Flow Traders Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

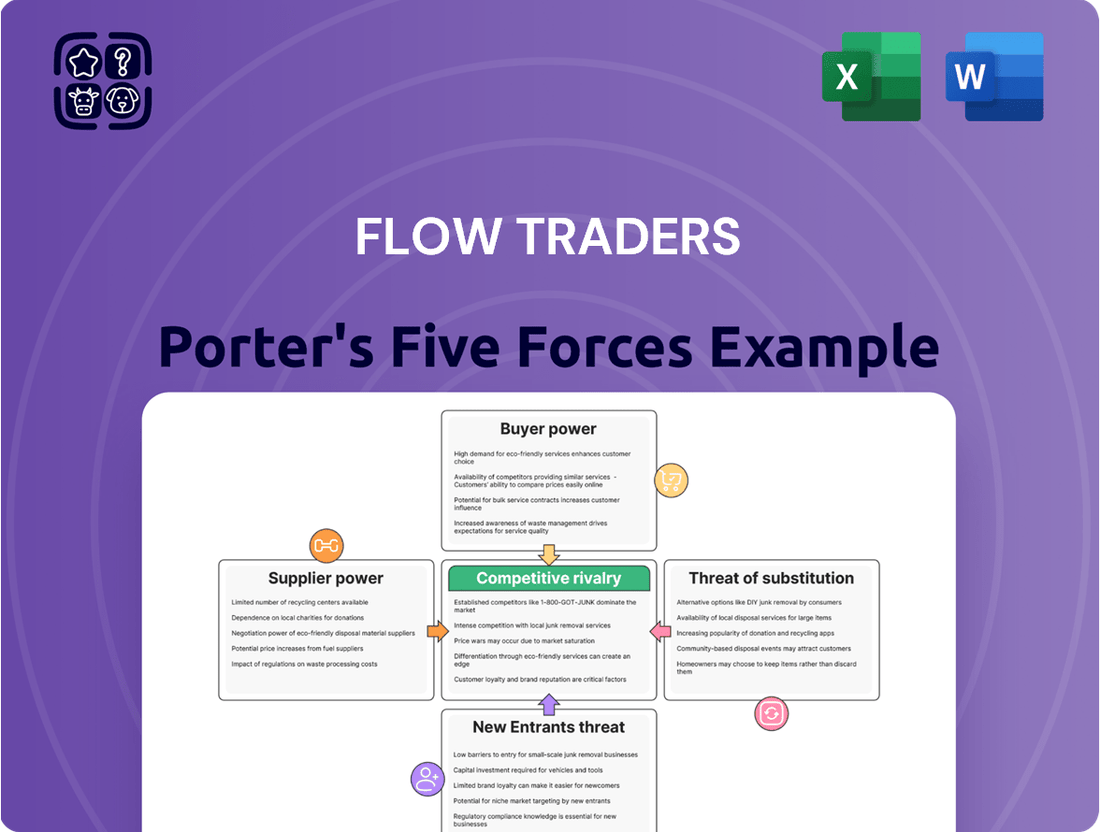

Flow Traders operates in a dynamic environment shaped by intense competition and evolving market structures. Understanding the forces at play is crucial for navigating this landscape. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants, and the ever-present risk of substitute products or services. We also examine the intensity of rivalry among existing competitors, revealing the true competitive pressures Flow Traders faces.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flow Traders’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Proprietary technology providers wield considerable influence over Flow Traders. Flow Traders' core business hinges on sophisticated, in-house developed trading systems and algorithms. Suppliers offering specialized software, ultra-fast network components, and real-time, low-latency market data are crucial. These providers often operate in niche markets, making their solutions difficult to replicate.

The bargaining power of these technology suppliers is amplified by the substantial switching costs associated with their specialized offerings. For Flow Traders, migrating to alternative high-performance trading platforms or data providers can be an immensely complex and expensive undertaking, often requiring significant re-engineering of existing infrastructure. For instance, integrating new low-latency data feeds can involve extensive testing and validation to ensure seamless operation within Flow Traders' demanding trading environment.

Flow Traders’ reliance on real-time, accurate market data is absolute; without it, competitive pricing is impossible. This dependence grants significant power to market data providers. For instance, in 2024, major data terminals like Bloomberg and Refinitiv continued to dominate the market, with their pricing structures often reflecting this consolidated power.

The essential nature of comprehensive and timely data feeds leaves Flow Traders with few viable alternatives. This lack of substitutability means these suppliers can dictate terms and influence the cost of crucial operational inputs, directly impacting Flow Traders' profitability and competitive edge in the trading landscape.

Flow Traders, as a leading provider of exchange-traded products (ETPs), relies heavily on direct access to a wide array of global exchanges and trading venues. This dependence gives these exchanges significant leverage. For instance, in 2024, the cost of exchange data feeds and co-location services continued to be a substantial operational expense for high-frequency trading firms like Flow Traders, with some major exchanges charging fees in the millions of dollars annually.

Many of these essential trading venues operate as monopolies or duopolies within their specific markets. This market structure allows them to dictate terms related to access fees, data provision, and co-location services, thereby exerting strong bargaining power. The ability of Flow Traders to efficiently execute trades and provide liquidity across diverse asset classes is directly tied to the cost and reliability of this access.

The bargaining power of these connectivity providers is further amplified by the critical nature of their services. Without seamless and cost-effective access, Flow Traders would struggle to maintain its competitive edge and fulfill its role in the market. For example, a single outage or a significant price hike from a key exchange could disrupt operations and impact profitability, demonstrating the suppliers' considerable influence.

Highly Specialized Talent

Flow Traders' reliance on highly specialized talent, including quantitative traders, software engineers, and risk managers, creates significant supplier power for these individuals. Their expertise is crucial for developing and operating the firm's sophisticated trading technology, making them a critical resource. This high demand translates into considerable leverage for these professionals when negotiating terms.

The competitive landscape for these sought-after skills means that compensation and benefits packages are often a key differentiator. Flow Traders, like many in the fintech sector, must offer attractive terms to attract and retain top talent. This is evident in their Q1 2025 results, which noted increased employee expenses as a contributing factor to higher fixed operating costs.

- Talent Dependency Flow Traders' core operations are built upon the unique skills of quants, engineers, and risk specialists.

- Market Demand These professionals are in high demand across the financial industry, increasing their bargaining leverage.

- Cost Implications Increased employee expenses, as seen in Q1 2025, directly reflect the cost of securing and retaining this specialized talent.

Financial Capital Providers

Financial capital providers, such as banks and investment funds, hold significant bargaining power, especially when Flow Traders requires external funding. This power is amplified during market volatility, where lenders can dictate higher interest rates or stricter terms. For instance, while Flow Traders has substantial internal capital, a sudden need for significant external liquidity could expose it to these pressures.

Flow Traders' strategic focus on retaining profits for its Trading Capital Expansion Plan, as highlighted in their 2023 annual report where they retained €140 million of net profit, directly addresses this by reducing reliance on external financiers. This proactive approach helps to insulate the company from potentially unfavorable lending conditions imposed by capital providers.

- Cost of Capital: Banks and other lenders can adjust interest rates based on market conditions and Flow Traders' perceived risk.

- Lending Terms: Providers can impose covenants or collateral requirements that restrict Flow Traders' operations.

- Availability of Funds: During economic downturns, access to capital can become limited, increasing the bargaining power of available lenders.

- Strategic Mitigation: Flow Traders' internal capital generation and retention strategy aims to lessen dependence on these external providers.

Flow Traders faces significant supplier power from technology providers, particularly those supplying critical low-latency market data and trading infrastructure. The specialized nature of these offerings and high switching costs mean suppliers can exert considerable influence over pricing and terms. For example, in 2024, major data providers like Bloomberg continued to hold a strong market position, impacting operational costs for firms like Flow Traders.

Exchanges also wield substantial bargaining power due to their monopolistic or duopolistic positions in specific markets. Access fees, data provision, and co-location services represent significant costs for Flow Traders, directly affecting its ability to compete. In 2024, these fees remained a substantial operational expense for high-frequency trading firms, with some exchanges charging millions annually.

The specialized talent Flow Traders relies on, such as quantitative traders and software engineers, also possesses considerable bargaining power. High demand for these skills in the financial sector increases their leverage. This was reflected in Q1 2025, where increased employee expenses were noted as a factor in rising operating costs.

Financial capital providers, like banks, can influence Flow Traders through interest rates and lending terms, especially during volatile market periods. Flow Traders' strategy of retaining profits, such as the €140 million in 2023, aims to reduce this dependency and mitigate the suppliers' power.

| Supplier Type | Key Dependencies for Flow Traders | Supplier Bargaining Power Factors | 2024/2025 Data/Observations |

|---|---|---|---|

| Technology Providers (Data, Software) | Low-latency market data feeds, trading algorithms, network components | Niche markets, high switching costs, essential for operations | Continued dominance of major data providers; pricing reflects market consolidation. |

| Global Exchanges | Direct access to trading venues, co-location services, data | Monopolistic/duopolistic market structures, essential for trade execution | Exchange fees and data costs remained significant operational expenses in 2024. |

| Specialized Talent (Quants, Engineers) | Developing and operating trading technology, risk management | High demand across industry, specialized skills | Increased employee expenses noted in Q1 2025 reflect costs of talent acquisition/retention. |

| Financial Capital Providers | External funding, liquidity | Market volatility, lending terms, availability of funds | Flow Traders' profit retention (€140 million in 2023) reduces reliance on external capital. |

What is included in the product

Flow Traders' Porter's Five Forces analysis dissects the competitive intensity within the electronic trading and liquidity provision market, assessing threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes and rival firms.

Visualize competitive intensity across all five forces with a single, intuitive dashboard, eliminating the need to comb through disparate data sources.

Customers Bargaining Power

Flow Traders caters to a wide array of institutional clients, including banks, asset managers, pension funds, and insurance companies, operating across both exchange-listed and over-the-counter markets. This extensive and diverse client portfolio inherently dilutes the bargaining power of any individual customer or even a small cluster of them. For instance, Flow Traders processed an average daily trading volume of €22.3 billion in the first half of 2024, highlighting the sheer scale of its operations and the distributed nature of its clientele.

The substantial volume of transactions handled by Flow Traders further diminishes the leverage any single client can exert. No one client represents a significant enough portion of the company's overall business to dictate terms or significantly influence pricing. This fragmentation ensures that Flow Traders is not overly reliant on any particular customer segment, reinforcing its pricing power.

Customers trading Exchange Traded Products (ETPs) prioritize efficient execution, consistent liquidity, and tight bid-ask spreads. These fundamental trading needs grant them leverage, as they can switch to alternative liquidity providers if Flow Traders' services become less attractive.

The market making environment is inherently competitive, meaning clients can readily find other firms offering similar trading conditions. This accessibility empowers customers, as they can exert pressure on providers like Flow Traders to maintain competitive pricing and service levels to retain their business.

In 2024, the average bid-ask spread for highly liquid ETPs remained exceptionally narrow, often in the single-digit basis points range. This reflects the intense competition among market makers to attract order flow, directly benefiting end-customers seeking cost-effective trading.

Institutional clients face minimal costs when shifting between liquidity providers or trading venues in search of superior pricing or enhanced liquidity. This low barrier to switching directly amplifies their bargaining power.

Should clients find Flow Traders' service or pricing unsatisfactory, they possess the flexibility to swiftly redirect their order flow to competing firms, thereby pressuring Flow Traders to maintain competitive offerings.

For instance, in 2024, the continued proliferation of electronic trading platforms and the increasing standardization of connectivity protocols mean that for many institutional investors, the technical hurdles to changing execution venues remain negligible.

Commoditized Nature of Basic Liquidity

The fundamental nature of providing liquidity, especially in widely traded Exchange Traded Products (ETPs), can lean towards being commoditized. While Flow Traders employs advanced technology and deep market understanding, the basic service of matching buyers and sellers in highly liquid markets can be seen as a standardized offering.

This commoditization directly impacts customer bargaining power. When the core service is perceived as similar across providers, clients, particularly institutional ones, become highly attuned to pricing. They are sensitive to the bid-ask spreads offered, and if Flow Traders' spreads widen, customers have readily available alternatives.

- Price Sensitivity: Institutional investors closely monitor trading costs, making spread differentials a key decision factor.

- Availability of Alternatives: The presence of multiple market makers in liquid ETPs means customers can easily switch providers if better pricing is available.

- Market Share Data: In 2023, the global ETF market surpassed $9 trillion in assets under management, indicating a vast pool of potential clients and a competitive landscape.

Regulatory Focus on Best Execution

Regulatory mandates across major financial markets, such as MiFID II in Europe and SEC rules in the United States, compel financial institutions to prioritize best execution for their clients. This means brokers and asset managers must actively seek the most advantageous trading conditions, including competitive pricing and efficient order fulfillment, when executing trades on behalf of their customers. This legal obligation significantly enhances the bargaining power of customers, as they can hold their service providers accountable for securing optimal trade outcomes.

This regulatory environment directly benefits Flow Traders' clients, who are empowered to demand superior pricing and execution quality. For instance, under MiFID II, firms are required to take all sufficient steps to obtain, when executing orders, the best possible result for their clients in terms of the total consideration, which includes price and all costs. This creates a competitive landscape where market makers like Flow Traders must continuously offer attractive terms to retain business.

- Regulatory Mandates: Rules like MiFID II and SEC regulations require best execution, empowering clients to seek better pricing and efficiency.

- Client Leverage: Customers can hold market makers accountable for achieving the most favorable trade terms, increasing their bargaining power.

- Competitive Landscape: This regulatory pressure forces market makers to offer competitive pricing and superior execution to win and retain business.

The bargaining power of Flow Traders' customers is significant due to the highly competitive nature of market making and the commoditized aspects of trading Exchange Traded Products. Institutional clients, prioritizing tight spreads and efficient execution, can easily switch providers if Flow Traders' offerings become less attractive. This is underscored by the fact that in 2024, average bid-ask spreads for liquid ETPs remained exceptionally narrow, often in the single-digit basis points, reflecting intense competition that directly benefits clients.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024/2023) |

|---|---|---|

| Client Concentration | Low (diverse client base dilutes individual power) | Flow Traders processed €22.3 billion daily in H1 2024. |

| Switching Costs | Low (minimal costs to change providers) | Standardized connectivity protocols in 2024 facilitate easy venue changes. |

| Price Sensitivity | High (clients focus on bid-ask spreads) | Narrow bid-ask spreads (single-digit bps) for liquid ETPs in 2024. |

| Availability of Alternatives | High (numerous market makers exist) | Global ETF market AUM exceeded $9 trillion in 2023. |

| Regulatory Environment | High (best execution mandates empower clients) | MiFID II/SEC rules require optimal trade outcomes, increasing client leverage. |

Same Document Delivered

Flow Traders Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of Flow Traders. You'll gain an in-depth understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the electronic trading industry. The detailed insights provided will equip you to make informed strategic decisions regarding Flow Traders' market position and future growth. This is not a sample, but the complete, ready-to-use analysis.

Rivalry Among Competitors

The market-making landscape, particularly for Exchange Traded Products (ETPs), is a battleground dominated by advanced high-frequency trading (HFT) firms and the quantitative trading arms of major financial institutions. These players, including Flow Traders, are locked in a relentless technological race, constantly seeking to outdo each other in speed, operational efficiency, and algorithmic sophistication.

This intense competition, driven by the pursuit of micro-second advantages, places significant pressure on profit margins. For instance, while specific profit margin data for HFT operations is often proprietary, the overall trading revenue for firms like Flow Traders in 2024 reflects the volume of trades executed in this environment. Flow Traders reported a net trading income of €317.9 million in the first half of 2024, underscoring the scale of activity in this competitive arena.

The market making landscape is intensely competitive, heavily influenced by the significant capital and advanced technology required. Success hinges on substantial investments in cutting-edge trading platforms, low-latency infrastructure, and deep pools of trading capital.

Firms like Flow Traders must constantly upgrade these technological capabilities and maintain significant capital reserves to stay ahead. This is clearly demonstrated by Flow Traders reporting a notable increase in technology expenditures during the first quarter of 2025, underscoring the ongoing need for investment to preserve a competitive advantage.

Competitive rivalry in the market is intensely focused on price, with participants constantly striving to offer the tightest bid-ask spreads. This aggressive pricing strategy directly impacts profitability, as narrower spreads mean lower margins for every transaction. For instance, in Q1 2024, Flow Traders reported a substantial increase in trading volumes, yet the average spread on many instruments remained compressed due to this competitive pressure.

This relentless pursuit of narrower spreads is a key driver of profit margin compression. As firms undercut each other on pricing to capture more client orders, the overall profitability for all market makers can diminish, especially when market volatility is low, reducing the natural spread widening that can occur during uncertain times. This dynamic makes it difficult to maintain robust profitability levels consistently.

Global and Multi-Asset Class Competition

Flow Traders faces intense competition due to its operations spanning Europe, the Americas, and Asia, and across a wide array of asset classes including ETPs, digital assets, fixed income, FX, and commodities. This broad geographical and asset class reach means specialized firms are actively competing in each niche, directly challenging Flow Traders' market share and profitability.

The competitive landscape is characterized by both global players and highly specialized entities. For instance, in the ETP market, firms like Virtu Financial and XTX Markets are significant competitors, while in digital assets, dedicated crypto market makers pose a distinct challenge. This multi-faceted competition necessitates continuous innovation and efficiency to maintain a leading position.

- Global Reach, Local Challenges Flow Traders' presence in major financial hubs means it contends with established local market makers in each region.

- Asset Class Specialization Competitors often focus on specific asset classes, developing deep expertise and tailored technology that can outmaneuver broader players.

- Technological Arms Race The need for sophisticated trading algorithms and low-latency infrastructure fuels a constant investment battle against technologically advanced rivals.

- Regulatory Arbitrage and Adaptation Different regulatory environments across geographies create both opportunities and competitive pressures, requiring agile adaptation.

Market Volatility Impact

Competitive rivalry in market making, particularly for firms like Flow Traders, is intensely shaped by market volatility. Profitability is directly tied to the fluctuations in asset prices. When markets are volatile, trading opportunities increase, potentially boosting revenues. However, periods of low volatility can significantly shrink these opportunities, intensifying competition as firms vie for fewer profitable trades. This dynamic directly impacts net trading income.

The sensitivity of market maker profitability to volatility means that periods of calm can be challenging. For instance, in 2023, while certain market events drove spikes in volatility, there were also sustained periods where trading volumes and spreads compressed, presenting headwinds for firms reliant on active trading. This compression forces a sharper focus on cost management and operational efficiency to maintain profitability amidst reduced revenue potential.

- Volatility drives trading opportunities: Higher volatility generally leads to wider bid-ask spreads and increased trading volumes, creating more potential profit for market makers.

- Low volatility compresses margins: Conversely, low volatility environments reduce trading frequency and narrow spreads, intensifying competition and squeezing profitability.

- Impact on Net Trading Income: Flow Traders' financial results often reflect this sensitivity, with net trading income fluctuating based on prevailing market conditions. For example, while 2024 has seen varying levels of volatility, the underlying competitive pressure remains as firms seek to capture market share in all environments.

Competitive rivalry in the market-making space, particularly for firms like Flow Traders, is characterized by an intense focus on technological advancement and operational efficiency. This means firms are constantly investing in sophisticated algorithms and low-latency trading infrastructure to gain a competitive edge.

The pursuit of narrower bid-ask spreads is a primary driver of this rivalry, directly impacting profit margins. Even with increased trading volumes, compressed spreads can limit profitability, as seen with Flow Traders' Q1 2024 results where higher volumes coincided with spread compression.

Flow Traders operates across multiple geographies and asset classes, facing both global competitors and specialized niche players. This broad exposure intensifies rivalry, as distinct competitors vie for market share in each segment, demanding continuous innovation.

Market volatility directly influences competitive dynamics; higher volatility can create more opportunities, while low volatility intensifies competition for fewer profitable trades, impacting net trading income.

| Competitor Type | Key Differentiator | Impact on Flow Traders |

| Global HFT Firms | Technological speed, algorithmic sophistication | Constant pressure on spreads and market share |

| Specialized Asset Class Players | Deep niche expertise, tailored technology | Challenges in specific trading segments |

| Quantitative Trading Arms of Banks | Large capital pools, integrated services | Significant competitive capacity and reach |

SSubstitutes Threaten

Direct investor trading and the rise of peer-to-peer platforms represent a significant threat of substitutes for traditional market makers. In decentralized finance (DeFi), for instance, platforms allow users to trade assets directly without intermediaries, potentially bypassing the need for market makers. While these platforms may currently be less efficient for high volumes or complex Exchange Traded Products (ETPs), their increasing sophistication could erode the demand for traditional liquidity provision in the future.

In less liquid or niche markets, traditional broker-dealers can step in as principals, offering a form of liquidity. While they might not match the efficiency of dedicated market makers, their involvement can serve as a substitute for investors. This is particularly relevant in areas where Flow Traders, specializing in ETPs, might not be the primary liquidity provider.

The increasing prevalence of passive investment strategies and buy-and-hold approaches presents a significant threat. As more investors opt for direct ownership of underlying assets or index-tracking funds, the demand for actively traded Exchange Traded Products (ETPs) could diminish. This shift directly impacts liquidity providers like Flow Traders, as fewer ETP transactions mean less business.

Furthermore, even within passive strategies, a move away from the frequent rebalancing of ETPs could curb trading volumes. For instance, if investors are simply buying and holding a broad market ETF without actively trading in and out, the opportunities for market makers to profit from bid-ask spreads are reduced. This trend, if widespread, could lead to lower overall market maker revenues.

Internalization of Order Flow by Large Institutions

Major institutional investors, such as large asset managers or brokerages, are increasingly opting to internalize their order flow. This means they match their own buy and sell orders within their firms instead of routing them to external liquidity providers like Flow Traders. This trend directly substitutes the need for external market makers, diminishing the pool of accessible order flow for firms specializing in providing liquidity.

For instance, in 2024, several significant financial institutions have publicly announced or expanded their internal crossing networks. This strategic shift allows them to capture tighter spreads and maintain greater control over their trading execution. When these large players internalize, it directly reduces the volume of trades available in the open market, impacting the revenue potential for independent liquidity providers.

- Reduced Order Flow: The internalization of order flow by large institutions directly decreases the volume of trades available for market makers to execute.

- Internal Crossing Networks: Major players are building or enhancing internal systems to match buy and sell orders, bypassing external liquidity providers.

- Impact on Liquidity Providers: This trend poses a significant threat by substituting the core service offered by firms like Flow Traders.

Technological Advancements in Exchange Models

Technological advancements pose a significant threat to traditional market-making models. Future innovations in exchange technology, such as fully transparent, continuous auction models, could reduce or eliminate the need for external market makers. These systems might offer liquidity through advanced order book matching, directly connecting buyers and sellers without intermediary firms.

The potential for algorithmic trading to evolve into self-sufficient liquidity providers, or for decentralized exchange (DEX) protocols to mature, represents a direct substitute for the services Flow Traders currently offers. For example, the growth in decentralized finance (DeFi) has seen automated market makers (AMMs) become increasingly sophisticated, facilitating trades without traditional intermediaries. While Flow Traders managed €33.4 billion in average daily volumes in Q1 2024, the rise of such alternative liquidity provision mechanisms could fragment market share.

- Emerging Exchange Technologies: Continuous auction models and advanced matching engines could bypass traditional market makers.

- DeFi and AMMs: Decentralized finance protocols offer alternative liquidity, potentially reducing reliance on firms like Flow Traders.

- Algorithmic Trading Evolution: Sophisticated algorithms could become self-sufficient liquidity providers.

- Market Fragmentation: The proliferation of new liquidity sources threatens to dilute the market share of established players.

The rise of direct trading platforms and decentralized finance (DeFi) presents a significant substitute. These platforms allow peer-to-peer trading, bypassing intermediaries like Flow Traders. While still developing, their increasing efficiency could challenge traditional market-making roles.

Institutional investors internalizing their order flow is another key substitute. By matching trades internally, they reduce reliance on external liquidity providers. For instance, in 2024, many large financial institutions expanded their internal crossing networks to capture tighter spreads.

| Substitute Type | Description | Impact on Flow Traders | 2024 Trend Example |

|---|---|---|---|

| Direct Trading Platforms/DeFi | Peer-to-peer asset exchange without intermediaries. | Reduced demand for external liquidity provision. | Growth in DeFi protocols offering AMMs. |

| Internalized Order Flow | Institutions matching trades within their own firm. | Decreased order flow available to external market makers. | Expansion of internal crossing networks by major financial players. |

Entrants Threaten

The market-making industry, particularly in Exchange Traded Products (ETPs) and high-frequency trading, presents a formidable barrier to entry due to exceptionally high capital requirements. New participants need significant funds to maintain adequate inventory, absorb potential market volatility, and comply with stringent regulatory capital adequacy rules. For instance, firms involved in high-frequency trading often operate with millions, if not billions, of dollars in capital to support their sophisticated technological infrastructure and rapid trading strategies.

Developing and maintaining the ultra-low-latency, high-throughput proprietary technology and infrastructure essential for competitive market making represents an enormous financial and technical hurdle for potential new entrants. Flow Traders, for instance, relies on a sophisticated technological backbone that requires continuous investment to stay ahead.

The sheer cost of building out such capabilities, including specialized hardware, extensive data center footprints, and high-speed network connectivity, can easily run into the tens or even hundreds of millions of dollars. This significant capital expenditure acts as a powerful deterrent, making it exceedingly difficult for newcomers to even begin competing on a level playing field.

In 2024, the ongoing arms race in technological advancement means that these infrastructure costs are not static; they escalate as existing players upgrade their systems to maintain their edge. A new entrant would not only need to match current standards but also anticipate future technological requirements, further amplifying the entry barrier.

The financial trading industry, particularly for firms like Flow Traders, faces a significant threat from the scarcity of specialized talent. This scarcity acts as a substantial barrier to entry for new competitors. The industry demands professionals with very specific skill sets, such as quantitative researchers who can develop complex trading algorithms, high-performance computing engineers to build and maintain robust trading infrastructure, and seasoned traders with deep market understanding.

Attracting and retaining these highly sought-after individuals is both difficult and costly. New entrants often lack the established employer brand and competitive compensation packages that established firms can offer, making it harder to build the necessary expertise from the ground up. For instance, compensation for top-tier quantitative traders in 2024 can easily exceed $500,000 annually, including base salary and bonuses, a significant hurdle for startups.

Regulatory Landscape and Compliance Costs

The financial markets, including those where Flow Traders operates, are characterized by a dense and evolving regulatory landscape. New participants must navigate complex licensing procedures, rigorous risk management protocols, and ongoing compliance obligations, all of which demand substantial investment in expertise and infrastructure.

These regulatory hurdles present a significant barrier to entry. For instance, in 2024, the European Securities and Markets Authority (ESMA) continued to emphasize robust MiFID II (Markets in Financial Instruments Directive II) compliance, which includes detailed reporting and conduct of business rules. Failing to meet these standards can result in hefty fines and operational restrictions.

Compliance costs can be a major deterrent for potential new entrants. These costs encompass legal fees, technology upgrades to meet data reporting requirements, and dedicated compliance staff. For example, a 2023 survey indicated that financial firms' spending on regulatory compliance saw an average increase of 10-15% year-over-year, a trend expected to persist into 2024.

- Stringent Licensing: Obtaining necessary authorizations from financial regulators like the SEC (in the US) or national competent authorities in Europe is a time-consuming and capital-intensive process.

- Risk Management Frameworks: New entrants must establish sophisticated systems for managing market, credit, and operational risks, often requiring significant upfront technology investment.

- Ongoing Compliance Burden: Adhering to regulations like Basel III/IV (for banks) or specific ETF rulebooks necessitates continuous monitoring and adaptation, adding to operational overhead.

- Data Reporting Requirements: Regulations like MiFID II and EMIR (European Market Infrastructure Regulation) mandate granular transaction reporting, requiring robust IT infrastructure and data management capabilities.

Established Relationships and Network Effects

Flow Traders, as an incumbent market maker, benefits significantly from deeply entrenched relationships with major stock exchanges, a diverse network of brokers, and a substantial base of institutional clients. These established connections are not easily replicated; they represent years of trust-building and operational integration, forming a formidable barrier for any new entity seeking to enter the market.

The network effects inherent in these relationships further solidify Flow Traders' position. For instance, a broader client base attracts more trading volume, which in turn enhances the liquidity and efficiency of Flow Traders' market-making services. This creates a virtuous cycle that new entrants would struggle to disrupt without comparable reach and proven reliability. In 2024, the global ETF market, where Flow Traders is a major player, saw continued growth, with assets under management exceeding $11 trillion, highlighting the scale of established networks in this sector.

- Established Relationships: Flow Traders maintains long-standing partnerships with over 75 exchanges globally, facilitating efficient trading operations.

- Client Network: The firm serves a broad spectrum of clients, including leading asset managers and hedge funds, fostering deep institutional ties.

- Network Effects: Increased trading volume from established clients enhances liquidity, making it harder for new entrants to offer competitive pricing and execution.

- Trust and Reputation: Years of consistent performance and regulatory compliance have built significant trust, a crucial intangible asset for market makers.

The threat of new entrants in the market-making space, particularly for firms like Flow Traders, is significantly dampened by substantial capital requirements, the need for advanced proprietary technology, and the scarcity of specialized talent. These factors create formidable barriers, demanding immense investment and expertise for any newcomer to compete effectively.

The complex regulatory environment and the value of established relationships with exchanges and clients further deter new players. In 2024, the ongoing evolution of financial regulations and the sheer scale of existing networks in sectors like ETFs, with over $11 trillion in assets under management, underscore the difficulty for new entrants to gain traction.

| Barrier | Description | Estimated Cost/Impact (2024) | Example for Flow Traders |

| Capital Requirements | Funds needed for inventory, volatility absorption, and regulatory capital. | Millions to Billions USD | Supporting high-frequency trading infrastructure. |

| Technology Infrastructure | Developing and maintaining ultra-low-latency trading systems. | Tens to Hundreds of Millions USD | Continuous upgrades to proprietary trading platforms. |

| Talent Acquisition | Hiring quantitative researchers, engineers, and traders. | Top talent compensation can exceed $500,000 annually. | Attracting and retaining specialized expertise. |

| Regulatory Compliance | Navigating licensing, risk management, and reporting. | Annual compliance spending increases of 10-15%. | Ensuring adherence to MiFID II and EMIR. |

| Established Relationships | Building trust and integration with exchanges and clients. | Partnerships with over 75 global exchanges. | Serving leading asset managers and hedge funds. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Flow Traders is built upon a robust foundation of data, drawing from Flow Traders' own annual reports and investor presentations, alongside industry-specific research from financial institutions and market intelligence providers.