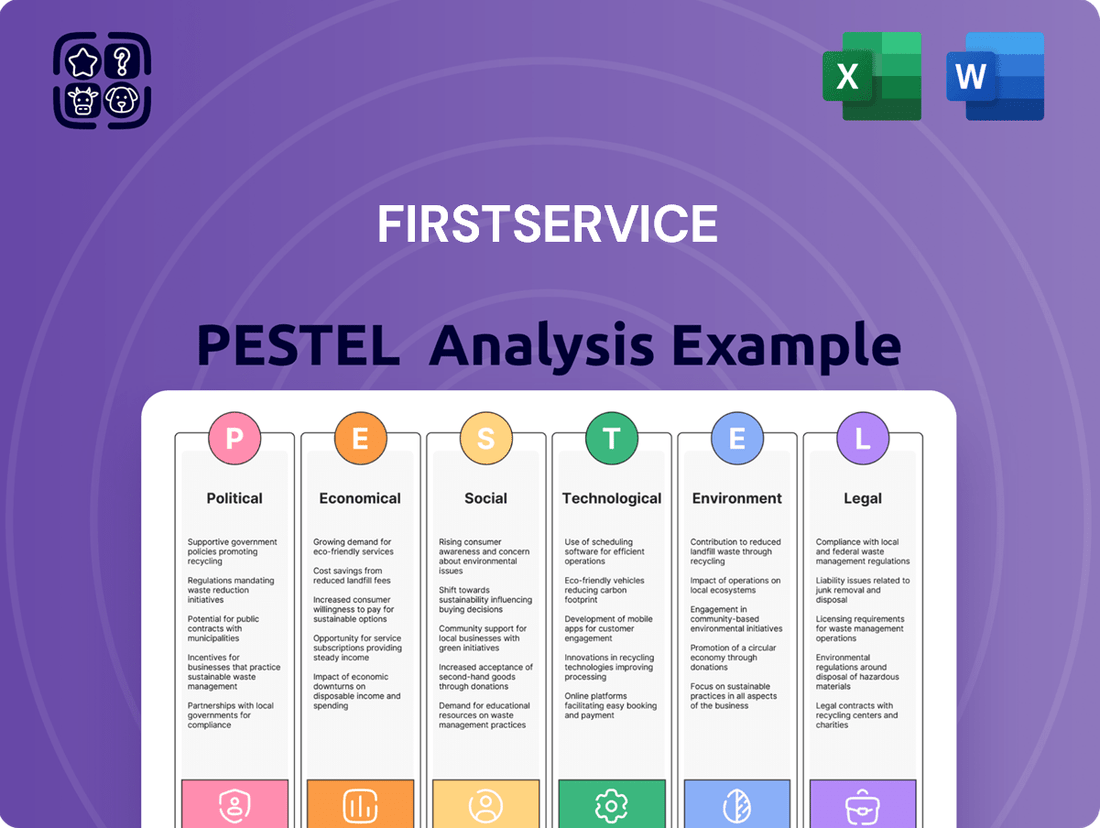

FirstService PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstService Bundle

Navigate the complex external forces shaping FirstService's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate, expert-level insights.

Political factors

Government regulations significantly shape FirstService's landscape. Changes in tenant rights, building safety codes, and community association governance at local, state, and federal levels directly influence operational strategies and compliance costs. For instance, evolving landlord-tenant laws in key markets like California, which saw significant updates in 2024 regarding eviction moratoriums and rent control, require constant adaptation of management practices.

Government initiatives aimed at boosting affordable housing, such as the proposed expansion of the First-Time Home Buyer Incentive in Canada, which saw a 5% increase in eligible home purchases in 2024, directly impact FirstService's residential management services. Similarly, urban development policies, like the Infrastructure Investment and Jobs Act in the US, which allocated $110 billion for roads, bridges, and transit, can spur commercial property demand and management opportunities.

Zoning regulations, for instance, the ongoing review of zoning laws in major metropolitan areas like Toronto to encourage higher density housing, can reshape the landscape for property developers and, consequently, the demand for FirstService's property management expertise in new urban configurations.

While FirstService primarily operates in North America, shifts in global trade policies and international relations can still ripple through its business. For instance, increased tariffs on goods used in home services, like building materials or equipment, could indirectly raise operational costs for its franchises. The U.S. Chamber of Commerce reported that in 2023, tariffs cost American businesses an estimated $50 billion annually, a figure that could impact supply chains for FirstService’s various brands.

Political Stability and Local Governance

The stability of local and regional governments is a critical factor for FirstService, as it directly shapes the regulatory landscape and the overall ease of conducting business within its operating areas. Political shifts or changes in local leadership can introduce new priorities, potentially leading to more stringent enforcement of regulations or altered approaches to property management and development. For instance, in 2024, several municipalities across North America saw significant local elections, with some new administrations signaling a focus on increased development fees or stricter zoning laws, which could impact FirstService's growth strategies.

FirstService must remain adaptable to these political currents. Changes in local governance can manifest as evolving business licensing requirements, new environmental regulations impacting property maintenance, or shifts in public service provision that affect the communities they serve. The company's ability to navigate these transitions smoothly is paramount to maintaining operational efficiency and client satisfaction. For example, a change in municipal leadership in a key market could lead to revised waste management contracts or new tenant protection ordinances, requiring swift adjustments to service delivery models.

- Regulatory Shifts: Local government changes can alter property development approvals and service contract bidding processes.

- Enforcement Variations: New leadership may increase scrutiny on compliance, impacting operational costs and procedures.

- Policy Prioritization: Evolving local agendas can influence demand for specific property management services or introduce new service mandates.

Franchise Industry Regulation

The franchise industry, a core operational area for FirstService Brands, is shaped by evolving political factors and regulatory frameworks. These regulations, covering areas like disclosure requirements, franchise agreement terms, and the dynamics between franchisors and franchisees, directly influence how FirstService can expand and manage its brands. For instance, shifts in regulations that might impact multi-unit ownership or necessitate greater financial transparency could alter FirstService's strategic growth plans.

Key regulatory considerations for the franchise sector in 2024-2025 include:

- Federal Trade Commission (FTC) Franchise Rule Updates: Ongoing scrutiny and potential revisions to disclosure requirements, such as the Franchise Disclosure Document (FDD), could impact the onboarding process for new franchisees and the transparency FirstService must provide.

- State-level Franchise Laws: Many states have their own franchise laws that can add layers of regulation beyond federal requirements, affecting areas like renewal rights and termination clauses.

- Labor Law Interpretations: Evolving interpretations of labor laws, particularly concerning the classification of franchisees and their employees, could introduce new compliance burdens or alter operating models for franchised businesses.

Political stability and government policies are crucial for FirstService's operations. Changes in local, state, and federal regulations, such as those affecting tenant rights, building codes, and zoning laws, directly impact property management and development. For example, in 2024, several North American cities saw local elections that could lead to revised development fees or stricter zoning, influencing FirstService's strategic growth.

What is included in the product

This FirstService PESTLE analysis comprehensively examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting FirstService.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the PESTLE landscape affecting FirstService.

Economic factors

Interest rate movements significantly shape the landscape for FirstService. For instance, a rising interest rate environment, like the one seen with the US Federal Reserve's aggressive hiking cycle through 2023 and into early 2024, directly increases borrowing costs for property developers. This can dampen new construction starts and, consequently, reduce demand for property management services. Homeowners also face higher mortgage payments, potentially impacting the resale market and the volume of transactions that require property management oversight.

Furthermore, credit market conditions, closely tied to interest rates, dictate the ease and cost with which companies like FirstService can access capital. In a tighter credit market, securing funds for strategic acquisitions or organic expansion becomes more challenging and expensive. For example, if corporate bond yields rise, FirstService's cost of debt financing for expansion projects will also increase, potentially impacting the profitability and feasibility of such initiatives.

The health of the North American real estate market directly influences FirstService's financial performance. In 2024, while some markets experienced cooling due to higher interest rates, overall property values in many key regions remained resilient, supporting demand for property management services. For instance, the U.S. median home price saw a modest increase year-over-year in early 2024, indicating continued underlying strength.

Rental demand is another critical factor. High rental demand, a trend observed in many urban centers throughout 2024, boosts occupancy rates for FirstService's residential clients, leading to higher management fees. Vacancy rates in major Canadian cities, for example, remained relatively low in early 2024, reflecting sustained tenant interest and a positive environment for property owners.

A strong real estate market translates to increased revenue for FirstService. When property values are rising and rental demand is high, property owners are more likely to invest in professional management to maintain and enhance their assets. This was evident in FirstService's own financial reports, which often highlight the correlation between market conditions and the growth of their property management divisions.

Inflationary pressures are a significant concern for FirstService, impacting its operating costs across various segments. In 2024, persistent inflation, particularly in labor and materials, has directly squeezed profit margins for property management and restoration services. For instance, rising wage demands in the service sector and increased costs for building supplies directly translate to higher expenses for FirstService's operations.

The ability to pass these increased costs onto clients is paramount to maintaining financial health. FirstService's success hinges on its capacity to negotiate favorable contracts and adjust service pricing in line with escalating expenses. Failure to do so could erode profitability, as evidenced by the challenges many service-based businesses faced in early 2024 when cost increases outpaced price adjustments.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical drivers for FirstService's businesses. When households have more discretionary funds, they are more likely to invest in property enhancements and ancillary services, benefiting both FirstService Residential and FirstService Brands. Conversely, economic slowdowns can curb spending on non-essential services.

In the U.S., real disposable personal income saw an increase, with a notable rise in consumer spending throughout 2024. For instance, retail sales, a proxy for consumer spending, have shown resilience, indicating a continued willingness to spend on goods and services. This trend directly impacts the demand for property management and maintenance services.

- Consumer Confidence: High consumer confidence generally translates to increased spending on home services and improvements.

- Disposable Income Growth: Rising disposable income allows homeowners to allocate more funds towards property maintenance and upgrades.

- Inflationary Pressures: Persistent inflation can erode purchasing power, potentially leading consumers to cut back on non-essential property services.

- Interest Rate Environment: Higher interest rates can impact mortgage affordability and consumer borrowing capacity, indirectly affecting spending on home-related services.

Franchise Economic Outlook

The franchising sector in North America is poised for continued expansion, which is a significant tailwind for FirstService Brands. This growth directly translates into increased demand for the property services that FirstService Brands offers through its various franchise networks. For instance, the International Franchise Association (IFA) projected that franchising would contribute over $780 billion to the U.S. GDP in 2024, with an estimated 1.2% growth in the number of franchise establishments.

A robust economic environment generally fuels consumer and business spending, benefiting franchise models across sectors. This positive economic sentiment supports FirstService Brands' strategic goal of expanding its franchise unit count and overall market share. The increasing number of franchise businesses creates a larger customer base for services like property maintenance, repair, and management.

- Projected Unit Growth: The franchising industry in North America is expected to see a steady increase in the number of franchise units, creating more opportunities for service providers.

- GDP Contribution: Franchising is a substantial contributor to the North American economy, with significant projected GDP figures for 2024 and 2025.

- Demand for Services: A growing franchise landscape directly correlates with heightened demand for property-related services, benefiting FirstService Brands' business model.

- Economic Tailwinds: Favorable economic conditions enhance consumer and business confidence, supporting investment in and expansion of franchise operations.

Economic factors significantly influence FirstService's operational environment. In 2024, interest rate hikes by central banks like the US Federal Reserve increased borrowing costs, potentially slowing property development and impacting transaction volumes. Inflation also presented challenges, raising operating expenses for FirstService's property management and restoration segments, necessitating careful cost management and pricing adjustments.

Consumer spending, buoyed by factors like increased disposable income in the US during early 2024, generally supports demand for property services. The franchising sector's projected growth, contributing significantly to GDP in 2024, also creates a larger customer base for FirstService Brands' service offerings.

The resilience of the North American real estate market, with modest home price increases observed in early 2024, and strong rental demand in urban centers, underpinned FirstService's revenue streams. These positive market dynamics, despite economic headwinds, generally favored property owners and, by extension, their service providers.

| Economic Factor | 2024/2025 Trend/Impact | FirstService Relevance |

| Interest Rates | Increasing, raising borrowing costs | Impacts property development, transaction volumes, and cost of capital |

| Inflation | Persistent, increasing operating expenses | Affects profit margins for property management and restoration services |

| Consumer Spending | Resilient, supported by disposable income | Drives demand for property enhancements and ancillary services |

| Franchising Growth | Projected expansion, significant GDP contribution | Expands customer base for FirstService Brands |

| Real Estate Market | Resilient, with modest price growth and strong rental demand | Supports property management revenue and asset values |

Full Version Awaits

FirstService PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FirstService PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a robust strategic overview for informed decision-making.

Sociological factors

Demographic shifts are significantly reshaping the property management landscape. For instance, the aging population in many developed nations, including the US and Canada, is driving demand for specialized senior living facilities and accessible housing solutions. In 2024, it's estimated that over 56 million Americans will be 65 or older, a figure projected to grow substantially. This necessitates property managers like FirstService to adapt services, focusing on accessibility features and tailored care support.

Urbanization continues to be a powerful trend, with a growing percentage of the global population moving to cities. By 2025, projections indicate that around 60% of the world's population will reside in urban areas. This concentration of people fuels demand for multi-family housing and commercial properties, increasing the need for efficient and technologically advanced property management services to handle dense urban living environments.

Modern lifestyles increasingly prioritize convenience and integrated living experiences, fueling demand for sophisticated property management. This includes a strong interest in smart home technology, shared community spaces like co-working areas and fitness centers, and on-demand services such as package delivery and concierge assistance. For instance, a 2024 survey indicated that over 60% of new homeowners consider smart home features a key deciding factor.

FirstService Residential, a major player in this space, must continuously adapt its service portfolio to align with these evolving resident expectations. Failing to offer these sought-after amenities and technologies can lead to decreased resident satisfaction and potentially impact property values. The company's ability to integrate these lifestyle-driven demands directly into its management strategies is crucial for its continued success in the 2024-2025 period.

The increasing demand for managed community living, such as condominiums and homeowners associations, directly benefits FirstService Residential. This trend is supported by data showing a significant portion of new housing starts are in these types of communities. For instance, in 2024, new residential construction data indicates a continued strong preference for multi-family dwellings and planned developments, which are the bedrock of FirstService's client base.

Understanding what residents in these managed communities want is crucial for FirstService to keep its clients happy and attract new ones. As of early 2025, surveys highlight resident desires for enhanced amenities, robust digital communication platforms, and sustainable living practices within their communities, all areas where FirstService Residential actively invests and adapts its service offerings.

Workforce Trends and Labor Availability

The availability of skilled labor is a critical factor for FirstService, directly influencing its ability to deliver property management and maintenance services efficiently and cost-effectively. For instance, a shortage of qualified tradespeople, such as plumbers or electricians, can lead to increased labor costs and project delays. In 2024, the U.S. Bureau of Labor Statistics reported a persistent demand for skilled trades, with projected job growth for HVAC technicians and electricians exceeding the average for all occupations.

Emerging workforce trends, including the rise of remote work and the gig economy, are reshaping how services are managed and delivered. While remote work can offer flexibility, it also presents challenges in overseeing on-site property maintenance and ensuring consistent service quality. The gig economy, on the other hand, can provide access to specialized skills on demand but requires robust management systems to ensure reliability and compliance.

- Skilled Labor Shortage: The demand for skilled trades in property maintenance, such as HVAC technicians and electricians, continues to outpace supply, potentially increasing labor costs for FirstService.

- Remote Work Impact: The shift towards remote work necessitates adaptive management strategies for property oversight and service delivery to maintain operational efficiency.

- Gig Economy Integration: Leveraging gig workers offers flexibility but requires careful vetting and management to ensure service quality and reliability across FirstService's portfolio.

Social Responsibility and Community Engagement

There's a growing expectation for companies to be good corporate citizens. This means actively contributing to the well-being of the communities they operate in and demonstrating a commitment to ethical practices. For FirstService, this translates into how clients and potential employees view the brand. A strong focus on social responsibility can significantly shape perceptions and influence choices.

FirstService's engagement in sustainability efforts and support for local communities can really boost its image. For instance, in 2023, FirstService Residential reported a 15% increase in resident satisfaction scores in communities where they implemented enhanced green initiatives, such as community gardens and energy-efficient upgrades. This kind of action not only appeals to clients who value environmental stewardship but also attracts talent that seeks purpose-driven employers.

The drive for corporate social responsibility (CSR) is becoming a key differentiator. Companies that actively invest in their communities and operate sustainably are often favored. This trend is particularly evident in the property management sector, where local impact is highly visible.

- Growing Client Demand for CSR: Surveys from 2024 indicate that over 60% of potential homebuyers consider a developer's or property manager's commitment to sustainability and community involvement as a significant factor in their decision-making.

- Employee Attraction and Retention: A 2024 report by Deloitte found that 70% of millennials and Gen Z prioritize working for companies with strong social and environmental values, directly impacting FirstService's ability to attract and retain top talent.

- Brand Reputation Enhancement: FirstService's participation in community clean-up drives and support for local charities, as seen in their 2023 initiatives which involved over 5,000 employee volunteer hours across North America, directly contributes to a positive brand image and strengthens client loyalty.

- Risk Mitigation: Proactive engagement in social responsibility can mitigate risks associated with negative publicity and regulatory scrutiny, ensuring a more stable operating environment for FirstService.

Societal attitudes towards community living and shared amenities continue to evolve, directly influencing demand for property management services. Residents increasingly expect seamless integration of technology and services that enhance convenience and social interaction within their communities. FirstService Residential must therefore prioritize offerings like advanced communication platforms and well-maintained communal spaces to meet these expectations.

The emphasis on convenience and lifestyle integration is a significant driver for managed communities. As of early 2025, a notable percentage of residents in managed properties seek integrated services, from package management to on-demand maintenance. FirstService's ability to deliver these conveniences directly impacts resident satisfaction and retention.

Furthermore, the growing desire for sustainable living practices is shaping consumer preferences. Communities that prioritize environmental responsibility, such as those with robust recycling programs or energy-efficient infrastructure, are more attractive. FirstService's investment in and promotion of such initiatives can therefore be a key differentiator in the 2024-2025 market.

Technological factors

The property technology (PropTech) sector is rapidly evolving, presenting significant opportunities for FirstService to boost operational efficiency and enhance tenant satisfaction. By integrating technologies like artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics, FirstService can streamline its property management functions. For instance, a report by Statista in early 2024 projected the global PropTech market to reach over $200 billion by 2027, indicating substantial investment and adoption trends.

Embracing this digital transformation is not just an advantage but a necessity for FirstService to maintain its competitive edge in the market. The ability to leverage technology for predictive maintenance, personalized tenant services, and optimized resource allocation will be crucial. Companies that effectively adopt these digital tools are better positioned to manage portfolios more effectively and attract new clients seeking modern, tech-enabled property solutions.

Automation, particularly AI-driven solutions like chatbots for tenant queries and smart building systems for energy efficiency, is a significant technological factor impacting property services. These advancements allow companies like FirstService to streamline operations, reduce overhead, and enhance the resident experience. For instance, AI-powered chatbots can handle a substantial volume of routine inquiries, freeing up human staff for more complex issues. Smart building technologies, such as automated HVAC and lighting controls, contribute to considerable energy savings, a growing concern for property owners and managers.

FirstService is increasingly leveraging big data analytics to uncover predictive insights. This allows them to anticipate market trends, forecast property performance, and even predict maintenance requirements for the properties they manage.

By analyzing vast datasets, FirstService can make more informed strategic decisions and deliver services proactively. For instance, in 2024, companies in the property management sector saw a significant increase in the adoption of AI-powered predictive maintenance solutions, with some reporting up to a 15% reduction in unexpected repair costs.

Cybersecurity and Data Privacy

FirstService's increasing reliance on digital platforms for property management and client data makes robust cybersecurity and data privacy essential. Protecting sensitive information is critical for maintaining client trust and avoiding significant financial and reputational damage. As of 2024, the global cost of data breaches is projected to reach $10 trillion annually, highlighting the immense financial risk associated with security failures.

Adherence to evolving data privacy regulations, such as GDPR and CCPA, is also paramount. Non-compliance can result in substantial fines. For example, under GDPR, companies can be fined up to 4% of their annual global revenue or €20 million, whichever is higher. FirstService must invest in advanced security infrastructure and ongoing employee training to mitigate these risks.

- Cybersecurity Investment: Companies in the property management sector are increasing their cybersecurity budgets to combat rising threats.

- Regulatory Landscape: Data privacy laws are becoming more stringent globally, requiring proactive compliance measures.

- Client Trust: A strong security posture is a key differentiator and essential for retaining and attracting clients.

- Financial Impact: Data breaches can lead to significant financial losses through fines, remediation costs, and reputational damage.

Integration of Smart Building Technologies

The increasing adoption of smart building technologies, driven by the Internet of Things (IoT), offers FirstService a prime opportunity to enhance its service offerings. These advancements allow for sophisticated energy management, improved security systems, and greater tenant comfort, creating a more appealing living and working environment. For instance, smart thermostats and lighting systems can reduce energy consumption significantly, a trend expected to accelerate as more buildings are retrofitted or built with these capabilities.

This technological shift allows FirstService to move beyond traditional property management by offering integrated solutions. Consider these key areas:

- Enhanced Energy Efficiency: Smart systems can optimize HVAC and lighting, potentially reducing energy costs for properties by up to 30% as reported in some commercial building case studies.

- Improved Security and Access: IoT-enabled security cameras, smart locks, and integrated alarm systems provide advanced protection and streamlined access control.

- Tenant Experience: Features like personalized climate control and smart building apps contribute to higher tenant satisfaction and retention rates.

- Data-Driven Operations: Real-time data from smart devices enables proactive maintenance and more efficient resource allocation for property managers.

Technological advancements are reshaping property management, with PropTech expected to surpass $200 billion globally by 2027. FirstService can leverage AI for predictive maintenance, potentially cutting unexpected repair costs by up to 15% as seen in 2024 industry trends. The integration of IoT in smart buildings offers enhanced energy efficiency, with potential savings of 30% on energy costs. Furthermore, robust cybersecurity is paramount, given that data breaches cost the global economy an estimated $10 trillion annually as of 2024.

Legal factors

Changes in property and real estate laws significantly impact FirstService's operational landscape. For instance, evolving landlord-tenant regulations, particularly in major markets like Florida, can alter lease agreement terms and eviction processes, directly affecting property management efficiency. In 2024, many states are reviewing or enacting new legislation concerning short-term rentals and affordable housing mandates, which could influence the types of properties FirstService is contracted to manage and the services required.

Real estate regulations, including those related to building codes and environmental standards, necessitate ongoing adaptation. Non-compliance can lead to substantial fines; for example, violations of accessibility laws can result in costly retrofits and legal challenges. FirstService must remain vigilant regarding updates to zoning ordinances, as these determine land use and development potential, influencing investment and management strategies for the properties in their portfolio.

Legislation protecting tenant rights, including those concerning rent control and eviction procedures, directly influences how FirstService Residential manages properties. For instance, in many U.S. states, laws like the Fair Housing Act of 1968 prohibit discrimination, impacting tenant selection and community policies. As of 2024, several cities are exploring or have implemented stricter rent stabilization measures, which can affect revenue projections for managed properties.

FirstService Brands, operating a vast network of franchise businesses, faces a complex legal landscape governed by franchise laws across North America. These regulations dictate crucial aspects like initial disclosure documents, ongoing compliance, renewal processes, and established procedures for resolving disputes between franchisors and franchisees.

Compliance with these franchise laws is paramount to maintaining operational integrity and avoiding potential legal challenges. For instance, the Franchise Disclosure Document (FDD) requirements, a cornerstone of franchise regulation, ensure transparency for potential franchisees. Failure to adhere to these detailed disclosure mandates can lead to significant penalties and legal entanglements.

Labor and Employment Laws

FirstService, with its substantial workforce of around 30,000 individuals, navigates a complex web of labor and employment laws. These regulations directly affect its operational costs and employee management strategies. Key areas include compliance with minimum wage laws, overtime provisions, and adherence to workplace safety standards, such as those mandated by OSHA. In 2024, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with many states also seeing increases in their state minimum wages, impacting companies like FirstService that operate across multiple jurisdictions.

The company's employee relations are also shaped by legislation governing unionization, discrimination, and wrongful termination. Staying abreast of evolving legal interpretations and potential litigation risks is crucial. For instance, the National Labor Relations Board (NLRB) has maintained an active stance on employee rights in recent years, influencing how companies engage with their workforce. As of early 2025, discussions around potential federal legislation concerning worker classification and benefits could introduce further compliance considerations.

Key legal factors impacting FirstService include:

- Wage and Hour Compliance: Adherence to federal and state minimum wage, overtime, and record-keeping requirements.

- Workplace Safety: Meeting Occupational Safety and Health Administration (OSHA) standards and other safety regulations to prevent accidents and ensure a secure working environment.

- Employee Relations and Discrimination: Navigating laws related to fair employment practices, anti-discrimination, and employee grievance procedures.

- Worker Classification: Ensuring correct classification of employees versus independent contractors, a continually scrutinized area by regulatory bodies.

Environmental Regulations and Disclosure Requirements

Environmental regulations are becoming more stringent, impacting how companies like FirstService manage their operations and client properties. These rules often focus on reducing building emissions, improving waste management practices, and enhancing energy efficiency. For instance, many jurisdictions are implementing stricter building codes that mandate lower carbon footprints for new constructions and renovations, directly affecting property management services.

The increasing focus on Environmental, Social, and Governance (ESG) factors means that disclosure requirements are also on the rise. Companies are expected to report transparently on their environmental performance, which can influence investor confidence and client relationships. Failure to comply with these evolving legal frameworks can lead to penalties and reputational damage.

- Building Emission Standards: Many cities, including New York and London, have introduced or are strengthening regulations like Local Law 97 (NYC) and the London Plan, which set aggressive targets for reducing greenhouse gas emissions from existing buildings.

- Waste Management Laws: Legislation mandating increased recycling rates and the reduction of landfill waste is becoming more common, requiring property managers to implement robust waste diversion programs.

- Energy Efficiency Mandates: Building performance standards are being updated to require higher levels of energy efficiency, often necessitating regular energy audits and retrofits for commercial and residential properties.

- ESG Disclosure Frameworks: While not always legally mandated in all regions, voluntary frameworks like those from the Task Force on Climate-related Financial Disclosures (TCFD) are increasingly becoming de facto requirements due to investor pressure and market expectations.

FirstService operates within a dynamic legal framework, where shifts in property, franchise, and employment laws directly influence its business model and profitability. For instance, evolving landlord-tenant regulations in 2024, particularly concerning rent stabilization in cities like New York, can impact revenue streams for managed residential properties. Similarly, stricter enforcement of wage and hour laws by the U.S. Department of Labor in 2024, coupled with increasing state minimum wages, directly affects FirstService's labor costs across its diverse operations.

Compliance with franchise disclosure requirements remains critical for FirstService Brands, ensuring transparency and mitigating legal risks. Furthermore, the company must navigate a growing body of environmental regulations, such as emission standards for buildings, which necessitate investments in property upgrades and efficient management practices to avoid penalties. As of early 2025, potential federal legislation on worker classification could introduce new compliance challenges.

Key legal factors impacting FirstService include:

| Legal Factor | 2024/2025 Trend/Impact | Example/Data Point |

| Property Law | Increasing tenant protections and rent control measures | Several U.S. cities exploring/implementing stricter rent stabilization in 2024. |

| Franchise Law | Emphasis on disclosure and compliance | Continued scrutiny of Franchise Disclosure Document (FDD) adherence. |

| Employment Law | Heightened focus on wage/hour compliance and worker classification | U.S. DOL increased enforcement of wage laws in 2024; potential federal legislation on classification in early 2025. |

| Environmental Law | Stricter building emission and energy efficiency standards | NYC's Local Law 97 targets significant building emission reductions. |

Environmental factors

Climate change is making extreme weather events more common and severe, directly affecting FirstService's core business. This means more damage to properties they manage, leading to increased demand for maintenance and restoration services. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters, each causing at least $1 billion in damages, a significant increase from previous years.

These events directly boost business for FirstService Brands like Paul Davis Restoration and First Onsite, as they are called upon to repair damage from floods, storms, and fires. The rising frequency of these occurrences translates into sustained, and likely growing, revenue streams for these specialized service divisions within FirstService.

The increasing focus on sustainability is reshaping the real estate sector. For instance, in 2024, the global green building market was valued at approximately $1.3 trillion, with projections showing continued robust growth. This trend directly impacts property developers and managers by creating a demand for eco-friendly construction materials and energy-efficient operational strategies.

FirstService’s capacity to integrate and promote green building practices presents a significant competitive edge. By offering solutions that enhance energy efficiency, reduce waste, and utilize sustainable materials, the company can attract environmentally conscious clients and investors. This aligns with a growing market preference, as evidenced by a 2025 survey indicating that over 60% of commercial property buyers consider sustainability certifications a key factor in their purchasing decisions.

Growing concerns over resource scarcity, particularly water and energy, directly affect FirstService's operational expenses and necessitate robust waste management strategies. For instance, the rising cost of energy, with global energy prices fluctuating, can significantly impact property management overheads. Effective waste diversion programs are becoming crucial for both cost control and regulatory adherence.

Energy Efficiency and Carbon Footprint Reduction

FirstService faces increasing pressure from regulators, clients, and investors to curb energy consumption and shrink the carbon footprint of the buildings they manage. This trend is particularly pronounced as global climate targets intensify, pushing for more sustainable building operations. For instance, the International Energy Agency reported in 2024 that buildings account for nearly 40% of global energy-related CO2 emissions, highlighting the significant impact of the sector.

This environmental focus creates a dual dynamic for FirstService: a challenge to adapt existing portfolios and an opportunity to lead with innovative solutions. The company can leverage this by offering advanced energy management services and facilitating the integration of renewable energy sources into managed properties, thereby enhancing property value and tenant appeal.

- Regulatory Push: Governments worldwide are implementing stricter energy efficiency standards for commercial and residential buildings, with many jurisdictions mandating emissions reductions by 2030 and beyond.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) criteria are now central to investment decisions, with a growing demand for transparency on carbon emissions and energy usage from property management firms.

- Client Demand: Tenants and property owners are increasingly prioritizing sustainability, seeking out properties that offer lower utility costs and demonstrate a commitment to environmental responsibility.

- Market Opportunity: FirstService can capitalize by developing and marketing specialized services for energy audits, retrofitting for efficiency, and implementing renewable energy solutions like solar panel installations.

Natural Disaster Preparedness and Resilience

FirstService, as a major player in property services, faces growing pressure to enhance its natural disaster preparedness and resilience. This includes developing robust plans for rapid response and recovery to safeguard properties and assist communities impacted by environmental events. For instance, the increasing frequency and intensity of extreme weather events, such as the record-breaking hurricane seasons in recent years, underscore the need for proactive strategies.

The company's ability to manage and mitigate the impact of natural disasters is crucial for its operational continuity and client trust. Consider the economic impact; in 2023, insured losses from natural catastrophes globally were estimated to be around $100 billion, highlighting the significant financial risks involved.

- Increased Investment in Resilience: FirstService is likely investing more in infrastructure hardening and mitigation services to protect the properties it manages.

- Supply Chain Vulnerability: Disruptions caused by natural disasters can impact the availability of essential services and materials, affecting FirstService's operational efficiency.

- Community Support Role: The company's role extends to supporting communities in their recovery efforts, requiring well-defined disaster response protocols.

- Climate Change Adaptation: Adapting to long-term climate change trends, such as rising sea levels and more frequent wildfires, necessitates strategic planning for future environmental challenges.

The increasing frequency of extreme weather events, such as those in 2023 which saw 28 billion-dollar weather disasters in the U.S. alone, directly drives demand for FirstService's restoration and maintenance services. This trend is projected to continue, bolstering revenue for divisions like Paul Davis Restoration and First Onsite.

The global green building market, valued at approximately $1.3 trillion in 2024, highlights a significant shift towards sustainability. FirstService can leverage this by offering eco-friendly solutions, appealing to the over 60% of commercial property buyers in 2025 who prioritize sustainability certifications.

Environmental regulations are tightening, with many jurisdictions mandating emissions reductions by 2030. This, coupled with investor scrutiny on ESG factors and growing client demand for sustainable properties, creates both challenges and opportunities for FirstService to offer specialized energy efficiency and renewable energy services.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry research firms. We meticulously gather insights from regulatory updates, market trends, and technological advancements to ensure comprehensive and accurate macro-environmental assessments.