Flow Traders PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

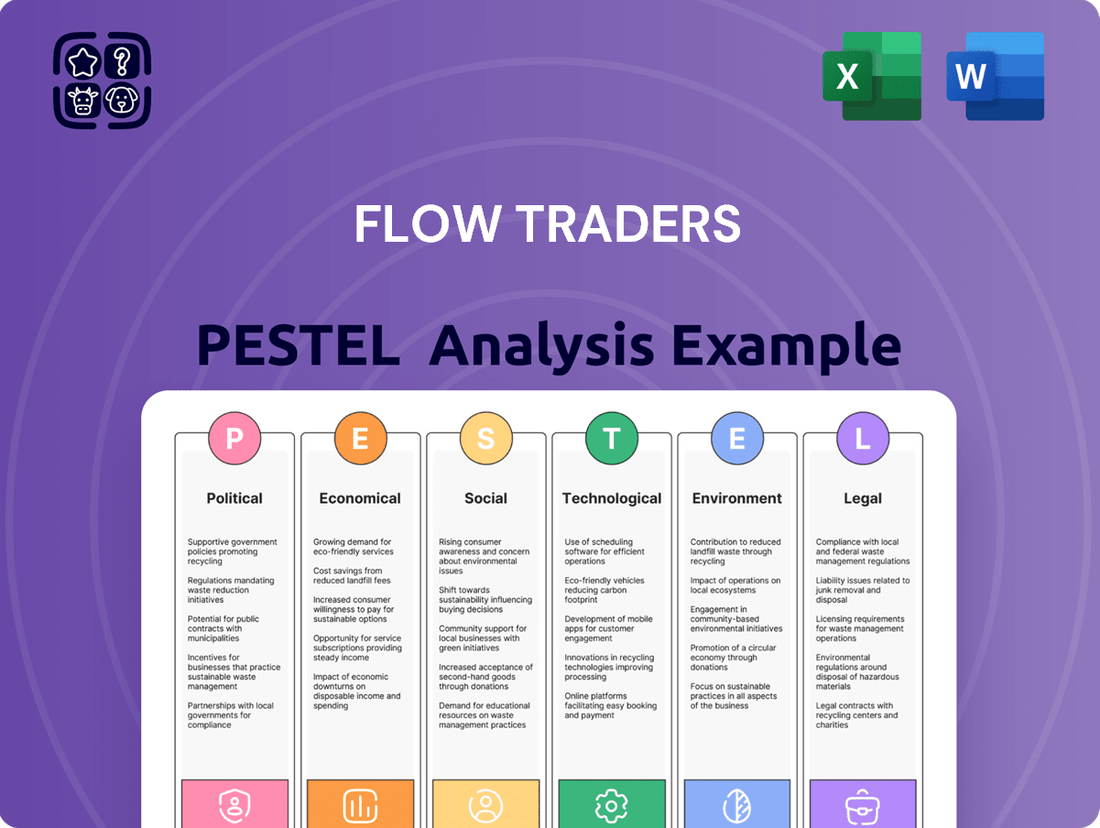

Navigate the complex external forces impacting Flow Traders with our expert PESTLE analysis. From evolving political landscapes to shifting economic tides, understand the critical factors shaping their operational environment. Gain a competitive edge by leveraging these comprehensive insights to refine your own market strategies. Don't miss out on actionable intelligence; download the full PESTLE analysis now and empower your decision-making.

Political factors

Governments and financial authorities are consistently evaluating and updating the rules that govern financial markets. These adjustments, whether to market structure, trading protocols, or capital mandates, can directly affect Flow Traders' operational strategies and earning potential. For instance, the ongoing refinement of MiFID II regulations in Europe continues to shape trading practices and reporting requirements for firms like Flow Traders.

Political stability across the regions where Flow Traders operates is a crucial element that impacts investor sentiment and overall trading activity. A stable political landscape fosters greater market confidence, which in turn tends to boost trading volumes. Conversely, political uncertainty can lead to heightened volatility and potentially reduced liquidity, presenting both challenges and opportunities for liquidity providers.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to inject significant volatility into global financial markets. This instability directly affects Flow Traders, as market makers, by widening bid-ask spreads and increasing the need for robust risk management to navigate fluctuating asset prices. For instance, the conflict in Ukraine in 2022 led to sharp price swings in energy and commodity ETFs, impacting trading volumes and liquidity.

Shifting trade policies, exemplified by the ongoing trade disputes between major economies like the US and China, can reroute capital flows and alter the attractiveness of various investment products. Changes in tariffs or trade agreements can directly influence the demand for Exchange Traded Products (ETPs) tracking specific sectors or regions, forcing Flow Traders to adapt their market-making strategies to these evolving economic landscapes. The US Inflation Reduction Act of 2022, for example, has spurred significant investment in green energy ETPs, creating new opportunities and challenges for market makers.

Government fiscal policies, like spending initiatives and tax adjustments, alongside central bank monetary actions such as quantitative easing or tightening, significantly shape market liquidity and interest rates. For example, the U.S. Federal Reserve's aggressive interest rate hikes throughout 2022 and into 2023 aimed to curb inflation, leading to higher borrowing costs and impacting investor sentiment across all asset classes, including ETPs.

These policy shifts directly influence the cost of capital for businesses and investors, affecting the valuation of securities. In 2024, ongoing discussions around fiscal stimulus packages in major economies could inject liquidity, while persistent inflation concerns might prompt continued monetary vigilance from central banks, creating a dynamic trading environment for fixed income and equity ETPs.

International Cooperation and Regulatory Harmonization

Flow Traders, as a global proprietary trading firm, is significantly impacted by international cooperation and regulatory harmonization in financial markets. Efforts to align regulations across different jurisdictions can streamline operations and reduce compliance costs, creating opportunities for more efficient market making. For instance, the ongoing discussions around MiFID III in Europe, aiming to further enhance market transparency and investor protection, could lead to a more unified framework, though the specifics of its implementation remain under development as of early 2025.

Conversely, regulatory divergence presents distinct challenges. When countries adopt differing rules for trading, capital requirements, or data reporting, Flow Traders must invest in adapting its systems and strategies to comply with each unique regime. This can increase operational complexity and potentially limit the firm's ability to leverage economies of scale across its global operations. The evolving landscape of digital asset regulation, with varying approaches between the EU's MiCA framework and more fragmented regulations in other regions, exemplifies this challenge.

- Harmonization benefits: Simplified compliance, reduced operational costs, and greater market access for global firms.

- Divergence challenges: Increased compliance burden, need for localized strategies, and potential for market fragmentation.

- Key areas of focus: Capital requirements, trading surveillance, data reporting standards, and digital asset regulation.

- Impact on Flow Traders: Directly affects the efficiency and cost-effectiveness of its market-making activities across different geographies.

Political Stability of Key Markets

The political stability within key operational and asset-based markets significantly impacts Flow Traders' business. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continued to influence European market volatility, directly affecting trading volumes and risk management strategies for firms like Flow Traders. Sudden policy changes, such as unexpected tax reforms or shifts in financial regulations in major trading hubs like the United States or the Netherlands, can create immediate market disruptions.

These disruptions directly challenge Flow Traders' core function of providing liquidity and quoting prices. A notable example from early 2025 could be a sudden imposition of trade barriers or capital controls in a significant Asian market where many Exchange Traded Products (ETPs) are listed, leading to wider bid-ask spreads and reduced trading activity. Such events necessitate rapid adjustments in risk models and hedging strategies to maintain operational efficiency and profitability.

- Geopolitical Risk Assessment: Flow Traders must continuously monitor political stability in over 30 countries where it operates and in the jurisdictions underlying its ETPs.

- Policy Shift Impact: A swift change in monetary policy or trading regulations in a major economy, like the US Federal Reserve's stance in late 2024, can trigger immediate market volatility.

- Market Disruption Scenarios: Political unrest in regions linked to commodity ETPs, such as the Middle East in early 2025, can cause price dislocations and impact Flow Traders' ability to hedge effectively.

- Regulatory Environment: The evolving regulatory landscape in the EU and US, with potential new rules on market making and capital requirements by mid-2025, requires proactive compliance and strategic adaptation.

Political decisions significantly shape financial markets, influencing Flow Traders' operations. Regulatory changes, such as potential updates to MiFID III in Europe by mid-2025, aim for greater transparency, impacting trading protocols. Political stability is paramount; for example, geopolitical tensions in Eastern Europe during 2024 continued to affect European market volatility and liquidity.

Government fiscal policies and central bank actions, like the US Federal Reserve's interest rate adjustments throughout 2023-2024, directly influence market liquidity and investor sentiment. Shifting trade policies, such as ongoing US-China trade discussions, can reroute capital flows and alter demand for Exchange Traded Products (ETPs), forcing adaptation in market-making strategies.

Regulatory divergence across jurisdictions, as seen in the varying approaches to digital asset regulation between the EU's MiCA framework and other regions, increases compliance burdens for global firms like Flow Traders. Conversely, regulatory harmonization efforts can streamline operations and reduce costs.

Political stability is key for investor confidence and trading volumes. In 2024, ongoing geopolitical tensions in Eastern Europe directly impacted European market volatility, affecting trading volumes and Flow Traders' risk management. Sudden policy shifts, like potential trade barriers in Asian markets by early 2025, can cause immediate disruptions, widening bid-ask spreads and reducing liquidity.

| Factor | Impact on Flow Traders | Example (2024-2025) |

|---|---|---|

| Regulatory Updates | Affects trading protocols, reporting, and compliance costs. | Ongoing refinement of MiFID II in Europe; potential MiFID III discussions by mid-2025. |

| Geopolitical Stability | Influences market volatility, investor sentiment, and trading volumes. | Continued geopolitical tensions in Eastern Europe impacting European market volatility in 2024. |

| Fiscal & Monetary Policy | Shapes market liquidity, interest rates, and investor behavior. | US Federal Reserve interest rate adjustments throughout 2023-2024 impacting borrowing costs and sentiment. |

| Trade Policy | Alters capital flows and demand for specific ETPs. | US-China trade disputes influencing investment product attractiveness. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces influencing Flow Traders, covering political, economic, social, technological, environmental, and legal factors.

It offers actionable insights to help Flow Traders navigate the dynamic landscape and capitalize on emerging opportunities.

A concise, actionable overview of Flow Traders' PESTLE factors, enabling rapid identification and mitigation of external threats, thereby reducing strategic uncertainty and boosting operational resilience.

Economic factors

Flow Traders' business model is intrinsically linked to market volatility, as this often widens bid-ask spreads, creating more opportunities for the firm to profit. For instance, during periods of heightened uncertainty, such as the initial phases of the COVID-19 pandemic in early 2020, trading volumes surged, directly benefiting market makers like Flow Traders. The firm reported a significant increase in net trading income during this time.

However, extreme or prolonged periods of volatility can present challenges. Unpredictable market swings can lead to wider risk exposures and potentially higher operational costs due to increased hedging needs and capital requirements. For example, the flash crash events or sudden geopolitical shocks necessitate more robust risk management frameworks, which can be resource-intensive.

Global economic factors, including the threat of recession or the actual onset of one, directly influence market volatility. As of late 2024 and into 2025, many economies are grappling with inflation concerns and the impact of interest rate hikes, leading to increased uncertainty and fluctuating asset prices. This environment, while potentially profitable, demands constant adaptation from Flow Traders.

Financial crises or major macroeconomic events, such as the European energy crisis or significant shifts in global trade policies, are key drivers of market volatility. These events can cause sharp, unpredictable movements in asset prices across various markets, creating both opportunities and risks for Flow Traders' trading strategies.

Changes in global interest rates directly affect Flow Traders' funding costs and the value of fixed-income Exchange Traded Products (ETPs). For instance, as of early 2024, major central banks like the Federal Reserve and the European Central Bank have maintained higher interest rate policies, impacting borrowing expenses for trading firms.

A rising interest rate environment, such as the hikes seen through 2023 and into 2024, can significantly influence bond markets. This environment can lead to decreased bond prices and potentially shift investor sentiment away from fixed-income assets, thereby affecting the demand for ETPs that track these markets.

The cost of capital for Flow Traders is directly tied to prevailing interest rates. Higher rates mean increased expenses for leveraging their trading positions, which can compress profit margins. Conversely, lower rates reduce these costs, potentially boosting profitability.

Investor preferences are also sensitive to interest rate changes. When rates are high, investors might find traditional savings accounts or newly issued bonds more attractive than ETPs, leading to reduced trading volumes and opportunities for Flow Traders.

Elevated inflation rates, such as the persistent consumer price index (CPI) growth observed in many developed economies throughout 2024, often prompt central banks to tighten monetary policy. This can result in higher interest rates and reduced liquidity, directly impacting market sentiment and trading volumes, which are crucial for Flow Traders' business model.

The erosion of purchasing power due to inflation directly affects the real value of capital. For Flow Traders, this means the capital deployed for trading purposes might have less effective buying power, potentially leading to lower transaction volumes or reduced profit margins on trades if not adequately hedged.

Increased inflation also translates to higher operational expenses. For example, rising energy costs, employee wage demands to keep pace with living costs, and increased costs for data and technology services can all squeeze profitability for a firm like Flow Traders, necessitating careful cost management strategies.

In the US, for instance, inflation remained a significant concern in early 2025, with the CPI hovering above the Federal Reserve's 2% target, leading to continued discussions about interest rate policy. This economic backdrop directly influences the trading environment and the strategies employed by liquidity providers.

Economic Growth and Investor Confidence

Robust global economic growth directly fuels higher trading volumes and broadens investor participation across financial markets. For Flow Traders, this translates to more opportunities in their core business of providing liquidity for Exchange Traded Products (ETPs).

Strong investor confidence, a key byproduct of healthy economic expansion, encourages greater diversification. This often leads to increased investment in ETPs, which are central to Flow Traders' revenue streams. For instance, global GDP growth was projected to be around 3.1% in 2024, a solid foundation for market activity.

- Economic Growth: Global GDP growth is anticipated to remain positive, supporting market liquidity.

- Investor Confidence: Rising consumer and business confidence generally correlates with increased ETP investment.

- Market Participation: Economic upturns typically see more individuals and institutions entering financial markets.

- ETP Demand: Higher confidence boosts demand for diversified investment vehicles like ETPs.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Flow Traders, a global trading firm. As they operate in numerous markets, changes in the value of currencies directly affect their financial performance. For instance, if the Euro weakens against the US Dollar, assets held in Euros would be worth less when translated into US Dollars for reporting purposes, impacting their consolidated financial statements. This currency risk is a constant consideration for managing international operations and investments.

The volatility of exchange rates can introduce considerable uncertainty into Flow Traders' profitability. A sudden appreciation of a key currency in which they hold assets could boost reported earnings, while a depreciation could have the opposite effect. This dynamic necessitates robust hedging strategies to mitigate potential losses. For example, in early 2024, the Euro experienced some volatility against the US Dollar, with fluctuations impacting the reported value of European-based assets for global financial institutions.

Flow Traders must actively manage its exposure to currency risk across its diverse international portfolio. This involves strategies such as forward contracts, currency options, and maintaining a balanced mix of assets and liabilities in different currencies. The effectiveness of these strategies directly influences the stability of their earnings and the valuation of their holdings. By Q1 2024, many financial institutions were actively adjusting their currency hedging positions in response to anticipated interest rate differentials and geopolitical events influencing currency markets.

- Impact on International Assets: Fluctuations directly alter the reported value of assets held in foreign currencies.

- Earnings Translation Risk: Changes in exchange rates affect the translation of foreign subsidiary earnings into the parent company's reporting currency.

- Hedging Imperative: Flow Traders employs financial instruments to offset potential losses from adverse currency movements.

- Market Volatility: The ongoing global economic environment, including inflation and interest rate policies, contributes to currency market volatility, requiring continuous adaptation.

Economic growth is a fundamental driver for Flow Traders, influencing trading volumes and investor activity. As of projections for 2024, global GDP growth was anticipated to remain positive, around 3.1%, providing a stable backdrop for financial markets. This growth generally correlates with increased investor confidence and broader participation in markets, particularly in diversified investment vehicles like Exchange Traded Products (ETPs), which are central to Flow Traders' business.

Full Version Awaits

Flow Traders PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flow Traders PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and competitive dynamics. The content and structure shown in the preview is the same document you’ll download after payment, offering a complete strategic overview.

Sociological factors

Demographic shifts are significantly reshaping the investor landscape. In many developed economies, an aging population might lead to a preference for more conservative, income-generating investments, potentially impacting demand for certain Exchange Traded Products (ETPs). Conversely, the rapid growth of younger, digitally-native investors, often referred to as Generation Z and Millennials, presents a contrasting trend. This demographic, comfortable with technology and online platforms, is increasingly drawn to accessible and often passively managed ETPs, driving demand for innovative trading solutions.

Understanding these evolving investor preferences is crucial for Flow Traders. For instance, by 2025, it's projected that Millennials and Gen Z will control a substantial portion of investable assets. Flow Traders must adapt its liquidity provision strategies and technological offerings to cater to the distinct needs and trading behaviors of these burgeoning investor segments. This includes enhancing digital interfaces and ensuring the availability of ETPs that align with younger investors' interests, such as those focused on ESG themes or emerging technologies.

The surge in financial literacy, amplified by readily available online resources and educational platforms, is empowering more people to take control of their investments. For instance, a 2024 survey indicated that over 60% of retail investors now conduct their own research before making investment decisions, a significant jump from previous years.

This growing self-directed approach directly benefits entities like Flow Traders, as it fuels demand for Exchange Traded Products (ETPs). The global ETP market reached an estimated $9 trillion in assets under management by early 2025, demonstrating the massive scale of this trend.

Consequently, increased individual participation in self-directed investing translates to higher trading volumes. This uptick in activity necessitates robust and efficient market making services, a core offering of Flow Traders, to ensure smooth price discovery and liquidity.

Public perception of high-frequency trading (HFT) and market making remains a significant sociological factor. Surveys in late 2024 indicated a mixed but often skeptical public view, with a majority expressing concern over the fairness and stability HFT brings to markets. This apprehension, fueled by past market volatility events attributed by some to HFT, can translate into increased demand for stricter oversight.

Regulatory bodies globally are actively reviewing HFT practices. For instance, the U.S. Securities and Exchange Commission (SEC) continues to examine market structure, with potential rule changes in 2025 aimed at enhancing transparency and mitigating risks associated with rapid trading. Such scrutiny could impose new compliance burdens and operational adjustments on firms like Flow Traders.

Negative public sentiment can also affect talent acquisition. Younger professionals entering the finance industry may be deterred by the perceived ethical gray areas or the intensity of HFT, impacting the pool of potential employees. Demonstrating a commitment to responsible trading and ethical conduct is therefore vital for attracting and retaining top talent in 2024 and beyond.

Talent Attraction and Retention

Flow Traders' success is intrinsically linked to its ability to attract and retain top-tier technology and finance talent. The financial services sector, particularly in high-frequency trading and market making, demands specialized expertise, creating a highly competitive landscape for skilled professionals.

The global competition for these specialized roles is intense. For instance, in 2024, the demand for skilled AI and machine learning engineers, crucial for algorithmic trading development, continued to outstrip supply, with average salaries for experienced professionals in major financial hubs like Amsterdam and New York often exceeding $200,000 annually.

Beyond competitive salaries, Flow Traders must cultivate a compelling work environment. Factors such as a positive company culture, robust opportunities for professional development, and a healthy work-life balance are increasingly important differentiators for attracting and retaining employees in 2024 and beyond. Companies that fail to address these sociological aspects risk losing valuable talent to competitors offering more attractive overall packages.

- Talent Demand: High demand for AI, machine learning, and quantitative finance specialists in 2024.

- Compensation Benchmarks: Experienced professionals in key financial hubs can command salaries upwards of $200,000 USD in 2024.

- Retention Drivers: Company culture, professional growth, and work-life balance are critical for retaining talent.

- Competitive Landscape: Fierce competition exists for specialized technology and finance roles globally.

Societal Expectations for Corporate Responsibility

Societal expectations are increasingly shaping how companies operate, with a significant focus on Environmental, Social, and Governance (ESG) principles. This growing emphasis means that businesses like Flow Traders are under scrutiny not just for their financial performance, but also for their impact on the planet and society. Investors, customers, and employees are all looking for evidence of responsible corporate citizenship.

Flow Traders, as a prominent player in the financial markets, must actively demonstrate its commitment to these ESG factors. Failing to do so can damage its reputation and make it less attractive to a broad range of stakeholders. For instance, in 2024, investor demand for ESG-compliant funds continued to surge, with global sustainable investment assets projected to reach over $50 trillion by 2025, according to various industry reports.

- Reputation Management: Maintaining a strong reputation is crucial for attracting and retaining clients and talent.

- Investor Attraction: A growing number of institutional investors prioritize ESG integration in their portfolios.

- Employee Engagement: Employees, particularly younger generations, are more likely to join and stay with companies that align with their values.

- Regulatory Landscape: Evolving regulations globally are mandating greater transparency and action on ESG issues.

Societal attitudes towards wealth management and investment are evolving, driven by increased financial literacy and a greater emphasis on passive investing strategies. This shift empowers individuals to take more control, directly fueling demand for products like Exchange Traded Products (ETPs) that Flow Traders specializes in. The global ETP market is substantial, reaching an estimated $9 trillion in assets under management by early 2025, highlighting the scale of this trend and the need for efficient market making.

Public perception of financial markets, including high-frequency trading (HFT), significantly influences regulatory approaches and talent acquisition. Skepticism regarding HFT's fairness can lead to calls for stricter oversight, as seen in ongoing reviews by bodies like the SEC. Furthermore, negative sentiment can deter potential employees, making it imperative for firms like Flow Traders to champion ethical practices and transparency to attract skilled professionals.

There is a growing societal expectation for businesses to operate responsibly, with Environmental, Social, and Governance (ESG) principles at the forefront. Stakeholders, including investors and employees, increasingly scrutinize corporate behavior beyond financial performance. By 2025, global sustainable investment assets are projected to exceed $50 trillion, underscoring the importance for Flow Traders to demonstrate a commitment to ESG factors to maintain its reputation and appeal.

Technological factors

The relentless evolution of AI and Machine Learning is pivotal for Flow Traders, supercharging their trading algorithms and risk oversight. These advancements facilitate quicker, more precise decision-making in the fast-paced electronic trading environment.

In 2024, AI adoption across financial services saw significant acceleration, with machine learning models increasingly used for predictive analytics and algorithmic trading. For instance, firms are leveraging AI to identify subtle market patterns, a capability directly beneficial to Flow Traders' high-frequency trading operations.

By integrating sophisticated AI, Flow Traders can refine their proprietary strategies, identifying fleeting arbitrage opportunities and optimizing execution. This technological edge is critical for maintaining competitiveness, especially as market participants increasingly rely on data-driven insights.

Furthermore, AI's role in risk management is expanding, with capabilities to detect anomalies and predict potential market disruptions. This is particularly relevant as global financial markets become more interconnected and volatile, demanding robust and adaptive risk controls.

Flow Traders relies heavily on ultra-low-latency infrastructure and network connectivity to maintain its competitive edge. This means continuously investing in and upgrading their trading systems and data links to ensure the fastest possible execution speeds. In Q1 2024, the company reported an average trade execution time that was a fraction of a millisecond, a critical factor in capturing narrow bid-ask spreads in volatile markets.

Flow Traders, as a technology-dependent trading house, confronts ongoing and sophisticated cybersecurity threats. Protecting its high-frequency trading algorithms, critical market data, and client confidentiality is paramount. In 2024, the financial services sector experienced a significant rise in sophisticated cyberattacks, with ransomware and phishing schemes posing particular challenges. A 2024 report indicated that the average cost of a data breach in financial services reached $5.90 million.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are reshaping the financial landscape, offering the potential to streamline trade settlement and clearing processes. Flow Traders must stay attuned to these advancements, particularly as digital assets and tokenized securities gain traction.

The adoption of DLT could lead to more efficient, transparent, and secure transactions, potentially reducing operational costs and counterparty risk for firms like Flow Traders. For instance, by early 2024, the global market for blockchain in financial services was projected to reach billions, indicating significant investment and development in this area.

- Revolutionizing Infrastructure: Blockchain and DLT can fundamentally alter how trades are settled and cleared, moving towards near real-time finality.

- Digital Assets and Tokenization: Flow Traders needs to evaluate strategies for participating in markets for tokenized real-world assets and digital currencies.

- Regulatory Scrutiny: The evolving regulatory frameworks surrounding DLT and digital assets present both opportunities and challenges that require careful navigation.

- Efficiency Gains: Implementing DLT solutions could offer substantial cost savings and operational efficiencies for high-frequency trading firms.

Big Data Analytics and Cloud Computing

Big data analytics is foundational for Flow Traders, enabling the processing of immense volumes of real-time and historical market data. This capability is crucial for spotting lucrative trading opportunities and effectively managing associated risks.

Cloud computing provides the essential scalable infrastructure required for these computationally demanding tasks. By leveraging the cloud, Flow Traders can efficiently handle the intensive processing needed for sophisticated trading algorithms and data analysis.

The market for big data and analytics solutions saw significant growth, with global spending estimated to reach over $300 billion in 2024, highlighting its increasing importance across financial services. Cloud infrastructure spending by financial institutions is also projected to continue its upward trajectory, exceeding $100 billion globally in 2025.

- Real-time data processing: Essential for identifying fleeting trading opportunities in volatile markets.

- Risk management: Advanced analytics help in quantifying and mitigating market, credit, and operational risks.

- Scalable infrastructure: Cloud computing allows for flexible resource allocation to meet fluctuating computational demands.

- Competitive edge: Firms with superior data analytics capabilities often outperform peers in trading execution and strategy development.

The integration of Artificial Intelligence and Machine Learning is transforming trading operations for Flow Traders, enhancing algorithmic precision and risk management capabilities. By 2024, AI adoption in finance accelerated, with machine learning models increasingly used for predictive analytics, directly benefiting Flow Traders' high-frequency trading.

Flow Traders' reliance on ultra-low-latency infrastructure means continuous investment in trading systems to ensure the fastest execution speeds; in Q1 2024, average trade execution times were fractions of a millisecond.

Blockchain and Distributed Ledger Technology (DLT) offer potential for streamlined trade settlement, with the global market for blockchain in financial services projected to reach billions by early 2024, indicating significant development.

Big data analytics and cloud computing are foundational, enabling the processing of vast market data for opportunity identification and risk management, with global spending on big data and analytics solutions exceeding $300 billion in 2024.

Legal factors

Flow Traders navigates a landscape shaped by intricate global financial market regulations, including MiFID II in Europe and components of the Dodd-Frank Act in the United States. These frameworks mandate strict adherence to rules governing market structure, transparency, and reporting, directly influencing operational expenditures and strategic decision-making.

The ongoing evolution of these regulations, such as proposed updates to MiFID II's transparency requirements for certain derivatives in 2024, necessitates continuous adaptation. Flow Traders must invest significantly in compliance infrastructure and expertise to meet these demands, impacting their cost base and competitive positioning.

For instance, enhanced reporting obligations under MiFID II have led to increased data management costs for many financial institutions. In 2023, the European Securities and Markets Authority (ESMA) reported that firms spent an estimated €5.5 billion annually on MiFID II compliance, a figure Flow Traders directly contends with.

Flow Traders must meticulously adhere to Anti-Money Laundering (AML) laws and international sanctions. Failure to comply can result in significant penalties, impacting financial stability. For instance, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the severity of these regulations.

Implementing strong AML and sanctions screening systems is paramount for Flow Traders to identify and report suspicious transactions. This proactive approach not only ensures legal standing but also safeguards the firm's integrity in the global financial landscape.

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR), significantly impact how companies like Flow Traders handle personal and market data. These laws mandate strict rules for data collection, storage, and processing, with non-compliance leading to substantial fines. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. Flow Traders' reliance on vast datasets for trading strategies makes adherence to these evolving legal frameworks absolutely critical for maintaining operational integrity and market trust throughout 2024 and into 2025.

Market Abuse and Insider Trading Regulations

Flow Traders, as a significant market maker, operates under stringent legal frameworks designed to prevent market abuse, manipulation, and insider trading. These regulations are crucial for fostering fair and transparent trading environments. For instance, in the European Union, the Market Abuse Regulation (MAR) imposes strict rules on issuers, market participants, and even individuals who possess inside information.

To comply, Flow Traders must maintain robust internal controls and sophisticated surveillance systems. These systems are essential for monitoring trading activities, identifying suspicious patterns, and ensuring adherence to legal obligations. Failure to comply can result in substantial fines and reputational damage, impacting its ability to operate effectively.

The regulatory landscape is continuously evolving to address new market practices and technological advancements. For example, during 2024, regulators continued to scrutinize algorithmic trading and high-frequency trading practices, areas where Flow Traders is a major participant. This means ongoing investment in compliance and technology is a necessity.

- Market Abuse Regulation (MAR): Sets out rules against insider dealing, unlawful disclosure of inside information, and market manipulation in the EU.

- Internal Controls: Flow Traders implements strict internal policies and procedures to detect and prevent illicit trading activities.

- Surveillance Systems: Advanced technology is employed to monitor transactions and identify potential market abuse in real-time.

- Regulatory Scrutiny: Continued focus by authorities on market integrity, particularly concerning electronic trading and market making activities.

Licensing and Authorization Requirements

Flow Traders operates in a highly regulated global financial landscape, necessitating adherence to a complex web of licensing and authorization mandates. For instance, in the European Union, its MiFID II (Markets in Financial Instruments Directive II) compliance is crucial, impacting its trading operations and reporting obligations. Failure to maintain these licenses could restrict market access, as seen with potential stricter licensing for certain digital asset activities that could emerge in 2024-2025.

Navigating these legal frameworks means Flow Traders must continuously adapt to evolving regulatory standards. Changes in capital requirements or conduct rules imposed by bodies like the European Securities and Markets Authority (ESMA) or the Securities and Exchange Commission (SEC) in the US directly influence operational costs and business strategies. For example, any new authorization requirements for market makers in emerging asset classes, such as certain tokenized securities, could present both challenges and opportunities for expansion.

Key considerations for Flow Traders include:

- Jurisdictional Licensing: Maintaining appropriate licenses in all operating regions, from Amsterdam to Singapore and New York.

- Regulatory Compliance: Adhering to evolving rules like MiFID II, Dodd-Frank, and any new frameworks governing digital assets.

- Authorization Impact: Understanding how new licensing requirements for specific financial products or services could affect market entry and growth.

- Cross-Border Operations: Managing the complexities of differing regulatory approvals needed to operate across multiple continents.

Flow Traders must navigate an increasingly stringent legal and regulatory environment, impacting its operational framework and strategic direction throughout 2024 and into 2025. Compliance with directives like MiFID II and Dodd-Frank necessitates substantial investment in technology and personnel, directly influencing operational costs and market competitiveness.

The evolving nature of financial regulations, particularly concerning market transparency and data reporting, requires continuous adaptation and significant financial outlay. For instance, the ongoing implementation of new reporting standards for derivatives in Europe, expected to be fully enforced in late 2024, demands robust IT infrastructure updates.

Adherence to Anti-Money Laundering (AML) and sanctions legislation is paramount, with substantial penalties for non-compliance. In 2023, financial institutions globally incurred billions in AML-related fines, underscoring the critical need for Flow Traders to maintain sophisticated screening systems to safeguard its reputation and financial stability.

| Regulation | Key Impact on Flow Traders | Estimated Compliance Cost (Illustrative) | 2024/2025 Focus |

|---|---|---|---|

| MiFID II | Enhanced transparency, reporting, and market structure rules | €5-10 million annually (estimate based on industry data) | Adapting to updated transparency requirements for derivatives |

| Dodd-Frank Act | Capital requirements, risk management, and derivatives oversight | €3-7 million annually (estimate based on industry data) | Ensuring continued compliance with evolving capital buffers |

| Market Abuse Regulation (MAR) | Strict rules against insider trading and market manipulation | Ongoing investment in surveillance technology | Strengthening real-time transaction monitoring |

| GDPR | Data privacy and protection for personal and market data | Up to 4% of global turnover in potential fines | Ensuring robust data governance and processing protocols |

Environmental factors

The surge in Environmental, Social, and Governance (ESG) investing is a dominant force shaping financial markets. In 2024, global ESG assets were projected to exceed $30 trillion, signaling a clear investor preference for sustainable and ethically managed companies. This trend directly impacts the demand for Exchange Traded Products (ETPs), with a notable increase in trading volumes for ETPs that track green indices or adhere to strict ESG criteria.

Flow Traders is positioned to benefit from this shift, as demand for green financial products, such as those focused on renewable energy or climate solutions, continues to climb. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has driven greater transparency and investor interest in Article 9 (impact-focused) funds, which often align with green objectives. This creates opportunities for Flow Traders to facilitate liquidity in these growing market segments.

Climate change presents indirect but significant risks to market stability, impacting Flow Traders' business. Extreme weather events, becoming more frequent and intense, can disrupt supply chains and damage physical assets, leading to price volatility in commodities and other underlying assets of Exchange Traded Products (ETPs). For instance, a severe drought in 2024 impacting agricultural yields could directly affect commodity ETPs.

Shifts in energy policy, driven by climate concerns, also introduce uncertainty. Governments worldwide are implementing carbon pricing mechanisms and investing in renewable energy, which can dramatically alter the valuations of companies in the fossil fuel sector and consequently impact related ETPs. The European Union's enhanced 2030 climate targets, for example, will undoubtedly reshape energy markets.

These systemic risks, stemming from climate change, can create unpredictable market conditions. Flow Traders, as a leading liquidity provider in ETPs, must account for this volatility when managing risk and providing continuous pricing across diverse asset classes. The increasing frequency of climate-related natural disasters, such as the record-breaking heatwaves and floods experienced globally in 2024, underscores the need for robust risk management frameworks.

Flow Traders, as a technology-driven trading firm, relies heavily on its data centers and high-performance computing infrastructure, which are significant energy consumers. The global push towards sustainability, particularly in 2024 and 2025, is intensifying scrutiny on corporate environmental impacts. This trend is likely to pressure Flow Traders to enhance its energy efficiency and explore greener energy sources for its operations.

Corporate Social Responsibility (CSR) and Reputation

Beyond direct environmental impact, societal expectations for Corporate Social Responsibility (CSR) significantly influence Flow Traders' brand image and ability to attract top talent. In 2024, a strong CSR profile is increasingly becoming a differentiator in the competitive financial services landscape. Commitment to environmental sustainability, fair labor practices, and ethical governance can bolster Flow Traders' reputation among investors, employees, and the broader community.

Demonstrating tangible progress in CSR initiatives can directly enhance Flow Traders' reputation. For instance, companies with robust ESG (Environmental, Social, and Governance) reporting, as highlighted by many financial institutions in 2024, often see improved investor confidence and a more positive public perception. This positive perception is crucial for maintaining stakeholder trust and supporting long-term business objectives.

- Enhanced Brand Image: Strong CSR practices contribute to a more favorable public and investor perception.

- Talent Attraction and Retention: Employees, particularly younger generations, increasingly prioritize working for socially responsible companies.

- Investor Confidence: A solid ESG track record can attract institutional investors focused on sustainable investments.

- Risk Mitigation: Proactive CSR can help avoid reputational damage from environmental or social missteps.

Regulatory Focus on Climate-Related Financial Risk

Financial regulators worldwide are intensifying their scrutiny of climate-related financial risks. This shift means institutions like Flow Traders must be adept at identifying, measuring, and managing these emerging threats. For instance, by the end of 2024, the European Securities and Markets Authority (ESMA) is expected to finalize new guidelines on climate risk management for investment firms, impacting how they assess portfolio exposures.

Flow Traders can anticipate evolving disclosure requirements and increased expectations regarding its operational resilience against climate-related disruptions. Initiatives such as the Task Force on Climate-related Financial Disclosures (TCFD) framework are becoming standard, with many jurisdictions, including the UK and parts of the EU, mandating compliance for larger entities. This means enhanced reporting on how climate change impacts business models and strategies.

- Increased Regulatory Scrutiny: Global financial regulators are prioritizing climate risk, leading to stricter oversight of financial institutions.

- Evolving Disclosure Mandates: Expect more comprehensive reporting requirements on climate-related financial risks, aligning with frameworks like TCFD.

- Focus on Resilience: Regulators are assessing how firms plan for and mitigate the impacts of climate change on their operations and investments.

- Potential for New Capital Requirements: As climate risks are better understood, prudential regulators might introduce specific capital buffers or stress tests related to climate scenarios.

The growing emphasis on Environmental, Social, and Governance (ESG) investing presents a significant opportunity for Flow Traders, with global ESG assets projected to surpass $30 trillion by 2024. This trend fuels demand for sustainable financial products, directly benefiting liquidity providers in this expanding market segment. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) has boosted interest in Article 9 funds, creating avenues for Flow Traders to support trading in these environmentally conscious investment vehicles.

Climate change poses indirect risks through increased market volatility from extreme weather events, impacting commodity ETPs. Policy shifts, such as carbon pricing and renewable energy investments, also create market uncertainty for companies and related ETPs, as seen with the EU's enhanced 2030 climate targets. Flow Traders must navigate these systemic risks and unpredictable market conditions, especially with climate-related natural disasters becoming more frequent, as evidenced by record-breaking global heatwaves and floods in 2024.

Flow Traders' operations, reliant on energy-intensive data centers, face increased scrutiny regarding environmental impact. The global drive for sustainability is pressuring firms to improve energy efficiency and adopt greener energy sources, a trend intensifying in 2024-2025. This focus on corporate environmental responsibility also influences brand image and talent acquisition, with a strong CSR profile becoming a key differentiator in the competitive financial services sector.

| Environmental Factor | Impact on Flow Traders | Data/Trend (2024-2025) |

| ESG Investing Growth | Increased demand for sustainable ETPs, revenue opportunities | Global ESG assets projected to exceed $30 trillion in 2024 |

| Climate Change Risks | Market volatility, price fluctuations in commodity ETPs | Increased frequency of extreme weather events (e.g., floods, heatwaves in 2024) |

| Energy Policy Shifts | Uncertainty in valuations of companies in fossil fuel sectors, impact on ETPs | EU's enhanced 2030 climate targets driving energy market transformation |

| Operational Sustainability | Pressure to improve energy efficiency and adopt green energy sources for data centers | Heightened global scrutiny on corporate environmental footprints |

| Regulatory Focus on Climate Risk | Increased compliance and reporting requirements (e.g., TCFD) | ESMA to finalize climate risk management guidelines for investment firms by end of 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Flow Traders draws from a comprehensive blend of financial market data, regulatory filings, and economic forecasts from leading global institutions. We incorporate insights from industry-specific research and news outlets to ensure a holistic view of the evolving landscape.