FirstService SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstService Bundle

FirstService boasts a strong brand reputation and diversified service offerings, key strengths that position them for continued success. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for navigating future growth.

Want to delve deeper into the strategic advantages and potential challenges that shape FirstService's market trajectory? Purchase our comprehensive SWOT analysis to unlock a detailed, actionable roadmap for informed decision-making.

Strengths

FirstService Corporation stands as a North American leader in property services, boasting a commanding presence through its two robust segments. FirstService Residential is the continent's largest manager of residential communities, a testament to its scale and operational efficiency. Complementing this, FirstService Brands delivers essential property services through a network of franchises and company-owned locations, showcasing a diversified approach to the market.

This strategic dual-segment structure allows FirstService to offer a comprehensive suite of services, effectively serving both residential and commercial property needs. Such diversification is crucial, as it creates multiple, stable revenue streams, reducing reliance on any single market segment and enhancing overall business resilience. This broad appeal positions them well for continued growth across various economic conditions.

FirstService has a strong history of reliable financial results, consistently beating its own target of at least 10% annual revenue growth and incremental EBITDA growth. This resilience is a key strength.

In 2024, the company saw its consolidated revenue jump by 20%, with Adjusted EBITDA increasing by an even more impressive 24%. These figures highlight significant top-line expansion and improved profitability.

FirstService has a strong track record of growth through strategic acquisitions, notably bolstering its FirstService Brands segment. The company's acquisition of Roofing Corp of America in late 2023, along with several smaller tuck-under acquisitions throughout 2024 and into early 2025, highlights a consistent strategy to expand both its geographic reach and its diverse service offerings.

These targeted acquisitions are instrumental in increasing FirstService's market share and broadening its operational capabilities across various home service sectors. For instance, the integration of new businesses allows for cross-selling opportunities and the introduction of innovative service solutions, directly contributing to revenue growth and market penetration.

Strong Cash Flow and Capital Allocation

FirstService's business model is a cash-generating machine, consistently producing robust cash flows. This financial strength allows for strategic capital allocation, funding growth through acquisitions and returning value to shareholders via dividends. Crucially, the company maintains a conservative debt profile, enhancing its financial flexibility.

This financial discipline is evident in their performance. For instance, in the first quarter of 2024, FirstService reported a significant increase in cash flow from operations, demonstrating the underlying strength of their service-based model. This allows them to pursue opportunities like their recent acquisitions in the property services sector, further solidifying their market position while keeping leverage in check.

- Consistent Cash Generation: The recurring revenue nature of FirstService's core businesses, such as property management and restoration services, fuels predictable and strong cash flows.

- Strategic Capital Deployment: Robust cash flow enables reinvestment in organic growth, accretive acquisitions, and shareholder returns, all while managing debt prudently.

- Financial Flexibility: Low leverage and strong cash conversion provide the company with the capacity to navigate economic cycles and capitalize on market opportunities.

Operational Efficiency and Margin Improvement

FirstService consistently enhances its operational efficiency, directly impacting its bottom line. This focus has led to a notable improvement in operating margins across its service delivery models.

The company's commitment to efficiency is evident in its financial performance. For instance, early 2025 data shows significant gains in Adjusted EBITDA margins for both the FirstService Residential and FirstService Brands segments, underscoring the success of these initiatives.

- Operating Margins: Improved through enhanced service delivery models.

- Adjusted EBITDA Margins: Showed significant expansion in early 2025 for key segments.

- Profitability Metrics: Strengthened by the company's ongoing efficiency drive.

FirstService excels with a dominant market position in North American property services, particularly as the largest manager of residential communities through FirstService Residential. This scale provides significant operating leverage and brand recognition. Additionally, the FirstService Brands segment offers a diversified revenue stream through a franchise and company-owned model, enhancing market penetration and service breadth.

The company's strategic focus on recurring revenue models, especially in property management, generates consistent and predictable cash flows. This financial strength underpins their ability to consistently exceed growth targets, as demonstrated by their 20% consolidated revenue increase and 24% Adjusted EBITDA growth in 2024. Their conservative debt management further bolsters financial flexibility, enabling strategic capital deployment for growth and shareholder returns.

FirstService's proven ability to integrate acquisitions effectively, such as Roofing Corp of America in late 2023 and ongoing tuck-under deals into early 2025, continually expands its market share and service capabilities. This disciplined M&A strategy drives cross-selling opportunities and revenue growth across its diverse service offerings.

Operational efficiency improvements are a key strength, leading to enhanced operating margins. Early 2025 data indicates significant gains in Adjusted EBITDA margins for both FirstService Residential and FirstService Brands, reflecting the success of these ongoing initiatives and strengthening overall profitability.

| Metric | 2024 Performance | Early 2025 Trend |

|---|---|---|

| Consolidated Revenue Growth | 20% | Continued strong growth |

| Adjusted EBITDA Growth | 24% | Robust expansion |

| Market Position | North American Leader (Residential & Brands) | Strengthening through acquisitions |

| Cash Flow Generation | Consistent & strong | Underpins growth and financial flexibility |

What is included in the product

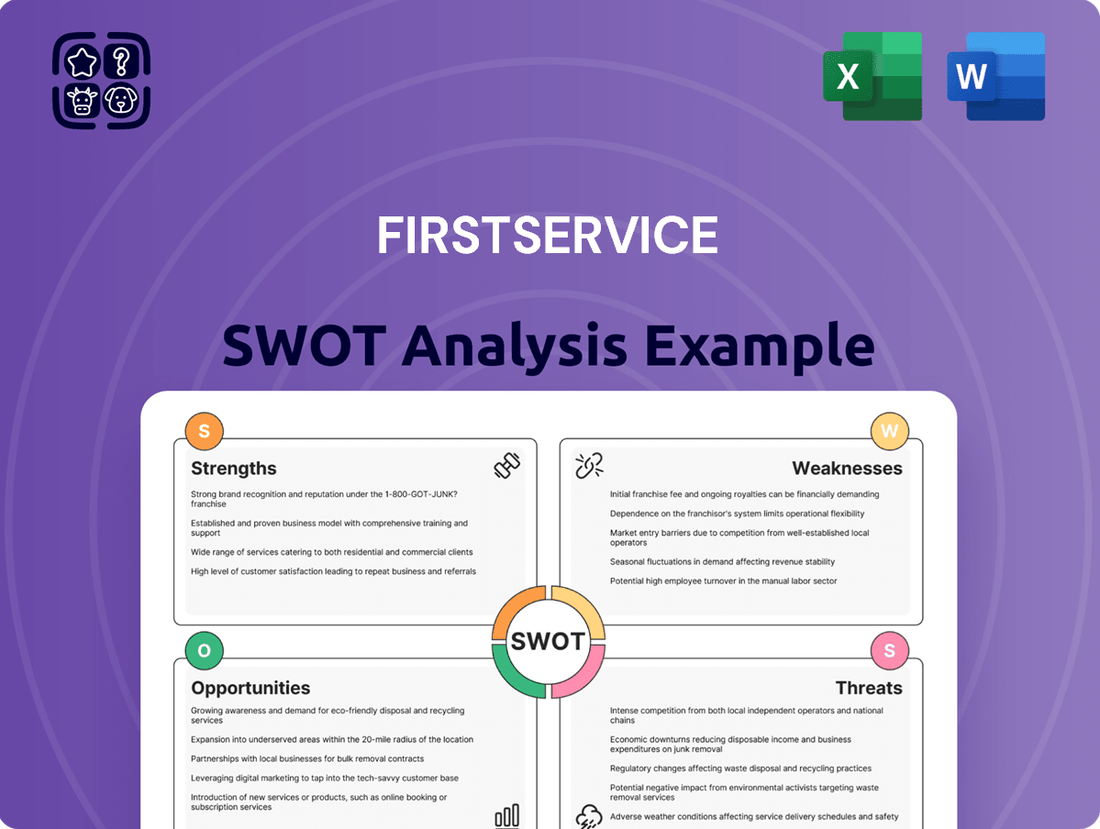

Delivers a strategic overview of FirstService’s internal and external business factors, identifying key strengths like its diversified portfolio and market leadership, while acknowledging potential weaknesses in integration and opportunities in market expansion.

Identifies key areas for improvement and competitive advantage, allowing for targeted strategic action.

Weaknesses

FirstService's significant concentration in North America, with 88% of its revenue stemming from the U.S. and 12% from Canada, presents a notable weakness. This heavy reliance on two specific markets makes the company particularly susceptible to regional economic slowdowns or adverse regulatory shifts within these geographies. A downturn in the U.S. or Canadian economies could disproportionately impact FirstService's financial performance compared to a more geographically diversified competitor.

FirstService's property services business, while generally stable, isn't immune to broader economic shifts. Factors like increasing rental costs, higher tenant churn, and varying occupancy levels can directly affect the demand for their management and maintenance services.

Should the real estate market experience a significant downturn or prolonged economic uncertainty, FirstService could see a reduction in service demand and a hit to its profits. For instance, a nationwide recession, if it were to occur, could lead to decreased property sales and leasing activity, indirectly impacting the need for property management.

While FirstService's acquisition strategy is a significant growth engine, integrating these new entities presents considerable challenges. The successful assimilation of acquired businesses, especially substantial ones like the Roofing Corp of America, demands substantial management focus and resource allocation to ensure operational continuity and achieve projected synergies.

Failure to effectively integrate can lead to operational disruptions, cultural clashes, and a failure to realize the full financial benefits of the acquisition. For instance, if the integration of a large acquisition like Roofing Corp of America, which was a significant deal in 2023, isn't smooth, it could impact earnings per share in the short to medium term.

Competitive Landscape

The property services sector, especially property management, is quite fragmented. This means there are many smaller, regional companies and specialized businesses competing with larger national ones. FirstService, while a leader, contends with this intense competition, which can indeed impact its pricing power and its slice of the market.

This competitive pressure is a significant weakness. For instance, in 2023, the property management industry saw a substantial number of smaller firms being acquired, indicating consolidation but also highlighting the presence of many players vying for contracts. This environment necessitates continuous innovation and efficient operations to maintain an edge.

- Fragmented Market: The property services industry is characterized by a large number of regional and niche competitors.

- Pricing Pressure: Intense competition can lead to downward pressure on service pricing, impacting FirstService's margins.

- Market Share Vulnerability: Smaller, agile competitors can potentially chip away at FirstService's market share in specific segments or geographies.

- Operational Efficiency Demands: The need to remain competitive requires constant focus on operational efficiency and cost management.

Potential Impact of Technology Disruptions

While FirstService is actively integrating technology, the swift evolution of PropTech, encompassing AI, IoT, and blockchain, presents a significant risk of disrupting established property management approaches. Keeping pace requires substantial and ongoing investment in new technologies to stay ahead of competitors and satisfy evolving client demands. For instance, the global PropTech market was valued at approximately $26.7 billion in 2023 and is projected to grow substantially, highlighting the competitive landscape FirstService operates within.

Failure to adapt quickly to these technological shifts could lead to a loss of market share. Companies that effectively leverage AI for predictive maintenance or IoT for smart building management could offer more efficient and cost-effective services. FirstService's commitment to innovation is crucial; for example, their 2023 annual report highlighted increased spending on technology infrastructure and digital solutions, indicating an awareness of this challenge.

- Rapid PropTech Advancements: Emerging technologies like AI and IoT can fundamentally alter property management operations.

- Competitive Disruption: Competitors adopting advanced PropTech could offer superior services, impacting FirstService's market position.

- Client Expectation Shifts: Clients will increasingly expect digitally integrated and data-driven property management solutions.

FirstService's heavy reliance on North America, particularly the U.S. market which accounts for 88% of its revenue, makes it vulnerable to regional economic downturns or policy changes. This geographic concentration limits its ability to offset potential losses in one area with gains in another, unlike more diversified global competitors.

The property services industry is highly fragmented, with numerous smaller, specialized companies competing for market share. This intense competition can exert downward pressure on pricing, potentially impacting FirstService's profit margins and its ability to maintain market dominance without significant operational efficiencies.

Integrating acquired businesses, such as the significant 2023 acquisition of Roofing Corp of America, poses substantial operational and cultural integration challenges. Ineffective integration can lead to disruptions, hinder synergy realization, and negatively affect financial performance, including earnings per share in the short to medium term.

The rapid evolution of PropTech, including AI and IoT, presents a risk of disruption. FirstService must make substantial, ongoing investments to keep pace with technological advancements to meet evolving client expectations and avoid losing market share to more agile, tech-savvy competitors.

| Weakness Category | Specific Challenge | Potential Impact | 2023/2024 Context |

| Geographic Concentration | 88% Revenue from U.S. | Vulnerability to U.S. economic slowdowns | Continued strong U.S. housing market in early 2024 provided a buffer, but future slowdowns remain a risk. |

| Market Competition | Fragmented industry | Pricing pressure, market share erosion | Industry consolidation continued in 2023, but numerous regional players persist, intensifying competition. |

| Acquisition Integration | Assimilation of acquired entities | Operational disruptions, failure to realize synergies | Successful integration of large acquisitions like Roofing Corp of America is critical for sustained growth and EPS. |

| Technological Adaptation | Rapid PropTech advancements | Risk of obsolescence, loss of competitive edge | Increased investment in digital solutions noted in 2023 reports; ongoing need to stay ahead of AI and IoT adoption. |

Preview Before You Purchase

FirstService SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The property management sector is rapidly embracing new technologies like AI, IoT, and cloud solutions. FirstService can capitalize on this by integrating these advancements to boost efficiency, predict maintenance needs, and simplify tenant interactions, such as rent payments and service requests.

The property services market's fragmented nature presents a substantial runway for FirstService. The company can pursue growth by entering new service lines or expanding into less-served geographic areas, a strategy that has historically fueled its diversification and market share gains.

For instance, FirstService Residential's expansion into new states and its acquisition of smaller regional players in 2024 demonstrate this ongoing opportunity. This approach allows for increased market penetration and the cross-selling of services, further solidifying its competitive position.

The North American property management services market is experiencing robust growth, with projections indicating continued expansion. This upward trend is fueled by increasing rental demand, ongoing urban development, and a clear preference for professional management solutions across both residential and commercial sectors. For instance, the residential property management market alone was valued at over $100 billion in 2023 and is expected to see a compound annual growth rate (CAGR) of approximately 5% through 2028, creating a fertile ground for FirstService to capitalize on.

Sustainability and Energy Efficiency Initiatives

The increasing global focus on environmental, social, and governance (ESG) factors presents a significant opportunity for FirstService. As real estate owners and occupiers prioritize sustainability, FirstService can leverage this demand by integrating green building practices and energy-efficient solutions into its service offerings. This aligns with growing market trends, with the global green building market projected to reach over $3 trillion by 2027, according to some industry estimates.

Capitalizing on this trend could involve offering specialized property management services focused on reducing carbon footprints, implementing smart building technologies for energy optimization, and advising clients on sustainable retrofits. These initiatives not only attract environmentally conscious clients but also have the potential to lower operating expenses for properties under management.

- Growing Demand for Green Building: The market for sustainable real estate solutions is expanding rapidly, driven by regulatory pressures and investor preferences.

- Cost Savings Potential: Implementing energy efficiency measures can lead to substantial reductions in utility costs for property owners.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability can bolster FirstService's image and attract a wider client base.

- New Service Revenue Streams: Offering specialized sustainability consulting and implementation services can create new avenues for revenue growth.

Build-to-Rent (BTR) and Evolving Housing Models

The burgeoning build-to-rent (BTR) sector, fueled by demographic trends like Millennial and Gen Z preferences for flexibility and Baby Boomers seeking hassle-free living, offers a significant avenue for growth. These evolving housing models require specialized property management services that FirstService is well-positioned to provide.

FirstService can capitalize on this trend by offering tailored solutions for BTR communities, including resident engagement platforms, amenity management, and efficient maintenance. For instance, the BTR market in the US saw substantial investment in 2023, with over $20 billion poured into the sector, indicating a strong demand for professional management services.

- Growing Demand: Millennials and Gen Z, prioritizing flexibility, are driving demand for rental housing.

- Investment Surge: The BTR sector attracted over $20 billion in US investment in 2023.

- Specialized Needs: BTR properties require unique management services beyond traditional rentals.

- FirstService Advantage: Expertise in property management aligns with the needs of this expanding market.

FirstService is positioned to benefit from the increasing adoption of technology within property management, including AI and IoT, to enhance operational efficiency and tenant services. The company can also leverage the fragmented nature of the property services market through strategic acquisitions and expansion into new service lines or geographies, mirroring its successful strategies in 2024.

The robust growth in the North American property management market, driven by rising rental demand and urban development, provides a strong tailwind, with the residential segment alone valued over $100 billion in 2023. Furthermore, the growing emphasis on ESG factors presents an opportunity to offer specialized green building and energy-efficient solutions, tapping into a market projected to exceed $3 trillion by 2027.

The expanding build-to-rent (BTR) sector, appealing to younger generations seeking flexibility and older demographics desiring convenience, offers another significant growth avenue. FirstService's expertise is well-suited to meet the specialized management needs of BTR communities, which attracted over $20 billion in US investment in 2023.

| Opportunity Area | Market Insight | FirstService Relevance | Data Point |

|---|---|---|---|

| Technology Integration | AI, IoT, cloud adoption in property management | Boost efficiency, predictive maintenance, tenant services | N/A (trend-based) |

| Market Fragmentation | Fragmented property services market | Acquisitions, new service lines, geographic expansion | FirstService Residential's 2024 expansion |

| Market Growth | North American property management services | Capitalize on increasing rental demand and urban development | Residential market > $100B (2023), 5% CAGR proj. to 2028 |

| ESG Focus | Global demand for sustainable real estate | Offer green building and energy-efficient solutions | Green building market > $3T proj. by 2027 |

| Build-to-Rent (BTR) | Growing demand for flexible housing models | Provide specialized BTR property management services | BTR sector attracted > $20B US investment (2023) |

Threats

Economic downturns, marked by rising interest rates and inflation, present a significant threat to FirstService. These conditions can depress rental rates and occupancy levels, directly impacting the demand for their property management and related services. For instance, in late 2023 and early 2024, persistent inflation and elevated interest rates have created headwinds for the real estate sector, potentially slowing down new development and increasing operating costs for property owners.

Increased tenant turnover and escalating operational expenses, such as labor, insurance, and utilities, further challenge FirstService during economic contractions. As property owners face tighter margins, they may delay essential maintenance or seek cost-saving measures, potentially affecting service volumes and profitability. The ongoing labor market dynamics in 2024, with wage pressures, also contribute to rising operational costs for service providers like FirstService.

The property services sector is highly fragmented, meaning FirstService contends with considerable rivalry from established national companies and a multitude of smaller, niche providers. This intense competition can exert downward pressure on pricing, potentially hindering market share growth and impacting profit margins.

For instance, in 2024, the residential property management segment, a key area for FirstService, saw an average contract renewal rate of around 90%, but new client acquisition faced increased competition, with some regional players offering aggressive introductory pricing, as noted in industry reports from late 2024.

FirstService faces a significant threat from evolving government regulations within the property management sector. New rent control measures and increasingly stringent building codes are becoming more common, directly impacting how FirstService operates its properties.

Navigating these regulatory shifts and ensuring full compliance presents a substantial challenge. This can lead to increased operational complexities and necessitate higher compliance costs, potentially affecting profitability and requiring significant resource allocation for adaptation.

Cybersecurity Risks and Data Privacy Concerns

As property management becomes more digitized, with increased reliance on digital platforms and Internet of Things (IoT) devices, cybersecurity risks and data privacy concerns are escalating for FirstService. A significant security breach could severely damage FirstService's hard-earned reputation, leading to substantial financial losses and a critical erosion of client trust. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the potential financial impact.

These threats are not theoretical; they represent tangible risks to operations and client relationships. The sensitive nature of the data handled by property management firms, including resident information and financial details, makes them attractive targets for cybercriminals. Protecting this data is paramount to maintaining business continuity and client satisfaction.

- Increased Digital Footprint: FirstService's expanding use of cloud-based property management software and IoT devices in managed properties creates a larger attack surface for cyber threats.

- Reputational Damage: A successful cyberattack could lead to negative publicity, impacting FirstService's ability to attract and retain clients, potentially costing millions in lost business.

- Regulatory Fines: Non-compliance with data privacy regulations, such as GDPR or CCPA, following a breach could result in significant financial penalties, adding to the overall cost of an incident.

- Client Data Compromise: Breaches can expose sensitive resident information, leading to identity theft and a severe loss of confidence in FirstService's security measures.

Labor Shortages and Employee Retention

Labor shortages remain a persistent hurdle for the multifamily sector, including property management firms like FirstService. Employee burnout is a significant factor, exacerbating difficulties in attracting and keeping skilled workers. This ongoing challenge directly impacts service quality and the overall efficiency of operations.

The struggle to find and retain qualified staff, particularly in skilled trades and customer-facing roles, can lead to delays in maintenance, reduced tenant satisfaction, and increased operational costs. For instance, in 2024, reports indicated that average employee turnover in property management could reach 30-40% annually, a figure that strains resources and impacts service delivery.

- Employee Burnout: High workloads and demanding tenant expectations contribute to burnout, making it harder to retain staff.

- Skilled Labor Gap: A shortage of experienced maintenance technicians and property managers affects the ability to deliver high-quality services.

- Operational Impact: Staffing issues can lead to slower response times for resident requests and property upkeep, potentially impacting tenant retention and property values.

Intensifying competition from both large national players and smaller, specialized firms poses a threat by potentially driving down service prices and limiting market share expansion for FirstService. In 2024, industry analyses highlighted aggressive pricing strategies from regional competitors in key markets, impacting new client acquisition rates.

Evolving government regulations, such as rent control measures and stricter building codes, add complexity and increase compliance costs for FirstService. Navigating these changes requires significant resource allocation and can affect operational efficiency and profitability. The increasing prevalence of these regulations across various jurisdictions presents a continuous challenge.

Cybersecurity risks are a growing concern due to FirstService's expanding digital footprint. A data breach could lead to substantial financial losses, reputational damage, and erosion of client trust, with the global average cost of a data breach in 2023 reaching $4.45 million, underscoring the potential financial impact.

Persistent labor shortages and employee burnout within the property management sector, including for FirstService, directly impact service quality and operational efficiency. High turnover rates, potentially reaching 30-40% annually in 2024 for property management roles, strain resources and affect the ability to deliver consistent, high-quality services.

| Threat Category | Specific Risk | Impact on FirstService | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Increased rivalry from niche providers | Price pressure, market share limitations | Regional competitors employing aggressive introductory pricing |

| Regulatory | New rent control and building codes | Higher compliance costs, operational complexity | Growing prevalence across multiple jurisdictions |

| Cybersecurity | Data breaches and privacy violations | Reputational damage, financial loss, loss of client trust | Global average cost of data breach $4.45 million (2023) |

| Labor Market | Shortages and employee burnout | Reduced service quality, operational inefficiency | Annual turnover rates of 30-40% in property management (2024 reports) |

SWOT Analysis Data Sources

This FirstService SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of FirstService's internal capabilities and external market positioning.