FREYR Battery Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

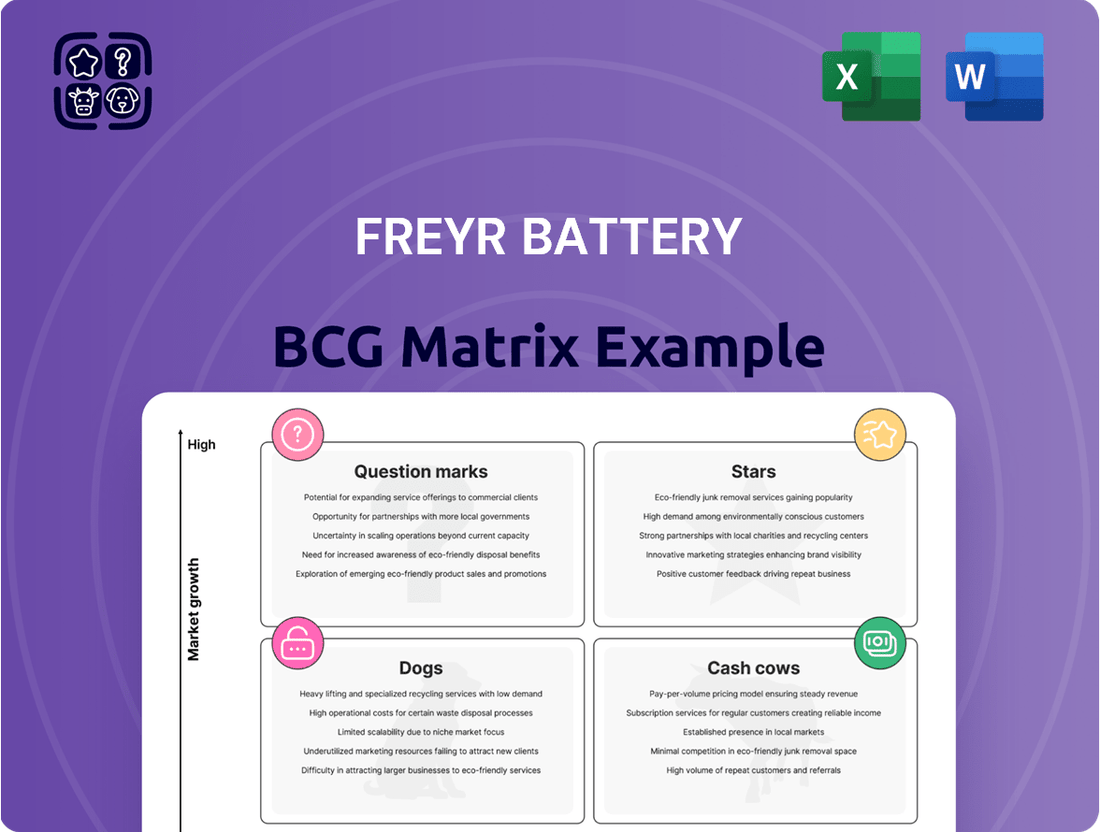

FREYR Battery's BCG Matrix offers a crucial snapshot of its product portfolio, identifying potential Stars, Cash Cows, Dogs, and Question Marks in the burgeoning battery market. Understanding these positions is key to navigating growth and resource allocation effectively.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for FREYR Battery.

Stars

FREYR Battery's proprietary semi-solid battery technology, licensed from 24M, is positioned as a potential star. This technology boasts claimed efficiencies, fewer manufacturing steps, and lower capital costs than conventional lithium-ion battery production. Successful scaling to gigawatt-hour (GWh) production could create a significant competitive edge in the expanding battery sector.

The company has made progress with automated unit cell production trials at its Customer Qualification Plant (CQP) in Norway. This is a vital milestone for the technology's commercialization, with the aim of achieving cost-competitive production.

The global energy storage market is booming, fueled by the surge in solar and wind energy installations. FREYR Battery's strategic shift towards energy storage systems (ESS) places it squarely in this expanding market. Demand for battery solutions in ESS is projected for robust growth through 2024 and beyond, presenting a significant opportunity for FREYR to become a leader.

FREYR Battery is actively pursuing the commercial mobility sector, encompassing electric vehicles (EVs) and marine applications, in addition to Energy Storage Systems (ESS). This strategic focus positions them to capitalize on the burgeoning demand for battery solutions in transportation. The electrification of the transport sector is a significant catalyst for battery market growth.

The commercial mobility segment, particularly electric trucks, is expected to see a substantial rise in its share of overall EV battery demand by 2030. This robust growth trajectory aligns perfectly with the characteristics of a 'Star' in the BCG Matrix, indicating high market share potential in a rapidly expanding industry.

Leveraging Renewable Energy for Production

FREYR Battery is strategically leveraging Norway's rich renewable energy resources, particularly hydropower, to produce low-carbon battery cells. This commitment to sustainability is a significant competitive edge, appealing to a growing segment of environmentally aware consumers and businesses. In 2024, Norway's electricity generation was overwhelmingly dominated by renewables, with hydropower accounting for approximately 88% of its total electricity production, providing FREYR with a reliable and clean energy foundation.

This focus on green production not only aligns with global Environmental, Social, and Governance (ESG) trends but also offers tangible benefits. By utilizing clean energy, FREYR can potentially reduce its operational carbon footprint, a factor increasingly scrutinized by investors and customers alike. This sustainable approach can translate into a long-term competitive advantage in a market where supply chain transparency and environmental impact are becoming paramount decision-making criteria.

- Low-Carbon Production: FREYR's use of Norway's hydropower aims to significantly reduce the carbon intensity of its battery cell manufacturing.

- Market Differentiation: The emphasis on renewable energy appeals to ESG-focused customers, setting FREYR apart from competitors.

- Cost Efficiency: Abundant renewable energy in Norway can offer stable and potentially lower energy costs compared to regions reliant on fossil fuels.

- Regulatory Alignment: FREYR's strategy aligns with increasing global regulations and incentives promoting green manufacturing and electrification.

Strategic Partnerships for Technology and Offtake

FREYR Battery's strategic partnerships are crucial for its growth, placing it in a strong position within the BCG Matrix. The company has secured technology licensing agreements, ensuring access to advanced battery manufacturing processes. Furthermore, conditional offtake agreements are in place, paving the way for future revenue streams once production is operational.

These collaborations are designed to accelerate FREYR's market entry and build a solid base for sales. For instance, the partnership with Nidec for Battery Energy Storage Solutions (BESS) is a significant step. This collaboration aims to leverage Nidec's expertise in BESS to secure a substantial market share. By mid-2024, FREYR had announced several key partnerships, including those focused on securing critical raw materials and advancing its manufacturing capabilities, reflecting a proactive approach to de-risking its expansion.

- Technology Licensing: Agreements in place for advanced battery cell production technology.

- Conditional Offtake Agreements: Securing future sales commitments for battery cells.

- Nidec Partnership: Collaboration focused on Battery Energy Storage Solutions (BESS) for market penetration.

- Market Foundation: These strategic alliances are building a robust foundation for revenue generation upon scaling production.

FREYR Battery's proprietary semi-solid battery technology, licensed from 24M, positions it as a potential star due to its claimed efficiencies and reduced manufacturing costs. The company's progress at its Norwegian Customer Qualification Plant (CQP) is a critical step towards achieving cost-competitive gigawatt-hour (GWh) production, a key indicator for a star in the BCG matrix.

The booming global energy storage market, driven by renewable energy growth, presents a high-growth opportunity for FREYR, especially with its strategic focus on Energy Storage Systems (ESS). Similarly, the electrification of commercial mobility, including electric trucks, is a rapidly expanding segment where FREYR aims to capture significant market share by 2030, aligning perfectly with the characteristics of a star.

FREYR's commitment to low-carbon production, leveraging Norway's abundant hydropower (which accounted for approximately 88% of its electricity production in 2024), offers a distinct competitive advantage. This focus on sustainability is crucial in a market increasingly driven by ESG considerations, further solidifying its star potential.

Strategic partnerships, including technology licensing and conditional offtake agreements, are vital for FREYR's growth and market entry. The collaboration with Nidec for Battery Energy Storage Solutions (BESS) is particularly significant, aiming to secure substantial market share and build a strong foundation for future revenue generation.

What is included in the product

FREYR Battery's BCG Matrix analysis categorizes its battery technologies based on market share and growth potential.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

Visualize FREYR's battery portfolio, alleviating strategic uncertainty by pinpointing Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

FREYR Battery's current revenue generation paints a picture of a company still in its developmental stages. As of 2024, the trailing twelve-month revenue stood at a modest $2.94 million USD. This limited income stream, coupled with recent net losses, signifies that FREYR has not yet established any business units or products that can be classified as 'Cash Cows,' which are typically characterized by high market share and low growth, generating substantial and consistent profits.

FREYR Battery's operations do not currently fit the Cash Cow quadrant of the BCG Matrix due to a lack of mature market share. A true cash cow requires a dominant position in a slow-growing, established market, which FREYR has yet to achieve.

FREYR is actively engaged in the development and pre-commercialization of its battery cell production. This means its products are not yet established market leaders in mature industries.

The company is targeting the electric vehicle (EV) and energy storage systems (ESS) sectors. These are dynamic, high-growth markets, not the mature, low-growth environments characteristic of cash cows. For instance, the global EV market was projected to reach over $800 billion by 2024, demonstrating significant growth potential.

Cash cows typically represent mature businesses with low investment needs and strong market positions. FREYR Battery, however, is currently in a high investment phase, which deviates from the traditional definition of a cash cow. The company is pouring significant capital into research and development, the commissioning of its production facilities, and the exploration of innovative manufacturing processes.

This intensive capital expenditure is necessary for FREYR to establish its competitive advantage and scale its operations in the rapidly evolving battery market. For instance, FREYR’s capital expenditures for 2023 were substantial, reflecting the ongoing build-out of its manufacturing capacity and technological advancements. These investments are crucial for future growth rather than generating immediate, low-investment returns characteristic of cash cows.

Focus on Future Profitability

FREYR Battery's focus on future profitability places it in the 'future stars' category of the BCG Matrix, not 'cash cows'. The company's stated goal is to achieve first revenues and EBITDA as soon as 2025, indicating a forward-looking strategy rather than current stable cash generation.

This means its current operations are not yet designed to be self-sustaining cash generators. Instead, FREYR is investing heavily to build capacity and market share for its planned battery production facilities, aiming for significant growth in the coming years.

- FREYR's projected revenue growth aims to capture a significant share of the expanding electric vehicle and energy storage markets.

- The company is focused on scaling production to achieve economies of scale, which is crucial for future profitability.

- Significant capital expenditure is being directed towards establishing manufacturing facilities in Norway and the United States.

- Achieving positive EBITDA by 2025 is a key milestone in its transition from an investment-heavy phase to a cash-generating entity.

No Established Profit Margins

Cash cows are typically characterized by high profit margins, a hallmark of established, dominant players in mature markets. These companies generate substantial profits with relatively low investment needs.

FREYR Battery, however, does not currently fit this description. The company has consistently reported net losses, which is contrary to the high profit margins expected of a cash cow. For instance, in the first quarter of 2024, FREYR reported a net loss of $60.4 million. This financial performance indicates that FREYR has not yet achieved the profitability levels required to be classified as a cash cow.

- No Established Profit Margins: FREYR Battery has not yet achieved positive net income or high profit margins.

- Consistent Net Losses: The company has reported ongoing net losses, a key indicator against cash cow status.

- Q1 2024 Performance: FREYR's net loss of $60.4 million in Q1 2024 highlights its current financial trajectory, which is far from that of a mature, profitable cash cow.

- Misalignment with BCG Matrix: FREYR's financial results do not align with the characteristics of a cash cow quadrant in the BCG Matrix.

FREYR Battery does not currently operate any business units that qualify as Cash Cows according to the BCG Matrix. This classification requires a high market share in a low-growth industry, generating consistent profits with minimal investment, none of which FREYR demonstrates at this stage.

The company's financial performance, including a net loss of $60.4 million in Q1 2024, clearly indicates it is not generating stable profits. FREYR is instead in a significant investment phase, building production capacity for the high-growth electric vehicle and energy storage markets.

FREYR's strategy is focused on future growth and market penetration, aiming for positive EBITDA by 2025. This forward-looking investment model positions it more as a potential 'Star' or 'Question Mark' rather than a mature Cash Cow.

FREYR Battery's current revenue of $2.94 million USD (trailing twelve months as of 2024) is indicative of its pre-commercialization status. This limited income stream, coupled with ongoing net losses, means no segment of its business currently fits the definition of a cash cow.

What You See Is What You Get

FREYR Battery BCG Matrix

The FREYR Battery BCG Matrix preview you see is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just a professionally formatted analysis ready for your strategic decision-making. You are getting the complete, ready-to-use report that has been meticulously prepared to provide clear insights into FREYR Battery's product portfolio. Once purchased, this exact file will be instantly downloadable, allowing you to immediately integrate its findings into your business planning and presentations.

Dogs

FREYR Battery's decision to cancel the Giga America project, a planned $2.6 billion facility in Georgia, signifies a strategic retreat from a significant investment. This move, announced in late 2023, reflects a reassessment of project viability amidst challenging market dynamics.

The cancellation was driven by a confluence of factors including elevated interest rates, declining battery prices, and a broader strategic shift within FREYR. These economic headwinds made the project unsustainable in its initial form, marking a substantial past investment that will not materialize as envisioned.

The Giga Arctic project in Norway, currently under construction, has experienced significant investment reductions, raising questions about its future as a core high-growth asset for FREYR Battery. The company is also exploring the potential sale of its entire European business, a move that further clouds the outlook for Giga Arctic’s original battery manufacturing plans.

This strategic re-evaluation suggests that Giga Arctic may not represent a high-growth or dominant market share opportunity for FREYR in its current form. FREYR announced in early 2024 that it was pausing construction on Giga Arctic to focus on its U.S. expansion, a decision that underscores the uncertainty surrounding the project’s original intent and its place within the company’s portfolio.

The battery manufacturing sector faces significant headwinds, notably an oversupply driven by Chinese competitors, creating a fiercely competitive, low-margin landscape. This challenging environment has directly affected FREYR Battery's ambitious factory expansion plans.

Consequently, FREYR's initial vision of large-scale, standalone battery production might be classified as a 'Dog' within the BCG matrix. This assessment stems from its current market standing and financial results, which haven't yet demonstrated the necessary market share or profitability to justify such capital-intensive operations.

Limited Current Battery Production Revenue

FREYR Battery's current financial standing, particularly concerning its battery production revenue, places it in a precarious position within the BCG matrix. As of the first quarter of 2024, FREYR had not yet achieved significant revenue from its battery manufacturing operations. This lack of substantial income from its core battery business, coupled with a strategic shift in focus towards solar energy solutions, indicates a potential "question mark" status for its battery ventures.

The company's pivot towards solar is a significant development. While FREYR has been investing in battery technology, the absence of commercial-scale production and sales means its battery segment is not yet a strong performer. This situation is characteristic of question mark products or businesses, which require substantial investment to grow but have uncertain future prospects. For instance, in Q1 2024, FREYR reported an operating loss of $77.3 million, highlighting the ongoing investment without corresponding revenue generation from batteries.

- Limited Revenue Generation: FREYR Battery has not yet realized significant revenue from its battery production efforts as of early 2024.

- Strategic Shift: The company's focus has increasingly shifted towards solar energy solutions, potentially diverting resources and attention from its battery manufacturing ambitions.

- Uncertain Future Prospects: The battery segment, not yet profitable and facing a strategic pivot, exhibits characteristics of a question mark in the BCG matrix due to its high investment needs and uncertain market position.

- Financial Performance: FREYR reported an operating loss of $77.3 million in Q1 2024, underscoring the significant capital expenditure required for its battery initiatives without immediate revenue returns.

High Cash Consumption without Returns from Battery Production

FREYR Battery's situation can be characterized by substantial cash outflow without immediate revenue generation from its core battery production. This is a common challenge for companies in capital-intensive industries focused on scaling new technologies.

The company has reported significant net losses, reflecting the heavy investment required to build and establish its battery manufacturing facilities. For instance, FREYR reported a net loss of $111.5 million in the first quarter of 2024, a substantial increase from the $65.6 million loss in the same period of 2023. This highlights the ongoing cash burn as they progress toward commercial production.

- High Cash Consumption: FREYR has been actively investing in its manufacturing infrastructure, including its Giga Arctic facility in Norway and its planned facility in the United States. These investments are necessary to scale production but contribute to high operational expenses.

- Lack of Returns from Battery Production: As of mid-2024, FREYR has not yet achieved significant commercial sales of batteries. The company is still in the process of ramping up production and securing customer agreements, meaning the revenue streams from battery sales are minimal to non-existent, thus no returns from this specific activity.

- Alignment with "Dog" Quadrant: This scenario places FREYR squarely in the "Dog" quadrant of the BCG Matrix. Investments are being made, but the ventures are currently yielding little to no return, requiring careful strategic evaluation.

FREYR Battery's battery manufacturing operations, particularly its ambitious expansion plans like Giga America and Giga Arctic, are currently exhibiting characteristics of "Dogs" in the BCG matrix. This classification stems from their low market share and low growth potential in the current competitive landscape.

The cancellation of the Giga America project in late 2023, a $2.6 billion investment, and the pausing of Giga Arctic construction in early 2024 highlight the challenges in achieving profitability and market dominance in battery production. These strategic retreats indicate that these ventures are not generating sufficient returns to justify continued high investment.

As of Q1 2024, FREYR reported substantial operating losses, with $77.3 million in operating loss, and a net loss of $111.5 million, underscoring the lack of revenue from battery sales. This financial performance, coupled with a strategic pivot towards solar energy solutions, reinforces the "Dog" classification for its battery segment.

The competitive pressure from Chinese manufacturers has created a low-margin environment, making it difficult for FREYR to establish a strong market position and profitability in battery production. This has led to a significant cash burn without commensurate returns from the battery business.

| Metric | Value (Q1 2024) | Status in BCG Matrix |

|---|---|---|

| Operating Loss | $77.3 million | Indicates low profitability |

| Net Loss | $111.5 million | High cash consumption without returns |

| Revenue from Battery Production | Minimal/None | Lack of market share and sales |

| Strategic Focus | Shifting towards solar energy | Reduced emphasis on battery growth |

Question Marks

FREYR Battery's semi-solid battery technology represents a significant innovation, but its commercialization is still in the early stages. While the technology holds immense promise for higher energy density and faster charging, scaling it to gigafactory levels presents considerable technical and manufacturing hurdles. The company is actively working on pilot production lines, aiming to validate the technology's performance and cost-effectiveness at scale.

This innovative technology, with its high-growth potential but currently unproven market adoption and profitability, firmly places it in the 'Question Mark' category of the BCG matrix. FREYR's strategy involves substantial investment in research and development, manufacturing process optimization, and securing key customer partnerships to drive market penetration. The company's success hinges on its ability to overcome these challenges and establish a dominant market position.

FREYR Battery's pivot to a US-focused solar company, marked by the acquisition of a 5GW solar module manufacturing facility in Texas, positions it within a rapidly expanding market. This strategic move into solar energy, a sector experiencing robust growth, presents significant potential for future expansion.

However, FREYR's current standing in the solar industry can be characterized as a 'Question Mark' within the BCG Matrix framework. Despite the high growth prospects of the solar market, FREYR's market share is presently minimal, necessitating substantial investment and successful market penetration to achieve a competitive position.

FREYR Battery is aiming to establish a significant presence in the solar energy sector by developing a 5-gigawatt (GW) solar cell facility. This move is designed to create an integrated production chain, from cells to modules, a crucial step for competitiveness. Construction is slated to commence in the second quarter of 2025.

This strategic initiative places FREYR squarely in the rapidly expanding US solar market, a sector projected for substantial growth. However, for FREYR, this represents a new venture with no existing market share in solar cell manufacturing, classifying it as a potential star or question mark within the BCG matrix depending on future market penetration and technological success.

Customer Qualification Plant (CQP) Output

FREYR Battery's Customer Qualification Plant (CQP) in Norway is currently a crucial hub for technology refinement and the creation of sample battery cells for potential clients. This facility is not yet a revenue-generating powerhouse or a significant market share contributor, but its output is paramount for validating FREYR's innovative semi-solid battery technology. The CQP's ability to successfully produce and deliver high-quality sample cells will be the determining factor in whether FREYR's core technology can advance from its current developmental stage to a 'Star' product in the competitive battery market.

- Focus: Technology development and sample cell production for customer validation.

- Current Status: Not a commercial production facility, thus not generating significant revenue or market share.

- Key Role: Essential for validating the semi-solid battery technology's viability.

- Future Potential: Success at the CQP is critical for transitioning the core technology into a 'Star' product.

Future Conventional Battery Technology Track

FREYR Battery is actively exploring and advancing discussions around conventional battery technology solutions, particularly within the United States and Europe. This strategic move diversifies their portfolio beyond their primary focus on next-generation battery chemistries.

While this diversification into more established battery technologies could potentially offer a quicker route to generating revenue, it also represents a new market entry for FREYR. The market share they can capture in this segment remains an unknown quantity, placing this venture squarely in the 'Question Mark' category of the BCG matrix.

Significant strategic investment will be crucial for FREYR to gain traction and establish a competitive position within the conventional battery market. Success here will depend on factors like production scalability, cost competitiveness, and securing key customer partnerships.

- Market Entry: FREYR is entering the conventional battery market, a segment with established players and different technological demands.

- Revenue Potential: Conventional technologies might offer a faster path to revenue compared to their more advanced, but less mature, offerings.

- Unknown Market Share: FREYR's future market share in conventional battery technology is not yet determined, classifying it as a 'Question Mark'.

- Strategic Investment Needed: Capital allocation will be vital to develop production capabilities, secure offtake agreements, and compete effectively in this established market.

FREYR's semi-solid battery technology, while innovative, is in its nascent commercialization phase. Scaling production to gigafactory levels presents significant technical and manufacturing challenges. The company's success hinges on overcoming these hurdles and establishing a dominant market position.

The venture into US solar energy, specifically the 5GW solar module manufacturing facility acquisition and the planned 5GW solar cell facility, positions FREYR in a high-growth market. However, FREYR's current minimal market share in solar necessitates substantial investment and successful penetration, classifying it as a 'Question Mark'. Construction for the solar cell facility is expected to begin in Q2 2025.

FREYR's exploration of conventional battery technologies in the US and Europe represents a diversification strategy. While this could accelerate revenue generation, it also means entering a market with established players where FREYR's future market share is yet to be determined, thus classifying this as a 'Question Mark' requiring strategic investment.

| Business Unit/Venture | BCG Category | Key Characteristics | Strategic Focus |

|---|---|---|---|

| Semi-Solid Battery Technology | Question Mark | High growth potential, unproven market adoption, significant R&D investment required. | Technology validation, manufacturing scale-up, customer partnerships. |

| US Solar Energy (Module & Cell Manufacturing) | Question Mark | Rapidly expanding market, new market entry, minimal current market share. | Market penetration, production capacity build-out (5GW planned), integrated production chain. |

| Conventional Battery Technologies (US/EU) | Question Mark | Diversification, potential for quicker revenue, unknown market share, established competitors. | Market entry, production scalability, cost competitiveness, securing offtake agreements. |

BCG Matrix Data Sources

Our FREYR Battery BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry research, and expert analysis to provide actionable strategic insights.