First Solar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Solar Bundle

First Solar navigates a dynamic solar energy landscape, facing moderate buyer power from large utility-scale projects and significant threat from new entrants due to technological advancements. The intense rivalry among established players, including those with lower manufacturing costs, also shapes their competitive environment. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping First Solar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

First Solar's reliance on cadmium telluride (CdTe) for its thin-film modules points to a potentially concentrated supplier base for these specialized inputs. The unique nature of their CdTe technology can make it difficult to source alternative suppliers for critical materials, thereby enhancing supplier leverage.

While First Solar's thin-film technology is unique, the broader solar market offers crystalline silicon as a significant alternative. This means if First Solar's specific material suppliers try to raise prices too much, customers could opt for crystalline silicon modules instead, indirectly weakening the bargaining power of First Solar's specialized suppliers.

First Solar faces substantial switching costs if it were to change its core materials or manufacturing processes. These costs would include significant investments in retooling facilities and substantial research and development expenditures, potentially disrupting its established vertically integrated operations. This makes it challenging and expensive for First Solar to shift away from its current specialized suppliers.

Importance of First Solar to Suppliers

First Solar's status as a premier American solar technology manufacturer, coupled with its aggressive expansion of production capabilities, positions it as a crucial client for its niche suppliers. This significant demand grants First Solar considerable bargaining power, particularly with those suppliers whose revenue streams are substantially dependent on the company's orders.

The company's substantial scale means that suppliers often rely on First Solar for a significant portion of their business. This dependence can shift negotiation leverage in First Solar's favor, allowing it to secure more favorable terms on raw materials and components. For instance, First Solar's 2024 expansion plans, including new facilities, amplify this importance for its supply chain partners.

- Substantial Customer Base: First Solar's large-scale manufacturing operations make it a key buyer for specialized solar component suppliers.

- Negotiating Leverage: The company's significant order volumes can translate into better pricing and terms from its suppliers.

- Supplier Dependence: Suppliers heavily reliant on First Solar's business may have less power to dictate terms.

- Capacity Expansion Impact: Increased manufacturing capacity, as seen in 2024, further solidifies First Solar's importance to its suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers forward integrating into solar module manufacturing or project development for First Solar is generally low. This is because the specialized expertise and significant capital required for these downstream activities are quite different from those of raw material suppliers. For instance, companies supplying polysilicon or specialized chemicals typically operate in a different industry segment than module assembly or utility-scale project development.

This low likelihood of forward integration by suppliers means they have less leverage over First Solar. They are less likely to become direct competitors by entering First Solar's core business. This dynamic helps to moderate the overall bargaining power of suppliers in the solar industry, particularly for a company like First Solar which has a differentiated manufacturing process.

Consider the capital expenditure involved: building a solar module manufacturing facility can cost hundreds of millions of dollars, and project development requires expertise in land acquisition, permitting, financing, and construction management. These are substantial barriers for typical raw material providers.

First Solar's bargaining power with its suppliers is generally strong due to its significant scale and the specialized nature of its CdTe technology, which can create supplier dependence. While the company relies on specific materials, its substantial order volumes and ongoing capacity expansions, such as its 2024 investments in new U.S. facilities, mean suppliers often depend heavily on First Solar for revenue, giving the company considerable leverage in negotiations for favorable terms.

The threat of suppliers forward integrating into First Solar's business is minimal, as the capital and expertise required for module manufacturing or project development are distinct from those of raw material providers. This lack of direct competition from suppliers further solidifies First Solar's advantageous position in managing supplier relationships and costs.

The company's strategic positioning as a leading domestic manufacturer, particularly with its 2024 capacity expansions, enhances its importance to its supply chain. This makes it less susceptible to aggressive pricing or unfavorable terms from its key material providers, as these suppliers are incentivized to maintain a strong relationship with a major customer like First Solar.

| Supplier Aspect | First Solar's Position | Impact on Bargaining Power |

|---|---|---|

| Supplier Concentration (CdTe materials) | Potentially concentrated | Can increase supplier power if alternatives are scarce |

| First Solar's Scale and Demand | High | Significantly increases First Solar's power; suppliers depend on its orders |

| Supplier Dependence on First Solar | High for some | Weakens supplier power; First Solar can negotiate better terms |

| Threat of Supplier Forward Integration | Low | Reduces supplier leverage; they are unlikely to become direct competitors |

| Capacity Expansion (e.g., 2024) | Increasing | Further strengthens First Solar's importance to suppliers, enhancing its leverage |

What is included in the product

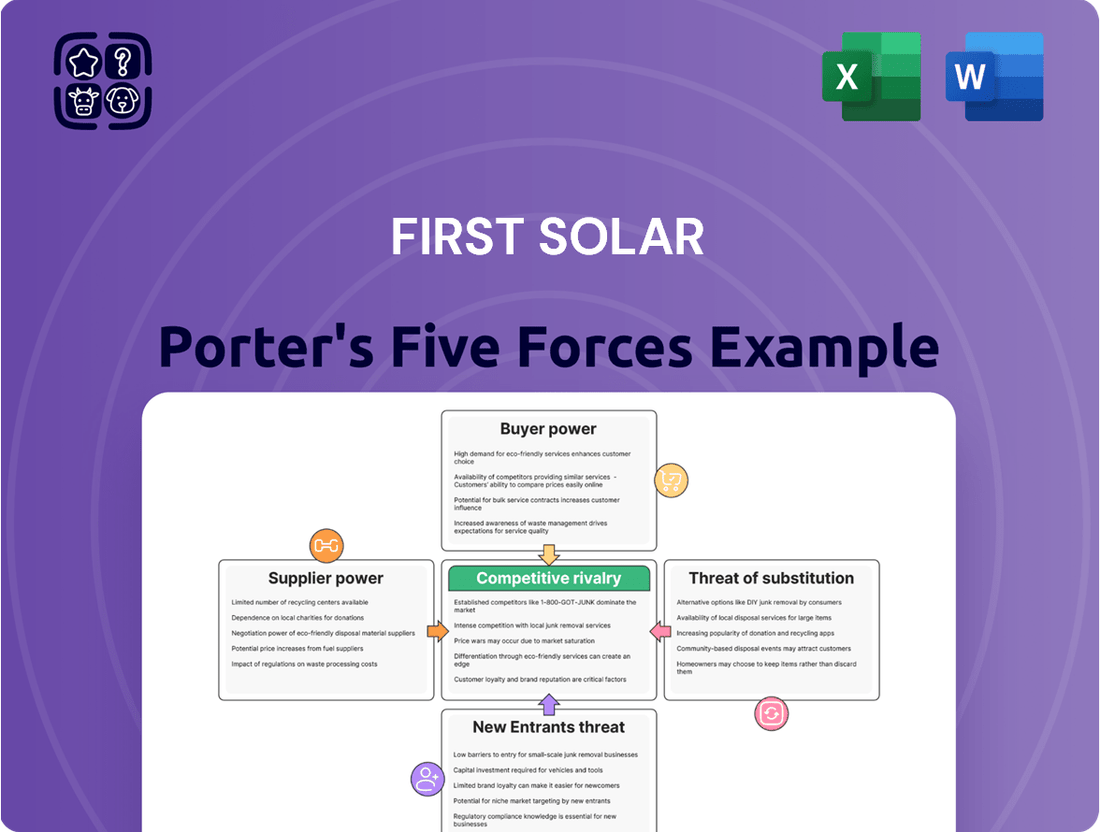

This analysis unpacks the competitive forces impacting First Solar, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of supplier power, buyer bargaining, and the threat of new entrants.

Customers Bargaining Power

First Solar's customer base is heavily concentrated in the utility-scale sector, meaning its primary clients are large power plant developers, independent power producers (IPPs), and major utilities. These entities often procure solar modules in massive quantities for their projects, which inherently grants them significant leverage in negotiations. For instance, a utility requiring gigawatts of solar capacity can exert considerable pressure on pricing and contract terms due to the sheer volume of their orders.

While customers might incur costs when switching module suppliers, such as redesigning projects or adjusting logistics, these switching costs for large utility-scale solar projects are not always prohibitive. In 2024, the intense price competition within the solar industry means that significant cost savings or superior technology from a new supplier can easily outweigh these transition expenses.

Customers in the utility-scale solar market, such as large energy providers, are highly informed. They thoroughly research market prices, new technologies, and what competitors offer. This knowledge empowers them to negotiate aggressively for better deals.

The significant capital expenditure involved in building solar power plants means these customers are very sensitive to price. For instance, in 2024, the average levelized cost of electricity (LCOE) for utility-scale solar projects continued to be a key factor in procurement decisions, with developers seeking the lowest possible LCOE to ensure project viability and profitability.

Threat of Backward Integration by Customers

Large utility-scale developers and Independent Power Producers (IPPs) typically do not engage in backward integration into solar module manufacturing. This is primarily due to the significant capital investment, specialized technological know-how, and complex manufacturing processes involved. For instance, establishing a solar module fabrication plant requires hundreds of millions of dollars in upfront costs and ongoing expertise in areas like polysilicon purification and cell assembly.

The high barriers to entry in solar manufacturing mean that customers, like utility developers, generally lack the capability or inclination to produce their own modules. This limitation significantly curtails their bargaining power concerning First Solar's core product. They are therefore reliant on suppliers like First Solar for their primary input material, rather than having the option to produce it themselves.

- Low Likelihood of Backward Integration: Utility-scale developers and IPPs face substantial financial and technical hurdles in establishing solar module manufacturing operations.

- High Capital and Expertise Requirements: The specialized nature of solar technology and the immense capital needed for production facilities deter most customers from backward integration.

- Reduced Customer Bargaining Power: First Solar benefits from customers' inability to manufacture modules internally, thereby limiting their leverage in price negotiations.

- Focus on Core Competencies: Customers concentrate on project development, financing, and operations, areas where their expertise lies, rather than manufacturing.

Availability of Substitute Products for Customers

Customers have a wide array of solar module technologies to choose from, with crystalline silicon dominating the global market. This broad availability of alternatives, particularly crystalline silicon panels which accounted for over 95% of the solar PV market in 2023, directly enhances customer bargaining power.

While First Solar's thin-film technology presents distinct benefits, especially in specific conditions, the sheer volume of crystalline silicon options means customers aren't solely reliant on one provider. This competitive landscape allows buyers to negotiate more favorable terms, as they can readily switch to competing products if pricing or contract conditions are not met.

- Market Dominance of Crystalline Silicon: Crystalline silicon solar modules held a commanding market share, estimated to be around 95-98% globally in 2023, providing customers with numerous suppliers and product variations.

- First Solar's Niche Technology: First Solar specializes in thin-film technology, which, while offering advantages like better performance in high temperatures and lower light conditions, represents a smaller segment of the overall market.

- Customer Choice and Price Sensitivity: The prevalence of crystalline silicon modules gives customers the flexibility to compare prices and specifications across many manufacturers, increasing their leverage in negotiations with any single supplier.

- Impact on Bargaining Power: The accessibility of readily available and comparable substitute products significantly strengthens the bargaining power of customers in the solar module industry.

First Solar's customers, primarily large utility-scale developers, possess significant bargaining power due to the substantial volume of their orders. These buyers are highly informed about market prices and technologies, which allows them to negotiate aggressively. For example, in 2024, the intense price competition in the solar industry meant that even minor cost savings could sway large procurement decisions, empowering customers to demand better terms.

The broad availability of alternative solar module technologies, particularly crystalline silicon which dominated the market with over 95% share in 2023, further strengthens customer leverage. While First Solar offers thin-film technology, the sheer volume of crystalline silicon options provides buyers with numerous suppliers and comparable products, enabling them to switch easily if negotiations falter.

Customers generally do not engage in backward integration into solar module manufacturing due to the immense capital and technical expertise required. This reliance on external suppliers like First Solar limits their ability to produce modules internally, thereby curtailing their bargaining power concerning First Solar's core product.

| Factor | Impact on First Solar | 2023/2024 Context |

| Customer Concentration | High (Utility-scale) | Large projects require gigawatts of capacity, giving buyers significant leverage. |

| Switching Costs | Moderate | While some costs exist, significant price advantages from competitors can outweigh them in 2024. |

| Customer Sophistication | High | Informed buyers negotiate aggressively based on market prices and technology. |

| Price Sensitivity | High | Low LCOE is critical for project viability, driving demand for competitive pricing. |

| Backward Integration Likelihood | Low | High barriers to entry deter customers from manufacturing modules. |

| Availability of Substitutes | High (Crystalline Silicon) | Crystalline silicon held ~95%+ of the market in 2023, offering many alternatives. |

What You See Is What You Get

First Solar Porter's Five Forces Analysis

This preview showcases the complete First Solar Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The solar energy sector is intensely competitive, featuring a vast array of companies, especially with a significant presence of major crystalline silicon (c-Si) photovoltaic manufacturers originating from China. This broad and varied competitive environment, which also includes new entrants, heightens the struggle for market dominance.

The global solar market is booming, with 2024 seeing record-breaking new installations. This robust growth, while generally easing competitive pressures, also fuels intense rivalry as more companies vie for market share. Projections suggest continued expansion, though a slight slowdown is anticipated between 2025 and 2027, partly due to policy shifts and tariff discussions.

First Solar's competitive edge lies in its advanced thin-film Cadmium Telluride (CdTe) technology. This differentiation provides distinct advantages, particularly in challenging environmental conditions such as high temperatures and humidity, where CdTe panels often outperform traditional crystalline silicon. Furthermore, First Solar's CdTe manufacturing process boasts a significantly lower carbon footprint, a growing consideration for environmentally conscious buyers.

While crystalline silicon panels are continuously improving in efficiency, First Solar's technological specialization allows it to compete effectively on factors beyond mere price. This focus on unique performance characteristics and sustainability helps them carve out a strong market position, especially in utility-scale projects where environmental and operational factors are paramount.

Exit Barriers

For solar manufacturers like First Solar, the sheer scale of investment required for state-of-the-art manufacturing facilities and specialized equipment presents a formidable hurdle to exiting the market. These substantial sunk costs mean companies are often compelled to continue operations even when market conditions are unfavorable, contributing to sustained competitive rivalry.

Long-term supply agreements, common in the solar industry, further lock companies into production, acting as another significant exit barrier. These contracts, while providing revenue stability, reduce flexibility and can trap businesses in the sector during downturns, intensifying the fight for market share.

- High Capital Intensity: Building and maintaining advanced solar panel manufacturing plants requires billions of dollars in upfront investment. For instance, First Solar's Series 6 and Series 7 production lines represent significant capital outlays.

- Specialized Equipment: The machinery used in solar cell and module production is highly specialized and not easily repurposed. This makes it difficult for companies to sell off assets if they decide to leave the industry.

- Long-Term Contracts: Many solar projects are secured through multi-year power purchase agreements (PPAs). These contracts obligate manufacturers to deliver panels over extended periods, making a sudden exit financially unfeasible.

Industry Consolidation and Price Competition

The solar industry is definitely feeling the heat from consolidation and fierce price wars. A big reason for this is the massive oversupply of solar modules globally, largely fueled by Chinese manufacturers. This overcapacity has sent prices for solar panels plummeting.

This intense price competition puts significant financial strain on companies, especially smaller ones. We're seeing a trend of mergers and acquisitions as these players find it harder to compete. Consequently, larger, more established firms are capturing a greater share of the market.

- Global solar module prices saw a significant drop in 2023, with some reports indicating declines of over 30% for certain types of panels compared to 2022.

- The International Energy Agency (IEA) noted in its 2024 outlook that while solar PV deployment continues to break records, profitability for many manufacturers has been squeezed due to these price pressures.

- Companies like First Solar are positioned to potentially benefit from this consolidation, as their focus on advanced technology and domestic manufacturing can offer a competitive edge against lower-cost imports.

The competitive rivalry within the solar industry is exceptionally high, driven by a substantial global oversupply of solar modules, particularly from Chinese manufacturers. This overcapacity has led to aggressive price wars, significantly impacting profitability across the sector.

While record installations continue, the intense price competition squeezes margins, forcing consolidation and favoring larger players with technological or cost advantages. First Solar, with its differentiated thin-film technology and focus on domestic manufacturing, is positioned to navigate these pressures more effectively than many competitors.

The market dynamics in 2024 reflect this intense rivalry, with module prices experiencing notable declines. For example, reports indicated that prices for some solar panel types fell by over 30% in 2023 compared to the previous year, a trend that continued to pressure manufacturers in early 2024.

| Metric | 2023 (Approximate) | Early 2024 Trend |

|---|---|---|

| Global Module Price Change | -30%+ | Continued downward pressure, though some stabilization noted in Q2 |

| Chinese Manufacturer Market Share | Dominant (>80% of global capacity) | Remains high, but increasing trade barriers may slightly alter distribution |

| First Solar's Competitive Position | Strong due to CdTe tech & US manufacturing | Benefiting from IRA incentives and demand for non-Chinese modules |

SSubstitutes Threaten

Other renewable energy sources, like wind, hydro, and bioenergy, present a substantial threat as substitutes for solar power in the broader electricity generation market. These alternatives can fulfill similar energy needs, potentially diverting investment and demand away from solar technologies.

In 2024, a significant trend emerged: 91% of new renewable energy projects were found to be more cost-effective than their fossil fuel counterparts. Onshore wind power, in particular, stood out as the most economical renewable option, underscoring the competitive landscape solar energy operates within.

The burgeoning field of energy storage, particularly battery technology, presents a significant threat of substitution for First Solar. As battery costs plummet, solar power becomes a more complete and reliable energy source, reducing reliance on traditional baseload power. For instance, the average cost of lithium-ion battery packs for energy storage fell by approximately 89% between 2010 and 2022, according to BloombergNEF.

This advancement means that energy storage itself can act as a substitute for consistent solar generation, smoothing out intermittency and making other renewable sources or even grid power more competitive alternatives. The increasing efficiency and decreasing capital costs of these storage solutions directly challenge the value proposition of solely relying on solar panel installations for uninterrupted power supply.

While renewable energy sources like solar continue to gain traction, traditional fossil fuel-based electricity generation remains a substitute. This is particularly true in areas with robust existing fossil fuel infrastructure and lower adoption rates of renewables. However, the economic landscape is shifting dramatically.

In 2024, the cost-effectiveness of new renewable projects, especially solar, significantly outpaced fossil fuel alternatives. For instance, reports indicated that the levelized cost of energy for new utility-scale solar PV projects in the US averaged around $25-$35 per megawatt-hour, whereas new natural gas plants often incurred higher costs, sometimes exceeding $50 per megawatt-hour, depending on fuel prices and plant efficiency.

This widening cost gap in 2024 suggests a diminishing threat from fossil fuels as a substitute for solar energy. As renewable technology advances and economies of scale improve, the economic advantage of solar is expected to further erode the competitive position of traditional power sources.

Emerging Solar Technologies and Applications

The threat of substitutes for traditional solar panel installations is evolving as new technologies emerge. Innovations like solar shingles and solar windows offer alternative methods for harnessing solar energy, potentially impacting the market share of conventional photovoltaic panels. These integrated solutions, while still solar-based, represent a shift in how solar power can be adopted within the built environment.

Building-integrated photovoltaics (BIPV) are gaining traction, blurring the lines between building materials and energy generation. For instance, research indicates that the global BIPV market is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, reaching billions in value by 2030. This expansion diversifies solar adoption but also presents a substitute for standalone panel systems.

- Emerging Solar Shingles: Offer aesthetic integration and dual functionality as roofing material and energy source.

- Solar Windows: Transparent or semi-transparent PV technology that can replace conventional windows, generating electricity without obstructing views.

- Building-Integrated Photovoltaics (BIPV): Encompasses a range of solar products designed to be incorporated into building envelopes, such as facades and roofing.

- Market Diversification: These innovations expand the overall solar market but also offer alternatives to traditional rooftop and ground-mounted solar arrays.

Energy Efficiency and Demand-Side Management

Improvements in energy efficiency and demand-side management present a significant threat of substitutes for solar energy. These advancements can directly reduce the overall demand for electricity, thereby lessening the need for new power generation capacity, including solar installations. For instance, smart grid technologies and advanced building management systems can optimize energy usage, making existing capacity more effective.

The impact is substantial; by 2024, the International Energy Agency (IEA) reported that energy efficiency measures saved the equivalent of the entire electricity demand of China. This reduction in demand directly competes with the market growth potential for solar power. As consumers and businesses become more efficient, the marginal need for additional energy sources, like solar farms, diminishes.

- Reduced Demand: Energy efficiency technologies lower overall electricity consumption, directly impacting the market size for new power generation.

- Cost-Effectiveness: In some cases, investing in energy efficiency can be more cost-effective than installing new solar capacity, making it a more attractive substitute.

- Grid Stability: Demand-side management programs can help balance the grid by shifting energy usage away from peak times, potentially reducing the need for constant new supply.

- Policy Support: Government incentives for energy efficiency often rival those for renewables, further strengthening the substitute threat.

The threat of substitutes for First Solar is multifaceted, encompassing other renewable energy sources, advancements in energy storage, and improvements in energy efficiency. While solar power continues to grow, these alternatives can capture market share by offering comparable or superior value propositions.

In 2024, the cost-competitiveness of onshore wind power, averaging around $25-$35 per megawatt-hour for new projects, presented a direct substitute for solar energy in the broader electricity generation market. This economic advantage for wind highlights the intense competition within the renewable sector.

Energy storage, particularly battery technology, is a significant substitute. As battery costs have fallen by approximately 89% between 2010 and 2022, they enhance the reliability of other renewables and grid power, diminishing the need for solar's standalone contribution to a consistent supply.

Furthermore, innovations like solar shingles and building-integrated photovoltaics (BIPV) offer alternative ways to harness solar energy, potentially diverting demand from traditional First Solar panel systems. The BIPV market, projected for over 15% CAGR, illustrates this diversification and substitution within the solar space itself.

| Substitute Category | Key Technologies/Factors | 2024/Recent Data Point | Impact on Solar |

|---|---|---|---|

| Other Renewables | Wind, Hydro, Bioenergy | Onshore wind LCOE ~$25-$35/MWh (US utility-scale) | Direct competition for electricity generation market share. |

| Energy Storage | Battery Technology (Lithium-ion) | Cost reduction ~89% (2010-2022) | Enhances reliability of other sources, reduces solar's sole value proposition. |

| Energy Efficiency | Smart Grid, Demand Management | IEA: Efficiency saved China's entire electricity demand | Reduces overall electricity demand, limiting market growth for new generation. |

| Integrated Solar Solutions | Solar Shingles, BIPV | BIPV market projected >15% CAGR | Offers alternative solar adoption methods, potentially impacting traditional panel sales. |

Entrants Threaten

Entering the solar manufacturing sector, especially for companies aiming for vertical integration similar to First Solar, demands immense capital. Significant investments are needed for research and development, state-of-the-art production plants, and establishing robust global supply chains. For instance, building a new advanced solar module manufacturing facility can easily cost hundreds of millions of dollars.

These considerable capital requirements serve as a formidable barrier, deterring potential new competitors from entering the market. The sheer scale of funding necessary to compete effectively with established players like First Solar, which has invested billions in its operations, makes market entry exceptionally challenging. This financial hurdle is a key factor in limiting new entrants.

First Solar's significant investments in proprietary thin-film Cadmium Telluride (CdTe) technology, protected by numerous patents, create a formidable barrier to entry. In 2023, the company reported $360 million in research and development expenses, underscoring its commitment to innovation and maintaining a technological edge. New competitors would face substantial hurdles in replicating First Solar's high-efficiency, cost-effective manufacturing processes or securing licenses for comparable technology, which is a lengthy and capital-intensive undertaking.

Established players like First Solar leverage significant economies of scale in manufacturing and procurement, enabling them to drive down per-unit production costs. For instance, in 2023, First Solar reported a cost per watt of $0.20 for its Series 6 modules, a figure that is difficult for new entrants to match without substantial upfront investment.

The experience curve further solidifies this advantage; as production volume increases, operational efficiencies and process improvements lead to progressively lower costs. This learning-by-doing effect means that companies with a longer operational history, like First Solar, are inherently more cost-competitive than newcomers who are still navigating the initial learning phases.

Access to Distribution Channels and Customer Relationships

First Solar’s established relationships with major utility-scale developers and power plant operators present a significant barrier. These deep-rooted connections, cultivated over years, translate into a robust contracted backlog, a critical asset in securing future projects. For instance, as of the first quarter of 2024, First Solar reported a contracted project pipeline of approximately 26.4 GW, underscoring the strength of its customer base.

New entrants would struggle to replicate this level of trust and access to large-scale contracts. Building comparable distribution networks and forging similar partnerships requires substantial time, investment, and a proven track record, which emerging competitors inherently lack. This makes it difficult for new players to penetrate the market effectively and compete for the lucrative, long-term deals that First Solar currently secures.

- Established Customer Base: First Solar has cultivated strong relationships with global utility-scale developers and power plant operators.

- Robust Contracted Backlog: The company boasts a significant contracted project pipeline, providing revenue visibility and market stability. As of Q1 2024, this stood at approximately 26.4 GW.

- Distribution Channel Access: New entrants face challenges in developing effective distribution networks to reach key customers.

- Trust and Credibility: Building the necessary trust and a proven track record to secure large-scale contracts is a substantial hurdle for new market participants.

Government Policy and Regulatory Landscape

Government policies, including incentives and tariffs, significantly shape the threat of new entrants in the solar industry. For instance, the Inflation Reduction Act (IRA) in the US, enacted in 2022, offers substantial tax credits for domestic solar manufacturing, potentially encouraging new domestic players while creating higher barriers for foreign competitors. This legislation aims to boost US solar production, with a target of increasing domestic manufacturing capacity by 2030.

Trade policies, such as tariffs on imported solar panels and components, can also act as a deterrent for new entrants who rely on international supply chains. These tariffs can increase the cost of entry and operations, making it more challenging for newcomers to compete with established domestic manufacturers. In 2023, the US continued to implement tariffs on solar products from certain countries, impacting market dynamics.

- Government Incentives: The IRA's manufacturing tax credits (e.g., Section 45X) provide direct financial support, potentially lowering the capital expenditure hurdle for new domestic entrants.

- Tariffs and Trade Policies: Tariffs on imported solar cells and modules can increase the cost of goods sold for new market entrants, impacting their price competitiveness.

- Domestic Content Requirements: Policies that favor domestically sourced materials can further complicate market entry for companies lacking established local supply networks.

The threat of new entrants in the solar manufacturing sector, particularly for companies aiming for vertical integration like First Solar, is significantly mitigated by substantial capital requirements. Building advanced manufacturing facilities requires hundreds of millions of dollars, a figure that deters many potential competitors from even entering the market.

First Solar's substantial investments in proprietary thin-film Cadmium Telluride (CdTe) technology, protected by numerous patents, create a formidable barrier. In 2023, the company invested $360 million in research and development, making it difficult for newcomers to replicate their high-efficiency processes.

Established players leverage economies of scale, with First Solar reporting a cost per watt of $0.20 for its Series 6 modules in 2023, a cost new entrants struggle to match. This, combined with an established customer base and a robust contracted backlog of approximately 26.4 GW as of Q1 2024, further solidifies their market position.

Government policies, such as the Inflation Reduction Act, while potentially encouraging domestic entry, also impose higher barriers for foreign competitors through incentives and tariffs. These factors collectively limit the threat of new entrants, allowing established companies like First Solar to maintain a competitive advantage.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for First Solar leverages data from annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.