First Watch Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Watch Bundle

Unlock the strategic blueprint behind First Watch's thriving breakfast, brunch, and lunch model. This comprehensive Business Model Canvas delves into their unique value proposition, customer relationships, and revenue streams, offering a clear roadmap to their success.

Discover how First Watch effectively manages its key resources and activities to deliver exceptional customer experiences and maintain a competitive edge. This detailed canvas is your key to understanding their operational excellence and market positioning.

Ready to gain a competitive advantage? Download the full First Watch Business Model Canvas to analyze their cost structure, revenue streams, and key partnerships, and apply these insights to your own business strategy.

Partnerships

First Watch cultivates strategic partnerships with food suppliers to guarantee a steady stream of fresh, high-quality ingredients. These relationships are vital for their made-to-order menu, particularly their focus on healthy and seasonal offerings. For example, in 2024, First Watch continued to emphasize sourcing from local and regional suppliers for produce, eggs, and meats, aiming to bolster freshness and community ties.

First Watch relies on its franchise partners as a crucial element of its growth strategy, allowing for rapid expansion and increased brand visibility across diverse markets. These partnerships are vital for penetrating new territories and establishing a strong presence in numerous states.

In 2023, First Watch reported that its franchise partners operated 171 of its total 518 restaurants, highlighting the significant role franchising plays in its overall footprint. The company carefully selects franchisees who demonstrate a commitment to its core values and operational excellence.

Furthermore, First Watch actively engages in acquiring franchised locations to bolster corporate ownership and secure growth opportunities. This strategic approach ensures greater control over brand standards and facilitates more efficient expansion initiatives.

First Watch's success hinges on strategic alliances with technology providers. These partnerships are crucial for integrating sophisticated point-of-sale (POS) systems, streamlining online ordering platforms, and implementing efficient waitlist management software. For instance, in 2024, many restaurants saw significant improvements in order accuracy and speed by adopting cloud-based POS solutions, with some reporting up to a 15% reduction in order errors.

Furthermore, collaborations with technology firms enable the deployment of advanced customer relationship management (CRM) tools, potentially incorporating AI for personalized loyalty programs and targeted marketing. This focus on technology allows First Watch to not only enhance operational efficiency but also to create a more engaging and seamless experience for its patrons, driving repeat business and customer satisfaction.

Delivery Service Platforms

First Watch’s reliance on delivery service platforms is a strategic move to broaden its customer base beyond its physical locations, especially given its focus on breakfast, brunch, and lunch. These partnerships are essential for tapping into the growing demand for convenient, off-premise dining options. For instance, in 2024, the demand for food delivery continued its upward trajectory, with industry reports indicating sustained growth in this sector, directly benefiting restaurants that leverage these services.

By integrating with major third-party delivery providers, First Watch can offer its signature daytime menu to a wider audience, including those who prefer to dine at home or in the office. This accessibility is key to capturing market share in a competitive casual dining landscape. While these collaborations incur fees that can affect profit margins, the increased sales volume and customer acquisition often outweigh these costs, particularly as consumer habits increasingly favor digital ordering and delivery, a trend that remained strong through 2024.

- Expanded Reach: Delivery platforms allow First Watch to serve customers who may not visit their physical restaurants, significantly increasing potential revenue streams.

- Convenience for Customers: Partnerships cater to the modern consumer’s desire for easy access to meals, supporting First Watch’s casual, daytime dining model.

- Revenue Growth Driver: Despite commission fees, these services are critical for driving overall sales volume and maintaining competitiveness in the evolving food service industry.

Community and Local Organizations

First Watch cultivates strong ties with community and local organizations, often channeling support through initiatives like donating a portion of kids' meal sales. For instance, in 2023, many First Watch locations participated in campaigns benefiting local schools and children's charities, reinforcing their commitment to neighborhood well-being.

These strategic alliances are instrumental in bolstering brand reputation and cultivating invaluable community goodwill. By actively participating in local events and supporting causes, First Watch aligns its operations with its core values of quality, exceptional hospitality, and genuine community engagement.

Such collaborations also serve to bolster local sourcing efforts, as seen in partnerships with regional farms for fresh produce, contributing to a positive and authentic brand image. This approach not only supports the local economy but also resonates with consumers increasingly prioritizing businesses with a local connection.

- Community Engagement: First Watch donates a portion of kids' meal sales to local organizations, fostering goodwill.

- Brand Reputation: Partnerships enhance brand image and align with quality and hospitality values.

- Local Sourcing: Collaborations can support local suppliers, strengthening community ties.

- Positive Image: Community involvement contributes to a favorable perception among customers.

First Watch's key partnerships extend to its franchise network, a vital component for its expansion. In 2023, franchisees operated 171 of its 518 restaurants, showcasing the significant role they play in market penetration and brand visibility. The company also collaborates with technology providers for POS systems and online ordering, aiming to improve efficiency and customer experience, with some reporting up to a 15% reduction in order errors in 2024 due to cloud-based solutions.

| Partner Type | Role | 2023/2024 Impact/Data |

|---|---|---|

| Franchisees | Market expansion, increased brand presence | Operated 171 of 518 restaurants in 2023 |

| Technology Providers | POS, online ordering, waitlist management | Cloud-based POS adoption led to ~15% order error reduction in 2024 |

| Delivery Platforms | Expanded customer reach, off-premise dining | Sustained industry growth in delivery demand in 2024 |

| Local Suppliers | Fresh, high-quality ingredients, community ties | Continued emphasis on local sourcing for produce, eggs, and meats in 2024 |

| Community Organizations | Brand reputation, community goodwill | Donations to local schools and children's charities in 2023 |

What is included in the product

A detailed breakdown of First Watch's operations, outlining their customer segments, value propositions, and revenue streams.

This model highlights First Watch's focus on fresh, healthy breakfast and lunch options, and their strategy for reaching and retaining health-conscious diners.

Simplifies complex business strategies into a clear, actionable framework, alleviating the pain of understanding and communicating organizational direction.

Activities

First Watch's core activity revolves around a dynamic menu development process. They introduce new dishes and seasonal ingredients five times annually, ensuring variety and capitalizing on current food trends. This commitment to innovation is backed by significant culinary research and extensive testing.

The company dedicates considerable resources to culinary exploration, including 'flavor tours,' to identify emerging tastes and ingredients. This proactive approach allows them to stay ahead of consumer preferences and maintain a fresh, appealing menu. The 18-month development cycle for their seasonal menus underscores a deep investment in quality and thoughtful execution.

Efficiently managing daily restaurant operations is paramount for First Watch, covering food preparation, service, cleanliness, and inventory. This ensures consistent quality, prompt service, and a positive customer experience. In 2024, First Watch continued to emphasize operational excellence, focusing on labor efficiency and reducing ticket times to enhance throughput.

First Watch's core activities revolve around meticulously managing its supply chain to procure fresh, high-quality ingredients. This involves a rigorous supplier selection process and a commitment to the 'Follow the Sun' philosophy, ensuring ingredients are sourced at their peak freshness.

This strategic sourcing directly impacts menu quality and is vital for controlling food costs. For instance, in 2023, First Watch reported that approximately 70% of their menu items utilized ingredients sourced from their extensive network of trusted suppliers, highlighting the centrality of this activity.

New Restaurant Development and Expansion

First Watch is aggressively expanding its footprint, focusing on both company-owned and franchised locations. This key activity involves meticulous site selection, efficient construction processes, and ensuring a successful grand opening for each new restaurant. The company has a clear vision for substantial unit growth, aiming to bring its unique breakfast, brunch, and lunch offerings to more communities.

The company's development pipeline remains strong, consistently delivering new restaurant openings that often surpass internal projections. For instance, in 2023, First Watch opened 41 new restaurants, a testament to their effective expansion strategy. This growth is geographically diverse, with new locations opening across various states, further solidifying their market presence.

- Aggressive Unit Growth: First Watch is committed to opening a significant number of new restaurants annually, both company-operated and franchised.

- Strategic Site Selection: Identifying prime locations with high consumer demand is crucial for the success of new restaurant developments.

- Efficient Construction and Launch: Streamlining the build-out and launch phases ensures new restaurants are operational and contributing to revenue quickly.

- Robust Development Pipeline: A consistent flow of new openings, often exceeding expectations, demonstrates the company's capacity for sustained expansion.

Franchise Management and Support

First Watch actively manages its franchise network through development, ongoing support, and rigorous oversight. This ensures all franchised locations consistently uphold brand standards and deliver the expected customer experience.

The company is strategically buying back franchised locations. This move aims to consolidate ownership and control growth opportunities, as seen in their ongoing franchise acquisitions.

- Franchise Development: First Watch actively seeks and vets potential franchise partners to expand its brand presence.

- Operational Support: The company provides comprehensive training, marketing assistance, and ongoing operational guidance to its franchisees.

- Brand Standard Enforcement: Regular audits and quality checks are conducted to ensure all franchised locations meet First Watch's high standards for food quality, service, and ambiance.

- Strategic Acquisitions: First Watch has been strategically acquiring franchised units to gain greater control over its expansion and brand image. For example, in 2023, they continued to acquire franchised locations, integrating them into their corporate-owned portfolio.

First Watch's key activities are centered on its innovative menu development, ensuring a fresh and appealing dining experience. This is supported by rigorous supply chain management for high-quality ingredients and aggressive unit growth through strategic expansion. Additionally, the company actively manages its franchise relationships, including strategic acquisitions of franchised locations to bolster corporate control and optimize growth.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Menu Innovation | Introducing new dishes and seasonal ingredients | 5 annual menu introductions; 18-month development cycle |

| Supply Chain Management | Sourcing fresh, high-quality ingredients | ~70% of menu items use sourced ingredients |

| Unit Growth | Expanding restaurant footprint | Opened 41 new restaurants in 2023 |

| Franchise Management | Supporting and acquiring franchised locations | Continued acquisition of franchised units in 2023 |

Preview Before You Purchase

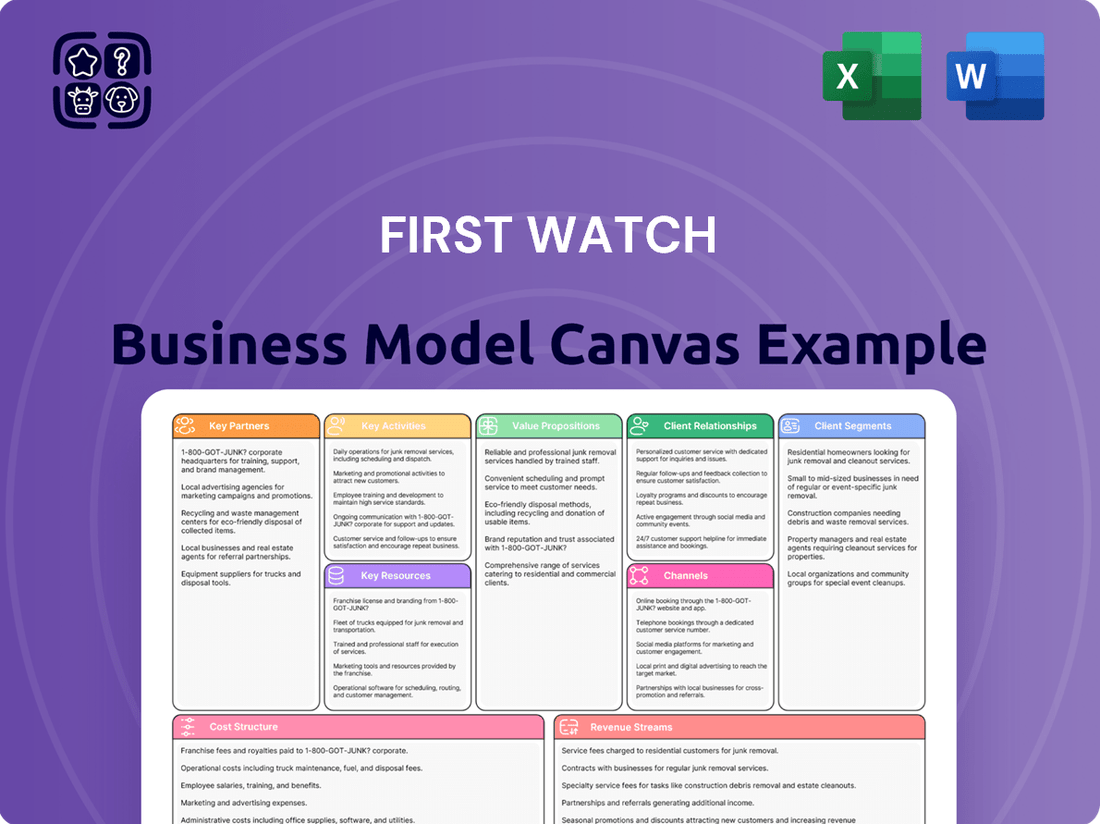

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, identical to what you see here, allowing you to immediately begin your strategic planning.

Resources

First Watch’s culinary expertise, embodied by its chef-driven menu development, is a core asset. This intellectual capital fuels the creation of fresh, made-to-order dishes, often incorporating seasonal ingredients. This focus on quality and innovation allows them to stand out.

The brand’s commitment to a chef-driven approach is evident in its constantly evolving menu. For instance, their seasonal specials, like the fall 2024 offerings, showcase this dedication to culinary creativity and fresh ingredients, a key differentiator in the competitive breakfast and brunch market.

First Watch's robust brand reputation, cultivated through a steadfast dedication to fresh ingredients, superior quality, and welcoming hospitality, stands as a vital intangible asset.

Recognition like being named a Most Loved Workplace and achieving the top spot for restaurant brands on Yelp in 2023 solidifies this positive public perception and trust.

This strong reputation directly translates into high customer loyalty, encouraging repeat business and acting as a powerful magnet for attracting new customers within the competitive casual dining landscape.

First Watch's extensive network of over 580 physical restaurant locations is a cornerstone of its business model. These restaurants, equipped with kitchens and dining areas, are the primary assets for delivering their unique breakfast, brunch, and lunch experience.

The physical infrastructure, including all operational elements within these numerous sites, is crucial for serving customers. This widespread presence allows First Watch to reach a broad customer base across multiple states.

The company's commitment to growth is evident in its ongoing expansion, with new restaurant openings continuing to bolster this vital physical resource. This expansion strategy directly leverages and enhances their established infrastructure.

Skilled Employees and Management Team

First Watch's success hinges on its dedicated and well-trained employees, encompassing kitchen staff, front-of-house teams, and corporate management. This skilled workforce is crucial for executing the brand's signature made-to-order approach and ensuring exceptional customer service, directly influencing brand perception and repeat business.

The company actively invests in employee experience and labor efficiency, recognizing that a motivated team is a productive team. This focus on internal development and operational streamlining helps maintain high standards across all locations.

- Employee Training: First Watch emphasizes comprehensive training programs to ensure all staff are proficient in food preparation, service standards, and brand values.

- Labor Efficiency: Strategies are in place to optimize staffing levels and workflows, aiming to maximize productivity while maintaining service quality.

- Employee Retention: By fostering a positive work environment and offering growth opportunities, First Watch seeks to retain its valuable talent pool.

Proprietary Recipes and Operational Processes

First Watch's proprietary recipes are the heart of its distinctive menu, featuring popular items like the "Wholesome Start" breakfast bowl and the "Farmhouse Hash." These unique culinary creations are a significant competitive advantage.

Beyond recipes, their established operational processes and systems for food preparation and service are crucial. These systems ensure a consistent customer experience across all of First Watch's nearly 500 locations, a key factor in brand loyalty.

The company's meticulous menu development process, which often involves extensive testing and refinement, underscores the value placed on these proprietary resources. For instance, in 2023, First Watch introduced several new seasonal menu items, a process that relies heavily on their established recipe and operational frameworks.

- Proprietary Recipes: Unique and carefully developed dishes that form the core of First Watch's appeal.

- Operational Excellence: Standardized processes for food preparation, service, and quality control across all units.

- Brand Consistency: These resources ensure that customers receive the same high-quality experience regardless of location.

- Menu Innovation: The foundation for introducing new and popular seasonal offerings, driving customer engagement.

First Watch's key resources include its chef-driven culinary expertise, evident in a constantly evolving menu featuring seasonal specials, and its strong brand reputation, bolstered by accolades like being named a Most Loved Workplace. The company's extensive network of over 580 physical restaurant locations forms the backbone of its service delivery, supported by a dedicated and well-trained workforce. Crucially, proprietary recipes and standardized operational systems ensure brand consistency and enable menu innovation, driving customer loyalty and a competitive edge.

Value Propositions

First Watch's core promise revolves around delivering fresh, made-to-order meals for breakfast, brunch, and lunch. This dedication to preparing food from scratch using quality ingredients sets them apart from establishments that might use more pre-prepared components.

This emphasis on freshness resonates strongly with a growing segment of consumers prioritizing health and a superior dining experience. In 2024, the demand for fresh, minimally processed foods continued to climb, with surveys indicating over 70% of consumers actively seeking out restaurants that highlight fresh ingredients.

First Watch's menu is a cornerstone of its value proposition, focusing on healthy and seasonal options. They rotate their menu five times annually, ensuring guests experience a fresh variety of dishes and flavors throughout the year.

This commitment to seasonal ingredients allows First Watch to highlight the freshest produce and cater to evolving consumer tastes for nutritious and flavorful meals. Their popular fresh juices and limited-time seasonal specials exemplify this approach, drawing customers seeking wholesome and exciting culinary experiences.

First Watch cultivates a casual and welcoming dining experience, making it a go-to spot for those seeking a relaxed meal. Their focus on daytime dining, from breakfast to lunch, fosters a comfortable atmosphere perfect for everything from catching up with friends to informal business meetings. In 2024, First Watch continued to emphasize this approachable vibe, a key element in attracting and retaining its customer base.

Award-Winning and Highly Rated Brand

First Watch's reputation as an award-winning and highly rated brand is a significant value proposition. The company has been recognized as a 'Most Loved Workplace,' underscoring its positive internal culture and employee satisfaction.

Furthermore, its consistent high rankings on platforms like Yelp, often placing it among the top restaurant brands, directly reflect customer appreciation for its offerings. This external validation speaks volumes about the quality of First Watch's food, the attentiveness of its service, and the overall dining experience it provides.

Such accolades serve as powerful trust signals for consumers. They attract new patrons who are actively seeking out proven and popular dining destinations, thereby expanding the customer base and driving revenue growth. For instance, in 2024, First Watch continued to be a favored choice, with many locations receiving consistent 4.5-star ratings or higher on review sites.

- Most Loved Workplace: Demonstrates strong employee satisfaction and a positive company culture.

- Top Restaurant Brand on Yelp: Indicates high customer satisfaction and positive dining experiences.

- Validation of Quality: Awards and ratings confirm excellence in food, service, and overall atmosphere.

- Customer Attraction: Builds trust and draws in new customers seeking reputable dining options.

Convenience through Daytime Hours and Digital Access

First Watch's commitment to daytime-only hours, typically from 7:00 AM to 2:30 PM, directly addresses the convenience factor for a significant segment of the dining population. This focused operating window caters to those seeking breakfast, brunch, and lunch options without the evening meal commitment. In 2024, this strategy continued to resonate, with many consumers prioritizing flexible dining times that fit their work and personal schedules.

Further enhancing this convenience is First Watch's robust digital access. The integration of online ordering for pickup and delivery through their own digital platforms and third-party apps significantly broadens their reach. This digital-first approach in 2024 allowed customers to easily access their favorite meals from anywhere, solidifying First Watch's position as a convenient choice for modern diners.

- Daytime Focus: Operating exclusively for breakfast, brunch, and lunch appeals to a broad customer base seeking convenient daytime dining options.

- Digital Accessibility: Online ordering for pickup and delivery via digital channels offers unparalleled convenience and expands service reach.

- Market Demand: In 2024, consumer trends indicated a strong preference for flexible and accessible meal solutions, aligning perfectly with First Watch's model.

First Watch's value proposition centers on its commitment to fresh, made-to-order breakfast, brunch, and lunch. They prioritize quality ingredients and scratch preparation, a key differentiator in the fast-casual market. This focus on freshness aligns with the growing consumer demand for healthier, minimally processed food options, a trend that remained strong throughout 2024.

The brand's menu innovation, featuring seasonal ingredients and five annual menu rotations, keeps offerings exciting and caters to evolving tastes. This strategy, coupled with their popular fresh juices and limited-time specials, appeals to diners seeking both wholesome and novel culinary experiences.

First Watch offers a relaxed, daytime-only dining atmosphere, making it an ideal spot for casual meals and informal meetings. Their operational hours, typically 7:00 AM to 2:30 PM, cater to a broad audience prioritizing convenience. In 2024, this daytime focus continued to be a significant draw, meeting consumer needs for flexible dining schedules.

The company's strong reputation, evidenced by awards like "Most Loved Workplace" and consistent high ratings on platforms like Yelp, builds significant trust. These accolades validate the quality of their food and service, attracting new customers seeking proven and popular dining destinations. In 2024, many First Watch locations maintained average ratings of 4.5 stars or higher.

First Watch's digital accessibility, including online ordering for pickup and delivery, further enhances its convenience factor. This digital-first approach in 2024 allowed customers to easily access their meals, solidifying its appeal to modern diners.

| Value Proposition Aspect | Key Benefit | 2024 Relevance |

|---|---|---|

| Fresh, Made-to-Order Meals | Healthier, higher quality dining experience | Continued strong consumer preference for fresh ingredients |

| Seasonal Menu & Innovation | Variety, exciting flavors, caters to evolving tastes | Diners actively seek novel and seasonal offerings |

| Daytime-Only Hours | Convenience, aligns with work/life schedules | Growing demand for flexible dining times |

| Strong Brand Reputation & Awards | Trust, validation of quality, customer attraction | High ratings (e.g., 4.5+ stars) drive new customer acquisition |

| Digital Ordering & Delivery | Accessibility, convenience, expanded reach | Essential for meeting modern consumer expectations |

Customer Relationships

First Watch cultivates strong customer relationships through a commitment to personalized and attentive service, aiming to create a consistently welcoming environment for every guest. This approach is designed to boost customer experience scores, a key metric for the company's success.

To further foster loyalty, First Watch empowers its restaurant managers with the authority to offer 'surprise and delight' giveaways. This initiative directly contributes to a sense of appreciation among patrons, encouraging repeat business and positive word-of-mouth referrals.

First Watch cultivates customer loyalty primarily through its exceptional dining experience and consistent quality, encouraging repeat business even without a formally advertised loyalty program. This approach is evident in their strong customer retention rates, a key indicator of loyalty.

Looking ahead, First Watch could significantly deepen customer engagement by adopting AI-driven personalization within loyalty initiatives. Imagine tailored offers and communications based on individual preferences, a strategy that has proven effective for many brands in the quick-service and casual dining sectors, potentially boosting same-store sales growth, which stood at 5.1% in the first quarter of 2024.

First Watch strengthens customer loyalty through robust community engagement and a commitment to social responsibility, embodying their 'You First culture'.

In 2024, their initiatives included donating a portion of kids' meal sales to local charities, directly impacting communities and resonating with socially conscious consumers.

This focus on giving back not only builds goodwill but also creates a tangible connection, demonstrating that First Watch values more than just transactions.

Direct Feedback and Communication Channels

First Watch prioritizes direct customer feedback through various channels. This includes in-restaurant interactions and digital platforms like their website and social media. By maintaining these open communication lines, First Watch can effectively gauge customer sentiment and identify areas for improvement.

This continuous feedback loop allows First Watch to promptly address any customer concerns and gather valuable insights. These insights are instrumental in their ongoing efforts to refine their menu, service, and overall dining experience. For example, in 2024, customer feedback directly influenced the introduction of several new plant-based menu options, which saw a significant uptake.

- In-Restaurant Feedback: Staff are trained to actively solicit and record customer comments.

- Digital Channels: Online surveys and social media monitoring provide broad feedback reach.

- Data Analysis: Feedback data is analyzed to identify trends and inform operational changes.

- Service Enhancement: Insights from feedback directly contribute to staff training and service protocols.

Looking ahead to 2025, First Watch plans to further enhance its customer-facing technologies. These advancements will streamline feedback collection and enable more personalized communication, further strengthening their customer relationships. This focus on technology aims to make it even easier for customers to share their thoughts and for First Watch to act on them.

Consistent Quality and Experience

A cornerstone of First Watch's customer relationships is the unwavering commitment to consistent quality in both food and service across its entire restaurant portfolio. This predictability is crucial for fostering customer loyalty, as patrons can confidently anticipate a reliable and enjoyable dining experience every time they visit.

First Watch's operational excellence is meticulously designed to uphold this brand promise of consistency. For instance, in 2023, First Watch reported systemwide sales of $1.9 billion, reflecting the broad appeal and trust built through their consistent delivery.

- Consistent Quality: Ensures a dependable dining experience, fostering trust and repeat visits.

- Operational Acuity: Drives the consistent delivery of food and service standards across all locations.

- Brand Reliability: Customers know what to expect, reinforcing positive brand perception.

- Customer Loyalty: Built on the foundation of predictable, high-quality experiences.

First Watch builds strong customer relationships through personalized service and community engagement, fostering loyalty without a formal program. They actively solicit feedback via in-restaurant interactions and digital channels, using insights to refine their offerings. Their commitment to consistent quality, evident in their 2023 systemwide sales of $1.9 billion, ensures a reliable and enjoyable experience, driving repeat business and brand trust.

Channels

First Watch's primary channel is its extensive network of physical restaurant locations. These are where customers enjoy the full dine-in breakfast, brunch, and lunch experience. As of early 2024, First Watch operates over 580 restaurants strategically placed across 31 states, making these brick-and-mortar establishments the core of their customer interaction and brand visibility.

First Watch leverages its website and a mobile app for online ordering, facilitating easy pickup at any of its locations. This channel is designed for customers prioritizing speed and convenience, offering a streamlined way to get their favorite breakfast and brunch items without the need to dine in.

In 2023, the restaurant industry saw a significant surge in off-premise dining, with digital orders accounting for a substantial portion of revenue for many brands. First Watch’s investment in its online platform directly addresses this trend, aiming to capture a larger share of this growing market segment.

First Watch partners with major third-party delivery platforms like DoorDash and Grubhub. This strategic alliance significantly broadens their customer reach, allowing them to serve individuals who prefer dining at home or in their offices. In 2024, the food delivery market continued its robust growth, with third-party platforms playing a crucial role in restaurant expansion.

Company Website and Social Media

First Watch leverages its company website as a central hub for comprehensive information, offering customers access to menus, restaurant locations, and crucial investor relations data. This digital presence is vital for transparency and accessibility.

Social media channels are actively utilized by First Watch for robust marketing campaigns, fostering brand loyalty, and enabling direct interaction with its customer base. These platforms are instrumental in highlighting new seasonal offerings and special promotions, driving engagement and foot traffic.

In 2023, First Watch reported a significant increase in digital engagement, with website traffic growing by approximately 15% year-over-year, and social media interactions seeing a similar upward trend. This digital focus directly supports their business model by driving awareness and customer acquisition.

- Website: Primary source for menus, locations, and investor information.

- Social Media: Used for marketing, brand building, and customer engagement.

- Digital Engagement: Website traffic increased 15% in 2023, indicating strong online presence.

Marketing and Advertising Campaigns

First Watch employs targeted marketing and advertising to connect with both new and existing patrons. These campaigns highlight the brand's core values and its rotating seasonal menus, ensuring customers are aware of fresh offerings.

Digital marketing plays a significant role, with campaigns designed to boost brand recognition. This is especially crucial in areas where First Watch has a strong presence and faces considerable competition.

- Digital Focus: First Watch invests in digital channels to reach a broad audience and drive traffic to their locations.

- Seasonal Promotions: Marketing efforts often center around seasonal menu changes, creating buzz and encouraging repeat visits.

- Brand Awareness: Campaigns aim to elevate the First Watch brand, emphasizing its unique position in the breakfast, brunch, and lunch market.

- Market Penetration: In high-density restaurant markets, advertising is intensified to capture a larger share of the customer base.

First Watch utilizes a multi-channel approach to reach its customers, blending physical presence with robust digital engagement. The company's website serves as a key informational hub, while social media actively drives brand awareness and customer interaction. These digital efforts are supported by targeted marketing campaigns, particularly crucial for promoting seasonal menu changes and increasing market penetration.

| Channel | Description | Key Metrics/Data (as of early 2024) |

|---|---|---|

| Physical Restaurants | Dine-in experience, core brand interaction | Over 580 locations across 31 states |

| Website & Mobile App | Online ordering, menus, locations, investor info | Website traffic increased 15% YoY in 2023 |

| Third-Party Delivery | Expanded reach via platforms like DoorDash, Grubhub | Continued robust growth in food delivery market |

| Social Media | Marketing, brand loyalty, customer engagement | Similar upward trend in social media interactions as website traffic |

Customer Segments

Health-Conscious Diners are a core customer group for First Watch. They actively seek out restaurants that prioritize fresh, wholesome, and often organic ingredients. This segment is drawn to First Watch's commitment to made-from-scratch cooking and its use of seasonal produce, which aligns perfectly with their desire for nutritious meals.

Offerings like First Watch's vibrant fresh juices and protein-packed power bowls are specifically designed to meet the dietary preferences of these health-focused individuals. For instance, their commitment to fresh ingredients is evident in their 2024 reporting, where they highlighted a significant portion of their produce sourced locally, reinforcing their appeal to this discerning demographic.

First Watch's commitment to a relaxed, casual dining atmosphere, coupled with its focus on breakfast, brunch, and lunch, strongly appeals to families and casual diners. This segment appreciates the unhurried environment perfect for weekend outings or mid-day meals. For instance, in 2023, First Watch reported strong performance, with same-store sales growth indicating a healthy customer base that includes these everyday dining groups.

First Watch actively courts brunch enthusiasts, a segment that values both elevated classic dishes and innovative seasonal specials. This focus is evident in their menu, which consistently features creative takes on breakfast and lunch favorites. For instance, their seasonal menus, like the popular Summer menu introduced in 2024, often highlight unique ingredient combinations that appeal to those seeking a fresh brunch experience.

The brand further strengthens its appeal to this demographic through a robust brunch cocktail program. Offering options like the "Farm Stand" Bloody Mary and various mimosas, First Watch positions itself as a destination for those who view brunch as a social occasion, often involving celebratory beverages. This strategy directly addresses the desire for a complete, enjoyable brunch outing.

Working Professionals and Business Lunchers

First Watch's daytime operating model is a significant draw for working professionals and those needing a convenient spot for business lunches. The emphasis on fresh, quality ingredients served efficiently caters to individuals with tight schedules, ensuring they can enjoy a satisfying meal without sacrificing productivity.

This segment values the ability to conduct informal business meetings in a relaxed yet professional atmosphere. First Watch's bright and airy environment, coupled with its menu of health-conscious and flavorful options, makes it an ideal choice for these occasions.

- Daytime Focus: Caters to lunch breaks and early afternoon meetings.

- Efficient Service: Meets the needs of busy professionals with limited time.

- Fresh & Healthy Options: Appeals to those seeking quality and nutritious meals.

- Business Meeting Venue: Provides a suitable atmosphere for informal professional gatherings.

Franchise Investors and Entrepreneurs

First Watch also actively courts franchise investors and entrepreneurs who are looking to own and operate their own restaurant locations. This segment is vital for First Watch's growth, as these individuals bring capital and operational expertise to expand the brand's footprint. Prospective franchisees must meet specific financial requirements, demonstrating a commitment to the brand's values and operational standards.

In 2024, the franchise model continues to be a significant driver for restaurant chains. For instance, the International Franchise Association reported that franchise businesses are projected to contribute over $800 billion to the U.S. economy in 2024, highlighting the sector's economic importance. First Watch's franchise partners are expected to have a net worth of at least $500,000, with $250,000 in liquid assets, underscoring the financial commitment involved.

- Franchise Investor Profile: Individuals or groups seeking to own and operate a First Watch restaurant.

- Expansion Strategy: This segment is key to First Watch's national and potentially international growth plans.

- Financial Requirements: Franchisees must meet certain net worth and liquidity thresholds, typically around $500,000 net worth and $250,000 in liquid assets as of recent franchise disclosure documents.

- Brand Alignment: A shared vision and commitment to First Watch's unique breakfast, brunch, and lunch concept are essential for successful partnerships.

First Watch's customer base is diverse, encompassing health-conscious individuals, families, and brunch aficionados. The brand's commitment to fresh, made-from-scratch ingredients and its daytime-only operating model appeal to a broad spectrum of diners seeking quality and convenience.

Working professionals also form a significant segment, utilizing First Watch for business lunches and informal meetings. Furthermore, franchise investors are crucial for the brand's expansion, bringing capital and operational expertise to new markets.

| Customer Segment | Key Characteristics | Value Proposition |

|---|---|---|

| Health-Conscious Diners | Seek fresh, wholesome, often organic ingredients; appreciate made-from-scratch cooking. | Nutritious meals, vibrant juices, power bowls, and commitment to seasonal produce. |

| Families & Casual Diners | Appreciate relaxed atmosphere, unhurried dining for weekend outings or mid-day meals. | Comfortable environment, diverse menu appealing to various tastes, strong same-store sales growth in 2023. |

| Brunch Enthusiasts | Value elevated classics and innovative seasonal specials; view brunch as a social occasion. | Creative menu items, robust brunch cocktail program, destination for enjoyable brunch experiences. |

| Working Professionals | Need convenient, quality meals for lunch breaks and business meetings; appreciate efficiency. | Fresh, healthy options served efficiently in a bright, professional atmosphere. |

| Franchise Investors | Seek to own and operate restaurant locations; possess capital and operational expertise. | Opportunity for brand expansion, financial investment in a growing concept, with typical net worth requirements of $500,000. |

Cost Structure

Food and beverage ingredients represent a substantial part of First Watch's expenses, reflecting their focus on fresh, made-to-order, and seasonal menu offerings. For instance, in 2024, the cost of key commodities like eggs, bacon, and coffee saw continued volatility, directly influencing their overall food costs.

Labor expenses are a significant component of First Watch's cost structure, encompassing wages for kitchen staff, servers, and management, alongside the cost of employee benefits. For instance, in 2024, labor costs typically represent a substantial portion of a restaurant's overall operating expenses, often ranging from 25% to 35% of revenue, a figure First Watch likely aims to optimize.

The company's emphasis on operational acuity and efficient labor management highlights the strategic importance of controlling these expenditures. Effective scheduling and training are crucial for maximizing productivity and minimizing overtime, directly impacting profitability.

Occupancy and operating expenses are a major component of First Watch's cost structure. These include the costs of leasing or owning their restaurant spaces, which can be substantial, especially as they expand. For instance, in 2023, First Watch reported total operating expenses of $1.01 billion.

Utilities like electricity, water, and gas, along with ongoing maintenance for their restaurant facilities, also add to these overheads. As First Watch continues to grow its physical presence, adding new locations, these essential operating costs are expected to increase in tandem with their expansion efforts.

Marketing and Advertising Expenses

First Watch allocates significant resources to marketing and advertising as a core component of its cost structure. These investments are crucial for driving customer traffic to its breakfast, brunch, and lunch locations and for building a strong, recognizable brand. The company understands that consistent and effective outreach is key to maintaining its competitive edge.

Looking ahead, First Watch has outlined plans to increase its marketing expenditures in 2025. This strategic scaling is designed to further amplify brand awareness and attract new customers, supporting its growth objectives. The focus will likely be on a blend of digital marketing, local store promotions, and broader brand-building campaigns.

- Digital Marketing: Investments in online advertising, social media engagement, and search engine optimization to reach a wider audience.

- Brand Awareness Campaigns: Efforts to enhance the overall perception and recognition of the First Watch brand through various media channels.

- Promotional Activities: Funding for in-store promotions, loyalty programs, and partnerships to encourage repeat business and attract new patrons.

- Market Research: Allocations for understanding consumer trends and preferences to tailor marketing messages effectively.

New Restaurant Development and Acquisition Costs

First Watch's aggressive growth plan necessitates significant capital investment in new restaurant development and the acquisition of existing franchise locations. These expenditures are foundational to their strategy for expanding market presence and driving long-term value.

In 2023, First Watch reported capital expenditures totaling $139.6 million, a substantial increase from $96.1 million in 2022, reflecting this commitment to expansion. This includes costs associated with building new restaurants, refreshing existing ones, and the strategic purchase of franchise units.

- New Restaurant Development: Costs cover site selection, leasehold improvements, equipment, and initial operating capital for new locations.

- Restaurant Remodels: Investments are made to update and enhance the dining experience in existing restaurants, ensuring brand consistency and appeal.

- Acquisition of Franchise-Owned Restaurants: Capital is allocated to buy back franchise locations, integrating them directly into First Watch's corporate portfolio for greater control and operational synergy.

- Total Capital Expenditures (2023): $139.6 million, demonstrating a significant ramp-up in investment for growth initiatives.

First Watch's cost structure is heavily influenced by its commitment to fresh ingredients, with food and beverage costs being a primary driver. Labor expenses, covering wages and benefits for a significant workforce, also represent a substantial outlay, often a considerable percentage of revenue. Furthermore, the company invests heavily in marketing to maintain brand visibility and drives growth through significant capital expenditures for new restaurant development and acquisitions.

| Cost Category | Description | 2023 Impact/Data |

|---|---|---|

| Food & Beverage Ingredients | Costs for fresh, made-to-order, and seasonal menu items. | Commodity price volatility (e.g., eggs, bacon) directly impacts these costs. |

| Labor Expenses | Wages, benefits for kitchen, serving, and management staff. | Typically 25%-35% of restaurant revenue; optimization is key. |

| Occupancy & Operating Expenses | Lease/ownership costs, utilities, maintenance for restaurant facilities. | Total operating expenses were $1.01 billion in 2023. |

| Marketing & Advertising | Investments in digital marketing, brand awareness, and promotions. | Planned increase in 2025 to support growth and brand visibility. |

| Capital Expenditures | Investment in new restaurant development and franchise acquisitions. | Reached $139.6 million in 2023, up from $96.1 million in 2022. |

Revenue Streams

First Watch's main income source is from customers enjoying their breakfast, brunch, and lunch meals, along with drinks, right in the restaurants. This is the heart of their daytime dining experience.

In 2023, First Watch reported that dine-in sales were the overwhelming majority of their revenue, highlighting the importance of the in-restaurant customer experience. This focus on the physical dining space is key to their business model.

Revenue streams from takeout and online orders are a significant component of First Watch's business model, catering to the growing demand for off-premise dining. This allows customers to enjoy their favorite breakfast, brunch, and lunch items at home or on the go, offering a convenient alternative to the dine-in experience.

In 2023, First Watch reported that digital orders, which include online and app-based sales, represented a substantial portion of their revenue, highlighting the success of their digital transformation efforts. This channel not only expands customer reach but also provides valuable data for personalized marketing and operational efficiency.

First Watch generates revenue through third-party delivery sales, partnering with platforms like DoorDash and Uber Eats to reach customers who value at-home dining convenience. This channel significantly broadens their market presence beyond traditional dine-in customers, especially as off-premise dining continues its upward trend.

Franchise Fees and Royalties

First Watch generates revenue from its franchised locations through initial franchise fees, which are lump sums paid by new franchisees to join the brand. This is complemented by ongoing royalty fees, typically calculated as a percentage of the franchised restaurant's gross sales. This dual approach to franchise revenue is a cornerstone of their asset-light expansion strategy, allowing for market penetration without significant capital outlay from the parent company.

For instance, in 2024, many successful franchise models see initial fees ranging from $35,000 to $50,000, with ongoing royalties often set between 4% and 6% of gross sales. This structure enables First Watch to scale its presence efficiently.

- Initial Franchise Fees: One-time payments from new franchisees.

- Royalty Fees: Ongoing percentage-based payments on gross sales from franchised locations.

- Asset-Light Growth: These fees support expansion without requiring direct capital investment for each new unit.

- Revenue Diversification: Provides a consistent income stream beyond company-owned locations.

Merchandise and Gift Card Sales

First Watch supplements its core dining revenue through the sale of branded merchandise and gift cards. While not a major income driver, these offerings contribute to brand visibility and customer engagement. For instance, in 2023, gift card sales represented a small but consistent portion of overall revenue, with many customers purchasing them as presents, thereby introducing new patrons to the First Watch experience.

These sales also act as a valuable marketing tool, fostering brand loyalty and encouraging repeat visits. Customers purchasing merchandise, like branded apparel or coffee beans, become walking advertisements. First Watch's focus remains on its breakfast, brunch, and lunch menu, but these ancillary revenue streams enhance the overall customer relationship and provide a modest financial uplift.

- Merchandise Sales: Branded apparel, coffee beans, and other items offer a tangible connection to the First Watch brand.

- Gift Card Program: Facilitates customer gifting and introduces new diners to the restaurant.

- Brand Loyalty: Both merchandise and gift cards contribute to building a stronger customer connection and encouraging repeat business.

- Ancillary Revenue: These streams provide a supplementary income source beyond the primary food and beverage sales.

First Watch's revenue primarily stems from dine-in customers enjoying their breakfast, brunch, and lunch offerings, a model that remained dominant in 2023. This focus on the in-restaurant experience is central to their business.

Digital orders, including online and app-based sales, have become a substantial revenue contributor, demonstrating the success of their digital initiatives and expanding reach. This channel is crucial for convenience and data collection.

Third-party delivery partnerships further broaden First Watch's customer base, catering to the increasing demand for at-home dining convenience. These collaborations are vital for market presence.

Franchised locations provide revenue through initial franchise fees and ongoing royalty payments, typically a percentage of gross sales. This asset-light strategy allows for efficient scaling.

In 2024, initial franchise fees can range from $35,000 to $50,000, with royalties often between 4% and 6% of gross sales, facilitating market penetration.

Ancillary revenue streams include branded merchandise and gift cards, which enhance brand visibility and customer engagement. Gift card sales, a small but consistent part of revenue in 2023, also introduce new customers.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Dine-In Sales | Customer purchases within the restaurant. | Overwhelming majority of 2023 revenue. |

| Digital Orders | Online and app-based sales. | Substantial portion of 2023 revenue. |

| Third-Party Delivery | Sales via delivery platforms. | Broadens market presence beyond dine-in. |

| Franchise Fees | One-time payments from new franchisees. | $35,000 - $50,000 (2024 estimate). |

| Royalty Fees | Percentage of gross sales from franchised locations. | 4% - 6% (2024 estimate). |

| Merchandise & Gift Cards | Branded items and gift certificates. | Consistent, modest uplift and brand engagement. |

Business Model Canvas Data Sources

The First Watch Business Model Canvas is informed by a blend of proprietary customer data, operational performance metrics, and competitive market analysis. This ensures each component accurately reflects current business realities and strategic opportunities.