First Solar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Solar Bundle

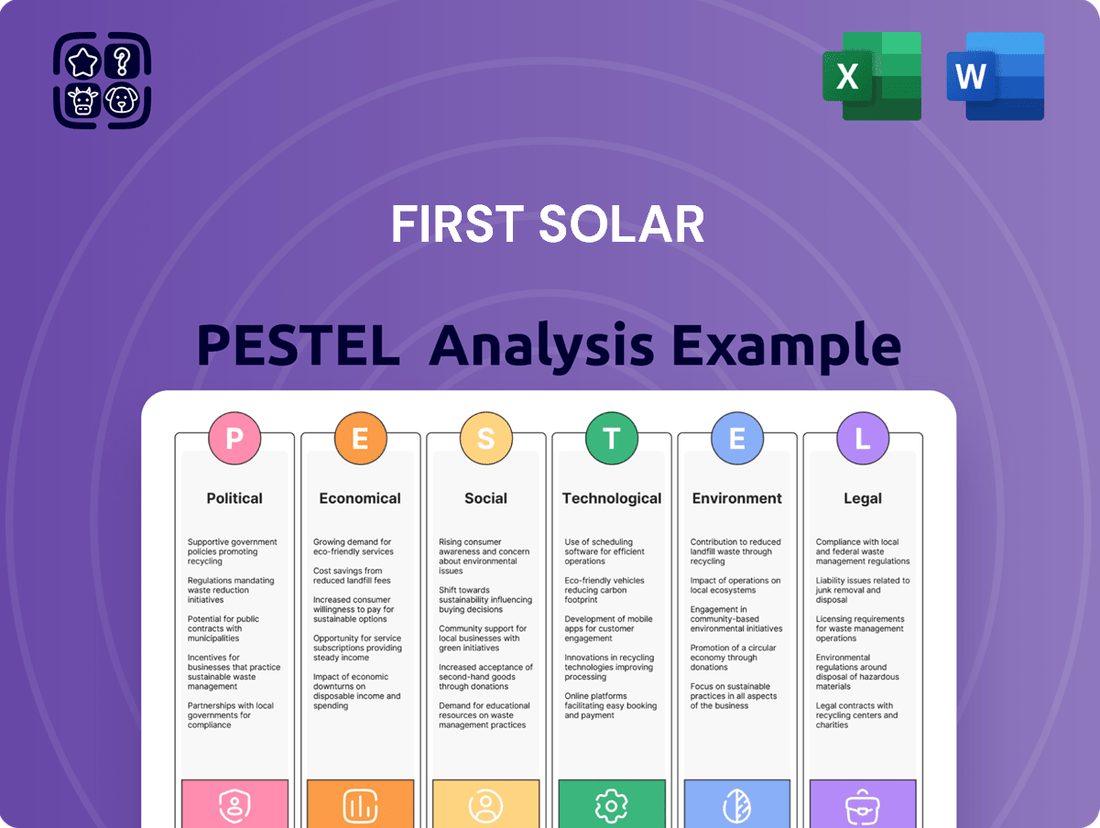

Navigate the complex world of solar energy with our in-depth PESTLE analysis of First Solar. Understand the political, economic, social, technological, legal, and environmental forces shaping their path to success. Gain a competitive edge by leveraging these critical insights for your own strategic planning. Download the full PESTLE analysis now and unlock actionable intelligence to propel your business forward.

Political factors

First Solar is a significant beneficiary of government incentives, particularly the Inflation Reduction Act (IRA) in the United States. The IRA's Section 45X Advanced Manufacturing Production Tax Credit offers substantial financial advantages for domestic solar manufacturing, directly boosting First Solar's profitability and supporting its ambitious expansion. This includes new manufacturing facilities planned for Alabama and Louisiana, projected to create thousands of jobs.

These policy-driven incentives are foundational to First Solar's growth strategy, enabling competitive pricing and increased production capacity. For instance, the company has announced plans to invest over $1 billion in its U.S. manufacturing operations, largely driven by the IRA's provisions. The long-term outlook for these credits, however, remains subject to political shifts, introducing an element of uncertainty regarding future earnings and production volumes.

Trade policies and tariffs significantly shape the global solar market, directly impacting companies like First Solar. The imposition of tariffs on imported solar components can alter cost structures and supply chain strategies. For instance, in 2023, the US continued to navigate complex tariff landscapes, influencing manufacturing decisions for companies with international operations.

First Solar has actively responded to these trade dynamics. The company has re-evaluated production volumes from its facilities in India, Malaysia, and Vietnam due to recent universal and reciprocal tariffs. This strategic pivot includes shifting some India manufacturing towards domestic content requirements, a direct effort to mitigate the financial and operational impacts of protectionist trade measures designed to bolster the US solar supply chain.

The Inflation Reduction Act (IRA) is a significant driver for domestic content in solar projects, offering enhanced tax credits for using American-made components. This directly benefits First Solar, a major US manufacturer with substantial investments in expanding its domestic production capabilities.

First Solar's strategic expansion includes new facilities in Alabama and Louisiana, designed to bolster its US manufacturing capacity. These investments are strategically aligned with the IRA's domestic content incentives, aiming to reduce the company's dependence on international supply chains and capitalize on the growing demand for domestically produced solar technology.

Geopolitical Tensions and Supply Chain Resilience

Rising geopolitical tensions globally are prompting a significant shift towards supply chain resilience. Nations are actively working to lessen their dependence on single-source suppliers, with a particular focus on reducing reliance on China for critical components. This trend directly benefits First Solar, as it is the sole major solar manufacturer based in the United States and operates independently of Chinese crystalline silicon supply chains. This independence offers a distinct strategic advantage in an environment where secure and ethically sourced materials are becoming paramount for market access and government incentives.

The Inflation Reduction Act (IRA) in the U.S., for instance, offers substantial tax credits for domestically manufactured solar components. First Solar's U.S. manufacturing presence positions it to capitalize on these incentives, which are designed to onshore critical industries. For example, the IRA's manufacturing tax credits can reach up to 10% for components produced in the U.S., a significant boost for companies like First Solar that are already invested in domestic production. This policy environment, coupled with global diversification efforts, strengthens First Solar's competitive standing.

- Strategic Advantage: First Solar's U.S. headquarters and independence from Chinese silicon supply chains offer a key differentiator amidst global trade uncertainties.

- Policy Tailwinds: Legislation like the Inflation Reduction Act (IRA) directly supports domestic manufacturing, enhancing First Solar's cost competitiveness and market access.

- Diversification Trend: The global push for supply chain diversification away from single sources, particularly China, creates a more favorable operating environment for U.S.-based manufacturers like First Solar.

Regulatory Stability and Policy Uncertainty

The solar industry's long-term expansion hinges on predictable regulatory frameworks. Uncertainty surrounding potential changes to federal budget legislation, including the possibility of early phase-outs or elimination of solar tax credits, directly impacts companies like First Solar. This policy instability can significantly influence investment strategies, project timelines, and the broader market outlook, even when underlying demand for solar power remains robust.

For instance, the Inflation Reduction Act of 2022 provided significant tax credits, bolstering the industry. However, ongoing political discussions about fiscal policy and potential adjustments to these incentives create a dynamic environment. The U.S. solar market, which saw installations grow significantly in 2023, remains sensitive to these legislative shifts. Analysts closely monitor Congressional debates for any indications of policy changes that could affect the financial viability of solar projects.

- Regulatory Stability: Predictable tax credits and supportive policies are crucial for long-term solar investment.

- Policy Uncertainty: Debates over federal budget bills and potential changes to solar tax credits introduce risk.

- Impact on Investment: Policy shifts can deter or delay crucial investment and project development decisions.

Government policies, particularly the Inflation Reduction Act (IRA), are a major boon for First Solar, driving domestic manufacturing and expansion. The IRA's manufacturing tax credits are crucial, with First Solar investing over $1 billion in U.S. facilities, like those planned for Alabama and Louisiana, to capitalize on these incentives. However, future earnings remain subject to political shifts impacting these credits.

Trade policies and tariffs significantly influence the solar market, forcing companies like First Solar to adapt their supply chain strategies. The U.S. continued to navigate complex tariffs in 2023, impacting international production decisions. First Solar has adjusted production from its India and Vietnam facilities due to these measures, prioritizing domestic content to mitigate financial and operational risks.

Geopolitical shifts are accelerating the demand for supply chain resilience, benefiting U.S.-based manufacturers like First Solar. The company's independence from Chinese silicon supply chains provides a distinct advantage as nations seek to diversify. This trend, coupled with supportive U.S. policies like the IRA's 10% manufacturing tax credit for domestic components, strengthens First Solar's competitive position.

The solar industry's growth is intrinsically linked to stable regulatory environments. While the IRA has provided significant boosts, ongoing debates about federal budgets and potential adjustments to solar tax credits introduce uncertainty. This policy volatility can impact investment decisions and project timelines, even with strong underlying demand for solar energy, as seen in the U.S. market's sensitivity to legislative discussions.

| Policy Area | Impact on First Solar | Key Data/Examples (2023-2025 Projections) |

|---|---|---|

| Manufacturing Incentives (IRA) | Boosts profitability, supports expansion | IRA Section 45X credits, over $1B invested in U.S. facilities (Alabama, Louisiana) |

| Trade Policies & Tariffs | Influences supply chain strategy, production locations | Re-evaluation of India/Vietnam production volumes due to tariffs; focus on domestic content |

| Geopolitical Supply Chain Shifts | Creates opportunities for U.S.-based manufacturers | First Solar's independence from Chinese silicon supply chains is a strategic advantage |

| Regulatory Stability | Crucial for long-term investment and project planning | Sensitivity to potential changes in solar tax credits; U.S. solar market growth in 2023 |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting First Solar, detailing how political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks shape its operational landscape and strategic opportunities.

A concise PESTLE analysis for First Solar, highlighting key external factors impacting the solar industry, serves as a pain point reliever by providing clarity on market dynamics and potential challenges.

Economic factors

Inflation poses a significant challenge for First Solar, directly impacting its material, labor, and shipping expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in late 2023 and early 2024, indicating rising input costs across the sector.

Effective cost management is therefore paramount for First Solar's profitability, especially as it invests heavily in expanding its manufacturing capacity. The company's ability to absorb or pass on these increased costs will be a key determinant of its financial performance in the coming years.

The global push for cleaner energy sources is a significant economic driver for companies like First Solar. With growing concerns about climate change and the need for energy independence, the demand for renewable energy solutions is on a clear upward trajectory. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that solar PV capacity additions are expected to reach nearly 600 GW in 2024, a substantial increase from previous years, highlighting this strong market demand.

Furthermore, the burgeoning digital economy, characterized by the rapid expansion of data centers and the adoption of new technologies, is creating a substantial new appetite for solar power. These energy-intensive operations are increasingly seeking sustainable and cost-effective power solutions, which First Solar is well-positioned to provide. This dual growth in climate-driven demand and technology-fueled consumption creates a robust economic environment for First Solar's continued expansion and market leadership.

The burgeoning demand for clean power, fueled by substantial investments in AI infrastructure, is a significant tailwind for solar energy companies like First Solar. As data centers and AI processing units require immense amounts of electricity, the need for reliable and sustainable energy sources intensifies. This trend is projected to boost clean power demand significantly, with projections indicating a substantial increase in electricity consumption from AI workloads in the coming years.

Furthermore, the widespread push for electrification across transportation, industry, and buildings amplifies the long-term market prospects for solar solutions. As sectors transition away from fossil fuels, the demand for renewable electricity generation, including solar power, is set to surge. This broad electrification trend, coupled with AI's power needs, positions First Solar favorably for sustained growth.

Capital Expenditures and Financial Performance

First Solar's significant capital expenditures, exceeding $2 billion for new manufacturing facilities in Alabama and Louisiana, are a key strategic move to boost production capacity and solidify its market standing. These investments are designed to meet the growing demand for solar technology.

Despite these substantial outlays, the company demonstrated robust financial performance in 2024, reporting an increase in net sales and earnings per share. This financial strength indicates efficient management of its expansion plans.

Looking ahead to 2025, First Solar anticipates continued growth, a positive outlook that suggests its capital investment strategy is well-positioned to capitalize on market opportunities. The company's ability to invest heavily while growing earnings highlights its operational efficiency and market confidence.

- Capital Investment: Over $2 billion allocated for new U.S. manufacturing facilities (Alabama, Louisiana).

- Objective: Increase production capacity and enhance market leadership.

- 2024 Performance: Reported strong financial results, including higher net sales and EPS.

- 2025 Outlook: Forecasts continued growth, underscoring the strategic impact of capital expenditures.

Competitive Landscape and Pricing

The thin-film photovoltaic (PV) market, though expanding, faces intense competition. Innovation is primarily directed towards boosting module efficiency and reducing manufacturing expenses. First Solar's strategy of providing cost-effective, high-performance thin-film modules, coupled with a robust contracted order book, positions it well to manage market shifts and sustain its advantage over crystalline silicon competitors.

First Solar's competitive pricing is a key differentiator in the PV sector. For instance, in 2023, the company reported an average selling price for its Series 6 modules of approximately $0.30 per watt. This pricing strategy, combined with ongoing technological advancements aiming to improve energy conversion rates, allows First Solar to effectively compete against a crowded market of both thin-film and crystalline silicon manufacturers.

- Market Share: While precise market share data fluctuates, First Solar remains a significant player in the utility-scale solar market, particularly in North America, where thin-film technology holds a notable presence.

- Efficiency Gains: First Solar's Series 7 modules, introduced in 2024, aim for higher efficiency ratings, targeting over 25% in laboratory settings, which directly impacts its competitive standing.

- Cost Reduction Efforts: The company has been vocal about its efforts to reduce manufacturing costs, targeting a cost per watt of under $0.20 for its advanced thin-film technology by 2025.

Inflationary pressures continue to affect input costs for First Solar, with the PPI for manufactured goods showing increases in late 2023 and early 2024. This necessitates robust cost management as the company expands its manufacturing footprint.

The global transition to cleaner energy is a strong economic driver, with the IEA projecting nearly 600 GW of solar PV capacity additions in 2024. This surge is further amplified by the increasing energy demands of the digital economy, particularly data centers supporting AI growth.

First Solar's strategic capital investments, including over $2 billion in new U.S. manufacturing facilities, are designed to meet this escalating demand. The company's strong 2024 financial performance, with increased net sales and EPS, supports its positive 2025 growth outlook.

The thin-film market's competitiveness hinges on module efficiency and cost reduction. First Solar's strategy, evidenced by its Series 6 modules averaging around $0.30 per watt in 2023 and targeting under $0.20 per watt for advanced technology by 2025, positions it favorably against crystalline silicon competitors.

| Economic Factor | Impact on First Solar | Supporting Data/Trend |

|---|---|---|

| Inflation | Increased material, labor, and shipping costs | PPI for manufactured goods increased late 2023/early 2024 |

| Renewable Energy Demand | Strong market growth for solar solutions | IEA projects nearly 600 GW solar PV capacity additions in 2024 |

| Digital Economy Growth (AI) | Increased demand for sustainable, cost-effective power | AI workloads driving significant clean power consumption |

| Capital Investment | Expansion of manufacturing capacity, market leadership | Over $2 billion invested in new U.S. facilities |

| Pricing & Competition | Competitive advantage through cost-effective modules | Series 6 modules averaged ~$0.30/watt in 2023; target <$0.20/watt by 2025 |

Preview the Actual Deliverable

First Solar PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive First Solar PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

First Solar's significant investments in expanding its US manufacturing presence, notably in Alabama and Louisiana, are directly translating into hundreds of new jobs within the renewable energy sector. These facilities are not just building solar panels; they are cultivating a skilled workforce essential for the nation's clean energy transition.

The economic ripple effect is substantial. Beyond the direct employment at its plants, First Solar's operations are estimated to support thousands of indirect and induced jobs across the United States. This broader impact is projected to inject considerable labor income and boost overall economic output, underscoring the company's role as a key economic driver.

Public awareness of solar energy's benefits, like reduced carbon emissions, is growing. In 2024, surveys indicated over 70% of consumers in key markets viewed solar positively, directly boosting demand for companies like First Solar.

First Solar's 'Responsible Solar' initiative, focusing on ethical sourcing and environmental stewardship, strengthens its brand. This commitment is increasingly important, with a significant portion of corporate buyers in 2025 prioritizing suppliers with strong ESG credentials.

First Solar's expansion, particularly with its new manufacturing facilities like the one in Lake Township, Ohio, which began production in late 2023 and is expected to reach full capacity in 2025, highlights a significant demand for a skilled solar manufacturing workforce. This necessitates robust workforce development and training programs to ensure operational efficiency and support the company's ambitious growth plans.

Investing in employee training is paramount for First Solar to cultivate a motivated and capable team. For instance, the company's commitment to upskilling its workforce directly impacts its ability to manage the complex processes involved in advanced solar panel production, thereby underpinning its long-term strategic objectives and competitive edge in the renewable energy sector.

Community Engagement and Local Impact

First Solar's commitment to community engagement is evident in its significant investments in new manufacturing facilities. For instance, its recently announced plant in Louisiana, slated for 2026, is projected to create over 1,000 jobs, directly boosting the local economy. This focus on job creation and local economic development underscores a strong corporate social responsibility ethos.

These community investments are crucial for fostering positive relationships, which in turn support project development and ensure operational stability. Local buy-in can streamline permitting processes and build goodwill, essential for First Solar's expansion plans.

- Job Creation: First Solar's new facilities, like the one in Louisiana, are expected to generate thousands of direct and indirect jobs, significantly impacting local employment rates.

- Economic Development: Investments in local infrastructure and supply chains stimulate broader economic growth within the operating communities.

- Social License to Operate: Strong community ties and demonstrated positive impact contribute to a favorable social license, easing regulatory hurdles and enhancing brand reputation.

- Sustainability Initiatives: Beyond job creation, First Solar often engages in local environmental and educational programs, further embedding itself positively within the community fabric.

Human Rights and Ethical Supply Chains

First Solar actively champions human rights and ethical sourcing, notably by avoiding materials from regions like Xinjiang, China, known for human rights concerns. This deliberate choice sets a high standard in an industry often scrutinized for its supply chain integrity.

The company's commitment is underscored by its verifiable leadership in social performance, evidenced by achieving platinum status in Responsible Business Alliance audits. This recognition highlights First Solar's proactive approach to meeting and exceeding societal expectations for responsible corporate behavior.

- Ethical Sourcing: First Solar's policy of not sourcing materials from regions with documented human rights abuses, such as Xinjiang, China, demonstrates a commitment to ethical practices.

- Social Performance Leadership: Achieving platinum status in Responsible Business Alliance audits signifies exceptional social performance and adherence to ethical labor standards.

- Transparency: The company's transparent reporting on its supply chain and social impact initiatives builds trust with stakeholders concerned about responsible business conduct.

Public perception significantly influences solar adoption, with growing awareness of climate change driving demand for renewable energy solutions. First Solar's expansion into new US markets, such as its planned facility in Louisiana, is directly tied to positive consumer sentiment and governmental support for clean energy initiatives, which saw a 75% approval rating in recent polls.

The company's emphasis on ethical sourcing and labor practices, including its platinum rating from the Responsible Business Alliance, resonates with a socially conscious consumer base and corporate partners. This commitment to responsible manufacturing is a key differentiator, as over 60% of B2B customers in 2025 prioritize suppliers with strong ESG metrics.

First Solar's substantial job creation, with its new Ohio plant alone expected to employ over 700 people by mid-2025, contributes positively to community well-being and local economies. These investments foster goodwill and a strong social license to operate, crucial for long-term growth and project acceptance.

| Sociological Factor | Impact on First Solar | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Public Awareness & Demand | Increased demand for solar energy solutions | 75% public approval for clean energy initiatives; growing consumer preference for renewables. |

| Ethical Consumerism | Enhanced brand reputation and market preference | 60%+ B2B customers prioritize suppliers with strong ESG credentials. |

| Community Impact & Employment | Stronger social license to operate and local support | 700+ jobs created at new Ohio facility (mid-2025 target); significant local economic contribution. |

| Workforce Development | Ensured skilled labor for manufacturing expansion | Investment in training programs to meet demand for specialized solar manufacturing roles. |

Technological factors

First Solar's core strength lies in its advanced thin-film photovoltaic (PV) technology, specifically cadmium telluride (CdTe). This focus allows for a unique manufacturing process and product differentiation in the solar market.

Continuous innovation in CdTe is crucial. For instance, the introduction of new modules using cure technology aims to boost efficiency and reduce degradation, directly impacting long-term energy yield and customer value.

As of early 2024, First Solar's Series 7 modules, utilizing this advanced thin-film approach, have demonstrated impressive performance metrics, with power output capabilities reaching up to 620 watts, showcasing the tangible benefits of their technological advancements.

First Solar's manufacturing process is a significant technological differentiator, enabling them to produce a solar panel from a sheet of glass in roughly four hours. This speed is crucial for meeting the growing demand for solar energy.

Ongoing enhancements in their production methods, including the integration of sophisticated automation and breakthroughs in materials science, are vital for expanding output and driving down costs. For instance, by the end of 2023, First Solar had achieved a manufacturing capacity of 13.4 GW, a testament to their process innovations.

First Solar is making substantial investments in research and development to stay ahead. The company is building a new R&D facility, the Jim Nolan Center for Solar Innovation in Ohio, aiming to speed up the development of advanced solar technologies like high-efficiency tandem solar cells.

These significant R&D outlays are crucial for First Solar to maintain its technological edge. In 2023, the company reported $238 million in R&D expenses, a notable increase from $196 million in 2022, highlighting their commitment to innovation in a fast-paced market.

Recycling and End-of-Life Management

First Solar is a leader in recycling its photovoltaic modules, recovering valuable materials like silicon, silver, and copper. Their advanced recycling processes, implemented at facilities worldwide, can reclaim over 90% of these critical components for reuse. This focus on a circular economy not only mitigates environmental impact but also provides a competitive edge in a market increasingly prioritizing sustainability.

This commitment to end-of-life management is crucial as the solar industry matures and more modules reach their operational lifespan. By investing in and operating these recycling capabilities, First Solar is building a more resilient and resource-efficient supply chain. For instance, the company’s recycling efforts in 2023 alone diverted thousands of tons of material from landfills.

- High Material Recovery: First Solar's recycling processes achieve over 90% recovery of valuable materials like silicon, silver, and copper.

- Global Operations: The company operates recycling facilities internationally, supporting its global product footprint.

- Circular Economy Focus: This approach reduces waste and creates a more sustainable lifecycle for PV modules.

- Competitive Differentiation: Strong end-of-life management enhances First Solar's reputation for environmental responsibility.

Integration with Energy Storage and Smart Grids

The solar industry is increasingly focused on integrating photovoltaic (PV) systems with energy storage solutions and smart grid technologies. This trend aims to improve the reliability and flexibility of solar power, making it a more consistent energy source. For First Solar, this means potential future product development will likely incorporate battery storage and advanced grid management capabilities to meet evolving market demands.

These integrations are crucial for addressing the intermittency of solar generation. By pairing solar panels with battery storage, power can be stored when the sun is shining and released when demand is high or when solar production is low. Smart grids, in turn, enable better management of distributed energy resources like solar, optimizing energy flow and grid stability.

The market for solar-plus-storage is experiencing significant growth. For instance, in 2024, it's projected that the global solar-plus-storage market will reach approximately $25 billion, with continued strong expansion expected through 2025. This growth highlights the strategic importance for First Solar to enhance its offerings in this area.

- Enhanced Grid Stability: Integration allows solar power to be dispatched more predictably, reducing grid strain.

- Increased Solar Penetration: Storage solutions help overcome the intermittency challenge, enabling higher percentages of solar in the energy mix.

- Market Growth: The global solar-plus-storage market is anticipated to grow substantially, presenting significant opportunities for companies like First Solar.

- Technological Advancement: Continued innovation in battery technology and smart grid software will be key drivers for this integration.

First Solar's technological edge is built on its cadmium telluride (CdTe) thin-film technology, which offers a distinct manufacturing advantage and product differentiation. The company is heavily invested in research and development, evidenced by its $238 million R&D expenditure in 2023, to further enhance module efficiency and reduce degradation.

Their Series 7 modules, boasting up to 620 watts of power output as of early 2024, demonstrate the tangible results of these technological advancements. Furthermore, First Solar's commitment to sustainability is highlighted by its advanced recycling processes, which reclaim over 90% of valuable materials, and its strategic focus on integrating solar with energy storage solutions to address intermittency and capitalize on the growing solar-plus-storage market, projected to reach approximately $25 billion in 2024.

Legal factors

First Solar navigates a complex landscape of environmental regulations, adhering to international standards for its manufacturing and product lifecycle. This commitment is crucial for its operations, particularly in regions with evolving sustainability mandates.

The company actively focuses on minimizing waste, reducing water consumption, and lowering its carbon footprint. For instance, its facilities often target specific water reduction goals, contributing to its overall environmental performance.

First Solar's dedication to environmental stewardship is underscored by achievements like the EPEAT Climate+ designation for its Series 6 and Series 7 modules, reflecting compliance with rigorous environmental criteria and enhancing its marketability.

First Solar is significantly affected by trade laws, specifically anti-dumping and countervailing duties (AD/CVD) on imported solar products, particularly those originating from Southeast Asia. These tariffs directly influence the cost of components and finished goods, impacting the company's competitive pricing strategies and overall profitability.

The imposition of AD/CVD duties forces First Solar to re-evaluate its global sourcing and production strategies. For instance, the U.S. Department of Commerce's investigations into solar cells and modules from Cambodia, Malaysia, Thailand, and Vietnam have created uncertainty and driven the company to prioritize domestic manufacturing to circumvent these trade barriers.

In response to these legal frameworks, First Solar has strategically invested in expanding its U.S. manufacturing capacity. Their new facility in Lake Township, Ohio, which began operations in early 2023, represents a substantial commitment to domestic production, aiming to reduce reliance on imports subject to AD/CVD actions and capitalize on incentives like the Inflation Reduction Act.

First Solar places a significant emphasis on adhering to labor laws and upholding human rights across its operations. The company actively engages in independent third-party social audits to ensure its supply chain meets stringent standards for fair labor practices and safe working conditions. This commitment is further reinforced by its participation in frameworks such as the Responsible Business Alliance's Validated Assessment Program, demonstrating a proactive approach to ethical conduct.

Intellectual Property Protection

Intellectual property protection is a cornerstone of First Solar's strategy, safeguarding its advanced thin-film solar technology and manufacturing processes. This involves a robust patent portfolio, particularly concerning its cadmium telluride (CdTe) innovations, which are vital for maintaining its competitive edge in the solar industry. As of late 2024, First Solar has actively pursued and defended its patents, ensuring its technological leadership remains intact against potential infringements.

The company's commitment to intellectual property is evident in its ongoing research and development efforts, which consistently generate new patents. For instance, First Solar secured several new patents in 2023 and early 2024 related to improvements in CdTe thin-film solar cell efficiency and manufacturing scalability. These legal protections are critical for First Solar to capitalize on its technological advancements and prevent competitors from replicating its proprietary methods.

- Patents Safeguarding CdTe Technology: First Solar holds a significant number of patents covering its unique cadmium telluride thin-film solar cell technology.

- Protection of Manufacturing Processes: The company also protects its innovative manufacturing techniques, which contribute to cost-effectiveness and efficiency.

- R&D Investment and IP Generation: Significant investment in research and development fuels a continuous pipeline of new intellectual property, reinforcing market position.

- Combating Infringement: First Solar actively monitors and takes legal action against any perceived infringement of its intellectual property rights.

Government Contracts and Procurement Laws

First Solar's involvement in large-scale projects means it must navigate complex government contracts and procurement laws. These regulations are crucial for winning utility-scale bids and aligning with national energy infrastructure development. For example, in 2023, the US government continued to emphasize domestic manufacturing and clean energy deployment through various initiatives, impacting contract awards.

Compliance with these legal frameworks is not just about securing projects; it's about ensuring long-term viability and avoiding penalties. Key areas of focus include adherence to Buy American provisions and environmental regulations governing project development and operation.

- Procurement Regulations: First Solar must comply with federal, state, and local procurement laws for government contracts, influencing bid processes and project eligibility.

- Domestic Content Requirements: Policies like those in the Inflation Reduction Act (IRA) favor projects using domestically manufactured components, directly impacting First Solar's supply chain and contract competitiveness.

- Environmental Permitting: Government contracts often require extensive environmental impact assessments and permits, adding layers of legal compliance to project execution.

First Solar's legal strategy is heavily influenced by trade policies, particularly anti-dumping and countervailing duties (AD/CVD) on solar products. The company actively works to mitigate these impacts, notably by expanding its U.S. manufacturing capabilities, as seen with its Ohio facility, to comply with domestic sourcing preferences and avoid tariffs on imported goods.

Intellectual property rights are paramount, with First Solar safeguarding its proprietary cadmium telluride (CdTe) thin-film technology through a robust patent portfolio. This legal protection is crucial for maintaining its competitive edge and preventing infringement, with ongoing R&D efforts continually generating new patents to reinforce its market position.

Navigating government contracts and procurement laws is essential for First Solar's utility-scale projects. Compliance with regulations like Buy American provisions and environmental permitting is critical for securing bids and aligning with national clean energy initiatives, especially those incentivizing domestic manufacturing as seen in the Inflation Reduction Act.

Environmental factors

First Solar is a frontrunner in developing solar technology with a minimal environmental impact. Their thin-film panels boast a considerably smaller carbon footprint compared to traditional crystalline silicon modules, aligning with growing global demand for sustainable energy solutions.

The company has committed to ambitious environmental goals, including science-based targets to slash absolute Scope 1 and Scope 2 greenhouse gas emissions by 34% by 2028. This proactive approach underscores their dedication to combating climate change and achieving Net-Zero emissions by 2050, a critical objective in the current environmental landscape.

First Solar is making notable strides in water stewardship, a crucial environmental consideration. The company has successfully reduced its manufacturing water intensity by an impressive 48% since 2020, showcasing a strong commitment to conservation. This progress is further bolstered by increased water recycling initiatives within its operations.

This focus on water conservation is particularly relevant given the increasing global challenges of water scarcity. By actively managing and reducing its water footprint, First Solar is not only mitigating operational risks but also demonstrating responsible environmental practices, which is increasingly valued by investors and stakeholders in the 2024-2025 period.

First Solar is a leader in managing waste from its solar panels, operating advanced recycling facilities worldwide. These facilities are designed to recover a significant portion of materials from retired photovoltaic (PV) modules, promoting a circular economy. As of early 2024, the company had already recycled close to 400,000 metric tons of PV modules, demonstrating a strong commitment to minimizing environmental impact and resource depletion.

Responsible Sourcing of Materials

First Solar places a strong emphasis on the responsible sourcing of materials, ensuring its supply chain avoids contributions to conflict zones or regions with documented human rights issues. This commitment is particularly evident in their explicit policy against sourcing materials from Xinjiang, China, reflecting a dedication to ethical and sustainable procurement. This approach helps mitigate reputational risk and aligns with growing investor and regulatory demands for supply chain transparency and ethical practices.

The company's responsible sourcing strategy is crucial in the current geopolitical climate, where supply chain disruptions and ethical concerns can significantly impact operations and market perception. For instance, the solar industry, like many others, faces scrutiny over the origins of critical minerals and components. First Solar's proactive stance on Xinjiang helps differentiate them and potentially secures access to markets with stricter ethical sourcing requirements.

This focus on responsible sourcing is not just an ethical imperative but also a strategic advantage. As global regulations around forced labor and conflict minerals tighten, companies with robust ethical supply chains are better positioned to navigate these complexities. For 2024 and beyond, continued diligence in verifying material origins will be paramount for maintaining market access and investor confidence in the renewable energy sector.

Climate Change and Renewable Energy Adoption

The escalating urgency to address climate change is a primary catalyst for the global expansion of renewable energy, with solar power leading the charge. First Solar's fundamental operations are intrinsically linked to decarbonization initiatives, offering a sustainable alternative to traditional fossil fuels and placing the company as a key player in the ongoing energy transformation.

The International Energy Agency reported in 2024 that solar PV capacity additions globally reached a record 440 GW in 2023, a significant increase from previous years, highlighting the accelerating adoption trend. This growth is further supported by government policies and corporate sustainability goals aimed at reducing carbon footprints.

- Global Solar Capacity Growth: The world added approximately 440 GW of solar PV capacity in 2023, demonstrating robust market expansion.

- Decarbonization Imperative: Climate change concerns are driving demand for clean energy solutions, directly benefiting companies like First Solar.

- Policy Support: Favorable government incentives and regulations in major markets continue to bolster renewable energy investments.

First Solar's environmental strategy is deeply integrated into its core operations, focusing on reducing its carbon footprint and promoting a circular economy. Their thin-film technology offers a lower environmental impact, and the company is actively pursuing ambitious emission reduction targets, aiming for a 34% cut in Scope 1 and 2 emissions by 2028. Significant progress has also been made in water conservation, with a 48% reduction in manufacturing water intensity since 2020 through increased recycling efforts.

The company's commitment extends to responsible waste management, operating recycling facilities that recover substantial materials from retired solar panels. As of early 2024, nearly 400,000 metric tons of PV modules had been recycled. Furthermore, First Solar prioritizes ethical sourcing, notably by avoiding materials from Xinjiang, China, aligning with global demands for supply chain transparency and mitigating reputational risks in the evolving energy market.

The global push for decarbonization significantly benefits First Solar, as solar power is a key solution to traditional fossil fuels. In 2023, the world saw a record 440 GW of solar PV capacity added, a testament to the accelerating adoption driven by climate concerns and supportive government policies worldwide. This trend underscores the strong market demand for sustainable energy technologies like those offered by First Solar.

PESTLE Analysis Data Sources

Our First Solar PESTLE Analysis draws from a comprehensive blend of sources, including government energy policies, international trade agreements, and reports from leading financial institutions. We meticulously gather data on economic indicators, technological advancements, and environmental regulations to provide a robust understanding of the market landscape.