First Solar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Solar Bundle

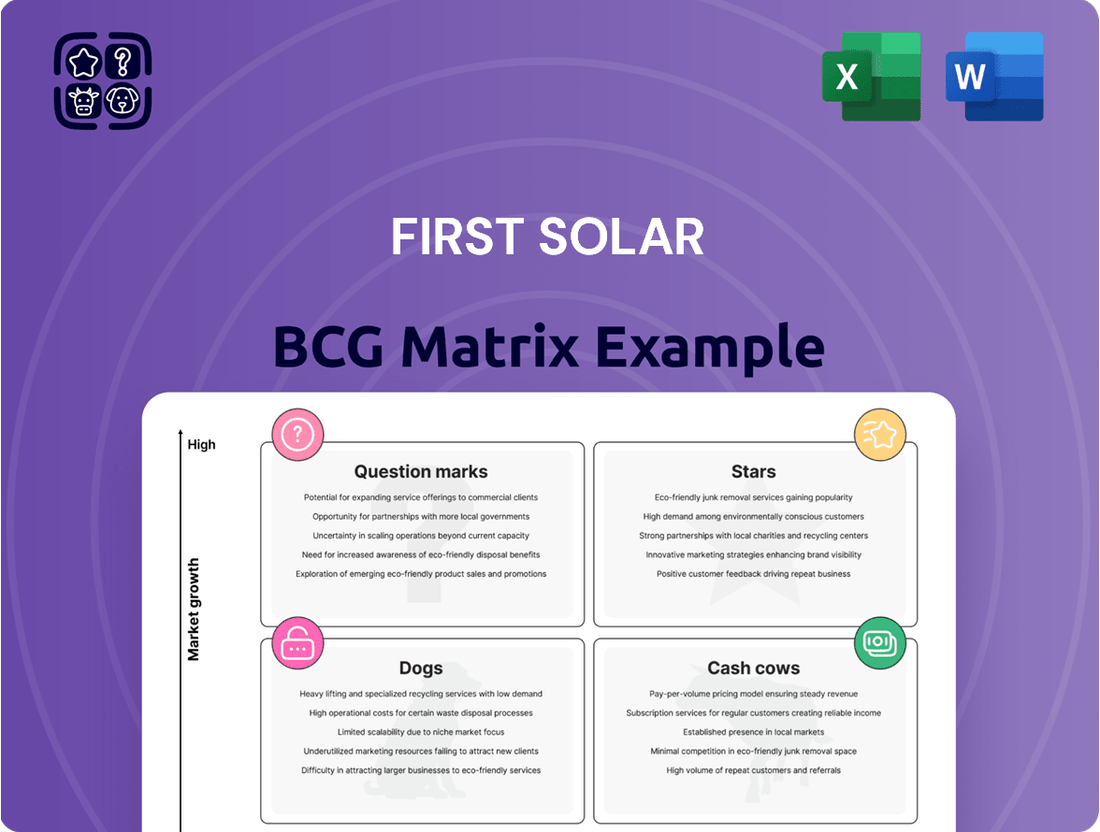

First Solar's position within the BCG Matrix reveals a dynamic interplay between market share and growth potential in the solar energy sector. Understanding whether their technologies are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to navigate this evolving industry.

Stars

First Solar stands as a dominant force in the U.S. thin-film solar manufacturing sector. As the only American company among the top global solar producers, its specialization in advanced thin-film photovoltaic technology offers a distinct competitive edge. This is particularly relevant with the increasing emphasis on domestic production and energy security within the United States.

First Solar's strategic emphasis on utility-scale projects positions it as a key player in the booming renewable energy sector. This focus allows the company to capitalize on the substantial demand from large-scale energy infrastructure, including power for burgeoning data centers and reshoring manufacturing operations. In 2024, First Solar secured a significant order for 1.7 GW of its advanced Series 7 modules with a leading utility developer, underscoring its dominance in this segment.

First Solar's advanced cadmium telluride (CdTe) thin-film technology is a significant differentiator. This proprietary approach excels in challenging environments, performing well in high temperatures and low light, which broadens its applicability and appeal. Furthermore, this technology effectively sidesteps tariffs targeting traditional crystalline silicon solar panels, providing a competitive edge in the market.

The company's commitment to innovation is evident in its recent achievement of a new world record for CdTe research cell conversion efficiency, reaching 23.1%. This technological advancement underscores First Solar's leadership in developing more efficient and cost-effective solar solutions.

Strong Bookings and Backlog

First Solar is experiencing exceptionally strong demand, evidenced by its impressive net bookings. This robust order pipeline provides significant revenue visibility for years to come.

- Strong Net Bookings: By the second quarter of 2024, First Solar had secured 3.6 GW in net bookings year-to-date.

- Extensive Contracted Backlog: The company's sales backlog is projected to reach 75.9 GW.

- Long-Term Visibility: This substantial backlog extends through 2030, offering considerable predictability for future revenue streams.

Beneficiary of U.S. Policy & Tax Credits

First Solar is a prime beneficiary of U.S. policy, especially the Inflation Reduction Act (IRA). This legislation provides significant tailwinds through measures like the Section 45X advanced manufacturing tax credits.

These credits directly boost First Solar's profitability by reducing manufacturing costs for its domestically produced solar modules. For instance, the IRA's Section 45X offers substantial credits per watt for solar cells and modules manufactured in the U.S., making First Solar's American-made products more competitive.

The financial advantages derived from these tax credits empower First Solar to make strategic investments. This includes expanding its manufacturing capacity within the United States, thereby strengthening its market position and contributing to the domestic renewable energy supply chain.

- IRA Impact: Section 45X tax credits for U.S.-made modules directly enhance profitability.

- Capacity Expansion: Tax credits enable strategic investments in increasing domestic manufacturing capacity.

- Market Competitiveness: Policy support strengthens First Solar's position against international competitors.

First Solar's strong market position and high growth potential place it firmly in the "Stars" category of the BCG Matrix. Its specialized thin-film technology and significant U.S. manufacturing presence, bolstered by favorable policies like the Inflation Reduction Act, drive substantial demand. The company's robust order backlog, extending through 2030, indicates sustained revenue growth and market leadership.

| Metric | Value (as of Q2 2024) | Significance |

|---|---|---|

| Net Bookings (YTD) | 3.6 GW | Demonstrates strong ongoing demand and sales momentum. |

| Sales Backlog | 75.9 GW | Provides exceptional long-term revenue visibility, extending to 2030. |

| CdTe Efficiency Record | 23.1% | Highlights technological leadership and potential for improved product performance. |

What is included in the product

This First Solar BCG Matrix overview details its product portfolio's position in market share and growth.

It offers strategic guidance on investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

A clear First Solar BCG Matrix overview visually clarifies business unit performance, easing the pain of strategic uncertainty.

Cash Cows

First Solar's established manufacturing footprint, spanning the U.S., Malaysia, Vietnam, and India, serves as a significant strength, positioning its modules as potential cash cows. The company's commitment to expanding its U.S. capacity, with plans for new facilities, further solidifies this advantage by ensuring a consistent and reliable supply chain.

First Solar's high-value recycling program, operational since 2005, positions its PV modules as a potential cash cow within the BCG matrix. This established initiative recovers up to 95% of module materials, showcasing strong circular economy principles and resource efficiency.

The program's success in material recovery, aiming for near-complete reclamation, not only minimizes environmental impact but also offers a pathway to cost reduction and potential revenue generation from recycled components. This operational strength underpins its cash cow status by ensuring consistent value extraction from end-of-life products.

First Solar's financial performance has been consistently strong, positioning it as a cash cow. The company reported impressive net sales of $4.2 billion for the year 2024. This robust figure underscores its mature product lines and ability to generate substantial cash flow.

Looking ahead, the outlook remains positive, with First Solar forecasting net sales between $5.3 billion and $5.8 billion for 2025. This projected growth further solidifies its status as a mature, high-performing business unit within the BCG matrix, capable of funding other ventures.

Vertical Integration

First Solar's strategy of vertical integration, encompassing everything from manufacturing its advanced photovoltaic (PV) modules to delivering complete utility-scale solar projects, positions it as a strong Cash Cow. This control over the value chain allows for significant cost efficiencies and a more predictable revenue stream, as evidenced by its robust financial performance.

In 2024, First Solar continued to leverage its integrated model to navigate supply chain complexities and deliver projects reliably. The company's ability to manage production and project execution internally contributes to its consistent cash generation, a hallmark of a Cash Cow in the BCG matrix.

- Reduced Costs: By controlling manufacturing and project development, First Solar minimizes reliance on third-party suppliers, leading to lower overall project costs.

- Supply Chain Resilience: Vertical integration provides greater control over the supply of critical components, enhancing stability and reducing vulnerability to external disruptions.

- Predictable Revenue: The end-to-end service offering, from module sales to project completion, creates a more predictable and stable revenue generation model.

- Market Dominance: This integrated approach allows First Solar to offer competitive pricing and reliable delivery, solidifying its position in the utility-scale solar market.

Operational Efficiency and Cost Management

First Solar's focus on operational efficiency and cost management positions its solar module manufacturing as a significant cash cow. Despite market fluctuations, the company consistently achieves high gross margins, a testament to its streamlined production processes. This efficiency directly translates into robust and reliable cash flow generation.

The company's impressive performance in 2023 highlights this strength. First Solar produced a record 12.1 gigawatts (GW) of solar modules, marking a substantial 33% increase compared to the previous year. This growth underscores their ability to scale production effectively while maintaining cost discipline.

- Record Production: Achieved 12.1 GW of solar modules in 2023, a 33% year-over-year increase.

- High Gross Margins: Demonstrates strong profitability through efficient operations.

- Consistent Cash Flow: Operational strengths fuel reliable cash generation.

First Solar's mature solar module manufacturing operations are a prime example of a cash cow within its BCG matrix. The company's established U.S. and international manufacturing footprint, with significant capacity expansion underway, ensures a stable and cost-effective production base. This allows for consistent generation of substantial cash flow, further bolstered by their high-value recycling program which recovers up to 95% of module materials.

| Metric | 2023 (Actual) | 2024 (Forecast) | 2025 (Forecast) |

|---|---|---|---|

| Net Sales | $3.6 billion | $4.2 billion | $5.3 - $5.8 billion |

| Module Production | 12.1 GW | - | - |

| Recycling Program Operational Since | 2005 | 2005 | 2005 |

Delivered as Shown

First Solar BCG Matrix

The First Solar BCG Matrix preview you're examining is the identical, fully unlocked document you'll receive immediately after purchase. This means you're seeing the complete, professionally formatted analysis, ready for immediate strategic application without any watermarks or demo limitations. You can confidently use this preview as a direct representation of the valuable, actionable insights you'll gain to inform your business decisions and planning.

Dogs

First Solar is experiencing lower capacity utilization at its overseas manufacturing plants, specifically in Malaysia and Vietnam. This situation is partly attributed to the lingering effects of U.S. tariffs on imported solar panels, which can influence demand and production schedules.

This underutilization suggests that these key international facilities may not be operating at peak efficiency, potentially impacting their profitability and First Solar's overall return on investment in these locations. For instance, while specific 2024 utilization rates for these facilities are not yet public, industry analysts have noted that global solar manufacturers have faced headwinds in maintaining high capacity utilization due to fluctuating trade policies and supply chain adjustments throughout 2023 and into early 2024.

First Solar faces significant competitive pressures, especially from lower-cost Chinese manufacturers. This intense competition can put a strain on profit margins, particularly in price-sensitive markets.

In 2024, the global solar market saw continued price erosion, with some analysts estimating average selling price (ASP) declines of up to 15% for certain solar panel types year-over-year. This dynamic is particularly evident in emerging markets like India, where aggressive bidding and the presence of state-subsidized competitors can drive down prices further.

These market conditions can transform certain segments into cash traps for First Solar. A cash trap occurs when a business unit requires significant investment to maintain its market share but generates insufficient returns to justify that investment, effectively draining resources that could be better utilized elsewhere.

First Solar's Series 7 modules, introduced in late 2023 and early 2024, encountered early production hurdles. These issues, primarily related to potential premature power degradation, led the company to book a significant $50 million warranty charge.

While First Solar has stated these manufacturing challenges have been addressed, the initial production phase of the Series 7 highlighted the inherent risks associated with bringing new, advanced technologies to market at scale. This situation underscores the importance of robust quality control during the ramp-up of new product lines.

Impact of Terminated Contracts

Terminated contracts can significantly disrupt a company's financial trajectory. For First Solar, a key example is the premature termination of a 400 MW contract with Plug Power, which directly affected its Q3 2024 revenue. This event, among others, can signal underlying issues with specific projects or partnerships, potentially impacting their standing in a BCG matrix analysis.

Such contract terminations often place a company's products or ventures into the 'Question Mark' category of the BCG matrix. This is because they represent investments with uncertain futures and potentially low market share, especially if the termination stems from performance issues. The financial impact is immediate, as seen with the Q3 2024 revenue shortfall.

- Contract Terminations: First Solar faced a significant contract termination in Q3 2024, impacting revenue.

- Plug Power Deal: A 400 MW contract with Plug Power was prematurely ended, highlighting potential project challenges.

- BCG Matrix Implication: These events can reclassify ventures into Question Marks due to uncertain future performance and market share.

- Revenue Impact: The termination directly reduced First Solar's reported revenue for the third quarter of 2024.

Potential for Oversupply and Price Pressure

The solar industry is susceptible to cycles of oversupply, particularly as new manufacturing capacity comes online. This can lead to significant price pressure across the market. For instance, in early 2024, reports indicated a substantial increase in global solar panel manufacturing capacity, outpacing demand growth, which contributed to a decline in average selling prices (ASPs) for certain panel types.

This oversupply environment can disproportionately impact companies with less differentiated product offerings or those focused on more commoditized market segments. When prices fall due to excess inventory, profit margins shrink, potentially affecting operational results. First Solar, with its focus on advanced thin-film technology, aims to mitigate some of this pressure compared to crystalline silicon manufacturers who often face more intense price competition.

- Oversupply Risk: Increased global solar manufacturing capacity can outstrip demand, leading to price declines.

- Price Pressure: Excess supply directly translates to lower average selling prices for solar panels.

- Impact on Margins: Less differentiated products are more vulnerable to margin erosion during periods of price pressure.

- First Solar's Position: The company's thin-film technology offers a degree of differentiation against commoditized silicon panels.

First Solar's international operations in Malaysia and Vietnam are experiencing lower capacity utilization, partly due to U.S. tariffs affecting demand and production schedules. This underutilization suggests these key facilities may not be operating at peak efficiency, impacting profitability and ROI.

The company faces intense competition, particularly from lower-cost Chinese manufacturers, which can squeeze profit margins in price-sensitive markets. In 2024, the global solar market saw continued price erosion, with some analysts estimating up to a 15% year-over-year decline in average selling prices for certain solar panel types.

These market conditions can create cash traps, where units require significant investment to maintain market share but generate insufficient returns. First Solar's Series 7 modules faced early production hurdles, leading to a $50 million warranty charge, underscoring the risks of scaling new technologies.

Contract terminations, like the 400 MW deal with Plug Power in Q3 2024, directly impact revenue and can signal underlying project issues. Such events often place ventures into the 'Question Mark' category of the BCG matrix due to uncertain future performance and market share.

The solar industry is also vulnerable to oversupply cycles, as seen in early 2024 with increased global manufacturing capacity outstripping demand. This leads to price pressure and reduced profit margins, though First Solar's thin-film technology offers some differentiation.

Question Marks

First Solar's investment in a new R&D center in Ohio and the acquisition of Evolar, a perovskite specialist, signals a strong push into high-growth, albeit uncertain, future technologies like high-efficiency tandem solar cells. This strategic move positions them to capture emerging market share in next-generation photovoltaic advancements.

First Solar's expansion into new U.S. manufacturing facilities, specifically in Alabama and Louisiana, positions its U.S. operations as a potential star in the BCG matrix. The Alabama facility is slated to begin operations in 2024, with the Louisiana plant following in the second half of 2025. These facilities represent a substantial capital expenditure aimed at boosting production capacity, a key indicator for growth potential.

While the investment is significant, the market adoption and full profitability of this increased capacity are still unfolding. This means that while the potential is high, the current market share and growth rate are still being established. The success of these new plants will heavily influence First Solar's classification as it moves beyond the question mark stage.

First Solar is strategically redirecting some of its future production from India to the U.S. market. This move is driven by the potential for significantly higher average selling prices (ASPs) in the U.S., which could boost the company's gross margins. For instance, U.S. solar module prices have seen fluctuations, but generally remain higher than in many other global markets due to demand, policy incentives, and supply chain considerations.

The company's ability to successfully capture U.S. market share with modules manufactured in India is still an unfolding story. This strategy hinges on navigating U.S. trade policies, logistics, and the competitive landscape. Success will be measured by First Solar's capacity to integrate these Indian-made products effectively into its U.S. sales channels and achieve its margin improvement targets.

TOPCon Patent Portfolio Litigation

First Solar's legal challenge against JinkoSolar over TOPCon patent infringement highlights a strategic move to safeguard its technological advancements. This action underscores the increasing value and competitive intensity surrounding next-generation solar cell technologies.

The outcome of this litigation could significantly influence the market landscape for TOPCon solar modules, potentially impacting market share and pricing dynamics for both companies and their competitors.

- Patent Protection: First Solar is actively defending its intellectual property in the rapidly evolving solar technology sector.

- Market Impact: The litigation could lead to licensing agreements or market disruptions for TOPCon technology.

- Competitive Landscape: Such disputes are becoming more common as companies vie for dominance in advanced solar manufacturing.

Space-Based Solar Power (SBSP) Potential

First Solar's advanced thin-film photovoltaic technology, particularly its cadmium telluride (CdTe) modules, offers a unique advantage for space-based solar power (SBSP) due to their high efficiency and potential for lightweight, flexible designs, crucial for orbital deployment. The company's commitment to scaling manufacturing, evidenced by its investment in a new U.S. TOPCon cell factory through its partnership with Talon PV, signals a readiness to support large-scale, advanced solar projects.

While SBSP is currently in its nascent stages with minimal market penetration, its long-term potential for providing continuous, clean energy is immense, positioning it as a high-growth, albeit highly speculative, venture. First Solar's technological foundation and manufacturing expansion could make it a key player in enabling this futuristic energy solution.

- Technological Advantage: First Solar's CdTe modules are inherently lighter and more flexible than traditional silicon panels, making them more suitable for space applications where mass and form factor are critical constraints.

- Manufacturing Scalability: The company's ongoing efforts to expand U.S.-based manufacturing capacity, including its partnership for a TOPCon cell factory, indicate a strategic move towards supporting large-scale, advanced solar projects, which would be essential for SBSP.

- Market Position: SBSP represents a frontier market with virtually zero current market share, but its potential for high growth and transformative impact on global energy supply makes it an area of significant future interest for companies with advanced solar capabilities.

First Solar's foray into new, high-potential solar technologies, such as perovskite cells, places them in a position of uncertainty regarding market adoption and profitability. These ventures represent significant R&D investment, aiming to capture future market share in advanced photovoltaic solutions.

The company's expansion into new U.S. manufacturing facilities, with the Alabama plant starting operations in 2024 and Louisiana in late 2025, signifies a substantial commitment to increasing production capacity. This strategic build-out is crucial for establishing a stronger market presence in the U.S. sector.

While these new facilities are designed to boost output, their ultimate impact on market share and profitability is still developing. The success of these investments will be key in moving these ventures from uncertain question marks to established stars.

First Solar's strategic shift to prioritize U.S. manufacturing over India for certain production lines is driven by the aim of achieving higher average selling prices (ASPs) in the U.S. market. This move could significantly improve the company's gross margins, as U.S. module prices have historically been higher due to demand and policy support.

The success of integrating Indian-manufactured modules into the U.S. market remains a key factor. Navigating U.S. trade policies and logistics is vital for First Solar to realize its margin improvement goals and solidify its market position.

First Solar's legal action against JinkoSolar concerning TOPCon patent infringement underscores the intense competition and increasing value of next-generation solar cell technologies. This defense of intellectual property is critical in the rapidly evolving solar industry.

The outcome of this patent dispute could reshape the market for TOPCon solar modules, influencing market share and pricing for all players in the advanced solar manufacturing space.

First Solar's advanced thin-film CdTe modules offer unique advantages for space-based solar power (SBSP) due to their lightweight and flexible nature, essential for orbital applications. The company's investment in U.S. manufacturing, including a TOPCon cell factory partnership, shows readiness for large-scale advanced solar projects.

SBSP is currently a nascent market with minimal penetration, but its long-term potential for continuous clean energy is vast, positioning it as a high-growth, speculative venture. First Solar's technological foundation and manufacturing expansion could make it a key player in this futuristic energy solution.

| Business Unit/Product | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Implications |

|---|---|---|---|---|

| U.S. Manufacturing Expansion (Alabama, Louisiana) | High (Emerging demand for domestic solar) | Low to Medium (Building capacity) | Question Mark | Invest to gain market share; monitor profitability. |

| Perovskite & Tandem Cell R&D | Very High (Future technology potential) | Very Low (Nascent technology) | Question Mark | Invest in R&D; explore partnerships to accelerate development. |

| CdTe Modules for Space-Based Solar Power (SBSP) | Extremely High (Futuristic, speculative) | Negligible (Pre-commercial) | Question Mark | Strategic partnerships and long-term R&D focus. |

| TOPCon Patent Defense | High (Competitive technology) | Medium (Defending existing position) | Question Mark | Legal defense to protect IP and market position. |

BCG Matrix Data Sources

Our First Solar BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.