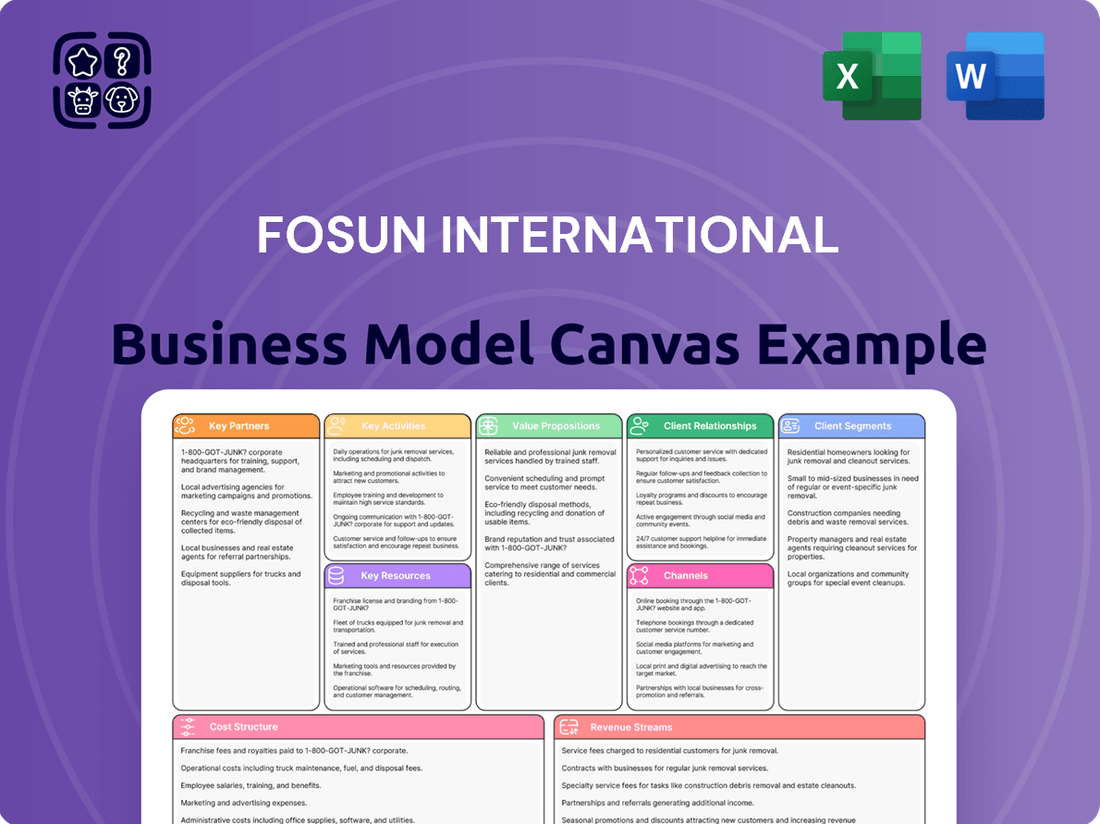

Fosun International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun International Bundle

Unlock the full strategic blueprint behind Fosun International's business model. This in-depth Business Model Canvas reveals how the company drives value across its diverse portfolio of industries, from healthcare to finance. See how their customer relationships and key resources create a competitive advantage.

Discover Fosun International's approach to revenue streams and cost structure, understanding the financial engine that powers their global operations. This canvas is essential for anyone seeking to grasp their unique market positioning and growth strategies.

Gain actionable insights into Fosun International's key partnerships and activities that enable their innovative product and service offerings. This comprehensive view is invaluable for entrepreneurs and strategists.

Dive deeper into Fosun International’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Fosun International cultivates robust strategic alliances with its portfolio companies, including Fosun Pharma, Yuyuan, Fosun Insurance Portugal, and Fosun Tourism Group. These collaborations are designed to harness their individual operational strengths and extensive market presence, fostering significant ecosystem synergy.

These deep-seated partnerships are instrumental in driving growth across various industry sectors by pooling resources and expertise. For instance, Fosun Pharma's advancements in biopharmaceuticals and Yuyuan's consumer brand strength create cross-promotional opportunities.

Fosun actively supports these subsidiaries in their global expansion efforts and operational enhancements. In 2023, Fosun Pharma continued its international growth, particularly in emerging markets, contributing to the group's overall global footprint.

Fosun International actively partners with financial institutions like banks and investment funds. These collaborations are crucial for managing capital efficiently, securing necessary financing, and jointly investing in high-potential opportunities. For example, Fosun established a biopharmaceutical industry fund with Shenzhen Guidance Fund to foster growth in the healthcare sector.

Fosun International actively partners with government entities worldwide to bolster its global reach and market penetration. A prime example is its collaboration with the Abu Dhabi Investment Office (ADIO), which provides crucial investment support and strategic resource connections, aiding Fosun's expansion into new territories. This type of engagement is vital for navigating regulatory landscapes and securing favorable market access.

These governmental alliances are instrumental in facilitating Fosun's international growth strategy, ensuring smoother entry into diverse economic environments and enhancing its industrial operations. Beyond commercial objectives, Fosun also engages in public welfare programs, such as the Rural Doctors Program, often with the support and collaboration of government bodies, underscoring a commitment to social responsibility alongside business development.

Technology and Innovation Partners

Fosun International actively collaborates with technology firms and leading research bodies to foster innovation throughout its diverse business segments. This strategic approach is especially evident in their healthcare and advanced manufacturing sectors. For example, they are involved in developing AI-driven drug discovery platforms and sophisticated robotic surgery systems, alongside digital health solutions, to maintain a competitive edge in technological progress.

Their commitment to technological advancement is a core strategic pillar. In 2024, Fosun continued to invest heavily in R&D, with specific initiatives targeting areas like AI, big data analytics for healthcare, and the integration of smart technologies in manufacturing processes. This focus ensures they are leveraging cutting-edge developments to enhance their product and service offerings.

- AI-Powered Drug Discovery: Partnerships aim to accelerate the identification and development of new pharmaceuticals by utilizing artificial intelligence to analyze vast datasets.

- Robotic Surgery Systems: Collaborations focus on advancing the precision and capabilities of robotic surgical tools, improving patient outcomes and surgical efficiency.

- Digital Health Solutions: Investments are directed towards creating integrated digital platforms that enhance patient care, remote monitoring, and personalized medicine.

- Intelligent Manufacturing: Fosun partners with tech providers to implement smart factory concepts, optimizing production through automation and data analytics.

Industry Experts and Service Providers

Fosun International leverages a robust network of industry experts and service providers to bolster its diverse business operations. These collaborations are crucial for refining market intelligence and optimizing service delivery across its global portfolio. For instance, in 2024, Fosun continued to deepen its relationships with specialized consultants to enhance its healthcare offerings and expand its presence in the tourism sector.

These strategic alliances extend to critical operational areas such as supply chain management and distribution logistics. By partnering with leading logistics firms, Fosun ensures efficient and reliable delivery of its products and services worldwide. This network is instrumental in achieving economies of scale and maintaining consistent quality standards, a key factor in its international expansion strategy.

Furthermore, these partnerships are vital for adapting global business models to local market nuances. Experts provide invaluable insights into regulatory environments, consumer preferences, and cultural specificities, enabling Fosun to tailor its strategies effectively. This localized approach, supported by expert guidance, has been a cornerstone of its success in emerging markets.

- Industry Experts: Collaborations with leading consultants in healthcare, tourism, and finance to drive innovation and market penetration.

- Service Providers: Partnerships with global logistics and distribution networks to ensure efficient supply chain management for its diverse product lines.

- Market Adaptation: Utilizing expert insights to integrate global strategies into local markets, enhancing relevance and customer engagement.

- Operational Efficiency: Enhancing service delivery and operational effectiveness through specialized external expertise and technological integration.

Key partnerships for Fosun International are multifaceted, encompassing strategic alliances with its own portfolio companies to leverage synergies, and collaborations with financial institutions for capital management and joint investments. Furthermore, partnerships with technology firms and research bodies are crucial for driving innovation, particularly in healthcare and advanced manufacturing.

These alliances extend to government entities to facilitate global expansion and navigate regulatory landscapes. In 2023, Fosun Pharma's international growth, supported by these partnerships, contributed significantly to the group's global footprint. The group also actively engaged with industry experts and service providers in 2024 to enhance market intelligence and operational efficiency across its diverse segments.

Fosun's strategic engagement with technology firms in 2024 included investments in AI-driven drug discovery platforms and digital health solutions, aiming to maintain a competitive technological edge.

Fosun International's strategic partnerships are vital for its ecosystem synergy and global expansion. These include deep-rooted collaborations with its own subsidiaries like Fosun Pharma and Yuyuan, joint ventures with financial institutions, and alliances with technology firms for innovation. For instance, in 2024, Fosun continued to deepen its relationships with specialized consultants in the healthcare sector.

| Type of Partner | Key Activities | Impact/Examples |

| Portfolio Companies | Synergy, Cross-promotion, Global Expansion | Fosun Pharma, Yuyuan, Fosun Insurance Portugal, Fosun Tourism Group |

| Financial Institutions | Capital Management, Financing, Joint Investments | Biopharmaceutical industry fund with Shenzhen Guidance Fund |

| Technology & Research Bodies | Innovation, R&D Acceleration | AI-driven drug discovery, Robotic surgery systems, Digital health solutions |

| Government Entities | Market Access, Regulatory Navigation, Investment Support | Collaboration with Abu Dhabi Investment Office (ADIO) |

| Industry Experts & Service Providers | Market Intelligence, Operational Enhancement, Local Adaptation | Consultants for healthcare, Logistics firms for supply chain |

What is included in the product

A diversified global conglomerate, Fosun International's Business Model Canvas outlines its strategy of leveraging its extensive customer base and robust financial services to drive growth across its diverse portfolio of businesses, including health, happiness, and wealth.

Fusun International's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap to navigate complex global operations and diverse business units.

It streamlines strategic planning by offering a one-page snapshot that highlights key relationships and potential inefficiencies, thereby reducing organizational friction.

Activities

Fosun International's strategic investments and acquisitions are central to its growth, focusing on its core health, happiness, and wealth segments. This involves actively identifying and integrating businesses that complement its existing operations and tap into emerging global trends.

In 2024, Fosun continued to emphasize investments in high-growth areas such as advanced healthcare technology and innovative pharmaceuticals. This strategic allocation of capital aims to bolster its position in the life sciences sector, a key pillar of its long-term vision.

The company actively pursues acquisitions and divestitures to refine its portfolio, ensuring resources are directed towards the most promising opportunities. This approach, which includes strategic advancements and timely exits, is designed to maximize shareholder value and maintain a dynamic business structure.

Fosun's engagement in tourism and financial services also sees strategic investment, with a focus on enhancing customer experience and expanding market reach. These investments are carefully chosen to align with evolving consumer demands and contribute to the overall synergy within its ecosystem.

Fosun International actively manages its broad portfolio, focusing on operational improvements and creating value across its health, happiness, and wealth segments. This strategic oversight involves guiding subsidiaries, sharing resources, and encouraging cooperation to build a powerful synergistic effect.

The company's approach aims to deepen its involvement in core industries, driving long-term profitability. For instance, in 2023, Fosun Pharma, a key health segment subsidiary, reported a revenue of RMB 42.16 billion, showcasing the operational scale and potential for growth within its managed assets.

Fosun International directly manages a diverse portfolio of industrial operations across the globe. This includes significant ventures in healthcare, consumer goods, tourism, and financial services, demonstrating a broad operational footprint. For instance, in 2024, Fosun continued to leverage its ownership of prominent brands like Club Med, a global leader in all-inclusive resorts, and Atlantis Sanya, a major tourism destination in China.

The company's operational strategy is built on a 'global organization + local operations' framework. This approach allows for centralized strategic direction while empowering local teams to cater to specific market needs. As of early 2024, Fosun maintained a presence in over 35 countries and regions, facilitating deeper market penetration and localized brand management.

In the pharmaceutical sector, Fosun Pharma, a key subsidiary, is actively involved in the manufacturing and worldwide distribution of a wide array of medicines and medical devices. This global supply chain management is crucial for its healthcare segment's reach and impact, especially evident in its ongoing efforts to expand access to innovative therapies.

Research, Development, and Innovation

Fosun International's commitment to Research, Development, and Innovation is a cornerstone of its strategy, especially within its health and intelligent manufacturing sectors. The company actively invests in R&D to create novel treatments and cutting-edge products. For instance, in 2024, Fosun Pharma continued to advance its pipeline, with several innovative drugs progressing through clinical trials. This focus on innovation is crucial for maintaining a competitive advantage and driving future growth.

The application of advanced technologies, such as Artificial Intelligence (AI), is central to Fosun's innovation efforts. By integrating AI, Fosun aims to enhance its product development processes and improve the efficacy of its offerings. This technological adoption is designed to streamline operations and deliver more sophisticated solutions to the market. The company's dedication to this area ensures a robust pipeline of new opportunities.

- Fosun Pharma's R&D Investment: In 2024, Fosun Pharma allocated a significant portion of its revenue towards research and development, aiming to bolster its pipeline of innovative medicines.

- AI Integration in Manufacturing: Fosun's intelligent manufacturing segment is increasingly leveraging AI for process optimization and quality control, enhancing production efficiency.

- Pipeline Development: The company prioritizes the development of new treatments for unmet medical needs, a key driver for its health business.

- Competitive Edge: Continuous investment in R&D and innovation allows Fosun to stay ahead in dynamic global markets.

Asset Light Transformation and Deleveraging

Fosun International is actively transforming its business model by adopting an asset-light strategy and focusing on deleveraging. This involves strategically divesting from asset-heavy, non-core businesses to sharpen its focus and strengthen its financial foundation. For instance, in 2023, the company continued its efforts to reduce its debt burden, aiming for a more agile operational structure.

This strategic pivot is designed to significantly reduce financial leverage, thereby enhancing the company's liquidity and bolstering its creditworthiness. By shedding less profitable or capital-intensive assets, Fosun aims to unlock capital for investment in more promising, lighter-touch ventures. This approach is crucial for building a more resilient and adaptable business model in the face of evolving market dynamics.

- Divestment of Non-Core Assets: Fosun has been actively selling off businesses that do not align with its core strategic objectives, particularly those requiring substantial capital investment.

- Debt Reduction Initiatives: The company has prioritized paying down debt, which is reflected in improvements in its debt-to-equity ratio over the past few years. For example, by the end of 2023, Fosun reported a continued reduction in its overall debt levels.

- Focus on Core Businesses: This transformation allows Fosun to concentrate resources and management attention on its more profitable and scalable operations, such as its healthcare and technology segments.

- Enhanced Financial Flexibility: The deleveraging process is expected to improve Fosun's financial flexibility, enabling it to pursue growth opportunities and navigate economic uncertainties more effectively.

Fosun International's key activities revolve around strategic investments, portfolio management, and operational oversight across its core segments. The company actively engages in mergers and acquisitions to bolster its health, happiness, and wealth businesses, while also refining its portfolio through divestitures. A significant focus in 2024 has been on investing in high-growth sectors like advanced healthcare technology and pharmaceuticals, exemplified by Fosun Pharma's continued pipeline development. Furthermore, the company actively manages its diverse industrial operations globally, leveraging a 'global organization + local operations' framework for market penetration and brand management.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Strategic Investments & Acquisitions | Focus on health, happiness, wealth segments; identifying and integrating complementary businesses. | Continued investment in advanced healthcare technology and innovative pharmaceuticals. |

| Portfolio Management | Active acquisition and divestiture to refine portfolio and maximize shareholder value. | Ongoing efforts to reduce debt and divest non-core, asset-heavy businesses. |

| Operational Oversight & Synergy | Managing diverse portfolio, improving operations, and fostering cooperation for synergistic effects. | Fosun Pharma revenue RMB 42.16 billion in 2023. |

| Research, Development & Innovation | Investing in R&D for novel treatments and cutting-edge products, integrating AI. | Fosun Pharma advancing multiple innovative drugs through clinical trials in 2024. |

What You See Is What You Get

Business Model Canvas

The preview you're examining is a genuine segment of the Fosun International Business Model Canvas. This means the document you are currently viewing is precisely the same one you will receive upon completing your purchase, offering full access to all its detailed sections and insights.

Rest assured, what you see here is not a simplified sample or a mockup; it's a direct representation of the final Fosun International Business Model Canvas. Once your order is processed, you will gain immediate access to this identical, comprehensive document, ready for your strategic analysis and application.

Resources

Fosun International's core strength lies in its vast and varied collection of over 300 subsidiaries and affiliated companies. This diverse range includes prominent names like Fosun Pharma, Yuyuan, Club Med, and Fidelidade, creating a robust network of industrial assets.

These businesses are strategically organized to support Fosun's 'health, happiness, and wealth' ecosystem, offering a broad spectrum of products and services to a global customer base. For instance, by the end of 2023, Fosun Pharma had a significant presence in the pharmaceutical and healthcare sectors, contributing substantially to the group's overall value.

Fosun International benefits from a strong capital base and adept financial management. This financial strength allows the company to pursue strategic investments and acquisitions, effectively navigating complex financial markets. For instance, in the first half of 2024, Fosun International reported a robust operating cash flow, demonstrating its capacity to generate funds internally.

The company maintains substantial cash reserves, providing a cushion for operational needs and opportunistic investments. Furthermore, its established access to offshore bond markets in 2024 has been crucial for securing diverse funding avenues, reinforcing its ability to finance growth and manage its financial obligations efficiently.

Fosun International's global network is a cornerstone of its strategy, spanning operations in over 35 countries and regions. This extensive reach provides unparalleled market access and allows for the efficient integration of resources across diverse geographies.

The company's 'global organization + local operations' approach is key to its success. This model enables Fosun to effectively tap into local market nuances while leveraging its worldwide organizational strength. For instance, in 2023, Fosun International's revenue from international operations continued to grow, underscoring the effectiveness of this balanced operational structure.

Human Capital and Experienced Management Team

Fosun International's human capital is a critical asset, boasting a workforce exceeding 100,000 individuals as of recent reports. This extensive employee base is complemented by an experienced management team, whose deep industry knowledge and forward-thinking global perspective are instrumental in navigating Fosun's diverse business segments.

This combination of a vast workforce and seasoned leadership fuels the company's capacity for innovation and operational efficiency. They are the driving force behind the successful implementation of Fosun's strategic objectives across its multifaceted global operations.

- Human Capital: Over 100,000 employees globally.

- Management Expertise: Deep industry knowledge and global strategic vision.

- Key Contributions: Driving innovation, operational excellence, and strategic execution.

- Impact: Essential for managing Fosun's complex, diversified business structure.

Innovation and R&D Capabilities

Fosun International's innovation and R&D capabilities are central to its business model, fueling growth and maintaining a competitive edge. The company has built a robust global innovation network, comprising more than 20 technology innovation centers. This extensive infrastructure is dedicated to advancing research in cutting-edge fields such as biopharmaceuticals, pioneering cell therapies, and leveraging artificial intelligence for accelerated drug discovery. This commitment to developing and nurturing new technologies and products is foundational for securing future expansion and market leadership.

Key aspects of Fosun's innovation and R&D include:

- Global Innovation System: Over 20 technology innovation centers worldwide.

- Focus Areas: Biopharmaceuticals, cell therapies, and AI-powered drug discovery.

- Strategic Importance: Crucial for developing new technologies and products.

- Competitive Advantage: Essential for future growth and market differentiation.

Fosun International's Key Resources are diverse and substantial, underpinning its expansive business operations. The company leverages its extensive network of over 300 subsidiaries, including key players like Fosun Pharma and Club Med, to create a powerful industrial ecosystem. Its financial strength is demonstrated by robust operating cash flow, as seen in the first half of 2024, and significant cash reserves, which enable strategic investments and access to global funding markets.

The company's global footprint, spanning over 35 countries, provides unparalleled market access and facilitates resource integration through its 'global organization + local operations' model. Furthermore, Fosun's human capital, exceeding 100,000 employees, coupled with an experienced management team, drives innovation and operational efficiency across its complex structure.

Fosun's commitment to innovation is evident in its global R&D network, featuring over 20 technology innovation centers focused on biopharmaceuticals, cell therapies, and AI-driven drug discovery, securing its future market position.

| Key Resource | Description | 2023/2024 Data Point | Strategic Importance |

| Subsidiary Network | Over 300 subsidiaries and affiliates | Fosun Pharma's significant sector presence | Industrial ecosystem creation |

| Financial Strength | Strong capital base, robust cash flow | Positive operating cash flow (H1 2024) | Investment capacity, market navigation |

| Global Network | Operations in over 35 countries | Growing international revenue (2023) | Market access, resource integration |

| Human Capital | Over 100,000 employees | Experienced management team | Innovation, operational efficiency |

| R&D Capabilities | Global innovation centers | Over 20 technology innovation centers | Future growth, competitive edge |

Value Propositions

Fosun International's core value proposition centers on an integrated 'Health, Happiness, and Wealth' ecosystem, designed to meet the multifaceted needs of modern families. This unique offering goes beyond individual products, creating a synergistic network that enhances overall customer well-being.

By connecting its diverse business segments, Fosun delivers a holistic suite of high-quality products and services. This cross-sector integration allows customers to access solutions that support their health, foster happiness, and build wealth, all within a unified framework.

For instance, in 2024, Fosun Pharma continued to expand its healthcare offerings, while Fosun Tourism Group provided leisure and travel experiences. Simultaneously, its wealth management arm, through entities like Fosun Hani, aimed to secure financial futures, demonstrating the practical application of this integrated model.

Customers can tap into a wide array of top-tier global products and services through Fosun's curated network of renowned brands and subsidiaries. This access spans critical sectors, offering everything from cutting-edge medical treatments and advanced pharmaceuticals to luxurious travel and leisure opportunities, alongside dependable financial services.

Fosun's commitment to excellence ensures these offerings meet high standards, aiming for unparalleled customer satisfaction. For instance, in 2024, Fosun Pharma continued its expansion in global markets, with its innovative CAR-T therapy receiving regulatory approval in key regions, demonstrating tangible progress in high-quality healthcare access.

Fosun International offers investors and businesses compelling strategic investment opportunities, acting as a robust platform for sustained long-term growth. By skillfully integrating its diverse industrial operations with its extensive investment capabilities, Fosun aims to unlock significant value.

The company’s deliberate approach to strategic advancements and carefully considered exits is designed to optimize shareholder and partner returns. This focus on core industries, such as health, happiness, and wealth, underpins its strategy for maximizing value creation across its portfolio.

For instance, in 2024, Fosun continued its strategic asset allocation, with particular emphasis on strengthening its core businesses. The company reported substantial growth in its healthcare segment, driven by innovation and market expansion, reflecting its commitment to long-term value generation.

Global Reach with Localized Solutions

Fosun International leverages its global footprint by integrating worldwide best practices with on-the-ground, localized strategies. This dual approach allows for agile adaptation to diverse market needs while simultaneously capitalizing on the efficiencies and insights gained from its international operations. For instance, in 2023, Fosun's overseas revenue continued to show robust growth, highlighting the effectiveness of this model in expanding its market presence.

This strategy translates into tailored product and service offerings that resonate deeply within specific cultural contexts. By understanding and respecting local nuances, Fosun enhances customer engagement and market penetration. This localized focus, supported by global resource integration, is a cornerstone of its sustained international expansion.

The benefits of this "Global Reach with Localized Solutions" value proposition are evident in several key areas:

- Market Adaptation: Ability to customize products and services to meet unique local consumer preferences and regulatory environments.

- Resource Synergy: Efficiently channeling global expertise, technology, and capital to support local business units.

- Risk Mitigation: Diversifying operations across various geographies reduces dependency on any single market.

- Enhanced Brand Equity: Building trust and recognition by demonstrating a commitment to local communities and their specific needs.

Commitment to Innovation and Sustainable Development

Fosun International's dedication to innovation, especially within healthcare and technology, is a core value proposition. This focus drives the development of cutting-edge products and services that aim to enhance patient outcomes and streamline healthcare delivery.

Their commitment to sustainable development underpins responsible business practices across all operations. This approach resonates with a growing segment of consumers and investors who prioritize environmental, social, and governance (ESG) factors. For example, Fosun Pharma's investments in R&D for novel therapies reflect this innovative spirit. In 2023, Fosun Pharma reported significant R&D expenditure, demonstrating a tangible commitment to bringing new treatments to market.

- Innovation in Healthcare: Fosun Pharma is actively developing mRNA vaccines and other biopharmaceuticals.

- Technological Advancement: Investments in AI and digital health solutions aim to improve service efficiency.

- Sustainable Operations: Implementing green initiatives across its business units to reduce environmental impact.

- Stakeholder Appeal: Attracting customers and investors who value forward-thinking and socially conscious companies.

Fosun International's value proposition is built on delivering an integrated "Health, Happiness, Wealth" ecosystem, offering a holistic suite of quality products and services across its diverse segments. This approach connects customers to solutions that support their well-being and financial security through a curated network of global brands.

The company provides access to top-tier global products and services, from advanced medical treatments via Fosun Pharma to leisure experiences from Fosun Tourism Group, and financial security through its wealth management arms. This comprehensive offering is designed to meet multifaceted family needs.

Fosun acts as a robust platform for strategic investment, integrating industrial operations with investment capabilities to unlock long-term growth and optimize returns. This focus on core sectors like health, happiness, and wealth underpins its value creation strategy.

For instance, in 2024, Fosun Pharma's CAR-T therapy gained regulatory approval in key markets, enhancing access to high-quality healthcare. Simultaneously, the company continued its strategic asset allocation, with healthcare reporting significant growth driven by innovation and market expansion.

Fosun International leverages its global reach by integrating worldwide best practices with localized strategies, ensuring tailored offerings that resonate with specific cultural contexts and consumer preferences. This dual approach enhances customer engagement and market penetration.

| Value Proposition Pillar | Key Offering | 2024 Highlight/Data Point |

|---|---|---|

| Integrated Ecosystem | Health, Happiness, Wealth | Fosun Pharma expanded healthcare offerings; Tourism Group provided leisure; Wealth management secured financial futures. |

| Global Access, Localized Solutions | Curated Network of Global Brands | Overseas revenue showed robust growth in 2023, demonstrating effective market expansion through localized strategies. |

| Innovation and Sustainability | Cutting-edge Products & Services | Fosun Pharma's significant R&D expenditure in 2023 fueled development of novel therapies, including mRNA vaccines. |

Customer Relationships

Fosun cultivates enduring, strategic partnerships with its portfolio firms, extending beyond mere investment to active operational involvement. This approach sees Fosun collaborating on growth blueprints, operational enhancements, and market penetration initiatives, aiming to build shared prosperity and integrated value across its diverse business network.

In 2024, Fosun’s commitment to these deep relationships is evident in its continued support for portfolio companies navigating dynamic global markets. For instance, its healthcare segment actively partners with companies like Fosun Pharma, driving innovation and global expansion, contributing to Fosun's overall resilience and adaptability.

Fosun International fosters direct consumer engagement for its brands like Club Med and Yuyuan. This strategy focuses on delivering premium experiences and products to build strong brand loyalty. For instance, Club Med's commitment to all-inclusive vacations aims to create memorable customer journeys. In 2024, the hospitality sector continued to see strong demand for curated experiences, a trend Fosun leverages.

Fosun International prioritizes robust investor relations by ensuring transparent financial reporting and holding annual results presentations. This commitment to open communication about its strategic path and financial health is crucial for fostering trust and securing ongoing capital.

In 2024, Fosun continued to emphasize clear dialogue with its stakeholders, addressing investor queries proactively. This consistent engagement helps to manage expectations and solidify confidence in the company's long-term growth trajectory.

B2B Partnerships and Client Management

Fosun International cultivates strong B2B partnerships, particularly within its financial services and broader B2B operations. These relationships are crucial, involving insurance clients, corporate entities, and businesses leveraging Fosun's expertise for investments or operational enhancements. These collaborations often feature bespoke solutions and extended contractual agreements, highlighting a commitment to sustained value creation.

Key aspects of Fosun's B2B client management include:

- Strategic Alliances: Forging deep ties with major corporate players and institutional investors, often co-investing or offering integrated financial and operational services.

- Tailored Solutions: Developing customized product and service offerings to meet the specific needs of diverse B2B clients, from insurance underwriting to asset management.

- Long-Term Contracts: Securing multi-year agreements that provide revenue stability and allow for deeper integration of Fosun's capabilities.

- Expertise Leverage: Acting as a strategic partner for businesses seeking Fosun's renowned investment acumen, operational efficiency, and global network reach.

Community Engagement and Social Responsibility Initiatives

Fosun International actively engages with communities through impactful social responsibility programs. A prime example is their ‘Rural Doctors Program,’ aimed at improving healthcare access in underserved areas. This initiative not only strengthens community ties but also bolsters Fosun's brand image as a responsible corporate citizen.

Beyond healthcare, Fosun participates in global public health cooperation, demonstrating a commitment to societal well-being on a broader scale. These efforts foster goodwill and underline the company's dedication to making a positive impact that extends beyond its core business operations.

- Rural Doctors Program: Focuses on enhancing healthcare services in rural regions, building local trust and support.

- Global Public Health Cooperation: Demonstrates Fosun's commitment to addressing worldwide health challenges, enhancing its international reputation.

- Brand Enhancement: These initiatives cultivate a positive brand perception, attracting customers and talent alike.

- Societal Contribution: Positions Fosun as a company invested in the betterment of society, creating long-term value.

Fosun International’s customer relationships span strategic partnerships with portfolio companies, direct engagement with consumers for its brands like Club Med, and robust B2B collaborations. The company also prioritizes strong investor relations through transparent reporting.

| Relationship Type | Key Activities | 2024 Focus/Examples |

|---|---|---|

| Portfolio Companies | Active operational involvement, growth strategy collaboration | Continued support for companies like Fosun Pharma in global expansion |

| Direct Consumers (e.g., Club Med) | Premium experiences, brand loyalty building | Leveraging demand for curated hospitality experiences |

| B2B Clients (e.g., Financial Services) | Tailored solutions, long-term contracts, strategic alliances | Bespoke financial and operational services for corporate entities |

| Investors | Transparent financial reporting, open communication | Proactive engagement and clear dialogue on strategic path |

Channels

Fosun International leverages its wholly-owned and majority-owned subsidiaries as the primary conduits for delivering its value propositions directly to customers. This structure grants significant control over the customer experience and service quality across its diverse portfolio.

Key examples of these direct operational channels include the expansive network of Fosun Pharma's healthcare facilities and distribution channels, the globally recognized Club Med resorts offering integrated vacation experiences, and Yuyuan's widespread retail presence for cultural and lifestyle products. Fosun Insurance Portugal's established branch network also serves as a crucial direct operational channel for its insurance services.

In 2023, Fosun Pharma reported revenues of RMB 43.0 billion, highlighting the substantial reach and economic impact of its direct operations. Similarly, Club Med, a significant contributor to Fosun's tourism segment, continued its recovery and expansion efforts, further solidifying its direct customer engagement model.

Fosun International leverages online platforms and digital ecosystems extensively, especially within its happiness and health sectors. This strategy enhances customer engagement and broadens sales and service delivery channels.

Examples include digital booking platforms for its tourism businesses, facilitating seamless travel arrangements. The company also utilizes e-commerce for a wide range of consumer products, making them readily accessible to a larger market.

Furthermore, Fosun is actively developing digital health management solutions. These platforms aim to improve patient care and accessibility to health services, reflecting a commitment to digital transformation in healthcare.

By investing in these digital ecosystems, Fosun aims to expand its reach, improve operational efficiency, and create more integrated customer experiences across its diverse business portfolio.

Fosun International utilizes its robust global sales and distribution channels, particularly strong in pharmaceuticals and consumer goods, to achieve broad market reach. This infrastructure is critical for effectively delivering its diverse portfolio of products and services worldwide.

The company's international footprint allows for efficient market penetration and expansion, including strategic growth initiatives in emerging markets such as the Middle East and Southeast Asia. This expansive network facilitates swift adoption of new offerings.

For instance, in 2024, Fosun Pharma continued to strengthen its international presence, with its products available in over 90 countries and regions, demonstrating the efficacy of its established distribution capabilities.

This global reach ensures that Fosun's innovative solutions, from life-saving medicines to everyday consumer items, can efficiently access and serve a vast customer base, driving revenue and market share growth.

Investment Funds and Financial Advisory Services

Fosun's wealth segment leverages investment funds and financial advisory services as crucial channels to engage both institutional and individual investors. These avenues are instrumental in gathering capital, effectively managing diverse assets, and delivering bespoke financial solutions tailored to client needs.

These channels facilitate capital raising, enabling Fosun to expand its investment capacity and pursue strategic growth opportunities. By offering a range of investment funds, the company caters to varied risk appetites and financial objectives.

- Investment Funds: Fosun offers a spectrum of investment funds, including private equity, venture capital, and public market strategies, attracting capital from a broad investor base.

- Financial Advisory: Provides personalized wealth management and financial planning services, guiding clients through complex investment landscapes.

- Capital Raising: These channels are vital for Fosun's ongoing efforts to raise capital for its various subsidiaries and investment platforms.

- Asset Management: Manages a significant and growing pool of assets under management, demonstrating client trust and operational efficiency.

Physical Locations and Experiential Venues

Fosun International leverages its physical locations and experiential venues as crucial channels for its tourism and leisure segments. These include well-known brands like Club Med resorts, the Atlantis Sanya resort, and the Taicang Alps Resort, all designed to offer deeply engaging and high-quality leisure experiences.

These tangible spaces are fundamental to Fosun's 'happiness' ecosystem, facilitating direct interaction with customers and the delivery of premium recreational services. For instance, Club Med, a significant part of Fosun's tourism portfolio, reported a strong rebound in 2024, with occupancy rates reaching approximately 75% in its European resorts by the end of Q3 2024, indicating robust demand for its physical offerings.

- Club Med Resorts: Offering all-inclusive vacation packages in diverse global locations.

- Atlantis Sanya: A luxury resort in China featuring water parks, aquariums, and marine life experiences.

- Taicang Alps Resort: A winter sports and leisure destination, enhancing year-round appeal.

Fosun International's channels are a dynamic blend of direct operations, digital platforms, global distribution networks, and physical experiential venues, ensuring broad market reach and customer engagement.

These channels are crucial for delivering value across its diverse segments, from healthcare and insurance to tourism and consumer goods, with digital integration enhancing accessibility and efficiency.

The company actively utilizes its subsidiaries' established networks and invests in digital ecosystems to expand reach and improve customer experiences. For instance, in 2024, Fosun Pharma's products were available in over 90 countries, showcasing its robust global distribution.

Club Med's strong performance in 2024, with occupancy rates around 75% in European resorts by Q3, underscores the effectiveness of its physical, experiential channels.

| Channel Type | Key Segments Served | Examples | 2023/2024 Data Points |

|---|---|---|---|

| Direct Operations | Healthcare, Insurance, Tourism, Consumer Goods | Fosun Pharma facilities, Fosun Insurance Portugal branches, Club Med resorts, Yuyuan retail | Fosun Pharma 2023 revenue: RMB 43.0 billion |

| Digital Platforms | Tourism, Health, Consumer Goods | Online booking, E-commerce, Digital health solutions | Continued development of digital health management solutions |

| Global Distribution | Pharmaceuticals, Consumer Goods | International sales networks, emerging market expansion | Fosun Pharma products in over 90 countries (2024) |

| Experiential Venues | Tourism & Leisure | Club Med resorts, Atlantis Sanya, Taicang Alps Resort | Club Med European resort occupancy ~75% (Q3 2024) |

Customer Segments

Global families increasingly prioritize health, driving demand for comprehensive solutions. Fosun International addresses this by offering a wide array of high-quality healthcare products, advanced medical services, and personalized health management. Their pharmaceutical arm, for instance, is a key player in developing innovative treatments.

Fosun's integrated approach includes a network of hospitals and health insurance plans, making healthcare more accessible worldwide. This strategy is particularly attractive to families seeking reliable and advanced medical care. In 2023, Fosun Pharma's revenue reached RMB 87.7 billion, showcasing significant growth in its healthcare segment.

Individual consumers and travelers represent a core customer base for Fosun International, encompassing families and individuals looking for enriching leisure, tourism, and lifestyle experiences. Fosun’s strategy here is to build a comprehensive happiness ecosystem.

This ecosystem includes well-known brands like Club Med, renowned for its all-inclusive resorts, and Atlantis Sanya, a premier destination offering unique attractions. These offerings are designed to cater to a wide range of preferences within the consumer and traveler segment, emphasizing diversity and quality.

Fosun’s commitment to this segment is evident in its ongoing investments. For instance, in 2023, Fosun Tourism Group, a key subsidiary, reported revenues driven significantly by its tourism operations, reflecting the sustained demand from individual consumers and travelers for its curated experiences.

Fosun International caters to a sophisticated clientele, including institutional investors, high-net-worth individuals, and family offices. These groups are drawn to Fosun's ability to identify and capitalize on global investment opportunities, offering them a pathway to diversified portfolios and enhanced wealth management. For instance, Fosun's global presence allows it to tap into emerging markets and established economies, providing unique investment avenues.

The company's appeal lies in its proven track record of value creation across various sectors, from healthcare and technology to finance and consumer goods. Institutional investors, managing substantial assets, appreciate Fosun's strategic approach to acquiring and integrating businesses, aiming for long-term growth and profitability. This segment relies on Fosun's asset management capabilities to navigate complex financial landscapes.

Businesses Seeking Strategic Capital and Operational Expertise

Fosun actively seeks businesses that need more than just funding. They are looking for companies that can benefit from strategic capital injections coupled with operational improvements and expanded global reach. These are typically businesses aiming for significant growth and market penetration. For instance, Fosun’s investment in **Club Med**, a global leisure company, exemplifies this by providing capital for expansion and operational expertise to enhance the customer experience.

These target businesses are essentially looking for a partnership that offers a unique blend of financial backing and deep industrial know-how. Fosun aims to be that partner, helping these companies to not only survive but thrive by leveraging its extensive network and management capabilities. In 2023, Fosun International reported a revenue of RMB 177.1 billion, underscoring its capacity to support substantial growth initiatives within its portfolio companies.

Fosun’s approach is to identify and nurture businesses with strong potential across diverse sectors, including health, happiness, and wealth. The focus is on companies that can integrate with Fosun’s existing ecosystem or represent new strategic growth avenues. Their portfolio demonstrates this breadth, encompassing sectors from tourism and healthcare to finance and technology.

- Strategic Capital Needs: Businesses requiring significant investment to fund expansion, research and development, or market entry.

- Operational Expertise Demand: Companies looking for partners to improve efficiency, streamline operations, and enhance management practices.

- Global Market Access Ambitions: Businesses aiming to expand their international footprint and reach new customer bases.

- Synergistic Potential: Firms whose operations can complement or integrate with Fosun’s existing business segments for mutual benefit.

Global Communities and Public Health Initiatives

Fosun International extends its reach beyond commercial endeavors to impact global communities through dedicated public welfare and social responsibility programs. These initiatives are integral to its business model, showcasing a commitment to societal well-being.

A significant aspect of this segment involves supporting public health. For instance, Fosun Pharma has been a key player in fighting malaria, with its antimalarial drug, artemisinin-based combination therapies (ACTs), playing a crucial role in global eradication efforts. By 2023, ACTs, including those developed by Fosun, were estimated to have saved millions of lives in endemic regions.

The company also focuses on rural healthcare enhancement, aiming to improve access and quality of medical services in underserved areas. This includes providing medical equipment, training healthcare professionals, and implementing health education programs. These efforts contribute to reducing health disparities and building more resilient communities.

Fosun's commitment to these global communities is demonstrated through tangible actions and strategic investments in public health and social welfare, reflecting a broader vision of sustainable development.

- Rural Healthcare Support: Initiatives focused on improving medical infrastructure and access in remote areas.

- Malaria Treatment Donations: Providing essential antimalarial drugs, contributing to global health security.

- Public Welfare Programs: Broader social responsibility efforts aimed at community upliftment and well-being.

Fosun International serves a diverse clientele, including global families seeking comprehensive health solutions, individuals and travelers desiring lifestyle experiences, and sophisticated investors looking for wealth management. These segments are unified by a desire for quality, accessibility, and curated offerings.

The company also targets businesses needing strategic capital and operational expertise for global expansion, as well as communities benefiting from public welfare and health initiatives. This broad reach underscores Fosun's commitment to creating value across multiple societal levels.

In 2023, Fosun Pharma's revenue reached RMB 87.7 billion, highlighting the strong demand from the healthcare segment. Similarly, Fosun's tourism operations, a key driver for consumers and travelers, showed sustained revenue growth.

| Customer Segment | Key Needs/Interests | Fosun's Offerings | 2023 Relevance (Examples) |

|---|---|---|---|

| Global Families (Health) | Comprehensive healthcare, advanced medical services | Pharmaceuticals, hospitals, health insurance | Fosun Pharma Revenue: RMB 87.7 billion |

| Individuals & Travelers (Lifestyle) | Enriching leisure, tourism, lifestyle experiences | All-inclusive resorts (Club Med), unique attractions (Atlantis Sanya) | Strong revenue from tourism operations |

| Institutional Investors & HNWI | Diversified portfolios, wealth management, global opportunities | Asset management, strategic investments | Proven track record in value creation |

| Businesses (Growth) | Capital, operational expertise, global market access | Strategic capital injections, management capabilities | Fosun International Revenue: RMB 177.1 billion |

| Communities (Welfare) | Improved healthcare access, social well-being | Rural healthcare support, malaria treatment donations | Artemisinin-based therapies estimated to have saved millions of lives |

Cost Structure

Fosun International dedicates substantial capital to acquiring and integrating businesses, a core element of its expansion strategy. These investment capital and acquisition costs encompass the purchase price of new ventures, thorough due diligence, and the expenses associated with merging them into existing operations.

For instance, in 2023, Fosun's investment activities, a significant part of its cost structure, were driven by its ongoing strategy to strengthen its core businesses and explore new growth areas. While specific figures for acquisition costs fluctuate annually, the company consistently allocates considerable resources to M&A, reflecting its ambition to build a diversified and resilient global conglomerate.

Fosun International's diverse industrial operations, spanning healthcare, tourism, and manufacturing, naturally come with significant operational expenses. Think about the costs associated with running hospitals, managing hotels, and operating factories across the globe. These are the backbone of their business, and they require ongoing investment to function smoothly.

These expenses are substantial and include everything from paying their employees and sourcing raw materials to investing in research and development and marketing their services. For instance, in 2023, Fosun Pharma, a key subsidiary, reported operating expenses of RMB 29.4 billion, reflecting the high costs of innovation and global expansion in the pharmaceutical sector.

The global nature of Fosun's footprint means these costs are spread across numerous regions, each with its own economic landscape and cost of doing business. Managing these varied expenditures efficiently is crucial for maintaining profitability and supporting the growth of their varied business units.

As a vast global conglomerate with a workforce exceeding 100,000 individuals, Fosun International's cost structure is significantly impacted by personnel expenses. These costs encompass salaries, comprehensive benefits packages, and ongoing training and development programs designed to maintain a skilled global workforce.

Beyond direct employee compensation, general and administrative (G&A) expenses represent another substantial component. These cover the essential corporate oversight, centralized support functions, and the operational costs associated with managing a diverse portfolio of businesses across various sectors and geographies.

For instance, in 2023, Fosun International's total employee benefits and remuneration expenses amounted to approximately RMB 24.1 billion (around $3.3 billion USD), highlighting the scale of their personnel investment. This figure underscores the critical role of human capital in the company's operational framework and overall cost makeup.

Research and Development (R&D) Investment

Fosun International places a significant emphasis on Research and Development (R&D) as a core component of its cost structure, especially within its health and intelligent manufacturing divisions. These investments are crucial for fostering innovation, leading to the creation of novel products and cutting-edge technologies.

The company's R&D expenditure covers a broad spectrum, from the intricate processes of drug discovery and the demanding requirements of clinical trials to the continuous advancement of manufacturing technologies. For instance, in 2023, Fosun Pharma's R&D expenses reached RMB 7.46 billion, demonstrating a strong commitment to innovation in the healthcare sector.

- Health Segment Focus: Substantial allocation to drug discovery, clinical trials, and biopharmaceutical innovation.

- Intelligent Manufacturing: Investment in advanced manufacturing technologies and process improvements.

- Innovation Pipeline: Funding for developing next-generation products and solutions across key business areas.

- 2023 R&D Expenditure: Fosun Pharma's R&D spending reached RMB 7.46 billion, reflecting a strategic investment in future growth.

Financing Costs and Debt Management

Fosun International's investment-centric strategy inherently involves significant financing costs, primarily stemming from interest payments on its substantial debt. As of the first half of 2024, the company continued its efforts to deleverage, aiming to lower its interest expenses.

The company's focus on reducing interest-bearing debt directly impacts its cost structure by mitigating the burden of financing. This strategy is crucial for improving profitability and financial flexibility.

- Interest Expense Reduction: Fosun has been actively working to decrease its overall debt levels to lower its interest payments.

- Debt Management Strategy: The company's approach involves optimizing its debt portfolio and exploring various financing options to manage costs effectively.

- Impact on Profitability: Successfully reducing financing costs directly contributes to improved net profit margins and enhanced shareholder value.

Fosun International's cost structure is heavily influenced by its significant investment in acquisitions and integration, alongside substantial operational expenses across its diverse global segments. Personnel and R&D spending are also major components, reflecting its strategy of growth and innovation.

Financing costs, particularly interest expenses on debt, represent another critical element. The company actively manages its debt to alleviate these costs and improve financial health, a strategy that remained a focus throughout 2023 and into the first half of 2024.

| Cost Category | Key Drivers | Notable 2023/2024 Data Points |

|---|---|---|

| Acquisition & Integration | M&A activities, due diligence, integration expenses | Consistent allocation to strengthen core businesses and explore new ventures. |

| Operational Expenses | Healthcare, tourism, manufacturing operations, raw materials, R&D, marketing | Fosun Pharma operating expenses: RMB 29.4 billion (2023). |

| Personnel Costs | Salaries, benefits, training for over 100,000 employees | Employee remuneration expenses: ~RMB 24.1 billion (approx. $3.3 billion USD) (2023). |

| Research & Development | Drug discovery, clinical trials, manufacturing tech advancement | Fosun Pharma R&D expenses: RMB 7.46 billion (2023). |

| Financing Costs | Interest payments on debt | Ongoing deleveraging efforts in H1 2024 to reduce interest expenses. |

Revenue Streams

Fosun International's primary revenue engine is its industrial operations, spanning critical sectors like health, happiness, and wealth. This means money comes in directly from the businesses they own and run in these areas.

For instance, in the health sector, revenue is generated from selling pharmaceutical products and providing medical services. In the happiness segment, this includes income from tourism and leisure offerings like Club Med and Atlantis Sanya. The wealth segment contributes through premiums and fees from financial services.

These diverse operational activities collectively fuel Fosun's financial performance. To illustrate the scale, in 2024, Fosun International reported a substantial total revenue of RMB192.14 billion, underscoring the significance of these direct operational revenue streams.

Fosun International's revenue streams are significantly boosted by investment returns and dividends from its diverse portfolio. This highlights its strategic approach, acting as both a hands-on industrial operator and a shrewd financial investor.

In 2023, Fosun reported that its financial segment, which includes investment income, played a crucial role in its overall performance. The company actively manages its investments across various sectors, seeking capital appreciation and steady income generation.

The dividends received from its equity stakes in companies like Fosun Pharma and other industrial holdings contribute a substantial portion of this revenue. These payouts are a direct result of the profitability and shareholder-friendly policies of its portfolio businesses.

Furthermore, returns from its investment funds, which can include private equity and venture capital activities, add another layer to its income generation. These funds allow Fosun to capitalize on growth opportunities across emerging and established markets, diversifying its financial gains.

Fosun International's wealth segment generates significant revenue through asset management fees. These fees are collected from both institutional investors and individual clients who entrust Fosun with managing their financial portfolios. This revenue stream is a core component of their financial services offering, reflecting the trust placed in their investment expertise.

A substantial portion of these asset management fees originates from Fosun's extensive insurance businesses. The company leverages its insurance operations to attract and manage assets, thereby creating a synergistic revenue model. This integration allows Fosun to offer a broader range of financial products and services to its customer base.

In 2023, Fosun International reported that its wealth segment, which includes asset management, contributed significantly to its overall financial performance. For instance, the company’s wealth management business saw robust growth, with management fees playing a crucial role. While specific figures for asset management fees alone are often embedded within broader segment reporting, the consistent growth in the wealth segment underscores the importance of this revenue stream.

Beyond insurance, other financial service entities within the Fosun group also contribute to asset management fee income. This diversification across various financial platforms broadens Fosun's reach and strengthens its position in the competitive asset management landscape. The company actively seeks to expand its managed assets under advisement across different client types and investment strategies.

Proceeds from Asset Divestments and Exits

Fosun International actively generates revenue through the divestment of non-core assets and strategic exits from certain investments. This approach is a key component of their asset-light strategy, aimed at improving financial flexibility and refining their overall portfolio. For instance, in 2023, Fosun announced the sale of a portion of its stake in its online healthcare business, which was anticipated to bring in significant proceeds.

These divestments not only boost liquidity but also allow Fosun to concentrate resources on its more promising and strategic business segments. The company's ongoing review of its asset base means that such revenue streams are a recurring element in their financial planning.

- Asset Sales: Revenue generated from selling off non-essential or underperforming assets.

- Investment Exits: Proceeds from divesting stakes in companies or projects where Fosun has previously invested.

- Portfolio Optimization: This strategy enhances financial health by freeing up capital and reducing exposure to less strategic areas.

- Strategic Realignment: Divestments support Fosun's broader goal of becoming more agile and focused on core growth areas.

Property Development and Management Income

Fosun International generates significant revenue from its property development and management arm, primarily through its Hive Property segment. This division concentrates on creating and running comprehensive urban commercial complexes and attractive tourist destinations, tapping into consumer spending and real estate value appreciation.

Key revenue drivers within this segment include:

- Sales of developed properties: Revenue from selling residential, commercial, and retail spaces within their integrated complexes.

- Rental income: Ongoing earnings from leasing commercial and retail units in their operational properties.

- Management fees: Income generated from providing property management services to both their own developments and potentially third-party properties.

- Tourism and hospitality revenue: Earnings from operating hotels, entertainment facilities, and other attractions within their tourist destinations.

In 2024, Fosun International continued to see contributions from its property segment, reflecting the ongoing demand for well-managed, multi-use urban spaces and leisure destinations. The company's strategy involves creating synergistic environments that not only generate sales but also provide stable, recurring income streams.

Fosun International's revenue streams are predominantly derived from its industrial operations, encompassing health, happiness, and wealth sectors. This direct engagement in running businesses, such as pharmaceuticals, medical services, tourism (Club Med), and financial services, forms the bedrock of its income. In 2024, the company's total revenue reached RMB192.14 billion, a testament to the strength of these operational activities.

Investment returns and dividends from its extensive portfolio also significantly contribute to Fosun's revenue. The company actively manages its stakes in various entities, including Fosun Pharma, to generate capital appreciation and income. Furthermore, its wealth segment, particularly asset management fees from insurance and other financial services, represents a crucial and growing income source, demonstrating a dual approach of operational management and strategic investment.

The company also generates revenue through the strategic divestment of non-core assets and investment exits, which enhances financial flexibility and allows for resource reallocation to more promising ventures. Additionally, its property development and management arm, Hive Property, contributes through property sales, rental income, and tourism-related earnings, further diversifying its revenue base.

| Revenue Stream | Description | Key Drivers | 2024 Relevance |

| Industrial Operations | Direct income from running businesses in health, happiness, and wealth sectors. | Pharmaceutical sales, medical services, tourism, financial services. | RMB192.14 billion total revenue in 2024 highlights its significance. |

| Investment Returns & Dividends | Income from equity stakes and managed investment funds. | Capital appreciation, dividends from portfolio companies (e.g., Fosun Pharma). | Crucial for overall financial performance, complementing operational income. |

| Asset Management Fees | Fees earned from managing client assets, primarily in the wealth segment. | Insurance operations, financial services, institutional and individual clients. | Consistent growth in wealth segment underscores importance. |

| Divestments & Exits | Proceeds from selling non-core assets and investments. | Strategic exits, portfolio optimization, asset-light strategy. | A recurring element for liquidity and strategic focus. |

| Property Development & Management | Revenue from real estate projects and operations. | Property sales, rental income, management fees, tourism and hospitality. | Continued contributions from urban complexes and tourist destinations. |

Business Model Canvas Data Sources

The Fosun International Business Model Canvas is constructed using a diverse range of data sources, including its extensive financial reports, comprehensive market research across its varied industries, and internal strategic planning documents. These inputs ensure a robust and accurate representation of the company's operations and market positioning.