Fluor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

Navigate the complex external forces shaping Fluor's future with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements impacting this global engineering giant. Gain critical insights into social trends, environmental regulations, and legal frameworks that influence its operations and strategic direction. Download the full version to unlock actionable intelligence and strengthen your own market strategy.

Political factors

Fluor's business is significantly shaped by its engagement with U.S. government contracts, particularly in the infrastructure and defense sectors. These contracts represent a substantial part of the company's project pipeline and directly influence its financial performance.

Fluctuations in government spending priorities or adjustments to budget allocations can have a direct and pronounced effect on Fluor's revenue streams and its secured project backlog. For instance, in 2023, Fluor was awarded $3.8 billion in U.S. government infrastructure and defense contracts.

The Department of Energy alone represented a considerable portion of these government awards, accounting for roughly 45% of the total $3.8 billion secured in 2023. This highlights the critical reliance on specific government agencies for a large segment of Fluor's work.

Fluor's global operations are significantly influenced by geopolitical tensions. These can manifest as trade restrictions and international security risks, directly impacting project viability. For instance, volatile regions like the Middle East and Eastern Europe present ongoing challenges, potentially leading to project cancellations or necessary scope adjustments. In 2023, these geopolitical factors caused a notable 22% reduction in Fluor's international project opportunities.

Fluor's global reach means that shifts in international trade policies and regulations are a significant consideration. These evolving rules directly impact how Fluor operates across different countries, often leading to higher expenses for ensuring compliance. Navigating varied import/export rules, the paperwork for international trade, and obtaining licenses for projects that cross borders adds layers of difficulty and cost to Fluor's worldwide endeavors. For instance, in 2023 alone, the company incurred $48.3 million in costs specifically related to trade regulation compliance.

Energy Sector Policy Changes

Government policies profoundly shape Fluor's energy project opportunities. For instance, the US Inflation Reduction Act of 2022, with its significant tax credits for clean energy, is expected to boost renewable energy project development, an area where Fluor is actively seeking growth. Conversely, policies that prioritize traditional oil and gas extraction could impact Fluor's existing project backlog, though the company is also involved in projects supporting energy transition technologies.

The global push towards decarbonization presents a dual-edged sword for Fluor. While it creates demand for new green energy infrastructure projects, it also necessitates adaptation for companies historically involved in fossil fuel projects. Fluor's strategic focus on diversifying into renewable sectors, such as offshore wind and hydrogen production, aims to capitalize on these evolving policy landscapes. For example, Fluor's involvement in projects like the US Department of Energy's hydrogen hubs signals a commitment to this transition.

- Renewable Energy Investment: Global investment in renewables reached approximately $500 billion in 2023, a trend that directly benefits engineering and construction firms like Fluor.

- Decarbonization Targets: Over 130 countries have set or are considering net-zero emission targets by mid-century, driving demand for low-carbon energy solutions and related infrastructure projects.

- Energy Transition Funding: Government initiatives, such as the European Union's Green Deal, allocate substantial funds to energy transition projects, offering significant opportunities for companies like Fluor.

Political Stability and Investment Decisions

Political stability is a critical consideration for Fluor, as it directly influences client confidence and the commitment to undertaking substantial capital projects. When governments provide a predictable and secure operating environment, clients are more inclined to allocate significant funds towards new ventures, which in turn bolsters Fluor's project pipeline and backlog.

Conversely, political volatility can lead to project delays or outright cancellations. This uncertainty makes clients hesitant to commit capital, directly impacting Fluor's ability to secure new awards and maintain a robust backlog of work. For instance, Fluor's 2024 financial performance was notably impacted by clients' cautious investment decisions stemming from prevailing geopolitical instability.

The company's backlog, a key indicator of future revenue, is sensitive to these political shifts. A stable political climate fosters long-term investment, whereas instability can cause clients to pause or re-evaluate their capital expenditure plans. This dynamic directly affects Fluor's revenue streams and overall financial health.

- Geopolitical Uncertainty: Clients' investment decisions are directly influenced by the perceived stability of the political landscape in countries where Fluor plans to operate.

- Project Feasibility: Political stability is a prerequisite for the successful execution and financial viability of Fluor's large-scale engineering and construction projects.

- Impact on Backlog: Political instability can lead to deferred or halted projects, negatively impacting Fluor's new awards and the overall size of its project backlog.

- 2024 Performance: Fluor's 2024 financial results highlighted how ongoing geopolitical challenges prompted clients to alter their investment strategies, affecting the company's performance.

Government policies significantly influence Fluor's project pipeline, especially in the infrastructure and energy sectors. The company's substantial U.S. government contracts, particularly with the Department of Energy, underscore this reliance. For example, in 2023, Fluor secured $3.8 billion in U.S. government contracts, with the Department of Energy accounting for approximately 45% of this total.

| Factor | Impact on Fluor | 2023 Data/Example |

| Government Spending Priorities | Directly affects revenue and backlog | $3.8 billion in U.S. government contracts secured |

| Energy Policy (e.g., IRA) | Drives opportunities in renewable energy | Expected boost in renewable project development |

| Geopolitical Tensions | Can lead to project cancellations/adjustments | 22% reduction in international project opportunities |

| Trade Regulations | Increases operational costs and complexity | $48.3 million in trade regulation compliance costs |

What is included in the product

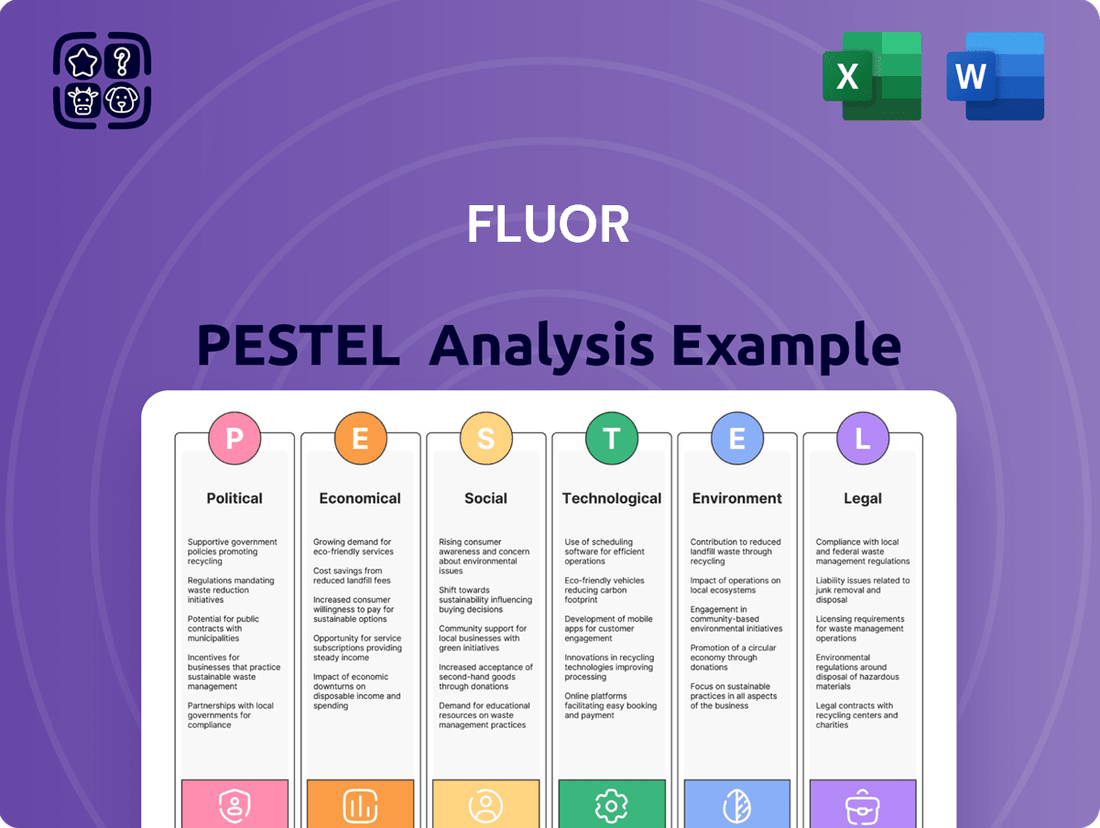

This PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping Fluor's global operations.

It provides actionable insights into navigating external challenges and capitalizing on emerging opportunities within Fluor's diverse markets.

Offers a structured framework to identify and mitigate external threats and opportunities, thereby reducing uncertainty and supporting proactive strategic decision-making.

Economic factors

Fluor's performance is intrinsically tied to global economic expansion. When economies are robust, there's a surge in capital investment for large infrastructure, energy, and industrial ventures, directly benefiting Fluor’s engineering and construction services. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023, signaling potential for increased project pipelines.

A positive economic climate encourages clients to commit to significant capital expenditures, translating into higher demand for Fluor's expertise. Conversely, a slowdown, like the 2.6% global growth estimated for 2023, often results in deferred or canceled projects, impacting Fluor's order book and revenue. The ongoing investment cycles in energy transition and infrastructure development are key drivers for Fluor’s future growth.

Commodity price volatility significantly impacts Fluor's business, especially in its Energy Solutions and Urban Solutions segments. Fluctuations in oil, gas, and mining materials directly affect project profitability and viability. For instance, a surge in oil prices can boost investment in new energy projects, a key area for Fluor, while a sharp decline might cause clients to postpone or cancel planned infrastructure development.

In 2024, the energy market has seen considerable swings. Brent crude oil prices, for example, have traded within a range, influencing capital expenditure decisions across the oil and gas industry. This dynamic directly shapes Fluor's order backlog and revenue streams from projects related to exploration, production, and refining.

Fluctuations in global interest rates directly impact Fluor's project financing costs and the attractiveness of new ventures for its clients. For instance, the U.S. Federal Reserve's continued monetary tightening through 2024, with benchmark rates holding steady above 5%, increases the cost of capital for large infrastructure and energy projects Fluor undertakes. This means higher borrowing expenses for Fluor and its clients, potentially delaying or scaling back investment in significant capital expenditures.

Access to robust and affordable credit is fundamental to funding Fluor's massive, multi-year projects. In 2024, while credit markets have shown some resilience, the cost of debt remains elevated compared to the low-interest rate environment of previous years. Companies relying on debt financing for capital-intensive projects, a core market for Fluor, face increased scrutiny and potentially higher borrowing costs, impacting project viability.

Currency Exchange Rate Variations

Currency exchange rate variations pose a significant challenge for Fluor, a global operator. Fluctuations in exchange rates can directly impact the profitability of its international projects and how its foreign earnings translate into U.S. dollars. For instance, if the U.S. dollar strengthens against a currency in which Fluor generates substantial revenue, those earnings will be worth less when converted back, potentially reducing reported profits.

Managing these foreign currency exposures is a constant endeavor for the company. Adverse movements can erode the value of overseas contracts and investments. In 2023, for example, a stronger dollar against several major currencies likely presented headwinds for U.S.-based multinational corporations like Fluor, impacting the reported value of their international operations.

The company's exposure is multifaceted, involving not only the translation of foreign subsidiary earnings but also the cost of materials and labor procured in different currencies for its global projects. Effective hedging strategies are crucial to mitigate these risks.

- Global Operations Impact: Fluor's worldwide presence means its financial results are sensitive to shifts in currency values across numerous international markets.

- Profitability Erosion: A stronger U.S. dollar can decrease the reported revenue and profit from international projects when translated back into dollars, as seen by many U.S. multinationals in 2023.

- Hedging Necessity: Continuous management and strategic hedging are essential to protect against potential losses arising from unfavorable currency movements.

- Cost of Goods and Services: Exchange rate volatility also affects the cost of materials and labor sourced internationally for Fluor's engineering and construction projects.

Inflationary Pressures and Supply Chain Costs

Rising inflation directly impacts Fluor's project costs, affecting everything from raw materials to labor and equipment. This is particularly challenging for fixed-price contracts, as cost increases can eat into profit margins. For instance, the U.S. Producer Price Index for inputs to construction industries saw significant year-over-year increases in 2023 and early 2024, highlighting the pressure on material costs.

Managing supply chain expenses is paramount in such an inflationary climate. Fluor's ability to secure materials and components efficiently, while mitigating price volatility, is key to maintaining project profitability. Global supply chain disruptions, exacerbated by geopolitical events and shifting demand, continue to add complexity and cost to project execution.

Fluor's overall competitiveness and profit margins hinge on its adeptness at navigating these inflationary pressures and optimizing its global supply chain. The company's success in maintaining healthy margins depends on its execution efficiency and its strategic sourcing capabilities. For example, in Q1 2024, Fluor reported that commodity price volatility was a factor they actively managed across their project portfolio.

- Inflationary Impact: Increased costs for materials, labor, and equipment directly affect Fluor's project profitability, especially on fixed-price contracts.

- Supply Chain Management: Efficiently managing global supply chain logistics and costs is critical for maintaining competitiveness and profit margins amid price volatility.

- Profit Margin Preservation: Fluor's ability to absorb or pass on cost increases, coupled with operational efficiencies, determines its success in preserving healthy profit margins.

- 2023/2024 Data Point: U.S. PPI for construction inputs showed elevated year-over-year growth in late 2023 and early 2024, underscoring the inflationary environment faced by companies like Fluor.

Global economic growth directly influences Fluor's project pipeline, with robust expansion driving demand for its engineering and construction services. The IMF projected global growth at 3.2% for 2024, a positive signal for increased capital investments. Conversely, economic downturns lead to project deferrals, impacting Fluor's order book.

Commodity price volatility, particularly for oil and gas, significantly affects Fluor's profitability and project viability in its energy-focused segments. For example, oil price fluctuations in 2024 directly influence capital expenditure decisions within the oil and gas industry, impacting Fluor's revenue streams.

Elevated interest rates, such as the U.S. Federal Reserve holding rates above 5% in 2024, increase the cost of capital for large projects, potentially leading clients to scale back or delay investments, which directly affects Fluor's business.

Inflationary pressures, evidenced by rising U.S. PPI for construction inputs in late 2023 and early 2024, increase Fluor's project costs, particularly for fixed-price contracts, impacting profit margins.

| Economic Factor | Impact on Fluor | 2024/2025 Data/Outlook |

| Global Economic Growth | Drives demand for infrastructure and energy projects. | IMF projected 3.2% global growth for 2024. |

| Commodity Prices | Affects profitability in energy and mining sectors. | Oil price volatility continues to influence capital expenditure in 2024. |

| Interest Rates | Impacts project financing costs and client investment decisions. | U.S. benchmark rates remained above 5% in 2024, increasing borrowing costs. |

| Inflation | Increases project material, labor, and equipment costs. | U.S. PPI for construction inputs showed elevated growth in late 2023/early 2024. |

Full Version Awaits

Fluor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fluor PESTLE Analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fluor Corporation. Gain actionable insights to inform your strategic decisions.

Sociological factors

The availability of skilled labor, particularly engineers, project managers, and construction professionals, is fundamental to Fluor's success in executing complex projects. In 2024, reports indicate a persistent shortage in specialized engineering fields across North America and Europe, potentially extending project timelines and increasing labor costs.

Demographic shifts, such as an aging workforce in many developed economies, present a dual challenge of potential skill gaps and increased competition for younger talent. For instance, the average age of skilled tradespeople in construction in the US has been steadily climbing, nearing 45 years old, highlighting the need for robust succession planning.

Fluor's strategic imperative must include proactive measures to attract, develop, and retain a globally diverse and highly skilled workforce. This involves investing in comprehensive training programs and fostering an inclusive work environment to counter the effects of talent scarcity and ensure consistent project delivery capabilities.

Public sentiment heavily influences the approval and pace of major infrastructure and energy projects, from nuclear facilities to fossil fuel ventures. In 2024, a significant portion of the public in many developed nations expressed concerns about the environmental impact of new energy infrastructure, creating hurdles for project developers.

As societal emphasis on sustainability intensifies, projects are increasingly scrutinized for their alignment with community values and environmental stewardship. This is evident in the growing demand for renewable energy solutions and a cautious approach to traditional fossil fuel projects.

Fluor's strategic focus on projects like the development of small modular reactors (SMRs) in Romania, intended to provide carbon-free electricity, directly addresses this societal shift. These initiatives aim to balance energy needs with environmental consciousness, reflecting a growing preference for cleaner energy technologies.

Stakeholder expectations for corporate social responsibility are significantly impacting Fluor's operations and project acquisition. This includes demands for ethical conduct, active community involvement, and prioritizing local content in development. Fluor's commitment to environmental stewardship, evidenced by its focus on programs that restore and protect natural environments in local communities, directly addresses these evolving societal demands.

Health and Safety Standards

Societal and regulatory pressure for robust health and safety in engineering and construction directly shapes Fluor's approach to its operations. A commitment to safety isn't just about compliance; it's fundamental to protecting employees, safeguarding the company's reputation, and preventing expensive accidents and legal issues.

Fluor's dedication to safety is reflected in its performance metrics. For instance, in 2024, the company reported a Total Recordable Incident Rate (TRIR) that was notably lower than the industry benchmark, underscoring their effective safety protocols.

- Industry-Leading Safety: Fluor consistently aims for safety performance that surpasses industry averages.

- Reputational Asset: A strong safety record enhances Fluor's standing with clients, employees, and the public.

- Risk Mitigation: Prioritizing health and safety minimizes the likelihood of costly incidents and potential litigation.

- Employee Well-being: The company's safety standards directly contribute to the health and security of its workforce.

Urbanization and Population Growth

The world is becoming increasingly urbanized, with more people than ever living in cities. This trend, coupled with overall population growth, is a major driver for infrastructure development. For companies like Fluor, this means a heightened demand for services related to building and managing everything from new transportation networks to advanced water systems and smart city technologies. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, up from 56% in 2021.

These demographic shifts create substantial opportunities for Fluor's Urban Solutions segment. Emerging markets, in particular, are experiencing rapid urbanization and are often in need of significant infrastructure upgrades. Fluor is actively positioning itself to capitalize on these projects, aiming to secure contracts that leverage its expertise in large-scale infrastructure development.

Fluor's strategic focus includes expanding its footprint in regions experiencing the most significant urban growth. This expansion is geared towards capturing a larger share of the market for new urban infrastructure projects.

- Urban Population Growth: The UN estimates global urban population will reach 6.7 billion by 2050, a significant increase from 4.3 billion in 2021.

- Infrastructure Demand: This urbanization fuels demand for transportation, utilities, and smart city solutions.

- Emerging Markets Focus: Fluor is targeting high-growth urban areas in developing economies for infrastructure projects.

- Fluor's Urban Solutions: The company's segment dedicated to urban development is poised to benefit from these trends.

Societal expectations for corporate responsibility are increasingly influencing Fluor's project selection and operational conduct. This involves heightened scrutiny on ethical practices, community engagement, and the prioritization of local labor and resources. Fluor's proactive engagement in community development initiatives and its commitment to environmental restoration, as seen in projects like the Singapore Changi Airport expansion, directly address these evolving public demands.

Public sentiment regarding energy sources and infrastructure development significantly impacts project viability. Growing awareness of climate change means projects must demonstrate clear environmental benefits or mitigation strategies. For example, in 2024, public opposition to new fossil fuel infrastructure has intensified in many Western nations, while support for renewable energy projects, such as offshore wind farms where Fluor has substantial involvement, continues to grow.

Demographic shifts, particularly the aging workforce in developed countries and the growing demand for skilled labor globally, present both challenges and opportunities. Fluor must navigate potential skill shortages by investing in training and development programs to ensure a competent workforce for its complex projects. The average age of skilled construction workers in the US, for instance, is approaching 45, underscoring the need for effective knowledge transfer.

Technological factors

Fluor is deeply embedding digital transformation and advanced analytics into its operations. They are actively using tools like Building Information Modeling (BIM) for design and construction, artificial intelligence (AI) for predictive insights, and the Internet of Things (IoT) to keep a close eye on projects in real-time. This integration is key to boosting efficiency and cutting costs.

These technological advancements directly contribute to improved project execution and safety across Fluor's worldwide projects. By embracing these digital tools, the company aims to streamline processes and mitigate risks effectively, ensuring better outcomes for complex engineering and construction endeavors.

A prime example of this is Fluor's application of advanced technologies in its energy transition projects during 2024. These initiatives saw an estimated 15% improvement in efficiency, showcasing the tangible benefits of their digital strategy.

The construction industry's embrace of automation and robotics is a significant technological shift. These advancements are poised to boost efficiency, cut labor expenses, and elevate safety standards on project sites. For instance, in 2023, the global construction robotics market was valued at approximately $1.7 billion and is projected to grow substantially.

Fluor's strategic integration of these technologies into its construction and maintenance offerings presents a clear competitive edge. This includes leveraging modular construction methods, which have been shown to shorten project timelines by up to 20% and reduce overall costs.

The drive towards sustainable and green technologies is a major technological factor influencing Fluor. Developing and implementing solutions like carbon capture, hydrogen production, renewable fuels, and waste-to-energy is crucial for Fluor's expansion within the evolving energy sector. This focus directly addresses global decarbonization targets and meets the increasing client demand for eco-conscious project execution.

Fluor's commitment to this area is evident in its growing participation in renewable energy projects. By 2024, the company reported a significant uptick in its involvement across various renewable energy domains, demonstrating a strategic alignment with the global shift towards cleaner energy sources.

Advancements in Engineering Software and Design Tools

Continuous advancements in engineering software and design tools are revolutionizing how complex projects are conceived and executed. These tools facilitate more efficient designs, detailed simulations, and seamless collaboration among global teams. For Fluor, this means a pathway to delivering more innovative, precise, and cost-effective solutions to its diverse client base.

Fluor’s commitment to staying ahead in this technological race is evident in its significant investments in research and development. These investments are crucial for integrating cutting-edge capabilities, such as artificial intelligence in design optimization and advanced digital twins for real-time project monitoring. For instance, in 2024, the company highlighted its use of advanced simulation software to streamline the design phase for a major petrochemical facility, reportedly reducing design iterations by 15%.

- Digital Transformation: Embracing advanced BIM (Building Information Modeling) and integrated design platforms enhances project visualization and clash detection, reducing on-site rework.

- AI and Machine Learning: Application of AI in generative design and predictive analytics for material selection and structural integrity analysis is becoming increasingly standard.

- Cloud-Based Collaboration: Utilizing cloud platforms allows for real-time data sharing and collaborative problem-solving across geographically dispersed engineering teams.

- Simulation and Modeling: Sophisticated simulation software allows for virtual testing of designs under various operational conditions, improving safety and performance outcomes.

Cybersecurity and Data Protection

Fluor's increasing reliance on digital platforms for project management and operations necessitates robust cybersecurity. The threat of cyber-attacks is a significant concern, potentially impacting operational integrity and client trust. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the risk.

Protecting sensitive project information and intellectual property is paramount. The management of artificial intelligence (AI) technologies, while offering efficiency gains, also introduces new vulnerabilities that require sophisticated protection strategies. In 2024, the cybersecurity market experienced substantial growth, with companies investing heavily in advanced threat detection and prevention systems.

- Growing Cyber Threats: The increasing sophistication and frequency of cyber-attacks globally pose a direct risk to Fluor's digital infrastructure and sensitive data.

- Intellectual Property Protection: Safeguarding proprietary designs, engineering data, and project plans from unauthorized access and theft is critical for competitive advantage.

- AI Vulnerabilities: The integration of AI in operations, while beneficial, can create new attack vectors that require specialized cybersecurity protocols.

- Client Trust and Reputation: A data breach could severely damage Fluor's reputation and erode client confidence, impacting future business opportunities.

Technological advancements, particularly in digital transformation and AI, are reshaping Fluor's operational landscape. The company's adoption of Building Information Modeling (BIM) and IoT for real-time project monitoring is enhancing efficiency and cost reduction. Fluor's strategic investment in these areas yielded an estimated 15% efficiency improvement in its 2024 energy transition projects.

The construction sector's increasing use of automation and robotics is a key technological trend, promising greater efficiency and safety. The global construction robotics market, valued at approximately $1.7 billion in 2023, is expected to see significant growth. Fluor's use of modular construction, which can shorten project timelines by up to 20%, further demonstrates this technological integration.

Fluor's focus on sustainable technologies like carbon capture and hydrogen production aligns with global decarbonization efforts and increasing client demand for green solutions. By 2024, Fluor reported a notable increase in its involvement in renewable energy projects, underscoring its strategic pivot towards cleaner energy infrastructure.

The integration of advanced engineering software and digital twins allows for more efficient design and real-time project oversight, crucial for complex global projects. Fluor's 2024 highlight of using advanced simulation software to reduce design iterations by 15% in a petrochemical facility project exemplifies this.

| Technology Area | Fluor's Application | Impact/Benefit | Industry Trend | 2023/2024 Data Point |

|---|---|---|---|---|

| Digital Transformation & BIM | Integrated design, clash detection | Reduced rework, improved visualization | Industry-wide adoption for efficiency | N/A (Ongoing Integration) |

| AI & Machine Learning | Generative design, predictive analytics | Optimized material selection, structural integrity | Increasingly standard in design | N/A (Ongoing Integration) |

| Automation & Robotics | On-site construction tasks | Increased efficiency, reduced labor costs, enhanced safety | Growing market, projected substantial growth | Global construction robotics market valued at ~$1.7 billion (2023) |

| Sustainable Technologies | Carbon capture, hydrogen, renewables | Addresses decarbonization, meets green demand | Major driver for energy sector expansion | Fluor reported increased involvement in renewable projects (2024) |

Legal factors

Fluor navigates a labyrinth of international and local regulations across its global operations, encompassing environmental, health, safety (EHS), labor, and anti-corruption laws. Failure to comply can lead to substantial penalties, costly legal battles, and severe damage to its brand. For instance, in 2023, penalties for environmental non-compliance in the U.S. alone reached billions of dollars across industries, a risk Fluor actively mitigates.

The company adheres to stringent international standards like ISO 9001:2015 for quality management and OHSAS 18001 (now ISO 45001) for occupational health and safety. These certifications are critical for securing contracts, particularly with governmental and large corporate clients who mandate such compliance. In 2024, the global market for EHS compliance software was projected to exceed $2.5 billion, highlighting the significant investment companies like Fluor make in regulatory adherence.

Contract law is fundamental to Fluor's operations, especially given the complex, multi-year nature of its large-scale engineering and construction projects. These agreements outline intricate obligations, making robust contract law frameworks and efficient dispute resolution processes essential for project success and financial stability.

Managing contractual disagreements and potential litigation poses a significant risk, particularly with legacy fixed-price contracts where cost overruns can directly impact profitability. These disputes can lead to substantial financial provisions and affect overall financial performance.

For instance, in 2024, Fluor recorded a financial provision linked to a jury verdict against one of its joint ventures involved in an infrastructure project. This highlights the tangible financial impact that contract disputes can have on the company's results.

Protecting Fluor's intellectual property, encompassing proprietary engineering designs, unique project methodologies, and technological innovations, is absolutely crucial for sustaining its competitive advantage in the global market. This includes safeguarding trade secrets and patents that underpin their operational efficiency and client solutions.

Navigating the complexities of intellectual property rights is a significant legal challenge, as these frameworks differ considerably across various countries. This global variation necessitates a robust legal strategy to ensure proprietary information remains secure and enforceable in diverse international jurisdictions where Fluor operates.

Fluor acknowledges its legal obligations and disclaims any intention or commitment to update its forward-looking statements, except where mandated by law. This stance is important for managing stakeholder expectations regarding future performance and potential disclosures.

Labor Laws and Employment Regulations

Fluor must navigate a complex web of labor laws across its global operations, covering everything from minimum wages and working hours to employee safety and the right to organize. For instance, in 2024, many jurisdictions are seeing increased scrutiny on gig economy worker classifications and mandated paid leave, which could affect Fluor's contingent workforce strategies and overall labor costs. Compliance with these diverse regulations is paramount to avoid costly legal battles and operational disruptions.

Changes in labor legislation can directly impact Fluor's bottom line and project execution. For example, a sudden increase in minimum wage requirements in a key operating country could raise project labor expenses, potentially affecting bid competitiveness and profitability. Similarly, new regulations concerning collective bargaining or union recognition could lead to protracted negotiations, impacting project schedules and incurring additional administrative overhead.

Fluor demonstrates a commitment to upholding International Labor Standards across its worldwide activities. This includes adhering to principles on freedom of association, the elimination of forced labor, and non-discrimination in employment. As of its latest reporting, Fluor has focused on enhancing its global human resources policies to ensure alignment with evolving international best practices, aiming to foster a consistent and fair employment environment.

The company's proactive approach to labor relations and legal compliance is underscored by its efforts to manage potential disputes effectively. By maintaining open communication channels with its workforce and relevant labor bodies, Fluor seeks to mitigate the risk of significant labor disputes that could jeopardize project delivery or damage its corporate reputation. This includes robust grievance procedures and a commitment to fair dispute resolution mechanisms.

Environmental Regulations and Permitting

Environmental regulations and the permitting process are significant hurdles for Fluor's operations, particularly in construction and project execution. Obtaining various environmental permits is a mandatory step, directly impacting project timelines and costs. For example, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter enforcement of air and water quality standards, requiring extensive documentation and mitigation plans for major infrastructure projects.

Compliance with evolving environmental laws, including those concerning carbon emissions and waste management, is paramount for securing project approvals and avoiding substantial penalties. Fluor must navigate regulations like the Inflation Reduction Act (IRA), which incentivizes clean energy projects but also imposes reporting requirements on emissions. Failure to comply can lead to costly fines and project delays, as seen in instances where companies have faced penalties for improper waste disposal.

New or changing legal requirements, especially those pertaining to environmental, health, and safety (EHS) matters, can directly affect Fluor's business model and operational strategies. As of mid-2025, there is a growing global trend towards more stringent regulations on hazardous materials and workplace safety, requiring continuous adaptation of Fluor's safety protocols and investment in compliance technologies. This dynamic legal landscape necessitates proactive engagement with regulatory bodies and ongoing risk assessment.

- Permitting Complexity: Obtaining environmental permits for new projects can take months, impacting project start dates.

- Carbon Emission Targets: Increasing global focus on net-zero emissions by 2050 necessitates compliance with evolving carbon reporting and reduction mandates.

- Waste Management Laws: Stricter regulations on the disposal and recycling of industrial waste require significant investment in sustainable practices.

- EHS Standards: Heightened scrutiny on environmental, health, and safety compliance demands robust internal auditing and training programs.

Fluor operates under a complex web of international and domestic laws, impacting everything from environmental protection to labor practices and anti-corruption measures. Non-compliance can result in hefty fines, protracted legal disputes, and significant reputational damage.

The company's adherence to quality and safety standards, such as ISO 9001:2015 and ISO 45001, is crucial for securing contracts, especially with government entities. The global market for EHS compliance software was projected to surpass $2.5 billion in 2024, underscoring the substantial investments required for regulatory adherence.

Contract law is fundamental to Fluor's large-scale projects, where intricate agreements define obligations and necessitate robust dispute resolution. For instance, in 2024, Fluor disclosed a financial provision stemming from a jury verdict against one of its joint ventures, highlighting the financial repercussions of contract disagreements.

Protecting intellectual property, including proprietary designs and methodologies, is vital for maintaining Fluor's competitive edge across diverse international markets. This requires navigating varying IP laws globally to ensure the security and enforceability of its innovations.

| Legal Area | Key Considerations for Fluor | 2024/2025 Data/Trends |

|---|---|---|

| Regulatory Compliance | Adherence to EHS, labor, and anti-corruption laws globally. | Billions in industry penalties for environmental non-compliance in the US in 2023. Increased scrutiny on gig worker classification and paid leave mandates in various jurisdictions in 2024. |

| Contract Law | Management of complex, multi-year project agreements and dispute resolution. | Fluor recorded provisions in 2024 related to contract disputes impacting financial results. |

| Intellectual Property | Protection of proprietary designs and methodologies across international jurisdictions. | Varied IP rights frameworks across countries require robust legal strategies for safeguarding trade secrets and patents. |

| Labor Laws | Compliance with wage, working hours, safety, and organization rights. | Global trend towards stricter workplace safety and potential impacts on contingent workforce strategies. |

Environmental factors

The intensifying global commitment to climate change mitigation, marked by increasingly rigorous regulations on carbon emissions, significantly influences how Fluor designs and executes its projects, especially within the energy industry. This regulatory landscape necessitates a strategic shift towards developing and deploying low-carbon technologies and solutions.

Fluor is actively responding to this pressure by focusing on reducing its own operational greenhouse gas emissions. Demonstrating tangible progress, the company successfully met its Net Zero 2023 commitment for operational Scope 1 and Scope 2 GHG emissions, signaling a proactive approach to environmental stewardship.

Growing concerns about resource scarcity, particularly water and key raw materials, are increasingly shaping project execution for companies like Fluor. This trend directly impacts the need for robust sustainable resource management practices. For instance, optimizing material usage in construction and engineering projects, alongside robust recycling programs, can significantly reduce environmental footprints. Fluor's commitment to sustainable procurement in 2024 and 2025 aims to bolster the preservation of natural resources by prioritizing suppliers with strong environmental credentials.

Large-scale infrastructure projects, a core business for Fluor, necessitate rigorous environmental impact assessments (EIAs) and robust biodiversity protection strategies. Failure to comply can lead to project delays, fines, and reputational damage. For instance, in 2023, the global environmental consulting market, which includes EIAs, was valued at over $40 billion, highlighting the significant regulatory and economic importance of these assessments.

Fluor actively works to integrate ecological considerations into its project lifecycles, aiming to minimize negative environmental footprints. This involves careful site selection, sustainable construction practices, and the implementation of mitigation measures to protect local flora and fauna. The company's commitment extends to supporting programs focused on ecological restoration and conservation, underscoring its understanding of the long-term value of environmental stewardship.

Waste Management and Pollution Control

Effective waste management and pollution control are paramount for Fluor, directly impacting regulatory compliance and its environmental impact. This necessitates the responsible handling of construction debris, hazardous substances, and the active prevention of pollution across its projects.

Fluor's commitment to environmental stewardship is evident in initiatives like its New Delhi office's eco-restoration efforts. These projects focused on improving water quality and mitigating flood risks through the removal of sludge, sewage, and litter, demonstrating a tangible approach to environmental remediation.

The company's operations, particularly in large-scale engineering and construction, generate significant waste streams. For instance, major infrastructure projects often involve substantial amounts of excavated earth, concrete, and other materials requiring careful management. While specific 2024 or 2025 data on Fluor's waste generation and recycling rates isn't publicly detailed yet, industry benchmarks indicate that construction and demolition waste can account for a large percentage of total waste in many regions.

- Regulatory Compliance: Adherence to stringent environmental laws regarding waste disposal and emissions is crucial to avoid fines and operational disruptions.

- Operational Efficiency: Implementing efficient waste reduction and recycling programs can lower disposal costs and resource consumption.

- Reputation Management: Strong environmental performance enhances Fluor's brand image and stakeholder trust.

- Risk Mitigation: Proactive pollution control measures minimize the risk of environmental incidents and associated liabilities.

Stakeholder Pressure for Green Solutions

Clients, investors, and the public are increasingly demanding infrastructure solutions that are environmentally sound and projects that are delivered sustainably. This trend directly influences Fluor's business, pushing the company to expand its green engineering and construction services and embed sustainability deep within its operational strategy.

Fluor's commitment to this evolving landscape is evident in its performance metrics. For instance, the company saw a significant rise in its sustainable infrastructure projects, which grew by 22.3% in 2023, indicating a strong market response to its green initiatives.

- Client Demand: A growing number of clients are specifying environmental performance criteria for new projects.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are becoming key considerations for investment decisions.

- Public Awareness: Increased public awareness of climate change fuels demand for sustainable development practices.

- Fluor's Response: The company's investment in and expansion of its green services portfolio directly addresses these pressures.

Environmental regulations continue to tighten globally, pushing Fluor to adopt low-carbon technologies and reduce its operational greenhouse gas emissions. The company achieved its Net Zero 2023 commitment for Scope 1 and 2 emissions, showcasing a proactive stance. Resource scarcity, particularly water and raw materials, is also a key concern, driving Fluor's focus on sustainable procurement in 2024 and 2025.

Fluor's projects, especially in infrastructure, require rigorous environmental impact assessments, a market valued at over $40 billion in 2023. The company integrates ecological considerations, from site selection to sustainable construction, and actively supports ecological restoration programs. Effective waste management and pollution control are vital for compliance and minimizing impact, as seen in initiatives like its New Delhi office's eco-restoration work.

Client demand for environmentally sound solutions is growing, with Fluor experiencing a 22.3% rise in sustainable infrastructure projects in 2023. This trend, coupled with investor scrutiny of ESG factors and increased public awareness of climate change, reinforces the need for Fluor to embed sustainability throughout its operations and expand its green services portfolio.

| Environmental Factor | Impact on Fluor | Fluor's Response/Action | Relevant Data/Year |

| Climate Change & Emissions | Increased regulatory pressure, need for low-carbon solutions | Met Net Zero 2023 for Scope 1 & 2 GHG emissions; focus on low-carbon tech | Net Zero 2023 commitment |

| Resource Scarcity | Need for sustainable resource management | Focus on sustainable procurement (2024-2025); optimizing material usage | Sustainable procurement focus |

| Environmental Impact Assessments (EIAs) | Regulatory requirement for large projects, risk of delays/fines | Integrating EIAs into project lifecycles; biodiversity protection strategies | Global EIA market > $40 billion (2023) |

| Waste Management & Pollution | Compliance necessity, operational impact | Responsible handling of waste; pollution prevention measures; eco-restoration projects | New Delhi office eco-restoration |

| Market Demand for Sustainability | Shift in client and investor preferences | Expansion of green engineering/construction services; 22.3% growth in sustainable projects (2023) | 22.3% project growth (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fluor is meticulously constructed using a diverse range of data sources, including reports from major financial institutions like the World Bank and IMF, as well as government publications and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Fluor's operations.