Fluor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

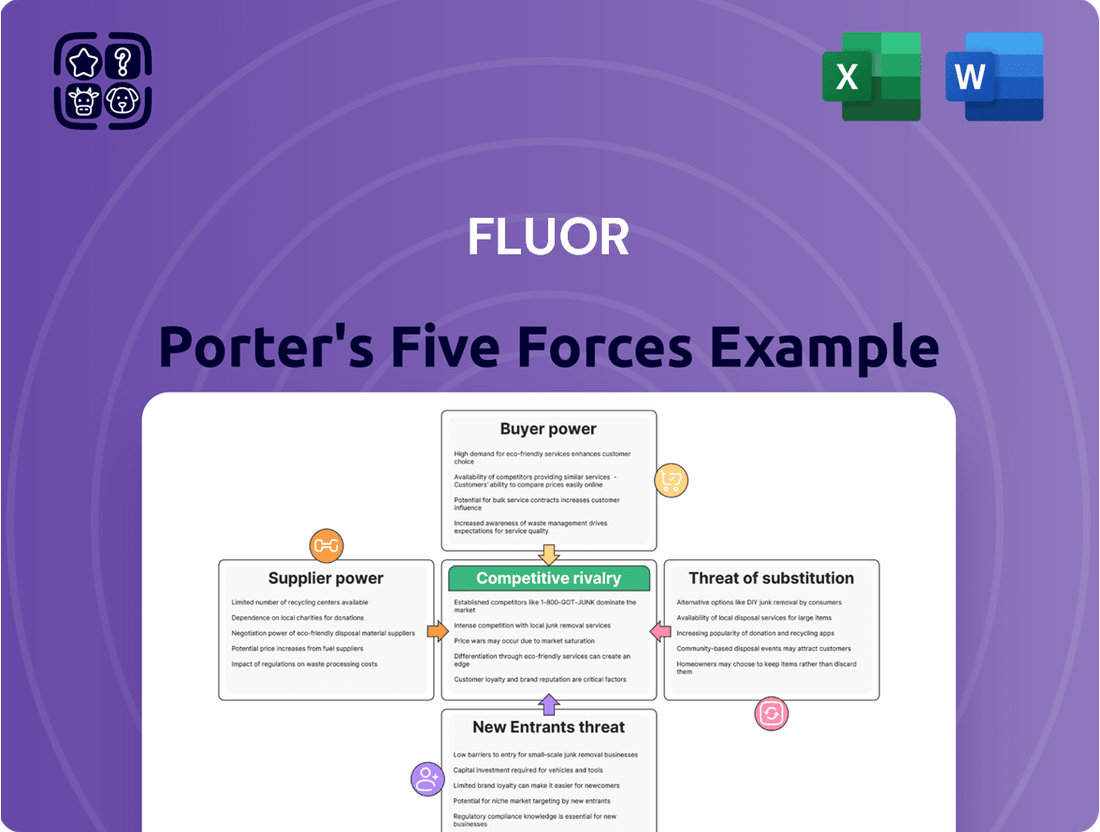

Fluor's competitive landscape is a complex web of industry forces, and understanding them is crucial for strategic success. Porter's Five Forces provides a powerful lens to dissect these pressures, revealing how supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry shape Fluor's market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fluor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fluor's reliance on a concentrated group of specialized equipment and technology providers, like major construction machinery manufacturers, significantly impacts its operational costs and project timelines. This limited pool of critical component suppliers can wield considerable bargaining power.

The global engineering and construction equipment manufacturing sector, for example, is characterized by a handful of dominant global players. In 2024, companies like Caterpillar, Komatsu, and Hitachi Construction Machinery continue to hold substantial market share, often exceeding 60% of the heavy equipment market in key regions. This market concentration grants these suppliers substantial leverage in negotiating prices, delivery schedules, and contract terms with large buyers such as Fluor.

A company's reliance on specific crucial raw materials significantly impacts the bargaining power of its suppliers. For instance, many construction firms depend heavily on steel and concrete, materials known for their price swings and potential supply chain hiccups. In recent years, steel prices alone have seen annual variations of 15-20%, demonstrating this volatility.

This inherent dependency grants suppliers substantial leverage. They can influence project expenses and schedules by adjusting prices or controlling availability. Such control can create challenges for companies trying to maintain predictable costs and meet project deadlines.

The persistent shortage of skilled labor in engineering and construction, particularly for specialized engineers and technical roles, significantly boosts the bargaining power of these human resource suppliers. Fluor faces heightened competition for this limited talent, directly impacting labor costs and project timelines. This trend is anticipated to continue, presenting ongoing challenges for talent acquisition through 2025.

High Switching Costs for Specialized Inputs

For Fluor, the bargaining power of suppliers is notably amplified when dealing with specialized inputs. Switching to a new provider for highly specialized equipment or intricately integrated technological solutions often necessitates substantial financial investment and can lead to considerable operational disruptions.

These switching costs aren't trivial. For instance, in certain projects, the expenses associated with reconfiguring and integrating new equipment from a different supplier have been estimated to fall within the range of $2.3 million to $4.7 million. Such significant financial hurdles inherently reduce Fluor's agility in seeking alternative suppliers, thereby enhancing the leverage held by existing suppliers.

- High Switching Costs: Significant financial and operational challenges arise when changing suppliers for specialized inputs.

- Estimated Reconfiguration Costs: Projects can incur $2.3 million to $4.7 million in expenses to reconfigure and integrate new equipment.

- Reduced Flexibility: These substantial costs limit Fluor's ability to negotiate favorable terms or easily move to alternative suppliers.

- Strengthened Supplier Power: The inherent switching difficulties empower suppliers, giving them greater influence in pricing and contract negotiations.

Proprietary Technology and Intellectual Property

Suppliers possessing proprietary technology or unique intellectual property wield significant leverage over companies like Fluor. These suppliers offer specialized solutions, such as advanced Building Information Modeling (BIM) software or AI-powered analytics platforms, which are increasingly vital for Fluor's project efficiency and precision. As digital transformation accelerates across the industry, the reliance on these critical, specialized inputs only intensifies.

This dependence translates directly into supplier bargaining power. For instance, a 2024 market report indicated that companies heavily reliant on specialized engineering software saw their operating costs increase by an average of 5% due to licensing renewals with limited negotiation windows. Fluor's ability to secure these cutting-edge tools at favorable terms is directly impacted by the uniqueness and indispensability of the supplier's offering.

- Proprietary technology grants suppliers substantial bargaining power.

- Fluor's reliance on advanced BIM and AI analytics amplifies this power.

- The accelerating adoption of digital tools makes these specialized inputs more critical.

- Industry data suggests significant cost increases for firms dependent on such software.

Fluor faces significant supplier bargaining power due to the concentrated nature of critical equipment providers and the high switching costs associated with specialized inputs. This leverage can impact project expenses and timelines, especially when dealing with proprietary technology and limited talent pools.

The dominance of a few key players in heavy machinery, such as Caterpillar and Komatsu, grants them considerable negotiation power in 2024. Furthermore, the scarcity of specialized engineering talent means suppliers of human capital can command higher rates, affecting Fluor's operational costs.

Switching suppliers for complex technological solutions can cost Fluor between $2.3 million and $4.7 million, severely limiting its flexibility and strengthening the position of existing providers. This dependence on unique offerings, like advanced BIM software, can lead to cost increases, with some firms experiencing average operating cost hikes of 5% due to software licensing in 2024.

| Factor | Impact on Fluor | 2024 Data/Trend |

|---|---|---|

| Equipment Market Concentration | Suppliers have strong pricing power | Top 3 heavy equipment manufacturers hold over 60% market share |

| Specialized Input Switching Costs | Limits Fluor's negotiation leverage | Estimated $2.3M - $4.7M per project |

| Proprietary Technology Reliance | Increases supplier control | 5% average operating cost increase for dependent firms (software licensing) |

| Skilled Labor Shortage | Drives up labor costs | Persistent shortage anticipated through 2025 |

What is included in the product

Evaluates the intensity of competition, the power of buyers and suppliers, the threat of new entrants and substitutes, all specific to Fluor's operating environment.

Identify and mitigate competitive threats with a clear, actionable overview of all five forces, transforming complex market dynamics into manageable strategic levers.

Customers Bargaining Power

Fluor's customers are frequently major corporations or government bodies engaged in massive projects within industries such as energy, chemicals, mining, and infrastructure. These clients often involve substantial capital outlays, granting them considerable influence during contract discussions.

The sheer scale of these projects means that a few large clients can represent a significant portion of Fluor's business. For instance, Fluor's 2023 revenue reached $14.4 billion, with a notable contribution from energy and chemical sectors, underscoring the magnitude of their client relationships and the bargaining power these clients wield.

Customers often leverage competitive bidding processes to secure Engineering, Procurement, and Construction (EPC) contractors, which significantly amplifies price pressure on companies like Fluor. In 2023 alone, Fluor actively participated in 412 major infrastructure and energy project bids, securing a win rate of 38%.

This win rate underscores the intense competition within the sector, empowering customers to negotiate more favorable terms and pricing. Consequently, Fluor faces the imperative to consistently offer competitive pricing and demonstrate superior value to win these crucial contracts.

Customer price sensitivity is a major factor for Fluor, particularly in sectors driven by commodities. When market conditions fluctuate, clients become acutely aware of project costs, seeking cost certainty before committing. This sensitivity can directly affect Fluor’s new business awards and overall backlog.

For instance, periods of economic downturn or unpredictable commodity prices often lead clients to reduce capital spending or postpone crucial projects. This trend was evident in late 2023 and early 2024, where many energy and mining clients cited these very reasons for delaying investment decisions.

As of early 2025, a significant number of potential clients are still waiting for greater market clarity and more predictable cost structures before finalizing their investment plans. This cautious approach from customers directly impacts Fluor's ability to secure new contracts and maintain a robust pipeline of work.

In-House Capabilities and Backward Integration Threat

Large clients, particularly those in sectors like oil and gas or chemicals, may possess significant in-house engineering and project management expertise. This capability allows them to consider backward integration, effectively performing some project functions themselves rather than outsourcing them entirely to EPC firms like Fluor. For instance, a major energy company might develop its own detailed engineering division or manage procurement directly, thereby reducing its dependency on external providers.

This threat of backward integration directly impacts Fluor's revenue streams and market share. When clients bring capabilities in-house, Fluor loses potential project revenue. To counter this, Fluor must continually demonstrate superior value, specialized skills, and cost-effectiveness to retain its client base and win new projects.

The ability of clients to integrate backward is a direct lever they can use in negotiations. They can leverage their internal capacity as a benchmark or a credible alternative to Fluor's services, potentially driving down pricing demands from Fluor. This competitive pressure necessitates constant innovation and efficiency improvements from Fluor.

- Client In-House Capabilities: Major corporations increasingly develop internal engineering and project management departments.

- Backward Integration Threat: Clients may choose to perform project segments in-house, reducing reliance on external EPCs.

- Revenue Impact: This trend directly affects Fluor's potential revenue and project pipeline.

- Competitive Necessity: Fluor must maintain specialized expertise and cost competitiveness to retain clients.

Information Asymmetry and Project Complexity

While Fluor Corporation is known for its specialized expertise in complex engineering and construction projects, sophisticated clients often possess a deep understanding of their specific project needs and relevant industry cost benchmarks. This existing client knowledge can reduce the traditional information asymmetry that might otherwise give Fluor significant leverage. For instance, in 2024, major energy companies often conduct extensive pre-feasibility studies, arming themselves with detailed technical specifications and cost estimates before engaging with EPC (Engineering, Procurement, and Construction) contractors like Fluor.

Despite this client awareness, the sheer complexity and scale of large-scale projects, such as petrochemical plants or advanced manufacturing facilities, still necessitate Fluor's integrated service offerings. Clients frequently seek a single, reliable partner capable of managing the entire project lifecycle, from initial design and engineering through procurement, construction, and even commissioning. This demand for seamless, end-to-end solutions means Fluor's comprehensive capabilities remain a critical factor, even when clients are well-informed.

- Reduced Information Asymmetry: Sophisticated clients often come with extensive project knowledge and industry data, diminishing Fluor's informational advantage.

- Project Complexity as a Counterbalance: The intricate nature of large-scale projects, however, still makes Fluor's integrated expertise highly valuable and often indispensable.

- Client Demand for Integrated Solutions: Clients prioritize comprehensive service providers who can manage projects from concept to completion, underpinning Fluor's strong market position.

Fluor's customers, often large corporations and government entities undertaking massive projects, wield significant bargaining power due to the substantial capital involved. This power is amplified by competitive bidding processes, where clients can leverage multiple EPC contractors to negotiate better terms and pricing.

Customer price sensitivity, particularly in commodity-driven sectors, further empowers clients to demand cost certainty, impacting Fluor's new business awards. Additionally, the threat of backward integration, where clients develop in-house capabilities, reduces dependency on firms like Fluor and exerts downward pressure on pricing.

| Customer Bargaining Power Factor | Impact on Fluor | Supporting Data (2023/2024) |

|---|---|---|

| Project Scale & Client Size | High influence due to large contract values | Fluor's 2023 revenue: $14.4 billion; significant portion from energy/chemicals |

| Competitive Bidding | Intensifies price pressure | Fluor participated in 412 major bids in 2023, with a 38% win rate |

| Price Sensitivity | Clients delay projects or demand cost certainty | Observed in late 2023/early 2024 due to economic/commodity volatility |

| Backward Integration Threat | Reduces reliance on EPCs, impacting revenue | Major energy companies developing in-house engineering/procurement expertise |

Preview the Actual Deliverable

Fluor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It provides a comprehensive Fluor Porter's Five Forces Analysis, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This actionable framework will equip you with a deep understanding of Fluor's competitive landscape.

Rivalry Among Competitors

The global engineering, procurement, and construction (EPC) sector is a crowded arena with formidable players. Companies like VINCI, Grupo ACS, Bechtel, and China State Construction Engineering Corporation are major global competitors, each with extensive resources and project portfolios. Fluor competes directly with these established giants, as well as numerous smaller, specialized firms that can target niche markets effectively.

This intense rivalry means that companies must constantly innovate and optimize their operations to maintain market share. For instance, in 2023, the global EPC market was valued at approximately $1.4 trillion, showcasing the scale of competition. Fluor's ability to secure projects depends heavily on its pricing, technical expertise, and project execution capabilities against such a diverse and powerful set of rivals.

The engineering, procurement, and construction (EPC) sector is characterized by very high fixed costs. These include significant investments in specialized equipment, advanced technology, and highly skilled labor. These substantial upfront expenses create pressure for companies to win projects to ensure their expensive assets are utilized, often leading to intense price competition among players.

This dynamic fuels industry consolidation. Smaller firms often struggle to compete with the scale and financial muscle of larger organizations, prompting mergers and acquisitions. Companies aim to achieve economies of scale, reduce overhead per project, and expand their geographical or service offerings. For example, in 2023, the global EPC market was valued at approximately $1.5 trillion, with a notable trend of larger players acquiring smaller competitors to bolster their market share.

The power generation EPC market exemplifies this trend, with a few dominant, well-established companies holding a significant portion of the business. These large entities can leverage their size to negotiate better terms with suppliers and spread their fixed costs over a larger project pipeline, further intensifying rivalry for smaller, less capitalized firms.

Competitive rivalry among Engineering, Procurement, and Construction (EPC) firms is intense, but differentiation through specialized expertise and technological innovation is key. Fluor, for instance, distinguishes itself by offering integrated solutions across sectors like energy, chemicals, and advanced technologies, leveraging its extensive project execution history and a strong emphasis on safety. This focus allows them to command premium pricing and secure projects where deep technical knowledge is paramount.

Slow Industry Growth in Certain Segments

While the broader Engineering, Procurement, and Construction (EPC) market is anticipated to expand, specific segments within it may face a more subdued growth trajectory. This uneven expansion can lead to heightened competition as players vie for a more limited pool of opportunities.

For instance, the overall engineering and construction industry's growth is projected to be a modest 2% in 2025. Such tempered expansion naturally intensifies competition for project contracts.

This scenario directly impacts profitability, as increased competition for slower-growing segments can exert downward pressure on profit margins for companies like Fluor.

- Slower Segment Growth: Certain EPC market segments are expected to experience low growth rates.

- Intensified Competition: This slow growth fuels more aggressive competition for available projects.

- Margin Pressure: The increased rivalry can negatively affect profit margins within these segments.

- 2025 Outlook: The engineering and construction industry anticipates a 2% overall spending increase in 2025, indicating a competitive landscape.

Exit Barriers and Overcapacity

High exit barriers, like substantial investments in specialized equipment and long-term contracts, can trap companies in an industry. For instance, in the engineering and construction sector where Fluor operates, significant upfront capital for project execution and leased facilities can make exiting difficult. This often results in companies staying operational even when profits are slim, leading to market overcapacity.

This persistent presence due to high exit barriers creates sustained competitive pressure. Companies are compelled to find ways to remain efficient and competitive. For Fluor, this means a continuous focus on operational optimization and innovation to maintain profitability amidst a crowded market. For example, in 2024, the global engineering and construction market faced ongoing challenges with project delays and cost overruns, underscoring the need for efficiency.

- High Capital Investments: Projects often require substantial upfront capital, making divestment costly.

- Long-Term Contracts: Commitments to clients can extend for years, obligating continued service provision.

- Specialized Assets: Industry-specific machinery and facilities have limited resale value outside the sector.

- Overcapacity Impact: Trapped firms contribute to excess supply, intensifying price competition.

Competitive rivalry in the EPC sector is fierce, with major global players like VINCI and Bechtel vying for projects against Fluor. This intense competition is further fueled by high fixed costs associated with specialized equipment and skilled labor, pushing companies to secure contracts to utilize assets effectively. The global EPC market's approximate $1.5 trillion valuation in 2023 highlights the sheer scale of this competitive landscape.

Companies like Fluor must differentiate themselves through specialized expertise and innovation to stand out in this crowded market. For example, Fluor's integrated solutions in energy and chemicals allow it to command premium pricing. However, the industry's projected modest 2% growth in 2025 means competition for contracts will remain intense, potentially pressuring profit margins for all players.

High exit barriers, such as significant capital investments and long-term contracts, often keep companies operating even with slim profits, leading to market overcapacity. This persistence exacerbates competitive pressure, as seen in 2024 challenges with project delays and cost overruns, underscoring the critical need for operational efficiency.

| Competitor | Global Reach | Key Sectors |

|---|---|---|

| Fluor | Global | Energy, Chemicals, Infrastructure |

| VINCI | Global | Construction, Concessions, Energy |

| Grupo ACS | Global | Construction, Infrastructure, Services |

| Bechtel | Global | Infrastructure, Defense, Government Services |

| China State Construction Engineering Corp. | Global | Infrastructure, Real Estate, Construction |

SSubstitutes Threaten

Large industrial clients, especially those with significant ongoing capital expenditure, are increasingly building out their internal engineering, procurement, and construction (EPC) capabilities. This trend presents a direct threat of substitution for companies like Fluor. For instance, major oil and gas producers or large chemical manufacturers might decide that bringing certain project management and design functions in-house offers better cost control and strategic alignment.

This internal capacity can substitute for external EPC providers, particularly for more standardized or less technically demanding projects. While Fluor offers specialized expertise for complex undertakings, a client’s in-house team can handle routine expansions or upgrades, thereby bypassing the need for Fluor’s services in those specific instances. This can chip away at Fluor’s market share for a segment of its potential business.

Modular and prefabricated construction methods are increasingly emerging as significant substitutes for traditional, on-site building processes. These approaches offer compelling advantages such as accelerated project timelines, enhanced cost predictability, and superior quality assurance due to controlled factory environments. For instance, the global modular construction market was valued at approximately $114.4 billion in 2023 and is anticipated to reach $201.6 billion by 2030, demonstrating a substantial compound annual growth rate (CAGR) of 8.5%.

Clients increasingly opt for specialized consulting firms for distinct project phases, a trend that directly challenges Fluor's integrated Engineering, Procurement, and Construction Management (EPCM) model. For instance, a client might engage a top-tier engineering design firm, then manage procurement independently, and finally hire a separate construction management company. This unbundling strategy allows for greater cost control and direct oversight, acting as a significant substitute for a single, comprehensive EPCM provider.

The market for standalone project management services is robust, with many firms focusing on specific niches like digital transformation or sustainability consulting, offering alternatives to Fluor's broad capabilities. In 2024, the global project management software market alone was valued at an estimated $5.1 billion, highlighting the significant investment clients are willing to make in managing projects, even without an integrated EPCM solution. This fragmented approach allows clients to cherry-pick expertise, potentially bypassing the need for Fluor's all-encompassing service package.

Alternative Technologies and Energy Solutions

The energy sector's rapid technological advancements present a significant threat of substitution for traditional Engineering, Procurement, and Construction (EPC) services. Emerging power generation technologies, like advancements in solar photovoltaic efficiency or next-generation battery storage, are increasingly viable alternatives to large-scale, conventional power plants. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 10% increase from 2022, according to the International Energy Agency (IEA). This shift indicates a growing market appetite for distributed and renewable energy solutions, potentially reducing demand for EPC services focused on traditional fossil fuel or large nuclear projects.

Fluor, like other established EPC players, faces the challenge of adapting its business model to incorporate these evolving technologies. Specialized providers focusing on these niche areas might offer more agile and cost-effective solutions, directly competing with Fluor's traditional project scopes. The increasing modularity and scalability of renewable energy projects, often deployed faster and with lower upfront capital requirements than massive traditional plants, further enhance their attractiveness as substitutes.

- Growing Renewable Capacity: Global renewable energy capacity additions hit a record 510 GW in 2023, a 10% rise from 2022, as reported by the IEA, indicating a strong market shift.

- Technological Advancements: Innovations in solar, wind, and battery storage technologies are making these alternatives increasingly competitive and appealing to energy consumers and investors.

- Market Share Risk: Failure to adapt core offerings to include these newer technologies could lead to Fluor losing market share to specialized, agile competitors.

- Shift in Project Demand: The demand for EPC services may increasingly pivot from large-scale, traditional power plants towards distributed, renewable, and storage-focused energy infrastructure.

Digital Platforms and DIY Tools for Project Management

The rise of sophisticated digital project management platforms and Building Information Modeling (BIM) tools presents a significant threat of substitutes for integrated EPC services. These technologies empower clients to manage complex projects with enhanced internal efficiency, potentially reducing their reliance on external providers for certain functions. For instance, the global project management software market was valued at approximately $6.9 billion in 2023 and is projected to grow substantially, indicating widespread adoption and increasing client capability.

While Fluor Corporation, like many in the industry, leverages these advanced tools, their increasing accessibility to clients means they can increasingly handle aspects of project oversight and execution internally. This shift can diminish the perceived value of a full-service, external EPC offering, as clients gain the capacity to manage more project components themselves. This trend suggests a potential erosion of market share if EPC providers cannot clearly articulate the unique value proposition beyond what clients can achieve with readily available technology.

- Increased Client Self-Sufficiency: Advanced digital platforms enable clients to directly manage scheduling, budgeting, and resource allocation, tasks previously outsourced to EPC firms.

- BIM Integration: Building Information Modeling allows for detailed digital representation and simulation of projects, giving clients greater control and understanding of project lifecycles.

- Reduced Perceived Value of External Services: As clients become more technologically adept, the need for comprehensive external project management support may decrease.

- Market Share Erosion: The threat of substitutes could lead to a fragmentation of the EPC market, with clients opting for modular services or in-house management for specific project phases.

Clients are increasingly opting for specialized consulting firms for distinct project phases, a trend that challenges Fluor's integrated EPCM model. This unbundling allows for greater cost control and direct oversight, acting as a significant substitute for a single, comprehensive EPCM provider. For example, a client might engage a top-tier engineering design firm, manage procurement independently, and then hire a separate construction management company.

The energy sector's rapid technological advancements also present a threat. Emerging power generation technologies, like solar photovoltaic efficiency and battery storage, are becoming viable alternatives to large-scale, conventional power plants. By the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 10% increase from 2022, according to the IEA, indicating a growing market appetite for distributed and renewable energy solutions.

Furthermore, sophisticated digital project management platforms and BIM tools empower clients to manage complex projects with enhanced internal efficiency. The global project management software market was valued at approximately $6.9 billion in 2023, demonstrating increasing client capability and potentially reducing reliance on external EPC providers for certain functions.

Clients are also building out their internal EPC capabilities, especially those with significant capital expenditure. This trend, particularly in sectors like oil and gas, allows major producers to bring project management and design functions in-house for better cost control and strategic alignment.

| Substitute Type | Key Characteristics | Example/Data Point |

|---|---|---|

| In-house EPC Capabilities | Cost control, strategic alignment | Major oil and gas producers building internal capacity |

| Specialized Consulting Firms | Niche expertise, cost control, direct oversight | Clients unbundling EPCM services |

| Modular/Prefabricated Construction | Accelerated timelines, cost predictability, quality assurance | Global modular construction market valued at $114.4 billion in 2023 |

| Digital Project Management/BIM | Enhanced client efficiency, internal management | Global project management software market valued at $6.9 billion in 2023 |

| Emerging Energy Technologies | Renewable alternatives, distributed solutions | 510 GW of global renewable capacity additions in 2023 |

Entrants Threaten

Entering the global Engineering, Procurement, and Construction (EPC) sector, especially for major industrial and infrastructure ventures, requires substantial capital. Companies need to invest heavily in specialized machinery, advanced technologies, and the sheer capacity to handle complex operations. For instance, acquiring cutting-edge tunneling equipment or establishing advanced fabrication yards can easily run into hundreds of millions of dollars.

This enormous upfront financial commitment acts as a significant deterrent for potential new players. Consider that a single large-scale project, like a new LNG terminal or a major highway system, can necessitate billions in initial outlays for design, materials, and labor mobilization. Such high capital requirements effectively create a formidable barrier, limiting the number of firms that can realistically compete.

In 2024, the average capital expenditure for establishing a competitive presence in the global EPC market, particularly for sectors like renewable energy infrastructure or petrochemical plants, is estimated to be in the range of $500 million to over $2 billion. This figure reflects the need for state-of-the-art facilities and a robust supply chain, making it exceptionally difficult for smaller or less-funded entities to enter and challenge established incumbents.

The Engineering, Procurement, and Construction (EPC) sector, particularly within energy and infrastructure, faces a formidable threat from new entrants due to extensive regulatory complexities. Companies must navigate a labyrinth of stringent requirements, including environmental impact assessments and permits that vary significantly by region. For instance, in 2024, major infrastructure projects in the European Union often involve multi-year approval processes, adding substantial time and cost. This intricate regulatory landscape demands specialized knowledge and considerable financial investment, acting as a significant deterrent for newcomers.

Established players like Fluor leverage significant economies of scale in areas such as bulk material procurement, centralized project management systems, and sophisticated risk hedging strategies. This extensive experience curve allows them to secure better pricing and optimize operational efficiency, which is crucial in the capital-intensive engineering and construction sector.

New entrants face a steep climb to match these cost advantages. For instance, Fluor's global supply chain network, built over decades, allows for substantial discounts on raw materials and specialized equipment, something a new competitor would find difficult to replicate quickly. In 2024, the average cost of materials for large-scale industrial projects saw continued volatility, making efficient procurement a key differentiator.

Furthermore, the experience curve translates into superior project delivery capabilities and a proven track record. This reliability is a significant barrier, as clients often prioritize established firms with a history of successful, on-time, and on-budget project completions, especially for complex, high-stakes endeavors.

Brand Reputation and Client Relationships

Fluor's formidable brand reputation and deeply entrenched client relationships act as a significant barrier to new entrants. This established trust, cultivated over decades, is crucial for securing the massive, complex projects characteristic of the engineering and construction sector. Newcomers struggle to replicate this intangible asset, which is fundamental in an industry where a proven track record and unwavering reliability are paramount.

For instance, Fluor's consistent performance in delivering large-scale projects, such as the recent $1.6 billion contract for a petrochemical facility in Saudi Arabia announced in early 2024, reinforces its market standing. New entrants would face the daunting task of building similar credibility and a global network of reliable partners and satisfied clients, a process that typically takes years and substantial investment. The ability to secure financing and insurance for mega-projects is also heavily influenced by an established reputation.

- Established Trust: Fluor's long history of successful project execution builds confidence among clients, making them hesitant to award high-stakes contracts to unproven entities.

- Client Loyalty: Existing relationships often translate into repeat business, as clients prioritize familiarity and proven performance over the risks associated with new suppliers.

- Access to Capital: A strong brand and reliable client base enhance a company's creditworthiness, facilitating access to the significant capital required for large projects.

- Industry Network: Fluor benefits from a robust network of subcontractors, suppliers, and regulatory bodies, which new entrants must painstakingly build from scratch.

Access to Skilled Talent and Specialized Expertise

The engineering and construction sector, particularly for large-scale projects, demands a highly specialized workforce. This includes experienced engineers across various disciplines, seasoned project managers capable of handling complex logistics, and skilled technicians with specific certifications. New companies entering this arena will find it incredibly difficult to attract and retain this critical talent pool. This is exacerbated by ongoing global shortages in skilled labor, a trend that intensified through 2024.

The challenge of acquiring skilled talent presents a significant barrier for new entrants. For instance, the demand for specialized construction managers outpaced supply by an estimated 15% in 2024, driving up recruitment costs and timelines. Companies that can demonstrate a strong existing talent base and proven retention strategies will have a distinct competitive advantage.

- High Demand for Specialized Skills: Industries like advanced manufacturing, renewable energy, and infrastructure require niche engineering expertise.

- Persistent Skilled Labor Shortages: Reports in late 2024 indicated that over 50% of construction firms struggled to find qualified workers.

- Increased Recruitment Costs: Competition for talent drives up salaries and benefits, making it more expensive for newcomers to build a team.

- Impact on Project Execution: A lack of experienced personnel can lead to project delays, cost overruns, and compromised quality.

The threat of new entrants into the Engineering, Procurement, and Construction (EPC) sector is significantly mitigated by the immense capital requirements. Establishing a competitive presence, particularly in large-scale industrial and infrastructure projects, necessitates investments often ranging from hundreds of millions to billions of dollars for specialized equipment, advanced technologies, and operational capacity. For example, in 2024, the estimated capital expenditure for a significant market entry in renewable energy infrastructure or petrochemical plants was between $500 million and over $2 billion, creating a formidable barrier for less-funded entities.

Regulatory hurdles also serve as a substantial deterrent. Navigating the complex web of environmental impact assessments, permits, and regional variations, which can lead to multi-year approval processes as seen in major EU infrastructure projects in 2024, demands specialized expertise and considerable financial outlay. This intricate landscape makes it exceptionally challenging for newcomers to enter and compete effectively.

The established players, like Fluor, benefit from significant economies of scale and a steep learning curve, allowing them to achieve cost advantages through bulk procurement and optimized operations. For instance, Fluor's decades-old global supply chain network provides substantial discounts on materials, a benefit new entrants would struggle to replicate quickly. In 2024, the fluctuating costs of materials for large industrial projects further highlighted the importance of efficient procurement as a key differentiator.

| Barrier to Entry | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | Substantial investment needed for machinery, technology, and operational capacity. | Estimated $500 million to over $2 billion for competitive entry in sectors like renewable energy or petrochemicals. |

| Regulatory Complexity | Navigating diverse and stringent environmental and permitting requirements. | Multi-year approval processes for major EU infrastructure projects. |

| Economies of Scale & Experience Curve | Cost advantages from bulk purchasing and operational efficiency gained over time. | Fluor's established supply chain offering material discounts; new entrants struggle to match. |

| Brand Reputation & Client Relationships | Established trust and loyalty from past project successes. | Fluor's $1.6 billion Saudi Arabia petrochemical facility contract reinforces market standing; new entrants need years to build similar credibility. |

| Skilled Labor Availability | Access to specialized engineers, project managers, and technicians. | Estimated 15% gap between demand and supply for specialized construction managers, driving up recruitment costs. |

Porter's Five Forces Analysis Data Sources

Our Fluor Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual reports, investor presentations, and industry-specific market research from leading firms.

We leverage publicly available financial statements, regulatory filings, and insights from industry trade publications to accurately assess the competitive landscape for Fluor.