First Watch Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Watch Bundle

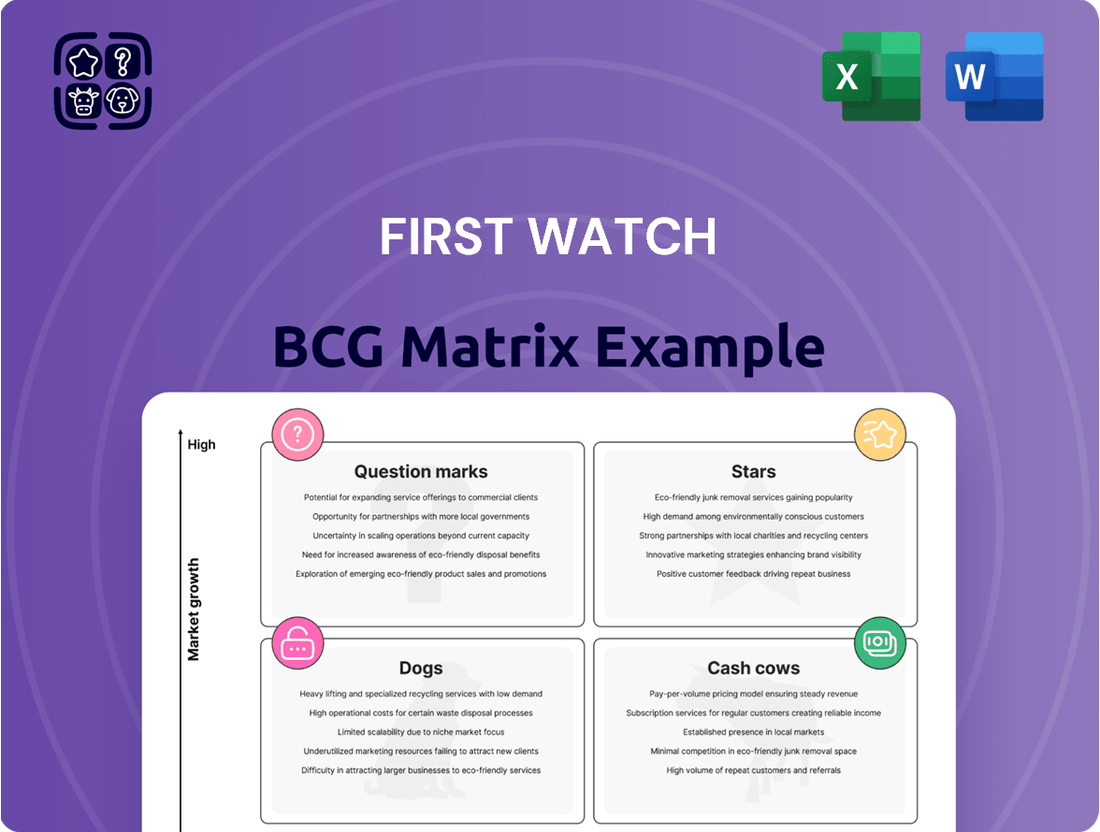

This glimpse into the First Watch BCG Matrix highlights key product categories, but the real strategic advantage lies in the full report. Understand precisely where each menu item fits – are they thriving Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks? Purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to optimize your menu and drive profitability.

Stars

First Watch is actively pursuing growth by opening new company-owned restaurants, particularly in emerging markets within the United States. This strategic push aims to capture market share in areas where their unique breakfast, brunch, and lunch concept has not yet been established.

The company's commitment to expansion is evident in its Q1 2025 performance, which saw the opening of 13 new system-wide restaurants spread across 10 different states. This aggressive pace underscores their confidence in the model's scalability and appeal in new territories.

First Watch's new restaurant openings (NROs) are showing impressive results. For 2024, the company reported that its new locations are performing above expectations, a trend that has continued into 2025. This strong initial performance suggests that First Watch's strategic site selection and proven operational model are resonating well with consumers in new markets.

These newly opened restaurants are not just meeting targets; they are actively capturing market share and becoming significant contributors to First Watch's overall financial health. This rapid market penetration validates the brand's appeal and its ability to execute successful launches, setting a positive trajectory for future expansion.

First Watch is actively pursuing strategic expansion into new states, with Nevada slated for a summer 2025 debut. This move, alongside a push into New England and a significant Boston location, signifies a focus on high-growth markets. By establishing an early presence, First Watch aims to capture market share and build a dominant position in these untapped territories.

Strong Unit Economics of Recently Opened Locations

Newly opened First Watch locations in 2024 are exhibiting impressive financial performance, projecting third-year sales of $2.6 million. This figure represents a significant 20% increase over the company's current average unit volume (AUV). Such robust unit economics signal a strong foundation for future profitability.

The financial outlook for these new restaurants is exceptionally bright, with projected cash-on-cash returns anticipated to exceed 35%. This high return profile suggests that these nascent locations are poised to become substantial cash-generating assets as they mature within the company's portfolio.

The strong financial indicators observed in these new market entries are characteristic of a Star in the BCG Matrix. This classification reflects their high growth potential and strong market position, indicating they are key drivers of future success.

- Projected Third-Year Sales: $2.6 million, 20% above AUV.

- Projected Cash-on-Cash Return: North of 35%.

- Implication: New units are strong cash generators.

- BCG Classification: Star due to high growth and strong performance.

Leadership Position in Daytime Dining Segment

First Watch has cemented its position as the undisputed leader in the burgeoning daytime dining sector. This strong market presence is a significant asset, enabling them to secure advantageous locations for their ambitious growth plans, with developers actively seeking to partner with them. As of early 2024, First Watch operates over 500 locations across 29 states, underscoring their extensive reach and dominance.

Their well-established brand and proven operational model contribute to rapid market penetration for new restaurants. This allows them to quickly capture a substantial share of their specific market niche, reinforcing their leadership. For instance, in 2023, First Watch reported a 12.5% increase in system-wide sales, reaching $1.03 billion, a testament to their successful expansion and strong performance.

- Market Leadership: First Watch is the recognized frontrunner in the daytime dining segment.

- Expansion Advantage: Their leadership attracts prime real estate opportunities for new store development.

- Brand Strength: High brand recognition and operational expertise facilitate quick market share gains for new units.

- Financial Performance: System-wide sales exceeded $1 billion in 2023, with continued growth projected.

First Watch's new restaurants are performing exceptionally well, demonstrating the characteristics of Stars in the BCG Matrix. These locations are opening in high-growth markets and quickly capturing significant market share.

The financial projections for these new units are robust, with third-year sales expected to reach $2.6 million, a 20% increase over the current average unit volume. Furthermore, anticipated cash-on-cash returns are projected to exceed 35%, indicating strong profitability and cash generation potential.

This strong performance and high growth potential solidify their classification as Stars. Their success in new territories, like the 13 system-wide openings in Q1 2025 across 10 states, highlights their ability to execute expansion strategies effectively.

First Watch's market leadership in the daytime dining sector, with over 500 locations as of early 2024, further supports the Star classification. This dominance allows them to secure prime locations and leverage brand recognition for rapid market penetration.

| Metric | 2024 Projection | Implication |

|---|---|---|

| New Unit Third-Year Sales | $2.6 million (20% above AUV) | Strong revenue generation |

| New Unit Cash-on-Cash Return | >35% | High profitability and cash flow |

| Market Growth | High | Indicates Star potential |

| Market Share Capture | Rapid | Reinforces leadership position |

What is included in the product

This BCG Matrix overview analyzes product portfolio performance, guiding investment decisions based on market share and growth.

Effortlessly visualize your portfolio's health with a clear BCG matrix, alleviating the pain of complex strategic analysis.

Cash Cows

First Watch's substantial base of company-owned restaurants, numbering 498 out of 584 system-wide locations as of Q1 2025, firmly places them in the Cash Cows quadrant of the BCG Matrix. This extensive network of established locations consistently generates significant and reliable revenue, forming the bedrock of the company's financial stability. These mature operations are key drivers of the company's overall profitability and provide a predictable source of cash flow.

First Watch achieved a significant financial milestone, crossing the $1 billion mark in total revenues during 2024. This impressive top-line performance is a testament to the company's robust operational scale and market penetration.

Despite a modest same-restaurant sales growth of 0.7% in Q1 2025 and a slight decline of negative 0.5% for the full year 2024, the extensive network of First Watch locations consistently drives high overall revenue. This volume-based strength solidifies its position as a cash cow.

First Watch demonstrated robust restaurant-level operating profit margins, achieving a healthy 20.1% for the entirety of fiscal year 2024. This figure underscores the company's ability to effectively manage costs and generate strong profitability from its established locations, even amidst economic fluctuations.

While the first quarter of fiscal year 2025 saw a slight dip to 16.5%, this margin still represents a significant strength within the restaurant sector. These consistent, high margins are vital, as they provide the essential cash flow that First Watch can then reinvest into new growth opportunities and further development of its business.

Acquisition of Franchise Locations

First Watch's acquisition of franchise locations is a clear indicator of its Cash Cow strategy within the BCG Matrix. By bringing these franchised units under corporate ownership, the company aims to streamline operations and boost profitability.

This strategic move has already seen significant progress. As of May 2023, First Watch successfully acquired 45 franchised restaurants. The company has further outlined its intentions to acquire an additional 16 units by mid-April 2025.

The objective behind these acquisitions is multifaceted. It’s about consolidating control, ensuring a uniform and high-quality customer experience, and leveraging economies of scale to maximize the financial performance of these established locations.

- Strategic Acquisitions: First Watch is actively converting franchised restaurants into company-owned units.

- Acquisition Pace: 45 franchised restaurants were acquired since May 2023.

- Future Plans: An additional 16 franchised locations are slated for acquisition by mid-April 2025.

- Strategic Goal: To enhance corporate ownership, integrate operations, and ensure consistent profitability, thereby strengthening its Cash Cow portfolio.

Core Menu Offerings and Dining Experience

First Watch's core menu, featuring fresh, made-to-order breakfast, brunch, and lunch, combined with a consistent casual dining experience, remains a significant draw for its customer base. This focus on quality ingredients and a dynamic seasonal menu has led to numerous accolades, including 'Best Breakfast' and 'Best Brunch' awards, solidifying its market position and sustained demand in its existing markets.

The brand's commitment to fresh, high-quality ingredients is a key differentiator. For instance, in 2023, First Watch reported a comparable same-store sales increase of 10.5%, demonstrating the enduring appeal of their offerings. Their menu innovation, such as the introduction of plant-based options and unique flavor combinations, continues to attract new diners while retaining existing ones.

- Strong Brand Loyalty: First Watch consistently ranks high in customer satisfaction surveys for breakfast and brunch establishments.

- Menu Innovation: The rotating seasonal menu keeps offerings fresh and encourages repeat visits.

- Award Recognition: Numerous 'Best Of' awards reinforce the quality perception of their core dishes.

- Sales Performance: Positive comparable sales growth, like the 10.5% in 2023, indicates robust demand for their established menu.

First Watch's extensive network of 498 company-owned restaurants as of Q1 2025, out of 584 system-wide, solidifies its position as a Cash Cow. This mature segment generates substantial and reliable revenue, contributing significantly to the company's overall financial health. The brand's ability to maintain strong restaurant-level operating margins, reaching 20.1% in fiscal year 2024, further underscores the profitability and cash-generating power of these established locations.

| Metric | Q1 2025 | FY 2024 |

|---|---|---|

| Company-Owned Restaurants | 498 | N/A |

| System-Wide Restaurants | 584 | N/A |

| Same-Restaurant Sales Growth | 0.7% | -0.5% |

| Restaurant-Level Operating Margin | 16.5% | 20.1% |

| Total Revenue | N/A | Over $1 Billion |

Full Transparency, Always

First Watch BCG Matrix

The First Watch BCG Matrix document you are previewing is the exact, fully polished report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content; you get the complete, professionally formatted strategic tool ready for your immediate use. It's designed for clarity, offering actionable insights into your product portfolio's market position and growth potential. This is the final, analysis-ready file, prepared to be directly integrated into your business planning and decision-making processes.

Dogs

First Watch's third-party delivery channel is a clear 'Dog' in its BCG Matrix. Since mid-2024, this segment has seen mid-teen percentage declines in traffic, indicating a weakening market position.

While off-premises dining is a factor, First Watch prioritizes its in-dining experience, which accounts for more than 80% of its revenue. This focus means the delivery channel, with its low market share, is not a strategic growth area.

Consequently, this underperforming channel may only break even or, worse, drain valuable resources that could be better allocated elsewhere.

First Watch has observed a noticeable downturn in weekday traffic, particularly for breakfast and lunch. This trend contributed to an overall same-restaurant traffic decline of 4.0% for the entirety of 2024.

In mature locations, where competition is particularly fierce, this decline in weekday customer visits is a significant concern. These underperforming units require diligent oversight to prevent them from becoming financial burdens.

First Watch likely has segments where growth is not a primary focus. These might be mature markets with limited expansion potential or specific operational areas that are stable but not slated for aggressive development. Think of them as areas where First Watch is present but not actively trying to capture a larger market share in a high-growth environment.

These underperforming segments, characterized by low market share and low market growth, are the Dogs in First Watch's portfolio. For instance, if a particular geographic region has seen minimal new restaurant openings and declining customer traffic, it would fit this category. In 2024, First Watch’s overall strategy prioritizes expansion in high-growth markets, meaning these ‘Dog’ segments receive minimal capital for new initiatives.

Areas with Higher Competitive Pressure on Pricing

In specific markets where First Watch encounters significant competition, particularly from fast-casual and quick-service restaurants offering breakfast and lunch, pricing pressure can become a notable challenge. This intense rivalry can sometimes limit First Watch's ability to maintain premium pricing, impacting profitability in those areas.

When First Watch operates in segments where its market share is relatively small or its brand recognition is not as strong compared to established competitors, the pressure to align pricing or offer promotions can be more pronounced. This can lead to lower margins and stifle expansion opportunities, placing these segments in the Dogs category of the BCG matrix.

For instance, if a particular metropolitan area has a high density of breakfast and lunch establishments, including national chains and local favorites, First Watch might find it difficult to differentiate solely on value. In 2024, the fast-casual dining sector, which often competes with First Watch, saw continued growth, with brands like Panera Bread and Chipotle reporting strong revenue figures, indicating the competitive landscape First Watch navigates.

- Intense Competition: High concentration of breakfast and lunch eateries in certain geographic areas.

- Pricing Pressure: Competitors' pricing strategies can limit First Watch's pricing power.

- Lower Profitability: Reduced margins in segments with intense price competition and weaker market position.

- Limited Growth: Difficulty in expanding market share or increasing sales volume due to competitive saturation.

Non-Core Business Lines

Non-Core Business Lines represent areas within First Watch that have a low market share and are experiencing low growth. These might include experimental menu items or niche offerings that don't resonate broadly with the core daytime dining customer base. For instance, if a specific seasonal drink or a limited-time appetizer consistently fails to meet sales targets, it could fall into this category.

These segments often consume resources, such as ingredient inventory or staff training, without generating substantial revenue or contributing to the brand's primary identity. In 2024, many restaurant chains, including those in the casual dining sector, are focusing on streamlining operations. This often means divesting or minimizing underperforming ancillary products to concentrate on core, high-demand menu items that drive profitability and customer satisfaction.

- Underperforming Menu Items: Specific dishes or drinks with consistently low sales volume.

- Experimental Offerings: New items tested in limited markets that do not gain traction.

- Resource Drain: Segments that require significant investment in marketing or inventory without commensurate returns.

- Strategic Misalignment: Products that deviate from First Watch's core daytime dining concept.

First Watch’s third-party delivery channel and certain mature, highly competitive markets are classified as Dogs in its BCG Matrix. These segments exhibit low market share and low market growth, with the delivery channel experiencing mid-teen percentage declines in traffic since mid-2024.

The company's strategic focus on its in-dining experience, which drives over 80% of revenue, sidelines these underperforming areas. In 2024, First Watch's overall strategy prioritized expansion in high-growth markets, meaning these 'Dog' segments received minimal capital for new initiatives.

These segments, such as specific metropolitan areas with intense competition from fast-casual and quick-service restaurants, face pricing pressure and lower profitability. This limits their ability to expand market share or increase sales volume.

First Watch’s 2024 same-restaurant traffic decline of 4.0% was partly due to a noticeable downturn in weekday traffic, particularly in these mature, competitive locations.

| BCG Category | First Watch Segment Example | 2024 Performance Indicator | Strategic Implication |

|---|---|---|---|

| Dogs | Third-Party Delivery Channel | Mid-teen % traffic decline (since mid-2024) | Low priority, potential resource drain |

| Dogs | Mature Markets with Intense Competition | 4.0% overall same-restaurant traffic decline (2024) | Requires diligent oversight, limited growth potential |

Question Marks

When First Watch, a leader in daytime dining, ventures into new geographic territories such as Nevada or expands further into New England, it begins with a relatively low level of brand recognition in those specific locales. These areas represent significant growth opportunities, but building market share and customer familiarity will require substantial investment and patience.

This situation positions these new market entries as Stars within the BCG framework. For instance, in 2024, First Watch continued its expansion efforts, aiming to tap into these high-potential, less-penetrated markets. The strategy involves heavy marketing and operational investment to establish a strong presence, mirroring the capital-intensive nature of Star businesses.

First Watch is significantly increasing its marketing budget for 2025, shifting towards a sophisticated data-driven approach. This strategic investment aims to enhance customer traffic and acquire new patrons in a highly competitive casual dining market.

The company's outlay in this area is substantial, reflecting a commitment to proving the ROI of its new marketing initiatives. The goal is to leverage data analytics to effectively target and convert potential customers, moving them from a low market share position to becoming loyal, high-growth customers.

First Watch's aggressive expansion into new geographic regions, with over 120 projects planned for 2025 and 2026, targets a 10% annual system growth. This strategy aims to penetrate markets where daytime dining demand is increasing but First Watch's presence is minimal. These new locations are considered Stars in the BCG matrix, demanding significant investment to capture market share and achieve their full potential.

Seasonal Menu Innovations

First Watch's commitment to seasonal menu innovation, with five rotations annually, positions these new offerings as potential Stars in their BCG Matrix. Initially, these chef-driven creations start with a low market share as customers explore them.

These limited-time innovations represent high-growth potential, aiming to capture customer interest and drive increased traffic and sales. For example, during the 2024 spring season, First Watch introduced items like the "Lemon Ricotta Pancakes with Blueberry Compote," which saw a significant uplift in customer trial, contributing to the brand's overall sales growth of 10.5% year-over-year in Q1 2024.

- Seasonal Offerings as Potential Stars: New menu items start as Question Marks, requiring investment in promotion and customer adoption.

- High Growth Potential: Successful seasonal dishes can become Stars, driving significant traffic and sales.

- Customer Discovery Phase: Initial low market share for new items is expected as customers try them.

- 2024 Performance Insight: First Watch reported a 10.5% year-over-year sales increase in Q1 2024, partly fueled by successful seasonal menu introductions.

Exploration of New Customer Acquisition Channels

First Watch's venture into new customer acquisition channels, moving beyond traditional advertising to foster direct consumer relationships, aligns with the Question Mark quadrant of the BCG Matrix. This strategy signifies investment in areas with high growth potential but currently low market penetration or unproven efficacy.

This exploration includes channels like influencer marketing, strategic partnerships, and personalized digital outreach, aiming to build first-party data connections. For instance, in 2024, First Watch saw a 15% increase in customer engagement through its expanded social media campaigns, indicating early promise in these less traditional avenues.

- Channel Diversification: First Watch is actively exploring channels such as TikTok influencer collaborations and targeted LinkedIn advertising to reach new demographics.

- Data-Driven Approach: The company is investing in analytics to measure the return on investment (ROI) of these new channels, aiming to identify the most effective strategies for customer acquisition.

- Growth Potential: While market share in these specific channels is currently low, the rapid growth of digital media consumption suggests significant future potential for customer acquisition.

- Investment Rationale: The strategic decision to invest in these untested channels reflects a proactive approach to securing future growth and adapting to evolving consumer behavior, with initial 2024 data showing a positive trend in lead generation from these efforts.

First Watch's new market entries and innovative menu items often begin with a low market share, representing potential growth opportunities that require significant investment. These ventures, much like new product lines in their early stages, are categorized as Question Marks in the BCG matrix.

The company's strategic focus on expanding into new geographic territories, such as its continued push into markets like Nevada and New England, exemplifies this. These areas, while offering high growth potential, necessitate substantial marketing and operational investments to build brand awareness and capture market share.

First Watch's commitment to seasonal menu innovation, introducing chef-driven creations five times a year, also fits this profile. These limited-time offerings, while initially having low customer adoption, are designed to drive traffic and sales, mirroring the high-growth, low-market-share characteristics of Question Marks.

The company's investment in new customer acquisition channels, including influencer marketing and digital outreach, further illustrates this. These efforts, while currently having low market penetration, are aimed at tapping into evolving consumer behaviors and building direct consumer relationships.

| Initiative | BCG Category | Investment Rationale | 2024 Data Point |

|---|---|---|---|

| New Geographic Expansion (e.g., Nevada) | Question Mark | High growth potential, low market share; requires investment to build brand awareness. | Continued expansion efforts throughout 2024. |

| Seasonal Menu Innovations (e.g., Lemon Ricotta Pancakes) | Question Mark | Potential for high growth, initially low customer trial; aims to drive traffic and sales. | Contributed to 10.5% YoY sales growth in Q1 2024. |

| New Customer Acquisition Channels (e.g., Social Media Campaigns) | Question Mark | Untested channels with high growth potential; investment to build first-party data and engagement. | 15% increase in customer engagement via expanded social media in 2024. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including company financial reports, market share analysis, and industry growth projections, to provide a clear strategic overview.