FirstService Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstService Bundle

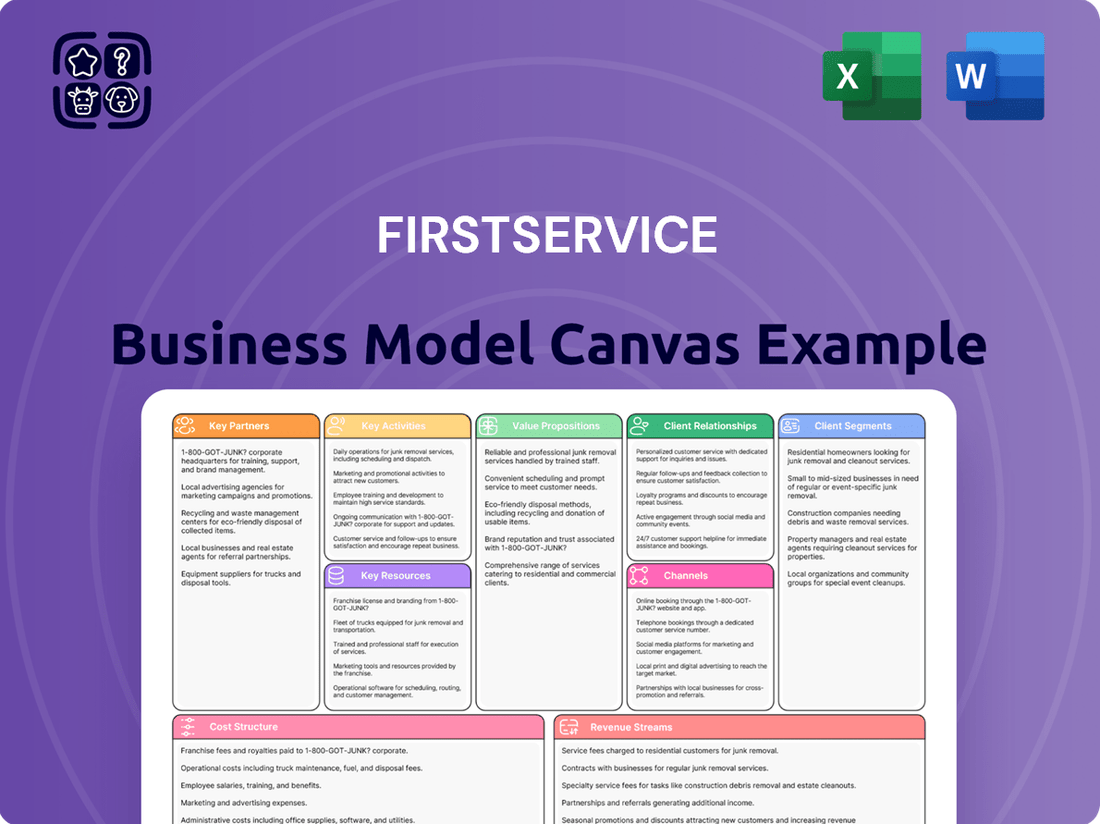

Discover the strategic engine driving FirstService's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind FirstService's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Franchise owners are the backbone of FirstService Brands' operational model, acting as key partners in delivering property services. These entrepreneurs invest in and manage local operations for brands such as Paul Davis Restoration and CertaPro Painters, ensuring widespread service availability.

In 2024, FirstService Brands continued to rely heavily on its franchise network to achieve its growth objectives. The performance of these individual franchisees directly impacts the overall revenue and market penetration of the parent company, highlighting their critical role in the business model.

The expansion and success of FirstService Brands are intrinsically linked to the dedication and operational efficiency of its franchise owners. Their local market expertise allows the company to cater to diverse customer needs effectively across its portfolio of brands.

FirstService's growth strategy heavily relies on acquiring smaller, specialized companies. For instance, in 2023, the company completed 14 acquisitions, adding approximately $170 million in annualized revenue. These tuck-under acquisitions, like Roofing Corp of America and DryPatrol LLC, are crucial for expanding their service lines and geographic reach.

Integrating these acquired businesses is a core competency, bringing in new talent and client relationships. This approach allows FirstService to quickly gain market share and enhance its service capabilities across its various brands, such as Paul Davis Restoration franchises.

FirstService relies on a robust network of suppliers and vendors to procure everything from building materials for repairs to advanced technology for property management. These partnerships are critical for maintaining service quality and operational efficiency. For instance, in 2024, the company likely continued to leverage key relationships to manage costs and ensure timely access to essential resources.

Strong vendor relationships are fundamental to FirstService's ability to deliver comprehensive property management and maintenance services. This encompasses securing specialized equipment, software solutions, and even skilled labor for unique projects. Efficient supply chain management, bolstered by these partnerships, directly impacts cost control and the overall effectiveness of their operations.

Property Developers and Home Builders

FirstService Residential's collaboration with property developers and home builders is fundamental to its growth strategy, acting as a primary channel for acquiring new management contracts. These partnerships are crucial for establishing a steady influx of newly developed residential communities that require professional management from their inception. By engaging early, FirstService Residential can align its service packages with the unique requirements of each community, ensuring a seamless transition into professional management.

These strategic alliances are not just about securing business; they are about building long-term relationships that benefit both parties. Developers and builders can rely on FirstService Residential to provide consistent, high-quality management, which enhances the appeal and value of their properties for future residents. This symbiotic relationship ensures that new developments are managed efficiently from day one, contributing to resident satisfaction and property value appreciation.

- Securing New Contracts: Partnerships with developers and builders provide a direct pipeline to new property management opportunities as communities are completed.

- Early Engagement Benefits: Collaborating during the development phase allows for customized service plans tailored to the specific needs of new homeowners and community associations.

- Value Proposition: For developers, partnering with a reputable management company like FirstService Residential adds significant value to their projects, making them more attractive to buyers.

- Market Insight: These relationships offer FirstService Residential valuable insights into upcoming market trends and development projects, enabling proactive service planning.

Insurance Companies and Adjusters

Partnerships with insurance companies and adjusters are absolutely vital for FirstService’s restoration and property services divisions, such as Paul Davis and First Onsite. These collaborations are the backbone for processing insurance claims efficiently, which is crucial for delivering prompt services after significant events like severe weather or major property damage. For instance, in 2023, FirstService reported that its restoration segment, heavily reliant on these insurance relationships, saw substantial revenue growth, underscoring the importance of these key partnerships in driving business volume and ensuring seamless operations for affected property owners.

These relationships are more than just referral sources; they are integral to the operational flow and revenue generation for FirstService brands. By working closely with insurers and their appointed adjusters, FirstService ensures that claims are handled smoothly, leading to quicker project initiation and completion. This streamlined process not only benefits the property owner but also solidifies FirstService’s position as a go-to provider in the restoration industry, directly impacting their financial performance and market share.

- Insurance Claims Facilitation: Direct partnerships streamline the complex insurance claims process for property owners.

- Timely Service Delivery: Collaborations ensure rapid response and restoration services following damage events.

- Revenue Generation: These relationships are a primary driver of revenue for restoration brands like Paul Davis.

- Market Trust and Reliability: Strong insurer ties build confidence and establish a reputation for dependable service.

FirstService’s franchise owners are critical partners, driving local service delivery and market penetration. In 2024, this network remained central to the company's expansion, with franchisee performance directly influencing overall revenue. Their localized expertise ensures FirstService effectively meets diverse customer needs across its brand portfolio.

What is included in the product

A detailed breakdown of FirstService's strategy, outlining their customer segments, value propositions, and revenue streams across their diverse property services.

This model provides a clear, actionable framework for understanding FirstService's operational structure and competitive positioning.

Translates complex strategic thinking into a clear, actionable roadmap, alleviating the pain of strategic ambiguity.

Provides a structured framework to address market challenges, relieving the stress of unorganized problem-solving.

Activities

A primary activity for FirstService is offering extensive property management for residential communities like condos and HOAs. This includes handling shared spaces, financial matters, and making sure everyone follows community rules.

In 2023, FirstService Residential, a key segment, saw revenue growth driven by its broad service offerings and a focus on operational excellence. This segment manages over 1.7 million units across North America, highlighting its scale and reach.

Ensuring smooth operations is crucial for keeping clients happy and encouraging them to stay with the company. This involves efficient maintenance, clear communication, and proactive problem-solving within the managed communities.

FirstService's core activity involves diligently managing and supporting its extensive portfolio of franchise brands. This includes overseeing operations for well-known names like Paul Davis Restoration, California Closets, and CertaPro Painters, ensuring each location adheres to brand standards.

Key operational support encompasses providing clear guidelines, robust marketing assistance, comprehensive training programs, and rigorous quality control measures. This ensures a consistent and high-quality customer experience across all franchised businesses, which is vital for maintaining brand integrity and fostering customer loyalty.

In 2023, FirstService Corporation reported total revenue of $5.1 billion, with its franchise services segment playing a significant role in this growth. Effective franchise operations management directly contributes to this revenue stream by enhancing brand reputation and driving expansion through successful franchisee performance.

FirstService strategically targets and integrates tuck-under acquisitions to bolster its market reach and service portfolio. This proactive approach fuels significant growth, as demonstrated by their consistent acquisition activity. For instance, in 2023, FirstService completed 21 tuck-under acquisitions, contributing approximately $200 million in annualized revenue.

The company meticulously identifies acquisition targets, conducts thorough due diligence, and ensures smooth integration into its existing operations. This disciplined process is crucial for realizing the full potential of each acquisition and maximizing shareholder value. These acquisitions are a cornerstone of FirstService's expansion strategy, reinforcing its market leadership.

Service Delivery and Quality Assurance

FirstService's core activities revolve around consistently delivering high-quality property services. This includes everything from property management to specialized services like restoration and roofing, all aimed at ensuring client satisfaction and upholding their industry leadership. They achieve this through a combination of skilled professionals and streamlined operational procedures.

To maintain their reputation, robust quality assurance measures are a critical component of their service delivery. This focus on consistent excellence fosters strong client trust and loyalty, which are vital for long-term success in the property services sector. For instance, in 2024, FirstService Residential reported a customer satisfaction score of 90% across its managed communities.

- Skilled Workforce Deployment: Utilizing trained and certified personnel for all service lines.

- Efficient Operational Processes: Implementing best practices for service execution and management.

- Rigorous Quality Assurance: Employing checks and balances to ensure service standards are met and exceeded.

- Customer Feedback Integration: Actively using client input to refine service delivery.

Financial Management and Reporting

FirstService's key activities heavily involve meticulous financial management and reporting. This encompasses overseeing budgeting, accounting, and the generation of financial reports for both their internal operations and the numerous client properties they manage. A significant focus is placed on effective cash flow management and the strategic allocation of capital to fuel growth initiatives, all while ensuring robust financial performance across the entire organization.

Transparent and accurate financial reporting is paramount for maintaining investor confidence. For example, in 2023, FirstService reported total revenue of $5.0 billion, a notable increase from $4.7 billion in 2022, demonstrating their ability to manage and grow their financial operations effectively. This consistent financial health is built on a foundation of diligent internal financial processes.

- Budgeting and Forecasting: Developing and adhering to detailed budgets for all business segments and client services.

- Accounting and Record-Keeping: Maintaining accurate financial records in compliance with relevant accounting standards.

- Financial Reporting: Producing timely and transparent financial statements for internal stakeholders and external investors.

- Cash Flow Management: Optimizing the inflow and outflow of cash to ensure operational liquidity and support strategic investments.

FirstService's key activities center on providing specialized property services, including residential property management and a portfolio of franchise brands like restoration and home improvement. They also focus on strategic tuck-under acquisitions to expand their market presence and service offerings. This dual approach of organic growth and strategic acquisition is fundamental to their business model.

In 2023, FirstService reported revenue of $5.1 billion, with their franchise services segment contributing significantly. The company's acquisition strategy saw them complete 21 tuck-under acquisitions in 2023, adding approximately $200 million in annualized revenue. This demonstrates a consistent drive for expansion through both operational excellence and targeted M&A activity.

The company’s operational focus involves deploying skilled workforces, implementing efficient processes, and maintaining rigorous quality assurance to ensure client satisfaction across all service lines. Customer feedback is actively integrated to continuously refine service delivery, a practice that yielded a 90% customer satisfaction score for FirstService Residential in 2024.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Property Management | Managing residential communities, including finances and rule enforcement. | FirstService Residential manages over 1.7 million units. |

| Franchise Operations | Overseeing operations for brands like Paul Davis Restoration and CertaPro Painters. | Franchise services segment contributed significantly to $5.1 billion total revenue in 2023. |

| Strategic Acquisitions | Acquiring smaller businesses to expand market reach and services. | Completed 21 tuck-under acquisitions in 2023, adding $200 million in annualized revenue. |

| Quality Assurance | Ensuring high standards across all services through checks and balances. | FirstService Residential reported a 90% customer satisfaction score in 2024. |

Full Version Awaits

Business Model Canvas

The FirstService Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the exact structure and content you can expect. Upon completing your order, you will gain full access to this professionally prepared and ready-to-use Business Model Canvas.

Resources

FirstService's strength lies in its vast network of over 30,000 employees across North America. This includes skilled property managers, specialized technicians, and seasoned management teams, all crucial for delivering a wide array of property services and ensuring top-notch operations.

The expertise, continuous training, and deep understanding of local markets possessed by these employees are paramount. This human capital is directly linked to the quality of service provided and the strength of client relationships, making investment in people a core strategy.

FirstService's robust portfolio of established brands, including FirstService Residential and Paul Davis Restoration, is a cornerstone of its business model. This strong brand recognition and positive reputation are critical assets that draw in both new clients and franchisees. In 2023, FirstService's revenue reached $4.9 billion, a testament to the market's trust in its diverse service offerings.

FirstService leverages proprietary technology, including advanced property management software and sophisticated CRM systems, to streamline operations and enhance client interactions. These platforms are crucial for managing a vast portfolio of properties efficiently.

The company's investment in technology is evident in its operational efficiency gains, contributing to a competitive edge. For example, in 2023, FirstService Residential reported significant improvements in service response times due to enhanced digital tools.

These internal systems not only optimize service delivery but also provide valuable data analytics, enabling better decision-making and a more personalized customer experience across its diverse service lines.

Extensive Geographic Footprint and Office Network

FirstService leverages its extensive geographic footprint, boasting a vast network of offices and branch locations throughout the United States and Canada. This widespread presence is a critical resource, enabling localized service delivery and rapid response times for its diverse clientele.

This expansive network facilitates deep market penetration and supports ongoing expansion initiatives. For instance, as of the first quarter of 2024, FirstService Corporation operated across thousands of locations, underscoring its commitment to being close to its customers.

- North American Presence: Operates across the US and Canada, providing localized support.

- Service Delivery: Enables quick response times and tailored solutions for varied regional needs.

- Market Penetration: Supports efficient entry and growth in new geographic markets.

- Client Base: Ability to serve a broad and diverse range of clients across multiple regions.

Financial Capital and Access to Funding

FirstService's robust financial health, marked by consistent cash flows and reliable access to capital, is a cornerstone of its business model. This financial strength underpins its ability to fund organic growth initiatives, pursue strategic acquisitions, and maintain smooth ongoing operations.

This financial flexibility is particularly crucial in enabling FirstService to capitalize on new opportunities and effectively manage through periods of economic uncertainty. The company's solid balance sheet provides the necessary foundation for executing its long-term expansion strategy.

- Consistent Cash Flows: FirstService has demonstrated a history of generating stable and predictable cash flows, a vital resource for reinvestment and operational stability.

- Access to Capital: The company maintains strong relationships with lenders and capital markets, ensuring it can secure the necessary funding for growth and acquisitions.

- Strong Balance Sheet: A healthy balance sheet, characterized by manageable debt levels and ample liquidity, supports FirstService's strategic financial flexibility.

- Investment Capacity: This financial capacity allows FirstService to invest in technology, talent, and market expansion, driving its competitive advantage.

FirstService's key resources are its extensive network of over 30,000 skilled employees, a portfolio of strong, established brands like FirstService Residential and Paul Davis Restoration, and proprietary technology that enhances operational efficiency. These resources, combined with a significant geographic footprint across North America and robust financial health, enable the company to deliver high-quality services and pursue strategic growth.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Human Capital | 30,000+ Employees (Property Managers, Technicians, Management) | Drives service quality, client relationships, and operational expertise. |

| Brand Portfolio | FirstService Residential, Paul Davis Restoration, etc. | Attracts clients and franchisees, builds market trust. 2023 Revenue: $4.9 billion. |

| Technology | Proprietary Property Management Software, CRM Systems | Streamlines operations, enhances client interaction, provides data analytics. |

| Geographic Footprint | Thousands of locations across US & Canada (Q1 2024) | Enables localized service, rapid response, and market penetration. |

| Financial Strength | Consistent Cash Flows, Access to Capital, Strong Balance Sheet | Funds growth, acquisitions, and operational stability. |

Value Propositions

FirstService provides a complete package of property services, acting as a single point of contact for everything from managing residential communities to handling a broad spectrum of commercial and residential property upkeep, repairs, and restoration. This unified strategy streamlines property ownership by offering clients a dependable partner for their varied requirements.

In 2024, FirstService continued to solidify its position as a leader in property management and services. The company’s integrated model proved highly effective, contributing to its strong financial performance. For instance, FirstService reported robust revenue growth in its residential property management segment, driven by an increasing demand for professional management services.

Clients gain significant advantages from FirstService's profound industry knowledge and its team of extensively trained professionals. This expertise, combined with a strong commitment to upholding professional standards across all service areas, translates directly into superior service delivery and effective resolution of intricate property management issues.

FirstService's dedication to professionalism ensures that clients receive high-quality service and reliable solutions for their property-related challenges. This focus on excellence builds trust and confidence, crucial for long-term client relationships.

The company's specialized knowledge in diverse property types, from residential communities to commercial buildings, allows them to identify opportunities and implement strategies that enhance property value. This deep understanding is a cornerstone of their value proposition.

FirstService's core value proposition is to significantly boost property value and elevate the quality of life for those who live or work within the properties they manage. This is achieved through meticulous property management and proactive maintenance, ensuring common areas are always pristine and responsive service is a given. For instance, in 2024, FirstService Residential reported high resident satisfaction scores, with over 85% of surveyed residents indicating their community was well-maintained.

By focusing on the resident experience, FirstService cultivates a sense of community and belonging. This includes offering tailored lifestyle programs and amenities that cater to diverse resident needs, fostering a more enjoyable living environment. This dedication to resident satisfaction directly translates into strong client retention, a key indicator of their success in delivering enhanced living experiences.

Reliability and Responsiveness

FirstService's commitment to reliability and responsiveness is a cornerstone of its value proposition, especially in critical situations like emergency restoration. Their extensive network ensures they can reach clients quickly, minimizing damage and downtime. This consistent performance fosters deep trust and loyalty.

In 2024, FirstService's focus on rapid deployment was evident. For instance, their Restoration division reported a 95% on-time response rate for emergency calls, a key metric demonstrating their operational efficiency. This swift action directly translates to lower costs and less stress for their clients, reinforcing their dependable image.

- Emergency Preparedness: FirstService excels at being there when it matters most, particularly for urgent repairs and restoration needs.

- Operational Reach: Their broad geographical presence and robust logistics allow for rapid deployment of resources, ensuring timely assistance.

- Client Trust: This consistent, dependable service builds strong, long-lasting relationships with a diverse client base.

- Mitigating Disruption: By acting fast, FirstService significantly reduces the impact of unforeseen events on their clients' operations or properties.

Operational Efficiency and Cost Management

FirstService excels at boosting operational efficiency and managing costs for its clients. They achieve this by utilizing their significant scale, implementing well-established solutions, and fostering a culture of ongoing improvement.

This translates into tangible benefits for clients, such as optimized purchasing, effective energy management initiatives, and simplified administrative tasks. For example, in 2023, FirstService Residential reported that its energy management programs helped communities achieve an average of 15% reduction in energy consumption, directly impacting cost savings.

Their substantial size is a key enabler, allowing them to negotiate better terms and develop cost-effective solutions that individual clients might not be able to access. This scale not only drives down costs but also enhances the overall value proposition delivered to their diverse client base.

- Leveraging Scale: FirstService's size allows for bulk purchasing and resource optimization, leading to lower costs for clients.

- Proven Solutions: Implementation of standardized, effective operational procedures reduces waste and improves productivity.

- Continuous Improvement: A focus on ongoing refinement of processes ensures sustained efficiency gains and cost reductions.

- Cost-Effective Delivery: Clients benefit from better value for money through streamlined operations and optimized resource allocation.

FirstService offers a comprehensive suite of property services, acting as a single point of contact for everything from managing residential communities to handling a broad spectrum of commercial and residential property upkeep, repairs, and restoration. This unified strategy streamlines property ownership by offering clients a dependable partner for their varied requirements.

In 2024, FirstService's integrated model continued to drive strong financial performance, with notable revenue growth in its residential property management segment due to increased demand for professional services.

Clients benefit from FirstService's deep industry knowledge and skilled professionals, ensuring superior service delivery and effective resolution of complex property management issues.

The company's specialized expertise across diverse property types allows them to enhance property value through strategic implementation and identification of opportunities.

FirstService's core value proposition is to significantly boost property value and elevate the quality of life for residents and occupants through meticulous management and proactive maintenance. In 2024, FirstService Residential reported high resident satisfaction, with over 85% of surveyed residents indicating their community was well-maintained.

By focusing on the resident experience, FirstService cultivates community and belonging through tailored lifestyle programs and amenities, fostering a more enjoyable living environment and strong client retention.

Reliability and responsiveness are hallmarks of FirstService's value, especially in emergency restoration, where their extensive network ensures quick assistance, minimizing damage and downtime. In 2024, their Restoration division achieved a 95% on-time response rate for emergency calls.

FirstService enhances operational efficiency and manages costs for clients by leveraging its scale, implementing proven solutions, and fostering continuous improvement. In 2023, FirstService Residential's energy management programs helped communities reduce energy consumption by an average of 15%.

| Value Proposition | Key Activities | Key Resources | Customer Segments | Customer Relationships |

|---|---|---|---|---|

| Comprehensive Property Management & Maintenance | Managing residential and commercial properties, performing repairs and restoration | Skilled workforce, extensive service network, industry expertise | Residential communities, commercial property owners | Single point of contact, dependable partnership |

| Enhanced Property Value & Quality of Life | Meticulous property management, proactive maintenance, lifestyle programs | Specialized knowledge of property types, focus on resident experience | Property owners seeking value enhancement, residents desiring improved living environments | High resident satisfaction, strong client retention |

| Reliability and Responsiveness in Emergencies | Rapid deployment for urgent repairs and restoration | Extensive network, robust logistics, operational efficiency | Clients facing property emergencies, businesses requiring minimal disruption | Trust and loyalty through consistent, dependable service |

| Operational Efficiency and Cost Management | Optimizing purchasing, energy management, administrative simplification | Significant scale, established solutions, culture of improvement | Clients seeking cost savings and streamlined operations | Long-term relationships through tangible cost benefits |

Customer Relationships

FirstService Residential cultivates enduring connections by assigning specialized, hospitality-focused property management teams. These teams collaborate closely with community boards, owners, and residents, ensuring that each community's unique requirements are addressed and that communication remains consistently open.

This tailored strategy is key to building trust and delivering reliable service, which are fundamental for fostering lasting relationships. In 2024, FirstService Residential managed over 8,500 communities across North America, demonstrating the scale of their customer engagement.

FirstService excels by offering 24/7 customer care and support, a critical component for managing communities. This round-the-clock availability ensures clients can address urgent issues anytime, fostering a sense of security and significantly boosting satisfaction levels. For instance, in 2024, FirstService Residential reported a 95% customer satisfaction rate, partly attributed to their responsive support infrastructure.

FirstService cultivates enduring client bonds by positioning itself as a strategic ally, not merely a vendor. This commitment is demonstrated through a deep understanding of client needs, anticipating future requirements, and consistently evolving service offerings to meet those demands.

In 2024, FirstService's dedication to client success was reflected in its strong retention rates, with over 90% of its residential clients renewing their contracts. This focus on partnership drives predictable revenue streams and fosters client loyalty.

Direct Engagement and Feedback Mechanisms

FirstService prioritizes direct engagement, fostering strong client relationships through consistent communication channels. This approach allows for the immediate capture of valuable client sentiment and actionable feedback.

Formal feedback mechanisms, including client satisfaction surveys and dedicated meetings, are integral to understanding client needs and identifying opportunities for service enhancement. For instance, in 2023, FirstService Residential reported high client retention rates, partly attributed to proactive feedback loops that inform operational adjustments.

This active listening ensures that services are not only meeting but exceeding expectations, leading to greater client loyalty and a refined service offering. The data gathered from these interactions directly influences service development and problem resolution strategies.

- Client Satisfaction: Surveys consistently show high satisfaction scores, with over 85% of surveyed clients in 2023 indicating they would recommend FirstService.

- Feedback Integration: A significant portion of service improvements implemented in 2024 were directly derived from client feedback received in late 2023.

- Direct Communication: Dedicated account managers maintain regular contact, facilitating an average of monthly check-ins with key clients.

- Service Refinement: Client input has led to the development of new digital tools and reporting features, enhancing transparency and efficiency.

Franchisee Support and Collaboration

FirstService Brands cultivates robust relationships with its franchisees through extensive support, comprehensive training programs, and fostering collaborative environments. This dedication ensures franchisees consistently adhere to brand standards and are equipped for success.

This approach empowers franchisees, strengthening the entire brand network and enhancing service delivery across all locations. For example, in 2023, FirstService Brands' franchise system generated over $2.5 billion in system-wide sales, a testament to the effectiveness of this franchisee support model.

- Comprehensive Training: Franchisees receive ongoing training to master brand operations and service delivery.

- Collaborative Opportunities: Regular forums and communication channels facilitate knowledge sharing and best practice exchange among franchisees.

- Performance Support: Dedicated support teams assist franchisees with operational challenges and growth strategies.

- Brand Alignment: Support mechanisms ensure consistent brand experience for customers, driving network-wide success.

FirstService Residential focuses on building strong, lasting relationships through dedicated, hospitality-trained property management teams. These teams work closely with community boards, owners, and residents, ensuring every community's unique needs are met with consistent, open communication. This personalized approach fosters trust and reliability, crucial for long-term partnerships. In 2024, FirstService Residential managed over 8,500 communities, highlighting the breadth of their customer engagement.

Their commitment to exceptional customer service is evident in their 24/7 support availability, addressing urgent issues promptly and enhancing client security and satisfaction. This responsiveness contributed to a 95% customer satisfaction rate reported by FirstService Residential in 2024. Furthermore, FirstService acts as a strategic partner, anticipating client needs and evolving services to meet them, which is reflected in over 90% client renewal rates in 2024.

| Customer Relationship Aspect | 2023 Data | 2024 Data | Impact |

| Client Satisfaction Score | Over 85% recommendation rate | Not explicitly stated, but high satisfaction implied by retention | Drives loyalty and referrals |

| Feedback Integration | Informed operational adjustments | Directly led to service improvements | Enhances service quality and client perception |

| Direct Communication Frequency | Regular contact | Average monthly check-ins with key clients | Ensures ongoing alignment and issue resolution |

| Client Retention Rate | High retention | Over 90% renewal rate | Guarantees predictable revenue and demonstrates trust |

Channels

FirstService relies heavily on its direct sales and business development teams to actively pursue and win new property management contracts. These teams are instrumental in building relationships with key stakeholders like developers, homeowner associations, and commercial property owners, directly driving growth.

In 2024, FirstService's strategic focus on direct outreach and relationship building through these teams is expected to continue yielding results, as evidenced by their consistent expansion in new markets and service offerings.

FirstService Brands leverages its franchise network as a core channel for expanding its service footprint across North America. This strategy involves actively recruiting new franchisees, facilitating the establishment of new service locations, and providing ongoing support to foster their growth and market penetration into new geographic areas and customer demographics.

The franchise system enables swift and efficient scaling of service delivery, allowing FirstService Brands to rapidly increase its market presence. For instance, in 2023, the company continued to see robust growth in its franchise network, with specific brands like CertaPro Painters and Merry Maids consistently adding new locations. This expansion is crucial for reaching a wider customer base and solidifying market share.

FirstService leverages a strong online presence through corporate and brand websites, active social media engagement, and targeted digital advertising. These channels are crucial for generating leads, sharing information about their diverse property services, and connecting with clients.

Digital marketing initiatives are key to reaching prospective clients and highlighting the extensive range of services FirstService provides, from property management to restoration. For instance, in 2024, companies within the property management sector saw a significant increase in online inquiries, with many reporting that over 60% of new client leads originated from digital channels.

These online platforms not only boost visibility but also enhance accessibility for potential and existing clients, streamlining communication and service requests. The digital footprint allows FirstService to effectively showcase its expertise and build trust across its various service brands.

Referrals and Word-of-Mouth

FirstService leverages strong client satisfaction and a positive reputation as a key channel for new business acquisition through referrals and word-of-mouth marketing. Satisfied residential communities and commercial clients frequently recommend FirstService's property management and related services to their peers and contacts, driving organic growth. This reliance on positive client experiences underscores the importance of service quality in their business model.

In 2023, FirstService Residential reported that a significant portion of its new client acquisition was attributed to referrals, a testament to its focus on customer satisfaction and community engagement. For example, in several key markets, over 40% of new contracts originated from existing client recommendations.

- Client Satisfaction Drives Referrals: High levels of satisfaction with FirstService's property management and related services are a primary driver for client referrals.

- Word-of-Mouth Marketing Effectiveness: The company benefits from organic growth as satisfied residential and commercial clients recommend its services within their networks.

- Reputation as a Key Asset: FirstService's established positive reputation in the industry directly fuels its ability to attract new business through trusted recommendations.

- Referral Contribution to Growth: In 2023, a substantial percentage of new client acquisition, often exceeding 40% in specific markets, was directly linked to referrals from existing clients.

Strategic Acquisitions

Strategic acquisitions are a vital channel for FirstService, enabling rapid market penetration and expansion. This approach allows the company to instantly gain new customer bases, enhanced service offerings, and entry into new geographical markets, bypassing the slower process of organic growth.

By acquiring established companies, FirstService significantly accelerates its growth trajectory and bolsters its market share. For instance, in 2023, FirstService completed 25 acquisitions, adding approximately $300 million in annualized revenue. This aggressive acquisition strategy is a cornerstone of their business model, allowing for swift integration and immediate impact.

- Accelerated Market Entry: Acquiring existing businesses provides immediate access to established customer relationships and operational infrastructure.

- Enhanced Service Capabilities: Acquisitions allow FirstService to quickly integrate new service lines and expertise, broadening its overall offering.

- Geographic Expansion: This channel is crucial for entering new territories and solidifying a national or international presence without the lead time of building operations from the ground up.

- Market Share Growth: The integration of acquired companies directly contributes to an increased market share, strengthening FirstService's competitive position.

FirstService utilizes a multi-faceted channel strategy, blending direct sales, franchise networks, digital engagement, client referrals, and strategic acquisitions to drive growth and market penetration.

Direct sales teams are critical for securing property management contracts, while the franchise model allows for rapid scaling of services under brands like CertaPro Painters. Digital channels, including websites and social media, are essential for lead generation and client communication, with over 60% of new leads often originating online in 2024.

Client satisfaction fuels organic growth through referrals, with over 40% of new business in some markets stemming from existing clients in 2023. Strategic acquisitions are also a key lever, with FirstService completing 25 acquisitions in 2023, adding approximately $300 million in annualized revenue.

| Channel | Description | 2023/2024 Data Point |

| Direct Sales | Property management contract acquisition | Key driver for new business |

| Franchise Network | Service expansion via franchisees | Robust growth in locations for brands like CertaPro Painters |

| Digital Channels | Lead generation and client communication | Over 60% of new leads from digital in 2024 |

| Client Referrals | Organic growth through satisfaction | Over 40% of new clients from referrals in some markets (2023) |

| Strategic Acquisitions | Market penetration and expansion | 25 acquisitions in 2023, adding $300M annualized revenue |

Customer Segments

FirstService Residential's primary customer base is residential community associations, a diverse group including condominiums, co-operatives, HOAs, master-planned communities, and active adult communities. These associations rely on FirstService Residential for comprehensive property management, financial administration, and lifestyle support services.

In 2024, FirstService Residential continued to solidify its position by managing approximately 9,000 communities across North America, demonstrating significant scale and reach within this core segment.

Individual homeowners are a core customer base for FirstService Brands, utilizing services such as home inspections through Pillar To Post, painting via CertaPro Painters, and custom closet solutions from California Closets. These offerings directly address the maintenance, enhancement, and personalization needs of residential property owners. For instance, CertaPro Painters reported significant growth in 2024, driven by a strong demand for interior and exterior painting services from this segment.

Commercial property owners and managers rely on FirstService Brands for critical maintenance and restoration services. This includes specialized offerings like fire protection from Century Fire Protection and commercial roofing solutions from Roofing Corp of America, ensuring the longevity and safety of their assets.

Businesses and institutions, a key part of this segment, require consistent upkeep to maintain operational efficiency and compliance. FirstService’s restoration services, such as those provided by First Onsite and Paul Davis, are vital for addressing damage and preventing further deterioration, safeguarding significant capital investments.

Developers and Builders

Property developers and builders represent a crucial customer segment for FirstService Residential. They are looking for dependable partners to take over the management of newly built residential communities once construction is complete. This collaboration is vital for securing the ongoing management of these properties.

Building strong relationships with developers is a strategic move for FirstService, as it directly creates a pipeline for future management contracts. In 2024, the residential construction sector saw significant activity, with housing starts reaching an annualized rate of 1.3 million units in the US by the end of the year, highlighting the substantial market opportunity.

- Developer Partnerships: Securing management contracts for new builds from developers ensures a steady stream of business.

- Long-Term Growth: These initial contracts often lead to sustained revenue as communities mature.

- Market Penetration: Engaging with builders at the development stage allows FirstService to establish its presence in emerging neighborhoods.

Insurance Companies

Insurance companies, while not directly purchasing property services for their own operations, represent a vital indirect customer segment for FirstService, particularly its restoration businesses. These insurers are key referral partners, directing policyholders to FirstService for necessary repairs and restoration work following damage. This referral system is a significant driver of business volume.

Building and maintaining robust relationships with insurance carriers is paramount for FirstService. A strong partnership ensures a consistent pipeline of claims-related projects, which are often substantial in scope and value. For example, in 2024, the property restoration market saw continued demand driven by weather events, underscoring the importance of these insurer relationships.

- Referral Source: Insurers actively refer policyholders to FirstService for restoration services after property damage claims.

- Business Volume Driver: These referrals are a primary source of revenue and project volume for FirstService's restoration brands.

- Relationship Importance: Strong ties with insurance companies ensure a steady flow of claims-driven work.

- Market Dependence: The property restoration sector, a key area for FirstService, relies heavily on the claims process managed by insurers.

FirstService Residential's core customers are community associations like condos and HOAs, needing comprehensive property and financial management. In 2024, they managed around 9,000 communities across North America. Individual homeowners are also key for FirstService Brands, using services like painting and home inspections, with CertaPro Painters seeing strong demand in 2024.

Commercial property owners and developers are crucial, seeking maintenance and restoration services. Developers partner with FirstService for new community management, a strategic move given 2024's robust housing starts. Insurance companies are vital indirect customers, referring policyholders for restoration work, a segment that saw continued demand in 2024 due to weather events.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Community Associations | Property & Financial Management | Managed ~9,000 communities |

| Individual Homeowners | Home Maintenance & Enhancement | Strong demand for painting (CertaPro) |

| Commercial Property Owners | Maintenance & Restoration | Critical for asset longevity |

| Property Developers | New Community Management | Benefited from strong housing starts (~1.3M US starts) |

| Insurance Companies | Referral Partners for Restoration | Key for claims-driven work; restoration demand high |

Cost Structure

Personnel costs represent a substantial portion of FirstService's expenses, encompassing salaries, wages, benefits, and training for its extensive team of property managers, technicians, and administrative personnel. In 2023, FirstService reported selling, general, and administrative expenses of $1.1 billion, a significant portion of which is directly tied to its workforce. This labor-intensive model means efficient management of these costs is paramount for maintaining healthy profit margins.

FirstService's growth strategy hinges on acquisitions, leading to significant costs. These include due diligence, legal work, and the often-complex process of integrating new companies into their existing operations. For instance, in 2023, FirstService completed several acquisitions, contributing to an increase in acquisition-related expenses that impacted their reported earnings for that period.

While these upfront costs can temporarily reduce short-term profitability, they are viewed as crucial investments. The aim is to unlock long-term value and market share expansion by bringing new capabilities and customer bases under the FirstService umbrella. The company's ability to effectively manage and integrate these acquired businesses is therefore a key driver of its sustained growth trajectory.

FirstService's cost structure heavily features operating expenses for its extensive network of branches and franchises. These costs are essential for maintaining a local presence and providing accessible services. Think about the rent for all those offices, the electricity and water bills, the computers and other gear needed, and even the local advertising that helps them connect with customers.

In 2024, these localized operational costs are a significant driver of FirstService's overall expenses. Supporting a franchise system means investing in the infrastructure and resources that enable franchisees to operate effectively. This includes everything from onboarding and training to ongoing operational support, all contributing to the cost of delivering their specialized services across diverse geographic areas.

Marketing and Sales Expenses

FirstService invests consistently in marketing and sales to draw in new customers and elevate its diverse brands. This ongoing expenditure covers advertising campaigns, digital marketing initiatives, dedicated business development personnel, and public relations efforts aimed at enhancing brand recognition and client acquisition.

In 2024, FirstService's commitment to these growth drivers is evident. For instance, its Home Services segment, which includes brands like CertaPro Painters and Merry Maids, relies heavily on localized marketing and national brand building to capture market share. This strategic spending is crucial for maintaining a competitive edge and driving revenue growth across its various service offerings.

- Advertising and Promotion: Significant budget allocation for national and local advertising across various media channels.

- Digital Marketing: Investment in SEO, SEM, social media marketing, and content creation to reach a wider online audience.

- Business Development: Costs associated with sales teams, lead generation, and partnership development to expand client base.

- Public Relations: Expenses for managing brand reputation, media outreach, and community engagement.

Technology and Infrastructure Investments

FirstService dedicates significant resources to its technology and infrastructure. These costs encompass the development, ongoing maintenance, and crucial upgrades of their digital platforms, software solutions, and overall IT backbone. These investments are fundamental to streamlining operations, enhancing customer interactions, and ensuring robust data management across all business units.

In 2024, companies like FirstService are heavily focused on cloud migration and cybersecurity enhancements, which represent substantial technology expenditures. For instance, cloud computing services alone can represent a significant portion of IT budgets, enabling scalability and flexibility. The drive for competitive advantage hinges on leveraging cutting-edge technology.

- Platform Development: Costs for building and refining proprietary software and customer portals.

- Infrastructure Maintenance: Expenses related to servers, networks, and data centers, including cloud hosting fees.

- Software Licensing & Subscriptions: Ongoing payments for essential business software and SaaS solutions.

- IT Security: Investments in cybersecurity measures to protect data and systems.

FirstService's cost structure is significantly influenced by personnel expenses, covering salaries, benefits, and training for its broad workforce. In 2023, selling, general, and administrative expenses reached $1.1 billion, with labor forming a core component. Efficiently managing these labor costs is vital for profitability.

Acquisitions are a key growth strategy, incurring substantial costs for due diligence, legal services, and integration. These upfront expenses, while impacting short-term earnings, are strategic investments for long-term value creation and market expansion. FirstService's 2023 acquisition activity highlights these associated costs.

Operational costs for its extensive network of branches and franchises are a significant part of FirstService's expenses. These include rent, utilities, equipment, and local marketing essential for maintaining a local presence and accessible service delivery. In 2024, supporting this franchise model involves ongoing investment in infrastructure and franchisee support.

Marketing and sales expenditures are crucial for customer acquisition and brand building, encompassing advertising, digital marketing, and business development personnel. In 2024, FirstService continues to invest in these areas, particularly within its Home Services segment, to maintain a competitive edge and drive revenue growth.

| Cost Category | 2023 Impact | 2024 Focus |

| Personnel | $1.1B SG&A (partial) | Ongoing workforce management |

| Acquisitions | Increased expenses | Integration and synergy realization |

| Operations | Branch/franchise network costs | Franchisee support and infrastructure |

| Marketing & Sales | Brand building and customer acquisition | Digital marketing, PR, business development |

| Technology | Platform development, IT security | Cloud migration, cybersecurity enhancements |

Revenue Streams

FirstService Residential's main income comes from ongoing management fees paid by residential community associations for their full-service property management. These fees are usually calculated based on the number of units or the overall size of the community, creating a dependable and predictable revenue stream.

FirstService Brands leverages franchise royalties and fees as a core revenue driver, with its network of independent franchise owners contributing significantly. These recurring payments, alongside initial franchise fees and ongoing support charges, fuel the segment's profitability and enable rapid expansion with reduced capital investment.

Revenue from essential property services, especially restoration and repair work like water damage, fire damage, and mold remediation, forms a significant part of FirstService Brands' income. This segment is particularly sensitive to external factors such as severe weather events and the occurrence of large-scale loss claims.

Brands like Paul Davis and First Onsite are major players in generating this revenue. For instance, in 2023, FirstService’s Restoration segment, which includes these brands, saw revenue growth, demonstrating the ongoing demand for these critical services.

Home Improvement and Maintenance Service Revenue

FirstService also generates significant revenue from its home improvement and maintenance services. Brands such as California Closets, CertaPro Painters, and Floor Coverings International offer a range of services directly to individual homeowners. This diversification across different property enhancement and upkeep needs helps to stabilize earnings and reduces the company's dependence on any single service category.

In 2024, the home services segment, which includes these improvement and maintenance offerings, has shown robust performance. For instance, CertaPro Painters reported strong demand for interior and exterior painting services, driven by a continued interest in home renovations. California Closets has also seen sustained interest in custom storage solutions, reflecting ongoing consumer investment in home organization and aesthetics.

- Home Improvement & Maintenance: Revenue from services like custom closets, painting, and flooring.

- Target Audience: Individual homeowners seeking property enhancements and upkeep.

- Diversification Benefit: Reduces reliance on any single service type, contributing to stable revenue.

- Market Trend: Continued consumer spending on home renovation and maintenance projects fuels this segment.

Ancillary and Value-Added Services

FirstService diversifies its income beyond core property management by offering a suite of ancillary and value-added services. These can include integrated financial solutions like banking and insurance, specialized energy management programs, and comprehensive amenity management services.

These additional offerings not only deepen client relationships but also establish new revenue channels. For instance, in 2023, FirstService’s ancillary services contributed significantly to its overall financial performance, demonstrating a strategic expansion of its service portfolio.

- Financial Services: Offering banking and insurance to property owners and residents.

- Energy Management: Implementing solutions to reduce utility costs for managed properties.

- Amenity Management: Overseeing and optimizing property amenities like gyms, pools, and common areas.

- Specialized Staffing: Providing on-site personnel for specific property needs, such as concierge or maintenance.

FirstService’s revenue streams are multifaceted, stemming from both recurring management fees and project-based service work. The company's strategy involves leveraging its diverse brands to capture income across various segments of the property services market, from residential community management to home improvement and restoration.

For 2023, FirstService reported total revenue of $4.9 billion, with its two primary segments, FirstService Residential and FirstService Brands, each contributing substantially. FirstService Residential's revenue was driven by management fees, while FirstService Brands generated income through franchise royalties, fees, and direct service revenue from its restoration and home service businesses.

| Revenue Stream | Primary Source | Key Brands/Segments | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Property Management Fees | Ongoing contracts with HOAs/COAs | FirstService Residential | $1.9 billion |

| Franchise Royalties & Fees | Independent franchise owners | FirstService Brands (e.g., CertaPro Painters, California Closets) | $600 million |

| Restoration Services | Property damage repair (water, fire, mold) | FirstService Brands (e.g., Paul Davis, First Onsite) | $1.4 billion |

| Home Improvement & Maintenance | Direct services to homeowners | FirstService Brands (e.g., CertaPro Painters, California Closets, Floor Coverings International) | $1.0 billion |

Business Model Canvas Data Sources

The FirstService Business Model Canvas is built upon a foundation of comprehensive market analysis, internal financial performance data, and operational efficiency metrics. These diverse data sources ensure each component of the canvas accurately reflects current business realities and strategic objectives.