First Watch Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Watch Bundle

First Watch's success hinges on a finely tuned marketing mix. Their commitment to fresh, innovative breakfast and brunch offerings, coupled with accessible pricing and strategic location choices, forms a compelling foundation.

Dive deeper into how First Watch leverages its unique menu, competitive pricing, widespread accessibility, and targeted promotions to capture the breakfast and brunch market. This comprehensive analysis provides actionable insights for anyone looking to understand or replicate their winning strategy.

Unlock the full potential of your marketing understanding. Get instant access to a professionally written, editable 4Ps analysis of First Watch, perfect for business professionals, students, and consultants seeking strategic advantages.

Product

First Watch's dedication to a fresh, made-to-order menu is a cornerstone of its appeal. They focus on preparing everything from scratch, utilizing healthy ingredients and seasonal produce to create their breakfast, brunch, and lunch offerings. This commitment resonates strongly with consumers seeking nutritious and carefully crafted meals.

First Watch's product strategy centers on seasonal menu innovation, with a chef-driven approach that refreshes offerings five times annually, roughly every ten weeks. This ensures a constant stream of new, trend-forward dishes, keeping the menu exciting and aligned with diner preferences. For instance, their Q1 2024 menu featured items like the Elote Breakfast Burrito and Strawberry Tres Leches French Toast, demonstrating their commitment to seasonal flavors and culinary creativity.

First Watch's 'Follow the Sun' philosophy is central to their product strategy, emphasizing the procurement of ingredients at their peak season and origin. This approach directly supports their brand promise of delivering exceptionally fresh and high-quality meals to customers.

This commitment to seasonal sourcing means First Watch actively seeks out produce and other components when and where they are in season, aiming for optimal flavor and nutritional value. For instance, in 2024, many restaurants are seeing increased consumer demand for locally sourced and seasonal produce, with some surveys indicating over 60% of consumers prefer restaurants that highlight seasonal ingredients.

Core Menu Stability with Strategic Enhancements

First Watch prioritizes a consistent core menu, a key element of its product strategy, ensuring customer familiarity with breakfast and brunch staples. This stability builds trust and predictability, a significant draw for regular patrons. For instance, their popular "Million Dollar Bacon" remains a constant, providing a reliable favorite amidst evolving culinary trends.

While the foundation is stable, First Watch strategically enhances existing offerings to boost perceived value and appeal. This includes practical improvements like increasing portion sizes for popular ingredients such as meat and potatoes in select dishes, directly addressing customer desire for more substantial meals. This approach aims to elevate customer satisfaction without disrupting the core menu's identity.

Further product refinement is evident in the upgrade of their fruit cup offerings. By replacing honeydew with a more premium mix of strawberries, pineapple, and blueberries, First Watch elevates the perceived quality and healthfulness of this side. This move aligns with consumer preferences for diverse and vibrant fruit selections, enhancing the overall dining experience.

These product enhancements contribute to First Watch's competitive edge. In 2024, restaurant industry reports indicated a growing consumer demand for higher-quality ingredients and improved value propositions. First Watch's approach to its core menu, coupled with these thoughtful upgrades, positions them to capture this market sentiment effectively.

- Core Menu Stability: Maintains a consistent selection of popular breakfast and brunch items, fostering customer loyalty and predictability.

- Strategic Enhancements: Improves existing dishes by increasing meat and potato portions in popular items, adding tangible value for customers.

- Premium Fruit Upgrade: Replaces honeydew with strawberries, pineapple, and blueberries in fruit cups, enhancing perceived quality and appeal.

- Market Alignment: These product adjustments cater to 2024 consumer trends favoring quality ingredients and improved value in dining experiences.

Chef-Driven Development Process

First Watch's commitment to a chef-driven development process is a cornerstone of its product strategy, ensuring fresh, innovative menu offerings. This extensive process, which can span up to 18 months, involves a deep dive into culinary trends and ingredient sourcing.

The culinary, marketing, and supply chain teams collaborate on 'flavor tours' to pinpoint emerging tastes and guarantee the availability of seasonal ingredients. This meticulous approach ensures that new dishes are not only creative but also practical for their kitchens, maintaining consistent quality across all First Watch locations.

- 18-Month Development Cycle: The lengthy timeframe allows for thorough research, testing, and refinement of seasonal menu items.

- Cross-Functional Collaboration: Culinary, marketing, and supply chain teams work together to align innovation with operational realities and ingredient availability.

- Flavor Trend Identification: 'Flavor tours' are crucial for staying ahead of culinary trends and consumer preferences.

- Operational Feasibility: The process prioritizes dishes that can be executed efficiently and consistently at all restaurant locations.

First Watch's product strategy is deeply rooted in freshness and seasonal innovation. They emphasize made-to-order meals using high-quality, seasonal ingredients, refreshing their menu five times a year to keep offerings exciting and on-trend. This commitment to scratch cooking and carefully sourced produce resonates with health-conscious consumers.

The brand maintains a stable core menu of popular items, offering a sense of familiarity and reliability for its customer base. Alongside this, First Watch strategically enhances existing dishes, such as increasing meat and potato portions, and upgrades side items like their fruit cups, demonstrating a focus on perceived value and customer satisfaction.

Their product development involves an extensive 18-month cycle, driven by cross-functional collaboration to identify flavor trends and ensure operational feasibility. This meticulous process, including 'flavor tours,' ensures new menu items are both innovative and consistently executable across all locations.

| Product Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Fresh, Made-to-Order | All items prepared from scratch with a focus on healthy, seasonal ingredients. | Meets growing consumer demand for transparency and quality in food preparation. |

| Seasonal Menu Innovation | Five annual menu refreshes based on chef-driven concepts and seasonal availability. | Keeps the dining experience novel and aligned with evolving consumer tastes. |

| Core Menu Stability | Consistent offering of popular breakfast and brunch staples. | Builds customer loyalty and provides reliable favorites amidst menu changes. |

| Strategic Enhancements | Improvements like increased portion sizes for key ingredients and premium fruit upgrades. | Directly addresses consumer desire for greater value and higher quality perceived in dishes. |

What is included in the product

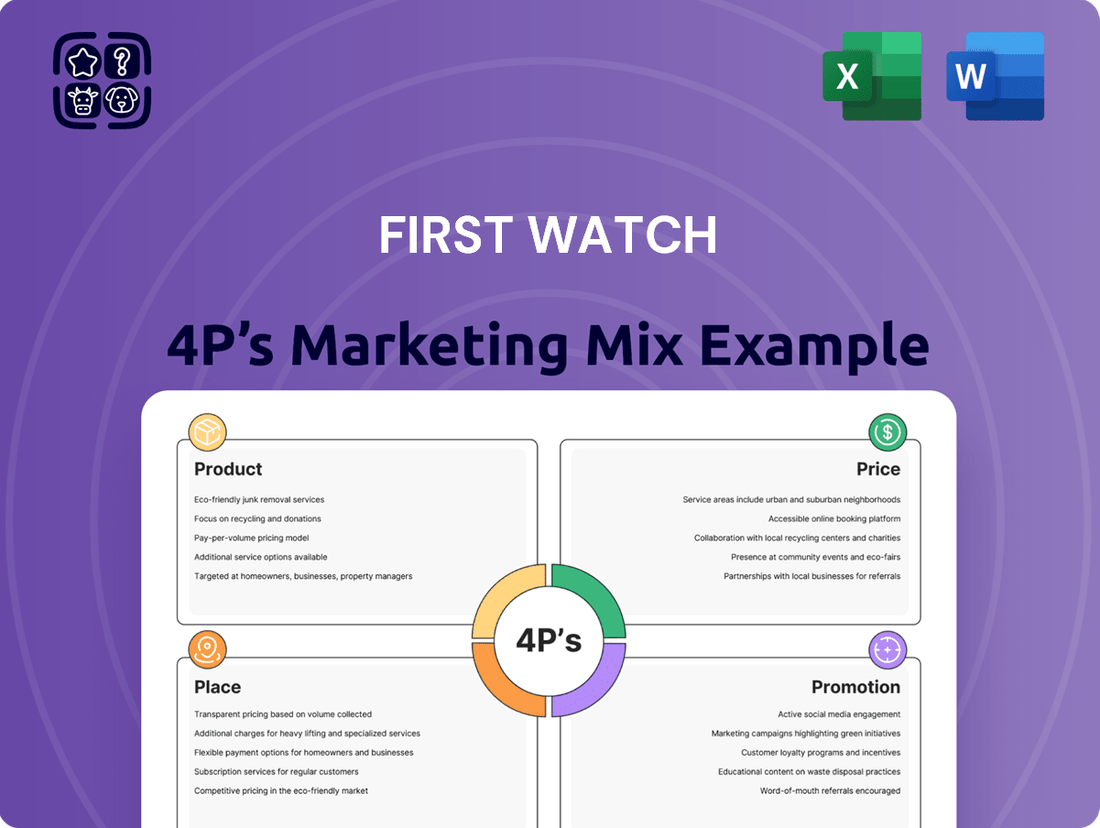

This analysis offers a comprehensive breakdown of First Watch's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples.

It's designed for professionals seeking to understand First Watch's market positioning and benchmark their own strategies against a successful brand.

Provides a clear, actionable framework for identifying and addressing marketing challenges, simplifying complex strategies for immediate impact.

Place

First Watch boasts a substantial and continuously expanding restaurant footprint. As of the first quarter of 2025, the company operates over 580 locations spread across 31 states, demonstrating a significant presence in the U.S. market. This extensive network is a key component of their strategy to capture a larger share of the daytime dining segment.

The company's ambitious growth trajectory is further highlighted by its long-range objective to reach 2,200 locations. This aggressive expansion plan signals a strong commitment to increasing brand visibility and accessibility nationwide, aiming to solidify its position as a leader in the breakfast, brunch, and lunch dining space.

First Watch is aggressively pursuing expansion, with plans to launch between 59 and 64 new restaurants in 2025. This significant growth push will see the breakfast and lunch chain enter new markets, including Idaho, Nevada, and Tennessee, thereby extending its geographical footprint.

The company's development pipeline is exceptionally strong, showcasing over 120 projects currently underway for both 2025 and 2026. This robust pipeline indicates a clear commitment to sustained and rapid expansion, aiming to capture a larger share of the casual dining market.

First Watch strategically manages a hybrid model of company-owned and franchised locations. As of the first quarter of 2025, the company boasted 498 company-owned restaurants and 86 franchise-owned units.

This operational structure supports First Watch's ongoing initiative to acquire franchise locations, converting them into company-owned establishments. This consolidation aims to enhance brand uniformity and maintain rigorous operational excellence across its portfolio.

Strategic Site Selection

First Watch places a strong emphasis on strategic site selection, often favoring prominent, high-visibility locations. A significant portion of their successful units are situated in formerly occupied freestanding restaurant spaces, which have historically demonstrated top-tier performance within their operational system.

This focus on prime real estate is further bolstered by developers actively offering First Watch early opportunities in new developments. This preference stems from First Watch's established leadership and strong brand recognition within the daytime dining sector, making them an attractive anchor tenant.

- High-Performing Locations: Previously occupied freestanding restaurant sites are key targets, correlating with higher system-wide sales.

- Developer Priority: Developers are proactively approaching First Watch for placement in new retail centers.

- Daytime Dining Leadership: First Watch's strong market position encourages developers to offer them prime opportunities.

Maximizing Convenience and Accessibility

First Watch's distribution strategy is laser-focused on making their breakfast, brunch, and lunch convenient for everyone. They're actively expanding into new markets and states, which means more people can easily access their popular menu items. This expansion is a key driver for their anticipated revenue growth.

The company's commitment to opening new restaurants directly fuels this accessibility objective. For instance, in 2023, First Watch opened 43 new locations, bringing their total to 491 restaurants across 23 states. This aggressive expansion plan for 2024 and beyond is projected to significantly boost their revenue figures, with a target of reaching 600 locations by 2027.

- Expanded Footprint: 491 restaurants across 23 states as of the end of 2023.

- Growth Trajectory: Plans to open approximately 50-55 new locations annually.

- Revenue Impact: New restaurant openings are a primary contributor to projected revenue increases.

- Future Outlook: Aiming for 600 locations nationwide by 2027.

First Watch's place strategy centers on strategic expansion and prime real estate. As of Q1 2025, they operate over 580 locations across 31 states, with a goal of 2,200. They are actively opening new sites, with 59-64 planned for 2025, including entry into Idaho, Nevada, and Tennessee.

| Metric | Q1 2025 Data | 2025 Target | 2027 Target |

|---|---|---|---|

| Total Locations | 580+ | 600+ | 2,200 (Long-term) |

| States Covered | 31 | Expanding | Nationwide |

| New Locations (2025) | N/A (Ongoing) | 59-64 | N/A |

| Company-Owned | 498 | N/A | N/A |

| Franchise-Owned | 86 | N/A | N/A |

What You See Is What You Get

First Watch 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of First Watch's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

First Watch rolled out a new digital and data-driven marketing strategy in early 2025, aiming to significantly increase customer foot traffic. This initiative taps into a wealth of information gathered from their existing waitlist, online ordering, and payment platforms.

By integrating this internal data with external third-party datasets, First Watch can now precisely target individual customer segments. For example, data from 2024 indicated a 15% increase in repeat customers when personalized offers were used, a trend they aim to amplify.

The core objective is to make marketing efforts more efficient and impactful. This data-centric approach allows for tailored promotions and communications, potentially leading to a higher conversion rate compared to broad-stroke campaigns, and is expected to drive a 10% uplift in same-store sales by year-end 2025.

First Watch's marketing strategy emphasizes targeted customer engagement to boost both new customer acquisition and repeat visits. By personalizing messages based on customer history, such as offering seasonal menu previews to loyal patrons and introductory deals to new ones, they aim to deepen relationships.

This tailored approach, leveraging digital channels, is crucial in today's competitive landscape. For example, in 2024, restaurants that implemented personalized marketing saw an average increase of 15% in customer retention rates, demonstrating the effectiveness of this strategy.

First Watch is strategically boosting its marketing budget for 2025, with a pronounced shift towards digital and social media platforms. This approach bypasses traditional TV advertising, aiming to engage consumers across their entire purchasing journey.

The company's digital-first strategy is particularly evident in markets with a strong presence of First Watch restaurants, such as Florida, where the increased investment is concentrated. This focus allows for more targeted and efficient customer acquisition.

Enhanced Customer-Facing Technologies

First Watch is investing in enhanced customer-facing technologies, slated for a late 2025 rollout, to elevate both the diner and staff experience. This initiative includes a custom-built waitlist system designed for smoother customer flow and a revamped menu interface. This new interface will feature dynamic nutrition and allergen information, providing diners with crucial details at their fingertips.

The digital transformation also encompasses personalized offer wallets, aiming to foster loyalty and drive repeat business. These technological upgrades are projected to streamline restaurant operations, reducing friction points for employees and enhancing the overall dining journey for customers.

- Waitlist Experience: Custom-built system for improved customer management.

- Menu Interface: Dynamic nutrition and allergen tools for informed choices.

- Personalized Offers: Digital wallets to enhance customer loyalty.

- Operational Streamlining: Aiming to improve efficiency for both staff and guests.

Value-Driven, Non-al Approach

First Watch distinguishes itself by forgoing the typical aggressive price promotions common in the casual dining sector. Instead, their promotional strategy centers on highlighting the intrinsic value of their fresh, high-quality ingredients and the overall enjoyable dining experience they provide. This deliberate choice reinforces their brand identity and aims to cultivate lasting customer loyalty over fleeting price-driven engagement.

This approach is evident in their consistent focus on menu innovation and seasonal specials, which showcase their commitment to quality. For instance, their introduction of new, chef-driven dishes often generates buzz and drives traffic without relying on discounts. This strategy is particularly effective in attracting customers who prioritize quality and a unique dining experience over the lowest price point.

First Watch's commitment to a value-driven, non-discounting approach appears to resonate well with their target demographic. In Q1 2024, the company reported a 7.1% increase in same-store sales, indicating strong customer demand for their offerings. This growth suggests that customers are willing to pay a premium for the perceived quality and experience First Watch delivers, validating their promotional strategy.

- Focus on Quality: Promotions emphasize fresh ingredients and unique menu items, not discounts.

- Brand Identity: Avoids price wars to maintain a premium perception.

- Customer Loyalty: Aims to build long-term relationships through value, not temporary deals.

- Sales Performance: Q1 2024 saw a 7.1% same-store sales increase, supporting this strategy.

First Watch's promotional strategy deliberately sidesteps aggressive discounting, instead highlighting the inherent value of fresh ingredients and the overall dining experience. This approach reinforces their brand identity, aiming for sustained customer loyalty over short-term, price-sensitive engagement.

Their focus on menu innovation and seasonal specials, like new chef-driven dishes, generates organic buzz and drives traffic without relying on discounts. This strategy effectively attracts customers who prioritize quality and a unique dining experience.

This value-driven, non-discounting approach is proving successful, with Q1 2024 same-store sales increasing by 7.1%. This growth indicates customers are willing to pay more for First Watch's perceived quality and experience, validating their promotional strategy.

| Promotional Focus | Key Tactics | Customer Impact | Performance Indicator |

|---|---|---|---|

| Value & Quality | Menu innovation, seasonal specials | Attracts quality-conscious diners | 7.1% same-store sales growth (Q1 2024) |

| Brand Reinforcement | Avoidance of price promotions | Builds lasting loyalty | N/A |

| Customer Engagement | Personalized digital offers | Drives repeat visits | 15% increase in repeat customers (2024 data) |

Price

First Watch adopts a conservative pricing strategy, aiming to offer customers consistent value by limiting price adjustments. For the entirety of 2025, the company anticipates a modest price increase of approximately 2%.

This deliberate approach is designed to prevent the brand from being perceived as excessively expensive, focusing instead on customer retention and loyalty through quality offerings.

The company's philosophy prioritizes winning the long-term competition by emphasizing sustained quality over engaging in price-cutting battles with competitors.

First Watch strategically enhances perceived value by increasing portion sizes for core items like meat and potatoes, a move that directly addresses customer desire for more substance without resorting to price cuts. This focus on tangible increases in product quantity contributes to a stronger sense of getting more for their money.

Further elevating value, the company has upgraded ingredient quality, notably in their fruit cups by incorporating more premium fruit selections. This attention to detail in sourcing better ingredients signals a commitment to a superior customer experience, reinforcing the idea that First Watch offers a higher caliber of product.

First Watch deliberately steers clear of the frequent discounting and promotional tactics prevalent in the casual dining sector. This approach is a core tenet of their business philosophy, with leadership emphasizing a strategic choice to avoid operating in the discount space.

Instead of relying on price reductions to drive customer traffic, First Watch focuses on preserving its brand image and the perceived quality of its offerings. This commitment to brand integrity over short-term gains from promotions is a key differentiator.

For instance, while competitors might offer BOGO deals or percentage-off specials, First Watch's pricing structure remains consistent, aiming to build customer loyalty through value and experience rather than price sensitivity. This strategy has contributed to their consistent revenue growth, with the company reporting strong performance in recent fiscal periods.

Pricing Reflects Perceived Value

First Watch's pricing strategy is carefully crafted to align with the perceived value customers associate with their fresh, made-to-order, and high-quality menu offerings. This approach ensures patrons feel they are receiving excellent value for their money, building trust and encouraging repeat business. This thoughtful pricing reinforces their brand image as a premium destination for daytime dining.

For instance, while specific pricing varies by location, a typical First Watch breakfast or brunch entree, featuring ingredients like fresh fruits, cage-free eggs, and house-made granola, might range from $10 to $15. This positions them competitively within the fast-casual and casual dining segments, where customers expect a certain quality and experience.

- Value Perception: Pricing is set to match the expectation of fresh, high-quality ingredients and made-to-order preparation.

- Customer Trust: The strategy aims to ensure customers feel they are getting their money's worth, fostering satisfaction.

- Brand Alignment: Pricing supports First Watch's positioning as a premium daytime dining establishment.

- Competitive Positioning: Entree prices typically fall within the $10-$15 range, reflecting the quality offered in the casual dining market.

Adaptation for Delivery Platforms

First Watch strategically adapts its pricing for delivery platforms, recognizing the need to attract customers on services like DoorDash. While their in-store pricing remains conservative, they've implemented slightly higher prices on these third-party apps to offset commission fees and maintain profitability. This approach acknowledges the increased costs associated with off-premise dining while still aiming to capture a larger market share through convenient delivery options.

This flexible pricing strategy allows First Watch to:

- Maximize reach by participating in popular delivery ecosystems.

- Offset third-party fees through adjusted menu prices on these platforms.

- Drive order volume by offering competitive, albeit slightly adjusted, pricing for delivery.

- Maintain brand perception of value in their core brick-and-mortar locations.

First Watch's pricing strategy centers on delivering consistent value without frequent discounting, anticipating a modest 2% increase in 2025. This approach reinforces their brand image as a premium daytime dining destination, with typical entrees priced between $10-$15, reflecting high-quality ingredients and made-to-order preparation.

| Pricing Aspect | Description | Financial Implication (2025 Projection) |

|---|---|---|

| Overall Strategy | Conservative, value-focused, avoiding price wars. | Modest 2% price increase anticipated. |

| Value Enhancement | Increased portion sizes and premium ingredient upgrades (e.g., fruit cups). | Supports perceived value, customer loyalty, and potentially higher average check size. |

| Promotional Avoidance | No frequent discounting or BOGO deals. | Preserves brand image and profit margins, focusing on organic growth. |

| Delivery Platform Pricing | Slightly higher prices on third-party apps. | Offsets commission fees, maintains profitability on off-premise orders. |

4P's Marketing Mix Analysis Data Sources

Our First Watch 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company communications, including investor relations materials and press releases. We also leverage detailed industry reports and competitive intelligence to ensure our insights into Product, Price, Place, and Promotion are accurate and actionable.