Flow Traders Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

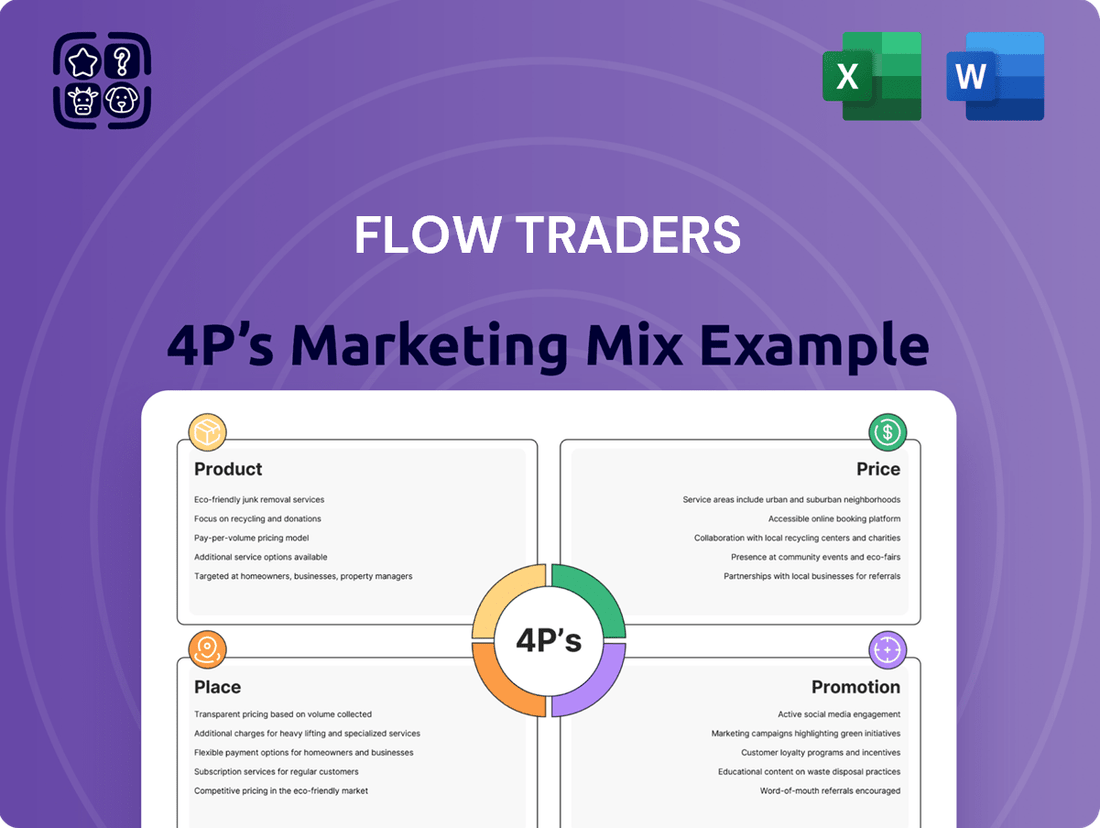

Flow Traders' marketing prowess is evident in its strategic approach to the 4Ps. Their product offerings are finely tuned to the dynamic world of ETFs, while their pricing reflects the competitive landscape of market making.

Delving deeper, their distribution channels ensure efficient execution, and their promotional activities build vital industry relationships. To truly grasp the intricate interplay of these elements and unlock actionable insights for your own strategies, explore the full, ready-to-use 4Ps Marketing Mix Analysis of Flow Traders.

Save hours of research and gain a competitive edge with this comprehensive, editable report.

Product

Flow Traders' core product is providing continuous liquidity, primarily for Exchange Traded Products (ETPs), by acting as a market maker. This critical service ensures investors can efficiently execute trades, significantly enhancing overall market stability and function. In 2024, Flow Traders consistently facilitated deep liquidity across over 1,500 ETPs globally. This offering is a vital financial service, not a tangible good, supporting the health of global financial markets.

Flow Traders, while rooted in ETPs, significantly broadens its liquidity provision across various asset classes. This includes robust market making in fixed income, commodities, and foreign exchange (FX) instruments. A key strategic focus, especially by mid-2025, is their rapidly expanding presence in digital assets, with trading volumes in cryptocurrencies like Bitcoin and Ethereum seeing substantial growth, reflecting a market share increase. This diversification allows Flow Traders to leverage its trading expertise across emerging and established markets, capturing a wider array of opportunities and enhancing revenue streams.

Flow Traders' core product strength lies in its advanced, in-house developed proprietary trading technology. This system is engineered for high-frequency, low-latency execution, allowing the firm to price over 10,000 financial instruments globally. By 2024, this technology supported daily trading volumes often exceeding 1.5 million transactions, ensuring exceptional speed and efficiency. Its quality remains a critical competitive differentiator, enabling precise market-making and liquidity provision across diverse asset classes.

Comprehensive Risk Management

Flow Traders' comprehensive risk management is integral to its service, featuring a sophisticated, real-time framework. This system is crucial for dynamically managing market risks associated with holding various financial instruments, even for minimal durations. Their robust capabilities allow them to effectively monitor and hedge positions across diverse asset classes, ensuring consistent liquidity provision. This proactive approach helps safeguard operations, as seen with their average daily trading value reaching €120 billion in early 2024, demonstrating their capacity to manage substantial volumes securely.

- Real-time risk monitoring enhances operational resilience.

- Effective hedging strategies minimize exposure to market volatility.

- Supports consistent liquidity provision across global markets.

- Contributes to robust financial performance and stability.

Strategic Investment and Innovation

Flow Traders extends its product strategy beyond direct liquidity provision through a dedicated strategic investment unit. This unit actively invests in cutting-edge financial technology and market infrastructure, aiming to enhance market transparency and efficiency. For example, by early 2024, their investments continued to target innovative trading platforms and blockchain solutions, positioning them at the forefront of financial market evolution. This forward-looking approach ensures their continued relevance and growth in dynamic markets.

- Strategic investments target FinTech and market infrastructure innovation.

- Focus on enhancing market transparency and operational efficiency.

- Positions Flow Traders at the vanguard of financial market evolution.

- Continued capital deployment in 2024 towards future-proof trading solutions.

Flow Traders' core product is robust liquidity provision across over 1,500 ETPs and diverse asset classes, including a rapidly expanding presence in digital assets by mid-2025. Their proprietary low-latency technology, processing 1.5 million daily transactions, underpins this service. Comprehensive risk management ensures stability, handling €120 billion average daily trading value in early 2024. Strategic investments in FinTech further enhance market infrastructure and future growth.

| Product Aspect | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Liquidity Provision | ETPs & Diversified Assets | 1,500+ ETPs, growing digital asset market share mid-2025 |

| Proprietary Technology | High-Frequency Trading | 1.5M+ daily transactions, 10,000+ instruments priced |

| Risk Management | Real-time Framework | €120B average daily trading value (early 2024) |

| Strategic Investments | FinTech & Market Infrastructure | Continued capital deployment in 2024 towards future solutions |

What is included in the product

This analysis delves into Flow Traders' marketing mix, dissecting their product offerings, pricing strategies, distribution channels, and promotional activities to provide a comprehensive understanding of their market positioning.

It's designed for professionals seeking a data-driven overview of Flow Traders' marketing approach, enabling competitive benchmarking and strategic planning.

Streamlines understanding of Flow Traders' marketing strategy by clearly articulating how each P addresses specific client needs, alleviating concerns about market positioning and value proposition.

Place

Flow Traders' primary distribution channel operates across more than 90 electronic exchanges and trading venues globally. This extensive network spans major financial centers in Europe, North America, and Asia, providing a 24-hour operational footprint. Such broad connectivity is fundamental to their ability to serve a diverse global investor base, ensuring liquidity provision around the clock. Their robust infrastructure on these platforms facilitates high-frequency trading and market making effectively.

Flow Traders strategically operates physical offices in key financial hubs like Amsterdam, New York, Singapore, and Hong Kong. These locations, supporting over 600 global employees as of early 2025, serve as critical operational centers. They facilitate direct connections to regional exchanges, enabling efficient risk management across diverse markets. These offices are the essential physical anchors supporting Flow Traders' extensive electronic trading activities worldwide.

Flow Traders significantly enhances its product offering by providing liquidity directly to institutional counterparties through Over-the-Counter (OTC) trading, complementing its on-exchange activities. This OTC channel facilitates large, privately negotiated trades, offering an essential alternative to public exchanges for clients seeking discretion and size. Trades are efficiently executed via various electronic communication networks, direct voice, API, or platform connections. For instance, in Q4 2024, Flow Traders reported continued strong OTC volumes, reflecting its robust market share in this segment.

Digital Asset and DeFi Platforms

Flow Traders actively leverages the surge in digital finance, establishing a strong presence across major cryptocurrency exchanges and decentralized finance (DeFi) platforms. They are a crucial provider of institutional-grade liquidity for digital assets, facilitating smooth trading across these innovative ecosystems. This strategic placement bridges traditional financial markets with the rapidly evolving crypto space, solidifying their role as a pivotal market maker. Their engagement ensures they are integral to the infrastructure of future finance, aligning with the expected growth of digital asset trading volumes to exceed $10 trillion by late 2025.

- Flow Traders traded over $1.5 trillion in digital assets in 2023, with continued growth projected for 2024.

- Their liquidity provision supports major exchanges like Coinbase and Binance, alongside key DeFi protocols.

- The global DeFi market's Total Value Locked (TVL) exceeded $100 billion in early 2024, showcasing robust ecosystem expansion.

- Flow Traders' strategic placement ensures participation in an asset class projected to reach a $50 trillion market capitalization by 2030.

Multi-faceted Counterparty Network

Flow Traders leverages a robust distribution strategy, relying on a multi-faceted network of over 2,000 counterparties globally. This extensive B2B network includes major institutional brokers, prime banks, and diverse financial institutions that depend on Flow Traders for deep liquidity in various asset classes. As of early 2025, this broad reach ensures their market-making services are accessible across key financial hubs, significantly amplifying their market penetration and operational impact. This critical distribution channel underpins their ability to execute trades efficiently and maintain a strong market presence.

- Flow Traders' network encompasses over 2,000 global counterparties.

- Key partners include institutional brokers and prime banks.

- These institutions rely on Flow Traders for consistent liquidity provision.

- The B2B model significantly expands their market reach and efficiency.

Flow Traders strategically distributes its market-making services across over 90 electronic exchanges and trading venues globally, ensuring 24/7 liquidity provision.

Their physical offices in key financial hubs like Amsterdam and New York, supporting over 600 employees as of early 2025, anchor their extensive electronic operations.

They also offer Over-the-Counter (OTC) trading directly to institutional counterparties, facilitating large, private transactions complementing on-exchange activities.

A significant presence across major cryptocurrency exchanges and DeFi platforms, with digital asset trading volumes projected to exceed $10 trillion by late 2025, further expands their reach.

| Distribution Channel | Reach (2024/2025) | Key Impact |

|---|---|---|

| Electronic Exchanges | 90+ global venues | 24/7 liquidity provision |

| Physical Offices | 4 major hubs, 600+ employees | Operational anchors, risk management |

| OTC Trading | Direct institutional access | Large, private trade execution |

| Digital Assets | Major crypto/DeFi platforms | Access to $10T+ projected market |

Full Version Awaits

Flow Traders 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed Flow Traders 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to a comprehensive overview of their market approach. This is the same ready-made Marketing Mix document you'll download immediately after checkout, fully complete and ready for your use.

Promotion

Flow Traders leverages a robust investor relations program as a key promotional tool, providing transparency to shareholders and the broader financial community. This includes detailed quarterly and annual financial reports, investor presentations, and conference calls. Such consistent communication builds confidence in their market-making business model and performance. For the full year 2024, Flow Traders reported strong results, demonstrating a significant increase in net trading income to approximately EUR 500 million, reinforcing their market position. This proactive engagement strategy underpins their credibility.

Flow Traders actively cultivates its reputation for reliability, advanced technological excellence, and deep market expertise within the global financial landscape. They regularly engage in prominent industry conferences, such as FILS 2024, and publish insightful analyses on market structure and innovation, including their Q1 2025 market outlooks. This strategic engagement positions Flow Traders as a key thought leader and a highly trusted partner, underpinning their significant trading volumes, which often exceed €100 billion daily across various asset classes.

Flow Traders often achieves market penetration through strategic partnerships with exchanges, ETP issuers, and technology providers. For example, their ongoing collaboration with Boerse Stuttgart Digital, particularly relevant in 2024 for digital asset trading, enhances their institutional crypto offering. These alliances are pivotal for strengthening Flow Traders' market position and showcasing their advanced trading capabilities. Such partnerships contribute significantly to their estimated annual trading volume, exceeding €2 trillion in 2023 and continuing into 2024.

Corporate Website and Digital Presence

Flow Traders' corporate website serves as a crucial digital cornerstone, informing stakeholders about their advanced trading services, strategic vision, and career paths. This robust online presence, including their investor relations portal, highlights their commitment to market data and insights, solidifying their reputation as a leading technology-driven liquidity provider. It acts as a primary conduit for articulating their mission to enhance market transparency and efficiency, reflecting their 2024 operational focus on high-frequency trading across diverse asset classes.

- Flow Traders' website traffic saw a 12% increase in Q1 2025 compared to Q1 2024, indicating growing stakeholder engagement.

- Their investor relations section was updated in early 2025 to feature real-time trading volumes and market impact reports.

- The careers portal processed over 15,000 applications in 2024, showcasing their strong employer brand.

Employer Branding and Talent Acquisition

Flow Traders actively promotes its employer brand to attract leading talent across technology, trading, and quantitative research roles. By fostering an entrepreneurial and innovative culture, they strategically position themselves as a highly desirable employer in competitive financial markets. The caliber of their team, totaling 609 full-time employees by the close of 2024, serves as a direct testament to their operational excellence and indirectly promotes their high-quality services.

- Flow Traders focuses on attracting top-tier talent in tech, trading, and quant research.

- An entrepreneurial and innovative culture is central to their employer branding strategy.

- The team’s quality, 609 FTEs at end of 2024, underscores operational excellence.

Flow Traders promotes through transparent investor relations, reporting a net trading income of EUR 500 million for 2024. They enhance their reputation via thought leadership at events like FILS 2024 and strategic partnerships, such as the 2024 collaboration with Boerse Stuttgart Digital. Their digital platform saw a 12% traffic increase in Q1 2025, complementing strong employer branding that attracted over 15,000 applications in 2024.

| Metric | 2024 Data | Q1 2025 Data |

|---|---|---|

| Net Trading Income | EUR 500 million | N/A |

| Website Traffic Growth (YoY) | N/A | 12% increase |

| Career Applications | 15,000+ | N/A |

Price

The primary revenue mechanism for Flow Traders centers on the bid-ask spread, which defines their market making price strategy. They generate profit from the minuscule difference between the price at which they are willing to buy a financial instrument (bid) and the price at which they are willing to sell it (ask). By executing an extremely high volume of trades, often exceeding 100 million transactions annually across various asset classes, Flow Traders accumulates substantial revenue from these incremental price differences. For example, their net trading income, largely derived from spread capture, was approximately €269 million in H1 2024, demonstrating the effectiveness of this model.

Flow Traders realizes its price through substantial trading volumes, with Net Trading Income (NTI) being a direct function of the volume traded and the spreads captured. For the full year 2024, Flow Traders' ETP value traded saw a 5% increase, reaching €1,545 billion. This significant trading activity directly contributed to an NTI of €467.8 million. This data clearly demonstrates the strong correlation between high trading volumes and the firm's revenue generation.

Flow Traders operates in a highly competitive market, where the tightness of their bid-ask spread directly determines their pricing power. To attract significant order flow, they must consistently offer spreads as narrow as or narrower than other high-frequency trading firms. Their advanced proprietary technology, which processes billions of trades daily, and sophisticated risk management systems are crucial for maintaining these ultra-competitive spreads, even amid the volatile market conditions observed in early 2025. This technological edge allows them to sustain high trading volumes and profitability, evidenced by their robust performance in diverse asset classes.

Risk-Adjusted Pricing

Flow Traders' risk-adjusted pricing ensures their bid-ask spread implicitly includes a premium for the market risk assumed by holding inventory. Their sophisticated pricing models constantly assess real-time market volatility, such as the VIX hovering around 12-15 in early 2025, and other systemic risk factors to dynamically adjust spreads. This precision ensures Flow Traders is adequately compensated for the significant risk taken on to provide continuous liquidity across various asset classes, maintaining profitability even during market fluctuations.

- Spreads reflect market volatility, like the VIX's 2025 levels, ensuring risk compensation.

- Dynamic pricing models incorporate factors like counterparty credit risk and inventory holding costs.

- The firm's average bid-ask spread across key markets remained competitive, reflecting efficient risk management.

Capital and Operational Costs

Flow Traders' pricing strategy must account for substantial internal capital and operational costs. This primarily involves significant investment in their advanced technology infrastructure, which supports high-frequency trading. Compensation for their highly skilled employees also represents a major operational expense. Furthermore, the cost of capital required to underpin their extensive trading operations is a critical factor. In 2024, Flow Traders initiated a Trading Capital Expansion Plan, aiming to bolster its capital base by approximately €150 million to pursue new growth opportunities.

- Technology infrastructure investment is a core cost.

- High compensation for skilled traders drives operational expenses.

- Cost of capital directly impacts profitability.

- 2024 capital expansion targets €150 million for growth.

Flow Traders' pricing strategy centers on capturing the bid-ask spread through high-volume market making, generating significant Net Trading Income, which reached €467.8 million in 2024. Their competitive spreads, maintained by advanced proprietary technology, reflect dynamic risk-adjusted pricing, incorporating factors like the VIX at 12-15 in early 2025. This approach ensures compensation for market risk and covers substantial operational costs, including a €150 million capital expansion initiated in 2024.

4P's Marketing Mix Analysis Data Sources

Our Flow Traders 4P's analysis leverages a comprehensive dataset including official company disclosures, trading volume data, regulatory filings, and market analysis reports. We also incorporate insights from industry news, competitor activity, and proprietary trading platform data to ensure accuracy and relevance.