Fluor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

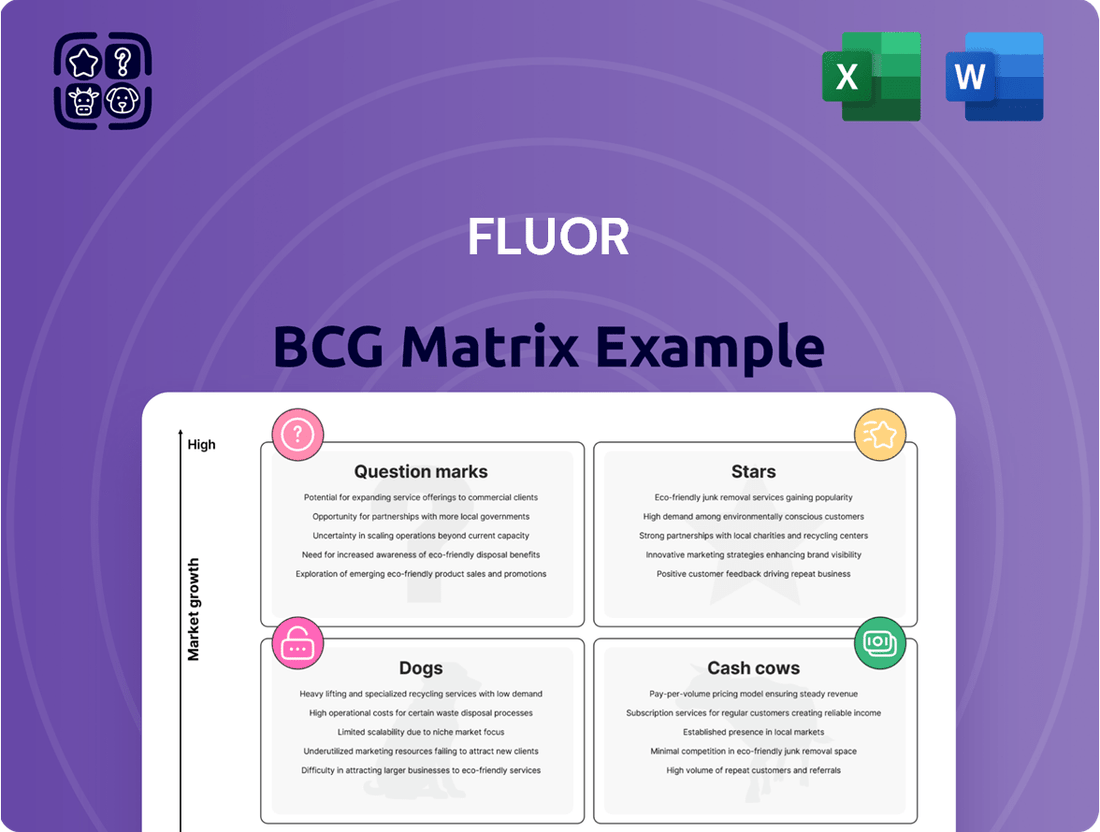

The BCG Matrix is a powerful tool for understanding a company's product portfolio. It categorizes products into four quadrants: Stars, Cash Cows, Dogs, and Question Marks, based on market share and market growth rate. This strategic framework helps businesses make informed decisions about resource allocation and future investments.

This preview offers a glimpse into how your products might fit within this critical strategic model. Imagine having a clear roadmap for optimizing your offerings and driving sustainable growth.

The full BCG Matrix report provides this clarity and much more. Gain detailed quadrant placements, data-backed recommendations, and a strategic blueprint to navigate your market effectively.

Purchase the full BCG Matrix today to unlock actionable insights and transform your product strategy from guesswork to informed decision-making.

Stars

Fluor's robust presence in Life Sciences & Pharmaceutical Projects is underscored by a multi-billion dollar EPCM contract awarded in Q1 2025 for a cutting-edge pharmaceutical facility in Indiana. This substantial project highlights Fluor's strategic positioning within the fast-growing life sciences sector, especially in advanced drug manufacturing capabilities.

This significant award, one of the largest single life science endeavors ever, bolsters Fluor's Urban Solutions segment. It demonstrates the company's ability to secure and execute complex, large-scale projects, solidifying its leadership in this high-growth niche market.

Fluor is strategically positioning itself within the burgeoning semiconductor and data center construction markets, recognizing the immense global demand for advanced technology infrastructure. The company's focus on these sectors is a clear indicator of its pursuit of high-growth opportunities. For instance, the US semiconductor industry alone saw significant investment announcements throughout 2024, with billions earmarked for new fabrication plants, directly benefiting construction firms like Fluor.

This strategic targeting aligns perfectly with Fluor's extensive engineering and construction capabilities, particularly in complex, technology-driven projects. The increasing emphasis on domestic semiconductor manufacturing, driven by national security and economic competitiveness, presents substantial opportunities for Fluor to leverage its expertise. Data center construction also continues its upward trajectory, fueled by the insatiable demand for cloud computing and artificial intelligence, with global data center construction spending projected to reach hundreds of billions in the coming years.

While detailed project pipelines are dynamic, Fluor's aggressive pursuit of work in these sectors signals a clear ambition to capture a significant market share. The company's ability to manage large-scale, intricate construction projects makes it well-suited for the demanding requirements of semiconductor fabs and hyperscale data centers. This strategic focus positions Fluor to capitalize on a market segment experiencing robust expansion and technological advancement.

Fluor's strategic involvement in major copper projects, such as the Q4 2024 award for the BHP Olympic Dam Smelter & Refinery Expansion, firmly places it in a high-demand sector. This is largely fueled by the global energy transition and the accelerating electrification of everything, creating a robust market for copper.

The rising global demand for copper, a critical component in renewable energy infrastructure and electric vehicles, directly translates into significant growth opportunities for Fluor's specialized expertise in this area. For instance, by the end of 2023, copper prices saw a notable increase, reflecting this burgeoning demand.

These substantial mining and metals projects are instrumental in driving the impressive growth witnessed within Fluor's Urban Solutions segment. This segment's expansion is a clear indicator of Fluor's successful strategy in leveraging its capabilities for critical infrastructure development.

Carbon Capture & Sequestration (CCS) FEED Services

Fluor's recent $500 million front-end engineering and design (FEED) contract for a cement plant carbon capture project in Germany highlights its significant early mover advantage in the burgeoning carbon capture market. This segment is essential for industrial decarbonization and is poised for substantial growth within the energy transition landscape. By securing these critical FEED contracts, Fluor is strategically positioning itself for future Engineering, Procurement, and Construction Management (EPCM) work, thereby capturing market share in this vital, emerging industry.

Fluor's strategic focus on Carbon Capture & Sequestration (CCS) FEED services places it in a strong position within the BCG Matrix, likely in the "Stars" category due to its high growth potential and current competitive strength. The company's ability to win substantial FEED contracts, such as the German cement plant project, indicates a strong demand for its expertise and a leading role in enabling industrial decarbonization efforts globally.

- High Growth Potential: The global carbon capture market is projected to reach hundreds of billions of dollars by 2030, driven by net-zero targets and regulatory incentives.

- Early Mover Advantage: Fluor's early engagement in securing significant FEED contracts provides a substantial lead over competitors in project execution and client relationships.

- EPCM Pipeline: Successful FEED phases directly translate into larger EPCM contracts, offering a clear pathway for revenue growth and market dominance.

- Decarbonization Driver: CCS is a crucial technology for hard-to-abate sectors like cement and steel, making Fluor's services indispensable for achieving climate goals.

Green Hydrogen Project Development

Fluor's involvement in green hydrogen projects, exemplified by their 2024 FEED contract for a Texas facility, firmly places them within a rapidly expanding sector. This market is crucial for decarbonization efforts globally, demanding substantial expertise in complex engineering and construction.

The green hydrogen market is projected for significant growth. For instance, BloombergNEF forecasts global green hydrogen production capacity to reach 39 million tonnes per year by 2030, a substantial increase from current levels. Fluor's early engagement allows them to build a strong foundation and expertise.

Securing these initial engineering and construction contracts is a strategic move. It positions Fluor to be a key player in the development of essential clean energy infrastructure, potentially leading to further project awards as the industry scales up.

- Green Hydrogen Market Growth: The sector is a high-growth area essential for future clean energy solutions.

- Fluor's Strategic Position: Awarded a FEED contract for a green hydrogen plant in Texas in 2024, showcasing active participation.

- Capability Requirement: The development of green hydrogen infrastructure demands significant engineering and construction capabilities.

- Early Mover Advantage: Securing early-stage contracts positions Fluor to capture a larger market share as the industry matures.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. Fluor's involvement in green hydrogen and carbon capture aligns perfectly with this definition.

The company's 2024 FEED contract for a Texas green hydrogen facility and its 2025 multi-billion dollar EPCM contract for a pharmaceutical plant demonstrate its engagement in rapidly expanding sectors. These ventures position Fluor to benefit from significant future growth driven by global decarbonization and life sciences advancements.

Fluor's strategic focus on these areas, supported by substantial project wins like the Olympic Dam expansion in late 2024, indicates a strong competitive position in markets with substantial future potential.

The company's early engagement and success in securing key contracts in these high-growth sectors are indicative of its 'Star' status within the Fluor BCG Matrix framework.

| Sector | Market Growth | Fluor's Position | Key Projects/Contracts | Year of Activity |

| Green Hydrogen | High | Leading | 2024 FEED Contract (Texas) | 2024 |

| Carbon Capture & Sequestration (CCS) | High | Early Mover | 2025 FEED Contract (Germany) | 2025 |

| Life Sciences & Pharmaceutical Projects | High | Strong | Q1 2025 EPCM Contract (Indiana) | 2025 |

What is included in the product

The Fluor BCG Matrix guides strategic decisions by categorizing business units based on market share and growth, informing investment and divestment choices.

Visualizes portfolio health, easing the pain of strategic resource allocation.

Cash Cows

Fluor's traditional infrastructure projects, like roads and bridges, represent a stable cash cow. The company's extensive, 25-year track record in Texas alone highlights its deep expertise and established market position in these mature sectors. This consistent presence translates into predictable demand and a reliable stream of cash flow, even if growth isn't explosive.

Fluor's Mission Solutions segment, a cornerstone of its government and defense business, acts as a significant cash cow. This segment consistently generates stable, recurring revenue through its established contracts with government entities.

These long-term agreements, often for essential and secure services, provide a predictable cash flow. For example, in 2023, Fluor secured a notable contract extension with the U.S. Department of Energy, valued at $7.7 billion, underscoring the ongoing demand and stability within this sector.

The company's strong reputation and deep expertise in executing complex government projects further solidify its position, ensuring continued contract awards and reliable financial returns from this business unit. This segment's predictable performance contributes significantly to Fluor's overall financial health.

Fluor's mature oil and gas asset maintenance and brownfield projects are classic cash cows. Despite the industry shift, Fluor maintains a strong presence, securing a significant market share in these essential services. These operations, though in a mature, low-growth sector, are vital for energy production and thus provide consistent, high-margin revenue for Fluor. Their integrated services model, which includes maintenance, operations, and brownfield expansions, fosters long-term client relationships and ensures a reliable stream of cash flow. For instance, in 2024, Fluor continued to secure substantial long-term contracts for maintenance and upgrades at established refining and petrochemical facilities, underscoring the enduring profitability of these mature assets.

Global Procurement & Supply Chain Services

Fluor's global procurement and supply chain services act as a significant cash cow, leveraging its extensive network and scale for consistent value generation. This segment, characterized by high market share in a relatively low-growth environment, efficiently drives profitability and strong operating cash flow.

These services are crucial for supporting Fluor's diverse project portfolio, ensuring cost-effectiveness and timely delivery. The established infrastructure and expertise in managing complex global supply chains contribute directly to the company's robust financial performance, particularly in generating reliable cash flows.

- High Market Share: Fluor commands a substantial portion of the market for global procurement and supply chain services within its industry, a testament to its long-standing presence and capabilities.

- Low Market Growth: While the overall market for these services may not be experiencing rapid expansion, Fluor's established position allows it to maintain and grow its revenue streams.

- Strong Operating Cash Flow: The efficiency and cost savings generated through these services are a primary driver of Fluor's consistent and healthy operating cash flow.

- Strategic Importance: These services are foundational to Fluor's project execution, providing a critical competitive advantage and supporting profitability across all business segments.

Large-Scale Chemical Facilities EPCM (Middle East)

Fluor's strategic emphasis on front-end engineering and design (FEED) packages for large-scale chemical facilities in the Middle East signals a mature market segment where the company is a dominant player. This focus on FEED is crucial for securing future Engineering, Procurement, and Construction Management (EPCM) contracts, which are characterized by their long-term nature and complexity.

These substantial chemical projects, once awarded, are known to generate consistent and predictable cash flows with stable profit margins for Fluor. The company's extensive experience and established presence in these established industrial sectors are key to maintaining its considerable market share.

- Market Position: Fluor has a strong market position in Middle Eastern EPCM for large chemical facilities.

- Revenue Stability: Long-term EPCM projects provide predictable and stable revenue streams.

- Profitability: These complex projects typically offer healthy and consistent profit margins.

- Strategic Focus: Emphasis on FEED packages ensures a pipeline of future EPCM work in this mature market.

Fluor's traditional infrastructure projects, like roads and bridges, represent a stable cash cow. The company's extensive, 25-year track record in Texas alone highlights its deep expertise and established market position in these mature sectors. This consistent presence translates into predictable demand and a reliable stream of cash flow, even if growth isn't explosive.

Fluor's Mission Solutions segment, a cornerstone of its government and defense business, acts as a significant cash cow. This segment consistently generates stable, recurring revenue through its established contracts with government entities. These long-term agreements, often for essential and secure services, provide a predictable cash flow. For example, in 2023, Fluor secured a notable contract extension with the U.S. Department of Energy, valued at $7.7 billion, underscoring the ongoing demand and stability within this sector. The company's strong reputation and deep expertise in executing complex government projects further solidify its position, ensuring continued contract awards and reliable financial returns from this business unit. This segment's predictable performance contributes significantly to Fluor's overall financial health.

Fluor's mature oil and gas asset maintenance and brownfield projects are classic cash cows. Despite the industry shift, Fluor maintains a strong presence, securing a significant market share in these essential services. These operations, though in a mature, low-growth sector, are vital for energy production and thus provide consistent, high-margin revenue for Fluor. Their integrated services model, which includes maintenance, operations, and brownfield expansions, fosters long-term client relationships and ensures a reliable stream of cash flow. For instance, in 2024, Fluor continued to secure substantial long-term contracts for maintenance and upgrades at established refining and petrochemical facilities, underscoring the enduring profitability of these mature assets.

Fluor's global procurement and supply chain services act as a significant cash cow, leveraging its extensive network and scale for consistent value generation. This segment, characterized by high market share in a relatively low-growth environment, efficiently drives profitability and strong operating cash flow. These services are crucial for supporting Fluor's diverse project portfolio, ensuring cost-effectiveness and timely delivery. The established infrastructure and expertise in managing complex global supply chains contribute directly to the company's robust financial performance, particularly in generating reliable cash flows.

| Segment | BCG Classification | Key Characteristics | Financial Contribution |

| Infrastructure (Roads, Bridges) | Cash Cow | Stable demand, deep expertise, established market position | Predictable cash flow |

| Mission Solutions (Govt. & Defense) | Cash Cow | Recurring revenue, long-term contracts, strong reputation | Significant, stable cash flow (e.g., $7.7B DOE contract in 2023) |

| Oil & Gas (Maintenance, Brownfield) | Cash Cow | Mature sector, high market share, essential services | Consistent, high-margin revenue |

| Global Procurement & Supply Chain | Cash Cow | High market share, low growth, efficient operations | Strong operating cash flow, cost-effectiveness |

| Front-End Engineering Design (FEED) - Middle East Chemical Facilities | Cash Cow | Dominant player in mature market, long-term EPCM potential | Stable profit margins, predictable cash flows from EPCM |

Preview = Final Product

Fluor BCG Matrix

The preview you're currently viewing is the exact Fluor BCG Matrix document you will receive upon purchase. This comprehensive strategic tool, ready for immediate application, is delivered in its final, unwatermarked format, ensuring you get precisely the analysis-ready content you need for informed decision-making and impactful presentations.

Dogs

In 2024, Fluor completed the divestiture of its Stork operations across continental Europe. This strategic move, followed by the sale of UK operations in Q1 2025, clearly signals that these European activities were considered non-core. The decision suggests these businesses likely exhibited low growth potential and possibly held a minor market share within Fluor's broader portfolio.

This divestment underscores a strategic realignment, indicating that the European Stork operations were not contributing effectively to Fluor's overarching strategic objectives or its targeted profitability levels. By shedding these segments, Fluor aims to free up capital that can be more effectively deployed into areas demonstrating higher growth potential and stronger alignment with the company's future direction.

Fluor has significantly reduced its exposure to legacy fixed-price contracts that have historically caused substantial cost overruns. These older projects, even if completed years ago, continue to represent financial liabilities and drain resources. In 2023, Fluor reported that its backlog had been substantially de-risked from these types of contracts.

These legacy contracts are characterized as low-return and low-growth assets for Fluor. They tie up capital and divert management focus from more profitable opportunities. By actively minimizing exposure to these problematic projects, Fluor aims to improve its overall financial health and operational efficiency.

Within Fluor's Energy Solutions segment, specific Liquefied Natural Gas (LNG) projects have been identified as underperformers, akin to the 'Dogs' in the BCG matrix. These projects, such as aspects of the LNG Canada development, faced significant headwinds in 2024, contributing to a decrease in segment profits due to cost overruns and schedule delays.

These particular LNG ventures are characterized by execution difficulties, leading to low profitability and potentially eroding Fluor's market share in specific LNG sub-segments. They represent a significant drag on the overall performance of the Energy Solutions segment, underscoring the inherent risks associated with highly complex and large-scale construction projects in the energy sector.

Small, Highly Fragmented O&M Contracts

Fluor's strategic divestment of its maintenance services business highlights a focus away from smaller, highly fragmented operations and maintenance (O&M) contracts. These types of contracts, often characterized by low barriers to entry and fierce competition, typically yield slim profit margins. For instance, in the broader industrial services sector, many smaller O&M providers operate with EBITDA margins in the single digits, making significant scale crucial for profitability. Fluor's strategic shift indicates a preference for higher-value, integrated solutions over these lower-margin, standalone services.

These fragmented O&M contracts often demand a disproportionate allocation of resources, including management attention and capital, relative to the financial returns they generate. The cost to manage numerous small contracts can outweigh the revenue, especially when competing with specialized, smaller firms. By moving away from this segment, Fluor can redirect its resources towards projects offering greater strategic alignment and profitability, potentially leveraging its expertise in more complex, integrated project delivery.

- Low Margins: Many fragmented O&M contracts operate with gross margins below 10%, significantly impacting net profitability.

- High Resource Intensity: Managing a large portfolio of small, disparate contracts requires substantial administrative and logistical overhead.

- Competitive Landscape: The O&M sector often sees intense competition from smaller, regional players with lower cost structures.

- Strategic Divestment: Fluor's past actions demonstrate a clear move away from businesses that do not align with its core strategy of integrated solutions.

Declining Refinery Projects in Specific Geographies

Revenue from Fluor's refinery projects in Mexico saw a decline in 2024, signaling a potentially stagnant or contracting market for such ventures in that specific geographical area. This trend suggests that these projects might be positioned as 'Dogs' within the BCG matrix if Fluor's market share is also low or diminishing.

The company's strategic pivot aims to reduce reliance on certain traditional oil and gas sectors, which likely includes areas experiencing reduced demand for new refinery construction or upgrades. This strategic repositioning is crucial for optimizing resource allocation and focusing on more promising growth avenues.

- Declining Mexican Refinery Revenue: Fluor's 2024 financial reports indicated a downturn in revenue specifically from refinery projects in Mexico.

- Market Position: If Fluor's market share in this segment is also contracting, these projects align with the characteristics of 'Dogs' in the BCG matrix.

- Strategic Diversification: Fluor is actively diversifying its portfolio, moving away from segments like certain traditional oil and gas infrastructure projects that may be underperforming.

- Focus on Growth Areas: This strategic shift allows Fluor to reallocate capital and resources towards markets and project types with higher growth potential and better return on investment.

Fluor's Stork operations in continental Europe, divested in 2024, and its maintenance services business, are examples of 'Dogs' in the BCG matrix. These segments likely exhibit low market share and low growth, consuming resources without substantial returns, as evidenced by single-digit EBITDA margins in similar industrial services contracts.

The underperforming LNG projects within Fluor's Energy Solutions segment, such as those impacted by cost overruns in 2024, also fit the 'Dog' profile. Furthermore, declining revenue from Mexican refinery projects in 2024 suggests these may also be considered 'Dogs' if Fluor's market share in that niche is not dominant.

These 'Dog' segments, characterized by low profitability and high resource intensity, led Fluor to strategically divest or reduce exposure. For instance, legacy fixed-price contracts, reported as substantially de-risked in 2023, were low-return and low-growth, tying up capital and management focus.

Fluor's divestment of Stork's European operations and its maintenance services business indicates a strategic shift away from low-margin, fragmented contracts. This allows reallocation of capital to higher-growth potential areas, improving overall financial health and operational efficiency.

Question Marks

NuScale's Small Modular Reactor (SMR) technology positions Fluor within a high-growth clean energy sector, offering significant future potential. However, NuScale is currently in its nascent stages, requiring substantial capital for development and facing considerable losses before achieving commercial viability. This investment profile places it in the 'question mark' category of the BCG matrix, demanding careful monitoring and strategic evaluation.

Fluor's Q1 2025 financial disclosures highlight this dynamic, reporting notable mark-to-market losses stemming from its NuScale investment. These losses underscore the significant cash expenditure associated with NuScale's advancement and the current uncertainty surrounding its near-term profitability and market penetration in SMR construction.

Early-stage renewable energy ventures, such as specific geothermal or offshore wind projects, often land in the question mark category of the Fluor BCG Matrix. These segments hold significant future promise, but Fluor's current market presence and established capabilities within them might be limited, requiring substantial upfront investment to develop expertise and secure projects.

In 2024, the global offshore wind market, for instance, continued its rapid expansion, with new capacity additions expected to accelerate. While Fluor is a significant player in the broader energy infrastructure space, its direct participation in these nascent sub-sectors represents a strategic bet on future growth, carrying inherent risks due to the unproven nature of some technologies and market dynamics.

Fluor is actively engaged in the Front-End Engineering Design (FEED) phase for green chemicals and hydrogen projects, clearly indicating its strategic focus on these expanding markets. This involvement suggests a strong pipeline of future opportunities.

However, transitioning from FEED to full-scale Engineering, Procurement, and Construction Management (EPCM) for these burgeoning sectors demands significant financial investment and specialized capabilities. Fluor's current market share in completed, large-scale EPCM projects for green chemicals and hydrogen is still in its formative stages, reflecting the nascent nature of these industries.

The global green hydrogen market, for instance, was valued at approximately $2.5 billion in 2023 and is projected to reach over $70 billion by 2030, according to various market analyses. Fluor's ability to secure and successfully execute these substantial EPCM contracts will be crucial for its long-term positioning.

New Digital & AI-Driven EPC Solutions

Fluor's technological prowess, evident in digital solutions like advanced data analytics and Building Information Modeling (BIM), positions it well for new digital and AI-driven Engineering, Procurement, and Construction (EPC) solutions. These innovations are crucial for enhancing efficiency and driving growth in a market eager for smarter project delivery.

The development and commercialization of distinct digital or AI-driven EPC service offerings represent a significant, high-growth opportunity. While Fluor currently uses these technologies internally, transforming them into standalone services means tapping into a nascent market. This shift requires substantial investment to build market share and achieve widespread adoption, but the potential for innovation and efficiency gains is immense.

- Market Potential: The global digital EPC market is projected to grow significantly, with AI in construction expected to reach over $2.5 billion by 2027, indicating a strong demand for these advanced solutions.

- Fluor's Role: Fluor's existing digital capabilities provide a strong foundation for developing and offering these specialized services, moving beyond internal efficiencies to external revenue streams.

- Investment Needs: Capturing market share in this segment will necessitate considerable investment in R&D, sales, and marketing to establish dedicated digital service portfolios.

- Competitive Landscape: Early movers in offering integrated AI and digital EPC solutions could gain substantial competitive advantages, setting new industry standards for project execution and cost-effectiveness.

Expansion into Untapped Emerging Geographies

Fluor’s strategic expansion into untapped emerging geographies represents a key growth driver, akin to a ‘Question Mark’ in the BCG Matrix. The company actively seeks out regions with burgeoning infrastructure needs and robust industrial development, identifying these as prime opportunities for significant future market share. For instance, as of 2024, many nations in Southeast Asia and Africa are experiencing accelerated infrastructure investment, with projections indicating continued high growth rates for the next decade.

These new market entries are characterized by a low current market penetration for Fluor but present a high potential for future expansion. Such ventures necessitate considerable initial capital outlay. This investment is directed towards understanding local market dynamics, establishing strategic alliances with local entities, and conducting thorough risk analyses to ensure a sustainable and profitable presence.

Fluor's approach to these emerging markets in 2024 involves:

- Targeting regions with projected GDP growth exceeding 5% annually.

- Focusing on sectors like renewable energy, transportation, and advanced manufacturing.

- Establishing joint ventures to mitigate local operational risks and leverage existing networks.

- Investing in localized talent development and supply chain integration.

Fluor's investments in early-stage technologies and new geographical markets often fall into the Question Mark category of the BCG Matrix. These areas represent significant future potential but currently demand substantial investment with uncertain near-term returns. The company's involvement in NuScale's Small Modular Reactors (SMRs) is a prime example, requiring considerable capital for development in a nascent clean energy sector.

Similarly, Fluor's strategic push into emerging markets in 2024, such as certain regions in Southeast Asia and Africa experiencing rapid infrastructure growth, also fits the Question Mark profile. While these markets offer high growth potential, Fluor's current penetration is low, necessitating significant upfront investment in understanding local dynamics and forming partnerships. This approach is characteristic of Question Marks, aiming to build market share in high-potential but currently underdeveloped areas.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.