FirstService Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstService Bundle

FirstService faces a complex competitive landscape, with significant power held by both buyers and suppliers influencing their profitability. Understanding the threat of new entrants and the intensity of rivalry is crucial for navigating this market.

The complete report reveals the real forces shaping FirstService’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts the property services sector, affecting companies like FirstService. If a small number of suppliers control key inputs, such as specialized maintenance equipment or advanced property management software, they can exert considerable pricing power. For instance, in 2024, the market for integrated smart building technology saw a notable consolidation, with three major providers capturing over 60% of the market share, potentially increasing costs for property service firms relying on these systems.

FirstService likely faces varying supplier bargaining power depending on the nature of the goods and services procured. For common, commoditized supplies, switching costs for FirstService are probably low, meaning suppliers have less power.

However, when FirstService utilizes specialized services or integrated technology solutions, the effort and potential disruption associated with changing providers can significantly increase switching costs. This elevates the bargaining power of those specific suppliers.

For standard maintenance supplies or basic labor, FirstService typically faces suppliers with largely undifferentiated offerings. This means many providers can offer similar products or services, which naturally reduces the bargaining power of any single supplier. In 2024, the competitive landscape for these common goods and services remained robust, preventing significant price increases from individual suppliers.

However, the situation changes when FirstService requires highly specialized services, proprietary technology, or skilled trades that are in limited supply. For instance, a unique restoration technique or a specialized HVAC component might only be available from a select few providers. In such cases, these suppliers possess more unique offerings, granting them increased leverage and the ability to command higher prices or more favorable terms from FirstService.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into property management or other services offered by FirstService is generally quite low. Many of FirstService's suppliers are typically focused on their specialized product or service delivery, and they likely do not possess the necessary scale, operational expertise, or strategic inclination to directly compete in the complex property management sector. This lack of capability or interest significantly curtails their ability to leverage forward integration as a source of power.

For instance, a supplier of landscaping equipment or cleaning supplies, while essential, would face substantial hurdles in replicating FirstService's comprehensive service model. These hurdles include building a customer base, developing management systems, and acquiring specialized talent. In 2024, the property management industry continues to demand sophisticated operational oversight and client relationship management, areas where niche suppliers often lack a competitive advantage.

- Low Forward Integration Threat: Suppliers typically lack the scale and expertise for direct competition in property management.

- Focus on Core Competencies: Suppliers are generally content to remain in their specialized product or service areas.

- Barriers to Entry for Suppliers: Entering property management requires significant investment in systems, talent, and client acquisition, which most suppliers are unwilling or unable to undertake.

Importance of FirstService to Supplier's Business

The bargaining power of suppliers to FirstService is significantly influenced by how crucial FirstService is to their overall business. If FirstService constitutes a substantial portion of a supplier's revenue, that supplier's leverage is diminished. They become more dependent on maintaining the relationship with FirstService, making them less likely to demand unfavorable terms.

Conversely, if FirstService represents only a minor client for a multitude of suppliers, these suppliers may possess greater bargaining power. In such scenarios, individual suppliers are less reliant on any single customer like FirstService, potentially enabling them to dictate more favorable pricing or contract conditions.

For instance, consider a supplier providing specialized cleaning chemicals. If FirstService, through its numerous property management contracts, represents 30% of that supplier's annual sales, the supplier has a strong incentive to keep FirstService satisfied. However, if FirstService is just one of hundreds of clients for a large chemical distributor, the distributor's dependence on FirstService is minimal, thus increasing the distributor's potential to exert influence.

- Supplier Dependence: A supplier's reliance on FirstService for a significant percentage of its revenue directly reduces its bargaining power.

- FirstService's Market Share: If FirstService is a dominant buyer in a particular market segment, its purchasing volume can give it considerable sway over suppliers.

- Supplier Concentration: A fragmented supplier base, where FirstService can easily switch between multiple providers, inherently weakens individual supplier bargaining power.

The bargaining power of suppliers for FirstService is generally moderate, leaning towards low for commoditized inputs and increasing for specialized services. High supplier concentration in niche markets, like advanced property management software where a few providers dominate, can lead to increased costs for FirstService. For example, in 2024, the market for integrated smart building technology saw significant consolidation, with three major providers capturing over 60% of market share, potentially impacting FirstService's procurement costs for these systems.

However, for common supplies and labor, FirstService benefits from a fragmented supplier base, limiting individual supplier leverage. The threat of forward integration by suppliers into property management services is minimal due to their lack of scale and expertise in that complex sector. Furthermore, if FirstService represents a substantial portion of a supplier's revenue, the supplier's bargaining power is reduced, as they become more dependent on the relationship.

| Factor | Impact on FirstService | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Moderate to High for Specialized Inputs | Smart Building Tech: 3 providers hold >60% market share. |

| Switching Costs | Low for Commoditized, High for Specialized | Low for cleaning supplies, high for integrated software. |

| Supplier Dependence on FirstService | Lowers Supplier Power | If FirstService is a major client (e.g., 30% of revenue), supplier power decreases. |

| Forward Integration Threat | Low | Suppliers typically lack scale/expertise for property management. |

What is included in the product

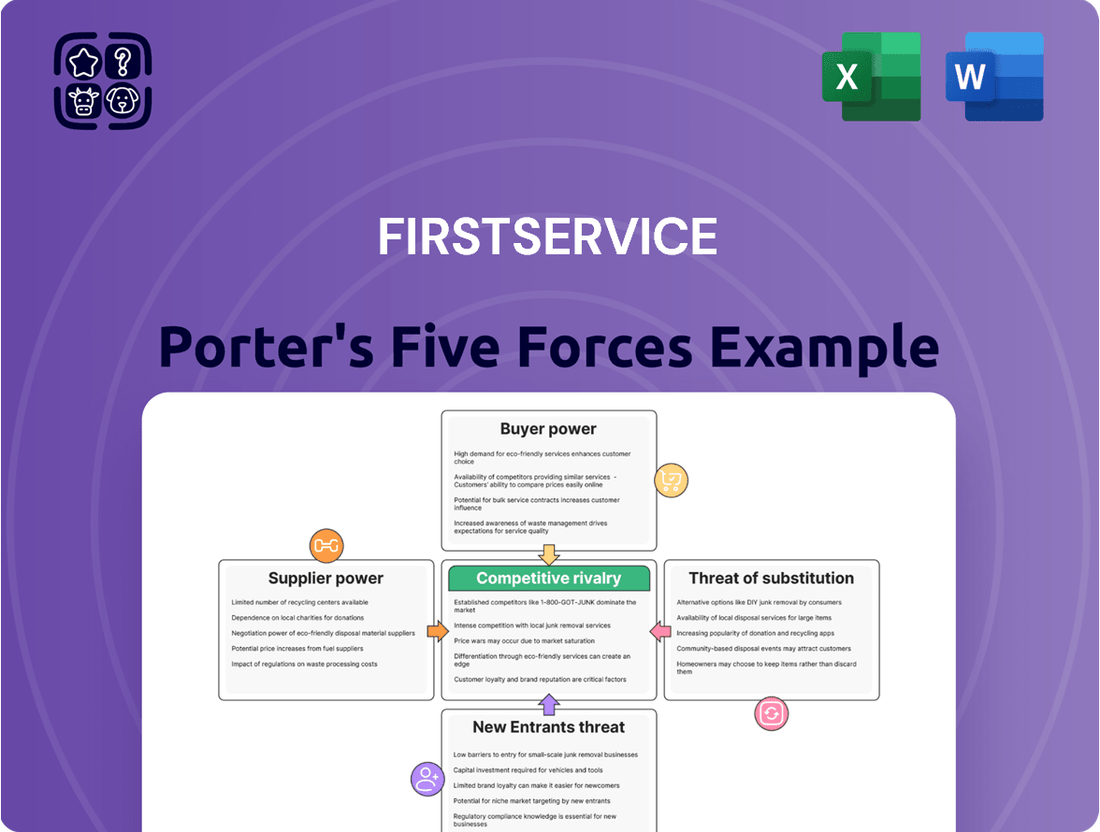

Analyzes the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes impacting FirstService's industry.

Instantly identify and quantify competitive threats with a visual, easy-to-understand framework, alleviating the pain of market uncertainty.

Customers Bargaining Power

FirstService's customer base is incredibly diverse and spread out, encompassing numerous residential communities and commercial properties throughout North America. This wide distribution means that individual customers, whether they are homeowners, condominium associations, or commercial property owners, typically don't have the leverage to significantly influence FirstService's pricing or terms.

The highly fragmented nature of FirstService's clientele is a key factor here. With so many individual customers, the loss of any single one, or even a small group, doesn't represent a substantial portion of the company's overall revenue, thus limiting their bargaining power.

For FirstService's residential property management, switching costs for community associations are often moderate. This is due to the significant administrative effort involved in transitioning management, existing contractual obligations, and the established rapport between the current management company and residents. These factors create a degree of stickiness, making a switch a more involved process.

With FirstService Brands, the situation varies. For individual property owners or businesses requiring a single service, like a one-time repair, switching costs can be quite low. However, if a customer opts for integrated solutions or ongoing maintenance contracts, the switching costs increase considerably, reflecting the investment in a particular provider's systems and service continuity.

Customers in the property management sector, particularly community associations, are highly sensitive to pricing. These entities operate with strict budgets, making them keen on cost-effectiveness. In 2024, with persistent inflation impacting operational costs for both service providers and associations, this price sensitivity is amplified, pushing customers to scrutinize every fee and seek competitive bids.

Availability of Substitutes for Customers

The bargaining power of customers is significantly influenced by the availability of substitutes. For FirstService, this means clients can opt for self-management, particularly smaller property owners, or engage local, independent property management firms. This abundance of alternatives empowers customers, allowing them to easily switch if they find FirstService's pricing or service quality unsatisfactory.

This competitive landscape is evident in the property management sector, where numerous players vie for market share. For instance, in 2024, the U.S. property management market was estimated to be worth billions, with a substantial number of smaller, regional, and independent operators contributing to this value. This diverse ecosystem provides a clear alternative for potential FirstService clients.

- Customer Choice: Property owners have a wide array of property management service providers to choose from, including specialized local firms and national competitors.

- Switching Costs: The ease with which customers can switch providers, especially for smaller or less complex properties, directly impacts FirstService's pricing flexibility.

- Market Saturation: A highly competitive market with many providers intensifies customer bargaining power by offering readily available alternatives.

- Service Differentiation: FirstService must continually differentiate its services to mitigate the impact of readily available substitute options.

Customer's Threat of Backward Integration

The threat of customers backward integrating, meaning they start performing the property management services themselves, is a key factor influencing customer power. This threat is more pronounced for simpler, smaller-scale tasks. For instance, a homeowner might decide to handle basic lawn care or minor repairs instead of hiring a service, directly impacting the demand for those specific services.

However, for more intricate and specialized services, the barrier to backward integration rises significantly. Managing a large homeowners association, for example, requires specialized software, legal knowledge, and a dedicated team. The significant investment in expertise and infrastructure makes it unlikely for individual customers or even groups of customers to effectively replicate these complex operations.

In 2024, the property management sector saw continued demand for specialized services, with companies focusing on technology integration and sustainability initiatives. This trend further solidifies the difficulty for customers to backward integrate into areas requiring advanced technological capabilities or specific regulatory compliance, thereby reducing customer power in these segments. For example, in the commercial real estate sector, the complexity of managing large mixed-use developments often deters individual tenants from attempting self-management.

- Customer backward integration is more feasible for basic property maintenance tasks.

- Complex services like large-scale community management present high barriers to customer self-performance.

- The need for specialized expertise and infrastructure limits customer integration in advanced property services.

- Technological advancements in property management in 2024 further reduce the likelihood of customer backward integration for sophisticated needs.

FirstService's customers, particularly individual property owners and smaller associations, possess moderate bargaining power. While price sensitivity is high, especially in 2024 due to inflationary pressures, the fragmented customer base and moderate switching costs for many services limit their ability to dictate terms. However, the availability of numerous substitute providers and the potential for backward integration in simpler tasks do provide some leverage, necessitating FirstService's focus on service differentiation and value.

| Factor | Impact on FirstService | 2024 Context |

|---|---|---|

| Customer Fragmentation | Lowers individual customer power | Vast residential and commercial client spread |

| Switching Costs (Residential) | Moderate | Administrative hurdles and established relationships |

| Switching Costs (Commercial/Brands) | Low (single service) to High (integrated) | Varies by service scope and contract length |

| Price Sensitivity | High | Amplified by 2024 inflation, budget constraints |

| Availability of Substitutes | Moderate to High | Numerous local and national competitors |

| Backward Integration Threat | Low (complex services) to Moderate (simple tasks) | High barriers for specialized tech/legal needs |

What You See Is What You Get

FirstService Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written FirstService Porter's Five Forces Analysis, detailing the competitive landscape for the company. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The North American property services sector is quite fragmented. This means there are many companies, ranging from big national ones to smaller local outfits, all vying for business.

FirstService is a significant player, but it's not alone. It competes with giants like CBRE Group, Jones Lang LaSalle, and Colliers International Group. These companies have substantial resources and market reach.

Beyond these major players, a vast number of smaller, regional, and niche service providers also contribute to the competitive landscape. This widespread competition means FirstService must constantly adapt and innovate to maintain its leadership position.

The North America property management services market is expected to see a compound annual growth rate of 6.7% between 2025 and 2033. This growth is largely fueled by rising rental demand and the continued expansion of urban areas.

Such a moderate growth trajectory implies that the competitive landscape will remain robust. Companies will likely intensify their efforts to secure new management contracts and broaden their operational reach, leading to ongoing rivalry for market share.

FirstService distinguishes itself by operating two primary platforms: FirstService Residential, the leading manager of residential communities, and FirstService Brands, a provider of diverse essential property services. This dual focus allows for cross-selling opportunities and a comprehensive service offering.

While property management can often be seen as a commodity, FirstService actively works to differentiate its services by emphasizing superior customer service, streamlined operational efficiencies, and a wide array of integrated solutions. This strategy aims to move beyond pure price competition.

For instance, in 2023, FirstService Residential managed over 2 million residential units across North America, showcasing its scale and market penetration. This extensive reach, coupled with a commitment to service quality, helps to solidify its competitive position and reduce the intensity of direct price wars.

Switching Costs for Customers

While customers can choose from various property management firms, the process of switching often involves considerable administrative effort and potential operational disruptions. This creates moderate switching costs for clients, offering some degree of stickiness for incumbent providers.

These moderate switching costs can contribute to a degree of stability in existing contracts. However, the highly competitive nature of the property management industry means that rivals are actively incentivized to develop strategies to mitigate these barriers and attract new clients.

For instance, some companies might offer incentives or streamlined onboarding processes to reduce the perceived hassle of switching. In 2024, the property management sector continues to see innovation in client retention and acquisition strategies, with many firms focusing on digital solutions to simplify the transition process.

- Moderate Switching Costs: While alternatives exist, switching property management involves administrative hurdles and potential disruption, leading to moderate switching costs for customers.

- Competitive Pressure: Intense industry rivalry compels competitors to actively work at overcoming these switching barriers to gain market share.

- Client Retention: These costs offer some stability for existing contracts, but the dynamic market necessitates continuous value delivery to prevent client attrition.

Exit Barriers

Exit barriers for companies in the property services sector are typically moderate. Significant investments in skilled personnel, specialized local infrastructure, and established client relationships make a clean exit challenging. This can result in less profitable entities remaining active in the market, contributing to ongoing competition.

For instance, a property management firm might have substantial assets tied up in local office leases, technology systems, and long-term contracts with property owners. Divesting these assets or winding down operations can incur considerable costs and complexities, potentially prolonging the presence of even underperforming competitors.

- Moderate Exit Barriers: Investments in personnel, infrastructure, and client relationships create moderate exit barriers in property services.

- Complexity of Divestment: Exiting or divesting business units can be intricate due to these embedded assets and relationships.

- Sustained Competition: This complexity can lead to the persistence of less profitable players, intensifying rivalry.

The competitive rivalry within the North American property services sector is significant, driven by a fragmented market with numerous players, from large corporations to smaller local firms. FirstService, a major entity, faces competition from industry giants like CBRE Group, Jones Lang LaSalle, and Colliers International Group, all possessing substantial resources and market reach.

The market's moderate growth, projected at 6.7% CAGR from 2025 to 2033, ensures continued intensity as companies strive to secure contracts and expand their operations. FirstService leverages its dual platforms, FirstService Residential and FirstService Brands, to offer comprehensive services and differentiate itself through superior customer service and integrated solutions, aiming to move beyond price-based competition.

While switching property management firms involves moderate client costs due to administrative effort and potential disruption, competitors actively seek to overcome these barriers. In 2024, the industry saw a focus on digital solutions to simplify client transitions, highlighting the ongoing efforts to attract new business and retain existing clients amidst robust competition.

| Competitor | 2023 Revenue (USD Billions) | Market Focus |

|---|---|---|

| CBRE Group | 22.5 | Commercial Real Estate Services & Investment |

| Jones Lang LaSalle | 20.1 | Real Estate Services & Investment Management |

| Colliers International Group | 4.0 | Real Estate Professional Services |

| FirstService Corporation | 2.0 (Approx. 2023) | Residential & Commercial Property Services |

SSubstitutes Threaten

For FirstService's property management segment, a key substitute is self-management by property owners or community associations. This is particularly prevalent for smaller properties where the cost of professional management might outweigh the perceived benefits. In 2023, the self-storage market, a related sector where FirstService operates through its brands, saw continued growth, indicating a willingness among consumers to manage their own assets.

Within FirstService Brands, which focuses on property services like restoration and home improvement, independent contractors represent a significant substitute. Property owners may also opt for DIY solutions for maintenance and repair tasks. For instance, the home improvement retail sector, a direct competitor for DIY services, reported robust sales in 2024, demonstrating the ongoing appeal of self-service options.

The threat of substitutes for FirstService's property management services is present, particularly from self-management or engaging independent contractors. These alternatives often present a lower upfront cost, appealing to budget-conscious clients. For instance, while a professional management fee might range from 8-12% of collected rents, a self-managing landlord or a loosely affiliated contractor could operate at a significantly lower percentage or even a flat fee.

However, this lower price point typically comes with a trade-off in professional expertise, operational efficiency, and the breadth of services offered. FirstService differentiates itself by providing specialized knowledge in areas like legal compliance, maintenance coordination, and financial reporting, which can be difficult and time-consuming for individuals to manage effectively. The company’s focus on scale also allows for better negotiation power with vendors, potentially leading to cost savings that offset higher management fees.

Customer propensity to substitute for FirstService is influenced by the perceived cost savings of DIY property management versus professional services. Factors like the ease of self-management and the availability of genuinely comparable, lower-cost alternatives play a significant role. For instance, if economic headwinds lead to increased operating costs for property owners, they might be more inclined to explore less expensive, though potentially less robust, solutions.

Quality and Scope of Substitute Services

While individual contractors or self-management can address rudimentary property maintenance, they often fall short when it comes to the comprehensive service spectrum, advanced technology integration, and rigorous compliance adherence that established providers like FirstService deliver.

This deficiency in both quality and breadth significantly curtails the threat of substitution for clients requiring holistic property management solutions.

- Limited Scope of Individual Providers: Small contractors typically specialize in one or two areas, such as landscaping or plumbing, lacking the integrated approach for all property needs.

- Technology Gap: Larger firms like FirstService leverage sophisticated property management software for accounting, communication, and maintenance tracking, a capability often absent in smaller operations.

- Compliance and Legal Expertise: Integrated providers offer expertise in complex regulatory environments and liability management, a crucial differentiator compared to independent operators.

- Scalability and Reliability: For larger portfolios, the ability to scale services and ensure consistent, reliable execution is a significant advantage that substitutes struggle to match.

Technological Advancements in Substitutes

Technological advancements are introducing new ways for property owners to manage their assets, potentially acting as substitutes for traditional property management services. The proliferation of do-it-yourself (DIY) property management software and online platforms allows owners to handle tasks like rent collection, tenant screening, and maintenance requests themselves. For instance, platforms like Buildium and AppFolio offer comprehensive solutions that, while powerful, often require significant time investment and specialized knowledge that FirstService’s integrated approach addresses.

While these technological substitutes can empower property owners, they frequently serve as complements rather than complete replacements for the comprehensive services offered by companies like FirstService. The complexity of managing multiple properties, navigating legal regulations, and handling unexpected issues often necessitates the expertise and scale that professional management provides. For example, in 2024, the property management software market was valued at approximately $3.5 billion, indicating significant adoption, yet the demand for outsourced professional services remains robust, highlighting the limitations of purely DIY solutions for many property owners.

- DIY Software Limitations: While platforms like Buildium offer robust features, they often demand significant owner time and expertise, which may not be available or desired by all property investors.

- Complementary Nature: Many DIY tools enhance efficiency but do not fully replace the need for specialized legal, financial, and on-the-ground operational oversight that professional managers provide.

- Market Data: The property management software market's continued growth in 2024, estimated around $3.5 billion, demonstrates increasing adoption of these tools, yet it also underscores the persistent need for professional management services.

The threat of substitutes for FirstService's offerings is primarily driven by property owners opting for self-management or utilizing independent contractors. These alternatives often appeal due to lower immediate costs, though they typically lack the comprehensive expertise and efficiency of professional services. For instance, while DIY property management software adoption is growing, with the market valued around $3.5 billion in 2024, it often requires significant owner time and specialized knowledge that FirstService’s integrated approach addresses.

Entrants Threaten

Entering the property services sector, particularly to compete with a company like FirstService, demands substantial financial resources. New players would need considerable capital to fund acquisitions, build robust technology systems, and establish a widespread operational presence across various regions. For instance, FirstService's 2023 annual report highlighted significant investment in technology and integration of acquired businesses, underscoring the financial barrier to entry.

FirstService's growth model often involves acquiring smaller, complementary businesses – a strategy known as tuck-under acquisitions. To effectively challenge FirstService, new entrants would need to execute a similar acquisition strategy to gain comparable scale and market share. This approach requires not only capital but also sophisticated M&A capabilities, which can be a significant hurdle for newcomers.

FirstService leverages significant economies of scale across its vast operational network. This includes centralized technology platforms, shared administrative functions, and substantial purchasing power, all of which contribute to lower per-unit costs.

For instance, in 2023, FirstService's consolidated revenue reached $5.0 billion, allowing for greater investment in efficiency-driving technologies and bulk purchasing discounts that smaller competitors cannot easily replicate.

New entrants face a steep challenge in matching these cost efficiencies. They would need substantial upfront investment to build a comparable infrastructure and achieve the same purchasing leverage, creating an initial competitive disadvantage.

This scale advantage directly impacts pricing flexibility and the ability to invest in innovation, making it difficult for newcomers to compete on cost in the early stages.

FirstService benefits from deeply entrenched brand loyalty, cultivated over decades of consistent, high-quality service delivery. This strong reputation acts as a significant barrier, making it challenging for newcomers to attract and retain customers. For instance, in 2023, FirstService Residential reported continued strong client retention rates, underscoring the stickiness of their established relationships.

Access to Distribution Channels

New entrants face a significant hurdle in accessing established distribution channels that FirstService already leverages. These channels, including direct sales teams, extensive referral networks, and deep community penetration, are crucial for client acquisition and retention.

Building comparable distribution networks requires substantial time and investment. For instance, a new competitor would need to replicate FirstService's multi-faceted approach, which has been cultivated over years of operation and client relationship management. This includes developing trust and visibility within the communities FirstService serves.

The difficulty in establishing these channels acts as a barrier, limiting the threat of new entrants. FirstService's existing infrastructure and brand recognition, built through consistent service delivery, make it challenging for newcomers to gain a foothold and compete effectively on distribution reach.

- Established Client Acquisition Channels: FirstService benefits from direct sales, referrals, and community presence.

- Resource Intensity for New Entrants: Developing similar networks is slow and costly.

- Trust and Network Building: Newcomers must invest heavily in gaining market trust and establishing their own referral streams.

- Barrier to Entry: The difficulty in replicating distribution capabilities limits the competitive threat.

Government Policy and Regulations

Government policy and regulations significantly influence the threat of new entrants in the property management sector. For instance, licensing requirements vary widely by state and municipality, demanding compliance with specific educational, experience, and examination standards. In 2024, some states continued to review or update their property management licensing laws, potentially increasing the initial burden for newcomers.

Navigating these varied regulatory landscapes poses a substantial barrier. New entrants must invest time and resources to understand and adhere to tenant rights legislation, building codes, and fair housing laws, which differ across jurisdictions. Failure to comply can result in penalties and operational disruptions, deterring less prepared businesses.

- Licensing Hurdles: Many jurisdictions require property managers to hold specific licenses, often involving exams and fees, which can be a significant upfront cost and knowledge barrier for new entrants.

- Compliance Complexity: Adhering to diverse local, state, and provincial regulations on tenant rights, eviction procedures, and property maintenance demands specialized legal and operational expertise.

- Varying Enforcement: The strictness of regulatory enforcement can differ, creating an uneven playing field where well-established firms with robust compliance systems have an advantage over new, less experienced players.

The threat of new entrants into the property services market, particularly against a player like FirstService, is significantly mitigated by high capital requirements and the need for substantial operational scale. New companies must invest heavily in technology, acquisitions, and establishing a broad geographic presence, mirroring FirstService's 2023 investments totaling billions to integrate acquired businesses and enhance its digital infrastructure.

FirstService's established brand loyalty, built over decades of consistent service, acts as a formidable barrier, making it difficult for newcomers to attract and retain clients. In 2023, FirstService Residential reported strong client retention, highlighting the sticky nature of their existing relationships which new entrants struggle to replicate.

Accessing and building robust distribution channels, including direct sales, referral networks, and deep community penetration, is another significant hurdle. Replicating FirstService's multi-faceted approach, cultivated over years of operation, requires considerable time and investment, limiting the competitive threat from new market participants.

Navigating complex and varied government regulations, such as licensing requirements and diverse tenant rights legislation across different jurisdictions, adds another layer of difficulty. In 2024, ongoing reviews of property management licensing laws in several states increased the compliance burden for potential new entrants, demanding specialized legal and operational expertise to avoid penalties.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for acquisitions, technology, and market presence. | Significant financial barrier, requiring substantial funding. | FirstService's 2023 reported revenue of $5.0 billion enabled significant investment in efficiency and growth. |

| Economies of Scale | Lower per-unit costs through centralized functions and bulk purchasing. | New entrants face higher initial operating costs and pricing disadvantages. | FirstService's scale allows for greater investment in technology and operational efficiencies. |

| Brand Loyalty & Reputation | Established trust and consistent service delivery over time. | Difficult for newcomers to gain market trust and attract clients. | FirstService Residential's strong client retention rates in 2023. |

| Distribution Channels | Existing networks of sales, referrals, and community penetration. | Time-consuming and costly to replicate established reach and relationships. | Replicating FirstService's deep community penetration takes years of effort. |

| Regulatory Compliance | Varying licensing, tenant rights, and property maintenance laws. | Requires significant investment in legal expertise and compliance infrastructure. | 2024 saw continued updates to state licensing laws, increasing compliance complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, industry-specific market research, and publicly available financial filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.