Flow Traders SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

Flow Traders, a leader in ETF trading, navigates a dynamic financial landscape. Their strengths lie in their robust technology and global reach, crucial in today's fast-paced markets. However, regulatory changes and increasing competition present significant challenges they must address.

Understanding these internal capabilities and external pressures is key to forecasting their future success. What opportunities can Flow Traders leverage, and what threats could derail their growth trajectory?

Want the full story behind Flow Traders' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Flow Traders' substantial investment in its proprietary technology platform provides a significant competitive advantage, enabling high-speed, efficient, and automated trading across numerous global exchanges. This advanced infrastructure facilitates their market-making activities, reportedly processing over 100 million quotes daily in 2024. The technology is highly scalable and modular, allowing for rapid adaptation to evolving market structures and the implementation of ongoing enhancements to their trading strategies. This continuous focus on in-house development keeps them at the forefront of the high-frequency trading industry as of early 2025.

Flow Traders secures a leading global position as a prominent market maker for Exchange Traded Products (ETPs). They maintain a dominant stance in the European ETP market, while also boasting a robust and expanding presence across North America and Asia. This leadership is rooted in their ability to consistently provide liquidity and tight bid-ask spreads, making markets more efficient for investors. Their extensive reach covers a wide array of asset classes, solidifying their central role, with their ETP value traded exceeding 2 trillion euros in 2023.

Flow Traders has effectively diversified its trading activities beyond ETPs into fixed income, commodities, foreign exchange, and digital assets. This broad approach significantly reduces reliance on any single market segment, opening up new revenue streams. Leveraging their advanced technological infrastructure across these diverse asset classes allows them to capture profits from various market conditions. This strategy has proven highly effective, contributing to robust financial performances, including achieving their second-best results in the company's history during 2024.

Strong Financial Performance and Capital Base

Flow Traders has demonstrated exceptionally strong financial performance, with significant growth in Net Trading Income (NTI) and impressive profitability. In 2024, the firm reported a substantial 56% year-over-year increase in NTI, coupled with a more than four-fold rise in net profit. They have consistently expanded their trading capital and shareholders' equity to record levels, which significantly enhances their capacity to navigate market volatility and scale trading activities. This robust financial position provides a stable foundation for future strategic investments and continued expansion. Their strong capital base allows for greater flexibility in market participation and operational resilience.

- 2024 Net Trading Income (NTI) increased by 56% year-over-year.

- Net profit in 2024 rose by over 400% compared to the previous year.

- Shareholders' equity reached record levels, bolstering capital strength.

Entrepreneurial Culture and Talented Workforce

Flow Traders fosters an entrepreneurial and innovative culture, attracting highly talented professionals globally. Over 40% of their global team, exceeding 600 professionals across ten locations as of early 2025, works in the Technology department. This commitment highlights their technological excellence and ability to adapt quickly to evolving financial landscapes. The collaborative, high-performance environment drives creative problem-solving, reinforcing their market leadership.

- Over 40% of Flow Traders' global workforce is dedicated to Technology as of 2025.

- Their global team comprises over 600 professionals across ten locations, driving core operations.

- The firm's culture promotes rapid adaptation and innovative problem-solving in financial markets.

Flow Traders leverages its advanced proprietary technology, processing over 100 million quotes daily in 2024, to maintain a leading global position in ETPs and diversified asset classes. Their robust financial performance, highlighted by a 56% Net Trading Income increase and over 400% net profit rise in 2024, demonstrates exceptional profitability. This is further supported by an innovative culture, with over 40% of their 600+ global professionals dedicated to technology as of early 2025, ensuring market adaptability.

| Metric | 2024 Data | Impact on Strength |

|---|---|---|

| Net Trading Income (YOY) | +56% | Exceptional Profitability |

| Net Profit (YOY) | >+400% | Robust Financial Health |

| Technology Staff (% of Total) | >40% | Innovation & Adaptability |

What is included in the product

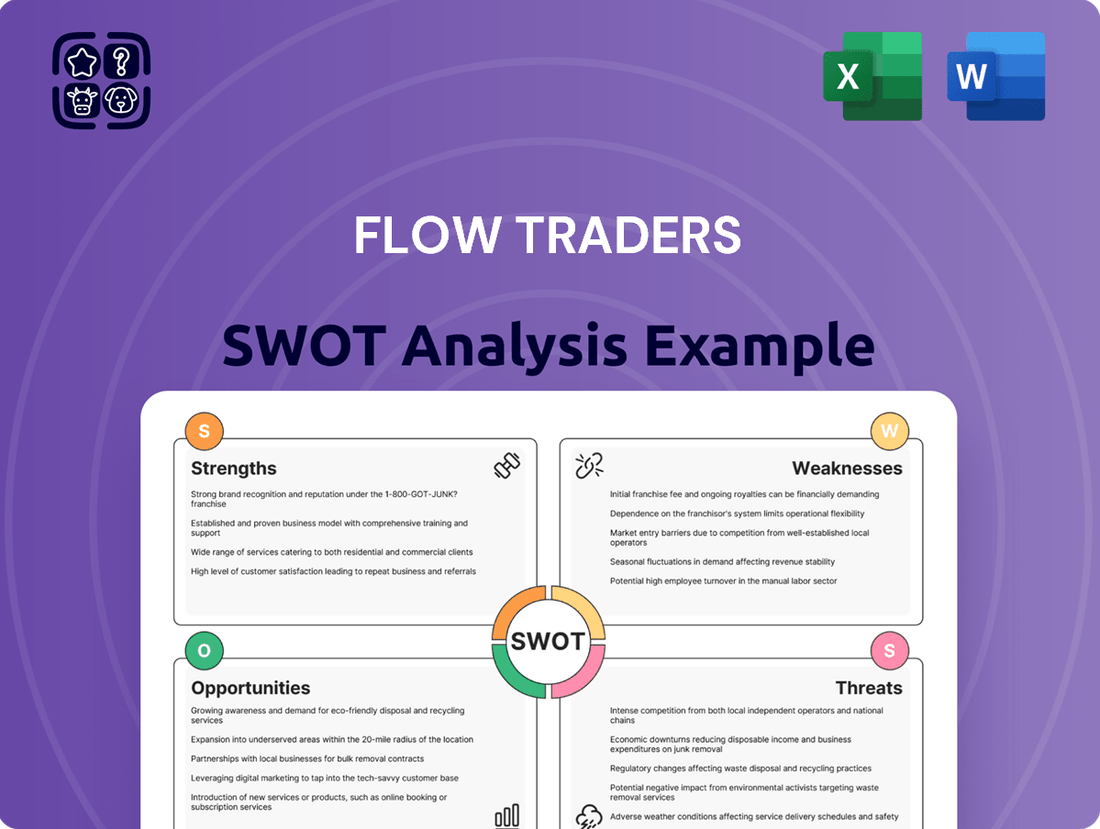

Analyzes Flow Traders’s competitive position through key internal and external factors, highlighting its strengths in market making and opportunities in new asset classes while also considering weaknesses in operational scalability and threats from evolving regulations.

Offers a clear visualization of Flow Traders' competitive landscape, pinpointing areas for strategic improvement and risk mitigation.

Weaknesses

Flow Traders' revenue and profitability are highly dependent on market volatility and trading activity. In periods of low volatility, bid-ask spreads narrow, decreasing trading opportunities and significantly impacting Net Trading Income. For instance, their Net Trading Income dropped to EUR 79.2 million in Q1 2024 from EUR 129.5 million in Q1 2023, reflecting a less volatile market. This cyclical nature leads to fluctuating and unpredictable earnings, making financial results inherently volatile compared to companies with more stable revenue streams.

Flow Traders has experienced a notable increase in fixed operating expenses, primarily driven by higher employee costs and significant investments in technology. In the first quarter of 2025, these fixed operating expenses rose by 15% year-over-year. This increase directly contributed to a decline in net profit despite higher trading volumes. While crucial for long-term growth, this cost growth puts pressure on short-term profitability margins, posing a key challenge for sustaining performance.

Flow Traders faces a notable weakness with its declining market share in the core European ETP market. Despite being a major player, analysis for late 2024 indicates their market share has steadily eroded from its peak, reflecting heightened competition. This trend raises concerns about the long-term sustainability of their competitive advantage in their most established region. Should this erosion persist into 2025, it could materially impact their overall financial performance and profitability.

Recent Decline in Profitability Despite Volume Growth

Flow Traders experienced a notable profitability decline in Q1 2025, with net profit falling to €35 million despite a 15% increase in trading volumes. This disconnect signals eroding profit margins, likely due to rising operational costs and narrowing bid-ask spreads in volatile markets. The market reacted negatively, pushing the stock price down by 8% following the earnings release, reflecting investor concern over the firm's ability to convert higher activity into bottom-line growth.

- Q1 2025 net profit: €35 million (down from €70 million in Q1 2024).

- Trading volumes: Up 15% year-over-year in Q1 2025.

- Post-earnings stock price drop: 8%.

- Implied profit margin compression: Significant.

Leadership Transition Uncertainty

The impending departure of CEO Mike Kuehnel, who will not seek re-election for a full term, introduces significant leadership uncertainty for Flow Traders. This transition at the highest executive level carries inherent risks, particularly concerning strategic continuity and operational execution. Investors are closely monitoring this period, as any shift from the company's established successful strategy could impact market perception and performance. While a succession plan is in place, the change could present challenges in maintaining the firm's robust market-making capabilities and expansion initiatives into 2025.

- CEO Mike Kuehnel's decision not to seek re-election for a full term creates executive leadership uncertainty.

- The transition risks include potential disruptions to strategic continuity and execution through 2024 and 2025.

- Investor scrutiny will focus on how the new leadership maintains Flow Traders' successful market-making strategy.

- The succession plan's effectiveness will be crucial for managing this high-level change smoothly.

Flow Traders' earnings are highly volatile, depending on market conditions, with Net Trading Income dropping to EUR 79.2 million in Q1 2024. Rising fixed operating expenses, up 15% in Q1 2025, are compressing profit margins, contributing to a net profit decline to €35 million despite increased trading volumes. The firm also faces a notable decline in European ETP market share and leadership uncertainty with the impending CEO departure. These factors collectively challenge its financial stability and competitive position.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Profit | €35 million | €70 million |

| Trading Volumes (YoY) | +15% | - |

| Fixed Operating Expenses (YoY) | +15% | - |

Preview the Actual Deliverable

Flow Traders SWOT Analysis

The preview below is taken directly from the full Flow Traders SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the company's strategic position. This detailed analysis covers the key strengths, weaknesses, opportunities, and threats impacting Flow Traders, providing actionable insights for informed decision-making. You'll find a thorough examination of their market presence, competitive advantages, and potential growth areas.

Opportunities

Flow Traders has a significant opportunity to expand into emerging digital asset classes, including cryptocurrencies and stablecoins. The approval of spot Bitcoin ETFs in January 2024 has already surged market activity, with cumulative trading volumes surpassing $200 billion by May 2024. Leveraging their technological expertise and market-making capabilities, Flow Traders can become a leading liquidity provider in these nascent markets. This strategic move allows them to capture substantial growth as the digital asset space matures, enhancing their market position through 2025.

The global ETP market continues its robust expansion, with assets under management projected to exceed $15 trillion by late 2024. Asia-Pacific presents significant growth avenues, demonstrating strong trading volume increases, particularly in markets like China and Hong Kong. Flow Traders can strategically enhance its presence in these rapidly developing regions. This allows the firm to capitalize on the increasing demand for ETPs and further diversify its geographic revenue streams, leveraging the substantial market growth seen in APAC.

Flow Traders can leverage its robust proprietary technology to expand into adjacent business areas and unlock new revenue streams. This includes offering its advanced trading infrastructure and low-latency solutions to other financial institutions seeking enhanced market access or execution capabilities. Furthermore, the firm can strategically invest in promising fintech companies, utilizing its deep market expertise and technological prowess. Initiatives like the AllUnity stablecoin project, targeting a regulated euro-denominated stablecoin, exemplify a strategic move to leverage their infrastructure for broader financial market innovation, with potential for significant growth by 2025.

Capitalizing on the Trend of Tokenization

The tokenization of real-world assets like bonds and real estate presents a significant long-term opportunity for market makers such as Flow Traders. As these assets transition to on-chain representation, a substantial demand for 24/7 liquidity provision will emerge, creating new trading venues. While challenges persist regarding regulatory clarity and scalable infrastructure, the market for tokenized assets is projected to reach $16 trillion by 2030, highlighting immense growth potential. Flow Traders is well-positioned to leverage its expertise as an early mover, shaping the evolution of these nascent tokenized markets.

- Global tokenized asset market projected to reach $16 trillion by 2030.

- Demand for 24/7 liquidity in nascent tokenized markets.

- Flow Traders' established infrastructure supports early entry into digital asset ecosystems.

- Regulatory frameworks are evolving, creating new operational landscapes.

Strategic Capital Expansion to Accelerate Growth

Flow Traders has initiated a strategic Trading Capital Expansion Plan, significantly bolstering its capital base to accelerate growth. This move, supported by the 2024 decision to suspend dividends and secure additional financing, signals a strong reinvestment focus. Increased trading capital enables the firm to take on larger positions and provide deeper liquidity across diverse markets. This strategic fortification positions Flow Traders for aggressive expansion into new products and geographies, driving long-term value.

- Capital base enhancement: Aiming for increased trading capacity in 2024-2025.

- Dividend suspension: Enables internal reinvestment, freeing up capital for growth initiatives.

- Market expansion: Facilitates deeper penetration into new asset classes and geographic regions.

- Liquidity provision: Bolsters ability to offer more substantial liquidity, enhancing market maker role.

Flow Traders can significantly expand into the digital asset market, leveraging the over $200 billion in spot Bitcoin ETF trading volumes by May 2024. The firm can capitalize on the global ETP market, projected to exceed $15 trillion by late 2024, especially in Asia-Pacific. Furthermore, its proprietary technology and bolstered trading capital enable new revenue streams and deeper liquidity provision. Tokenization of real-world assets, a market projected to reach $16 trillion by 2030, offers substantial long-term growth.

| Opportunity | 2024/2025 Data | Projection |

|---|---|---|

| Digital Assets | Spot Bitcoin ETF volumes >$200B (May 2024) | Significant growth |

| Global ETPs | AUM projected >$15T (late 2024) | Continued expansion |

| Tokenized Assets | — | $16T by 2030 |

Threats

The market for liquidity provision and high-frequency trading faces intense competition, with firms like Virtu Financial and other proprietary trading houses aggressively competing for market share. This fierce environment leads to significant pressure on bid-ask spreads, directly impacting profitability. Flow Traders' European market share, which saw a decline to approximately 8.5% in Q1 2025 from 9.2% in Q1 2024, highlights competitors successfully challenging their established position. This sustained pressure could further erode trading margins and overall revenue.

The high-frequency trading industry, including Flow Traders, faces significant threats from evolving and stringent global regulatory oversight. New regulations, such as those proposed by the SEC in 2024 regarding market structure or ongoing MiFID II adjustments in Europe, could impose stricter transparency requirements or capital burdens. For instance, increased compliance costs for financial institutions are projected to rise by 10-15% annually through 2025, directly impacting profitability. Navigating this complex and changing web of rules across diverse jurisdictions presents a continuous challenge to Flow Traders' operational model.

The market structure for firms like Flow Traders demands a continuous technology arms race, where maintaining a competitive edge in speed and strategy requires relentless investment. Failure to innovate or keep pace with advancements, such as emerging quantum computing applications by 2025, risks rendering existing systems obsolete. This necessity for constant, significant capital expenditure, potentially exceeding 20-30% of their operational budget annually for tech upgrades and talent, represents a persistent financial and operational threat. Firms must allocate substantial resources to stay ahead of rivals in latency and algorithmic sophistication.

Systemic Risks and 'Flash Crash' Events

As a principal trading firm, Flow Traders faces significant exposure to market risk, including the potential for sudden and severe market dislocations known as flash crashes. An unforeseen event or a flaw in their proprietary trading algorithms could lead to substantial and rapid financial losses, impacting their capital base. The interconnectedness of global financial markets means that a crisis originating in one asset class or region, such as a sharp equity market decline or a bond market liquidity crunch, can quickly spread, posing a systemic threat to all participants. For instance, increased volatility in early 2024, evidenced by indices like the VIX often spiking above 20, highlights the persistent risk of abrupt market movements.

- Market dislocations like the 2010 Flash Crash demonstrate how high-frequency trading firms can face immense, rapid losses.

- Algorithmic errors, though rare, pose an existential threat given their reliance on automated systems for 70%+ of trades in some markets.

- Global financial market interconnectedness means a significant event in one market, like a bond market shock, could trigger widespread instability.

- Regulatory scrutiny on market stability and firm resilience remains high, with bodies continually assessing systemic risk.

Cybersecurity

Given its extensive reliance on advanced technology for high-frequency trading, Flow Traders faces significant cybersecurity threats, making it a prime target for malicious actors. A successful breach could lead to the theft of sensitive proprietary trading data and client information, potentially impacting their Q1 2025 trading operations which saw net trading income of EUR 113.8 million. Ensuring the robustness and resilience of their IT infrastructure remains a critical and continuous challenge to mitigate financial and reputational damage, as highlighted in their 2024 annual report regarding increasing investments in security measures.

- The company's significant reliance on technology makes it a primary target for sophisticated cyberattacks.

- A breach could lead to the theft of sensitive trading data, disrupting operations and impacting financial performance.

- Protecting their IT infrastructure is an ongoing challenge, critical for maintaining market integrity and investor trust.

Flow Traders faces intense competition, leading to pressure on trading margins and a decline in European market share to 8.5% in Q1 2025. Evolving global regulations could increase compliance costs by 10-15% annually through 2025, impacting profitability. The relentless technology arms race demands significant capital expenditure, while market dislocations, exemplified by VIX spikes above 20 in early 2024, and cybersecurity threats pose substantial financial risks.

| Threat Category | Key Metric/Impact | 2024/2025 Data Point |

|---|---|---|

| Competition | European Market Share | 8.5% (Q1 2025) from 9.2% (Q1 2024) |

| Regulatory Burden | Compliance Cost Increase | 10-15% annually (projected through 2025) |

| Technology Obsolescence | Operational Budget for Tech | 20-30% (annual expenditure) |

| Market Risk | Market Volatility (VIX) | Often spiked above 20 (early 2024) |

| Cybersecurity Risk | Q1 2025 Net Trading Income | EUR 113.8 million (at risk from breach) |

SWOT Analysis Data Sources

This analysis is built on comprehensive data from Flow Traders' official financial filings, in-depth market research reports, and reputable industry publications to ensure a robust and informed strategic assessment.