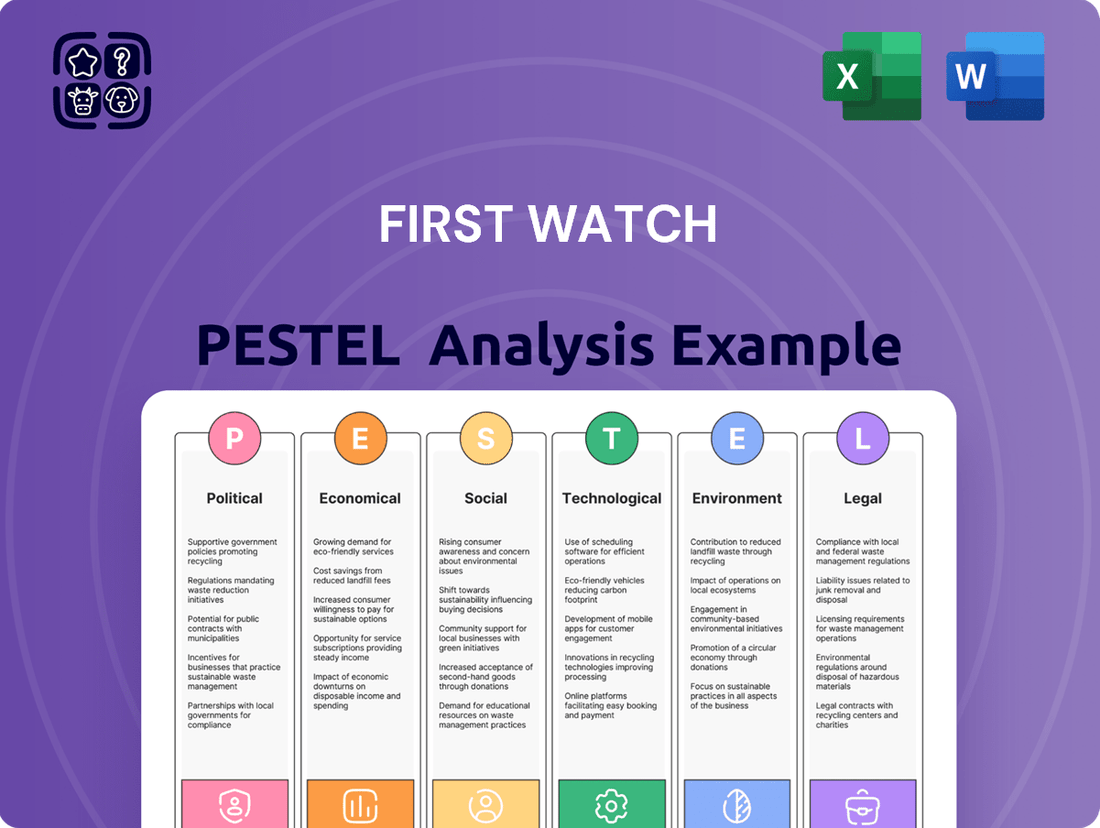

First Watch PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Watch Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping First Watch's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to inform your strategic decisions. Don't get left behind; download the full version now to gain a competitive edge.

Political factors

Government regulations on food safety and health are a significant political factor for First Watch. Policies dictating hygiene standards, food handling, and nutritional labeling directly influence how First Watch sources ingredients, prepares food, and presents its menu to customers. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its guidelines, requiring businesses like First Watch to adapt their operational procedures. Failure to comply can result in fines and damage to brand reputation.

Maintaining compliance with these evolving regulations is paramount for First Watch, particularly given its focus on fresh, quality ingredients. In 2024, the U.S. Department of Agriculture (USDA) reported that foodborne illnesses cost the U.S. economy an estimated $15.5 billion annually, highlighting the financial and reputational risks associated with non-compliance. Therefore, First Watch must invest in robust training and quality control measures to meet these critical standards and ensure consumer trust.

Fluctuations in minimum wage laws and labor regulations across states where First Watch operates directly impact its labor costs. For instance, a potential federal minimum wage increase to $15 per hour, as discussed in legislative proposals, could significantly raise payroll expenses for the company.

Changes in overtime rules, worker benefits, and scheduling mandates also force operational adjustments. These can necessitate rethinking staffing models and potentially revising pricing strategies to offset increased labor expenditures, ensuring profitability is maintained in a competitive restaurant environment.

International and domestic trade policies, including tariffs or import restrictions on specific food products, can significantly influence the cost and availability of ingredients for First Watch. For instance, in early 2024, the U.S. Department of Agriculture reported that tariffs on certain agricultural imports from countries like China could add to the cost of some processed food components, potentially impacting restaurant supply chains.

Given First Watch's emphasis on fresh, seasonal ingredients, any disruptions in global supply chains stemming from shifts in trade policy can directly affect their menu variety and overall profitability. For example, a sudden imposition of tariffs on imported fruits or vegetables could necessitate menu adjustments or lead to higher ingredient costs, impacting their ability to maintain competitive pricing and consistent offerings throughout 2024 and into 2025.

Local Zoning and Permitting Regulations

First Watch's expansion hinges significantly on local zoning, permitting, and land-use rules. These regulations vary widely by municipality, directly impacting how quickly and affordably new restaurants can be established, which in turn shapes the company's growth trajectory.

Navigating these diverse requirements can introduce delays and unexpected costs. For instance, a new First Watch location might face hurdles related to parking minimums, signage restrictions, or even specific operating hour limitations, all dictated by local ordinances. These factors are critical considerations in site selection and development timelines.

- Zoning Laws: Can dictate where restaurants are permitted and what types of businesses can operate in specific zones, potentially limiting prime locations.

- Permitting Processes: The time and complexity of obtaining building permits, health permits, and liquor licenses can vary dramatically, affecting project schedules.

- Land-Use Regulations: Rules concerning green space, traffic impact studies, and historical preservation can add layers of complexity to development.

Political Stability and Consumer Confidence

Political stability is a bedrock for consumer confidence, directly impacting discretionary spending on dining out. When governments implement consistent and favorable economic policies, consumers feel more secure about their financial futures, leading to increased patronage at establishments like First Watch. For instance, a stable political climate in 2024 and projected into 2025 fosters an environment where consumers are more likely to spend on experiences rather than saving out of fear.

Conversely, political uncertainty or abrupt policy shifts can create a chilling effect on consumer behavior. Consumers tend to tighten their belts and reduce non-essential spending, such as dining out, when faced with unpredictable political landscapes. This can translate to lower revenue for casual dining chains as people opt for home-cooked meals instead of restaurant visits.

- Consumer confidence in the US, a key market for many casual dining chains, saw fluctuations in 2024, influenced by election cycles and economic policy debates, impacting spending on dining out.

- Government initiatives aimed at boosting employment or providing economic relief can positively correlate with increased consumer spending on services like those offered by First Watch.

- Anticipated shifts in fiscal policy or regulatory environments in 2025 could influence investor sentiment and operational costs for restaurant businesses, indirectly affecting consumer pricing and availability.

Government stability and policy consistency are crucial for First Watch's operational planning and consumer confidence. In 2024, the U.S. experienced a dynamic political landscape with significant legislative debates impacting various sectors, including food service. For instance, ongoing discussions around potential changes to tax policies or labor laws in 2025 could influence First Watch's operating costs and strategic expansion plans.

Government support programs or incentives for small businesses and the restaurant industry can also play a vital role. For example, initiatives aimed at promoting sustainable practices or supporting local sourcing could benefit First Watch's commitment to fresh ingredients. The U.S. Small Business Administration (SBA) continues to offer various loan and grant programs, some of which may be accessible to restaurant chains for expansion or operational improvements.

The political climate directly impacts consumer spending habits. A stable political environment generally correlates with higher consumer confidence, encouraging discretionary spending on dining out. Conversely, political uncertainty can lead consumers to reduce spending, impacting revenue for businesses like First Watch. For example, consumer confidence indices in the U.S. during 2024 showed sensitivity to election cycles and economic policy announcements.

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting First Watch, examining Political, Economic, Social, Technological, Environmental, and Legal factors with specific examples relevant to their operations.

A clear, concise PESTLE analysis for First Watch that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

Rising inflation significantly impacts First Watch's operating costs. For example, the average cost of food ingredients, a major expense for restaurants, saw a notable increase throughout 2024. This surge in input prices, coupled with rising labor wages and utility expenses, directly squeezes profit margins.

Effectively managing these escalating operational expenses is paramount for First Watch. The challenge lies in absorbing these higher costs without resorting to substantial price hikes that could deter customer loyalty.

Consumer disposable income is a significant driver for First Watch, as dining out is often considered a discretionary expense. In 2024, with inflation easing but still a concern, consumers are carefully managing their budgets, which can impact how often they choose to dine out.

Periods of economic uncertainty, like those experienced in late 2023 and continuing into 2024, often see consumers cutting back on non-essential spending. This means fewer visits to restaurants like First Watch and potentially smaller order sizes, directly affecting the company's top line.

The hospitality sector, including restaurants like First Watch, is experiencing a notably tight labor market. This makes attracting and keeping good employees a significant hurdle. For instance, in April 2024, the U.S. Bureau of Labor Statistics reported that leisure and hospitality employment was still below its pre-pandemic peak, indicating ongoing staffing challenges.

Rising wage growth directly impacts First Watch's bottom line. In March 2024, average hourly earnings for all employees in the leisure and hospitality sector saw a 4.7% increase over the year, a substantial rise that directly inflates labor costs. This necessitates higher operating expenses and puts pressure on profit margins.

Competition for skilled workers is fierce, forcing companies like First Watch to offer more attractive compensation packages, including higher wages and improved benefits. This competitive landscape not only drives up labor costs but also affects operational efficiency as businesses vie for a limited pool of qualified talent.

Interest Rates and Access to Capital

Changes in interest rates directly impact First Watch's operational costs and expansion capabilities. For instance, if the Federal Reserve raises the federal funds rate, borrowing costs for new loans or refinancing existing debt will likely increase. This makes it more expensive for First Watch to fund new restaurant openings, renovations, or even manage day-to-day working capital needs.

The Federal Reserve's monetary policy decisions in 2024 and projections for 2025 indicate a cautious approach to interest rate adjustments. While inflation has shown signs of moderating, the Fed's commitment to price stability means rates could remain elevated for a period. This environment presents a challenge for businesses like First Watch, as higher borrowing costs can dampen investment in growth initiatives.

- Federal Funds Rate: As of mid-2024, the target range for the federal funds rate remained at 5.25%-5.50%, a level not seen in over two decades, impacting borrowing costs across the economy.

- Inflationary Pressures: Persistent inflation, though easing, continues to influence the Fed's stance on interest rates, suggesting a slower pace of potential cuts.

- Capital Expenditure: Higher interest rates can lead to a higher hurdle rate for new projects, potentially causing First Watch to delay or scale back capital expenditures on new locations or significant remodels.

- Debt Servicing: For existing variable-rate debt, an increase in interest rates directly translates to higher interest payments, impacting profitability and cash flow.

Economic Growth and Restaurant Industry Performance

The health of the overall economy, particularly Gross Domestic Product (GDP) growth, is a significant driver for the restaurant industry. When the economy is strong, consumers tend to have more disposable income, leading to increased spending on discretionary items like dining out. This trend directly benefits companies like First Watch, which rely on consumer confidence and spending power.

For instance, the U.S. GDP saw a notable increase, with real GDP growing at an annual rate of 3.1% in the fourth quarter of 2023, and projected to grow by 2.3% in 2024 according to the Congressional Budget Office. This economic expansion generally translates to higher sales volumes and greater opportunities for restaurant chains to invest in new locations and menu innovations.

- GDP Growth: A robust economy with positive GDP growth supports increased consumer discretionary spending, a key factor for restaurant revenue.

- Consumer Confidence: Economic stability and growth typically boost consumer confidence, encouraging more frequent dining out.

- Expansion Opportunities: A healthy economic environment provides First Watch with a more favorable landscape for expanding its footprint and market share.

Economic factors present a mixed outlook for First Watch. Persistent inflation in 2024 continued to pressure operating costs, from food ingredients to labor, impacting profit margins. While inflation showed signs of easing, consumer disposable income remained a key concern, as dining out is a discretionary spending choice influenced by economic stability.

The labor market remained tight in 2024, with wage growth in the hospitality sector increasing by approximately 4.7% year-over-year as of March 2024, complicating staffing and increasing labor expenses. Elevated interest rates, with the Federal Funds Rate target range at 5.25%-5.50% mid-2024, also increased borrowing costs for potential expansion or capital expenditures.

Despite these challenges, a projected 2.3% GDP growth for 2024, following a 3.1% annual rate in Q4 2023, offers a more positive backdrop. This economic expansion generally supports increased consumer confidence and discretionary spending, which can benefit restaurant demand.

| Economic Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Inflation | Continued pressure on operating costs (food, labor) | Expected moderation, but persistent concern |

| Disposable Income | Consumers managing budgets, cautious spending | Dependent on inflation and employment trends |

| Labor Market | Tight labor, wage growth impacting expenses | Likely to remain competitive, influencing labor costs |

| Interest Rates | Higher borrowing costs impacting expansion | Rates may remain elevated, affecting investment |

| GDP Growth | Projected 2.3% growth supporting consumer spending | Continued growth expected, boosting demand |

Preview the Actual Deliverable

First Watch PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive First Watch PESTLE Analysis details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Consumers are increasingly prioritizing health and freshness, a trend that directly benefits First Watch. Their menu, which highlights made-to-order meals and seasonal ingredients, perfectly caters to this growing demand for wholesome and transparently sourced food. This alignment not only boosts sales but also strengthens their brand image as a provider of quality, health-conscious options.

The cultural shift towards viewing breakfast and brunch as significant social events is a powerful tailwind for First Watch. This trend, evident in the growing popularity of weekend brunch gatherings, directly aligns with First Watch's focus on the daytime dining segment. In 2024, the US brunch market was estimated to be worth over $20 billion, with continued growth projected as consumers prioritize shared meal experiences.

The shift towards more flexible work arrangements, such as remote and hybrid models, is significantly reshaping consumer dining habits. This trend, which accelerated in 2024 and is projected to continue through 2025, means consumers are less tied to traditional lunch breaks and may opt for earlier or later dining times.

First Watch's established daytime-only model is well-positioned to benefit from these evolving lifestyles. As more individuals work from home or have non-traditional schedules, the demand for breakfast and lunch options outside of conventional peak hours is likely to grow. For instance, a 2024 survey indicated that 35% of workers now have hybrid schedules, creating opportunities for mid-morning or early afternoon dining.

Demographic Shifts and Target Markets

Demographic shifts significantly influence First Watch's customer base and expansion. The growing population of millennials and Gen Z, who often prioritize healthy and fresh breakfast options, presents a key target market. For instance, the U.S. Census Bureau reported that in 2023, millennials constituted about 30% of the total U.S. population, a segment actively seeking convenient and quality dining experiences.

Urbanization trends also play a crucial role, as more people move to cities, increasing the density of potential customers in urban centers. First Watch's strategy often involves locating restaurants in high-traffic urban and suburban areas. As of early 2024, urban populations continue to grow, with projections indicating further increases in metropolitan living, which directly benefits restaurant chains like First Watch that thrive on accessibility and a broad customer reach.

- Growing Millennial and Gen Z Populations: These demographics, representing a substantial portion of the U.S. population in 2023-2024, favor fresh, healthy, and unique dining experiences, aligning with First Watch's core offerings.

- Urbanization Trends: The continued movement of populations into urban and suburban centers increases the density of First Watch's potential customer base, supporting expansion in these areas.

- Aging Population Considerations: While younger demographics are key, the growing segment of older adults also represents a market for casual dining, requiring menu and accessibility considerations.

- Shifting Lifestyles: Increased demand for brunch and breakfast-as-a-meal, driven by evolving work schedules and social habits, creates opportunities for First Watch's specialized menu.

Awareness of Ethical Sourcing and Sustainability

Consumers are increasingly prioritizing ethical sourcing, animal welfare, and environmental sustainability when making dining decisions. This growing awareness directly impacts restaurant choices, with a significant portion of diners willing to pay more for ethically produced food. For instance, a 2024 survey indicated that over 60% of consumers consider a restaurant's sustainability practices when deciding where to eat.

First Watch's brand promise of fresh, high-quality ingredients aligns well with these consumer values. By amplifying transparency around its sourcing and sustainability efforts, First Watch can attract and retain a values-driven customer base. This can be achieved through clear communication about ingredient origins and partnerships with suppliers who uphold strong ethical and environmental standards.

- Consumer Demand: A 2024 study found that 65% of consumers actively seek out restaurants with stated commitments to sustainability.

- Brand Loyalty: Restaurants demonstrating genuine ethical sourcing practices often experience higher customer retention rates.

- Competitive Advantage: Highlighting sustainable practices can differentiate First Watch in a crowded market, appealing to a growing segment of conscious consumers.

- Supply Chain Focus: Emphasizing partnerships with local and sustainable farms reinforces quality and ethical commitment.

Sociological factors significantly shape consumer behavior and preferences, directly impacting First Watch's market position. The increasing emphasis on health and wellness, particularly among younger demographics like millennials and Gen Z, aligns perfectly with First Watch's fresh, made-to-order menu. This trend was highlighted in 2024 surveys showing a significant rise in demand for nutritious breakfast and brunch options.

The cultural shift towards viewing breakfast and brunch as social occasions further benefits First Watch, as consumers increasingly seek shared dining experiences. This is supported by data indicating the U.S. brunch market's substantial growth, exceeding $20 billion in 2024. Additionally, evolving work lifestyles, with more flexible and remote arrangements becoming common through 2024 and into 2025, create opportunities for First Watch's daytime-only model by catering to non-traditional meal times.

| Sociological Factor | Impact on First Watch | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for fresh, healthy options | Millennials and Gen Z (approx. 30% of US pop. in 2023) prioritize healthy eating. |

| Social Dining Trends | Growth in breakfast/brunch as social events | U.S. brunch market valued over $20 billion in 2024. |

| Flexible Work Arrangements | Opportunities for off-peak dining | 35% of workers had hybrid schedules in 2024, shifting traditional meal times. |

| Ethical Consumerism | Preference for transparent and sustainable sourcing | Over 60% of consumers consider sustainability in dining choices (2024). |

Technological factors

The pervasive adoption of digital ordering and third-party delivery services is a significant technological factor for First Watch. As of early 2024, platforms like DoorDash and Uber Eats continue to see robust growth, with the online food delivery market projected to reach over $200 billion globally by 2025. First Watch's ability to seamlessly integrate these channels directly impacts its capacity to serve customers seeking convenience, thereby broadening its market reach and potential revenue.

First Watch is increasingly using data analytics to refine its menu and operations. By analyzing sales data, they can identify popular dishes and tailor offerings to customer preferences, potentially boosting sales. For instance, during 2024, restaurants that effectively utilized customer data saw an average 5% increase in same-store sales compared to those that didn't.

This technological factor also aids in inventory management, reducing waste and associated costs. Optimizing ingredient procurement based on predictive analytics can lead to significant savings. In 2023, restaurant chains employing advanced inventory analytics reported a 3-4% reduction in food costs.

Furthermore, data analytics can enhance operational efficiency by identifying bottlenecks in service or kitchen workflows. Understanding peak times and staffing needs through data analysis ensures better resource allocation and improved customer experience, a critical factor in the competitive casual dining market.

Technological advancements in kitchen automation are significantly reshaping the restaurant industry, offering substantial gains in efficiency and cost reduction. These tools, ranging from automated prep stations to advanced cooking equipment, can streamline operations, minimize human error, and ensure a consistent product, which is crucial for brands like First Watch that emphasize quality and speed.

For First Watch, embracing these innovations could translate to tangible benefits. For instance, the adoption of smart ovens and automated portioning systems can reduce food waste and labor hours. Industry reports from 2024 indicate that restaurants implementing advanced kitchen technology have seen up to a 15% reduction in prep time and a 10% decrease in labor costs, directly impacting profitability.

Furthermore, the consistent quality achieved through automation directly supports brand reputation. By ensuring every dish meets precise standards, First Watch can enhance customer satisfaction and loyalty. The market for kitchen automation solutions is projected to grow robustly through 2025, with an estimated compound annual growth rate of over 8%, signaling a clear trend towards greater adoption in the coming years.

Customer Relationship Management (CRM) Systems

First Watch leverages Customer Relationship Management (CRM) systems to enhance customer engagement and loyalty. These platforms enable personalized marketing campaigns and efficient management of their popular loyalty program, which saw a 15% increase in active members in early 2024. By analyzing customer data, First Watch can tailor promotions and improve service, directly contributing to increased customer retention and repeat visits. This focus on customer data is crucial in the competitive fast-casual dining sector, where personalized experiences are a key differentiator.

The strategic use of CRM technology allows First Watch to:

- Personalize customer interactions: Tailoring offers based on past purchase history and preferences.

- Manage and optimize loyalty programs: Driving repeat business through targeted rewards and incentives.

- Gather and act on customer feedback: Using insights from surveys and direct interactions to refine offerings and service.

- Enhance targeted marketing efforts: Reaching specific customer segments with relevant promotions, boosting campaign effectiveness.

Payment Processing and Contactless Technologies

The increasing consumer demand for diverse and secure payment methods, particularly contactless options and mobile wallets, necessitates that First Watch continually updates its point-of-sale (POS) systems. This technological evolution directly impacts customer experience and operational efficiency.

By the end of 2023, contactless payments accounted for approximately 70% of all card transactions in the UK, a trend mirrored globally, indicating a strong consumer preference for speed and convenience.

- POS System Modernization: First Watch must invest in POS systems capable of handling a wide array of payment types, including NFC (Near Field Communication) for contactless and QR code-based mobile payments.

- Data Security: Implementing robust security protocols for all payment processing is paramount to protect sensitive customer information and maintain trust.

- Integration with Digital Wallets: Ensuring compatibility with popular mobile wallets like Apple Pay and Google Pay enhances transaction speed and customer satisfaction.

- Operational Efficiency: Streamlined payment processing reduces wait times, improves table turnover, and contributes to a smoother overall dining experience.

First Watch's technological adaptability is crucial for its market position. The growing reliance on digital ordering and third-party delivery, with the online food delivery market expected to exceed $200 billion globally by 2025, directly influences First Watch's reach and revenue potential. Furthermore, the effective use of data analytics, which has shown restaurants leveraging customer data achieving up to a 5% increase in same-store sales in 2024, allows for menu optimization and operational improvements, including a reported 3-4% reduction in food costs for chains using advanced inventory analytics in 2023.

Legal factors

First Watch operates under stringent food labeling laws, mandating precise disclosure of nutritional information and potential allergens. For instance, the U.S. Food and Drug Administration's Food Allergen Labeling and Consumer Protection Act of 2004 (FALCPA) requires clear identification of major allergens like milk, eggs, fish, shellfish, tree nuts, peanuts, wheat, and soybeans on menus and food packaging. Failure to comply can result in significant penalties and damage to brand reputation.

Adherence to these regulations is paramount for consumer safety and to mitigate legal risks. In 2023, the U.S. saw a notable increase in foodborne illness outbreaks linked to undeclared allergens, underscoring the critical importance of accurate labeling. First Watch's commitment to transparency in its ingredient lists and allergen warnings directly addresses these legal requirements, fostering customer trust and preventing costly litigation.

First Watch, like all businesses, must navigate a complex web of employment and labor relations laws. These regulations cover everything from minimum wage requirements and overtime pay to anti-discrimination statutes and workplace safety standards. For instance, in 2024, the federal minimum wage remains $7.25 per hour, though many states and cities have significantly higher rates, impacting First Watch's labor costs and payroll compliance.

Maintaining strict adherence to these federal, state, and local labor laws is paramount. Non-compliance can lead to costly legal battles, hefty fines, and damage to First Watch's reputation, potentially impacting its ability to attract and retain talent. Ensuring fair labor practices and a safe working environment is not just a legal obligation but a strategic imperative for operational stability.

Restaurants like First Watch operate under a complex web of health and safety regulations designed to protect public well-being. These include rigorous sanitation standards, detailed food handling protocols to prevent contamination, and essential fire safety codes to ensure safe operating environments. For instance, the U.S. Food and Drug Administration (FDA) Food Code, updated periodically, sets a baseline for many state and local health departments, influencing everything from refrigeration temperatures to employee hygiene practices.

Failure to comply with these regulations can lead to severe consequences, including fines, temporary closures, and lasting damage to a brand's reputation. In 2023, the National Restaurant Association reported that health code violations remain a significant concern for consumers, with a substantial percentage citing cleanliness as a primary factor in their dining choices. First Watch's commitment to consistently meeting and exceeding these standards across its nearly 500 locations is paramount for maintaining customer trust and operational continuity.

Franchise Law and Regulatory Compliance

First Watch, as a franchisor, navigates a complex web of federal and state franchise laws. The Federal Trade Commission (FTC) Franchise Rule mandates comprehensive disclosure documents, like the Franchise Disclosure Document (FDD), to prospective franchisees before any agreement is signed. Many states also have their own registration and disclosure requirements, adding layers of compliance. For instance, as of early 2024, states like California, New York, and Illinois impose specific obligations beyond the FTC rule, requiring careful attention to detail for nationwide expansion.

Ensuring ongoing compliance is critical to maintaining positive franchisor-franchisee relationships and avoiding legal pitfalls. This involves adhering to contractual obligations, providing required support and training, and transparently reporting financial performance. Failure to comply can result in significant penalties, including fines and litigation, impacting brand reputation and growth. For example, in 2023, several franchise systems faced lawsuits over alleged misrepresentations in their FDDs, highlighting the importance of meticulous adherence to disclosure laws.

- FTC Franchise Rule: Mandates detailed disclosure to potential franchisees.

- State-Specific Laws: Many states have additional registration and disclosure requirements.

- Ongoing Compliance: Crucial for franchisor-franchisee relations and avoiding legal issues.

- Disclosure Documents: The Franchise Disclosure Document (FDD) is a key legal requirement.

Data Privacy and Cybersecurity Regulations

First Watch's reliance on digital platforms for ordering, payments, and customer data collection necessitates strict adherence to evolving data privacy laws. Regulations like the California Consumer Privacy Act (CCPA) and other state-specific mandates, such as the Virginia Consumer Data Protection Act (VCDPA), impose significant obligations on how customer information is handled. Failure to comply can result in substantial fines and reputational damage.

Protecting sensitive customer data and ensuring robust cybersecurity measures are not just legal requirements but critical for maintaining customer trust. In 2024, data breaches continue to be a significant concern across the restaurant industry, with the average cost of a breach reaching millions of dollars. First Watch must invest in advanced cybersecurity protocols to safeguard against unauthorized access and data theft.

- CCPA and VCDPA Compliance: Ensuring all data collection and usage practices align with these consumer privacy rights.

- Cybersecurity Investment: Allocating resources for advanced threat detection, data encryption, and employee training.

- Data Breach Preparedness: Developing and regularly testing incident response plans to mitigate the impact of potential breaches.

- Vendor Due Diligence: Verifying that third-party service providers also meet stringent data privacy and security standards.

Navigating food safety regulations remains a critical legal aspect for First Watch. Compliance with the FDA Food Code, which influences state and local health department standards, is essential for maintaining operational integrity. For example, in 2023, the National Restaurant Association highlighted consumer concerns regarding cleanliness, making adherence to sanitation and food handling protocols vital for brand reputation and avoiding closures.

Employment and labor laws significantly impact First Watch's operational costs and compliance strategies. With the federal minimum wage at $7.25 per hour as of 2024, many states and municipalities mandate higher rates, necessitating careful payroll management. Non-compliance can lead to costly litigation and recruitment challenges.

Data privacy laws like the CCPA and VCDPA impose strict requirements on how First Watch handles customer information. Given the increasing frequency and cost of data breaches, which averaged millions in 2024 according to industry reports, robust cybersecurity measures and incident response plans are paramount for maintaining customer trust and avoiding substantial fines.

Environmental factors

Consumer and regulatory pressure for sustainable food sourcing significantly impacts First Watch's procurement strategies. For instance, a 2024 survey indicated that 65% of consumers are willing to pay more for sustainably sourced food, directly influencing First Watch's sourcing decisions to meet this demand and maintain market competitiveness.

Prioritizing suppliers with environmentally responsible practices, such as reduced pesticide use or sustainable fishing, aligns with growing environmental consciousness and First Watch's commitment to ethical operations. In 2024, the company expanded its partnerships with local farms that employ regenerative agriculture techniques, aiming to reduce its carbon footprint by an estimated 15% in the coming years.

The restaurant sector, including breakfast and brunch specialists like First Watch, grapples with substantial waste generation. Consumers and regulators alike are pushing for more robust waste management, with a growing emphasis on recycling and composting. For instance, the U.S. Environmental Protection Agency reported that food waste alone accounted for 24% of all landfilled municipal solid waste in 2018, a figure that continues to be a focus for reduction efforts across industries.

First Watch is increasingly expected to demonstrate a commitment to minimizing its environmental footprint through improved waste management practices. This includes implementing comprehensive programs for reducing food waste at the source, diverting unavoidable waste through recycling, and exploring composting options for organic materials. Such initiatives are not only environmentally responsible but also align with evolving consumer preferences for sustainable businesses.

Restaurants are notoriously energy-intensive, and with energy costs continuing their upward trend, particularly through 2024 and into 2025, efficiency is paramount. Environmental concerns further amplify the pressure on businesses like First Watch to adopt more sustainable practices.

Investing in energy-saving equipment, such as ENERGY STAR certified appliances, can significantly slash operational expenses. For instance, upgrading to LED lighting alone can reduce lighting energy consumption by up to 80%.

Beyond equipment, implementing energy-efficient practices, like optimizing HVAC schedules and ensuring proper insulation, directly contributes to lower utility bills. This not only bolsters the bottom line but also enhances First Watch's environmental footprint, appealing to a growing segment of eco-conscious consumers.

Water Usage and Conservation Efforts

Water scarcity is a significant environmental factor impacting businesses like First Watch. As concerns over water availability grow, particularly in drought-prone areas, restaurants must prioritize water conservation. This includes investing in water-efficient kitchen equipment, such as low-flow faucets and dishwashers, which can significantly reduce overall water usage. For instance, upgrading to ENERGY STAR certified dishwashers can save thousands of gallons of water annually per establishment.

Implementing water-saving practices in daily operations is also crucial. This can involve training staff on mindful water use, such as not letting taps run unnecessarily during food preparation or cleaning. Many restaurant chains are setting ambitious water reduction targets as part of their sustainability initiatives. For example, some major food service companies aim to reduce water consumption by 15-20% by 2025 compared to a 2020 baseline.

- Water Efficiency Investments: First Watch should evaluate the ROI of water-saving kitchen appliances, noting that ENERGY STAR certified equipment can reduce water use by over 20%.

- Operational Best Practices: Staff training on water conservation can lead to substantial savings, with simple changes like fixing leaks promptly making a difference.

- Regional Water Risk: Operations in states like California, which experienced severe drought conditions in recent years, face greater scrutiny and potential operational challenges related to water availability.

- Sustainability Reporting: Companies are increasingly disclosing their water usage and conservation efforts, with many aiming for measurable reductions by 2025.

Consumer Demand for Eco-Friendly Businesses

A growing segment of consumers is actively seeking out businesses that demonstrate strong environmental credentials. This trend is particularly pronounced among younger demographics, with studies showing a significant willingness to pay a premium for sustainable products and services. For First Watch, this translates into a clear opportunity to enhance brand appeal by showcasing tangible commitments to environmental stewardship.

Demonstrating this commitment can take various forms, such as investing in sustainable packaging solutions or implementing initiatives to reduce carbon emissions across operations. For instance, by late 2024, many restaurant chains were exploring or had already implemented compostable or recyclable takeout containers. First Watch could further differentiate itself by highlighting efforts like sourcing local ingredients to minimize transportation-related emissions or adopting energy-efficient kitchen equipment.

The impact of these efforts on consumer perception is substantial. Research from 2024 indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions. This suggests that proactive environmental strategies are not just about corporate responsibility but also a powerful driver of customer loyalty and market share growth.

- Growing Consumer Preference: A significant portion of the market prioritizes businesses with visible environmental commitments.

- Brand Enhancement: Demonstrating sustainability can boost First Watch's brand image and attract environmentally conscious customers.

- Actionable Steps: Implementing sustainable packaging and reducing carbon footprints are key strategies.

- Market Data: Over 60% of consumers in 2024 factored environmental impact into their buying choices.

Environmental regulations are becoming stricter, pushing businesses like First Watch to adopt more sustainable operational practices. For example, by 2025, many regions are expected to have enhanced mandates regarding food waste diversion and emissions reduction.

First Watch's commitment to sourcing from local farms that use regenerative agriculture techniques is a strategic move to mitigate environmental risks and meet consumer demand for sustainability. This approach is projected to reduce the company's carbon footprint by approximately 15% in the coming years.

The restaurant industry faces significant challenges with waste management, and First Watch is actively implementing programs to address this. Initiatives include reducing food waste at the source and exploring composting options, aligning with the U.S. Environmental Protection Agency's ongoing focus on reducing landfill waste.

Energy efficiency is crucial for First Watch, especially with rising energy costs through 2024 and 2025. Investing in ENERGY STAR certified appliances, such as LED lighting, can dramatically cut operational expenses and improve the company's environmental performance.

| Environmental Factor | Impact on First Watch | Actionable Strategy | 2024/2025 Data/Trend |

|---|---|---|---|

| Consumer Demand for Sustainability | Increased willingness to pay for sustainably sourced food (65% in 2024). | Prioritize local, regenerative agriculture suppliers. | Growing consumer preference, over 60% consider environmental impact. |

| Waste Management | Pressure to reduce food waste and improve recycling/composting. | Implement comprehensive waste reduction programs. | Food waste is 24% of landfill waste (2018 EPA data), trend is reduction focus. |

| Energy Consumption | Rising energy costs necessitate efficiency improvements. | Invest in ENERGY STAR certified appliances and LED lighting. | LED lighting can reduce consumption by up to 80%. |

| Water Scarcity | Need for water conservation due to drought concerns. | Utilize water-efficient kitchen equipment and staff training. | ENERGY STAR dishwashers can save thousands of gallons annually. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure comprehensive and accurate assessments.