First Solar Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Solar Bundle

First Solar's marketing prowess is built on a solid foundation of strategic Product innovation, competitive Pricing, expansive Place in the market, and impactful Promotion. Understanding how these elements interweave is key to grasping their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for First Solar. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

First Solar's thin-film PV solar modules are at the core of their product strategy, leveraging proprietary cadmium telluride (CdTe) technology. This approach differentiates them from crystalline silicon competitors by offering a demonstrably lower carbon footprint in manufacturing, a key selling point for environmentally conscious buyers. For instance, First Solar's CdTe modules have a manufacturing carbon footprint that is up to 30% lower than crystalline silicon, according to their own lifecycle assessments.

The company’s commitment to innovation is evident in their ongoing research and development efforts. They are actively exploring and investing in next-generation thin-film technologies, such as perovskites and tandem solar cells, aiming to further enhance module efficiency and performance. This forward-looking R&D ensures their product offering remains competitive and at the forefront of solar technology advancements, with targets for improved energy yield per module.

First Solar’s Product strategy extends beyond simply manufacturing photovoltaic (PV) modules. They offer comprehensive PV solar energy solutions, a key differentiator in the market. This means they are involved in the entire process, from developing and constructing to operating large-scale, grid-connected solar power plants worldwide.

Their approach is a vertically integrated one, covering the complete lifecycle of solar projects. This end-to-end capability, from producing their advanced thin-film modules to delivering utility-scale projects, provides customers with a streamlined and reliable energy solution. For instance, in 2023, First Solar announced plans for a new 3.5 GW manufacturing facility in the United States, further solidifying their commitment to integrated production and project delivery.

First Solar's utility-scale focus is a cornerstone of its marketing strategy, offering specialized solutions for massive power generation projects. This deliberate concentration leverages the inherent strengths of their thin-film technology, making it exceptionally suitable for expansive solar installations.

The company's product development is precisely engineered to address the rigorous demands of utility companies and independent power producers, ensuring their offerings meet the critical performance and reliability standards for large-scale operations.

In 2023, First Solar secured orders for approximately 26 GW of its Series 6 and Series 7 modules, a significant portion of which is destined for utility-scale projects, underscoring their continued dominance in this segment.

Advanced Technology Development

First Solar’s commitment to technological advancement is a cornerstone of its marketing strategy, reflected in substantial investments in research and development. These efforts are geared towards enhancing their proprietary Cadmium Telluride (CdTe) thin-film technology and exploring next-generation materials like perovskites. This focus ensures they remain at the forefront of solar innovation, delivering increasingly efficient and cost-effective solutions.

The company operates dedicated R&D facilities in California and Ohio. In 2023, First Solar announced a significant expansion of its U.S. manufacturing capacity, including investments in R&D, to support its technological roadmap. This expansion underscores their drive to refine their existing CdTe platform and investigate promising new semiconductor materials, aiming for higher power conversion efficiencies and improved durability.

First Solar's innovation pipeline is designed to yield:

- Enhanced CdTe Performance: Continuous improvement in their core technology for greater energy yield.

- Perovskite Exploration: Research into new materials to potentially unlock even higher efficiencies and new applications.

- Sustainable Manufacturing: Development of processes that minimize environmental impact throughout the product lifecycle.

Sustainable and Responsibly Produced Modules

First Solar's product strategy heavily emphasizes sustainability, setting its thin-film modules apart. These modules boast a significantly lower carbon footprint and a reduced wafer footprint compared to many crystalline silicon competitors. This commitment extends to their operational practices.

The company's advanced recycling program is a cornerstone of its responsible production. This program facilitates closed-loop semiconductor recovery, further bolstering the environmental credentials of their solar modules. First Solar reported that by the end of 2023, its recycling program had recovered over 90% of the materials from retired modules, with a focus on reclaiming valuable elements like cadmium telluride.

- Lower Carbon Footprint: First Solar's thin-film technology results in a lower lifecycle carbon footprint per watt compared to traditional silicon panels.

- Reduced Material Usage: The thinner nature of their modules means less raw material is required, minimizing the physical footprint.

- Advanced Recycling Program: First Solar's commitment to a circular economy includes a robust recycling process, aiming for maximum material recovery from end-of-life modules.

- Sustainable Sourcing: The company prioritizes responsible sourcing of materials used in module manufacturing, contributing to an overall more sustainable product.

First Solar's product strategy centers on its advanced thin-film Cadmium Telluride (CdTe) photovoltaic (PV) modules, which offer a lower manufacturing carbon footprint, a key differentiator. Their focus on utility-scale projects means their products are engineered for high performance and reliability in large installations.

The company's commitment to innovation is evident in its ongoing R&D for next-generation technologies like perovskites, aiming to boost module efficiency. Furthermore, their integrated approach, from module manufacturing to project delivery, provides comprehensive solutions for clients.

First Solar's product offering is deeply rooted in sustainability, highlighted by their lower carbon footprint and advanced module recycling program. By the end of 2023, their recycling initiatives had successfully recovered over 90% of materials from retired modules, emphasizing a circular economy approach.

| Product Focus | Key Differentiator | Sustainability Aspect | Market Segment | 2023 Order Intake (approx.) |

| Thin-film CdTe PV Modules | Lower carbon footprint in manufacturing | Reduced material usage, advanced recycling | Utility-scale projects | 26 GW |

What is included in the product

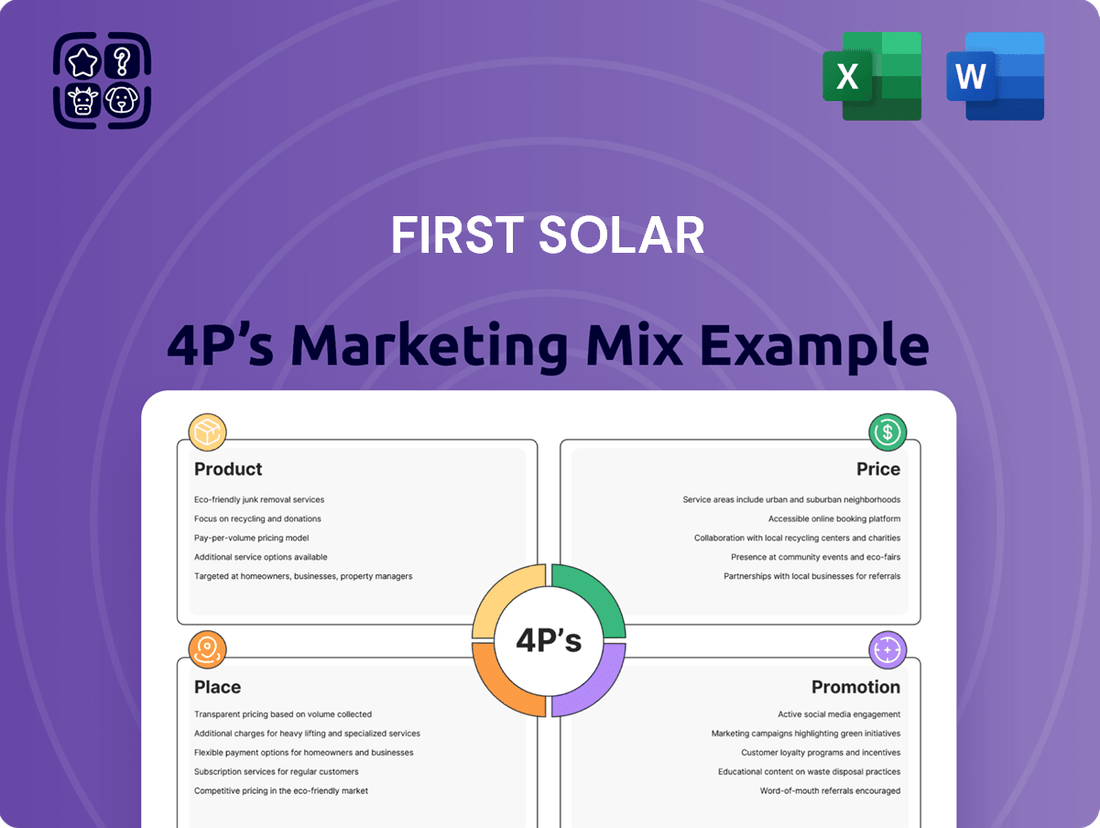

This First Solar 4P's Marketing Mix Analysis provides a comprehensive examination of their product offerings, pricing strategies, distribution channels, and promotional efforts within the competitive solar energy market.

It offers actionable insights for stakeholders seeking to understand First Solar's market positioning and strategic approach to customer engagement and market penetration.

This First Solar 4P's analysis acts as a pain point reliever by clearly outlining how their Product, Price, Place, and Promotion strategies address market challenges and customer needs in the solar industry.

Place

First Solar largely operates with a direct sales model, meaning they interact directly with major buyers like utility companies, independent power producers, and large commercial clients. This strategy is ideal for the significant scale of solar projects they undertake, enabling them to offer highly customized solutions and end-to-end service from the initial planning stages right through to the operational phase.

First Solar's global manufacturing footprint is a key element of its marketing mix, enabling it to serve diverse markets. The company operates major facilities in the United States, including Ohio, Alabama, and Louisiana, alongside significant operations in Vietnam, Malaysia, and India. This strategic international presence allows First Solar to efficiently meet escalating global demand for its advanced solar technology.

This expansive network is designed for scalability and market responsiveness. First Solar has ambitious plans to further bolster its production capabilities, projecting over 25 gigawatts (GW) of annual global manufacturing capacity by the close of 2026. This expansion underscores their commitment to leading the solar manufacturing sector and supporting the global energy transition.

First Solar is significantly bolstering its US manufacturing footprint, with new plants in Alabama and Louisiana joining its established Ohio facility. This expansion is a direct response to increasing demand for solar modules and the favorable policy landscape, particularly incentives from the Inflation Reduction Act (IRA).

The company's investment in domestic production, totaling billions of dollars, is designed to meet the growing need for solar energy solutions manufactured within the United States. This strategic move positions First Solar to benefit from policies encouraging onshoring and aims to secure a larger share of the rapidly expanding US solar market.

Informational Hub via Website

First Solar's website functions as a vital informational hub, directly supporting its sales by detailing its advanced photovoltaic technology, extensive project portfolios, and robust sustainability commitments. This digital platform is instrumental in educating potential clients about the company's offerings, thereby facilitating informed decisions and a smoother customer journey.

The site offers in-depth technical specifications and compelling case studies, empowering prospective customers with the data needed to evaluate First Solar's solutions. For instance, in 2023, First Solar reported a significant increase in its order backlog, reaching 27.4 GWdc, underscoring the market's confidence in its technology, which is prominently featured on their website.

- Technology Showcase: Detailed explanations of First Solar's thin-film technology, emphasizing efficiency and durability.

- Project Portfolio: Interactive maps and descriptions of completed and ongoing solar projects globally.

- Sustainability Focus: Information on responsible manufacturing, recycling programs, and environmental impact reduction.

- Customer Resources: Access to technical documentation, white papers, and client testimonials.

Selective Market Focus

First Solar strategically concentrates its bookings on key markets like the United States and India. This selective focus allows the company to capitalize on supportive government policies and its competitive strengths, such as its thin-film technology, which is particularly well-suited for certain environmental conditions and applications.

This targeted approach helps First Solar optimize its sales potential by concentrating resources where they can achieve the greatest impact and secure favorable terms. For instance, in the U.S., the Inflation Reduction Act (IRA) provides significant incentives that bolster demand for domestically manufactured solar components, a key area for First Solar.

India represents another crucial market where First Solar has secured substantial orders, benefiting from the country's ambitious renewable energy targets and the company's established presence and manufacturing capabilities. This deliberate market selection underscores First Solar's strategy to build a resilient and profitable business by aligning its production with areas offering the most advantageous market dynamics and policy support.

Key market engagements include:

- United States: Significant bookings driven by IRA incentives and domestic manufacturing focus.

- India: Major orders secured, aligning with national renewable energy expansion goals.

- Strategic Focus: Prioritizing markets where policy and competitive advantages create optimal sales conditions.

First Solar's place strategy is deeply rooted in its direct sales model and a robust global manufacturing presence. By engaging directly with major clients like utilities and independent power producers, the company tailors solutions for large-scale projects. Its manufacturing facilities, strategically located in the US, Vietnam, Malaysia, and India, are designed for scalability, with a projected 25 GW of annual global capacity by the end of 2026.

The company's website acts as a crucial sales support tool, showcasing its advanced thin-film technology, project successes, and sustainability efforts, which contributed to a 27.4 GWdc order backlog in 2023. First Solar also strategically focuses its sales efforts on key markets such as the United States, benefiting from the Inflation Reduction Act, and India, aligning with its renewable energy targets.

| Metric | Value | Year/Period |

|---|---|---|

| Global Manufacturing Capacity Projection | Over 25 GW | End of 2026 |

| Order Backlog | 27.4 GWdc | 2023 |

| US Manufacturing Investment | Billions of dollars | Ongoing |

Full Version Awaits

First Solar 4P's Marketing Mix Analysis

The preview you see here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive First Solar 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You are viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

First Solar's promotion strategy centers on a business-to-business (B2B) approach, targeting utility-scale developers, independent power producers, and financial investors. Their outreach emphasizes the long-term value and reliability of their advanced thin-film solar technology, a key differentiator in the competitive landscape.

Marketing efforts often showcase the environmental, social, and governance (ESG) advantages of First Solar’s products, aligning with the sustainability goals of their corporate clients. For instance, in 2023, First Solar announced plans to invest $1.1 billion in expanding its U.S. manufacturing capacity, signaling a commitment to domestic production and supply chain resilience, a message resonating with energy sector leaders.

First Solar champions content marketing, deploying detailed white papers and compelling case studies. These resources are key to educating potential customers on the benefits of their thin-film solar technology and integrated solutions.

This strategy aims to foster market understanding and generate demand for First Solar's unique value proposition. For instance, their focus on thin-film technology is a differentiator in a market often dominated by silicon-based panels.

By providing in-depth educational content, First Solar builds credibility and positions itself as a thought leader. This approach is crucial for a company offering specialized, high-value solar products and services.

First Solar prioritizes industry event participation, like their presence at RE+ 2024, to foster crucial connections and display their latest technological advancements. These gatherings are vital for engaging with potential customers, collaborators, and key industry figures, reinforcing their position as a leader in solar technology.

Digital Marketing and Investor Relations

First Solar leverages targeted digital marketing, including email campaigns and LinkedIn, to effectively reach its business-to-business (B2B) customer base. This approach ensures their message resonates with key decision-makers in the industry.

The company also prioritizes a strong investor relations (IR) strategy. This includes regular webcasts, timely press releases, and comprehensive annual reports to keep the investment community informed about financial performance, future projections, and strategic direction.

- Digital Reach: First Solar's B2B focus is supported by digital channels like LinkedIn, crucial for engaging industry professionals.

- Investor Communication: They maintain transparency with investors through webcasts, press releases, and annual reports.

- Financial Transparency: These IR efforts communicate First Solar's financial results, guidance, and strategic outlook.

Public Relations and Policy Engagement

First Solar actively pursues public relations to underscore the benefits of large-scale solar projects and ethically sourced materials. Their efforts focus on shaping public perception and fostering a favorable environment for solar adoption.

The company prioritizes engagement with lawmakers and local communities. This outreach aims to build stronger backing for solar energy and illustrate its role in economic development. For instance, in 2023, First Solar announced a significant expansion of its manufacturing capacity in the United States, creating thousands of jobs and contributing to local economies, a narrative they actively promote.

- Policy Advocacy: First Solar participates in discussions with government bodies to advocate for policies supporting renewable energy deployment and domestic manufacturing.

- Community Outreach: They engage with local stakeholders to address concerns, share project benefits, and build trust within communities where they operate.

- Supply Chain Transparency: First Solar highlights its commitment to responsible manufacturing and supply chain practices, aiming to differentiate itself in the market.

- Economic Impact Messaging: The company emphasizes the job creation and economic stimulus associated with its projects and manufacturing facilities.

First Solar's promotional activities are highly targeted, focusing on educating and influencing key stakeholders within the B2B solar market and the investment community. Their strategy emphasizes technological differentiation, ESG benefits, and economic impact, supported by robust content marketing and direct engagement.

In 2024, First Solar continued to highlight its U.S. manufacturing expansion, with plans for new facilities expected to create thousands of jobs. This commitment to domestic production, coupled with their advanced thin-film technology, serves as a core promotional message to utility-scale developers and policymakers.

The company's investor relations efforts in 2023 and early 2024 focused on communicating strong financial performance and strategic growth initiatives, including significant capital expenditures for capacity expansion. These communications aim to bolster investor confidence and support their valuation.

First Solar actively participates in industry forums and events, such as RE+ 2024, to showcase their latest innovations and engage directly with potential clients and partners. This direct interaction is crucial for reinforcing their brand as a leader in sustainable solar solutions.

Price

First Solar employs value-based pricing for its utility-scale projects, emphasizing the long-term economic and performance benefits of its thin-film technology. This strategy acknowledges the total cost of ownership, including lower degradation rates and better performance in hot climates, which translates to higher lifetime energy yields for developers.

The company's modules are positioned as a competitive, high-performance, and ethically sourced option compared to traditional crystalline silicon panels. For instance, in 2024, First Solar's average selling price per watt for utility-scale projects has been reported to be in the range of $0.25-$0.35, reflecting the premium associated with its advanced technology and sustainability profile.

First Solar's strategy centers on offering competitive costs through its advanced thin-film technology. This approach simplifies manufacturing, potentially leading to lower per-unit production expenses compared to traditional silicon-based solar panels.

While panel efficiency is important, First Solar highlights its ability to deliver cost-effective solutions for large-scale solar deployments. For instance, in Q1 2024, First Solar reported a gross margin of 21.7%, demonstrating their focus on cost management and competitive pricing in the utility-scale market.

First Solar's financial performance and pricing strategy are heavily shaped by government tax credits and incentives. The advanced manufacturing production credit, specifically Section 45X of the Internal Revenue Code, is a key driver. This incentive directly impacts the cost-effectiveness of their solar panel production.

In 2024, First Solar capitalized on these incentives by selling tax credits, which generated significant proceeds. This revenue stream provides a crucial financial cushion, allowing for more competitive pricing and bolstering the company's overall financial outlook. For instance, the company reported substantial benefits from these credits in its recent financial disclosures.

Pricing Policies and Backlog

First Solar’s pricing policies are heavily influenced by its significant contracted backlog, which stood at approximately 26.7 GW as of the end of the first quarter of 2024. This substantial order book provides revenue visibility and pricing power.

The company's strategy often incorporates adjusters within these long-term agreements, allowing for potential increases in the average selling price (ASP) tied to technological advancements. This incentivizes innovation and rewards performance.

- Contracted Backlog: As of Q1 2024, First Solar had a contracted backlog of 26.7 GW, providing strong revenue visibility.

- ASP Adjusters: Agreements often include provisions for ASP increases linked to achieving specific technology roadmap milestones.

- Technology-Driven Pricing: Pricing strategy is designed to capture value from ongoing improvements in module efficiency and performance.

Market Conditions and Tariff Adjustments

First Solar's pricing strategy is intricately linked to prevailing market conditions, including demand fluctuations and competitor pricing. The company's guidance for 2024, for instance, reflects an awareness of these external pressures. Tariff impacts, particularly those affecting module sales and pricing in specific markets, are a significant consideration in their ongoing tariff adjustments.

The company's approach to pricing is dynamic, adapting to the economic landscape. For example, in early 2024, First Solar anticipated that the IRA tax credits would bolster demand, but also acknowledged the potential for increased competition and pricing pressure. This necessitates a careful balance in their pricing models to remain competitive while accounting for policy shifts.

- Market Demand: Fluctuations in global solar demand directly influence First Solar's pricing power.

- Competitor Pricing: The pricing strategies of competitors, both domestic and international, are continuously monitored.

- Tariff Impact: Recent and potential future tariff changes necessitate ongoing adjustments to sales guidance and module pricing.

- Economic Conditions: Broader economic factors, including inflation and interest rates, play a role in overall market pricing for solar technology.

First Solar's pricing strategy is value-based, highlighting the long-term benefits of its thin-film technology, with average selling prices for utility-scale projects in the $0.25-$0.35 per watt range in 2024. This approach is supported by government incentives like the Section 45X tax credit, which directly impacts production costs and allows for more competitive pricing.

The company's substantial contracted backlog of 26.7 GW as of Q1 2024 provides pricing power, often including adjusters for technological advancements. First Solar dynamically adapts pricing to market conditions, competitor strategies, and tariff impacts, balancing competitiveness with policy shifts.

| Metric | Value | Period | Notes |

|---|---|---|---|

| Average Selling Price (Utility-Scale) | $0.25 - $0.35 / watt | 2024 | Reflects premium for advanced technology and sustainability. |

| Contracted Backlog | 26.7 GW | Q1 2024 | Provides revenue visibility and pricing power. |

| Gross Margin | 21.7% | Q1 2024 | Demonstrates effective cost management and competitive utility-scale pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for First Solar is grounded in a comprehensive review of their product offerings, pricing strategies, distribution channels, and promotional activities. We leverage official company reports, investor relations materials, industry publications, and market intelligence databases to ensure accuracy.