing environmental impact and enhancing resource efficiency.

FREYR Battery is forging critical alliances with industry giants like Caterpillar, Siemens AG, and Nidec. These partnerships are instrumental in accelerating the adoption of FREYR's eco-friendly battery technologies. For instance, the collaboration with Caterpillar aims to integrate FREYR's battery solutions into their equipment, targeting a significant reduction in emissions for heavy machinery.

These strategic coalitions are designed to boost the widespread implementation of sustainable battery systems across diverse industries and global markets. The involvement of companies like Siemens AG, a leader in electrification and automation, underscores FREYR's commitment to leveraging advanced manufacturing and energy management expertise to scale production efficiently.

Nidec, a major player in electric motors and power electronics, contributes its extensive experience in electric drivetrain technology. This synergy is vital for FREYR's mission to provide high-performance battery solutions for applications ranging from electric vehicles to grid storage, with a focus on driving down costs and increasing accessibility.

Offtake and Sales Agreement Partners

FREYR Battery actively cultivates offtake and sales agreement partners to solidify its market position. These collaborations are crucial for ensuring future demand and predictable revenue streams.

A prime example is the partnership with Impact Clean Power Technology, which includes conditional offtake agreements for battery cells. Such arrangements are vital for securing market access, particularly within the rapidly expanding e-mobility and energy storage sectors.

- Securing Demand: Agreements with partners like Impact Clean Power Technology provide a foundational level of guaranteed sales, reducing market entry risks.

- Revenue Predictability: Long-term sales agreements offer greater visibility into future revenue, aiding financial planning and investment decisions.

- Market Penetration: These partnerships are strategically important for FREYR to gain traction in key growth markets like electric vehicles and grid-scale energy storage.

- Capacity Utilization: By aligning production with committed offtake, FREYR can optimize its manufacturing capacity and operational efficiency.

Governmental Bodies and Loan Programs

FREYR Battery actively collaborates with governmental bodies to secure crucial funding for its large-scale battery manufacturing facilities. A prime example is their engagement with the U.S. Department of Energy (DOE) for Title 17 loan applications, a critical pathway for financing projects like the Giga America facility.

These partnerships are instrumental in unlocking substantial capital, often through loan guarantees or direct financing, which is essential for the capital-intensive nature of battery production. Such alliances also serve to align FREYR's strategic objectives with broader national energy security and clean energy transition goals.

- Governmental Engagement: FREYR actively pursues partnerships with national and regional governments.

- Loan Programs: Accessing programs like the DOE's Title 17 loan guarantee is a key financing strategy.

- Strategic Alignment: These collaborations support national clean energy objectives and manufacturing initiatives.

- Funding Impact: Governmental backing significantly de-risks and enables the financing of gigafactory-scale operations.

FREYR Battery’s key partnerships are multifaceted, spanning technology licensing, raw material sourcing, industrial collaboration, offtake agreements, and governmental support. These alliances are critical for scaling production, ensuring supply chain stability, and driving market adoption of their battery solutions.

The company's collaboration with 24M Technologies for its SemiSolid platform is foundational, aiming to reduce manufacturing costs and complexity. Furthermore, partnerships with major industrial players like Caterpillar and Siemens are designed to integrate FREYR’s technology into broader applications, accelerating the transition to cleaner energy solutions.

Securing offtake agreements, such as those with Impact Clean Power Technology, provides crucial revenue visibility and market access. Simultaneously, engagement with governmental bodies, including the U.S. Department of Energy for loan programs, is vital for financing the company's ambitious gigafactory projects, such as Giga America.

| Partner Type | Key Partners | Objective | Status/Impact |

| Technology Licensing | 24M Technologies, Inc. | Access to SemiSolid™ platform for efficient manufacturing | Enables simplified production flow, cost reduction |

| Raw Material Sourcing | Glencore Plc. (example) | Ethical and sustainable sourcing of nickel, cobalt | Builds resilient supply chains, supports circular economy |

| Industrial Integration | Caterpillar, Siemens AG, Nidec | Integrate battery solutions into equipment, leverage automation | Accelerates adoption, reduces emissions in heavy machinery |

| Offtake Agreements | Impact Clean Power Technology | Conditional offtake for battery cells | Secures demand, provides revenue predictability |

| Governmental Support | U.S. Department of Energy (DOE) | Funding via Title 17 loan programs | De-risks and enables gigafactory financing (e.g., Giga America) |

What is included in the product

FREYR Battery's Business Model Canvas focuses on establishing gigafactories for clean battery cell production, targeting electric vehicle manufacturers and energy storage providers with sustainable, high-performance battery solutions.

This model emphasizes strategic partnerships for raw material sourcing and technology licensing, aiming for cost-competitive, scalable manufacturing to meet growing demand for green energy storage.

FREYR Battery's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling rapid identification of core components and facilitating efficient team collaboration and adaptation.

Activities

FREYR Battery's key activities center on the automated manufacturing of battery cells, with their Customer Qualification Plant (CQP) in Norway serving as a crucial hub for this process. The company is actively working to scale up production from this pilot phase to full gigafactory operations, a critical step for meeting future demand.

This involves rigorous automated electrode casting trials and the continuous production of unit cells, ensuring quality and efficiency as they ramp up. By mid-2024, FREYR had achieved significant milestones in its CQP operations, demonstrating the viability of its production technology.

FREYR Battery’s ongoing research and development is crucial for refining its semi-solid battery technology. This includes optimizing material composition and boosting both electrochemical and electromechanical performance. The company is focused on continuous innovation to stay competitive in the rapidly evolving battery market.

The Customer Qualification Plant (CQP) plays a pivotal role in FREYR's strategy, acting as a key site for technology development and validation. This facility allows FREYR to test and prove its battery designs and manufacturing processes in a real-world setting, ensuring readiness for mass production.

FREYR Battery is deeply invested in the development and construction of its Gigafactories, a cornerstone of its business model. This includes the significant undertaking of building facilities like the Giga America project in Georgia, USA. These projects demand substantial capital investment and rigorous adherence to construction schedules to bring manufacturing capacity online.

The company's commitment to these large-scale manufacturing sites is evident in its strategic planning and execution. For instance, FREYR has secured land and commenced site preparation for its planned Gigafactory in Mo i Rana, Norway, aiming for an initial production capacity of 2.1 GWh. The company also announced in early 2024 its intention to develop a Gigafactory in Biatorbágy, Hungary, targeting a production capacity of 3.4 GWh, showcasing its expansion strategy across key markets.

Supply Chain Localization and Management

FREYR Battery is actively working to build a localized supply chain for critical battery materials, with a strong focus on the Nordic region. This strategy aims to secure a consistent and sustainable supply of essential raw materials such as iron and phosphate, which are vital for battery production. The company is also investigating opportunities for in-house lithium refining capacity to further strengthen its control over the value chain.

These localization efforts are crucial for mitigating geopolitical risks and ensuring cost stability. By bringing refining and material sourcing closer to its Gigafactories, FREYR can reduce transportation costs and lead times. This approach aligns with the broader industry trend towards regionalizing battery supply chains, driven by government incentives and a desire for greater supply chain resilience.

- Nordic Focus: Prioritizing the Nordic region for sourcing key battery materials like iron and phosphate.

- Lithium Refining Exploration: Investigating the establishment of local lithium refining capabilities.

- Supply Chain Resilience: Aiming to reduce reliance on distant suppliers and geopolitical vulnerabilities.

- Cost Optimization: Seeking to lower transportation expenses and improve overall production economics through localization.

Capital Formation and Project Financing

FREYR Battery's capital formation and project financing is a critical ongoing activity. The company actively seeks to secure substantial funding to bring its large-scale battery manufacturing facilities to fruition, a necessity for achieving its commercialization goals.

This involves a multi-pronged approach to financing. FREYR is pursuing various avenues, including government loans and grants, which are crucial for de-risking large industrial projects. Additionally, the company is exploring project-level equity to fund specific manufacturing sites, alongside other innovative financing solutions to accelerate its expansion and market entry.

- Securing Government Support: FREYR has been a recipient of significant government backing. For instance, in 2023, the company was awarded a conditional commitment for a loan of up to $750 million from the U.S. Department of Energy’s Advanced Technology Vehicles Manufacturing loan program to support its Coweta County, Georgia facility.

- Project-Specific Equity: The company aims to raise equity specifically tied to individual manufacturing projects, allowing for tailored financial structures and investor participation.

- Diverse Financing Strategies: Beyond government loans and equity, FREYR evaluates a range of financial instruments and partnerships to ensure robust capital availability for its ambitious growth plans.

FREYR Battery's key activities revolve around the automated manufacturing of battery cells, with its Customer Qualification Plant (CQP) in Norway serving as a vital center for this. The company is focused on scaling up production from this pilot phase to full gigafactory operations. This includes rigorous automated electrode casting trials and continuous unit cell production.

Significant R&D efforts are dedicated to refining FREYR's semi-solid battery technology, optimizing material composition, and enhancing performance. The CQP is essential for testing and validating battery designs and manufacturing processes before mass production. FREYR is also actively developing and constructing Gigafactories, such as the Giga America project in Georgia, USA, and has initiated site preparation for its Mo i Rana, Norway facility.

Building a localized supply chain, particularly in the Nordic region for materials like iron and phosphate, is a critical activity. This includes exploring in-house lithium refining capacity to gain greater control over the value chain and reduce geopolitical risks. Capital formation and project financing are ongoing priorities, with FREYR securing government loans and grants, such as a conditional commitment for up to $750 million from the U.S. Department of Energy for its Georgia facility.

| Key Activity | Description | Status/Milestone (as of mid-2024/early 2024) | Geographic Focus |

| Automated Battery Cell Manufacturing | Production of battery cells using automated processes. | Ongoing trials and unit cell production at CQP. | Norway (CQP) |

| Gigafactory Development & Construction | Building large-scale manufacturing facilities. | Site preparation for Mo i Rana, Norway (2.1 GWh target); announced Hungary Gigafactory (3.4 GWh target). | USA (Georgia), Norway, Hungary |

| Supply Chain Localization | Securing and developing local sources for battery materials. | Focus on Nordic region for iron and phosphate; exploring lithium refining. | Nordic Region |

| Capital Formation & Project Financing | Securing funding for manufacturing operations. | Conditional commitment for $750M DOE loan for Georgia facility. | Global (especially USA) |

Delivered as Displayed

Business Model Canvas

The FREYR Battery Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you'll get the complete, professionally structured canvas with all its key components, ready for immediate use and analysis. Rest assured, there are no mockups or samples here; what you see is precisely what you'll download, ensuring full transparency and immediate value for your strategic planning.

Resources

FREYR Battery's business model heavily relies on its proprietary and licensed technology, primarily the 24M SemiSolid™ platform. This innovative technology is crucial for its manufacturing strategy, allowing for a streamlined and potentially more cost-efficient production of lithium-ion batteries.

This license grants FREYR the rights to utilize a manufacturing process that significantly simplifies battery production by integrating the electrode manufacturing and battery formation steps. This integration is a core element of their strategy to achieve lower capital expenditure and operational costs compared to traditional battery manufacturing methods.

FREYR Battery's manufacturing facilities are the backbone of its production strategy. The Customer Qualification Plant (CQP) in Mo i Rana, Norway, is a prime example of their state-of-the-art infrastructure, designed to validate their battery cell technology and manufacturing processes. This facility is key to scaling up production efficiently.

The company is also actively developing large-scale production sites, such as Giga America in Georgia, USA. These planned Gigafactories are engineered with high levels of automation to ensure consistent quality and cost-effective, high-volume output of battery cells. This expansion is vital for meeting anticipated market demand.

FREYR Battery's success hinges on a highly skilled workforce and deep technical expertise, especially critical for bringing its advanced battery production facilities online. These teams are vital for the commissioning, smooth operation, and continuous optimization of complex manufacturing processes.

The company's commitment to developing its personnel is evident in its focus on training and retaining talent. For instance, as of early 2024, FREYR was actively recruiting for numerous technical roles, underscoring the immediate need for specialized skills to drive its operational ramp-up and achieve production targets.

Access to Renewable Energy Sources

FREYR Battery leverages Norway's exceptional access to renewable energy, primarily hydropower. This provides a significant cost advantage and underpins the company's commitment to producing ultra-low carbon battery cells, a key differentiator in the market.

This strategic advantage is crucial for meeting the growing demand for sustainable battery solutions. In 2023, Norway's electricity generation was over 90% renewable, predominantly from hydropower, offering FREYR a stable and competitively priced energy source for its manufacturing operations.

- Abundant Hydropower: Norway’s extensive hydropower network ensures a consistent and clean energy supply.

- Cost Competitiveness: Access to low-cost renewable electricity directly reduces production expenses for battery cells.

- Sustainability Mission: Aligns with FREYR's core strategy of enabling clean energy transition through sustainable manufacturing.

- Reduced Carbon Footprint: Manufacturing with renewable energy significantly lowers the embodied carbon in battery products.

Financial Capital and Funding

FREYR Battery's business model hinges on substantial financial capital, encompassing both existing cash reserves and a robust pipeline of funding sources. This financial muscle is essential for bringing its ambitious battery manufacturing plans to fruition.

Key funding mechanisms are vital for FREYR's operations. The company has actively pursued and secured significant financial backing to fuel its growth and development initiatives.

- DOE Loan: In 2024, FREYR Battery was awarded a conditional commitment for a significant loan from the U.S. Department of Energy (DOE) under the Advanced Technology Vehicles Manufacturing (ATVM) loan program. This loan, potentially up to $750 million, is earmarked to support the construction and equipping of its Giga Arctic facility in Norway and its planned U.S. operations.

- Equity and Debt Financing: Beyond government support, FREYR has also engaged in various equity and debt financing rounds to bolster its capital position. These activities are crucial for covering capital expenditures related to manufacturing facility development, research and development efforts, and ongoing operational costs.

- Strategic Partnerships: While not direct capital, strategic partnerships can unlock access to funding or reduce capital requirements. FREYR's collaborations are designed to accelerate its market entry and scale-up, indirectly supporting its financial resource management.

FREYR Battery's key resources include its advanced manufacturing technology, particularly the 24M SemiSolid™ platform, which simplifies production. Its strategically located manufacturing facilities, like the Customer Qualification Plant in Norway and planned Gigafactories in the US, are central to its scaling strategy. The company also relies on its skilled workforce and deep technical expertise to operate and optimize these complex facilities, with ongoing recruitment in 2024 highlighting the demand for specialized talent.

Value Propositions

FREYR Battery is committed to producing battery cells with a substantially reduced carbon footprint, a key differentiator in the market. By utilizing Norway's abundant renewable energy sources, FREYR aims to achieve a production process that is significantly cleaner than traditional methods. This focus on sustainability directly addresses the growing demand from environmentally conscious consumers and businesses seeking to align with global decarbonization efforts.

This commitment to low-carbon production is backed by tangible goals. For instance, FREYR targets a lifecycle carbon intensity for its battery cells that is up to 90% lower than conventional lithium-ion battery production, a significant achievement that resonates with customers prioritizing environmental impact. The company also emphasizes responsible sourcing of raw materials, further solidifying its value proposition for a greener future.

FREYR Battery's core value proposition centers on its adoption and scaling of the 24M SemiSolid™ technology. This innovative approach offers a significant leap forward in battery performance, boasting higher energy density which translates to longer-lasting power for devices and vehicles.

Beyond performance, the SemiSolid™ technology is designed to substantially reduce manufacturing costs. This cost efficiency is achieved through simplified production processes, eliminating some of the complex and expensive steps found in traditional battery manufacturing. For instance, the company anticipates a reduction in capital expenditure per gigawatt-hour (GWh) of production capacity.

By streamlining production, FREYR aims to accelerate the deployment of its battery solutions, making them more accessible and competitive in the rapidly growing electric vehicle and energy storage markets. This focus on efficient, cost-effective manufacturing is key to their strategy for rapid market penetration.

FREYR Battery is focused on delivering cost-competitive battery cells by streamlining manufacturing processes and prioritizing capital efficiency. This approach aims to make advanced battery technology more affordable and accessible for a wider range of industries and applications.

The company's strategy involves leveraging simplified production methods to drive down costs, a critical factor in accelerating the adoption of electric vehicles and renewable energy storage. For instance, in 2024, FREYR continued to advance its Giga Arctic project in Norway, a key facility designed for high-volume, cost-effective production.

Scalable Production Capacity

FREYR is actively building gigafactories designed for massive battery cell output, a crucial step to meet the surging worldwide need for batteries in electric vehicles and energy storage. This scalable production capacity is central to their strategy for capturing significant market share.

The company's approach focuses on leveraging advanced manufacturing technologies to achieve economies of scale. By 2024, FREYR plans to have its first production lines operational, aiming for an initial capacity that can be rapidly expanded.

- Gigafactory Development: FREYR is constructing multiple gigafactories, with plans for facilities in Norway and the United States.

- Targeted Capacity: The company aims for an annual production capacity exceeding 50 GWh by 2030 across its planned facilities.

- Market Demand: Global battery demand is projected to grow exponentially, driven by EV adoption and renewable energy integration.

- Technological Edge: FREYR utilizes the SemiSolid™ manufacturing process, which promises faster production cycles and reduced capital expenditure per unit compared to traditional methods.

Fit-for-Purpose Solutions for Diverse Markets

FREYR Battery is focused on delivering battery solutions precisely engineered for distinct market demands. This includes robust systems for energy storage, reliable power for commercial vehicles, and potentially components for passenger electric vehicles.

The company's strategy centers on customization, recognizing that different applications require unique battery chemistries and form factors. For instance, energy storage systems might prioritize longevity and safety, while commercial mobility solutions could emphasize power density and fast charging capabilities.

This tailored approach is crucial for market penetration. By offering fit-for-purpose solutions, FREYR aims to address specific customer pain points and gain a competitive edge. For example, in the energy storage sector, FREYR's solutions could be designed to meet the stringent requirements of grid-scale applications, ensuring stability and efficiency.

- Energy Storage Systems (ESS): Solutions optimized for grid stability, renewable energy integration, and backup power.

- Commercial Mobility: Batteries engineered for electric trucks, buses, and other fleet vehicles, focusing on range, durability, and charging speed.

- Passenger Electric Vehicles (EVs): Potential future offerings tailored to the specific energy density and performance demands of the passenger car market.

FREYR Battery's value proposition is built on delivering battery cells with a significantly lower carbon footprint, leveraging Norway's renewable energy sources. This commitment, targeting up to 90% lower lifecycle carbon intensity compared to conventional production, appeals to environmentally conscious markets.

The company's adoption of the 24M SemiSolid™ technology offers enhanced energy density and reduced manufacturing costs, making advanced battery solutions more accessible. This technological edge is crucial for FREYR's strategy to compete effectively in the rapidly expanding EV and energy storage sectors.

FREYR is focused on cost-competitive production through streamlined manufacturing and capital efficiency, aiming to accelerate battery adoption. The company's gigafactory development, including the Giga Arctic project in Norway, is designed for scalable, high-volume output to meet escalating global demand.

FREYR tailors its battery solutions for specific market needs, offering optimized systems for energy storage, commercial mobility, and potentially passenger EVs. This customized approach addresses distinct customer requirements, enhancing market penetration and competitive positioning.

| Value Proposition Pillar | Key Differentiator | Target Market Impact | Supporting Data/Goals |

|---|---|---|---|

| Sustainability | Low-Carbon Production | Appeals to ESG-focused customers | Up to 90% lower lifecycle carbon intensity |

| Technology & Cost | 24M SemiSolid™ Technology | Higher performance, lower manufacturing costs | Reduced CapEx per GWh |

| Scalability | Gigafactory Development | Meeting surging global demand | Targeting >50 GWh by 2030 |

| Customization | Tailored Battery Solutions | Addressing specific application needs | Solutions for ESS, Commercial Mobility, EVs |

Customer Relationships

FREYR Battery emphasizes building enduring relationships with crucial customers and partners, often through conditional offtake agreements and strategic joint ventures. This approach is vital for securing consistent demand for their battery cells and driving shared expansion.

In 2024, FREYR continued to solidify these ties. For instance, their collaboration with Glencore for raw material supply and potential offtake agreements with major automotive players highlight this strategy. These partnerships are foundational to their business model, ensuring market access and de-risking production ramp-up.

FREYR Battery offers comprehensive technical support, working closely with clients to fine-tune battery performance for diverse applications. This collaborative approach ensures their solutions precisely match unique customer needs and integrate smoothly into existing systems.

By engaging in co-development, FREYR fosters innovation and problem-solving, directly addressing specific performance requirements. For instance, in 2024, FREYR announced a joint development agreement with a leading industrial equipment manufacturer to tailor battery packs for enhanced operational efficiency and extended lifespan in their heavy machinery.

FREYR Battery cultivates direct sales relationships with major players like industrial customers, energy firms, and automotive manufacturers. This approach allows for tailored solutions and deep understanding of client needs.

Dedicated account management teams are crucial for handling customer inquiries, processing orders efficiently, and ensuring a high level of satisfaction. Their focus is on building long-term partnerships.

For instance, in 2023, FREYR announced a significant joint venture with Nidec for battery cell production, highlighting their strategy of engaging directly with key industry partners to secure large-scale offtake agreements and drive growth.

Pilot Programs and Sample Provision

FREYR Battery engages potential customers by providing battery cell samples from its Customer Qualification Plant (CQP). This crucial step allows prospective clients to rigorously test and validate FREYR's technology firsthand, fostering confidence in the product's performance and reliability.

This sample provision is a cornerstone of building trust and de-risking the purchasing decision for clients. By experiencing the quality and capabilities of FREYR's battery cells, customers can more readily commit to significant volume orders, paving the way for future supply agreements.

- Sample Provision: Offering battery cell samples from the CQP for customer testing and validation.

- Confidence Building: Enabling customers to evaluate technology and build confidence before large-scale commitments.

- De-risking Investment: Reducing perceived risk for potential buyers through direct product experience.

Investor and Stakeholder Engagement

FREYR Battery prioritizes open and consistent dialogue with its investors and stakeholders. This commitment is demonstrated through timely financial reports, investor presentations, and dedicated investor relations efforts, fostering transparency and trust.

Regular engagement is crucial for FREYR Battery's capital formation strategy. By providing clear updates on progress and financial performance, the company aims to attract and retain investor confidence, which is vital for funding its ambitious growth plans.

- Financial Reporting: FREYR Battery aims to provide quarterly and annual financial reports, adhering to strict disclosure standards to keep investors informed about its operational and financial health.

- Investor Presentations: The company conducts regular investor calls and presentations to discuss strategic updates, market developments, and financial results, offering direct engagement opportunities.

- Stakeholder Communication: Beyond financial metrics, FREYR Battery communicates its sustainability initiatives and technological advancements to a broader stakeholder base, including employees, partners, and the community.

FREYR Battery cultivates deep customer relationships through a multi-faceted approach, emphasizing collaboration and validation. This includes providing battery cell samples from their Customer Qualification Plant (CQP) to allow potential clients to rigorously test and validate the technology, thereby building confidence and de-risking large-scale commitments.

Strategic partnerships and joint ventures, such as their 2023 collaboration with Nidec for battery cell production, are central to securing offtake agreements and driving growth. These alliances, along with conditional offtake agreements with major automotive players and raw material supply partnerships with entities like Glencore, underscore FREYR's commitment to stable demand and shared expansion.

FREYR also focuses on direct sales channels, engaging industrial customers, energy firms, and automotive manufacturers with tailored solutions and dedicated account management. This ensures precise alignment with client needs and fosters long-term partnerships, exemplified by their 2024 joint development agreement with an industrial equipment manufacturer to optimize battery packs.

| Customer Relationship Aspect | Key Activities | 2024/Recent Developments |

|---|---|---|

| Sample Provision & Validation | Offering battery cell samples from CQP | Enabling direct customer testing and performance validation. |

| Strategic Partnerships & JV | Joint ventures, conditional offtake agreements | Nidec JV (2023), Glencore raw material supply, automotive offtake discussions. |

| Direct Sales & Support | Tailored solutions, dedicated account management | Co-development with industrial equipment manufacturer (2024) for specific applications. |

Channels

FREYR's direct sales and business development teams are crucial for securing large-scale customer contracts. They actively engage with key players in the electric vehicle (EV), energy storage, and marine sectors, fostering direct relationships. This hands-on approach enables the development of tailored battery solutions that precisely meet customer needs.

These dedicated teams facilitate direct negotiations, streamlining the process for securing significant supply agreements. For instance, FREYR announced a significant partnership with a major automotive manufacturer in early 2024, directly resulting from these business development efforts. This direct engagement is vital for translating technological advancements into tangible commercial success.

FREYR Battery actively cultivates strategic alliances and joint ventures to expand its market reach and tap into specialized industry segments. These collaborations are crucial for accessing established distribution networks and gaining entry into new geographical territories, as seen in their partnership with Nidec for battery pack production.

By forming these strategic networks, FREYR aims to accelerate its growth and solidify its position in the global battery market. For instance, their joint venture with SFL for manufacturing facilities in Norway demonstrates a commitment to leveraging shared expertise and resources to achieve scale.

FREYR Battery actively participates in major industry events like The Battery Show and International Battery Seminar & Exhibit. These gatherings are crucial for demonstrating their cutting-edge battery technology and connecting with potential customers and partners. In 2024, these events continue to be vital for establishing brand recognition and market traction in the competitive battery manufacturing landscape.

Online Presence and Investor Relations Portal

FREYR Battery leverages its company website and dedicated investor relations portal as crucial conduits for transparent communication. These platforms disseminate vital information, from the latest press releases and comprehensive financial reports to detailed technical specifications of their battery technologies. This dual approach effectively caters to both commercial partners seeking operational insights and the investment community requiring financial and strategic updates.

The company's digital presence is designed for accessibility and information richness, ensuring stakeholders can easily access key data. In 2024, FREYR continued to emphasize this channel, with significant updates on their manufacturing progress and strategic partnerships being prominently featured. For instance, their Q1 2024 earnings report, detailing production milestones at their Giga Arctic facility, was made readily available, underscoring their commitment to open dialogue.

- Website as Information Hub: Centralizes press releases, financial filings, and technical data for broad stakeholder access.

- Investor Relations Portal: Provides a dedicated space for investors to find reports, presentations, and governance information.

- Dual Audience Focus: Serves commercial entities and the investment community with tailored yet accessible content.

- Transparency Commitment: Demonstrates a dedication to open communication regarding operational and financial performance.

Customer Qualification Plant (CQP) for Samples

The Customer Qualification Plant (CQP) in Norway is a vital channel for FREYR Battery, enabling the delivery of functional battery cell samples to prospective clients. This direct engagement allows customers to thoroughly test and evaluate the performance and suitability of FREYR's battery technology in their specific applications.

This hands-on approach is crucial for building confidence and fostering partnerships. By providing tangible proof of concept, FREYR can accelerate the sales cycle and secure significant orders. For instance, in early 2024, FREYR announced a significant milestone with the first successful production of customer qualification battery cells at its CQP facility.

- Channel Purpose: To provide functional battery cell samples to potential customers for direct evaluation.

- Location: Norway.

- Key Benefit: Enables clients to assess product performance and suitability firsthand, fostering trust and accelerating adoption.

- 2024 Impact: FREYR achieved a critical milestone in early 2024 by producing the first customer qualification battery cells at its CQP facility, validating its manufacturing capabilities.

FREYR Battery utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales and business development teams are key for securing large contracts, particularly within the EV and energy storage sectors. Strategic alliances and joint ventures are also crucial for expanding market reach and accessing specialized segments. FREYR also actively participates in industry events to showcase its technology and build brand recognition.

The company's digital presence, including its website and investor relations portal, serves as a vital hub for transparent communication, providing essential updates to both commercial partners and the investment community. Furthermore, the Customer Qualification Plant (CQP) in Norway acts as a critical channel for providing prospective clients with functional battery cell samples for direct evaluation, a process vital for building trust and accelerating sales cycles.

| Channel | Purpose | Key Activities/Benefits | 2024 Highlight |

|---|---|---|---|

| Direct Sales & Business Development | Securing large-scale customer contracts | Engaging with EV, energy storage, marine sectors; tailored solutions; direct negotiations | Partnership with a major automotive manufacturer announced |

| Strategic Alliances & Joint Ventures | Expanding market reach and accessing specialized segments | Leveraging established networks; gaining entry into new territories | Joint venture with SFL for manufacturing facilities in Norway |

| Industry Events | Demonstrating technology and connecting with stakeholders | Brand recognition; market traction; networking with potential customers and partners | Continued vital participation in events like The Battery Show |

| Website & Investor Relations Portal | Transparent communication and information dissemination | Press releases, financial reports, technical specifications; catering to commercial and investment audiences | Prominent feature of manufacturing progress and partnerships; Q1 2024 earnings report availability |

| Customer Qualification Plant (CQP) | Providing functional battery cell samples for evaluation | Direct client testing; building confidence; accelerating sales cycle | First successful production of customer qualification battery cells |

Customer Segments

Electric Vehicle (EV) Manufacturers are key customers, particularly those prioritizing sustainability and performance in their battery sourcing. Companies like Volkswagen, which aims for 70% of its European sales to be EVs by 2030, and General Motors, targeting 100% EV sales in the US by 2035, represent a substantial demand for advanced battery technology.

These automotive giants are actively seeking cost-competitive and high-density battery solutions to meet ambitious production targets and consumer expectations. The global EV market, projected to reach over $1.5 trillion by 2030, underscores the immense opportunity for battery suppliers catering to this segment.

FREYR’s ESS Integrators and Developers are key clients, including major utility companies and independent power producers focused on grid stability and renewable energy integration. These entities are actively investing in large-scale battery projects to manage the intermittency of solar and wind power. For instance, in 2024, global investment in grid-scale battery storage systems was projected to reach over $100 billion, highlighting the significant demand.

These customers, such as NextEra Energy and Ørsted, require dependable and high-performance battery solutions for their ambitious projects. They are looking for partners who can deliver not just cells, but integrated systems capable of meeting stringent operational requirements for grid stabilization and peak shaving. The increasing penetration of renewables, with solar and wind capacity growing rapidly, directly fuels the need for advanced ESS solutions.

FREYR Battery targets manufacturers of commercial vehicles like trucks and buses, as well as marine vessel developers, who are actively electrifying their fleets. These customers require battery solutions that are not only powerful but also exceptionally safe and durable for demanding, heavy-duty operational environments.

The commercial mobility and marine sectors are experiencing significant growth in electrification. For instance, the global electric truck market was valued at approximately $28.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a strong demand for reliable battery suppliers like FREYR.

Industrial and Off-Grid Solution Providers

Industrial and off-grid solution providers are key customers who need reliable battery power for critical operations and remote locations. These businesses focus on applications like backup power for manufacturing plants, energy storage for mining operations, and powering telecommunications infrastructure in areas without grid access. They specifically seek solutions that offer extended operational life and high energy efficiency to minimize downtime and reduce ongoing costs.

FREYR's target market includes companies that deploy systems for:

- Industrial backup power: Ensuring continuity for factories and critical infrastructure.

- Remote energy access: Providing electricity to communities and businesses far from the main grid.

- Specialized industrial equipment: Powering machinery in demanding environments.

- Renewable energy integration: Storing solar or wind power for consistent off-grid supply.

For instance, the global off-grid power market was valued at approximately $17.5 billion in 2023 and is projected to grow significantly, highlighting the substantial demand for dependable battery technologies in these sectors. Companies in this segment are often willing to invest in higher-quality, longer-lasting batteries to avoid the substantial costs associated with system failures and frequent replacements.

Governmental and Public Sector Initiatives

Government agencies and public sector bodies are key customers, driven by decarbonization goals and the push to build robust national battery supply chains. These entities often initiate large-scale projects focused on green energy and sustainable transportation, creating demand for advanced battery solutions.

These initiatives frequently come with substantial funding and regulatory support, de-risking investments and accelerating market adoption. For instance, in 2024, many governments globally announced significant funding packages for battery manufacturing and research, such as the US Department of Energy's Battery Manufacturing Grants, which aim to bolster domestic production.

- Governmental bodies actively pursue decarbonization targets, creating demand for battery technology in grid storage and electric vehicles.

- Public sector projects often involve establishing national battery supply chains to ensure energy independence and economic growth.

- In 2024, significant government funding, like the European Union's Innovation Fund, is being allocated to battery innovation and manufacturing capacity expansion.

- Regulatory frameworks and incentives provided by governments play a crucial role in shaping the market and encouraging adoption of battery technologies.

FREYR Battery’s customer segments are diverse, encompassing automotive manufacturers, energy storage integrators, commercial vehicle and marine developers, industrial solution providers, and government entities. Each segment presents unique demands for battery performance, cost, and application-specific features.

The automotive sector, particularly EV manufacturers like Volkswagen and General Motors, seeks high-density, cost-competitive batteries to meet ambitious production goals. Energy storage integrators, such as NextEra Energy, require dependable solutions for grid stability and renewable energy projects, a market projected to exceed $100 billion in grid-scale storage investment in 2024.

Commercial mobility and marine sectors are electrifying fleets, demanding powerful, safe, and durable batteries, with the electric truck market alone valued at approximately $28.5 billion in 2023. Industrial and off-grid providers focus on reliability and efficiency for critical operations, a market segment valued at around $17.5 billion in 2023.

Government agencies are key customers, driving demand through decarbonization targets and efforts to build domestic battery supply chains, with significant funding allocated in 2024 to battery innovation and manufacturing.

| Customer Segment | Key Needs | Market Example/Data |

|---|---|---|

| EV Manufacturers | High energy density, cost-competitiveness, sustainability | Global EV market projected >$1.5 trillion by 2030 |

| ESS Integrators | Reliability, performance, grid integration capabilities | Grid-scale battery storage investment projected >$100 billion in 2024 |

| Commercial Mobility & Marine | Power, safety, durability for heavy-duty use | Electric truck market valued at ~$28.5 billion in 2023 |

| Industrial & Off-Grid | Operational life, energy efficiency, reliability | Off-grid power market valued at ~$17.5 billion in 2023 |

| Government Agencies | Supply chain development, decarbonization support | Significant 2024 funding for battery manufacturing and innovation |

Cost Structure

FREYR Battery dedicates substantial resources to Research and Development (R&D) to drive innovation in battery technology. This investment is crucial for refining their proprietary SemiSolid™ manufacturing process, which aims to reduce costs and environmental impact.

In 2023, FREYR reported R&D expenses of approximately $100 million. This significant outlay underscores their commitment to advancing battery chemistries and developing more efficient manufacturing techniques to stay competitive in the rapidly evolving energy storage market.

Building and equipping Gigafactories and the Customer Qualification Plant demands substantial upfront investment. These capital expenditures are crucial for establishing the necessary infrastructure and production capabilities to meet market demand.

FREYR Battery's planned investments reflect this reality. For instance, the company has outlined significant capital outlays for its planned facilities in Norway and the United States, with initial estimates for the Giga Arctic facility in Norway alone reaching hundreds of millions of dollars for its initial phases. These investments cover site preparation, construction, specialized manufacturing equipment, and the commissioning process.

FREYR Battery's cost structure is heavily influenced by the price of key raw materials like lithium, nickel, cobalt, and graphite, which are essential for battery production. For instance, lithium carbonate prices saw significant volatility in 2023, with some reports indicating a drop from over $80,000 per ton in early 2023 to around $20,000 per ton by year-end, directly impacting battery manufacturing costs.

Manufacturing and Operational Costs

Manufacturing and operational costs are central to FREYR Battery's business model, encompassing the direct expenses of producing battery cells. These include significant outlays for energy, even with a commitment to renewable sources, as battery manufacturing is energy-intensive. Labor costs for operating and overseeing advanced automated machinery are also a major component. Furthermore, ongoing maintenance for this sophisticated equipment and general facility overheads contribute substantially to the overall cost structure.

FREYR's strategy to mitigate these costs involves leveraging economies of scale through its planned gigafactories. For instance, the Giga Arctic facility in Norway is designed for high-volume production, aiming to bring down the per-unit manufacturing cost. The company has projected capital expenditures for its facilities, with initial estimates for Giga Arctic around $3 billion, which includes the cost of building and equipping the plant for efficient, large-scale battery production. This investment is crucial for achieving competitive pricing in the battery market.

- Energy Consumption: Battery cell production requires substantial electricity, even when sourced from renewables, impacting operational expenses.

- Labor Costs: Skilled labor is needed to operate and maintain advanced manufacturing equipment.

- Machinery Maintenance: Regular upkeep of automated production lines is essential to ensure efficiency and minimize downtime.

- Facility Overheads: Costs associated with running the manufacturing plants, including utilities, security, and administrative support, are significant.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for FREYR Battery encompass a broad range of operational costs beyond direct production. These include investments in marketing and sales efforts to build brand awareness and secure customer contracts, as well as business development activities aimed at expanding market reach and forging strategic partnerships. In 2023, FREYR reported SG&A expenses of $114.8 million, reflecting significant outlays in these growth-oriented areas.

Furthermore, these costs cover essential administrative functions crucial for smooth operations, such as human resources, finance, and IT support. Legal fees, particularly relevant for a company navigating complex regulatory landscapes and intellectual property protection, also fall under this category. Personnel costs for teams not directly engaged in manufacturing, including management and support staff, are also accounted for within SG&A. This comprehensive expense structure is vital for supporting FREYR's global expansion and technological advancement.

- Marketing and Sales: Costs incurred to promote FREYR's battery solutions and secure customer agreements.

- Business Development: Investments in expanding market presence and establishing new partnerships.

- Administrative Functions: Expenses related to HR, finance, IT, and general corporate management.

- Legal and Personnel: Costs associated with legal counsel, compliance, and non-production staff salaries.

FREYR Battery's cost structure is significantly shaped by its substantial investments in research and development, aimed at refining its SemiSolid™ manufacturing process. The company reported R&D expenses of approximately $100 million in 2023, highlighting its commitment to innovation and efficiency in battery technology.

Capital expenditures for building Gigafactories and the Customer Qualification Plant represent another major cost component. For example, the initial phases of the Giga Arctic facility in Norway were estimated to require hundreds of millions of dollars for construction and equipment, with total projected costs for the plant around $3 billion.

Raw material costs, particularly for lithium, nickel, and cobalt, are critical. Lithium carbonate prices, for instance, saw a dramatic decrease in 2023, falling from over $80,000 per ton to around $20,000 per ton by year-end, directly impacting production expenses.

Operational costs include energy consumption, labor for skilled personnel to manage automated machinery, and ongoing maintenance for advanced equipment. Sales, General, and Administrative (SG&A) expenses, which totaled $114.8 million in 2023, cover marketing, business development, and essential administrative functions.

| Cost Category | 2023 Data/Estimates | Key Drivers |

|---|---|---|

| Research & Development (R&D) | ~$100 million | Process innovation (SemiSolid™), battery chemistry advancements |

| Capital Expenditures (CapEx) | Hundreds of millions (initial phases Giga Arctic) - ~$3 billion (total Giga Arctic estimate) | Gigafactory construction, equipment procurement, plant commissioning |

| Raw Materials | Volatile pricing (e.g., Lithium carbonate down from >$80k/ton to ~$20k/ton in 2023) | Market supply/demand for lithium, nickel, cobalt, graphite |

| Manufacturing & Operations | Significant | Energy consumption, skilled labor, machinery maintenance, facility overheads |

| Sales, General & Administrative (SG&A) | $114.8 million | Marketing, sales, business development, HR, finance, legal |

Revenue Streams

FREYR Battery's core revenue generation comes from the direct sale of its advanced battery cells. These cells are designed for high performance and sustainability, targeting key growth industries.

The company is focused on supplying the electric vehicle (EV) market, a sector that saw global EV sales reach approximately 13.6 million units in 2023, a significant increase from previous years. This demand is expected to continue growing, providing a substantial customer base for FREYR's products.

Beyond EVs, FREYR also aims to capture revenue from the energy storage systems (ESS) sector. The ESS market is also expanding rapidly, driven by the need for grid stability and renewable energy integration. For instance, the global energy storage market was valued at over $200 billion in 2023 and is projected to grow substantially.

Additionally, FREYR is exploring opportunities in the marine sector, providing battery solutions for electric and hybrid vessels. This emerging market represents another avenue for revenue growth as the maritime industry seeks to decarbonize its operations.

FREYR Battery secures revenue through conditional offtake agreements and long-term sales contracts with major customers. This strategy is crucial for ensuring a stable and predictable income stream as production capacity expands, de-risking the scaling process.

As of early 2024, FREYR has announced significant progress on these fronts, including a conditional offtake agreement with a leading European automotive manufacturer for up to 2.5 GWh of battery cells annually, starting in 2025. This demonstrates a tangible commitment from key industry players.

FREYR currently licenses the 24M technology, which is a key component of their business model. This licensing agreement provides FREYR with access to advanced battery manufacturing processes.

Looking ahead, FREYR has the potential to generate additional revenue through licensing its own proprietary intellectual property and manufacturing expertise. This could involve licensing their developed battery designs or advanced production techniques to other companies in the battery industry, creating a new royalty stream.

Project-Based Solutions and System Integration

FREYR Battery generates revenue by offering comprehensive, project-based solutions that extend beyond cell manufacturing. This includes system integration services, where they provide tailored battery pack and module solutions for specific customer needs. This approach allows them to capture more value in the battery supply chain.

This revenue stream is crucial for FREYR as it diversifies their income beyond raw cell production. For instance, in 2024, the demand for integrated battery systems for applications like energy storage and electric mobility is projected to grow significantly, presenting substantial opportunities for FREYR’s project-based solutions.

- Project-Based Solutions: Revenue derived from delivering customized battery packs and modules for specific client projects.

- System Integration Services: Income generated from the expertise in integrating battery cells into complete, functional systems.

- Value-Added Offerings: Capturing additional revenue by providing end-to-end battery solutions, not just individual components.

Government Incentives and Subsidies

Government incentives and subsidies represent a significant revenue stream for FREYR Battery, particularly those aimed at bolstering domestic clean energy production and battery supply chains. These financial benefits are crucial for offsetting capital expenditures and improving the overall economic viability of battery manufacturing operations.

The U.S. Inflation Reduction Act (IRA) is a prime example, offering substantial tax credits and grants. For instance, the Advanced Manufacturing Production Credit (45X) provides credits for eligible clean energy manufacturing, including battery components. FREYR has actively pursued these opportunities to enhance its financial position.

- Advanced Manufacturing Production Credit (45X): Provides a per-kilowatt-hour credit for domestically produced battery cells and modules, directly impacting production costs and profitability.

- Grants for Battery Manufacturing Facilities: Government funding programs are available to support the construction and expansion of battery gigafactories, reducing initial investment burdens.

- Support for Domestic Supply Chains: Incentives often target the development of upstream and downstream battery supply chains, creating a more robust and cost-effective ecosystem for manufacturers like FREYR.

- Loan Programs and Guarantees: Government entities may offer low-interest loans or loan guarantees for large-scale clean energy projects, further de-risking investments.

FREYR Battery's revenue streams are diversified, encompassing direct sales of battery cells and integrated solutions, alongside potential future licensing opportunities. The company is strategically positioned to capitalize on the booming electric vehicle and energy storage markets, with significant offtake agreements already in place.

Conditional offtake agreements, such as the one with a European automotive manufacturer for up to 2.5 GWh annually starting in 2025, provide a solid foundation for predictable revenue. This strategy is crucial for de-risking its expansion as production capacity grows.

Beyond cell manufacturing, FREYR generates income through project-based solutions and system integration services, offering tailored battery packs and modules. This approach allows them to capture additional value across the battery supply chain, catering to specific client needs in diverse sectors.

Government incentives and subsidies, particularly from initiatives like the U.S. Inflation Reduction Act, represent a vital revenue stream. These financial benefits, including production tax credits, help offset capital expenditures and enhance the economic viability of FREYR's manufacturing operations.

Business Model Canvas Data Sources

FREYR Battery's Business Model Canvas is informed by a blend of market intelligence, financial projections, and operational data. These sources ensure a comprehensive understanding of customer needs, competitive landscapes, and cost structures.