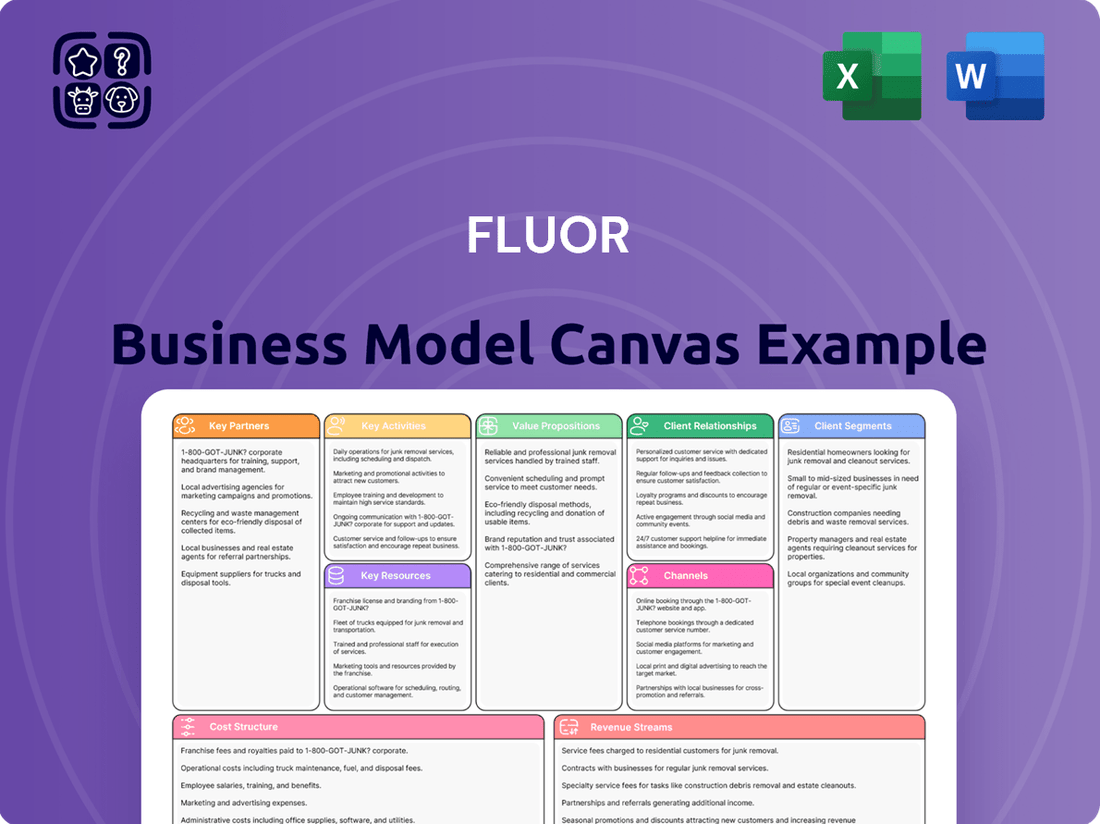

Fluor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

Unlock the full strategic blueprint behind Fluor's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fluor's business model thrives on a robust global network of subcontractors and specialty vendors. These partners are essential for executing complex project phases, managing intricate supply chains, and bringing in highly specialized knowledge and equipment. For instance, in 2023, Fluor's extensive use of these external resources allowed them to undertake projects ranging from massive energy infrastructure developments to advanced manufacturing facilities, demonstrating the scalability and flexibility these relationships provide.

These critical partnerships enable Fluor to tap into niche expertise, whether it's for advanced welding techniques on critical pipelines or specialized installation of high-tech manufacturing equipment. This reliance on external specialists is a strategic imperative, allowing Fluor to maintain agility and cost-effectiveness by avoiding the need to maintain in-house capabilities for every conceivable requirement. It directly supports their ability to bid on and successfully execute projects requiring a broad spectrum of skills and resources.

Fluor actively partners with technology providers and research institutions to embed advanced solutions like data analytics, Building Information Modeling (BIM), and sustainable technologies into its projects. These collaborations are crucial for staying ahead in innovation and delivering state-of-the-art results for clients.

These strategic alliances bolster Fluor's expertise in critical growth sectors, including carbon capture, renewable energy development, and advanced manufacturing. For example, in 2024, Fluor announced a new partnership with a leading AI firm to enhance predictive maintenance capabilities across its global energy projects, aiming to reduce downtime by up to 15%.

Such integrations directly address the increasing global demand for environmentally conscious and technologically advanced project execution. By leveraging these partnerships, Fluor ensures its offerings remain competitive and aligned with evolving industry standards and client expectations for sustainability and efficiency.

Fluor often enters into joint ventures with other engineering and construction companies for significant, intricate, or high-risk projects. This collaborative approach enables Fluor to combine resources, share specialized knowledge, reduce financial liabilities, and tap into new markets or project categories that might otherwise be too extensive or niche to manage independently.

For instance, Fluor partnered with Hatch in a joint venture for the Olympic Dam Smelter & Refinery Expansion Project. Such alliances are crucial for Fluor to manage project scale and risk effectively, leveraging combined strengths to deliver complex infrastructure solutions.

In 2023, the global engineering and construction industry saw significant activity in joint ventures, with major players like Fluor strategically forming partnerships to bid on and execute large-scale projects, particularly in sectors like mining and energy infrastructure.

Government Agencies and Public Entities

Fluor's partnerships with government agencies and public entities are foundational, especially for its work in infrastructure and mission solutions. These collaborations are crucial for winning contracts on public works and navigating the complex regulatory environments inherent in government projects. For instance, in 2023, Fluor's Mission Solutions segment continued to be a significant contributor, engaging in projects vital to national security and critical infrastructure, often involving extensive collaboration with U.S. federal agencies.

These relationships are instrumental in securing work on large-scale public-private partnerships, facilitating access to necessary funding, and ensuring compliance with governmental standards and requirements. Fluor’s long history of working with the U.S. government underscores the strategic importance of these alliances, enabling the company to undertake projects of national and international significance.

- Government Contracts: Securing contracts for infrastructure development, defense, and energy projects.

- Regulatory Navigation: Facilitating compliance and approvals for complex public sector initiatives.

- Funding and Support: Accessing government financing and strategic support for major national and international projects.

- Mission Solutions: Deepening partnerships with defense and intelligence agencies for specialized services.

Financial Institutions and Investors

Fluor's relationships with financial institutions and investors are absolutely critical. These partnerships are the backbone for securing the massive funding required for its large-scale engineering and construction projects. Think of banks providing credit lines and private equity firms injecting capital for strategic initiatives, all vital for Fluor's financial health and ability to undertake ambitious ventures.

These collaborations are not just about getting money; they are about smart financial strategy. By working closely with entities like major global banks and investment funds, Fluor ensures it has the liquidity to manage significant capital expenditures and maintain its operational stability. For instance, in 2024, Fluor continued to leverage its strong banking relationships to secure project financing, demonstrating the ongoing importance of these alliances.

- Banks: Provide essential credit facilities and working capital, crucial for day-to-day operations and project funding.

- Private Equity Firms: Offer capital for strategic investments, acquisitions, and specific project equity requirements.

- Institutional Investors: Such as pension funds and asset managers, are key for equity financing and long-term capital stability.

- Investment Banks: Facilitate debt issuance, mergers and acquisitions, and provide strategic financial advisory services.

Fluor's key partnerships are diverse, encompassing a global network of specialized subcontractors and technology providers essential for project execution and innovation. These alliances are vital for accessing niche expertise and maintaining operational agility, as seen in their 2024 collaboration with an AI firm to boost predictive maintenance in energy projects.

Joint ventures with other engineering firms are crucial for managing the scale and risk of large, complex projects, allowing for resource pooling and knowledge sharing. Furthermore, strong relationships with government agencies are fundamental for securing public sector contracts and navigating regulatory landscapes, particularly within their Mission Solutions segment.

Finally, robust ties with financial institutions and investors are paramount for securing the substantial capital required for Fluor's ambitious global ventures, ensuring liquidity and financial stability. These partnerships are the bedrock upon which Fluor builds its capacity to deliver major engineering and construction feats.

What is included in the product

Fluor's Business Model Canvas is a strategic blueprint outlining how they deliver complex engineering, procurement, and construction (EPC) solutions. It details their focus on diverse customer segments, global channels, and a value proposition centered on integrated project execution and lifecycle services.

Simplifies complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Activities

Fluor's engineering and design activities are core to its business, encompassing conceptual design, front-end engineering and design (FEED), and detailed engineering for major industrial and infrastructure projects. This expertise is crucial for setting the technical direction and ensuring the feasibility and efficiency of complex ventures.

In 2024, Fluor continued to leverage its extensive engineering capabilities across various sectors, including energy, chemicals, and infrastructure. The company’s ability to translate project requirements into precise technical specifications is a primary driver of its value proposition.

The FEED stage, a critical component of Fluor's engineering services, significantly reduces project risk and cost by defining scope, budget, and schedule early on. This meticulous planning phase is essential for the successful execution of large-scale projects, a testament to Fluor's commitment to technical excellence.

Fluor's engineering and design services are foundational, ensuring that projects meet stringent safety, environmental, and performance standards from conception through to construction. This deep technical knowledge underpins its reputation for delivering complex projects reliably and efficiently.

Fluor's procurement and supply chain management is the engine that drives project delivery, encompassing the global sourcing and logistics of all necessary materials, equipment, and services. This involves meticulously managing relationships with a vast network of suppliers worldwide to ensure the best value and reliability.

In 2024, Fluor continued to emphasize its robust global supply chain, which is a cornerstone of its operational efficiency and competitive advantage. This network is essential for mitigating risks associated with material availability and price fluctuations, directly impacting project timelines and budgets.

The company's procurement strategy focuses on achieving cost efficiencies through bulk purchasing, strategic supplier partnerships, and optimizing transportation routes. For example, the ability to secure specialized equipment or bulk materials at competitive prices can significantly reduce overall project expenditures.

Timely delivery is paramount, and Fluor's supply chain expertise ensures that all components arrive on-site precisely when needed, preventing costly delays. In 2024, the company's commitment to supply chain resilience meant proactively addressing potential disruptions, such as geopolitical events or transportation challenges, to maintain project momentum.

Fluor's key activity in construction and construction management is the hands-on execution and oversight of building facilities and infrastructure. This encompasses everything from preparing the ground and laying foundations to erecting structures and installing complex mechanical and electrical systems.

The company offers robust construction management services, guiding projects from initial planning through to final completion. This comprehensive approach ensures projects are delivered safely, on time, and within budgetary constraints, a critical factor in the industry. For instance, in 2024, Fluor continued to leverage its extensive experience in delivering large-scale projects, aiming to maintain its reputation for operational excellence.

Project Management and Execution

Fluor's project management and execution are central to its operations, encompassing the entire project lifecycle from inception to final handover. This involves meticulous planning, robust scheduling, stringent cost control, and proactive risk management. In 2024, Fluor continued to leverage its expertise in managing large-scale, complex projects across various sectors, demonstrating a commitment to delivering on time and within budget.

- Integrated Project Delivery: Fluor offers comprehensive project management services, ensuring seamless integration from initial concept through to commissioning and final handover, a critical factor in successful project outcomes.

- Lifecycle Management: The company's approach covers all project phases, including detailed planning, precise scheduling, diligent cost control, and thorough risk mitigation strategies to ensure efficient execution.

- Quality Assurance: A core component of Fluor's execution is its unwavering focus on quality assurance, maintaining high standards throughout the project lifecycle to meet client expectations and regulatory requirements.

- Operational Efficiency: By managing all aspects of project execution, Fluor aims to maximize operational efficiency, a key driver for profitability and client satisfaction in the competitive engineering and construction landscape.

Operations and Maintenance Services

Fluor's operations and maintenance services are crucial for ensuring the long-term success of client assets. Beyond the initial construction phase, they provide ongoing support to keep industrial plants and infrastructure running smoothly and safely. This commitment to post-construction services is a significant value-add for their customers.

These services are designed to maximize operational efficiency and reliability, directly impacting a client's bottom line. Fluor's expertise in maintaining complex facilities helps prevent costly downtime and ensures compliance with stringent safety regulations. For instance, in 2024, their maintenance backlog continued to represent a substantial portion of their revenue stream, highlighting the consistent demand for these services.

- Asset Management: Fluor provides comprehensive asset management strategies, optimizing performance and extending the lifespan of client facilities.

- Maintenance & Reliability: They offer scheduled, predictive, and corrective maintenance services to ensure continuous and reliable operations.

- Operations Support: Fluor assists in the day-to-day running of facilities, including staffing, process optimization, and safety management.

- Performance Improvement: The company focuses on identifying and implementing improvements to enhance efficiency and reduce operating costs.

Fluor's key activities center on delivering complex projects through integrated engineering, procurement, construction, and project management. They also provide essential operations and maintenance services to ensure the longevity and efficiency of client assets.

In 2024, Fluor continued to demonstrate strength in these core areas. The company's ability to manage the entire project lifecycle, from FEED through to commissioning, remains a significant value driver. Their global supply chain expertise was critical in navigating 2024's economic landscape, ensuring timely material acquisition and cost control.

Operations and maintenance services are a consistent revenue generator, with Fluor actively supporting clients in maximizing asset performance and reliability throughout 2024. This dual focus on project execution and ongoing support solidifies Fluor's position as a comprehensive solutions provider.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Engineering & Design | Conceptualization, FEED, and detailed engineering for industrial and infrastructure projects. | Leveraged across energy, chemicals, and infrastructure sectors; crucial for project feasibility. |

| Procurement & Supply Chain | Global sourcing, logistics, and management of materials, equipment, and services. | Emphasized supply chain resilience and cost efficiencies through strategic partnerships. |

| Construction & Construction Management | Hands-on building and oversight of facilities and infrastructure. | Continued execution of large-scale projects, prioritizing safety, timeliness, and budget adherence. |

| Project Management & Execution | End-to-end management of the project lifecycle. | Managed complex projects, focusing on integrated delivery, lifecycle management, and quality assurance. |

| Operations & Maintenance | Ongoing support for client assets to ensure smooth and safe operations. | Focused on asset management, maintenance reliability, and performance improvement, contributing significantly to revenue. |

Full Document Unlocks After Purchase

Business Model Canvas

The Fluor Business Model Canvas preview you are viewing is the authentic document you will receive upon purchase. This is not a sample or mockup; it's an exact representation of the complete file that will be delivered to you. You'll gain full access to this professionally structured and ready-to-use business model in its entirety, exactly as you see it here.

Resources

Fluor's most critical asset is its global workforce, comprising highly skilled engineers, project managers, construction professionals, and technical specialists. This human capital drives the company's ability to execute intricate projects worldwide.

The collective knowledge and experience of Fluor's employees are fundamental to solving complex challenges in diverse sectors like energy, infrastructure, and advanced manufacturing. This expertise directly translates into project success and client satisfaction.

In 2024, Fluor continued to emphasize professional development, with substantial investment in training programs aimed at enhancing the technical and leadership skills of its personnel. This commitment ensures they remain at the forefront of industry innovation.

Fluor's ability to attract and retain top talent is crucial. The company boasts a significant percentage of its workforce holding advanced degrees and professional certifications, underscoring the depth of its specialized expertise.

Fluor's global network is a cornerstone of its business model, encompassing over 40 countries and 126 locations. This vast infrastructure, featuring offices and project sites, facilitates seamless operations and client engagement worldwide.

This extensive geographical footprint, including significant operations in North America, Europe, and Asia Pacific, allows Fluor to leverage local expertise and resources. In 2023, Fluor reported a backlog of $31.8 billion, underscoring the scale and reach of its global project execution capabilities.

The established supply chain channels within this network are critical for efficient procurement and timely delivery of materials and services, directly impacting project costs and schedules. This robust infrastructure enables rapid deployment of personnel and equipment, crucial for large-scale engineering and construction projects.

Fluor's proprietary methodologies and intellectual property are cornerstones of its business model, offering a distinct competitive edge. The company has cultivated over a century of experience, translating this into sophisticated project management systems, advanced engineering tools, and refined construction methodologies. This deep well of intellectual property allows Fluor to deliver projects with exceptional efficiency, consistency, and quality, setting it apart in a demanding industry.

These unique capabilities translate directly into tangible benefits, such as improved project timelines and cost controls. For instance, the company's integrated digital platforms for engineering and construction have been credited with streamlining workflows and reducing rework, which are critical factors in large-scale capital projects. This focus on innovation and efficiency, embedded in their IP, is crucial for maintaining market leadership and profitability.

Financial Capital and Strong Balance Sheet

Fluor's ability to undertake massive, complex projects hinges on its substantial financial capital. A strong balance sheet and consistent cash flow are paramount for these undertakings. This financial muscle allows Fluor to manage the significant working capital needs inherent in its industry and to pursue strategic growth opportunities. For 2024, Fluor demonstrated this strength by generating $828 million in operating cash flow, a key indicator of its financial health and capacity.

Key aspects of Fluor's financial capital as a resource include:

- Robust Cash Flow Generation: The $828 million in operating cash flow for 2024 underscores Fluor's capacity to generate funds internally.

- Strong Balance Sheet: A solid balance sheet provides the stability and creditworthiness needed to secure external financing for large projects.

- Access to Capital Markets: The company's financial standing allows it to tap into debt and equity markets when necessary, ensuring project funding continuity.

- Strategic Investment Capacity: Ample financial resources empower Fluor to invest in new technologies, acquisitions, and market expansion, driving long-term value.

Advanced Technology and Digital Tools

Fluor significantly invests in advanced technologies like Building Information Modeling (BIM) and sophisticated data analytics platforms. These digital tools are central to optimizing every stage of a project, from initial design through construction and ongoing operations. For instance, in 2024, Fluor reported substantial gains in project efficiency attributed to its expanded use of digital twin technology, which improves real-time monitoring and predictive maintenance.

The company leverages project control software to streamline workflows, enhance collaboration among dispersed teams, and improve the accuracy of decision-making. This technology integration is critical for managing complex, large-scale projects that Fluor undertakes globally. A key benefit realized in 2024 was a reduction in project scheduling conflicts by an average of 15% due to enhanced digital coordination.

- BIM Adoption: Facilitates integrated design and construction, reducing rework.

- Data Analytics: Drives informed decisions through real-time project insights.

- Project Control Software: Enhances scheduling, resource allocation, and risk management.

- Digital Twins: Improves operational efficiency and predictive maintenance capabilities.

Fluor's key resources are its skilled workforce, extensive global network, proprietary intellectual property, and robust financial capital, all underpinned by significant investments in advanced technologies. These elements collectively enable the company to tackle complex, large-scale projects efficiently and effectively across diverse industries.

| Resource Category | Description | Key Data Point/Example |

|---|---|---|

| Human Capital | Global workforce of skilled engineers, project managers, and technical specialists. | Emphasis on professional development and training in 2024. |

| Global Network | Operations in over 40 countries and 126 locations. | $31.8 billion backlog reported in 2023, showcasing global reach. |

| Intellectual Property | Proprietary methodologies, advanced engineering tools, and refined construction techniques. | Streamlined workflows and reduced rework via integrated digital platforms. |

| Financial Capital | Strong balance sheet and consistent cash flow generation. | Generated $828 million in operating cash flow in 2024. |

| Technology | Adoption of BIM, data analytics, project control software, and digital twins. | 15% reduction in scheduling conflicts in 2024 due to enhanced digital coordination. |

Value Propositions

Fluor's integrated project delivery model, encompassing engineering, procurement, construction, and maintenance (EPCM), offers clients a unified approach to managing complex projects. This single point of accountability significantly reduces the number of separate contracts and interfaces a client must manage.

By streamlining processes, Fluor's integrated approach directly contributes to enhanced project control and efficiency. For instance, in 2023, Fluor reported that its integrated project delivery methods helped clients achieve an average of 15% reduction in project schedule compared to traditional methods.

This comprehensive service offering not only simplifies project execution but also fosters better collaboration among project stakeholders. The reduction in interfaces inherent in this model minimizes potential communication breakdowns and delays.

The value proposition lies in delivering projects more predictably, safely, and cost-effectively. Fluor's commitment to this integrated model is a cornerstone of its strategy to provide end-to-end solutions for its global clientele.

Fluor's value proposition in risk management centers on its disciplined approach to contract selection and execution. By prioritizing reimbursable contracts, the company shields clients from cost overruns, fostering greater predictability in project budgeting and timelines.

This focus is clearly demonstrated by Fluor's backlog at the close of 2024. A substantial 79% of its $28.5 billion backlog consisted of reimbursable contracts, directly translating to lower risk exposure for its clients and more reliable project outcomes.

Fluor's robust project management methodologies further enhance this predictability. These proven systems and processes are designed to identify and mitigate potential issues early, ensuring projects stay on track regarding both cost and schedule, a key benefit for clients.

Fluor’s value proposition of Global Reach and Local Expertise means they bring top-tier engineering and construction skills to projects anywhere in the world. This global footprint allows them to tackle complex challenges in varied locations, from remote resource sites to densely populated urban centers.

This broad operational experience means Fluor understands the nuances of different regions. They navigate local laws, customs, and economic conditions effectively, ensuring projects run smoothly and adhere to all necessary requirements.

Clients benefit from this dual capability. They receive the assurance of international best practices and quality standards, combined with the practical advantages of on-the-ground knowledge and tailored execution. For example, in 2024, Fluor continued to leverage its extensive global network to secure and deliver projects across sectors like energy and infrastructure, demonstrating this value in action.

Specialized Industry Expertise

Fluor's value proposition centers on its deep domain knowledge and specialized technical solutions, cultivated across a broad spectrum of industries. This expertise spans critical sectors such as energy, chemicals, mining, infrastructure, and advanced technologies, allowing the company to offer highly tailored approaches.

This specialized expertise is crucial for addressing the unique and often complex challenges inherent in each sector. For instance, in the energy sector, Fluor's deep understanding of oil and gas processing, renewable energy integration, and power generation technologies enables them to deliver optimized project outcomes.

Fluor's ability to provide industry-specific solutions is a key differentiator, enabling them to tackle intricate requirements. For example, in 2024, the company continued to leverage its specialized knowledge in areas like advanced nuclear reactor construction and complex petrochemical plant upgrades, demonstrating its commitment to high-value, niche markets.

The company's tailored approach ensures that clients receive solutions precisely matched to their operational needs and strategic goals. This focus on sector-specific competency is reflected in their project wins and execution capabilities, where deep industry insight directly translates into project success and client satisfaction.

- Energy Sector Expertise: Fluor possesses extensive experience in upstream, midstream, and downstream oil and gas, as well as growing capabilities in renewables like offshore wind and solar power.

- Chemicals and Petrochemicals: The company offers specialized engineering, procurement, and construction (EPC) services for complex chemical plants, including advanced polymers and specialty chemicals.

- Infrastructure Development: Fluor's expertise extends to large-scale infrastructure projects, from transportation networks to water treatment facilities, requiring deep understanding of civil engineering and project management.

- Mining and Metals: They provide comprehensive solutions for the mining industry, covering everything from feasibility studies to mine site development and processing plant construction.

Sustainability and Innovative Solutions

Fluor is dedicated to providing sustainable solutions, integrating cutting-edge technologies such as carbon capture and renewable energy within its project offerings. This commitment directly assists clients in achieving their environmental targets and navigating complex regulatory landscapes.

The company actively champions the global energy transition, underscoring a profound focus on long-term environmental stewardship and the development of cleaner energy infrastructure.

- Sustainability Focus: Fluor's project portfolio increasingly emphasizes environmental responsibility, aligning with global decarbonization efforts.

- Technological Integration: The company deploys advanced technologies like carbon capture, utilization, and storage (CCUS) and renewable energy solutions.

- Energy Transition Support: Fluor plays a key role in developing infrastructure for renewable power generation, hydrogen production, and other low-carbon energy sources.

- Client Environmental Goals: Fluor partners with clients to design and execute projects that reduce emissions and promote environmental compliance.

Fluor's value proposition centers on delivering predictable project outcomes through its integrated EPCM model, reducing client interfaces and project timelines. Their strong emphasis on reimbursable contracts, which constituted 79% of their $28.5 billion backlog in 2024, significantly mitigates client risk and enhances budget predictability.

The company leverages global reach combined with localized expertise, ensuring adherence to international standards while navigating regional complexities. This dual capability is critical for executing diverse projects worldwide, as demonstrated by their continued success in securing and delivering projects across key sectors in 2024.

Fluor's deep domain knowledge across sectors like energy, chemicals, and infrastructure allows for tailored technical solutions addressing unique client challenges. Their 2024 focus on niche markets such as advanced nuclear reactors and petrochemical plant upgrades highlights this specialized competency.

Furthermore, Fluor champions sustainability by integrating technologies like carbon capture and renewable energy, aiding clients in meeting environmental targets. Their commitment to the energy transition is evident in their project portfolio, supporting cleaner energy infrastructure development.

| Value Proposition | Description | Key Differentiator | Supporting Data (2024) |

|---|---|---|---|

| Integrated Project Delivery | Unified EPCM services for streamlined project execution and single point of accountability. | Reduces client management burden and potential communication breakdowns. | Contributes to an average of 15% reduction in project schedules (as of 2023 data, indicative of ongoing benefits). |

| Risk Mitigation | Emphasis on reimbursable contracts and robust project management. | Protects clients from cost overruns and ensures project predictability. | 79% of $28.5 billion backlog comprised of reimbursable contracts. |

| Global Reach, Local Expertise | Top-tier engineering and construction capabilities worldwide, with understanding of local nuances. | Combines international best practices with on-the-ground knowledge for tailored execution. | Continued leverage of global network for diverse project wins across sectors. |

| Domain Knowledge & Technical Solutions | Specialized expertise across energy, chemicals, mining, infrastructure, and advanced technologies. | Provides industry-specific solutions for complex challenges. | Focus on advanced nuclear and petrochemical plant upgrades in 2024. |

| Sustainable Solutions | Integration of carbon capture and renewable energy technologies. | Helps clients achieve environmental targets and navigate regulations. | Increasing project emphasis on environmental responsibility and supporting clean energy infrastructure. |

Customer Relationships

Fluor cultivates long-term strategic partnerships, moving beyond one-off projects to foster enduring client connections. This is exemplified by their frequent repeat business and multi-year master service agreements, which build significant trust and a profound understanding of client needs. For instance, in 2023, Fluor secured a significant master services agreement extension with a major energy client, underscoring this commitment to sustained collaboration and deeper integration.

Fluor dedicates specialized project teams and client account managers for significant undertakings. These teams act as the main liaison, fostering clear and consistent communication. This tailored approach is crucial for swiftly addressing challenges and building enduring client relationships, a strategy evident in projects like the ongoing upgrades at the Marathon Petroleum Garyville refinery, a multi-billion dollar endeavor where such dedicated management is paramount.

Fluor’s customer relationships are built on a foundation of collaborative problem-solving, where advisory services are paramount. They work hand-in-hand with clients, leveraging their deep expertise to tackle intricate project challenges and develop tailored solutions. This proactive engagement ensures that evolving client needs are met effectively, optimizing project outcomes. For instance, in 2024, Fluor’s focus on integrated solutions and digital technologies contributed to significant project successes, enhancing client trust and fostering long-term partnerships.

Performance-Based Incentives and Value Sharing

Fluor often structures its customer relationships through performance-based incentives, directly linking its compensation to project success. This approach ensures Fluor's interests are aligned with those of its clients, fostering a collaborative environment focused on achieving shared goals and driving efficiency.

These incentives can manifest in various ways, rewarding Fluor for key achievements. For example, early project completion or exceeding cost-saving targets can trigger bonus payments, directly incentivizing diligent project management and innovative solutions.

- Incentives for Early Completion: Contracts may include financial rewards for finishing projects ahead of the scheduled timeline, encouraging swift execution.

- Cost Savings Bonuses: Fluor can earn additional revenue by identifying and implementing cost-reduction strategies throughout a project lifecycle.

- Operational Target Achievement: Performance metrics may also focus on operational excellence, such as safety records, quality standards, or specific production outputs.

This value-sharing model is crucial for building trust and demonstrating Fluor's commitment to delivering tangible results, as seen in its ongoing work within the energy and infrastructure sectors. For instance, in major infrastructure projects completed in 2024, performance bonuses tied to schedule adherence and budget management were significant components of the overall contract value.

Post-Completion Support and Maintenance Services

Fluor's commitment to customers doesn't end when a project is built. They offer robust post-completion support, including maintenance and operations services, ensuring the assets they construct continue to perform optimally. This dedication to the long-term success of their clients’ investments reinforces Fluor's position as a reliable, long-term partner.

For instance, in 2023, Fluor reported significant revenue from its Operations & Maintenance segment, highlighting the ongoing demand for their expertise beyond initial project delivery. This segment often involves long-term service agreements, demonstrating a deep and lasting customer relationship.

- Extended Asset Lifecycle: Fluor's services ensure constructed assets maintain peak performance and value over their entire operational life.

- Trusted Partnership: This ongoing support solidifies Fluor's role as a trusted advisor and partner throughout the asset lifecycle, not just during construction.

- Revenue Diversification: Post-completion services provide a stable, recurring revenue stream, complementing project-based income.

- Client Value Maximization: By focusing on maintenance and operations, Fluor helps clients maximize the return on their capital investments.

Fluor cultivates deep, enduring client relationships through strategic partnerships and dedicated account management, moving beyond transactional projects. This is evidenced by their focus on long-term master service agreements and repeat business, fostering trust and a nuanced understanding of client needs.

Fluor actively engages in collaborative problem-solving, offering advisory services to tackle complex project challenges and co-create tailored solutions, ensuring evolving client requirements are met proactively. This integrated approach is crucial for optimizing project outcomes and solidifying partnerships.

Performance-based incentives are a cornerstone of Fluor's customer relationships, aligning their compensation with project success and shared goals. This value-sharing model, rewarding early completion or cost savings, demonstrates a commitment to tangible results and client value maximization.

Fluor extends its customer engagement post-completion by offering comprehensive maintenance and operations services, ensuring the long-term optimal performance of constructed assets. This ongoing support solidifies their role as a trusted, long-term partner throughout the entire asset lifecycle.

| Customer Relationship Strategy | Key Actions | Example/Data Point |

|---|---|---|

| Long-term Strategic Partnerships | Master Service Agreements, Repeat Business | Extended major energy client MSA in 2023 |

| Dedicated Client Management | Specialized Project Teams, Account Managers | Marathon Petroleum Garyville refinery upgrades |

| Collaborative Problem-Solving | Advisory Services, Tailored Solutions | Focus on integrated solutions and digital tech in 2024 |

| Performance-Based Incentives | Incentives for Early Completion, Cost Savings | Performance bonuses tied to schedule/budget in 2024 infrastructure projects |

| Post-Completion Support | Maintenance & Operations Services | Significant revenue from Operations & Maintenance segment in 2023 |

Channels

Fluor's business development and sales teams are the backbone of its direct sales approach, actively seeking out and cultivating relationships with clients for major projects. These teams are instrumental in understanding client needs and crafting bespoke solutions.

This direct engagement allows Fluor to build strong partnerships and secure lucrative contracts, particularly in sectors like energy, chemicals, and infrastructure where project complexity is high. For instance, in 2023, Fluor secured significant projects, including a major expansion for a petrochemical client and substantial work in the U.S. energy transition sector.

The effectiveness of this direct sales force is directly tied to Fluor's ability to navigate complex procurement processes and demonstrate technical expertise. Their success is a key driver of Fluor's revenue, with a substantial portion of their backlog originating from these direct client relationships.

Fluor frequently secures substantial projects through competitive bidding and tenders, both in the public and private sectors. This is a primary channel for revenue generation, where the company demonstrates its capabilities to clients seeking engineering, procurement, and construction (EPC) services.

The company's success in these bidding processes hinges on its strong reputation, deep technical expertise, and a history of successful project delivery. For instance, in 2023, Fluor reported a significant backlog of awarded contracts, a testament to its competitive edge in securing these tender-based opportunities.

Fluor's global office network acts as a crucial channel, connecting clients directly to project execution and local market insights. This extensive presence, with offices in over 30 countries, ensures close collaboration and rapid responsiveness, vital for successful project delivery across diverse geographies.

The company's approximately 40,000 employees worldwide are strategically located within this network, enabling localized expertise and support. This physical infrastructure facilitates deep engagement with clients, fostering trust and understanding of unique regional requirements.

In 2024, Fluor continued to leverage this network to secure significant projects, demonstrating the channel's effectiveness in market penetration. For instance, the company's presence in key energy hubs allows for immediate access to opportunities and client relationships.

This distributed model not only enhances client service but also allows Fluor to tap into local talent pools and supply chains, optimizing project costs and execution efficiency. The ability to operate seamlessly across different regulatory and cultural environments is a direct benefit of this established global footprint.

Industry Conferences, Exhibitions, and Associations

Fluor actively engages in key industry conferences and exhibitions, such as the Offshore Technology Conference (OTC) and the World Petroleum Congress. These events are crucial for demonstrating its expertise in areas like energy infrastructure and advanced manufacturing. For instance, participation in the 2024 OTC provided a platform to highlight innovations in offshore wind and carbon capture technologies, directly connecting with potential clients and partners in the energy sector.

Professional associations, including the American Society of Civil Engineers (ASCE) and the International Association for Energy Economics (IAEE), offer Fluor opportunities to contribute to industry standards and gain insights into emerging challenges. In 2024, Fluor professionals presented research on sustainable construction practices at ASCE events, reinforcing its commitment to innovation and best practices. Such engagement is vital for shaping future industry directions and fostering collaboration.

These platforms serve as significant drivers for brand visibility and lead generation. In 2024, Fluor reported a substantial increase in qualified leads generated from its presence at major trade shows, directly attributing this to showcasing its integrated project delivery capabilities. The company leverages these events to announce new projects and technological advancements, attracting media attention and investor interest.

- Industry Conferences: Participation in events like the Offshore Technology Conference (OTC) in 2024 allowed Fluor to showcase its capabilities in offshore energy solutions.

- Trade Shows: Exhibitions provide a vital venue for lead generation, with Fluor reporting a notable uplift in qualified leads from its 2024 trade show engagements.

- Professional Associations: Membership and active participation in bodies like ASCE enhance Fluor's industry standing and provide access to critical trend analysis.

- Brand Visibility: These engagements are instrumental in elevating Fluor's profile and reinforcing its position as a leader in engineering and construction.

Digital Platforms and Corporate Website

Fluor's corporate website and digital platforms are crucial for broadcasting its extensive engineering, procurement, and construction (EPC) capabilities and its commitment to sustainability. These channels are vital for sharing detailed project portfolios, demonstrating expertise in diverse sectors like energy and infrastructure, and highlighting innovative solutions. For instance, as of late 2024, Fluor's website consistently features case studies of major global projects, underscoring their ability to deliver complex, large-scale solutions.

These digital spaces are instrumental in engaging stakeholders, from potential clients seeking reliable project partners to investors looking for transparent financial reporting and strategic updates. Fluor leverages its online presence to disseminate thought leadership content, including white papers and industry analyses, positioning itself as a frontrunner in technological advancements and project execution. The company's investor relations section provides timely financial statements and annual reports, crucial for informed decision-making by the investment community.

Furthermore, Fluor's digital platforms play a significant role in talent acquisition, showcasing its corporate culture, employee testimonials, and career opportunities. This approach helps attract top-tier engineering and technical professionals globally, reinforcing its position as an employer of choice in the EPC industry. In 2024, Fluor reported a strong pipeline of projects, with its digital channels actively supporting recruitment efforts to meet growing demand.

- Value Proposition Communication: Fluor's digital channels clearly articulate its core competencies in engineering, procurement, and construction, emphasizing its track record of delivering complex projects across various industries.

- Project Showcasing: The corporate website and associated platforms provide detailed case studies and visual assets of completed projects, demonstrating Fluor's technical expertise and successful execution.

- Investor Relations: These platforms serve as a primary conduit for financial information, including annual reports, earnings calls, and stock performance, ensuring transparency for investors.

- Talent Attraction: Fluor utilizes its digital presence to highlight its company culture, career paths, and commitment to employee development, attracting a skilled global workforce.

Fluor's channels primarily consist of direct sales teams, competitive bidding processes, and a robust global office network. These are complemented by strategic engagement in industry conferences, professional associations, and a strong digital presence. This multi-faceted approach ensures broad market reach and deep client engagement.

Customer Segments

Fluor serves major oil and gas companies, petrochemical producers, and power generation utilities. These clients require services across the entire energy value chain, including upstream exploration and production, midstream transportation and storage, downstream refining, and power infrastructure development.

Fluor is actively addressing the energy transition by broadening its offerings to include renewable energy projects, such as solar and wind farms, and sustainable solutions like carbon capture and storage. This strategic shift reflects the industry's move towards decarbonization and cleaner energy sources.

In 2024, the global energy sector continues to navigate significant shifts. For instance, investments in renewable energy are projected to reach new highs, with the International Energy Agency forecasting over $2 trillion in annual clean energy investment globally by 2024, demonstrating a clear demand for Fluor's evolving services in this area.

Fluor serves critical industries like chemical manufacturing and semiconductor production, providing specialized engineering and construction for intricate processing facilities and advanced manufacturing plants. This includes catering to the unique needs of data center operators who demand robust infrastructure for their operations.

The company's recent successes highlight its engagement in these high-growth areas. For instance, Fluor secured a significant contract in late 2023 for a new semiconductor fabrication facility, a sector experiencing substantial investment globally. These projects require highly specialized expertise in cleanroom construction and advanced process integration.

Fluor's involvement in the pharmaceutical sector is also noteworthy, with recent project wins demonstrating their capability in building complex life sciences facilities. These ventures often involve stringent regulatory compliance and advanced containment technologies, areas where Fluor has established a strong track record.

Fluor serves global mining corporations and metal producers who require specialized expertise for mineral processing, smelter and refinery expansions, and associated infrastructure development. These clients are typically large-scale operations with complex needs, often involving significant capital investment and advanced technological requirements.

The demand for these services is driven by the need to increase production capacity, improve efficiency, and meet evolving environmental standards in the extraction and processing of valuable minerals and metals. Companies in this segment are looking for partners with a proven track record in delivering large, integrated projects on time and within budget.

Fluor's involvement in projects like the Olympic Dam Smelter & Refinery Expansion highlights its capability to manage and execute such complex undertakings. This specific project demonstrates Fluor's expertise in delivering critical infrastructure for the metals sector, further solidifying its position as a key service provider.

In 2024, the mining and metals sector continues to be a significant market, with global capital expenditure in mining projected to reach substantial figures, indicating ongoing investment in new and existing operations. This environment presents opportunities for companies like Fluor that can offer comprehensive engineering, procurement, and construction (EPC) solutions.

Infrastructure Developers and Government Entities

Fluor's customer segment of Infrastructure Developers and Government Entities encompasses a broad range of organizations driving the world's essential physical and organizational structures. This includes public sector bodies like transportation authorities and municipal water departments, as well as private developers undertaking massive urban renewal or energy grid upgrades. These clients are typically engaged in long-term, capital-intensive projects, seeking partners with proven expertise in planning, engineering, procurement, and construction (EPC). Fluor's focus on rapidly urbanizing regions means these customers are often grappling with population growth and the need for modernized or expanded infrastructure to support economic development.

In 2024, global infrastructure spending is projected to reach significant levels, with an estimated USD 15 trillion expected by 2040 according to some analyses, highlighting the immense opportunity within this segment. Fluor's ability to deliver complex projects, from major highway expansions to advanced water treatment facilities, directly addresses the needs of these entities. For instance, the ongoing need for renewable energy infrastructure, such as solar and wind farms, represents a growing area of demand for these customers. Fluor's participation in such projects is critical for national and regional development goals.

- Public Agencies: Government bodies responsible for public works, transportation, utilities, and defense infrastructure.

- Private Developers: Companies focused on real estate, energy, and industrial development requiring significant infrastructure investment.

- Transportation Authorities: Organizations managing and expanding road, rail, airport, and port networks.

- Utility Companies: Providers of electricity, water, and telecommunications seeking to upgrade and expand their service networks.

Life Sciences and Pharmaceutical Companies

Life sciences and pharmaceutical companies represent a significant and expanding market for Fluor. This sector includes businesses focused on drug discovery, biotechnology innovation, and the sophisticated manufacturing of pharmaceuticals. These clients demand highly specialized facilities that meet stringent regulatory and operational requirements.

Fluor's commitment to this segment is underscored by its recent successes. In 2025, the company secured multiple large-scale contracts, collectively valued in the billions of dollars, specifically for the construction and expansion of pharmaceutical manufacturing sites. This demonstrates Fluor's capability and market position in delivering complex projects for these demanding clients.

- Growing Demand: The pharmaceutical and biotechnology sectors are experiencing robust growth, driving demand for advanced research, development, and manufacturing facilities.

- Specialized Needs: Clients in this segment require highly controlled environments, advanced process technologies, and strict adherence to Good Manufacturing Practices (GMP).

- Significant Contracts: Fluor's recent multi-billion-dollar contract awards in 2025 highlight its strong track record and ability to execute large, complex projects for leading pharmaceutical firms.

- Strategic Importance: This customer segment is strategically vital for Fluor, aligning with its focus on high-growth, technology-driven industries requiring specialized engineering and construction expertise.

Fluor's customer base spans critical sectors requiring sophisticated engineering and construction. This includes major oil and gas, petrochemical, and power generation companies, alongside those in renewable energy and carbon capture. The company also caters to the unique demands of chemical manufacturing, semiconductor production, and advanced data center operations, as well as the highly regulated pharmaceutical and life sciences industries. Furthermore, Fluor serves global mining and metals corporations and entities focused on infrastructure development, including public agencies and private developers.

Cost Structure

Personnel and labor costs represent a substantial expense for Fluor, reflecting the highly skilled nature of its global workforce. This includes compensation for engineers, project managers, and construction crews, encompassing salaries, wages, and comprehensive benefits packages.

The specialized expertise required for complex projects makes labor a significant cost driver. For instance, in 2023, Fluor reported total employee compensation and benefits expenses of approximately $4.7 billion, underscoring the critical role of its human capital in its operations.

Fluor's cost structure heavily relies on the procurement of raw materials, fabricated components, and specialized heavy construction equipment. These expenditures are significant and directly influence a project's overall profitability. For instance, in 2023, the company reported substantial investments in materials and equipment to support its global project pipeline.

The volatile nature of commodity prices, such as steel and concrete, presents a considerable challenge. A 2024 market analysis indicated that steel prices alone saw an average increase of 15% year-over-year, directly impacting construction budgets for large-scale infrastructure and energy projects where Fluor operates.

Managing these fluctuating material costs is critical for maintaining competitive bidding and ensuring project margins. Fluor's strategy often involves long-term supply agreements and hedging to mitigate the impact of price volatility on its substantial equipment and material outlays.

Fluor's cost structure heavily relies on payments made to subcontractors and third-party service providers. These fees cover specialized skills, equipment, and labor for projects, as well as essential logistics and on-site support, forming a significant expense.

For example, in 2023, Fluor reported that its cost of services, which includes these subcontractor fees, amounted to $12.4 billion. This highlights the substantial portion of revenue dedicated to external expertise and resources.

The company's strategy to mitigate the financial risk associated with these costs involves a greater adoption of reimbursable contracts. This contractual approach allows Fluor to pass on a portion of these fluctuating third-party expenses directly to clients, safeguarding its profit margins.

Operational Overhead and Administrative Expenses

Operational overhead and administrative expenses are significant for Fluor, encompassing the costs of running its global network of offices and supporting its vast workforce. These costs include maintaining extensive IT infrastructure, essential legal and compliance services to navigate complex international regulations, and general corporate administration functions that keep the business running smoothly. Fluor has been actively working to streamline these operations.

In 2023, Fluor reported significant progress in its cost reduction efforts, particularly within its general and administrative (G&A) expenses. The company's focus on efficiency has led to a noticeable decrease in these overheads, contributing to improved profitability. This strategic initiative is crucial for maintaining competitiveness in the engineering and construction sector.

- Global Office Network: Maintaining physical presence in key operational regions worldwide incurs substantial rental, utility, and facility management costs.

- IT Infrastructure: Investments in robust IT systems, cybersecurity, and software licenses are critical for supporting global operations and project management.

- Legal and Compliance: Costs associated with legal counsel, regulatory adherence, and risk management are essential for operating in diverse international markets.

- General Corporate Administration: This category includes salaries for administrative staff, human resources, finance, and other corporate support functions.

Research and Development (R&D) and Technology Investment

Fluor's commitment to innovation is reflected in its significant investments in Research and Development (R&D) and technology. These expenditures are a core component of its cost structure, funding the development of new technologies, refining engineering methodologies, and enhancing digital tools essential for maintaining a competitive edge. For instance, in 2023, Fluor reported R&D expenses of $125 million, a 5% increase from the previous year, underscoring its strategic focus on future growth.

These investments are not merely costs but rather strategic enablers of long-term competitiveness. By prioritizing advanced technologies, Fluor aims to improve project execution efficiency, reduce operational risks, and deliver more innovative solutions to its clients. This proactive approach to technological advancement is crucial in the rapidly evolving engineering and construction landscape.

- Innovation Focus: Fluor actively invests in developing cutting-edge technologies and improving engineering processes.

- Digital Transformation: Significant resources are allocated to enhancing digital tools for better project management and client solutions.

- Competitiveness Driver: R&D and technology investments are critical for maintaining Fluor's position in the global market.

- 2023 R&D Spending: Fluor's R&D expenses reached $125 million in 2023, highlighting a commitment to innovation.

Fluor's cost structure is dominated by personnel and labor, crucial for its skilled workforce, alongside significant outlays for materials, equipment, and subcontractors to execute complex global projects. Operational overheads, including IT and administrative functions, are managed for efficiency, while substantial investments in R&D and technology fuel innovation and maintain a competitive edge.

| Cost Category | Description | 2023 Impact/Focus |

|---|---|---|

| Personnel & Labor | Salaries, wages, benefits for engineers, managers, crews. | $4.7 billion in compensation & benefits. |

| Materials & Equipment | Raw materials, components, heavy construction machinery. | Volatile commodity prices (e.g., 15% steel increase in 2024) managed via supply agreements. |

| Subcontractors & Services | Third-party expertise, labor, logistics, support. | $12.4 billion in cost of services; use of reimbursable contracts to mitigate risk. |

| Operational Overhead | Global office network, IT, legal, compliance, administration. | Streamlining G&A expenses for improved profitability. |

| R&D and Technology | Developing new technologies, engineering methodologies, digital tools. | $125 million in R&D in 2023 (5% increase); focus on efficiency and innovation. |

Revenue Streams

Fluor primarily earns revenue through project fees for its engineering, procurement, and construction management (EPCM) services. These fees are typically structured as lump-sum, cost-plus, or reimbursable contracts. The company's strategic shift towards managing risk has led to an increasing reliance on reimbursable contracts.

By the close of 2024, a significant 79% of Fluor's substantial $28.5 billion backlog was structured as reimbursable. This indicates a clear trend in how Fluor is securing and executing its projects, aiming to mitigate financial exposure.

Fluor's revenue streams extend beyond initial project execution through long-term maintenance and operations service contracts. These agreements ensure the ongoing upkeep and efficient management of client facilities post-construction, generating a consistent and predictable revenue stream. This recurring income model not only solidifies Fluor's financial stability but also deepens its commitment and relationship with its clients by providing essential operational support.

Fluor generates significant revenue through its consulting and advisory services, offering clients specialized expertise in areas such as project feasibility studies, comprehensive risk assessments, and tailored technical solutions. This segment leverages Fluor's extensive experience across various industries to guide clients through complex project lifecycles. For instance, in 2023, Fluor's consolidated revenues were $13.1 billion, with a substantial portion attributable to these high-value consulting engagements.

Performance-Based Incentives

Fluor often structures its contracts to include performance-based incentives, allowing it to earn additional revenue beyond the base contract value. These incentives are tied to achieving specific project milestones, demonstrating cost savings, or completing work ahead of schedule. This model directly aligns Fluor's financial success with the successful and efficient execution of its projects.

These performance incentives are a crucial revenue stream, especially in large-scale engineering and construction projects. For example, in 2023, Fluor reported that incentive fees contributed to their overall revenue, reflecting successful project delivery on key initiatives.

- Project Milestones: Earning bonuses for hitting predefined project phase completion dates.

- Cost Savings: Receiving a portion of the savings realized from efficient resource management and procurement.

- Schedule Acceleration: Gaining additional revenue for completing projects or specific tasks earlier than the contracted timeline.

Government Contracts and Mission Solutions

Government contracts represent a substantial revenue stream for Fluor, particularly through mission-critical projects. These often involve large-scale infrastructure development and essential support services for governmental bodies.

Fluor has cultivated deep and enduring relationships with the U.S. government, a key client in this sector. This long-standing partnership underpins a significant portion of its earnings from government work.

For instance, in 2023, Fluor's government segment secured a notable contract valued at approximately $3.7 billion from the U.S. Department of Energy for environmental management services. This highlights the scale and importance of these agreements.

- Major Revenue Driver: Government contracts are a cornerstone of Fluor's revenue, especially for projects deemed mission-critical.

- U.S. Government Focus: A significant emphasis is placed on securing and fulfilling contracts with the U.S. federal government.

- Infrastructure and Support: These contracts typically span infrastructure projects and vital operational support services.

- Contract Value Example: In 2023, Fluor received a contract worth around $3.7 billion from the U.S. Department of Energy.

Fluor's revenue is primarily generated through its extensive engineering, procurement, and construction management (EPCM) services, often structured via lump-sum, cost-plus, or reimbursable contracts. The company is increasingly favoring reimbursable contracts to manage risk, with 79% of its $28.5 billion backlog in 2024 being reimbursable.

Beyond project completion, Fluor secures recurring revenue through long-term maintenance and operations service contracts. Additionally, consulting and advisory services, covering feasibility studies and risk assessments, contribute significantly, as seen when consolidated revenues reached $13.1 billion in 2023.

Performance-based incentives, tied to milestones, cost savings, or schedule acceleration, represent another key revenue stream. Government contracts, especially with the U.S. government, are a major contributor, evidenced by a $3.7 billion U.S. Department of Energy contract in 2023.

| Revenue Stream | Description | 2023 Data/Notes |

|---|---|---|

| EPCM Services | Project fees from engineering, procurement, and construction management. | Backlog in 2024 was $28.5 billion, with 79% reimbursable. |

| Maintenance & Operations | Long-term contracts for facility upkeep and management post-construction. | Provides consistent and predictable revenue. |

| Consulting & Advisory | Specialized expertise in project feasibility, risk assessment, and technical solutions. | Contributed to $13.1 billion in consolidated revenues in 2023. |

| Performance Incentives | Additional revenue earned for achieving project milestones, cost savings, or schedule acceleration. | Reflected in revenue from successful project delivery in 2023. |

| Government Contracts | Revenue from mission-critical projects and support services for governmental bodies. | Included a $3.7 billion U.S. Department of Energy contract in 2023. |

Business Model Canvas Data Sources

The Fluor Business Model Canvas is constructed using a blend of internal financial reporting, project-specific data, and extensive market intelligence. These sources provide the foundational insights needed to accurately define Fluor's value proposition, customer segments, and revenue streams.