Fosun International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun International Bundle

Fosun International operates within a dynamic global landscape, influenced by shifting political alliances and evolving trade policies that can significantly impact its diverse business ventures. Economic volatility, including currency fluctuations and varying growth rates across key markets, presents both opportunities and challenges for the conglomerate. Understanding these external forces is crucial for any stakeholder looking to navigate Fosun's complex operations.

Technological advancements are rapidly reshaping industries where Fosun has a strong presence, from healthcare to finance, necessitating continuous adaptation and investment. Societal trends, such as changing consumer preferences and demographic shifts, directly influence demand for Fosun's products and services. Furthermore, the increasing focus on environmental sustainability and corporate social responsibility creates new regulatory pressures and strategic imperatives.

Legal frameworks and compliance requirements vary significantly across Fosun's international operations, demanding meticulous attention to detail and robust risk management. To truly grasp the strategic implications of these PESTLE factors for Fosun International, gain an edge with our in-depth analysis—crafted specifically for Fosun International. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Fosun International, a major Chinese investment conglomerate, is deeply sensitive to shifts in global geopolitical landscapes and trade policies. For example, escalating trade friction between the US and China, which saw tariffs impacting billions of dollars in goods in 2023, directly influences Fosun's cross-border investment strategies and the cost of goods within its global supply chains, particularly affecting its consumer and healthcare businesses.

The company's ability to navigate international trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), which involves 15 Asia-Pacific countries, is critical. These agreements, and any changes to them, can unlock or restrict market access and investment opportunities for Fosun’s diverse portfolio companies, impacting profitability and growth trajectories.

In 2024, continued geopolitical realignments and the potential for new trade blocs or protectionist measures present ongoing challenges. Fosun must remain agile, reassessing its market presence and investment diversification to mitigate risks associated with trade disputes and political instability across key operating regions.

The Chinese government's domestic regulatory environment significantly shapes Fosun International's operations and investment choices. For instance, recent healthcare reforms, aimed at increasing affordability and access, directly impact Fosun Pharma's business model. In 2024, China's focus on financial market stability also led to adjustments in capital controls and foreign investment guidelines, affecting Fosun's global M&A activities.

Fosun must navigate evolving consumer protection laws, which in 2024 saw increased scrutiny on e-commerce platforms and product safety standards, directly relevant to its retail and consumer goods segments. Compliance with these dynamic regulations is paramount for maintaining its market position and ensuring sustained growth within China's complex economic landscape.

Fosun International significantly benefits from government initiatives aimed at bolstering strategic sectors. For instance, China's "Made in China 2025" plan, which extends into 2025, actively encourages advancements in high-tech manufacturing and biopharmaceuticals, areas where Fosun has substantial investments. This government backing translates into tangible advantages such as preferential tax policies and access to funding, as seen in the increased R&D tax credits available for innovative enterprises in these fields. These supportive policies are crucial for accelerating Fosun's growth and fostering innovation, particularly within its healthcare and technology segments.

International Investment Regulations

Fosun International, as a global operator, faces a complex web of international investment regulations. These include varying foreign direct investment (FDI) rules, antitrust legislation, and national security assessments across different countries, impacting its capacity for acquisitions and market expansion. For instance, in 2023, global FDI flows saw a notable rebound, but regulatory scrutiny, particularly in strategic sectors, remained a significant factor for multinational corporations like Fosun.

Navigating these diverse legal frameworks requires diligent compliance and strategic negotiation. Fosun's ability to enter or exit markets is directly influenced by these external political factors. In 2024, many nations are expected to continue reviewing and potentially tightening regulations around inbound investments, especially concerning technology and critical infrastructure, which could affect Fosun's strategic maneuvering.

- FDI Scrutiny: Many countries are increasing their review of foreign direct investments, especially in sensitive industries.

- Antitrust Enforcement: Global antitrust authorities are actively examining mergers and acquisitions, potentially imposing conditions or blocking deals.

- National Security Reviews: Jurisdictions are enhancing national security reviews for foreign investments, impacting cross-border M&A activities.

- Regulatory Uncertainty: Evolving regulations create an environment of uncertainty that requires proactive legal and strategic planning.

Political Stability in Key Markets

Political stability in countries where Fosun International operates, particularly in its tourism and financial services sectors, is a crucial factor. Instability can disrupt operations, create policy uncertainty, and potentially devalue assets. For instance, in 2023, geopolitical tensions in some European markets where Fosun has financial holdings introduced volatility, impacting investment sentiment.

Fosun's extensive global footprint, spanning over 20 countries in 2024, serves as a natural hedge against localized political risks. However, significant investments in regions experiencing heightened political uncertainty, such as certain emerging markets in Asia and Africa, still present considerable operational challenges. The company's strategy involves continuous monitoring of political landscapes to adapt its investment strategies accordingly.

- Fosun's direct exposure to tourism and financial services in politically volatile regions like parts of North Africa and the Middle East requires careful risk management.

- The company's diversified portfolio, including substantial holdings in Portugal's banking sector and the United Kingdom's insurance market, mitigates the impact of single-market political instability.

- As of early 2025, economic sanctions and trade policy shifts in some major economies continue to influence Fosun's cross-border investment decisions and operational costs.

Fosun International navigates a complex political environment, with government policies in China significantly shaping its domestic operations and investment strategies. Recent healthcare reforms in China, for example, directly impact Fosun Pharma's business model, while the nation's focus on financial market stability in 2024 influenced capital controls and foreign investment guidelines, affecting Fosun's global M&A activities.

Globally, Fosun faces increasing scrutiny on foreign direct investments (FDI), with many countries in 2024 reviewing and potentially tightening regulations, especially concerning technology and critical infrastructure. This heightened regulatory environment, coupled with active antitrust enforcement and national security reviews by global authorities, necessitates diligent compliance and strategic planning for Fosun's cross-border expansion.

Fosun's political risk exposure is managed through its diversified global footprint, spanning over 20 countries by 2024. However, investments in regions with political uncertainty, such as certain emerging markets, still present operational challenges. For instance, geopolitical tensions in 2023 impacted investment sentiment in European markets where Fosun holds financial assets.

What is included in the product

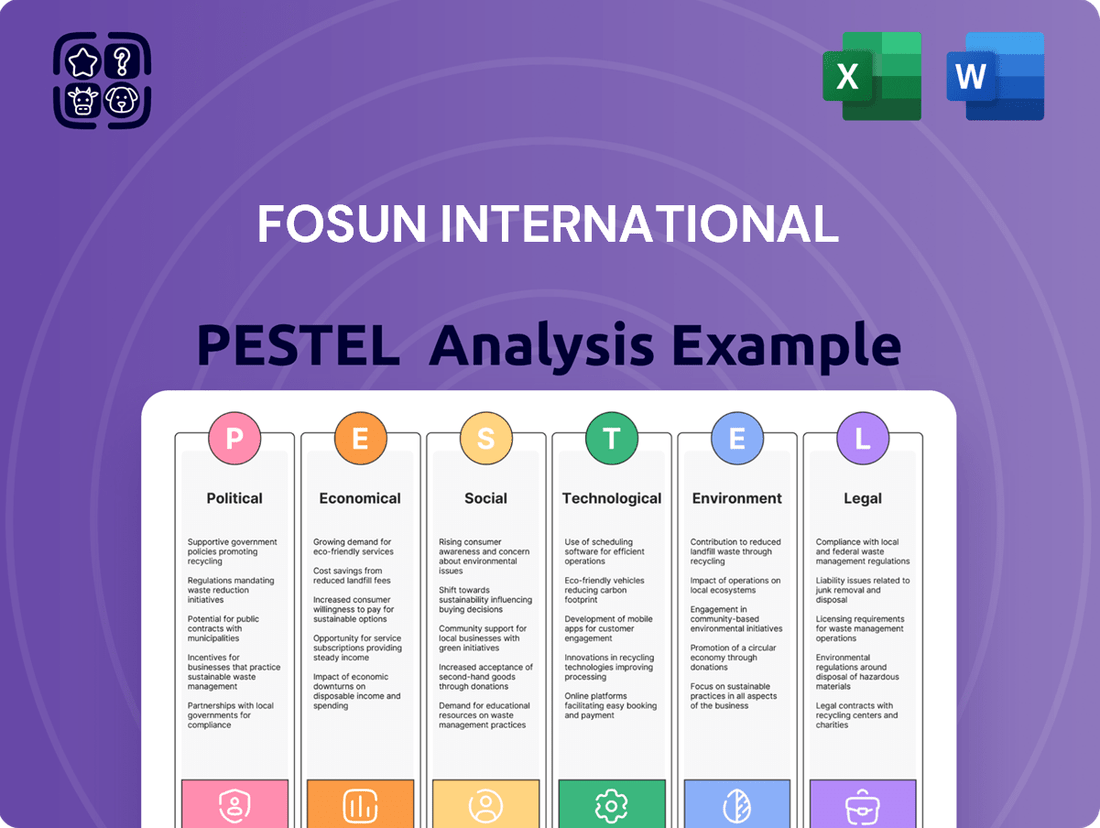

This PESTLE analysis delves into the political, economic, social, technological, environmental, and legal forces impacting Fosun International, offering a comprehensive view of its operating landscape.

A clear, actionable PESTLE analysis for Fosun International, highlighting key external factors that can be proactively managed to mitigate risks and capitalize on opportunities, thus relieving strategic planning anxieties.

Economic factors

Fosun International's broad reach across health, happiness, and wealth sectors means it's directly impacted by global economic shifts like recessions and inflation. Changes in how much people can spend are a big factor.

Despite these global headwinds, Fosun demonstrated resilience in its 2024 performance, largely by leaning into household consumption trends. This focus helped offset some of the broader economic uncertainties.

To successfully navigate these fluctuating economic conditions, Fosun's core strategies involve carefully managing its diverse asset portfolio and diligently maintaining healthy debt-to-equity ratios. These financial disciplines are crucial for stability.

Changes in global interest rates and credit market conditions significantly affect Fosun's borrowing expenses and the returns on its investments. Higher interest rates generally increase financing costs, while tighter credit conditions can limit access to capital, impacting Fosun's ability to fund its operations and strategic initiatives.

In 2024, Fosun demonstrated resilience by successfully accessing the offshore USD bond market, issuing $500 million in bonds. Furthermore, the company refinanced syndicated loans totaling approximately $1.2 billion, signaling improved access to capital and more favorable credit market conditions for the conglomerate.

These improved credit conditions are crucial for Fosun's strategic advancements, enabling it to pursue growth opportunities and manage its portfolio effectively. Favorable financing terms support a balanced approach to both investment in new ventures and strategic exits from existing ones, optimizing capital allocation.

Currency exchange rate volatility presents a significant challenge for Fosun International, a global conglomerate with substantial international revenue streams. Fluctuations in exchange rates directly impact the reported value of its overseas earnings when translated back into its reporting currency, potentially affecting profitability and financial statements.

In 2024, Fosun's global footprint was evident, with approximately 48% of its total revenue originating from overseas operations. This considerable reliance on international markets underscores its exposure to the unpredictable nature of currency movements, as a strengthening or weakening of key foreign currencies against its reporting currency can lead to substantial gains or losses.

To navigate this inherent risk, Fosun employs strategies such as financial hedging instruments, including forward contracts and options, to lock in exchange rates for future transactions. Furthermore, its diversified international business portfolio, spanning various geographies and industries, helps to naturally offset some currency-related risks by spreading exposure across different economic environments.

Consumer Spending Power and Market Demand

Fosun International's strategic emphasis on household consumption, especially within its healthcare, consumer goods, and tourism segments, is inherently linked to the ebb and flow of consumer spending power and overall market demand. As economies expand and individuals see their disposable incomes rise, particularly in its core markets, the demand for Fosun's diverse offerings naturally strengthens.

The company's stated aim to further solidify its presence in the household consumption sector means its financial performance will be increasingly sensitive to shifts in consumer confidence and purchasing behavior. For instance, China's retail sales saw a significant increase, growing by 7.2% year-on-year in the first four months of 2024, indicating a robust consumer environment that Fosun aims to leverage. This trend is crucial for Fosun's health, happiness, and wealth management segments.

- Consumer Spending Power: Rising disposable incomes in key markets like China directly fuel demand for Fosun's consumer-focused businesses.

- Market Demand: Fosun's targeted sectors, including healthcare and tourism, are highly responsive to changes in consumer sentiment and economic conditions.

- Economic Growth Impact: Continued economic expansion is essential for maintaining and increasing the purchasing power that drives sales across Fosun's portfolio.

- Household Consumption Focus: The company's strategic pivot towards household consumption makes it a direct beneficiary of positive consumer spending trends.

Asset Divestment and Portfolio Optimization

Fosun International has been strategically divesting non-core assets as part of its 'business streamlining and advancements and exits' initiative. This move is designed to sharpen its focus on core operations, improve its financial standing, and boost liquidity. The company sees this as a crucial step to optimize its overall portfolio and reduce financial leverage.

In 2024, Fosun reported approximately RMB17.5 billion in signed asset divestments at the group level. This significant figure underscores the aggressive nature of its divestment strategy. The primary goal behind these sales is to strengthen the company's balance sheet and enhance its financial flexibility.

Key aspects of this strategy include:

- Focus on Core Businesses: Divesting non-essential assets allows Fosun to concentrate resources and management attention on its most promising and strategic business segments.

- Balance Sheet Optimization: The proceeds from divestments are used to reduce debt, thereby lowering financial risk and improving key financial ratios.

- Enhanced Liquidity: Selling off assets injects cash into the business, providing greater flexibility for investments, operations, and weathering economic downturns.

- Improved Financial Health: By streamlining its operations and reducing its debt burden, Fosun aims to achieve a more robust and sustainable financial profile.

Fosun International's performance is closely tied to global economic conditions, with consumer spending power being a key driver. The company's strategic focus on household consumption, particularly in its health, happiness, and wealth sectors, directly benefits from rising disposable incomes. For instance, China's retail sales growth of 7.2% in the first four months of 2024 highlights a robust consumer environment that Fosun aims to capitalize on.

Navigating fluctuating interest rates and credit markets is critical for Fosun. In 2024, the company demonstrated its ability to access capital by issuing $500 million in USD bonds and refinancing approximately $1.2 billion in syndicated loans, indicating improved credit conditions. These financing efforts are vital for funding growth and managing its diverse asset portfolio effectively.

Currency exchange rate volatility poses a significant challenge for Fosun, given that about 48% of its revenue in 2024 came from overseas operations. The company employs hedging strategies and benefits from its diversified international portfolio to mitigate these risks, which can impact the translation of foreign earnings into its reporting currency.

Fosun's strategic divestment of non-core assets, with approximately RMB17.5 billion in signed asset sales at the group level in 2024, aims to sharpen focus, improve financial health, and enhance liquidity. This streamlining is crucial for optimizing its portfolio and reducing financial leverage, thereby strengthening its balance sheet and financial flexibility.

| Economic Factor | 2024 Impact/Data | Fosun's Response/Strategy |

| Consumer Spending | China retail sales grew 7.2% (Jan-Apr 2024) | Focus on household consumption sectors (health, happiness, wealth) |

| Interest Rates & Credit Markets | Issued $500M USD bonds, refinanced ~$1.2B loans | Accessing capital markets, managing debt-to-equity ratios |

| Currency Exchange Rates | 48% of 2024 revenue from overseas | Employing hedging instruments, diversifying international portfolio |

| Asset Divestment | ~RMB17.5B in signed divestments (Group level) | Streamlining business, reducing leverage, enhancing liquidity |

Preview the Actual Deliverable

Fosun International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fosun International breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the conglomerate's global operations. Gain valuable insights into market dynamics, regulatory landscapes, and future trends. This is your complete guide to understanding the external forces shaping Fosun's strategic decisions.

Sociological factors

A significant global trend is the increasing focus on health and wellness, which naturally boosts demand for healthcare products, services, and proactive health management. This societal shift is a key driver in consumer choices and healthcare spending patterns. For instance, global health and wellness spending reached an estimated $4.5 trillion in 2023, demonstrating the market's substantial growth. This trend directly benefits companies like Fosun International, which has strategically positioned itself within this expanding sector.

Fosun's substantial investments in healthcare, encompassing pharmaceuticals, medical devices, and health services, align perfectly with this growing societal emphasis on well-being. Their commitment is evident in advancements such as their work on CAR-T cell therapy, a cutting-edge cancer treatment, and their long-standing efforts in combating diseases like malaria, which continues to be a significant global health concern. These initiatives underscore Fosun's response to the rising health consciousness by providing solutions that address critical health needs.

Consumers increasingly seek personalized and premium leisure experiences, driving growth in sectors like cultural tourism. Fosun Tourism Group, a key part of Fosun International, is actively responding to this trend. For instance, Club Med, a flagship brand, has seen strong performance, with its first half of 2024 revenue reaching €850 million, up 12% year-on-year, reflecting this demand for high-quality, tailored holidays.

Fosun's strategic investments in expanding its resort portfolio, such as recent developments in the Maldives and Portugal, directly cater to these evolving preferences for unique and enriching travel. The successful international rollout of initiatives like the Yuyuan Garden Lantern Festival also highlights a growing appetite for cultural exchange and immersive activities, as evidenced by the festival attracting over 1.2 million visitors in its 2024 Paris iteration.

Demographic shifts are significantly impacting global markets, with aging populations becoming a prominent trend. In many developed nations, the proportion of individuals aged 65 and over is steadily increasing, a pattern also emerging in key developing economies. This demographic evolution directly translates into a heightened demand for healthcare services, encompassing everything from routine medical care to specialized geriatric services and advanced medical products.

Fosun International's healthcare segment is strategically positioned to leverage these long-term demographic trends. The company is actively developing and investing in innovative solutions designed to address critical unmet clinical needs, particularly those associated with an aging populace. For instance, by 2023, China's population aged 60 and above reached over 290 million, a substantial market for healthcare expansion.

Digital Lifestyles and Online Consumption

The ongoing shift towards digital lifestyles significantly impacts how Fosun International's diverse portfolio interacts with consumers. The pervasive adoption of digital technologies has cemented online consumption as a primary channel for accessing products and services across various sectors. For instance, by 2025, global e-commerce sales are projected to exceed $7 trillion, underscoring the imperative for Fosun's consumer-facing businesses to robustly engage with these digital trends.

Fosun's strategic focus on consumer products and tourism necessitates a keen adaptation to evolving e-commerce patterns and digital consumer engagement. This involves leveraging online platforms not just for transactions, but also for building brand loyalty and providing seamless customer experiences. For example, the tourism sector, a key area for Fosun, is increasingly reliant on online booking and personalized digital services.

The integration of advanced technologies, such as artificial intelligence (AI), is becoming crucial for staying competitive. Fosun's tourism segment, in particular, can explore AI-driven solutions to offer highly personalized travel recommendations and enhance customer service, thereby catering to the sophisticated demands of digitally native travelers. By 2024, the global AI in travel market was valued at approximately $2.5 billion and is expected to grow significantly.

- Digital adoption: Over 60% of global consumers now prefer online shopping for many categories, a trend expected to persist and grow.

- E-commerce growth: Global e-commerce sales are anticipated to reach over $7 trillion by 2025, presenting a massive opportunity for digital-first strategies.

- AI in tourism: The AI in travel market was valued around $2.5 billion in 2024, highlighting the increasing reliance on technology for personalized experiences.

- Consumer engagement: Companies that prioritize digital engagement and personalization see higher customer retention rates, often by 10-15%.

Corporate Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility (CSR) and community involvement are increasingly shaping how companies like Fosun International are perceived and how they interact with stakeholders. This heightened focus on social impact directly influences Fosun's public image and its ability to maintain strong relationships within the communities where it operates.

Fosun actively demonstrates its commitment to social welfare through initiatives such as the 'Rural Doctors Program.' This program, which aims to improve healthcare access in underserved areas, has garnered international recognition, notably being acknowledged by the UN Global Compact. Such dedicated efforts in promoting social value are instrumental in bolstering Fosun's reputation and reinforcing its long-term sustainability strategy.

- Reputation Enhancement: Fosun's CSR activities, like the 'Rural Doctors Program,' contribute to a positive corporate image, attracting socially conscious investors and consumers.

- Stakeholder Relations: Active community engagement fosters goodwill and trust, which can mitigate potential conflicts and build stronger partnerships.

- Sustainability Focus: By addressing social needs, Fosun aligns its business practices with sustainable development goals, improving its resilience and long-term viability.

- Global Recognition: UN Global Compact recognition for programs like 'Rural Doctors' validates Fosun's commitment to global social standards.

Societal expectations are increasingly influencing corporate behavior, pushing companies like Fosun International to prioritize corporate social responsibility (CSR). This heightened awareness of social impact directly affects Fosun's public image and its ability to foster strong relationships with stakeholders and the communities it serves. Fosun's 'Rural Doctors Program,' recognized by the UN Global Compact, exemplifies this commitment to social welfare and improving healthcare access in underserved regions, significantly bolstering its reputation and long-term sustainability.

Technological factors

Fosun International is making significant strides in digital transformation, with a particular focus on integrating Artificial Intelligence (AI) across its varied business segments. This strategic push aims to streamline operations and elevate customer interactions. For instance, in its healthcare arm, Sisram Medical, the company is exploring AI for highly accurate skin analysis, a move that could revolutionize personalized skincare solutions.

Furthermore, Fosun's tourism and hospitality ventures are leveraging advanced AI capabilities. They are investigating the use of AI-Generated Content (AIGC) technology to personalize guest room experiences. This includes tailoring room environments to individual preferences and deploying digital human services to enhance guest engagement and support within resorts.

Technological innovation is a key driver for Fosun International, especially within its healthcare and biopharmaceutical operations. The company's commitment to research and development is substantial, boasting over 20 global technology innovation centers. These centers are dedicated to advancing cutting-edge fields such as CAR-T cell therapy and the development of novel pharmaceuticals.

Fosun's strategic focus on innovation is designed to accelerate the introduction of new medical treatments to the global market. In 2023, Fosun Pharma reported a significant increase in R&D expenditure, reaching approximately RMB 7.2 billion, underscoring its dedication to pioneering new therapies and expanding its innovative drug pipeline.

The rapid expansion of e-commerce and online platforms presents significant opportunities for Fosun's consumer and tourism segments to connect with a broader customer base. In 2024, global e-commerce sales were projected to reach over $7 trillion, highlighting the sheer scale of these digital marketplaces. Effectively utilizing these channels is paramount for Fosun to deepen market penetration and accelerate sales growth, aligning with shifting consumer purchasing habits.

Data Analytics and Personalization

Fosun International leverages advanced data analytics to deeply understand customer needs across its health, happiness, and wealth segments. This capability allows for highly personalized product and service offerings, directly impacting customer satisfaction and loyalty. For instance, in 2024, Fosun's digital platforms are increasingly utilizing AI-driven insights to tailor financial advisory services and health management plans, leading to more effective engagement.

The strategic application of data analytics enables Fosun to refine its operational efficiency and marketing outreach. By analyzing consumer behavior patterns, the company can optimize inventory, streamline supply chains, and develop more targeted marketing campaigns. This data-driven approach is crucial for staying competitive in diverse markets, ensuring resources are allocated where they yield the greatest impact.

- Personalized Health Solutions: In 2024, Fosun Pharma's digital health initiatives are incorporating patient data to offer customized treatment recommendations and wellness programs.

- Tailored Wealth Management: Fosun Wealth is deploying sophisticated algorithms to analyze market trends and individual risk profiles, providing bespoke investment strategies.

- Optimized E-commerce: Data analytics are guiding product recommendations and promotions on Fosun's e-commerce platforms, enhancing user experience and conversion rates.

- Predictive Maintenance: In its manufacturing and industrial arms, Fosun is using data to predict equipment failures, reducing downtime and operational costs.

Cybersecurity and Data Privacy

The escalating digitalization across Fosun's operations, particularly within its financial services and healthcare divisions, places immense importance on robust cybersecurity and the safeguarding of sensitive customer data. Failure to protect this information can lead to significant reputational damage and financial penalties.

Compliance with evolving international data privacy standards, such as GDPR and similar regulations, is not merely a legal requirement but a cornerstone for maintaining customer trust and operational integrity. Fosun's investment in secure IT infrastructure and advanced data protection measures directly impacts its ability to operate and grow in these critical sectors.

- Data Breach Costs: Globally, the average cost of a data breach reached $4.45 million in 2024, a 15% increase from 2023, highlighting the financial impact of inadequate cybersecurity.

- Regulatory Fines: Non-compliance with data privacy laws can result in substantial fines, with GDPR violations potentially costing up to 4% of annual global turnover.

- Customer Trust: According to a 2024 survey, over 70% of consumers are less likely to do business with a company that has experienced a data breach.

- Investment in Security: Fosun's commitment to cybersecurity is reflected in its IT spending, which aims to bolster defenses against increasingly sophisticated cyber threats.

Fosun International is heavily investing in AI and advanced analytics across its diverse business units, aiming to personalize customer experiences and optimize operations. Their healthcare arm, Sisram Medical, is exploring AI for accurate skin analysis, while tourism ventures are utilizing AI-generated content for tailored guest room environments. The company's commitment to R&D, evidenced by over 20 global innovation centers, fuels advancements in areas like CAR-T cell therapy.

The rapid growth of e-commerce, with global sales projected to exceed $7 trillion in 2024, presents a significant avenue for Fosun's consumer and tourism segments to expand their reach. Utilizing sophisticated data analytics, Fosun aims to understand customer needs deeply, enabling personalized product and service offerings in health, wealth, and happiness sectors, enhancing engagement and loyalty.

The increasing digitalization necessitates robust cybersecurity measures, as data breaches can cost an average of $4.45 million globally in 2024. Fosun's investment in secure IT infrastructure and adherence to data privacy standards like GDPR are crucial for maintaining customer trust and operational integrity. This focus is vital given that over 70% of consumers are less likely to engage with companies experiencing data breaches.

| Technological Factor | Fosun's Application | Impact/Opportunity | Key Data Point (2024/2025) |

| Artificial Intelligence (AI) & Analytics | Personalized healthcare, tailored tourism experiences, refined marketing, optimized operations | Enhanced customer satisfaction, operational efficiency, competitive advantage | AI-driven insights for tailored financial advisory and health management plans. |

| E-commerce & Digital Platforms | Broader customer reach for consumer and tourism segments | Accelerated sales growth, deeper market penetration | Global e-commerce sales projected to exceed $7 trillion. |

| Research & Development (R&D) | Advancements in CAR-T cell therapy, novel pharmaceuticals, innovative medical treatments | Pipeline expansion, market leadership in biopharmaceuticals | Fosun Pharma's R&D expenditure reached approximately RMB 7.2 billion in 2023. |

| Cybersecurity & Data Privacy | Safeguarding sensitive customer data, ensuring compliance with global standards | Maintaining customer trust, avoiding financial penalties, operational integrity | Average cost of a data breach reached $4.45 million globally in 2024. |

Legal factors

Fosun International navigates a vast landscape of international and domestic legal frameworks, impacting its operations across over 35 countries and regions. This necessitates strict adherence to diverse financial regulations, stringent healthcare industry standards, and comprehensive consumer protection laws worldwide.

In 2023, Fosun reported a significant focus on enhancing its compliance infrastructure, a critical element given the global nature of its investments. The company's ability to adapt to evolving regulatory environments, such as the increasing scrutiny of cross-border investments and data privacy laws like GDPR, directly influences its operational efficiency and market access.

For instance, Fosun's healthcare segment, particularly its investments in pharmaceutical companies, is subject to rigorous approval processes and post-market surveillance by bodies like the FDA in the US and the EMA in Europe. Failure to comply can lead to substantial fines and reputational damage, underscoring the importance of robust legal and regulatory oversight.

Fosun International, as a global investment powerhouse, must meticulously adhere to anti-trust and competition laws across its diverse operational landscapes. These regulations are designed to prevent monopolies and ensure a level playing field for all market participants. For instance, in 2023, the European Commission continued its scrutiny of major acquisitions, with significant merger control reviews impacting large-scale transactions, a trend likely to persist into 2024 and 2025.

Navigating these complex legal frameworks is paramount for Fosun to avoid substantial fines and operational disruptions. In 2024, regulators in key markets like the United States and China have shown increased assertiveness in enforcing competition statutes, particularly concerning technology and cross-border deals. Failure to comply could result in penalties that significantly impact Fosun's financial performance and strategic growth.

Protecting its intellectual property (IP) is crucial for Fosun International, particularly concerning its innovative pharmaceutical products and technological breakthroughs. For instance, the company holds numerous patents for its biopharmaceutical innovations, which are essential for maintaining its competitive edge in a rapidly evolving healthcare landscape. Navigating the complex web of patent laws and IP enforcement across its global operations, including key markets like China and Europe, is a continuous strategic imperative.

Data Privacy Regulations (e.g., GDPR, local equivalents)

Data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and China's Personal Information Protection Law (PIPL), significantly shape Fosun International's operations, particularly in its healthcare and financial services sectors. These laws mandate stringent rules around the collection, processing, storage, and transfer of personal and sensitive data, directly impacting how Fosun manages customer and patient information.

Compliance is not merely a legal obligation but a cornerstone for maintaining consumer trust and avoiding substantial penalties. For instance, GDPR violations can result in fines up to 4% of annual global turnover or €20 million, whichever is greater. Fosun's commitment to robust data governance frameworks is therefore essential for its continued legal operation and reputation management in these data-intensive industries.

Key implications for Fosun include:

- Enhanced Data Security Measures: Implementing advanced cybersecurity protocols to protect sensitive data from breaches.

- Consent Management: Ensuring clear and informed consent is obtained from individuals before collecting or processing their data.

- Data Minimization: Collecting only the data that is absolutely necessary for specific purposes.

- Cross-Border Data Transfers: Adhering to strict protocols when transferring data internationally, especially between regions with different privacy laws.

Labor Laws and Employment Regulations

Fosun International navigates a complex web of labor laws across its global operations, demanding strict adherence to varying national employment standards. This includes regulations on minimum wage, working hours, health and safety protocols, and fair dismissal procedures, all of which impact operational costs and human resource management strategies. For instance, in China, recent adjustments to labor contract laws in 2023 aim to provide greater protection for gig economy workers, a segment Fosun may utilize.

- Compliance with diverse national labor laws: Fosun must manage differing regulations regarding wages, working conditions, and employee benefits in every country it operates, potentially affecting its global HR strategy and costs.

- Employee rights and non-discrimination: Adherence to laws preventing discrimination based on gender, age, or other protected characteristics is crucial for maintaining ethical employment practices and avoiding legal challenges, with global trends emphasizing greater inclusivity.

- Impact of evolving labor legislation: Changes in employment laws, such as those concerning remote work or the rights of contract employees, require continuous adaptation of Fosun's HR policies to ensure ongoing compliance and employee satisfaction.

- International labor standards: Fosun's commitment to International Labour Organization (ILO) conventions, where applicable, guides its approach to fundamental principles and rights at work, reinforcing its corporate social responsibility.

Fosun International faces significant legal and regulatory hurdles, particularly concerning anti-trust laws and data privacy. For instance, in 2023, the European Commission continued its intensive merger control reviews, impacting large-scale transactions, a trend expected to intensify in 2024 and 2025. Data privacy laws like GDPR and China's PIPL mandate stringent data handling practices, with GDPR violations potentially incurring fines up to 4% of global annual turnover or €20 million.

Environmental factors

Fosun International is actively engaged in addressing climate change, setting ambitious targets to peak carbon emissions by 2028 and achieve carbon neutrality by 2050. This commitment is underscored by the release of their 2024 ESG Report and Climate Information Disclosures Report.

These reports are structured to align with leading international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board's IFRS S2, demonstrating a commitment to transparent and standardized reporting on their environmental performance.

Investors and rating agencies are increasingly focused on Environmental, Social, and Governance (ESG) criteria, which directly impacts Fosun's strategic decisions and ability to secure funding. This heightened scrutiny means companies like Fosun must actively demonstrate strong ESG performance to attract and retain capital.

Fosun has demonstrably responded to this trend, maintaining robust ESG credentials. For instance, the company achieved an AA MSCI ESG rating, placing it among leaders in its sector. Furthermore, its inclusion in S&P Global's Sustainability Yearbook 2025 underscores its commitment to sustainable business practices and transparency.

Fosun International's broad portfolio, spanning industries from tourism to pharmaceuticals, directly confronts the growing issue of resource scarcity. This reality demands a strategic pivot towards sustainable resource management to ensure long-term operational viability. For instance, the company's significant investments in areas like renewable energy and eco-friendly manufacturing are critical responses to global resource constraints.

In 2024, global efforts to combat climate change intensified, with many nations setting ambitious emission reduction targets. Fosun's commitment to energy conservation and emission reduction across its diverse business units, such as its insurance and industrial segments, directly addresses these environmental pressures. This focus on efficiency is not just about compliance but also about mitigating risks associated with volatile resource prices and increasing regulatory scrutiny.

Environmental Regulations and Compliance

Fosun International's global footprint necessitates strict adherence to a complex web of environmental regulations. These cover everything from curbing pollution and managing waste effectively to conducting thorough environmental impact assessments for new projects. The company’s commitment to compliance is paramount for maintaining its operational licenses and reputation worldwide.

Fosun actively engages in the continuous review and updating of its environmental policies and management systems. This proactive approach ensures alignment with evolving international laws and stringent industry best practices, mitigating risks and fostering sustainable operations across its diverse business segments.

- Pollution Control: Fosun invests in technologies to minimize emissions and effluents, aligning with global targets like those set by the Paris Agreement, which many of its operating regions adhere to.

- Waste Management: The company implements comprehensive waste reduction, recycling, and responsible disposal programs, aiming to reduce landfill reliance by a target of 15% by 2025.

- Environmental Impact Assessments: Thorough EIAs are conducted for all new developments, ensuring potential environmental consequences are identified and mitigated before project commencement.

- Sustainability Reporting: Fosun's sustainability reports, often aligned with GRI standards, detail its environmental performance and progress toward sustainability goals, providing transparency to stakeholders.

Sustainable Tourism and Green Initiatives

Fosun International, particularly through its Fosun Tourism Group and brands like Club Med, is navigating the growing demand for sustainable tourism. This includes a commitment to integrating environmentally friendly practices across its global resort portfolio. For instance, Club Med has been actively working on reducing its carbon footprint, with initiatives like sourcing local produce and implementing energy-efficient technologies in its operations.

The company's strategic focus on sustainability is a direct response to increasing consumer awareness and regulatory pressures. By 2024, a significant portion of the travel industry is expected to have robust sustainability reporting, and Fosun is positioning itself ahead of this curve. This includes investments in eco-friendly infrastructure and community engagement programs at its destinations.

Fosun's green initiatives are not just about compliance but also about enhancing brand value and attracting environmentally conscious travelers. In 2023, Club Med reported a notable increase in guest satisfaction scores related to its sustainability efforts. The company aims to be a leader in this space, setting benchmarks for responsible tourism within the industry by 2025.

Key aspects of their approach include:

- Environmental protection: Implementing measures to conserve biodiversity and reduce waste at resort locations.

- Social responsibility: Engaging with local communities and supporting their economic development.

- Sustainable operations: Focusing on energy efficiency, water conservation, and responsible sourcing of materials.

- Guest education: Informing travelers about sustainable practices and encouraging their participation.

Fosun International is actively addressing environmental challenges, aiming to peak carbon emissions by 2028 and achieve carbon neutrality by 2050, as detailed in its 2024 ESG and Climate Information Disclosures. The company's commitment to sustainability is reflected in its AA MSCI ESG rating and inclusion in S&P Global's Sustainability Yearbook 2025, demonstrating a strong response to investor focus on ESG criteria.

Responding to global climate action, Fosun is implementing energy conservation and emission reduction strategies across its diverse business units, including insurance and industrial segments, to mitigate risks from volatile resource prices and stricter regulations. The company also prioritizes adherence to complex international environmental regulations, covering pollution control, waste management, and impact assessments to maintain operational licenses and reputation.

Fosun's tourism segment, exemplified by Club Med, is integrating eco-friendly practices to meet growing demand for sustainable travel, focusing on biodiversity conservation, waste reduction, and responsible sourcing. These green initiatives not only ensure compliance but also enhance brand value, with Club Med aiming for leadership in responsible tourism by 2025.

| Environmental Focus Area | Fosun's Commitment/Action | Target/Metric | Reporting Framework |

|---|---|---|---|

| Climate Change | Carbon emission reduction and neutrality goals | Peak emissions by 2028, Carbon Neutrality by 2050 | TCFD, IFRS S2 |

| Resource Management | Sustainable resource management across industries | Investments in renewable energy, eco-friendly manufacturing | Internal Reporting, ESG Reports |

| Pollution & Waste | Pollution control and waste management programs | Target 15% reduction in landfill waste by 2025 | GRI Standards |

| Sustainable Tourism | Eco-friendly practices in tourism operations | Guest satisfaction increase from sustainability efforts | Club Med internal metrics |

PESTLE Analysis Data Sources

Our Fosun International PESTLE analysis is grounded in a comprehensive review of official government publications, reports from international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a data-driven understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.