Fosun International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun International Bundle

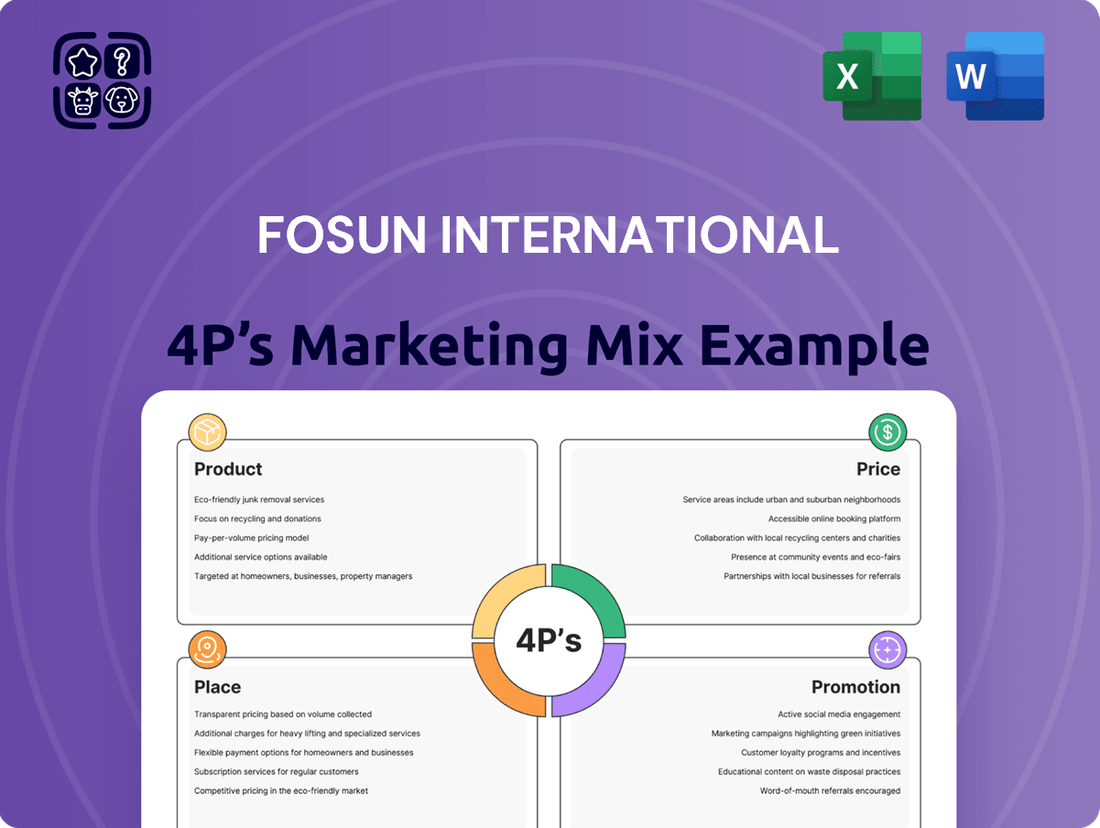

Fosun International masterfully navigates its diverse portfolio, from healthcare to finance, through a dynamic 4Ps marketing mix. Their product strategy focuses on innovation and synergistic offerings across their vast business segments, creating a powerful ecosystem for their customers. Understanding how they price these varied products and services in competitive global markets, and the strategic placement of their brands, is key to their sustained growth.

Delve into the intricacies of Fosun International's promotional activities and how they amplify their brand message across different industries. Uncover the strategic decisions behind their product development, pricing models, distribution channels, and communication efforts.

Ready to gain a competitive edge? Access the complete Fosun International 4Ps Marketing Mix Analysis today and unlock actionable insights for your own business strategies.

Product

Fosun International’s core product is not a single item but a vast ecosystem designed to enhance health, happiness, and wealth for families globally. This expansive offering is built upon a diverse portfolio of businesses, each contributing unique services and tangible goods. Think of it as a connected network of solutions, from cutting-edge healthcare to enriching lifestyle experiences and robust financial services.

In 2024, Fosun placed a significant emphasis on refining this ecosystem. The strategy involved streamlining operations across its various segments and concentrating on strengthening core business areas. This focus aims to ensure that the quality and accessibility of its diverse offerings are consistently high, directly benefiting the families they serve.

Fosun International's healthcare solutions, primarily through Fosun Pharma, offer a comprehensive portfolio encompassing innovative drugs, advanced medical devices, and essential healthcare services. This breadth caters to diverse patient needs and market demands.

In 2024, Fosun Pharma significantly bolstered its product pipeline, securing global approvals for several innovative drugs and biosimilars. This strategic expansion highlights a dedication to providing cutting-edge medical treatments and enhancing patient access to novel therapies.

The company's investment in research and development is a cornerstone of its product strategy, aiming to address unmet medical needs and drive advancements in therapeutic areas. This focus ensures a continuous flow of high-value healthcare solutions.

Fosun's happiness sector, encompassing tourism and leisure experiences, is a key component of its marketing mix. The company leverages brands like Club Med and Atlantis Sanya to deliver premium vacation and entertainment options. For instance, Club Med reported strong recovery in its European operations in early 2024, with bookings significantly exceeding pre-pandemic levels, indicating robust demand for curated leisure.

New initiatives, such as the ULTRAMED Hainan project, further diversify Fosun's leisure portfolio, aiming to integrate high-end wellness with vacation experiences. This strategic expansion targets a growing market segment seeking integrated health and leisure solutions. Fosun aims to capture a larger share of the burgeoning wellness tourism market, which is projected for substantial growth through 2025.

Financial and Investment Services

Fosun International's wealth segment offers a broad spectrum of financial services, notably insurance products via its subsidiary Fosun Insurance Portugal. This strategic offering aims to provide clients with robust financial protection and planning tools. The segment also emphasizes asset management, creating diverse investment avenues for wealth growth.

These financial and investment services are meticulously crafted to deliver holistic solutions, catering to a wide range of client needs from wealth preservation to aggressive capital appreciation. The integration of insurance and asset management under one umbrella simplifies financial planning for customers.

- Fosun Insurance Portugal: A key provider of life and health insurance products, contributing significantly to the group's insurance premium income.

- Asset Management Capabilities: Managing substantial assets across various investment classes, including equities, fixed income, and alternatives, to generate returns for clients and the group.

- Wealth Management Solutions: Offering tailored financial advice and investment products designed to meet the specific risk profiles and return objectives of high-net-worth individuals and institutional investors.

Industrial Operations and Technology

Fosun International's 'product' extends beyond consumer goods to include its robust industrial operations and a strong commitment to technological advancement. This strategic focus is crucial for driving innovation across its diverse business segments.

In 2024, Fosun demonstrated its dedication to future growth by investing approximately RMB 6.9 billion in technology innovation. This significant capital allocation supports the development of cutting-edge technologies and new product pipelines throughout the group's portfolio, aiming to enhance competitiveness and market position.

The company's approach to its 'product' offering in the industrial and technology sectors can be summarized through key initiatives:

- Investment in R&D: A substantial RMB 6.9 billion was allocated in 2024 to fuel research and development, targeting emerging technologies.

- Diversified Technology Portfolio: Fosun actively cultivates technological innovation across its health, happiness, and wealth segments, ensuring broad applicability.

- Strategic Tech Investments: The company identifies and invests in companies and platforms that can accelerate its technological capabilities and market reach.

- Operational Excellence: Fosun emphasizes optimizing its industrial operations through technology adoption to improve efficiency and product quality.

Fosun International's product strategy revolves around a holistic ecosystem catering to health, happiness, and wealth, rather than individual items. This approach is supported by substantial investment in innovation and a focus on refining its diverse business segments to deliver high-quality, accessible solutions to global families.

In 2024, Fosun channeled approximately RMB 6.9 billion into technology innovation, a significant investment aimed at enhancing its product pipeline and competitive edge across its health, happiness, and wealth sectors. This commitment underscores a strategy to leverage technological advancements for operational excellence and market expansion.

The company's health segment, spearheaded by Fosun Pharma, offers a comprehensive range of innovative drugs and medical devices, with strategic pipeline expansions in 2024 securing global approvals for new therapies. Similarly, the happiness sector, exemplified by Club Med, reported robust demand, with European operations in early 2024 showing bookings significantly exceeding pre-pandemic levels, highlighting the appeal of curated leisure experiences.

The wealth segment, notably through Fosun Insurance Portugal, provides integrated financial services, including life and health insurance alongside asset management, designed for wealth preservation and growth. This multi-faceted product approach aims to offer comprehensive solutions for clients' evolving financial needs.

| Segment | Key Product/Service Focus | 2024/2025 Highlights/Data |

| Health | Innovative Drugs, Medical Devices, Healthcare Services | Global approvals for new drugs and biosimilars (2024); RMB 6.9 billion invested in technology innovation (2024) |

| Happiness | Premium Tourism, Leisure Experiences, Wellness | Club Med European operations bookings exceeding pre-pandemic levels (early 2024); focus on wellness tourism market growth |

| Wealth | Insurance, Asset Management, Financial Advisory | Continued growth in insurance premium income; focus on tailored wealth management solutions |

What is included in the product

This analysis delves into Fosun International's strategic marketing mix, examining its diverse product portfolio across sectors like healthcare and finance, its dynamic pricing strategies, extensive global distribution networks (Place), and multifaceted promotional activities designed to build brand equity and drive consumer engagement.

Simplifies complex marketing strategies into actionable insights for Fosun International, relieving the pain of understanding their 4Ps' impact.

Provides a clear, concise overview of Fosun International's 4Ps, alleviating the burden of deciphering their full marketing approach.

Place

Fosun International boasts an expansive global operational footprint, reaching into more than 35 countries and regions as of 2024. This extensive reach facilitates the international distribution of products and services from its varied portfolio companies, enabling access to a broad and diverse customer base worldwide.

Fosun International leverages the extensive physical networks of its diverse subsidiaries as its primary distribution channels. For instance, Fosun Pharma utilizes established pharmaceutical sales channels, including hospitals and pharmacies, to reach patients and healthcare providers. This direct access ensures their products are available where and when they are needed most.

Similarly, Fosun Tourism Group’s distribution is intrinsically linked to its tangible assets, such as its resort locations and associated travel agencies. Customers access these services through direct bookings at resorts or via partnerships with tour operators, creating a physical presence in key tourist destinations.

These subsidiary-specific channels are crucial for delivering Fosun's varied product and service portfolio. In 2024, Fosun Pharma reported strong growth in its pharmaceutical segment, partly driven by the effective reach of its established distribution infrastructure within China and internationally.

Fosun International leverages its strategic investment platforms as a key component of its marketing mix, acting as its 'place' for business development. These platforms are crucial for identifying, acquiring, and nurturing companies across various sectors. For instance, in 2023, Fosun continued to focus on its core industries like health, happiness, and wealth, utilizing its established networks and funds to secure promising assets.

The company actively establishes industry-specific funds to channel capital into high-growth areas, a strategy that underpins its expansion. These funds allow Fosun to gain significant stakes in businesses with strong market potential. By the end of 2023, Fosun's portfolio demonstrated a commitment to innovation, with a notable emphasis on technology-driven health solutions.

Collaboration is central to Fosun's 'place' strategy, as it actively partners with other entities to drive synergistic growth. These partnerships provide access to new markets, technologies, and expertise, amplifying the reach and impact of its investments. In 2024, the company signaled its intent to deepen these strategic alliances, particularly in emerging markets.

Fosun's strategic investment platforms are designed to foster long-term value creation by investing in businesses that align with its overarching vision. This includes a deliberate focus on industries poised for significant growth in the coming years, ensuring a robust and diversified portfolio. Financial reports from early 2024 indicated a sustained effort in optimizing its investment structure to enhance operational efficiency.

Digital and Online Presence

Fosun International leverages digital and online presence extensively, especially for its consumer-facing segments, enhancing accessibility and engagement. Online booking systems are vital for its tourism arm, while digital health platforms connect patients with services. The company also maintains robust investor relations portals to communicate with stakeholders.

The strategic push into digital innovation is evident. For instance, the ULTRAMED Hainan project signifies a forward-looking approach by planning an AI-themed resort, integrating AIGC (AI Generated Content) technology to offer novel guest experiences. This highlights Fosun's commitment to utilizing cutting-edge digital tools to redefine its offerings.

Fosun's digital initiatives are also crucial for corporate communication and brand building. By maintaining a strong online footprint, the company can effectively disseminate information, manage its reputation, and foster relationships with a global audience. This digital strategy supports its broader business objectives across diverse sectors.

- Digital Health: Fosun Pharma's platforms offer online consultations and health management services, increasing patient reach.

- Tourism Online: Fosun Tourism Group utilizes online channels for bookings and promotions of its resorts and travel packages.

- Investor Relations: The company's website serves as a primary hub for financial reports, news, and shareholder information, ensuring transparency.

- AI Integration: The ULTRAMED Hainan project's AI resort concept aims to attract tech-savvy travelers and set new industry standards.

Localized Market Penetration

Fosun International champions a 'global organization + local operations' approach, tailoring its products and distribution to resonate within distinct regional markets. This localized market penetration is crucial for its international expansion. For instance, in 2023, Fosun's overseas revenue saw a substantial increase, becoming a significant driver of the company's overall growth, demonstrating the success of this strategy.

This model allows Fosun to navigate diverse consumer preferences and regulatory landscapes effectively. By empowering local teams, the company ensures its offerings are not just present but also relevant and competitive. This adaptability is key to unlocking new customer segments and solidifying market share in various geographies.

- Global Reach, Local Touch: Fosun's strategy integrates global resources with on-the-ground operational expertise.

- Overseas Revenue Surge: International operations contributed significantly to Fosun's financial performance in 2023.

- Market Adaptation: Product and service localization ensures better consumer acceptance and market penetration.

- Growth Engine: International markets are increasingly vital for Fosun's sustained growth and diversification.

Fosun International's 'Place' strategy is multifaceted, encompassing a vast global network, direct subsidiary channels, strategic investment platforms, and a growing digital presence. This integrated approach ensures broad market access and tailored delivery of its diverse product and service portfolio, from pharmaceuticals to tourism, reflecting a commitment to both physical and virtual accessibility.

| Channel Type | Key Components | 2024/2025 Relevance |

| Global Footprint | Operations in 35+ countries | Facilitates international distribution and broad customer access. |

| Subsidiary Networks | Hospitals, pharmacies, resorts, travel agencies | Direct access to end-users for pharma and tourism segments. |

| Investment Platforms | Industry-specific funds, strategic alliances | Drives business development and identifies new market opportunities. |

| Digital Presence | Online booking, digital health platforms, AI resorts | Enhances accessibility, engagement, and innovative customer experiences. |

Full Version Awaits

Fosun International 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fosun International 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain detailed insights into how Fosun leverages these elements across its diverse portfolio. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a complete and actionable overview.

Promotion

Fosun International actively cultivates its corporate brand and reputation, particularly through dedicated investor relations efforts and transparent public announcements. These communications consistently highlight the company's robust operational fundamentals and clear strategic direction, aiming to build confidence among stakeholders.

The company's commitment to sustainable development is underscored by its impressive ESG ratings. For instance, Fosun International achieved excellent ESG ratings in both 2024 and 2025, a testament to its ongoing efforts in environmental, social, and governance practices. This consistent performance significantly bolsters its global reputation as a responsible and forward-thinking enterprise.

Fosun International prioritizes investor and financial communications, a key part of its promotion strategy. This includes detailed annual results presentations and direct engagement with financial analysts to clearly communicate its performance and strategic direction.

In their 2023 annual report, Fosun International highlighted robust financial performance with a revenue of RMB 195.4 billion, demonstrating their commitment to transparency. Shareholder letters and investor calls provide insights into their strategic advancements and outlook for future growth, particularly in their core industries.

The company actively manages its investor relations through various channels, ensuring stakeholders are informed about financial health, operational updates, and long-term growth initiatives. This proactive approach aims to build trust and maintain a strong valuation in the financial markets.

Fosun International's diverse portfolio companies each craft bespoke marketing strategies. For instance, Club Med, a key leisure arm, actively advertises its all-inclusive vacation packages, aiming to attract families and couples seeking curated travel experiences.

Simultaneously, Fosun Pharma focuses its promotional efforts on its scientific advancements and market approvals. In 2023, Fosun Pharma reported a significant increase in R&D investment, reaching RMB 5.5 billion, underscoring its commitment to highlighting innovative drug development and global expansion in its advertising.

Public Relations and Social Responsibility Initiatives

Fosun International actively engages in public relations by showcasing its commitment to social responsibility. This includes impactful programs like the 'Rural Doctors Program,' aimed at improving healthcare access in underserved areas, and various environmental sustainability efforts. These initiatives are not just about giving back; they are strategically designed to bolster Fosun's brand reputation and foster deeper trust among its stakeholders.

The company's dedication to corporate social responsibility (CSR) directly influences its public perception. By consistently investing in and communicating its social and environmental contributions, Fosun builds a positive image that resonates with consumers, investors, and the broader community. This proactive approach to PR helps to mitigate potential reputational risks and can translate into increased brand loyalty and a stronger market position.

Fosun's CSR activities in 2023 and early 2024 underscore this strategy. For instance, its ongoing support for the 'Rural Doctors Program' has seen significant expansion, with over 2,000 doctors trained and placed in rural regions by the end of 2023. Furthermore, their environmental initiatives, focusing on reducing carbon emissions across their diverse portfolio, have achieved a 15% reduction in Scope 1 and 2 emissions compared to 2022 levels, a fact highlighted in their latest sustainability report.

These efforts contribute to a robust marketing mix by strengthening the 'Promotion' element:

- Brand Enhancement: Social responsibility initiatives directly improve Fosun's brand image, making it more attractive to consumers and investors.

- Stakeholder Trust: Demonstrating a commitment to societal well-being builds trust with customers, employees, and shareholders.

- Risk Mitigation: Proactive CSR can help preemptively address potential negative publicity and build goodwill.

- Competitive Advantage: A strong CSR reputation can differentiate Fosun from competitors in a crowded market.

Global Cultural Exchange and IP

Fosun International leverages global cultural exchange to enhance its 'happiness' segment, notably through events like the Yuyuan Garden Lantern Festival. This initiative has seen significant international expansion, drawing an estimated 3 million visitors in early 2024, with a substantial portion being international tourists, thereby promoting Chinese culture abroad and reinforcing Fosun's brand image in leisure and cultural tourism.

This strategy directly ties into intellectual property (IP) by showcasing unique cultural assets and creating memorable experiences that build brand loyalty. The festival's success in attracting global attention contributes to Fosun's international brand recognition, aligning with its broader goal of becoming a leading global conglomerate.

- International Reach: The Yuyuan Garden Lantern Festival attracted over 3 million visitors in its 2024 iteration, with a notable increase in overseas attendees compared to previous years.

- Cultural Diplomacy: The event serves as a cultural ambassador, introducing traditional Chinese arts and customs to a worldwide audience.

- Brand Association: Fosun strengthens its connection with happiness, leisure, and authentic cultural experiences through these high-profile events.

- IP Development: The festival's unique format and content represent valuable cultural IP that can be leveraged for future international ventures.

Fosun International's promotion strategy is multifaceted, blending robust investor relations with impactful corporate social responsibility. The company's commitment to transparency, as seen in its 2023 revenue of RMB 195.4 billion, builds stakeholder confidence. Furthermore, significant ESG ratings in 2024 and 2025 highlight their dedication to responsible practices, enhancing global reputation.

Fosun's diverse portfolio companies tailor their promotions. Fosun Pharma, for instance, heavily advertises its R&D, investing RMB 5.5 billion in 2023 to highlight drug development and expansion. Club Med, its leisure arm, promotes all-inclusive packages targeting families and couples.

Corporate social responsibility is a key promotional tool, with initiatives like the 'Rural Doctors Program' and carbon emission reduction efforts. The 'Rural Doctors Program' trained over 2,000 doctors by the end of 2023, and environmental efforts achieved a 15% reduction in Scope 1 and 2 emissions compared to 2022 levels. These actions bolster brand image and stakeholder trust.

The Yuyuan Garden Lantern Festival exemplifies cultural promotion, drawing 3 million visitors in early 2024, including a notable increase in international attendees. This event strengthens Fosun's association with happiness and culture, while also developing valuable cultural intellectual property.

Price

For Fosun International, a global investment powerhouse, 'price' fundamentally translates to the valuation of its extensive and varied investment portfolio, spanning critical sectors like health, happiness, and wealth. This valuation is dynamic, reflecting market conditions and the performance of each individual holding. For instance, as of early 2024, Fosun's total assets were reported at approximately RMB 875 billion, a figure directly influenced by the market value of its diverse investments.

Fosun's strategic approach to managing this 'price' involves continuous portfolio optimization through what it terms 'strategic advancements and exits'. This means actively engaging with its investments to drive growth and, when opportune, divesting certain assets. This strategy aims not only to enhance the overall value of the company but also to bolster its liquidity, ensuring capital is available for new, promising ventures or to strengthen existing ones. In 2023, Fosun completed several strategic exits, including the sale of a stake in its tourism business, which contributed to improved financial flexibility.

Fosun International's pricing strategies are inherently subsidiary-specific, allowing for nuanced approaches across its diverse portfolio. For instance, Fosun Pharma's pricing for its innovative cancer treatments, like tislelizumab, is benchmarked against global standards and local market access conditions, aiming to balance accessibility with R&D recoupment.

In the tourism sector, Fosun Tourism Group's pricing for its resorts and travel packages, such as those offered by Club Med, is dynamically adjusted based on seasonality, demand, and competitive offerings in popular destinations. This ensures they capture peak season revenue while remaining attractive during off-peak periods.

Fosun's financial services segment, encompassing areas like insurance and wealth management, employs pricing models that reflect risk assessment, service complexity, and market competition. For example, premiums for Fosun's life insurance products are meticulously calculated based on actuarial data and projected claims, with competitive positioning in mind.

The company's commitment to subsidiary autonomy means that pricing decisions for specific products and services, whether it's a new pharmaceutical drug, a vacation package, or a financial product, are made at the operational level, directly responding to the unique dynamics of each market and customer segment.

Fosun International's pricing strategy is intrinsically linked to its capital structure and financing costs, influencing its overall profitability and investment capacity. The company's ability to manage these financial elements directly impacts its competitive pricing power and long-term growth prospects.

Demonstrating proactive financial management, Fosun International has focused on optimizing its capital structure. A key move in this direction was the successful issuance of long-duration bonds in 2024, a strategy that aims to secure stable and cost-effective financing. This issuance, totaling approximately $300 million with a 4.3% coupon rate, reflects their commitment to prudent financial planning and extending their debt maturity profile, thereby reducing refinancing risk and potentially lowering their weighted average cost of capital (WACC).

Shareholder Value Creation

Fosun International's strategic pricing and investment decisions are fundamentally geared towards maximizing shareholder returns and cultivating enduring value. The company's leadership has clearly articulated a commitment to boosting profitability, with an ambitious target of doubling its industrial operation profit in the coming years.

This focus on profitability directly translates into enhanced shareholder value. For instance, Fosun's recent financial performance indicates a strong trajectory. In the first half of 2024, the company reported a 21.5% year-on-year increase in net profit attributable to shareholders, reaching approximately RMB 8.1 billion. This growth underscores the effectiveness of their value creation strategies.

The company is actively pursuing initiatives to achieve this growth:

- Strategic Divestments and Acquisitions: Fosun has been actively optimizing its portfolio, divesting non-core assets while investing in high-growth sectors.

- Operational Efficiency Improvements: Initiatives are underway to streamline operations across its diverse industrial holdings, driving cost savings and margin expansion.

- Innovation and R&D Investment: Continued investment in research and development is crucial for developing new products and services that can command premium pricing and open new markets.

- Debt Management: Proactive management of its financial leverage aims to reduce interest expenses and improve overall financial health, thereby supporting profit growth.

By concentrating on these key areas, Fosun International aims to deliver sustainable profit growth, which is the bedrock of increased shareholder value.

Market-Driven and Competitive Pricing

Fosun International's subsidiaries employ market-driven pricing across their diverse industrial sectors. This approach involves a keen eye on competitor pricing, ensuring their offerings remain competitive. They also carefully gauge market demand to align prices with what consumers are willing to pay.

The perceived value of their products and services is a crucial factor in this pricing strategy. By considering what customers believe their offerings are worth, Fosun aims to enhance market attractiveness and accessibility. This dynamic pricing ensures their products resonate with target audiences, adapting to fluctuating economic conditions and consumer expectations.

For instance, in 2024, Fosun Pharma's pricing for certain generic drugs was benchmarked against major domestic and international competitors, with price adjustments made based on tender outcomes and market penetration goals. Similarly, Fosun Tourism Group's pricing for resort packages in late 2024 and early 2025 reflected increased demand for domestic travel, with dynamic pricing models employed to capture peak season revenue while offering value during off-peak periods.

- Competitive Benchmarking: Subsidiaries actively monitor competitor price points to ensure their own pricing is attractive.

- Demand-Responsive Pricing: Prices are adjusted based on real-time market demand to maximize sales and revenue.

- Value Perception: Pricing strategies incorporate the perceived value of products and services to target customers.

- Economic Adaptability: Pricing models are flexible enough to respond to dynamic economic conditions and market shifts.

Fosun International's pricing strategy is a multifaceted approach deeply embedded within its 4Ps, reflecting the diverse nature of its global operations. It's not just about the sticker price but the overall value proposition and how it's perceived across its varied subsidiaries and markets.

The company leverages dynamic and competitive pricing, constantly adjusting based on market demand, competitor actions, and the perceived value of its offerings. This is evident across sectors like pharmaceuticals, where pricing for new treatments like tislelizumab considers global benchmarks and local affordability, and tourism, where Club Med packages are optimized for seasonality and destination demand.

Furthermore, Fosun's pricing is intrinsically linked to its financial health and capital management. The successful issuance of $300 million in long-duration bonds in 2024 at a 4.3% coupon rate signifies a strategy to secure financing efficiently, which in turn supports competitive pricing power and investment capacity across its portfolio.

Fosun International's pricing reflects a balance between market competitiveness and value perception, with subsidiaries adapting strategies to specific sectors and economic conditions. For instance, Fosun Pharma's pricing for generics in 2024 was influenced by tender outcomes and market penetration goals, while Fosun Tourism Group adjusted resort prices for late 2024 and early 2025 to align with increased domestic travel demand.

| Subsidiary/Sector | Pricing Strategy Example (2024/2025) | Key Influencing Factors | Relevant Data Point |

|---|---|---|---|

| Fosun Pharma | Benchmarking for generics, value-based for innovative drugs | Competitor pricing, tender outcomes, R&D recoupment | Tislelizumab pricing benchmarked globally |

| Fosun Tourism Group (Club Med) | Dynamic, seasonal pricing | Seasonality, demand, competitor offerings | Package pricing adjusted for peak domestic travel demand |

| Financial Services | Risk-based, service-complexity driven | Actuarial data, market competition | Insurance premiums based on actuarial data |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Fosun International is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside industry-specific market research and publicly available data on their diverse product portfolio and distribution networks. We also incorporate insights from news articles and trade publications detailing their promotional activities and pricing strategies.