Fosun International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun International Bundle

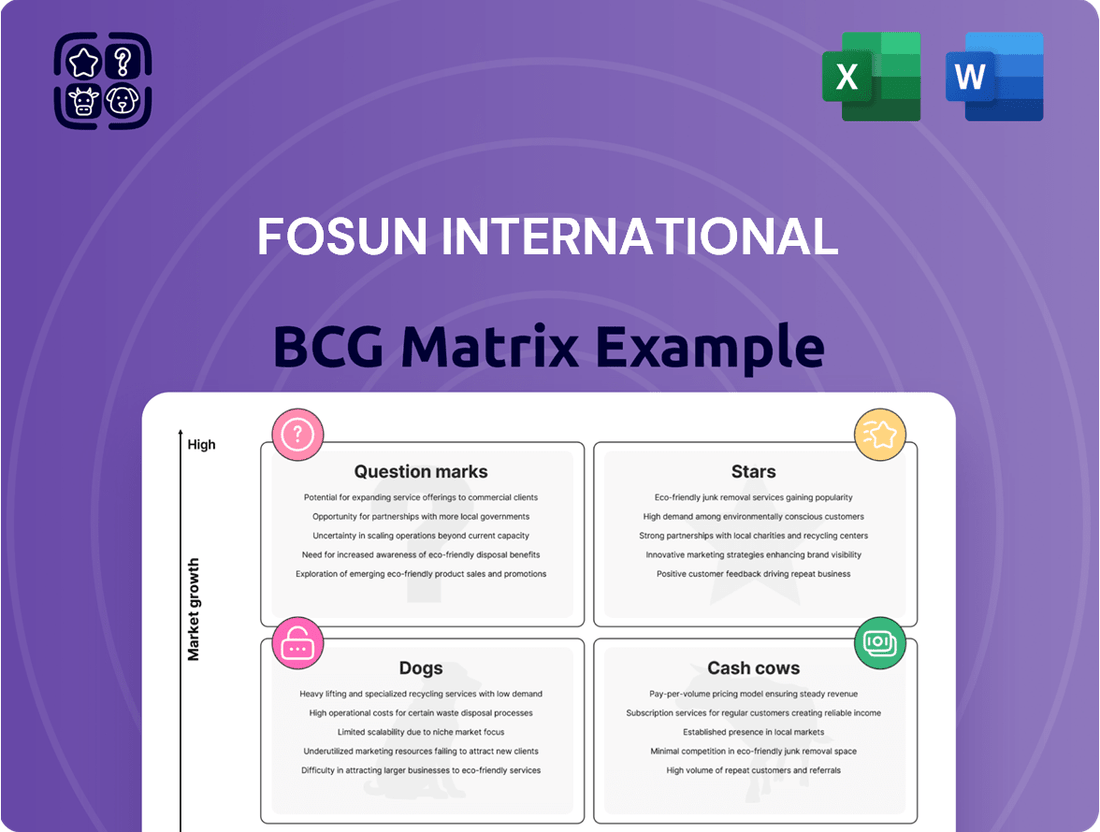

Curious about Fosun International's strategic positioning? Our preview of their BCG Matrix offers a glimpse into how their diverse portfolio might be categorized. You'll see the potential for growth and stability, but to truly unlock the strategic advantage, you need the full picture.

Don't settle for partial insights. Purchase the complete Fosun International BCG Matrix to gain a definitive understanding of their Stars, Cash Cows, Dogs, and Question Marks. This detailed breakdown will empower you to make informed decisions about resource allocation and future investments.

Imagine having a clear roadmap to Fosun International's market dominance and potential challenges. The full BCG Matrix provides exactly that, with actionable insights and data-backed recommendations that can transform your own strategic planning.

Ready to move beyond speculation? Invest in the complete Fosun International BCG Matrix today and equip yourself with the knowledge to navigate their business landscape with confidence and foresight.

Stars

Club Med, under Fosun International, is a strong contender in the premium resort market. In 2024, its business volume hit €2,090 million, a 7% increase at comparable exchange rates, highlighting its success. This growth is particularly impressive as Club Med has fully transitioned to premium and Exclusive Collection resorts, catering to a discerning clientele.

The premium positioning is clearly paying off, with mountain resorts showing exceptional growth. These specific locations saw a 20% surge in business volume in 2024, indicating a robust demand for high-end, all-inclusive mountain experiences. This segment is a key driver of Club Med's global performance.

Fosun Pharma's focus on oncology and immune-inflammatory innovative drugs is a significant driver of its growth. In 2024, the company reported a 16.08% year-on-year increase in net profit, reaching RMB2.77 billion, largely due to its success in this segment.

Key products such as Han Si Zhuang have seen widespread adoption, with approvals in more than 30 countries. Furthermore, their CAR-T cell therapy, Yi Kai Da, has made a substantial impact, benefiting over 800 lymphoma patients in mainland China.

These advancements, supported by substantial R&D investment and a robust global commercialization strategy, position Fosun Pharma's innovative therapies as strong contenders in rapidly expanding market sectors.

Fosun Insurance Portugal, as a key component of Fosun International’s wealth ecosystem, exhibited robust performance in 2024. The company achieved total gross written premiums of approximately EUR6,172 million, a testament to its sustained growth and operational excellence.

Its overseas revenue surged to EUR1.84 billion in 2024, underscoring its successful international expansion strategy and strong global presence. This significant international revenue highlights Fosun Insurance Portugal's ability to compete effectively in diverse markets.

This segment consistently generates substantial cash flow, a critical indicator of its financial health and a supporting factor for its star status. The strong cash generation capability allows for reinvestment and further strategic development.

Fosun Insurance Portugal commands a high market share in its core and expanding international markets, reinforcing its position as a star performer within the Fosun portfolio. This market dominance signifies its competitive advantage and the trust placed in its offerings by a broad customer base.

Atlantis Sanya

Atlantis Sanya is a shining Star in Fosun International's portfolio, demonstrating exceptional performance as a premier marine-themed resort. In the first half of 2024, it generated an impressive RMB866 million in business volume, underscoring its market leadership.

The resort’s ability to attract and retain visitors is evident in its record-high average occupancy rate of 89.6%. This consistent strong performance, coupled with a significant market share within the expanding Chinese tourism sector, firmly establishes Atlantis Sanya’s status as a high-growth, high-share asset within Fosun’s happiness segment.

- Atlantis Sanya's 2024 Performance: RMB866 million in business volume (H1 2024).

- Occupancy Rate: Maintained a record-high average of 89.6%.

- Market Position: Leading one-stop marine-themed integrated resort in China.

- BCG Classification: Stars within Fosun's happiness segment due to strong growth and market share.

Henlius's Overseas Commercialization

Henlius, a biopharmaceutical company where Fosun Pharma has a significant stake, is making impressive strides in international markets. Their innovative products are gaining serious traction, showing strong potential for future growth. This overseas commercialization is a key indicator for its position within Fosun International's broader business portfolio.

Key milestones include the marketing approval of HANSIZHUANG in the European Union and the U.S. and Canadian approvals for HANQUYOU in early 2025. These approvals in major regulatory regions highlight the global demand for Henlius's advanced biopharmaceutical offerings.

This expansion signifies a substantial increase in market share for these cutting-edge products, reflecting Henlius's growing capabilities and market penetration. The successful entry into these key markets is a testament to the company's research and development prowess.

- Global Market Entry: HANSIZHUANG approved in the EU, HANQUYOU approved in the US and Canada (early 2025).

- High Growth Potential: Demonstrates significant international demand and market acceptance for innovative biopharmaceuticals.

- Increasing Market Share: Successful global expansion leads to a growing presence in key regulated markets.

Fosun Pharma's innovative drugs, particularly in oncology and immunology, are classified as Stars. In 2024, Fosun Pharma's net profit increased by 16.08% to RMB2.77 billion, driven by these successful segments. Products like Han Si Zhuang are approved in over 30 countries, and Yi Kai Da CAR-T therapy has benefited over 800 patients in China, demonstrating high growth and market share.

Henlius, a Fosun Pharma affiliate, also shows Star potential with significant international expansion. HANSIZHUANG gained EU marketing approval, and HANQUYOU received US and Canadian approval in early 2025. This global market penetration indicates strong growth and increasing market share for their biopharmaceutical innovations.

What is included in the product

This BCG Matrix overview analyzes Fosun International's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The Fosun International BCG Matrix offers a clear, one-page overview, instantly relieving the pain of scattered business unit performance data.

Cash Cows

Fosun Pharma's established generic drug portfolio represents a significant cash cow for Fosun International. These products, like their established cardiovascular and antibiotic medications, operate in mature markets where demand is stable, and Fosun Pharma often holds a considerable market share. This consistency in sales and demand allows these generics to generate predictable and substantial cash flow.

The operational efficiency and extensive distribution networks for these established generics mean they contribute significantly to Fosun Pharma's profitability without demanding large, ongoing investments in research and development or marketing. For instance, in 2023, Fosun Pharma's generics segment continued to be a reliable revenue generator, underpinning the company's financial stability.

Yuyuan, a key pillar within Fosun International's structure, significantly contributes to the company's happiness segment, with a strong focus on household consumption. While brand-specific financial details aren't publicly segmented, its role as a core subsidiary implies a robust market presence.

As part of Fosun's core subsidiaries, which collectively generated 70.1% of the group's total revenue in 2023, Yuyuan benefits from established consumer goods categories within China. This strong market share translates into dependable revenue streams.

These mature brands within Yuyuan likely operate as cash cows, meaning they generate substantial and consistent profits with minimal need for significant reinvestment to maintain their market position. This stability is vital for Fosun's overall financial health.

Fosun's traditional insurance business, a cornerstone of its wealth segment, continues to be a reliable generator of income. While not experiencing the rapid expansion of its international ventures, these mature operations boast a loyal customer base and a solid market position, ensuring consistent premium collections and profits. This stability provides a crucial financial bedrock, enabling Fosun to allocate capital towards its growth-oriented initiatives.

Foryou Club Membership Platform

The Foryou Club Membership Platform, a key component of Fosun International's tourism business, functions as a cash cow within the BCG matrix. In the first half of 2024, it achieved a business volume of RMB173 million and boasted over 6.9 million members. This indicates a stable, established customer base that consistently contributes to revenue.

While not experiencing explosive growth, the platform's strength lies in its loyalty and recurring revenue streams from membership operations and digital services. It represents a mature offering that reliably supports the tourism segment's financial performance.

- Foryou Club's business volume: RMB173 million (H1 2024)

- Foryou Club's membership base: Over 6.9 million members (H1 2024)

- Platform role: Stable revenue generation through loyalty and digital services

- Market position: Mature offering contributing steadily to Fosun Tourism

Vacation Asset Management Center

The Vacation Asset Management Center, a component of Fosun International's tourism segment, specializes in overseeing vacation properties, including those belonging to external parties. This business unit generated RMB294.01 million in revenue during the first half of 2024.

This operation is characterized by its focus on managing existing vacation assets, which typically translates to a more moderate growth trajectory. However, its core function of optimizing asset utilization and earning management fees positions it as a reliable source of stable income.

- Focus: Management of vacation assets, including third-party destinations.

- H1 2024 Revenue: RMB294.01 million.

- BCG Matrix Classification: Likely a Cash Cow due to stable income from management fees and asset optimization, with potentially lower growth compared to other units.

- Strategic Implication: Provides consistent cash flow to support other business units or investments within Fosun.

Fosun International's established generic drug portfolio, particularly within Fosun Pharma, continues to function as a reliable cash cow. These products operate in mature markets with stable demand, ensuring predictable revenue generation. For example, in 2023, the generics segment remained a stable contributor to Fosun Pharma's financial performance.

Yuyuan, a core subsidiary, leverages its strong market presence in established consumer goods categories within China, contributing significantly to Fosun's overall revenue. Its role as a stable revenue generator, likely with minimal reinvestment needs, solidifies its cash cow status.

The Foryou Club Membership Platform and Vacation Asset Management Center within Fosun Tourism also exhibit cash cow characteristics. The Foryou Club reported RMB173 million in business volume and over 6.9 million members in the first half of 2024, indicating consistent revenue from loyalty and digital services.

The Vacation Asset Management Center generated RMB294.01 million in revenue during the first half of 2024, focusing on optimizing existing assets and earning management fees, which points to stable income generation.

| Business Unit | BCG Category | Key Financial Data (2023/H1 2024) | Strategic Role |

|---|---|---|---|

| Fosun Pharma Generics | Cash Cow | Stable revenue generator (2023 data) | Underpins financial stability, predictable cash flow |

| Yuyuan | Cash Cow | Contributes to 70.1% of group revenue (2023) via established consumer goods | Dependable revenue streams, stable profits |

| Foryou Club Membership | Cash Cow | RMB173 million business volume, 6.9M+ members (H1 2024) | Recurring revenue from loyalty and digital services |

| Vacation Asset Management | Cash Cow | RMB294.01 million revenue (H1 2024) | Stable income from asset optimization and management fees |

Delivered as Shown

Fosun International BCG Matrix

The Fosun International BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you are seeing the exact strategic analysis, including all data points and visual representations, that will be delivered to you, ready for immediate application in your business planning.

Dogs

Fosun International has been strategically streamlining its operations, a key aspect of its BCG Matrix approach, by divesting non-core financial assets. This initiative focuses on exiting businesses that are either underperforming or no longer align with the company's long-term strategic vision. For instance, in May 2024, Fosun completed the sale of its entire stake in HAL, a German private bank, signaling a deliberate move away from asset-heavy and potentially lower-growth financial ventures.

Underperforming legacy real estate holdings within Fosun International’s portfolio, particularly those not aligned with its strategic ‘happiness’ or ‘health’ ecosystems, can be categorized as dogs in the BCG matrix. These assets may represent a drag on resources, consuming capital without contributing meaningfully to Fosun's evolving asset-light strategy or future growth prospects. For instance, certain older commercial properties in less dynamic urban areas might fall into this category, requiring ongoing maintenance and management without offering significant returns.

Fosun's strategic pivot necessitates a closer look at the performance and future utility of such legacy assets. By the end of 2023, Fosun's real estate segment, while still a significant part of its business, has seen strategic adjustments. For example, the company has been actively divesting non-core assets to streamline operations and focus on high-growth areas.

Fosun International is actively managing its investment portfolio, aiming for a strategic balance between acquiring new assets and divesting existing ones. In 2024 alone, the company divested approximately RMB17.5 billion at the group level.

These divestitures often target investments that have shown stagnant growth, delivered low returns, or have drifted away from Fosun's core strategic areas. Such non-strategic assets, while potentially holding value, may not offer the anticipated future upside or align with the company's forward-looking objectives.

By shedding these types of holdings, Fosun frees up capital and resources that can be redeployed into more promising ventures within its key sectors: health, happiness, and wealth. This strategic pruning is crucial for maintaining a dynamic and high-performing portfolio.

Cainiao Investment

Fosun International's investment in Cainiao, a logistics company, appears to be positioned as a 'dog' within its Business Growth Matrix. This classification is largely due to a substantial one-off non-cash impairment loss of RMB4.35 billion that Fosun recorded in 2024 concerning this specific investment. Such a significant write-down strongly suggests that Cainiao's performance has fallen short of initial expectations or its current market valuation, signaling a weaker financial contribution and potentially a less favorable strategic alignment within Fosun's broader portfolio at that time.

The RMB4.35 billion impairment loss in 2024 for Cainiao is a critical data point. It signifies that the investment's book value was adjusted downwards considerably, reflecting a decline in its perceived worth or future earning potential. This directly aligns with the characteristics of a 'dog' in the BCG Matrix, which typically represents low market share and low market growth, leading to minimal cash flow generation and often requiring divestment or restructuring.

- Impairment Loss: RMB4.35 billion in 2024 for Cainiao investment.

- Implication: Underperformance relative to expectations or market value.

- BCG Classification: Indicates a 'dog' due to weak financial contribution and strategic fit.

Any Businesses Explicitly Scaled Back Due to Streamlining

Fosun International's strategic pivot in recent years has involved a deliberate effort to reduce financial leverage and shed non-core assets. This streamlining process often targets business units that exhibit low growth prospects and a limited market share, fitting the description of 'dogs' within a BCG matrix framework. Such divestitures or significant scaling back are intended to free up capital and management focus for more promising ventures, thereby improving the company's overall financial health and operational efficiency.

While specific publicly disclosed unit-level divestitures fitting the 'dog' category are often part of broader portfolio adjustments, Fosun's stated strategy points to such actions. For instance, in 2023 and early 2024, the company has been active in portfolio optimization. For example, Fosun Pharmaceutical, a key subsidiary, has been involved in strategic reviews of certain business lines. While not explicitly labeled as 'dogs' in public statements, units with declining revenue or profitability that do not align with future growth strategies are prime candidates for scaling back or divestment. Fosun’s management has emphasized a focus on core businesses like health, happiness, and wealth, implying that underperforming or non-strategic assets may be reduced.

- Fosun's Debt Reduction Efforts: The company has actively worked to lower its net debt ratio, aiming for a more robust balance sheet.

- Divestment of Non-Core Assets: Fosun has indicated a strategy to sell off businesses that are not central to its primary growth pillars.

- Focus on Core Segments: Strategic emphasis remains on health, happiness (tourism and leisure), and wealth (financial services).

- Portfolio Optimization: This involves scrutinizing all business units for performance and strategic alignment, potentially leading to the scaling back of 'dog' category assets.

Fosun International's 'dogs' are assets with low market share and low growth potential, often requiring divestment or restructuring. The significant RMB4.35 billion impairment loss recorded in 2024 on its Cainiao investment exemplifies this category. This write-down indicates underperformance and a potential lack of strategic fit, aligning with the characteristics of a 'dog' in the BCG matrix. Such assets consume resources without generating substantial returns, prompting Fosun to strategically prune its portfolio.

By divesting these underperforming assets, Fosun aims to reallocate capital and management attention towards its core growth sectors: health, happiness, and wealth. This strategic optimization is crucial for enhancing overall portfolio performance and financial health. The company's active portfolio management, including the divestment of approximately RMB17.5 billion in 2024, underscores this commitment to shedding non-core and low-return ventures.

| Asset/Segment | BCG Classification | Rationale/Data Point |

|---|---|---|

| Cainiao Investment | Dog | RMB4.35 billion impairment loss in 2024 due to underperformance. |

| Legacy Real Estate Holdings | Dog | Underperforming assets not aligned with strategic ecosystems, consuming capital without significant returns. |

| Divested Financial Assets (e.g., HAL stake) | Dog | Exited businesses with low growth prospects or non-alignment with strategic vision, freeing up capital. |

Question Marks

While Fosun Pharma's CAR-T therapy Yi Kai Da is already on the market, the overall CAR-T cell therapy sector is experiencing rapid growth and demands significant, continuous investment in research and development. This investment is crucial for exploring new therapeutic areas and developing next-generation treatments.

Fosun Pharma's complete acquisition of Fosun Kairos in 2024 clearly demonstrates their dedication to this field. However, future pipeline products in this advanced area represent significant question marks, requiring substantial cash outlays as they aim to capture considerable market share.

Finloop, incubated by Fosun Wealth Holdings and launched in Hong Kong in 2024, represents Fosun International's foray into the burgeoning fintech sector with its AI-driven institutional wealth management platform. As a recent entrant, it is positioned as a Question Mark in the BCG matrix, characterized by its low current market share within the competitive wealth management landscape.

Operating within the high-growth fintech space, Finloop offers advanced solutions, including virtual asset management, tapping into a rapidly expanding market. The platform's success hinges on its ability to capture significant market adoption and effectively scale its innovative AI-powered services to challenge established players.

Given its 2024 establishment, Finloop's financial performance and market penetration are still in early stages. The significant investment required to develop and deploy cutting-edge AI technology, coupled with the need to build brand recognition and client trust in the digital asset space, contributes to its Question Mark status.

The ULTRAMED Hainan Project, a groundbreaking AI-themed resort slated for an October 2024 launch, positions itself as a potential star in Fosun International's portfolio. This ambitious venture aims to pioneer experiential tourism by integrating advanced AI, including AIGC for personalized guest rooms and digital human G.O. services.

While the resort taps into a high-growth market, its novelty means it currently holds a low market share. This characteristic places it firmly in the question mark category of the BCG matrix, demanding substantial investment to build brand awareness and validate its unique market proposition.

Fosun Pharma's Early-Stage Innovative R&D Pipelines

Fosun Pharma's commitment to cutting-edge innovation places several key areas within its early-stage R&D pipeline firmly in the question mark category of the BCG matrix. The company is channeling substantial resources into next-generation therapeutic modalities.

These include radiopharmaceuticals, RNA therapeutics, gene editing technologies, and the burgeoning field of AI-powered drug discovery. While these areas represent significant scientific advancements with high growth potential, the individual products are predominantly in early-stage research or preclinical development.

This means they require considerable R&D investment without guaranteed commercial viability or current market presence.

- Radiopharmaceuticals: Targeted therapies with potential in oncology, currently in preclinical stages.

- RNA Therapeutics: Including mRNA vaccines and therapies, with early clinical trial data emerging.

- Gene Editing: Investigating CRISPR-based therapies for genetic disorders, with initial research ongoing.

- AI-Powered Drug Discovery: Utilizing artificial intelligence to accelerate the identification and development of novel drug candidates, a foundational investment.

New International Market Entries (e.g., Africa, Middle East for Pharma)

Fosun Pharma is strategically positioning itself for growth in emerging markets, with a particular focus on Africa, the Middle East, and Southeast Asia. This expansion into over 40 African countries highlights a commitment to tapping into regions with significant untapped potential.

These new market entries, while promising high growth, represent Fosun Pharma's 'Question Marks' in the BCG matrix. Initial market share is expected to be modest, necessitating considerable investment in building out sales networks, adapting products to local needs, and establishing robust distribution channels. For instance, in 2024, the pharmaceutical market in Africa was projected to reach approximately $60 billion, with Sub-Saharan Africa showing a compound annual growth rate of over 5%.

- Africa Expansion: Targeting over 40 countries, demonstrating a broad reach in a high-potential continent.

- Investment Needs: Substantial capital required for infrastructure, distribution, and localization efforts.

- Market Potential: Emerging markets like Africa and the Middle East offer significant long-term growth opportunities for pharmaceutical companies.

- Initial Share: Expectation of low initial market penetration, typical for new entrants in the 'Question Mark' category.

Fosun International's ventures in emerging technologies and new markets, such as Finloop in fintech and its expansion into Africa, are classified as Question Marks. These initiatives operate in high-growth sectors but currently possess low market share, necessitating significant investment to achieve potential market leadership.

The company's early-stage R&D in areas like radiopharmaceuticals and gene editing also fall into this category. While these hold promise for future breakthroughs, they require substantial capital for development and validation, with uncertain market outcomes.

The ULTRAMED Hainan Project, a novel AI-themed resort launched in October 2024, is another example. Its innovative concept aims to capture a growing experiential tourism market, but as a new entrant, it needs considerable investment to build brand recognition and customer adoption.

| Business Unit/Initiative | BCG Category | Key Characteristics | Investment Needs | Market Potential |

|---|---|---|---|---|

| Finloop (Fintech) | Question Mark | AI-driven wealth management, low current market share, high-growth sector | Significant for technology development, marketing, and client acquisition | High, driven by digital asset growth and AI adoption |

| Fosun Pharma R&D (Radiopharmaceuticals, Gene Editing, RNA, AI Drug Discovery) | Question Mark | Early-stage, next-generation therapeutics, high scientific potential, low current market share | Substantial and continuous for research, clinical trials, and regulatory approval | Very High, addressing unmet medical needs and future healthcare trends |

| ULTRAMED Hainan Project (AI Resort) | Question Mark | Novel AI-themed tourism, launched Oct 2024, low initial market penetration | Significant for brand building, operational scaling, and AI integration | High, catering to demand for unique, tech-enhanced travel experiences |

| Emerging Market Expansion (e.g., Africa) | Question Mark | Entry into high-growth but nascent markets, low initial market share | Extensive for infrastructure, distribution networks, localization, and market penetration | High, driven by growing middle classes and increasing healthcare/consumer spending |

BCG Matrix Data Sources

Our Fosun International BCG Matrix draws from comprehensive financial filings, industry growth forecasts, and competitor analysis to provide a clear strategic overview.