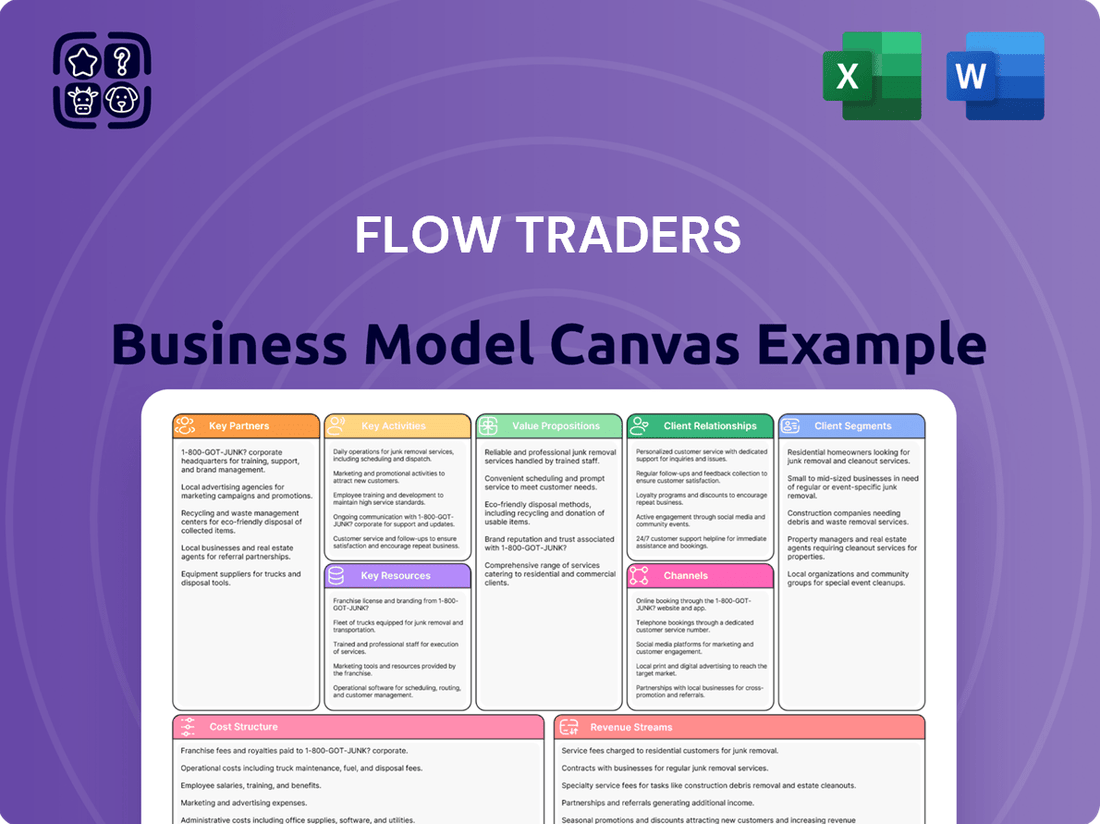

Flow Traders Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

Unlock the full strategic blueprint behind Flow Traders's business model. This in-depth Business Model Canvas reveals how the company drives value through its unique market-making capabilities and captures market share in the dynamic ETF landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading proprietary trading firm.

Dive deeper into Flow Traders’s real-world strategy with the complete Business Model Canvas. From its core value proposition of providing liquidity to its extensive network of key partners, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in financial markets.

Want to see exactly how Flow Traders operates and scales its business in the competitive world of electronic trading? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Flow Traders’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies in financial services.

Transform your research into actionable insight with the full Business Model Canvas for Flow Traders. Whether you're validating a business idea in fintech or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Flow Traders maintains critical partnerships with over 200 global trading venues, including major exchanges like NYSE, Nasdaq, and Euronext. These relationships provide the essential infrastructure and direct access needed to quote prices and execute trades across a vast array of ETPs and other securities. Securing crucial memberships is paramount for their market making capabilities. Maintaining low-latency connectivity further ensures efficient trade execution, directly impacting their operational effectiveness and trading volumes in 2024.

Flow Traders' collaboration with major Exchange Traded Product (ETP) issuers like BlackRock (iShares), Vanguard, and State Street (SPDR) is fundamental to its operations. As an Authorized Participant (AP) and lead market maker, Flow Traders ensures these ETPs maintain a liquid and efficient secondary market right from their launch. This crucial role supports the vast ETP ecosystem, which saw global ETP assets under management (AUM) exceed $12 trillion by early 2024. These partnerships are vital for the continuous growth and stability of the entire ETP landscape.

Strategic partnerships with central clearing counterparties (CCPs) like the Options Clearing Corporation (OCC) and LCH are non-negotiable for Flow Traders.

These relationships are crucial for mitigating counterparty risk and ensuring efficient trade settlement, with the OCC clearing over 11.5 billion options contracts in 2023 alone.

Additionally, robust relationships with prime brokers are vital for financing, facilitating securities lending, and accessing necessary leverage for trading operations.

These financial intermediaries form the backbone of post-trade processing and comprehensive risk management, underpinning the firm's market-making activities in 2024.

Technology & Data Providers

Flow Traders depends on key technology and data providers for its high-frequency trading operations. These partners deliver essential high-performance hardware, co-location services within major exchange data centers, and critical real-time market data feeds. This infrastructure, crucial for ultra-low latency execution, powers the firm's proprietary trading algorithms, a core competitive advantage. For instance, maintaining such infrastructure involves significant operational expenditure, with data and technology costs consistently being a notable line item in financial reports.

- Co-location services at key exchanges like the NYSE and Euronext ensure minimal latency.

- Access to real-time market data is vital, processing terabytes of information daily.

- Investment in advanced hardware remains a priority, reflecting ongoing tech expenditure in 2024.

- These partnerships directly support Flow Traders' market-making efficiency across global markets.

Regulatory Bodies & Compliance Partners

A transparent relationship with financial regulators, such as the SEC in the US and the AFM in the Netherlands, is crucial for Flow Traders. This proactive engagement ensures the firm adheres to evolving market regulations and maintains its operational licenses, a fundamental requirement for a high-frequency trading firm. Legal and compliance consulting firms also serve as vital partners, assisting in navigating the complex global regulatory landscape, especially as new directives like MiFID III are anticipated.

- Flow Traders reported a compliance-related expense of €5.7 million in 2023, reflecting ongoing regulatory commitments.

- The firm operates across over 100 trading venues globally, each with distinct regulatory requirements.

- 2024 regulatory focus includes digital asset frameworks and increased scrutiny on market manipulation prevention.

- Maintaining licenses requires continuous adaptation to regulations updated for market integrity and investor protection.

Flow Traders relies on a robust network of key partnerships, including over 200 global trading venues like NYSE and Nasdaq, ensuring direct market access and low-latency execution. Collaborations with major ETP issuers, such as BlackRock and Vanguard, are crucial for their Authorized Participant role, supporting the $12 trillion global ETP market by early 2024. Strategic alliances with central clearing counterparties and prime brokers underpin risk management and financing. Furthermore, vital relationships with technology providers and regulators maintain operational integrity and compliance, with 2024 focusing on digital asset frameworks.

| Partnership Type | Key Partner Examples | 2024 Relevance |

|---|---|---|

| Trading Venues | NYSE, Nasdaq, Euronext | 200+ venues for direct market access |

| ETP Issuers | BlackRock, Vanguard | Supports >$12T global ETP AUM |

| Regulators | SEC, AFM | Compliance with evolving digital asset frameworks |

What is included in the product

Flow Traders' business model focuses on providing liquidity across various asset classes, leveraging sophisticated technology and a global presence to connect buyers and sellers and profit from bid-ask spreads.

This model is built on high-frequency trading strategies and a strong risk management framework, serving institutional clients and exchanges worldwide.

Flow Traders' Business Model Canvas effectively addresses the pain point of market uncertainty by clearly outlining their value proposition in providing liquidity across diverse asset classes.

It simplifies the complex landscape of electronic trading by presenting a one-page snapshot of their key activities and customer segments, easing the burden of understanding their core operations.

Activities

Flow Traders' core activity centers on robust algorithmic trading and market making, providing continuous, two-sided quotes across thousands of ETPs and various financial instruments on global exchanges. This sophisticated operation leverages proprietary pricing algorithms that dynamically adjust to real-time market conditions. The primary objective is to maintain deep liquidity, which is crucial given the high volatility observed in certain markets during 2024. By doing so, Flow Traders efficiently captures the bid-ask spread, a key driver of their revenue, reflecting their significant role in facilitating price discovery and efficient market functioning.

Flow Traders dedicates substantial resources to quantitative research and strategy development, a core activity driving its market-making success. Their quantitative analysts, often called quants, continuously model complex market behaviors and analyze vast datasets to pinpoint new trading opportunities. This team is crucial for designing and refining the mathematical logic underpinning their high-frequency trading algorithms, ensuring adaptability in dynamic markets. For instance, in 2024, Flow Traders continued to heavily invest in its technology and R&D, which represented a significant portion of its operational expenditure, reflecting its commitment to algorithmic innovation.

Flow Traders actively engages in constant, real-time risk management, hedging its exposure to market fluctuations.

Their sophisticated technology platform continuously monitors net positions across various asset classes, automatically executing hedging trades to maintain a market-neutral stance.

This systematic approach is critical for protecting the firm's capital, evidenced by their robust financial position in 2024.

Such rigorous risk controls underpin their stable profitability, ensuring resilience even in volatile market conditions.

Technology Infrastructure Development & Maintenance

Developing, maintaining, and continuously upgrading Flow Traders' proprietary, low-latency trading platform is a core activity. This involves extensive software engineering, sophisticated network architecture management, and hardware optimization to handle immense volumes of market data and trade orders. The goal is to maximize speed, reliability, and capacity, crucial for high-frequency trading operations. In 2023, Flow Traders reported significant investment in technology, with IT-related expenses being a substantial part of their operational costs, reflecting their commitment to infrastructure superiority.

- Flow Traders employs hundreds of technology professionals globally, with a significant portion dedicated to platform development.

- Their infrastructure processes billions of market data points daily, requiring constant optimization.

- Latency is measured in microseconds, emphasizing the need for cutting-edge hardware and software.

- Continued investment is crucial, with technology expenses remaining a key operational outlay in 2024.

Regulatory Compliance & Reporting

Adhering to a complex web of global financial regulations is a crucial daily activity for Flow Traders, ensuring operational integrity. This involves meticulous trade reporting and continuous monitoring for compliance with market-making obligations across diverse jurisdictions. Engaging proactively with regulatory authorities is vital, especially given evolving frameworks like MiFID II and ongoing discussions on digital asset regulation in 2024. This commitment maintains their social license to operate in key financial markets worldwide.

- Flow Traders reported over 1.7 billion euro in net trading income in 2023, necessitating robust compliance for every transaction.

- Their 2024 regulatory focus includes adapting to new ESRS reporting standards and ongoing DORA implementation.

- Compliance ensures adherence to market-making obligations, which contribute to market liquidity, a core business activity.

- The firm manages compliance across over 10 global offices, reflecting a broad regulatory landscape.

Flow Traders' core activities revolve around sophisticated algorithmic market making, providing deep liquidity across global ETPs and financial instruments, reflecting their significant role in price discovery. This operation is driven by continuous quantitative research and the development of proprietary, low-latency trading technology, essential for processing billions of market data points daily in 2024. Constant, real-time risk management hedges market exposure, protecting capital and ensuring stable profitability. Additionally, rigorous adherence to complex global financial regulations is vital, supporting their operational integrity and market access.

| Activity Area | Key Focus | 2024 Relevance |

|---|---|---|

| Market Making | Bid-ask spread capture | Maintaining liquidity in volatile markets |

| Tech & R&D | Proprietary platform, algorithms | Significant operational expenditure |

| Risk Management | Hedging exposure | Robust financial position |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means that the structure, content, and formatting are precisely what you can expect in the final deliverable. There are no mockups or sample sections; you are seeing a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, enabling you to immediately start analyzing and refining Flow Traders' strategy.

Resources

Flow Traders' core strength lies in its proprietary technology platform, encompassing advanced pricing models, sophisticated execution algorithms, and robust risk management systems. This internally developed intellectual property provides a critical competitive advantage, ensuring unparalleled speed and efficiency in market making. It is the indispensable engine powering their operations, allowing real-time adaptability across diverse asset classes. The firm continuously invests heavily in its tech stack, a key factor in its 2024 performance, as evidenced by its strong trading results.

Flow Traders relies heavily on its specialized human capital, a core team of quantitative researchers, software developers, and experienced traders. This talent pool combines deep financial market knowledge with advanced mathematical and technological expertise, essential for their high-frequency trading operations. In 2024, the company continues to prioritize attracting and retaining top-tier professionals globally, vital for maintaining its competitive edge in volatile markets. Their ability to innovate and execute complex strategies directly stems from this skilled workforce.

A substantial capital base is crucial for Flow Traders, enabling them to post collateral for trades and settle transactions efficiently. This robust financial foundation allows the firm to absorb potential short-term trading losses, maintaining market stability. As of early 2024, Flow Traders continues to emphasize its strong balance sheet, which directly underpins its extensive market-making capacity across various asset classes. Access to essential credit lines and established relationships with prime brokers are vital for managing daily liquidity needs and financing their diverse trading positions.

High-Performance IT Infrastructure

High-performance IT infrastructure is crucial for Flow Traders, encompassing a global network of servers, co-location facilities within exchange data centers, and ultra-high-speed telecommunication links. This sophisticated physical infrastructure is designed to minimize latency, which is the critical factor for successful high-frequency trading strategies. It represents a substantial and ongoing capital investment, with firms often spending millions annually to maintain their technological edge. For instance, top-tier HFT firms continuously upgrade to fiber optic networks capable of transmitting data at near light speed, reducing round-trip times to microsecond levels. In 2024, the drive for lower latency continues, with new fiber routes and advanced network protocols being deployed to gain even a fractional advantage in execution speed.

- Global network of low-latency servers.

- Co-location within major exchange data centers.

- Ultra-high-speed fiber optic telecommunication links.

- Significant ongoing capital expenditure for upgrades.

Global Exchange Memberships & Connectivity

Direct memberships and established connectivity with hundreds of trading venues globally are a key resource for Flow Traders. These memberships grant the right to trade directly on the exchange and provide the technical access needed for the firm's algorithms to interact with the market. This global footprint, essential for their market-making operations, allows for significant diversification and enables 24-hour trading operations. In 2024, maintaining this extensive network remains vital for their liquidity provision across various asset classes.

- Direct access to over 100 global trading venues.

- Enables algorithmic trading and market making.

- Facilitates 24-hour global trading operations.

- Crucial for diversification across asset classes.

Flow Traders' key resources encompass its cutting-edge proprietary technology, including advanced algorithms and risk systems, alongside highly specialized human capital like quant researchers and traders. A substantial capital base, crucial for market making and liquidity, underpins their operations. This is further supported by a global, high-performance IT infrastructure designed for ultra-low latency and direct connectivity to hundreds of trading venues worldwide, all continually invested in to maintain a competitive edge in 2024.

| Resource Category | 2023 Investment/Focus | 2024 Strategic Importance |

|---|---|---|

| Proprietary Technology | Ongoing R&D expenditure for algorithms | Core differentiator, speed and efficiency |

| Human Capital | Recruitment of 40+ professionals (2023) | Innovation, complex strategy execution |

| Capital Base | Average trading capital of €2.5bn+ | Market stability, extensive capacity |

Value Propositions

Flow Traders delivers continuous market liquidity, ensuring investors can consistently buy or sell Exchange Traded Products (ETPs) throughout trading hours. Their constant presence with competitive bid and ask prices significantly reduces the risk of market participants facing illiquidity, a crucial factor in volatile markets. This commitment enhances overall market health and boosts investor confidence in the ETP ecosystem. In 2024, Flow Traders continues to be a top liquidity provider, facilitating seamless transactions across global ETP markets.

Flow Traders leverages technological efficiency and competitive pricing to significantly narrow bid-ask spreads for Exchange Traded Products. This directly translates to lower implicit transaction costs for all market participants, from large institutions to individual retail investors. In 2024, their continuous quoting helps ensure highly liquid markets. This makes ETP trading more efficient and affordable across various global exchanges.

Flow Traders' continuous quoting activity across numerous financial instruments helps the market discover the true, fair value of assets. By rapidly integrating new information into their prices, they contribute significantly to a more efficient market where asset prices accurately reflect all available data. This active market making, evidenced by their substantial trading volumes and presence on over 200 venues in 2024, reduces mispricing and limits arbitrage opportunities for other participants. Their role is crucial in maintaining robust liquidity and transparent pricing, which benefits all market users.

Global, Multi-Asset Class Access

Flow Traders offers extensive liquidity across a wide array of global asset classes, including equities, fixed income, and commodities, primarily through its exchange-traded product (ETP) market-making activities. This enables investors to gain diversified market exposure from a single, efficient access point. The firm’s active participation supports the development and growth of innovative ETPs tracking various market segments worldwide. As of 2024, Flow Traders continues to be a key liquidity provider across numerous global exchanges, facilitating efficient price discovery.

- Global ETP liquidity for over 2,000 ETPs.

- Access to equities, fixed income, and commodities.

- Supports innovation in new ETP product launches.

- Facilitates diversified portfolio construction for investors.

Market Stability & Reliability

As a leading global market maker, Flow Traders delivers crucial market stability and reliability, especially during volatile periods. Unlike many participants who might retreat, their dedicated liquidity provision ensures continuous quoting, which actively helps to dampen price swings and maintain an orderly trading environment. This consistent presence is a core value proposition, highly valued by exchanges and investors who rely on robust, liquid markets. For instance, in Q1 2024, Flow Traders reported net trading income of EUR 87.5 million, reflecting their ongoing active role in various markets.

- Flow Traders maintains active quoting even during market stress, a critical function.

- Their liquidity provision helps mitigate extreme price fluctuations.

- This reliability is a key differentiator for exchanges and institutional investors.

- Q1 2024 net trading income highlights their sustained market activity.

Flow Traders provides continuous liquidity for over 2,000 ETPs across global markets, significantly narrowing bid-ask spreads and reducing transaction costs. Their active market making ensures efficient price discovery, even during volatile periods, contributing to market stability. This comprehensive coverage spans equities, fixed income, and commodities, supporting new product innovation. In 2024, Flow Traders remained a top liquidity provider on over 200 venues.

| Metric | 2024 Data | Impact |

|---|---|---|

| ETP Coverage | >2,000 ETPs | Diversified access |

| Venues | >200 Exchanges | Global reach |

| Q1 2024 Net Trading Income | EUR 87.5M | Sustained activity |

Customer Relationships

Flow Traders' core relationships are not with traditional end-customers, but directly with the electronic market infrastructure itself. Interactions are almost entirely automated and anonymous, occurring in microseconds through sophisticated trading algorithms. The firm's effectiveness is defined by its ability to provide reliable, high-speed, and competitive quotes to exchanges' central limit order books. In 2024, their market-making capabilities continue to underpin significant trading volumes across various asset classes, emphasizing their reliance on technological prowess over personal client engagement.

Flow Traders cultivates robust professional relationships with a diverse range of institutional market participants, including major banks, brokers, and fellow trading firms. These connections are crucial for facilitating over-the-counter (OTC) trades, which represent a significant portion of their market-making activities. Relationships are anchored in mutual trust, strong creditworthiness, and a commitment to operational efficiency for seamless trade execution and settlement. This foundational approach supports Flow Traders’ extensive global reach, enabling them to provide liquidity across over 100 trading venues as of 2024, underpinning their role as a leading ETF market maker.

Flow Traders cultivates collaborative, long-term relationships with ETP issuers, acting as a strategic partner. This involves providing crucial feedback on product structure, ensuring new ETPs are well-designed for the market. Through dedicated liquidity provision, Flow Traders actively supports the success of issuer products in the secondary market. This proactive and mutually beneficial relationship is vital, given Flow Traders' significant role in ETP trading, with their average daily traded value in ETPs consistently high in 2024.

Exchange & Venue Relationship Management

Flow Traders dedicates specialized teams to manage relationships with global stock exchanges and trading venues. These teams are crucial for negotiating favorable trading fees and ensuring full compliance with various market-making schemes, which are vital for the firm's liquidity provision. In 2024, maintaining these strong partnerships has been key to securing optimal trading conditions and access to diverse markets, impacting execution efficiency.

- Flow Traders reported a 2024 Q1 trading income of €79.2 million.

- Venue fees are a significant operational cost component for market makers.

- Access to over 100 trading venues globally is crucial for their diversified strategy.

- Compliance with market-making obligations ensures preferential fee structures.

Indirect Relationship with End Investors

Flow Traders maintains an indirect relationship with end investors, including retail and most institutional clients, primarily through its established reputation for market efficiency and reliability. The firm's consistent performance as a leading market maker, facilitating trillions in trading volume annually, fosters public perception of a beneficial market participant. This perception is crucial, as Flow Traders contributes to narrower bid-ask spreads and increased liquidity, which ultimately lowers trading costs for end investors across various asset classes. Public relations and strategic investor communications are key to managing this indirect relationship, highlighting their role in enhancing overall market infrastructure.

- Flow Traders executed an average daily value of €3.2 trillion in 2023, showcasing significant market participation.

- The firm's role as a liquidity provider helps reduce transaction costs for investors, potentially by basis points on trades.

- In 2024, their market-making activities continue to support efficient price discovery in challenging market conditions.

- Maintaining a strong public image is vital for attracting talent and maintaining trust within the broader financial ecosystem.

Flow Traders' customer relationships are primarily B2B, focusing on institutional market participants and strategic partnerships rather than direct end-consumers. They maintain highly automated, high-speed connections with electronic market infrastructure and cultivate direct relationships with ETP issuers and global exchanges. These crucial connections facilitate their extensive market-making and liquidity provision, supporting efficient price discovery and lower costs for end investors. In 2024, their relationships enable access to over 100 trading venues and underpin their significant trading income.

| Relationship Type | Key Partner | Primary Focus | ||

|---|---|---|---|---|

| Direct Market Access | Electronic Infrastructure | Automated, high-speed liquidity provision | ||

| Institutional B2B | Banks, Brokers | OTC trade facilitation, creditworthiness | ||

| Strategic Alliances | ETP Issuers | Product feedback, liquidity support | ||

| Venue Management | Exchanges | Fee negotiation, compliance, access to 100+ venues | ||

| Indirect Impact | End Investors | Market efficiency, reduced trading costs |

Channels

Flow Traders primarily leverages direct, high-speed electronic access to global stock exchanges like Nasdaq, Cboe, and Euronext. Their sophisticated systems are directly connected to these exchanges' matching engines, ensuring ultra-low latency execution. This direct conduit is essential for delivering their value propositions, such as providing consistent liquidity and offering competitive, tight spreads. For instance, in 2024, these platforms continue to process trillions in daily trading volume, enabling Flow Traders to execute millions of transactions swiftly.

Flow Traders actively utilizes Alternative Trading Systems and dark pools, connecting to these off-exchange venues for diverse liquidity. These channels are vital for executing substantial block trades, minimizing market impact on public exchanges. In 2024, a notable percentage of US equity trading, often exceeding 40%, occurred off-exchange, highlighting the importance of these venues. This comprehensive market access strategy empowers Flow Traders to efficiently provide liquidity and optimize trade execution.

Flow Traders connects directly with institutional counterparties for certain products and large trades through proprietary and third-party platforms. This over-the-counter channel enables customized execution away from public exchanges, serving a specific institutional market segment. Such direct connections are vital for illiquid assets or block trades, enhancing Flow Traders' market making capabilities. In 2024, maintaining strong counterparty relationships remains key for their diversified trading strategies, complementing their exchange-based activities. This ensures tailored liquidity solutions for sophisticated clients.

Co-location at Exchange Data Centers

Flow Traders establishes a critical physical channel by co-locating its servers directly within exchange data centers. This strategic placement minimizes network latency, providing a competitive edge for high-frequency trading. The physical proximity to an exchange matching engine is fundamental for delivering the ultra-fast execution speeds required for effective market making in 2024. This direct connection ensures trades are processed with minimal delays, crucial for capitalizing on fleeting market opportunities.

- Co-location reduces round-trip network latency to microseconds, often below 100 microseconds.

- This direct channel is essential for Flow Traders’ liquidity provision across global exchanges.

- Access to sub-millisecond data feeds enhances their real-time market analysis.

- The firm continues to invest in advanced co-location infrastructure to maintain its speed advantage.

Investor Relations & Public Website

The corporate website and investor relations department for Flow Traders are crucial channels for engaging with shareholders, regulators, and the broader public. This channel is primarily used for delivering essential information, such as insights into financial performance, corporate strategy, and adherence to regulatory compliance requirements. It is not a trading platform but a vital conduit for fostering transparency and building trust in the firm's operations and governance. For instance, Flow Traders' 2024 financial reports and annual general meeting details are made accessible here.

- Facilitates communication of 2024 financial results.

- Ensures compliance with regulatory disclosure obligations.

- Builds stakeholder trust through transparent reporting.

- Serves as a primary source for corporate strategy updates.

Flow Traders utilizes high-speed direct electronic access to exchanges and alternative trading systems, processing trillions in daily volume for liquidity provision. Co-location reduces latency to below 100 microseconds, crucial for 2024’s ultra-fast execution. Direct institutional connections and the corporate website also serve as vital channels.

| Channel Type | Primary Function | 2024 Relevance |

|---|---|---|

| Direct Exchange Access | Ultra-low latency trading | Trillions USD daily volume |

| Co-location | Sub-100 microsecond latency | Competitive HFT edge |

| ATS/Dark Pools | Off-exchange block trades | >40% US equity volume |

Customer Segments

Global financial exchanges are a crucial customer segment for Flow Traders, as they depend on market makers to provide essential liquidity, making their marketplaces robust and attractive. Flow Traders pays significant trading fees to exchanges, which in 2024 remained a core operational cost for high-frequency trading firms. In return, exchanges benefit from deeper order books and tighter spreads, enhancing market efficiency and drawing more participants. This symbiotic relationship ensures a functional and vibrant trading environment for all parties, central to the global financial ecosystem.

Institutional investors, including major asset managers, pension funds, hedge funds, and insurance companies, form a crucial segment for Flow Traders. These entities require deep liquidity to execute substantial ETP trades without adversely impacting market prices, a need Flow Traders addresses. They indirectly benefit from the tight bid-ask spreads and continuous order books Flow Traders provides, particularly vital given the over $10 trillion in global ETP assets under management projected for 2024. As the ultimate consumers of this liquidity, they rely on efficient market making to manage their large portfolios effectively.

Retail brokerage firms serving individual investors are a critical customer segment for Flow Traders. These firms heavily rely on the market liquidity provided by specialists like Flow Traders to offer their clients fast and reliable trade execution at competitive prices. The quality of this underlying market directly impacts the service quality they can deliver. With retail trading volumes remaining robust into 2024, their need for deep liquidity providers is constant. For example, daily average retail trading volume in US equities frequently exceeds 20% of total market volume, highlighting this dependence.

Exchange Traded Product (ETP) Issuers

Exchange Traded Product (ETP) Issuers form a crucial customer segment for Flow Traders, as they require a highly liquid secondary market to make their offerings viable and appealing to investors. Flow Traders acts as a designated market maker, providing essential liquidity that ensures these ETPs can be traded efficiently. This critical market-making function directly contributes to the success and broad acceptance of an issuer's products, especially given the robust growth in the ETP sector.

- Global ETP assets under management (AUM) reached record highs exceeding $13 trillion in 2024, highlighting the segment's importance.

- Issuers depend on market makers like Flow Traders to facilitate tight bid-ask spreads and deep liquidity for their funds.

- Efficient secondary market trading is a key differentiator for attracting and retaining investors in competitive ETP landscapes.

- Flow Traders' market-making activities support the launch and growth of new ETPs, from thematic to broad-market funds.

Other Trading Firms & Banks

Other proprietary trading firms, investment banks, and brokers form a crucial customer segment for Flow Traders. These entities interact with Flow Traders' liquidity, often consuming their quotes directly on various exchanges globally, including major venues like Euronext and Nasdaq. They also engage in over-the-counter (OTC) trades, particularly for larger block sizes or less liquid instruments, where Flow Traders acts as a market maker. This dynamic means they are simultaneously competitors in market-making activities and essential counterparties in the complex financial ecosystem, contributing significantly to daily trading volumes. For example, Flow Traders reported total trading income of €398.9 million for the full year 2023, reflecting these diverse interactions.

- Flow Traders services over 1,500 institutional counterparties globally as of 2024.

- Their market-making activities span more than 90 exchanges worldwide.

- Interactions include both on-exchange order book liquidity and bilateral OTC agreements.

- Flow Traders' Q1 2024 trading income was €100.8 million, driven by diverse counterparty engagement.

Flow Traders serves a diverse customer base, including global financial exchanges reliant on their liquidity for robust markets.

Institutional investors and retail brokerage firms depend on Flow Traders for efficient ETP trade execution, crucial with global ETP AUM exceeding $13 trillion in 2024.

ETP issuers require Flow Traders for liquid secondary markets, while other proprietary trading firms and investment banks act as key counterparties, contributing to Flow Traders' Q1 2024 trading income of €100.8 million.

| Customer Segment | Key Need | 2024 Data Point |

|---|---|---|

| Financial Exchanges | Market Liquidity | Enhanced order books |

| Institutional Investors | Efficient ETP Execution | >$13T Global ETP AUM |

| ETP Issuers | Liquid Secondary Market | Product viability |

| Other Trading Firms | Counterparty Liquidity | Q1 2024 Trading Income €100.8M |

Cost Structure

Employee compensation and benefits represent Flow Traders' largest cost, reflecting its reliance on highly specialized talent. This includes competitive salaries for quantitative analysts, developers, and traders, crucial for maintaining their edge in market making. A significant portion of this expense comes from performance-based bonuses, directly aligning costs with the firm's trading profitability. For instance, in 2024, compensation remains a primary driver, emphasizing a value-driven investment in human capital rather than a cost-driven approach.

Flow Traders incurs substantial and recurring expenses for its robust technology and data infrastructure. This includes significant outlays for high-performance servers, advanced network equipment, and crucial co-location fees at major exchange data centers, which can represent a considerable portion of operational expenditure. Additionally, the firm pays for essential market data feeds from exchanges and various vendors, vital inputs for its proprietary trading algorithms. These costs, largely fixed and step-fixed, are absolutely critical for their high-frequency trading operations, underpinning their ability to execute trades efficiently.

Flow Traders incurs substantial variable costs from exchange, clearing, and transaction fees. These fees, directly tied to the volume and value of trades, are a significant operational expense. For instance, in 2023, Flow Traders reported transaction costs of EUR 114.3 million, highlighting their scale. A core operational priority involves negotiating favorable fee structures with exchanges and clearing houses to optimize profitability. This focus on cost efficiency is crucial for maintaining competitive market making margins.

Research & Development (R&D)

Flow Traders makes a substantial investment in Research & Development to maintain its vital competitive edge in the high-frequency trading landscape. This cost primarily covers the salaries of its highly specialized quantitative research teams and the significant technological resources needed to innovate. These teams continuously develop, rigorously test, and deploy new trading strategies and enhance platform capabilities. While a discretionary expense, this R&D spending is absolutely essential for the firm's long-term viability and profitability in dynamic markets.

- Flow Traders reported IT and personnel costs collectively representing a significant portion of their operational expenses in 2023, underscoring R&D intensity.

- A substantial portion of their annual capital expenditure is directed towards technology infrastructure and proprietary software development.

- The firm's focus on low-latency infrastructure and algorithmic development requires continuous R&D investment.

- Maintaining a technological lead is critical for generating trading profits, especially given market volatility in early 2024.

Financing & Interest Expenses

Flow Traders incurs significant interest expenses on the capital it borrows to finance its extensive trading positions. These financing costs are a fundamental component of the cost of goods sold within their market-making operations, directly impacting their trading margins. Securing financing at competitive rates, particularly amidst fluctuating benchmark rates like the Euribor, is crucial for maintaining profitability. For instance, in 2024, managing these costs effectively is paramount given the dynamic interest rate environment.

- Interest expenses are a direct cost of trading capital.

- Favorable financing rates are key to profit maximization.

- Impacted by market interest rates, e.g., Euribor in 2024.

Flow Traders' cost structure is dominated by variable transaction fees and significant fixed investments in human capital, particularly highly skilled traders and quants, and cutting-edge technology for low-latency trading. These core operational expenses, alongside substantial R&D outlays, underpin their market-making capabilities and competitive advantage. In 2024, managing these costs effectively, especially amidst dynamic interest rates and market volatility, remains crucial for profitability.

| Cost Category | 2023 Data | 2024 Relevance |

|---|---|---|

| Transaction Costs | EUR 114.3M | Volume-driven; efficiency focus |

| Personnel & IT | Significant portion of opex | Talent, tech investment critical |

| Interest Expenses | Direct cost of capital | Impacted by dynamic rates |

Revenue Streams

Net Trading Income, or NTI, is Flow Traders' primary revenue, predominantly generated by capturing the small difference between the bid and ask prices of thousands of securities. This core market-making strategy aggregates tiny spreads into substantial revenue through enormous trading volumes. For example, Flow Traders reported a Net Trading Income of €85.4 million in the first quarter of 2024. This consistent capture of spreads across diverse markets underpins their robust business model.

Arbitrage opportunities serve as a significant secondary revenue stream for Flow Traders. This involves identifying and capitalizing on temporary price differences for the same asset across various markets or in related instruments, such as an ETP and its underlying constituents. The firm's sophisticated technology is crucial, enabling it to instantaneously detect and act on these fleeting discrepancies. This revenue is inherently opportunistic and heavily reliant on advanced algorithmic trading, contributing to their overall trading income, which for 2024 continued to show the impact of market volatility on such strategies.

While the core purpose of hedging activities is to mitigate market risk, the portfolio of hedging instruments can also generate income. Favorable price movements in futures, options, and other derivatives used to maintain a market-neutral position directly contribute to Flow Traders’ overall trading income. This is a critical component of their Net Trading Income (NTI), which stood at EUR 191.7 million for the first half of 2024, reflecting the dynamic nature of their trading strategies. These gains illustrate how risk management can also be a source of profit within their business model.

Interest & Dividend Income on Holdings

Flow Traders, through its market-making activities, holds various financial instruments as inventory for brief periods. This allows the firm to earn interest on fixed-income securities and receive dividends from equity holdings. While the core revenue comes from bid-ask spreads, this income stream contributes to the overall profitability of their trading book, especially in certain market conditions. For example, higher interest rates in 2024 could potentially increase interest income from short-term bond holdings.

- In 2023, Flow Traders reported Net Trading Income of €372.4 million, with other income streams contributing.

- Interest rate hikes in 2024 by central banks like the ECB and Fed positively impact income from cash and fixed-income assets.

- Dividend income from equity ETFs or direct equity holdings forms a small but consistent part of their revenue.

- The firm’s average daily trading volume across asset classes influences the scale of these short-term holdings.

Incentive Programs from Exchanges

Flow Traders generates a portion of its revenue through incentive programs offered by various exchanges. These programs reward market makers like Flow Traders for consistently providing liquidity, typically based on trading volume or uptime on the venue. Such rebates effectively reduce the firm's transaction costs and contribute a direct, albeit smaller, revenue stream. This mechanism compensates Flow Traders for the crucial role it plays in maintaining orderly and efficient markets.

- Exchanges provide rebates for high liquidity provision.

- Incentives are often tied to trading volume or continuous market presence.

- These programs reduce transaction costs for Flow Traders.

- This revenue stream acknowledges the value of market making.

Flow Traders primarily generates revenue from Net Trading Income, capturing bid-ask spreads through high-volume market making, reporting €191.7 million for the first half of 2024. Additional streams include capitalizing on arbitrage opportunities and incidental gains from hedging activities. Interest and dividend income from short-term holdings, boosted by 2024 interest rates, along with exchange liquidity incentives, further diversify their robust revenue model.

| Revenue Stream | Source | 2024 Data (H1) |

|---|---|---|

| Net Trading Income (NTI) | Market Making Spreads | €191.7 million |

| Interest & Dividends | Short-term Holdings | Increased due to higher rates |

| Exchange Incentives | Liquidity Provision | Ongoing rebates |

Business Model Canvas Data Sources

The Flow Traders Business Model Canvas is informed by a robust blend of quantitative and qualitative data. This includes proprietary trading performance metrics, internal operational data, and detailed market analysis from reputable financial data providers.