Fluor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

Fluor's strengths lie in its global reach and diverse project portfolio, but its reliance on large-scale infrastructure projects presents significant opportunities and threats. Understanding the nuances of their market position requires a deeper dive into their competitive landscape and operational efficiencies. Discover the complete picture behind Fluor's market position with our full SWOT analysis.

This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to capitalize on the engineering and construction giant's potential. Want the full story behind Fluor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fluor's global presence is a significant strength, allowing it to serve clients across diverse regions and industries, including energy, chemicals, mining, infrastructure, and advanced technologies. This broad operational scope, encompassing engineering, procurement, construction, and maintenance, helps to buffer the company against downturns in any single market. For instance, in 2023, Fluor reported revenue from operations across numerous countries, demonstrating its extensive international footprint.

Fluor demonstrated remarkable financial resilience in 2024, reporting a substantial increase in revenue and net income, bolstered by the strategic deconsolidation of NuScale. This financial strength is further evidenced by the company achieving its highest operating cash flow since 2015, a clear indicator of enhanced financial management and a robust balance sheet.

The company's commitment to shareholder value is underscored by its active program of share repurchases, reflecting confidence in its financial stability and future prospects. This focus on cash flow generation and capital return positions Fluor favorably for continued growth and investment.

Fluor has strategically shifted its business model towards a greater reliance on reimbursable contracts. This transition has substantially de-risked its project pipeline.

By late 2024, the company reported that roughly 80% of its backlog consisted of reimbursable agreements. This is a significant increase from previous periods, where fixed-price contracts posed greater financial volatility.

The emphasis on reimbursable contracts directly mitigates the risk of cost overruns, which had previously impacted profitability on fixed-price projects. This strategic pivot enhances Fluor's revenue stability and predictability.

This change in contract mix provides a more secure financial foundation, allowing for better operational planning and execution across its diverse project portfolio.

Expertise in Complex and High-Value Projects

Fluor's expertise in complex and high-value projects is a significant strength. The company has a proven track record of successfully managing large-scale, intricate initiatives that demand integrated solutions and sophisticated project management techniques. This capability allows Fluor to tackle challenging projects across diverse industries.

Recent contract awards underscore Fluor's leadership in specialized sectors. For instance, in 2023, Fluor secured a substantial contract for a life sciences facility in Europe and a significant mining project in South America, totaling over $2 billion in new awards for these complex ventures. These wins highlight Fluor's ability to deliver impactful projects globally, even in highly regulated and technically demanding environments.

- Global Reach: Fluor's ability to execute projects worldwide demonstrates its capacity to navigate international markets and diverse regulatory landscapes.

- Industry Leadership: Recognition in sectors like life sciences and mining points to deep technical knowledge and proven execution capabilities.

- Financial Scale: Handling projects valued in the billions signifies robust financial management and resource allocation expertise.

- Integrated Solutions: Fluor's strength lies in combining engineering, procurement, and construction (EPC) to offer comprehensive project delivery.

Strategic Focus on Growth Sectors

Fluor's strategic focus on growth sectors, outlined in its 'Building a Better Future' strategy, is a significant strength. This plan, evolving to 'grow and execute' for the 2025-2028 period, actively targets areas poised for substantial expansion. The company is positioning itself to capitalize on global trends by prioritizing investments in the energy transition, advanced technologies, life sciences, and critical minerals.

This strategic alignment is crucial for future success. For instance, Fluor has secured significant awards in these areas. In early 2024, they announced a major contract for a clean hydrogen production facility, a key component of the energy transition. Furthermore, their backlog in the advanced technologies sector saw a notable increase in Q1 2024, reflecting successful project wins and a strong market demand.

- Targeting High-Growth Markets: Fluor's strategy centers on sectors like energy transition, advanced technologies, life sciences, and critical minerals, ensuring alignment with global economic shifts.

- 'Grow and Execute' for 2025-2028: This refined strategy emphasizes not just identifying growth opportunities but also the robust execution of projects within these key sectors.

- Securing Key Projects: Early 2024 saw Fluor awarded significant contracts in clean hydrogen and advanced technology sectors, demonstrating tangible progress in executing their growth strategy.

- Positioning for Sustainable Expansion: By focusing on these dynamic industries, Fluor is building a foundation for sustained revenue growth and market leadership in the coming years.

Fluor's strategic shift to a majority of reimbursable contracts, reaching approximately 80% of its backlog by late 2024, significantly reduces project cost overrun risk. This de-risking enhances revenue stability and predictability, providing a more secure financial foundation. The company's ability to successfully manage complex, high-value projects, evidenced by over $2 billion in new awards for life sciences and mining in 2023, further highlights its execution prowess.

Fluor's financial performance in 2024 showed considerable strength, with a substantial increase in revenue and net income, partly due to the NuScale deconsolidation. The company achieved its highest operating cash flow since 2015, underscoring improved financial management and a robust balance sheet. This financial resilience is complemented by an active share repurchase program, signaling confidence in future prospects and a commitment to shareholder value.

Fluor is strategically positioned in high-growth sectors such as energy transition, advanced technologies, life sciences, and critical minerals, as detailed in its evolving 'grow and execute' strategy for 2025-2028. Early 2024 contract wins, including a significant clean hydrogen facility project, demonstrate the successful implementation of this focus. This targeted approach aims to capitalize on global trends and ensure sustained revenue growth.

| Metric | 2023 | Early 2024 (Q1/H1) | Significance |

|---|---|---|---|

| Reimbursable Contract % of Backlog | ~75% (approx.) | ~80% | Reduced cost overrun risk, enhanced revenue stability |

| Major Contract Wins (2023) | >$2 Billion (Life Sciences & Mining) | - | Demonstrates expertise in complex, high-value projects |

| Operating Cash Flow | - | Highest since 2015 | Indicates strong financial management and liquidity |

| Strategic Sector Growth | Ongoing | Key project wins (e.g., Clean Hydrogen) | Alignment with global growth trends (Energy Transition, Tech) |

What is included in the product

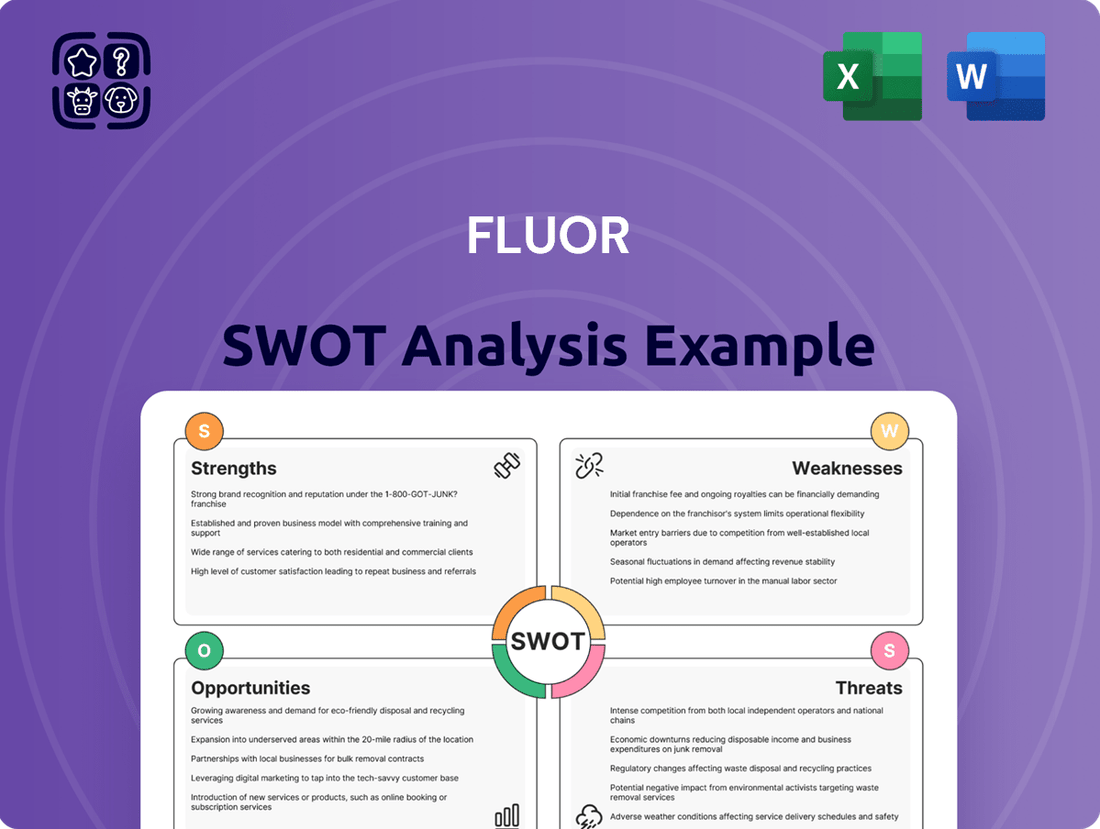

Delivers a strategic overview of Fluor’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights, reducing analysis paralysis.

Weaknesses

Fluor's Energy Solutions segment faced significant profitability headwinds in 2024. This segment, a substantial contributor to Fluor's overall revenue, saw its profit margins squeezed due to escalating costs and ongoing schedule difficulties on a major project that was in its final stages.

The challenges were exacerbated by a noticeable dip in productivity on this large, nearing-completion project. These issues collectively impacted the segment's financial performance, highlighting a key area of concern for Fluor's operational efficiency and project execution capabilities.

Fluor's significant reliance on the oil and gas sector, particularly within its Energy Solutions segment, exposes it to the inherent cyclicality of these markets. This dependence means that downturns in energy prices can directly impact the company's project pipeline and revenue streams.

For instance, volatility in crude oil and natural gas prices, a persistent issue throughout 2024 and into 2025, can trigger project delays or outright cancellations. This directly reduces demand for Fluor's engineering, procurement, and construction services, creating a challenging operating environment.

Despite an improvement in overall operating cash flow, Fluor's legacy fixed-price projects remain a significant drain. Management anticipates up to $200 million in additional funding needs for these older ventures in 2025. These projects continue to represent an ongoing financial burden and inherent risk for the company.

Competition and Margin Pressure

Fluor operates within the engineering and construction sector, an arena defined by its demanding competitive landscape and substantial client influence. This environment inherently puts pressure on pricing and profitability.

Maintaining healthy profit margins presents a persistent hurdle for Fluor. Despite ongoing strategic adjustments aimed at bolstering profitability, the company experienced some margin erosion in 2024, highlighting the ongoing challenges in this area. For instance, while specific margin figures fluctuate, the industry average for large-scale EPC projects often hovers in the low to mid-single digits, making even minor deteriorations impactful.

- Intense Industry Competition: The engineering and construction market is known for its high level of competition, impacting Fluor's ability to command higher prices.

- Customer Bargaining Power: Clients in this sector often possess significant leverage, contributing to margin pressures.

- Challenges in Margin Improvement: Despite strategic efforts, Fluor has faced difficulties in consistently improving its profit margins, as seen with instances of deterioration in 2024.

- Tight-Margin Business Model: The inherent nature of the engineering and construction business often results in slim profit margins, demanding rigorous cost management.

Operational Hurdles and Project Execution Risks

Fluor has recently grappled with significant operational hurdles, particularly in executing large-scale projects. For instance, challenges encountered with Liquefied Natural Gas (LNG) Canada (LNGC) and the monetization of Small Modular Reactors (SMRs) have drawn analyst attention. These difficulties can translate into substantial cost overruns and project delays.

These execution risks directly impact Fluor's financial performance and market standing. Beyond the immediate financial strain, such setbacks can erode client confidence, making it harder to secure future contracts and potentially impacting the company's backlog visibility. For example, in the first quarter of 2024, Fluor reported a net loss of $118 million, partly influenced by project challenges.

- Project Delays: Significant delays in key projects like LNGC have led to increased costs and revenue recognition challenges.

- Cost Overruns: Execution difficulties have resulted in cost escalations on several major projects, impacting profitability.

- Reputational Risk: Persistent operational issues can damage Fluor's reputation, affecting its ability to win new business.

- SMR Monetization Challenges: The company is facing hurdles in realizing value from its SMR technology investments, adding to financial uncertainty.

Fluor's profitability has been hampered by margin erosion in 2024, a persistent challenge in the highly competitive engineering and construction sector where customer bargaining power often dictates pricing. The company's reliance on legacy fixed-price projects continues to be a significant financial burden, with up to $200 million in additional funding anticipated for these ventures in 2025.

Operational execution remains a key weakness, as evidenced by challenges with major projects like LNGC and SMR monetization, which have led to cost overruns and delays. For example, Fluor reported a net loss of $118 million in Q1 2024, partly due to these project-related difficulties. These issues not only impact current financials but also pose a reputational risk, potentially affecting future contract wins.

| Weakness Area | Impact | Supporting Data/Examples |

|---|---|---|

| Profit Margin Pressure | Reduced profitability due to competition and customer leverage. | Industry average margins for large EPC projects are often low single digits; margin erosion observed in 2024. |

| Legacy Project Financial Strain | Ongoing costs and financial risk from older fixed-price contracts. | Anticipated $200 million in additional funding needs for legacy projects in 2025. |

| Project Execution Difficulties | Cost overruns, delays, and potential reputational damage. | Challenges with LNGC and SMRs; $118 million net loss in Q1 2024 attributed partly to project issues. |

Full Version Awaits

Fluor SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an authentic look at the Fluor SWOT analysis. Purchase unlocks the complete, in-depth report, offering a comprehensive understanding of Fluor's strategic position.

Opportunities

Fluor is well-positioned to benefit from the accelerating global shift towards cleaner energy and cutting-edge technologies. The company's expertise aligns with the growing investments in renewable energy infrastructure, such as solar and wind power projects, which are crucial for decarbonization efforts. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to grow significantly, offering substantial opportunities for Fluor's engineering and construction services.

Furthermore, emerging sectors like carbon capture and sequestration (CCS) present a significant growth avenue, as industries worldwide seek to reduce their carbon footprint. Fluor's involvement in advanced technologies, including life sciences, semiconductors, and data centers, also taps into robust market expansion. The semiconductor industry alone saw substantial investment in new fabrication plants in 2024, driven by demand for advanced chips.

Global infrastructure investment is on the rise, with an estimated $78 trillion needed by 2040, according to the Global Infrastructure Hub. This massive spending, especially in developing nations experiencing rapid urbanization, directly benefits Fluor. The company is well-positioned to capitalize on this trend, particularly in critical sectors like transportation networks, essential water and wastewater management systems, and the development of advanced smart city technologies designed to improve urban living.

Fluor's dedicated Urban Solutions segment is already demonstrating the company's ability to capture this growth. In 2023, this segment saw its revenue increase by 15%, reaching $2.1 billion. This expansion highlights Fluor's strategic focus and proven track record in delivering complex urban development projects, further solidifying its competitive advantage in a burgeoning market.

Fluor actively seeks strategic partnerships and potential mergers and acquisitions (M&A) to bolster its capabilities and market standing. This strategy allows the company to broaden its operational footprint, incorporate cutting-edge technologies, and solidify its competitive advantage in crucial sectors.

For example, in 2024, Fluor announced a joint venture with a renewable energy developer to expand its presence in the burgeoning offshore wind market, leveraging shared expertise and resources to capture a larger market share.

These strategic moves are designed to not only expand Fluor's geographic reach but also to integrate specialized skills and innovative solutions, thereby enhancing its overall value proposition to clients and stakeholders.

Leveraging Strong Backlog for Future Revenue

Fluor's substantial ending backlog of $28.5 billion at the close of 2024 provides a robust platform for sustained revenue growth. A significant portion of this backlog is reimbursable, offering a degree of predictability and mitigating risk in revenue streams.

This strong order book directly supports Fluor's optimistic revenue growth projections for 2025. The company anticipates this backlog will translate into tangible financial performance throughout the upcoming fiscal year.

- Ending Backlog (2024): $28.5 billion

- Reimbursable Portion: Significant, contributing to revenue stability

- Impact on 2025: Supports optimistic revenue growth forecasts

- Future Revenue Generation: Strong foundation for continued performance

Government Contracts and Defense Initiatives

Fluor's Mission Solutions segment, a cornerstone for its government and defense work, is experiencing notable growth. This division, which handles nuclear, civil, defense, and intelligence projects for various governmental bodies, has demonstrated consistent improvement. A significant development occurred in 2024 when Fluor secured a multi-billion-dollar contract with the Department of Energy (DOE), underscoring the sector's robust demand and Fluor's competitive position.

This stable sector offers a predictable revenue stream and presents numerous long-term project opportunities. The consistent flow of government business, particularly in defense and infrastructure, provides a reliable foundation for Fluor's operations. Such contracts often span several years, offering visibility and stability in project pipelines.

- Multi-Billion Dollar DOE Contract: Fluor secured a significant contract from the Department of Energy in 2024, highlighting its strength in government projects.

- Stable Revenue Streams: The Mission Solutions segment benefits from consistent, long-term government engagements, offering predictable income.

- Long-Term Project Pipeline: Defense and civil initiatives typically involve multi-year commitments, ensuring sustained business for Fluor.

- Strategic Government Partnerships: Fluor's deep involvement in nuclear, civil, defense, and intelligence sectors fosters strong relationships with government entities.

Fluor is poised to capitalize on the global energy transition, with significant opportunities in renewable energy infrastructure and emerging sectors like carbon capture. The company's expertise in advanced technologies, including semiconductors and life sciences, also taps into rapidly expanding markets. Global infrastructure investment, projected to reach $78 trillion by 2040, offers substantial project potential, particularly in transportation and smart city development.

Fluor's strategic partnerships and potential M&A activities in 2024, such as its joint venture in offshore wind, are designed to enhance its capabilities and market reach. The company's substantial $28.5 billion ending backlog in 2024 provides a strong foundation for sustained revenue growth into 2025, with a significant portion being reimbursable for added stability.

The Mission Solutions segment shows robust growth, evidenced by a multi-billion dollar contract secured with the Department of Energy in 2024. This sector offers stable, long-term project opportunities in defense and civil initiatives, reinforcing Fluor's position with government entities.

| Opportunity Area | Market Context/Data | Fluor's Relevance |

|---|---|---|

| Renewable Energy | Global renewable energy market valued at ~$1.3 trillion in 2023, projected significant growth. | Expertise in solar, wind, and infrastructure development aligns with decarbonization efforts. |

| Emerging Technologies | Semiconductor industry saw substantial new fab investments in 2024. | Involvement in advanced technologies like life sciences, semiconductors, and data centers. |

| Global Infrastructure | Estimated $78 trillion needed by 2040 for global infrastructure. | Well-positioned for transportation, water management, and smart city projects. |

| Strategic Growth | Joint venture in offshore wind announced in 2024. | Partnerships and M&A to expand capabilities and market standing. |

| Backlog Strength | Ending backlog of $28.5 billion at close of 2024. | Provides robust platform for sustained revenue growth into 2025. |

| Government Contracts | Multi-billion dollar DOE contract secured in 2024. | Strong position in Mission Solutions segment for stable, long-term government projects. |

Threats

Fluor's global footprint, with operations across numerous countries, inherently exposes the company to significant geopolitical risks. Fluctuations in government policies, the imposition of new trade restrictions, and the escalation of international conflicts can directly disrupt ongoing projects. For instance, geopolitical tensions in regions where Fluor operates could lead to project delays or outright cancellations, impacting revenue streams and profitability.

The economic consequences of such instability are substantial. Changes in currency exchange rates due to political events, increased costs associated with navigating complex international regulations, and the potential for asset seizure in volatile regions are all tangible threats. In 2024, ongoing conflicts and trade disputes globally continued to create an unpredictable environment, requiring robust risk management strategies for companies like Fluor.

The cyclical nature of the engineering and construction sector, particularly within energy markets, presents an ongoing challenge for Fluor. This inherent ebb and flow means demand for their services can shift dramatically based on broader economic conditions and industry trends.

Persistent volatility or sustained downturns in commodity prices, such as oil and gas, directly threaten Fluor's business. Lower prices often translate to reduced capital expenditure by clients in these sectors, thereby dampening demand for Fluor's project execution and engineering capabilities, and can negatively impact the profitability of existing projects.

For instance, the energy sector's sensitivity to oil price fluctuations is well-documented; a sustained period of prices below $70 per barrel, as seen intermittently in recent years leading up to 2024, typically leads to project deferrals and cancellations, directly impacting Fluor's backlog and revenue potential.

Moreover, market cyclicality can lead to periods of overcapacity in certain construction segments, intensifying competition and potentially driving down margins for companies like Fluor, even when overall economic activity is stable.

Fluor operates in a highly competitive landscape, facing significant rivalry from other major Engineering, Procurement, and Construction (EPC) firms worldwide. This intense competition frequently translates into aggressive bidding for projects, which can put considerable pressure on profit margins. For instance, in the fiscal year 2023, Fluor reported revenues of $13.8 billion, highlighting the scale of operations within this competitive environment.

This competitive pricing environment is particularly acute for more standardized project offerings where differentiation is less pronounced. Companies often must absorb costs or accept lower margins to secure contracts, impacting overall profitability. The global nature of the EPC market means Fluor is not only competing with established players but also with emerging regional competitors who may have lower overheads.

Project Execution and Cost Overrun Risks

Fluor still faces considerable threats from project execution and cost overruns, even with a move towards reimbursable contracts. Any lingering fixed-price agreements present a direct risk of financial losses if costs escalate beyond initial estimates. For instance, in 2023, Fluor reported that its backlog included approximately $3.3 billion in fixed-price contracts, which are more susceptible to cost overruns than reimbursable ones.

Key factors contributing to these risks include potential labor shortages, the reliability of subcontractor performance, and the ever-present possibility of unforeseen events impacting project timelines and budgets. These challenges can lead to significant financial strain and legal entanglements, directly affecting Fluor's profitability and operational stability.

- Persistent Fixed-Price Contracts: As of the end of 2023, Fluor's backlog still contained a significant portion of fixed-price contracts, carrying inherent risks of cost escalation.

- Labor and Subcontractor Volatility: Shortages in skilled labor and potential underperformance by subcontractors can directly lead to project delays and increased costs.

- Unforeseen Event Impact: Geopolitical instability, supply chain disruptions, or unexpected site conditions can trigger cost overruns and project execution challenges.

- Legal and Dispute Potential: Project delays and cost overruns often increase the likelihood of legal disputes, further impacting financial performance.

Technological Disruption and Cybersecurity

Fluor faces significant threats from rapid technological advancements, particularly in construction. For instance, the rise of modular construction and advanced robotics, as highlighted by industry reports in early 2024, necessitates substantial and ongoing investment in new equipment and training to maintain a competitive edge. Failure to adapt quickly could lead to missed opportunities and decreased market share.

Furthermore, Fluor’s increasing digitalization of operations and project management exposes it to escalating cybersecurity risks. A major data breach, which could disrupt operations and compromise sensitive client information, represents a critical threat. In 2023, the global cost of cybercrime was estimated to be over $10 trillion, underscoring the pervasive and costly nature of these threats for companies like Fluor.

- Technological Obsolescence: Competitors adopting newer, more efficient construction technologies could outpace Fluor if it doesn't invest in innovation.

- Cybersecurity Breaches: Attacks could lead to operational downtime, data theft, significant financial losses, and reputational damage.

- Data Integrity Risks: Compromised operational data due to cyber threats could lead to flawed project execution and costly errors.

- Increased IT Spending: The need to constantly upgrade and secure technological infrastructure represents a growing operational cost.

Fluor's significant exposure to fixed-price contracts, which constituted approximately $3.3 billion of its backlog at the end of 2023, presents a direct risk of financial losses if project costs escalate beyond initial estimates. This is compounded by the potential for labor shortages and subcontractor underperformance, both of which can lead to project delays and increased expenses, impacting profitability.

SWOT Analysis Data Sources

This Fluor SWOT analysis is meticulously constructed using a combination of publicly available financial statements, comprehensive industry market research reports, and expert analyses of global economic and geopolitical trends to provide a robust and actionable assessment.