First Solar Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Solar Bundle

Unlock the strategic blueprint behind First Solar's innovative business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear understanding of their market dominance. Download the full version to gain actionable insights for your own business strategy.

Partnerships

First Solar's business model relies heavily on strategic suppliers for essential raw materials and components, ensuring a consistent supply chain for its advanced thin-film solar modules. This includes crucial partnerships for materials like tellurium and cadmium, vital for their cadmium telluride (CdTe) technology.

Furthermore, First Solar actively pursues technology partnerships to stay at the forefront of solar innovation. A prime example is their acquisition of Evolar, a company specializing in perovskite solar cell technology, signaling a commitment to developing and integrating next-generation photovoltaic solutions. In 2023, First Solar announced plans to invest $684 million to expand its U.S. manufacturing capacity, highlighting the importance of these partnerships in scaling production.

First Solar frequently teams up with Engineering, Procurement, and Construction (EPC) firms to build and install massive solar farms. These companies are essential for bringing utility-scale projects to life, bringing specialized construction skills to the table. For instance, in 2023, First Solar announced a significant partnership with a major EPC provider for a new 4 GW manufacturing facility in Louisiana, highlighting the scale of these collaborations.

First Solar actively collaborates with leading research and development institutions and universities to drive technological advancements and secure its market leadership. These strategic alliances are crucial for staying ahead in the rapidly evolving solar industry.

A prime example of this commitment is their partnership with the Jim Nolan Center for Solar Innovation located in Ohio. This collaboration focuses on pushing the boundaries of solar cell efficiency and exploring novel applications for photovoltaic technology.

Through these R&D partnerships, First Solar aims to develop next-generation solar modules that offer higher energy conversion rates and improved durability. These advancements are vital for reducing the levelized cost of energy (LCOE) and making solar power even more competitive globally.

Financial Institutions and Investors

First Solar heavily relies on partnerships with financial institutions and investors to fuel its capital-intensive operations. These collaborations are crucial for securing the substantial funding required for both expanding manufacturing capabilities and developing large-scale solar power projects. For instance, in 2024, First Solar announced significant investments and financing arrangements to support its ongoing capacity expansion, underscoring the vital role of these financial relationships in enabling their ambitious growth plans and maintaining robust liquidity.

These partnerships are not just about project-specific financing; they extend to securing capital for new manufacturing facilities, which are essential for meeting growing demand. By working with a diverse range of financial entities, First Solar can diversify its funding sources and ensure access to capital even during periods of economic uncertainty. This strategic approach to financial partnerships allows them to undertake major capital expenditures with greater confidence.

- Project Financing: Securing debt and equity for utility-scale solar projects.

- Manufacturing Expansion Capital: Funding for new and existing production facilities.

- Investment Partnerships: Collaborating with institutional investors for long-term growth.

- Liquidity Management: Ensuring sufficient cash flow to meet operational and investment needs.

Government Agencies and Policy Makers

First Solar actively cultivates relationships with government agencies and policymakers to navigate complex regulatory environments and capitalize on supportive legislation. These collaborations are crucial for leveraging significant incentives, such as those provided by the Inflation Reduction Act (IRA) and its Section 45X advanced manufacturing tax credits.

These partnerships allow First Solar to enhance the cost-competitiveness of its U.S.-manufactured solar panels. For instance, the IRA's production tax credits and investment tax credits are designed to bolster domestic clean energy manufacturing, directly benefiting companies like First Solar.

- IRA Impact: The Inflation Reduction Act, enacted in 2022, is projected to drive substantial growth in U.S. solar installations and manufacturing capacity, with First Solar positioned as a key beneficiary.

- Section 45X: This provision offers tax credits for domestically produced solar components, directly reducing manufacturing costs for First Solar's U.S.-made modules.

- Policy Advocacy: Engaging with policymakers helps First Solar advocate for policies that promote solar energy adoption and create a stable, favorable market for its products.

First Solar's key partnerships extend to customers, primarily utility companies and independent power producers, who purchase their solar modules for large-scale projects. These relationships are foundational for revenue generation and market penetration. In 2023, First Solar secured significant module supply agreements totaling over 11 GW, demonstrating the strength of these customer partnerships.

Collaborations with technology providers and research institutions are also vital for First Solar's innovation pipeline, ensuring they remain at the cutting edge of thin-film solar technology. Their acquisition of Evolar in 2023, focusing on perovskite technology, exemplifies this strategic approach to integrating next-generation advancements.

Furthermore, partnerships with financial institutions and investors are critical for funding First Solar's capital-intensive manufacturing expansions and project developments. In 2024, the company announced substantial investments and financing to bolster its U.S. manufacturing capabilities, highlighting the essential role of these financial alliances in driving growth and maintaining operational liquidity.

| Partnership Type | Key Activities | 2023/2024 Impact/Data |

|---|---|---|

| Customers (Utilities, IPPs) | Module sales for utility-scale projects | Secured over 11 GW in module supply agreements in 2023 |

| Technology & R&D | Innovation, next-gen tech integration | Acquisition of Evolar (perovskite technology) in 2023 |

| Financial Institutions & Investors | Project financing, manufacturing expansion capital | Significant investments and financing announced in 2024 for U.S. capacity expansion |

What is included in the product

This Business Model Canvas outlines First Solar's strategy of providing cost-effective, high-quality solar technology and comprehensive project development services to utility-scale customers worldwide.

It details their focus on innovative manufacturing, robust supply chain, and long-term customer relationships to drive sustainable growth in the renewable energy sector.

The First Solar Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, allowing stakeholders to quickly grasp complex operations and identify areas for improvement.

Activities

First Solar's central operation is the design and large-scale manufacturing of sophisticated thin-film photovoltaic solar modules. This core activity is underpinned by their exclusive use of cadmium telluride (CdTe) technology, setting them apart from competitors relying on silicon-based solar cells.

The company's manufacturing process is a continuous, high-volume operation within their advanced facilities. As of early 2024, First Solar is actively expanding its production capacity, with notable investments in new plants in Alabama and Louisiana, aiming to significantly boost their module output to meet growing demand.

First Solar's commitment to research and development is paramount, focusing on improving its thin-film solar technology. This dedication translates into enhanced efficiency and cost reductions, making their products more competitive in the global market. Their R&D labs in California and Ohio are at the forefront of this innovation.

Key R&D initiatives include developing advanced photovoltaic technologies, such as high-efficiency tandem solar cells. They are also actively exploring novel materials like quantum dots to push the boundaries of solar energy conversion. These advancements are crucial for maintaining their technological edge.

In 2024, First Solar continued to invest significantly in R&D to accelerate the development and commercialization of next-generation solar solutions. This ongoing investment is vital for their long-term strategy to lead in the evolving solar industry.

First Solar actively develops and constructs utility-scale solar power plants, going beyond just manufacturing. This crucial activity encompasses everything from finding suitable locations and meticulous project planning to securing necessary permits and managing the entire construction phase. This end-to-end capability allows them to offer complete solar energy solutions to their major clients.

In 2023, First Solar announced plans for a new manufacturing facility in Louisiana, aiming to support the growing demand for their advanced solar technology in utility-scale projects. This expansion highlights their commitment to the development and construction segment by ensuring a robust supply chain for their power plant projects.

Sales and Distribution of Solar Modules

First Solar's commercial engine is driven by the sales and distribution of its advanced PV solar modules across the globe. A significant emphasis is placed on the United States market, where the company actively secures long-term contracts. This strategic approach has resulted in a robust contracted backlog of module sales, providing a predictable revenue stream.

The company's commitment to growth is evident in its sales performance. In 2024, First Solar achieved a record high, selling an impressive 14.1 gigawatts (GW) of modules. This surge in sales underscores the increasing demand for their technology and their ability to meet market needs.

- Global Module Sales: First Solar distributes its PV solar modules to a diverse customer base worldwide.

- U.S. Market Focus: A primary strategic objective is to strengthen its presence and sales within the United States.

- Contracted Backlog: The company manages a substantial backlog of module sales through long-term agreements.

- 2024 Sales Record: In 2024, First Solar reported a record 14.1 GW of modules sold, highlighting strong market demand and execution.

Operation and Maintenance (O&M) of Power Plants

First Solar actively engages in the operation and maintenance (O&M) of the solar power plants it develops and builds. This commitment extends beyond initial construction, focusing on ensuring the sustained performance and unwavering reliability of the installed solar systems throughout their operational lifespan.

By offering these comprehensive lifecycle services, First Solar cultivates robust and lasting relationships with its customers. This approach not only enhances customer satisfaction but also maximizes the overall value derived from the solar power assets over time. For instance, in 2023, First Solar's O&M services contributed to the efficient operation of a significant portion of its installed capacity, underscoring its dedication to long-term asset management.

- Ensuring Long-Term Performance: First Solar's O&M teams conduct regular inspections, preventative maintenance, and rapid response to any issues, minimizing downtime and maximizing energy generation.

- Maximizing Asset Value: Proactive maintenance and performance optimization through O&M services help extend the operational life of solar plants and ensure they meet or exceed projected financial returns.

- Customer Relationship Management: Providing ongoing O&M builds trust and loyalty, positioning First Solar as a reliable, full-service partner for solar energy projects.

- Operational Efficiency Data: In 2023, First Solar reported that its O&M services helped maintain an average plant availability above 98% for many of its contracted projects.

First Solar's key activities revolve around the design, manufacturing, and sale of its proprietary thin-film solar modules, particularly those using cadmium telluride (CdTe) technology. The company also actively develops and constructs utility-scale solar power plants, offering end-to-end solutions. Furthermore, First Solar provides operation and maintenance (O&M) services for the solar facilities it builds, ensuring long-term performance and customer satisfaction.

| Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Module Design & Manufacturing | Producing advanced thin-film CdTe solar modules. | 14.1 GW modules sold in 2024. |

| Utility-Scale Project Development & Construction | Developing and building large solar power plants. | New facility planned in Louisiana to support demand. |

| Sales & Distribution | Selling modules globally, with a strong U.S. focus. | Record contracted backlog of module sales. |

| Operation & Maintenance (O&M) | Ensuring sustained performance of installed solar systems. | Maintained average plant availability above 98% in 2023. |

Delivered as Displayed

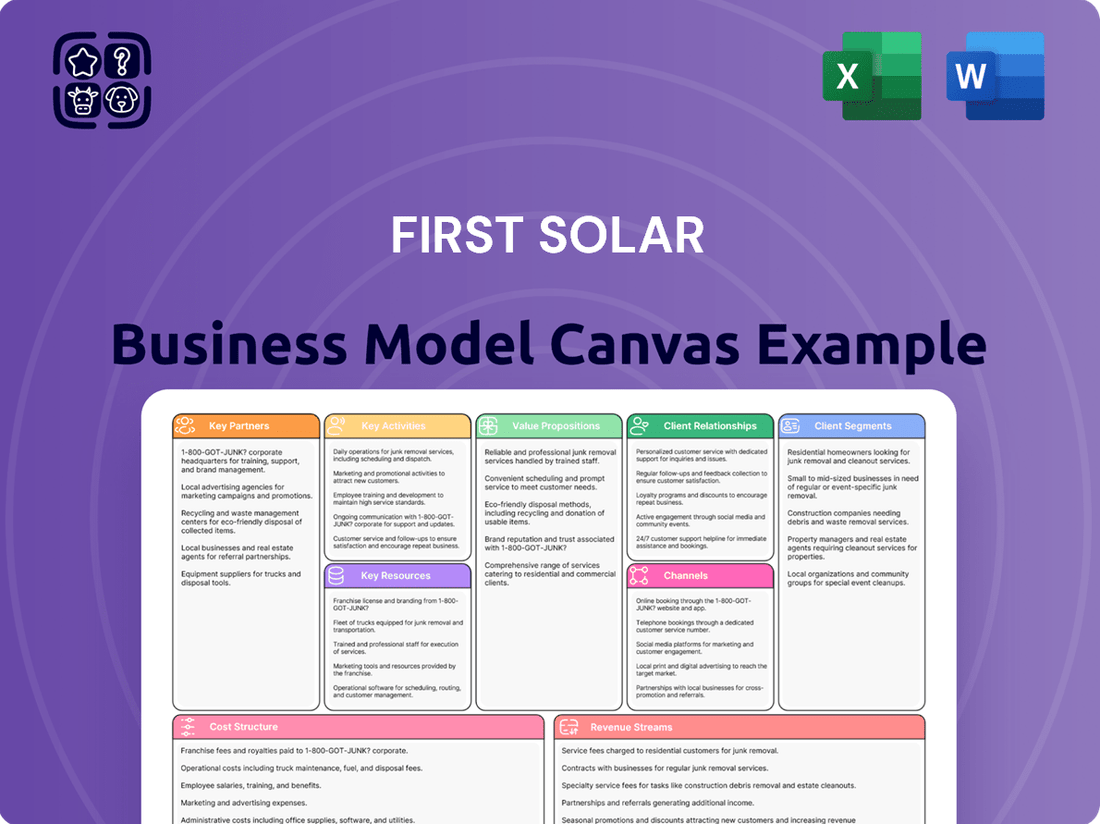

Business Model Canvas

The First Solar Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means all sections, data, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess the comprehensive nature of this strategic tool, knowing it's a direct representation of what you'll gain access to.

Resources

First Solar's most significant key resource is its proprietary cadmium telluride (CdTe) thin-film photovoltaic technology. This innovation is central to their competitive edge in the solar industry.

CdTe technology provides distinct advantages, excelling in performance under hot and humid conditions and boasting a lower carbon footprint than conventional crystalline silicon. This makes their modules particularly well-suited for diverse environmental challenges.

In 2023, First Solar reported a manufacturing capacity of 25 GW, with their CdTe technology underpinning this significant output. Their commitment to this proprietary process is a cornerstone of their operational strategy and market differentiation.

First Solar's advanced manufacturing facilities are a cornerstone of its operations, boasting significant capacity in the United States and abroad. These state-of-the-art plants are engineered for high-volume production of their thin-film solar modules, a key differentiator in the market.

The company continues to expand its manufacturing footprint, with new plants like the one in Alabama already operational and another under construction in Louisiana. This strategic expansion is designed to meet growing demand and solidify First Solar's position as a leading U.S.-based solar manufacturer.

By the close of 2026, First Solar projects its annual production capacity to surpass 25 gigawatts (GW). This aggressive ramp-up in capacity underscores their commitment to scaling operations and driving down costs through advanced manufacturing techniques.

First Solar's robust intellectual property portfolio, featuring patents for its advanced thin-film solar technology and manufacturing techniques, is a cornerstone of its business model. This IP acts as a significant competitive advantage, protecting its innovations and market share.

The company's commitment to research and development is exemplified by facilities like the Jim Nolan Center for Solar Innovation, which drives continuous technological advancement. This focus ensures First Solar remains at the forefront of the solar industry, a crucial element for long-term success.

First Solar's intellectual property is not just defensive; it's a proactive asset. The company has actively engaged in patent litigation to safeguard its innovations, underscoring the commercial value and strategic importance of its R&D capabilities in the competitive solar landscape.

Skilled Workforce and Human Capital

First Solar's highly skilled workforce, encompassing engineers, scientists, manufacturing specialists, and project managers, is a cornerstone of its business model. Their collective expertise is instrumental in driving technological innovation, optimizing production processes, and ensuring the successful execution of large-scale solar projects.

The company's commitment to talent development and its expanding employee base directly support its ambitious growth trajectories. As of early 2024, First Solar continued to invest in its workforce, recognizing human capital as a key enabler for achieving its manufacturing and deployment targets.

- Engineering and R&D: Expertise in thin-film technology and advanced manufacturing processes.

- Manufacturing Excellence: Skilled operators and technicians ensuring high-quality module production.

- Project Management: Professionals adept at managing complex, global solar project development and execution.

- Innovation Culture: A workforce focused on continuous improvement and the development of next-generation solar solutions.

Strong Financial Position and Access to Capital

First Solar's strong financial standing, evidenced by substantial cash reserves and controlled debt, is a cornerstone of its business model. As of the first quarter of 2024, the company reported approximately $2.4 billion in cash and cash equivalents, providing significant flexibility. This robust financial position directly supports its ambitious capital expenditure plans, including the expansion of its manufacturing capacity in the United States and internationally.

This access to capital is critical for First Solar to pursue and secure large-scale solar projects, which often require substantial upfront investment. For instance, the company is investing heavily in its new manufacturing facility in Louisiana, expected to be operational by late 2024, and expanding its existing Ohio plant. These investments are vital for meeting the growing demand for its advanced thin-film solar modules and maintaining its competitive edge in the rapidly expanding renewable energy sector.

- Healthy Cash Balance: Approximately $2.4 billion in cash and cash equivalents as of Q1 2024.

- Manageable Debt Levels: Allows for strategic financial maneuvering and investment.

- Capital Expenditure Support: Funds manufacturing expansion and R&D initiatives.

- Access to Capital: Crucial for securing large-scale projects and long-term growth.

First Solar's key resources are its proprietary CdTe thin-film technology, advanced manufacturing facilities, a robust intellectual property portfolio, a skilled workforce, and a strong financial position. These elements collectively enable the company to produce high-performance solar modules, expand its global reach, and maintain a competitive edge in the renewable energy market.

| Key Resource | Description | 2024 Data/Relevance |

| Proprietary CdTe Technology | Thin-film photovoltaic technology offering advantages in hot climates and lower carbon footprint. | Underpins First Solar's module performance and market differentiation. |

| Manufacturing Facilities | State-of-the-art plants with significant and expanding production capacity. | Projected 2026 capacity to exceed 25 GW; new plants in Alabama and Louisiana operational/under construction. |

| Intellectual Property | Patents for thin-film technology and manufacturing techniques. | Protects innovations and provides a significant competitive advantage. |

| Skilled Workforce | Engineers, scientists, manufacturing specialists, and project managers. | Essential for driving innovation, optimizing production, and executing projects; ongoing investment in talent. |

| Financial Standing | Strong cash reserves and manageable debt. | Q1 2024 cash and equivalents: ~$2.4 billion, supporting capital expenditures for expansion. |

Value Propositions

First Solar's high-performance, responsibly produced modules stand out in the market. Their advanced thin-film technology delivers exceptional energy yield, even in less-than-ideal weather, a key advantage for many projects. In 2023, First Solar's average module efficiency reached 19.5%, demonstrating their commitment to cutting-edge technology.

The company's dedication to responsible production is a significant draw. By focusing on a lower carbon footprint throughout their manufacturing, First Solar appeals to environmentally conscious customers. Their manufacturing process uses significantly less energy and water compared to traditional silicon-based modules, contributing to a more sustainable energy future.

First Solar's thin-film technology is designed to significantly lower the cost of solar electricity, pushing towards grid parity even without government support in important regions. This commitment to affordability makes solar power a much more practical choice for generating electricity on a large scale.

By offering competitive pricing, First Solar is actively driving the broader acceptance and implementation of photovoltaic technology across the energy sector.

First Solar's vertically integrated model covers everything from manufacturing their advanced thin-film solar modules to developing, building, and even operating utility-scale solar projects. This end-to-end approach means customers deal with just one company, streamlining the entire process and ensuring a smoother path from concept to operational power plant.

This comprehensive offering simplifies complex solar projects for clients, providing a single point of accountability and expertise. For instance, in 2023, First Solar announced a significant expansion of its manufacturing capacity in the U.S., aiming to produce enough modules to power 3.5 million homes annually by 2026, showcasing their commitment to delivering complete solutions.

Reliable and Scalable Energy Generation

First Solar's value proposition centers on providing dependable and expandable energy generation. Their advanced photovoltaic (PV) modules are engineered for consistent performance, a critical attribute for large-scale energy projects where stable power output is paramount. This reliability underpins their appeal to utility companies and independent power producers.

The company's commitment to manufacturing expansion directly addresses the increasing global appetite for solar power. By scaling up production, First Solar ensures it can meet substantial demand, positioning itself as a key player in the transition to renewable energy. This focus on scalability is a core component of their business strategy.

First Solar's robust contracted backlog serves as a concrete indicator of their delivery capability and market confidence. As of the first quarter of 2024, the company reported a contracted backlog of 27.8 GW, valued at approximately $20.3 billion. This substantial volume highlights their proven ability to secure and execute large-scale projects, reinforcing their reputation for reliable and scalable energy solutions.

- Reliable Power: First Solar’s thin-film technology offers consistent energy generation, even in challenging conditions.

- Scalable Manufacturing: The company is actively expanding its production capacity, with plans to reach 35 GW of annual capacity by the end of 2025.

- Contracted Backlog: A significant backlog of 27.8 GW (as of Q1 2024) demonstrates their ability to deliver on large-scale projects.

American-Made Technology and Supply Chain Security

First Solar's commitment to American-made technology is a significant value proposition, especially for customers prioritizing supply chain resilience and domestic content. As a U.S.-headquartered company and a leading domestic manufacturer, they offer the assurance of products built within the United States.

This focus resonates strongly with clients navigating geopolitical complexities and evolving trade policies, where reliance on foreign manufacturing can introduce uncertainty. First Solar's domestic production base allows them to tap into and benefit from specific policy incentives designed to bolster U.S. manufacturing capabilities.

- Domestic Manufacturing Advantage: First Solar is a U.S.-based manufacturer, offering products made in America.

- Supply Chain Security: This appeals to customers seeking to reduce reliance on overseas supply chains, enhancing predictability and control.

- Policy Alignment: Their U.S. manufacturing footprint allows them to capitalize on domestic policy incentives, such as those aimed at promoting clean energy manufacturing within the United States. For instance, the Inflation Reduction Act (IRA) provides significant tax credits for domestic content and manufacturing.

First Solar provides high-performance, responsibly manufactured thin-film modules designed for superior energy yield, even in varied weather conditions. Their commitment to sustainability is evident in a manufacturing process that uses less energy and water, appealing to environmentally conscious clients.

The company's vertically integrated model streamlines solar project development, from module manufacturing to project operation, offering clients a single point of accountability. This end-to-end approach ensures a smoother project lifecycle.

First Solar's value proposition is built on dependable and scalable energy generation, backed by a substantial contracted backlog of 27.8 GW as of Q1 2024, valued at approximately $20.3 billion. This demonstrates their proven ability to deliver large-scale projects reliably.

As a U.S.-based manufacturer, First Solar offers supply chain security and benefits from domestic policy incentives, such as those within the Inflation Reduction Act, appealing to customers prioritizing resilience and American-made products.

| Value Proposition | Key Feature | Supporting Data/Fact |

|---|---|---|

| High-Performance Modules | Thin-film technology for superior energy yield | Average module efficiency reached 19.5% in 2023. |

| Responsible Production | Lower carbon footprint, less energy/water usage | Contributes to a more sustainable energy future. |

| Cost-Effectiveness | Driving down the cost of solar electricity | Aims to achieve grid parity without subsidies. |

| Vertical Integration | End-to-end project solutions | Streamlines project development from manufacturing to operation. |

| Reliability & Scalability | Consistent performance, expanding capacity | Contracted backlog of 27.8 GW (Q1 2024); aiming for 35 GW annual capacity by end of 2025. |

| Domestic Manufacturing | U.S.-made products, supply chain security | Benefits from U.S. policy incentives like the IRA. |

Customer Relationships

First Solar cultivates deep, long-term strategic partnerships with major players in the renewable energy sector, including utility-scale developers, independent power producers, and large commercial and industrial entities. These collaborations are founded on a commitment to reliability and the provision of comprehensive, integrated solutions that span many years.

The strength of these relationships is clearly demonstrated by First Solar's significant contracted backlog, which extends well into 2030. This substantial order book underscores the enduring trust and value customers place on the company's offerings and its ability to deliver consistently over extended project lifecycles.

First Solar's dedicated account management is crucial for its utility-scale solar projects. These teams offer specialized support, technical knowledge, and project coordination, guiding clients from inception to completion.

This personalized strategy is vital for ensuring customer satisfaction and meeting the unique demands of each solar power plant. For instance, in 2023, First Solar delivered 2.9 GW of modules, highlighting the scale of operations managed by these dedicated teams.

First Solar cultivates strong customer relationships by offering comprehensive lifecycle services, from initial project development and financing support to engineering, construction, and ongoing operation of solar power plants. This integrated approach, which saw First Solar achieve approximately $4.1 billion in revenue in 2023, makes it a sticky partner for clients once a project is initiated.

This holistic support system significantly enhances customer loyalty and fosters long-term collaboration, as clients benefit from a single, reliable provider managing all facets of their solar investments. This deep integration is a key differentiator, making First Solar a challenging partner to dislodge mid-project.

Technology and Performance Support

First Solar offers robust technology and performance support, ensuring customers maximize their solar investments. This includes ongoing technical assistance and detailed performance monitoring for their advanced solar modules and integrated systems. By proactively addressing potential issues, they guarantee optimal operation, boosting energy output and extending the lifespan of installations.

Their dedication to continuous research and development is a cornerstone of this support. This commitment ensures First Solar's products remain at the forefront of efficiency and reliability, directly enhancing customer value and fostering long-term relationships. For instance, their Series 6 module achieved a record efficiency of 22.3% in early 2024, demonstrating this ongoing innovation.

- Ongoing Technical Support: Providing expert assistance for system operation and maintenance.

- Performance Monitoring: Utilizing advanced analytics to track and optimize energy generation.

- Continuous R&D Investment: Regularly enhancing product technology for superior performance and competitiveness.

- Extended System Lifespan: Ensuring installations operate efficiently for many years, maximizing return on investment.

Policy and Incentive Guidance

First Solar actively guides its U.S. customers through the intricate landscape of government policies and incentives, notably the Section 45X advanced manufacturing tax credits. This expert assistance empowers clients to optimize the financial returns on their solar projects by effectively leveraging these crucial benefits.

This policy and incentive guidance is a cornerstone of First Solar's customer relationships, particularly in the United States. By demystifying complex regulations and highlighting available financial advantages, First Solar transforms potential hurdles into tangible economic gains for its partners.

- Policy Navigation: First Solar provides expert advice on navigating federal and state solar policies.

- Incentive Maximization: The company helps customers fully utilize tax credits and other financial incentives, such as the Section 45X credit.

- Value Addition: This service enhances the profitability and overall attractiveness of First Solar's solar solutions.

- Customer Support: It fosters stronger customer relationships through dedicated expertise and support.

First Solar's customer relationships are built on long-term strategic partnerships, comprehensive lifecycle services, and expert technical and policy support. This approach, exemplified by their significant contracted backlog extending into 2030 and robust revenue generation, like the $4.1 billion in 2023, fosters deep customer loyalty.

The company's commitment to continuous R&D, leading to advancements like their Series 6 module achieving 22.3% efficiency in early 2024, ensures customers receive cutting-edge technology. Furthermore, their guidance on navigating crucial incentives, such as the Section 45X tax credit, adds substantial financial value.

| Customer Relationship Aspect | Description | 2023/Early 2024 Data Point |

|---|---|---|

| Partnership Focus | Long-term strategic alliances with developers and IPPs. | Contracted backlog extending into 2030. |

| Lifecycle Services | Integrated support from development to operations. | Approx. $4.1 billion in revenue in 2023. |

| Technical Support & R&D | Ongoing assistance and product innovation. | Series 6 module achieved 22.3% efficiency (early 2024). |

| Policy & Incentive Guidance | Expert navigation of tax credits (e.g., Section 45X). | Empowering clients to optimize project returns. |

Channels

First Solar relies on a dedicated direct sales force to engage with major clients like utility companies, independent power producers, and large-scale project developers. This approach is crucial for navigating the complexities of utility-scale projects, which often involve substantial investments and intricate contractual agreements.

This direct channel facilitates tailored solutions and in-depth technical consultations, ensuring that First Solar's offerings precisely meet the demanding requirements of large solar deployments. For instance, in 2023, First Solar secured significant orders, demonstrating the effectiveness of their direct sales strategy in closing large, multi-gigawatt deals.

First Solar's strategic project development teams are crucial channels, identifying and nurturing large-scale solar opportunities. These internal experts de-risk projects from inception, ensuring a steady flow of potential business.

By working directly with clients, these teams guide projects from initial concept through to the shovel-ready phase. This hands-on approach solidifies First Solar's role as a direct supplier of modules and integrated solutions.

In 2024, First Solar reported a significant backlog of contracted utility-scale projects, underscoring the effectiveness of these development teams in securing future sales and market share.

First Solar actively participates in key industry events like RE+ in the US and Intersolar Europe, crucial for showcasing their advanced Series 6 and upcoming Series 7 modules. These platforms are vital for demonstrating technological leadership and fostering connections within the global solar community.

These gatherings serve as significant lead generation channels, allowing First Solar to directly engage with potential utility-scale developers, EPCs, and financiers. In 2023, RE+ alone saw over 25,000 attendees, providing a concentrated audience for First Solar's business development efforts.

By exhibiting at these trade shows, First Solar gains invaluable market intelligence, understanding emerging customer needs and competitive advancements. This direct feedback loop is essential for refining their product roadmap and sales strategies, ensuring they remain at the forefront of the rapidly evolving solar market.

Online Presence and Investor Relations

First Solar actively cultivates its online presence through a comprehensive corporate website and a dedicated investor relations portal. These digital platforms are crucial for disseminating detailed information regarding their advanced solar technology, product offerings, financial results, and unwavering commitment to sustainability. In 2023, First Solar reported a significant increase in revenue, reaching $3.56 billion, underscoring the growing demand for their solutions, which is effectively communicated through these channels.

The investor relations section acts as a vital, transparent conduit for financially-literate decision-makers. It provides timely updates, SEC filings, and presentations, ensuring stakeholders have access to the data needed for informed analysis. This commitment to transparency is essential for building trust and facilitating investment, especially as the company navigates the dynamic renewable energy market.

Digital marketing efforts further amplify First Solar's reach, targeting key audiences with tailored content. This strategic approach ensures that potential investors, partners, and customers are aware of the company's value proposition and technological leadership. First Solar's ongoing investments in research and development, which are highlighted online, are critical for maintaining their competitive edge in the global solar industry.

- Corporate Website: Central hub for product, technology, and sustainability information.

- Investor Relations Portal: Dedicated space for financial reports, presentations, and shareholder communications.

- Digital Marketing: Targeted campaigns to reach investors, partners, and customers.

- Transparency: Commitment to providing clear and accessible financial and operational data.

Strategic Partnerships and Alliances

First Solar actively cultivates strategic partnerships, particularly with Engineering, Procurement, and Construction (EPC) firms. These collaborations are crucial for expanding market reach and tapping into new project pipelines. For instance, in 2023, First Solar announced a significant supply agreement with an EPC partner for a large-scale solar project in the United States, highlighting the importance of these relationships in securing substantial orders.

These alliances function as vital indirect sales channels. By integrating First Solar's advanced thin-film photovoltaic (PV) modules into their comprehensive project solutions, EPC partners effectively broaden First Solar's market penetration. This symbiotic relationship allows First Solar to access projects that might otherwise be out of direct reach, amplifying its overall sales volume and brand presence in diverse geographical regions.

- EPC Partnerships: Key alliances with firms like Swinerton Renewable Energy and Mortenson Construction have been instrumental in delivering large utility-scale projects.

- Technology Integration: Partnerships often involve co-development or integration of First Solar's technology into broader energy solutions, enhancing value for end-customers.

- Market Access: Alliances provide entry into specific markets or customer segments where direct sales efforts might be less efficient, as seen in international project wins facilitated by local partners.

First Solar leverages its direct sales force and strategic project development teams to engage directly with large-scale clients, ensuring tailored solutions for complex utility projects. Industry events and a robust online presence, including a dedicated investor relations portal, serve as crucial channels for lead generation, market intelligence, and transparent communication with stakeholders. Strategic partnerships, particularly with EPC firms, act as vital indirect channels, expanding market reach and project access.

Customer Segments

Utility-scale solar project developers are a cornerstone customer segment for First Solar. These companies focus on constructing massive solar farms that feed directly into the national electricity grid. First Solar's thin-film technology, known for its efficiency and suitability for large-scale deployments, makes them a preferred supplier for these developers.

In 2024, the global utility-scale solar market continued its robust expansion, driven by renewable energy targets and decreasing costs. First Solar's ability to deliver high-volume, reliable modules positions them to capture a significant share of this market, particularly as developers seek partners capable of meeting ambitious project timelines and performance expectations.

Independent Power Producers (IPPs) are key customers for First Solar, as these companies build and manage power plants to sell electricity. First Solar supplies them with solar modules and integrated solutions for their projects. In 2024, the global solar market saw significant growth, with IPPs playing a crucial role in deploying utility-scale projects.

IPPs are looking for dependable, budget-friendly, and high-performing solar technology that can generate power for decades. First Solar's thin-film technology is particularly attractive to them for its performance in varied conditions and its lower carbon footprint during manufacturing, a factor increasingly important for sustainable energy portfolios.

First Solar directly serves electric utilities by supplying them with solar modules and comprehensive integrated solutions. These utilities are actively expanding their renewable energy portfolios to comply with mandates, diversify their energy sources, and lower their carbon footprints. In 2024, utilities continued to be major drivers of utility-scale solar development, with a significant portion of new solar capacity additions attributed to their investments.

Large Commercial and Industrial (C&I) Companies

First Solar is increasingly targeting large Commercial and Industrial (C&I) companies that have substantial energy needs and ambitious sustainability targets. These corporations are actively seeking to integrate solar power into their operations to achieve cost savings and fulfill environmental commitments, often aligned with initiatives like the RE100, which aims for 100% renewable electricity usage.

These large C&I customers represent a significant growth area for First Solar, driven by the economic advantages and the growing imperative for decarbonization. For example, in 2024, many Fortune 500 companies continued to announce substantial renewable energy procurement targets, with solar playing a pivotal role in their strategies to reduce Scope 2 emissions.

- High Energy Consumption: Large C&I entities typically require significant amounts of electricity, making the cost-saving potential of solar highly attractive.

- Sustainability Goals: Many corporations are committed to ambitious environmental, social, and governance (ESG) targets, including the use of renewable energy.

- RE100 Initiative: Companies participating in the RE100 campaign actively seek solar solutions to power their operations with 100% renewable electricity.

- Long-Term Power Purchase Agreements (PPAs): These companies often enter into long-term PPAs, providing stable revenue streams for solar project developers and manufacturers like First Solar.

Government and Public Sector Entities

Government and public sector entities represent a crucial customer segment for First Solar, particularly those focused on public infrastructure, military installations, and community-driven solar initiatives. These organizations often prioritize dependable, top-tier solar technology, with a strong preference for solutions manufactured domestically.

First Solar's significant investment in U.S. manufacturing, including its advanced factory in Ohio, directly addresses this demand. For instance, the company announced in 2023 a substantial expansion of its U.S. production capacity, aiming to reach 4.5 gigawatts annually by 2024. This commitment to domestic production is a key differentiator, aligning with government procurement policies that may favor or require American-made components.

These public sector clients are often driven by long-term energy security, cost predictability, and the economic benefits of supporting domestic industries. Their projects can range from powering government buildings and public schools to large-scale solar farms designed to provide clean energy for entire communities.

Key considerations for this segment include:

- Reliability and Durability: Public sector projects require long-term performance and minimal maintenance, making First Solar's thin-film technology, known for its resilience, particularly attractive.

- Domestic Manufacturing Advantage: Government incentives and Buy American provisions can create a competitive edge for First Solar's U.S.-produced modules.

- Scalability for Public Projects: The ability to supply large volumes of panels is essential for powering significant public infrastructure like military bases or utility-scale community solar farms.

First Solar's customer base is diverse, primarily serving large-scale solar project developers and Independent Power Producers (IPPs) who build and operate solar farms. Electric utilities also represent a significant segment, integrating solar into their portfolios to meet renewable energy mandates. Additionally, large Commercial & Industrial (C&I) companies are increasingly important, driven by sustainability goals and cost savings.

In 2024, the demand for utility-scale solar remained strong, with developers and IPPs seeking reliable, high-volume suppliers like First Solar. Utilities continued to expand their renewable energy capacity, often driven by regulatory requirements and a desire for energy diversification. The C&I sector saw growing adoption of solar as businesses focused on reducing their carbon footprint and operational costs.

First Solar's thin-film technology is a key differentiator for these segments, offering performance advantages in various conditions and a lower manufacturing carbon footprint. The company's commitment to domestic manufacturing, particularly its expanded U.S. production capacity, also appeals to government and public sector clients who prioritize local supply chains and energy security.

The company's ability to deliver large volumes of high-quality modules is crucial for meeting the ambitious deployment targets of its core customer segments. These clients rely on First Solar for consistent performance and long-term value, making the company a strategic partner in the global transition to clean energy.

Cost Structure

First Solar's manufacturing and production costs are a substantial part of its business model. These costs encompass the essential raw materials needed for their thin-film solar modules, the direct labor involved in running their factories, and the overhead expenses tied to maintaining large-scale production sites.

In 2024, First Solar continued to invest heavily in expanding its manufacturing capacity. For instance, the company announced plans for a new facility in Louisiana, adding to its existing footprint. These capital expenditures for new and existing plants are a significant driver of their cost structure, directly impacting the unit cost of their solar panels.

First Solar dedicates significant resources to Research and Development, a core component of its strategy to advance its thin-film photovoltaic technology. These investments are essential for staying ahead in the competitive solar market by improving efficiency and reducing manufacturing costs.

In 2023, First Solar reported R&D expenses of $235 million. This substantial figure reflects ongoing efforts to enhance their Cadmium Telluride (CdTe) solar cell technology, which is key to their product differentiation and market position.

These R&D costs cover a broad spectrum of activities, including the compensation of highly skilled scientists and engineers, the acquisition and maintenance of advanced laboratory equipment, and the rigorous testing and prototyping necessary for developing next-generation solar modules.

First Solar faces significant capital expenditures for expanding its manufacturing capacity. These investments are crucial for meeting the escalating demand for solar modules. For instance, the company has committed substantial funds to its new facilities in Alabama and Louisiana. These expansions are designed to bolster global production capabilities and ensure a steady supply of solar technology.

Sales, General, and Administrative (SG&A) Expenses

First Solar's Sales, General, and Administrative (SG&A) expenses encompass a range of operational costs vital for its global B2B model. These include marketing efforts to reach utility-scale customers, the operational costs of its sales force, and the essential functions of corporate administration and legal departments. For instance, in 2023, First Solar reported SG&A expenses of $827 million. This figure reflects the investment needed to manage a complex international business and maintain strong relationships with key partners.

The company's commitment to a global presence and the intricate nature of its operations, particularly in the renewable energy sector, inherently drive significant SG&A outlays. These costs are not just about day-to-day operations but also about strategic positioning and long-term sustainability. Investor relations and corporate governance are also key components, ensuring transparency and accountability to stakeholders. These activities are crucial for building trust and securing future investments in a capital-intensive industry.

- Marketing and Sales: Costs associated with promoting First Solar's technology and managing its global sales teams.

- Corporate Administration: Expenses for human resources, finance, IT, and other overhead functions supporting the entire organization.

- Legal and Compliance: Expenditures for legal counsel, regulatory compliance, and contract management, especially critical in international markets.

- Investor Relations and Governance: Costs related to communicating with shareholders, managing board activities, and adhering to corporate governance standards.

Warranty and Recycling Program Costs

First Solar manages expenses linked to its product warranty commitments and its module collection and recycling initiatives. These environmental and product stewardship duties create a long-term financial obligation and a continuous operating expenditure.

These costs are recognized as integral to the company's dedication to responsible manufacturing practices. For instance, in 2023, First Solar reported warranty and recycling reserves of $224 million, reflecting its proactive approach to managing these future liabilities.

- Warranty Obligations: Costs incurred for repairing or replacing defective modules within the warranty period.

- Recycling Program Costs: Expenses related to collecting, processing, and recycling end-of-life solar modules.

- Long-Term Liability: These commitments represent ongoing financial exposure for the company.

- Responsible Production: Costs are viewed as essential for maintaining environmental stewardship and product lifecycle management.

First Solar's cost structure is heavily influenced by manufacturing, R&D, SG&A, and product stewardship. In 2023, R&D was $235 million, and SG&A was $827 million, demonstrating significant investments in technology and operations. The company also allocated $224 million for warranty and recycling reserves, highlighting its commitment to product lifecycle management.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

| Manufacturing & Production | N/A (Included in Cost of Revenue) | Raw materials, direct labor, factory overhead |

| Research & Development (R&D) | $235 | Personnel, lab equipment, prototyping |

| Sales, General & Administrative (SG&A) | $827 | Marketing, sales force, corporate administration, legal |

| Warranty & Recycling | $224 | Product repairs/replacements, module collection/processing |

Revenue Streams

First Solar's main income comes from selling its high-tech thin-film solar panels. These modules are primarily purchased by companies that develop large solar farms, independent power producers, and big businesses looking to power their operations.

In 2024, the company saw net sales of $4.2 billion, largely due to selling more modules to external customers. This highlights the significant role of module sales in their overall financial performance.

First Solar also generates significant revenue by developing and selling large-scale, grid-connected solar power plants. This business segment captures value across the entire project lifecycle, from initial planning to the final sale to long-term asset owners.

In 2023, First Solar reported booking 26.4 GWdc of utility-scale projects, a record year for bookings, indicating strong demand for their project development services. This robust pipeline is crucial for future revenue generation through project sales.

First Solar's business model includes a significant and expanding revenue source from selling Section 45X Advanced Manufacturing Production Tax Credits. These credits, enabled by the U.S. Inflation Reduction Act, are generated from their domestic manufacturing operations and can be transferred to other companies.

In 2024, these tax credit sales provided a notable boost to First Solar's cash flow. The company anticipates continued sales of these credits in 2025, further solidifying this income stream.

Operation and Maintenance (O&M) Services

First Solar generates recurring revenue through operation and maintenance (O&M) services for certain solar power plants it develops. This stream is crucial for ensuring the sustained performance and efficiency of solar assets over their lifespan. While not the primary revenue generator, O&M services provide a stable, long-term income foundation for the company.

- O&M Services: First Solar offers ongoing operation and maintenance for solar power plants it develops, ensuring optimal performance and longevity of solar assets.

- Recurring Revenue: This service provides a predictable, long-term income stream, contributing to financial stability.

- Contribution to Stability: While not the largest revenue segment, O&M services are vital for the consistent financial health of the company.

Licensing and Technology Royalties

While First Solar's primary revenue comes from selling its advanced solar modules, the company also taps into revenue through licensing its groundbreaking thin-film technology. This intellectual property can be licensed to other manufacturers, allowing them to utilize First Solar's patented processes and designs. These licensing agreements typically involve royalty payments, contributing a less visible but still significant income stream.

Specific figures for First Solar's licensing and technology royalty revenue are not always prominently disclosed in public financial reports, making it a less transparent revenue stream compared to module sales. However, the value of their proprietary technology, particularly their Cadmium Telluride (CdTe) thin-film advancements, is substantial. For instance, as of early 2024, First Solar continues to invest heavily in R&D, aiming to further enhance the efficiency and cost-effectiveness of its CdTe technology, which underpins its licensing potential.

- Proprietary Technology: Licensing of First Solar's advanced thin-film solar technology, including its Cadmium Telluride (CdTe) processes.

- Royalty Payments: Revenue generated from fees paid by partners and manufacturers for the use of First Solar's patented designs and manufacturing techniques.

- Limited Disclosure: Detailed financial data on this specific revenue stream is often not publicly itemized, making precise quantification challenging.

- Strategic Value: The licensing of its technology allows First Solar to monetize its R&D investments and expand the reach of its innovations beyond its direct manufacturing capacity.

First Solar's revenue streams are diverse, primarily driven by the sale of its advanced thin-film solar modules to utility-scale developers and large corporations. The company also generates substantial income from developing and selling complete solar power plants, capturing value across the project lifecycle.

A significant and growing revenue source in 2024 and beyond is the sale of Section 45X Advanced Manufacturing Production Tax Credits, a direct benefit from the U.S. Inflation Reduction Act. Additionally, First Solar offers operation and maintenance services for its developed plants, providing a stable, recurring income stream.

The company also monetizes its intellectual property through licensing its thin-film technology, though these figures are less transparent. This multi-faceted approach ensures robust financial performance and market presence.

| Revenue Stream | Primary Activity | 2024 Data/Notes |

|---|---|---|

| Module Sales | Selling thin-film solar panels | Net sales of $4.2 billion driven by module sales |

| Project Development & Sales | Developing and selling grid-connected solar power plants | Record 26.4 GWdc bookings in 2023 |

| Tax Credit Sales (Section 45X) | Transferring manufacturing production tax credits | Provided a notable boost to cash flow in 2024 |

| Operation & Maintenance (O&M) | Providing ongoing services for solar plants | Stable, long-term recurring income |

| Technology Licensing | Licensing thin-film technology to other manufacturers | Monetizes R&D investments; less publicly itemized |

Business Model Canvas Data Sources

The First Solar Business Model Canvas is built using financial disclosures, market research reports, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information on revenue streams, cost structures, and key partnerships.