FirstService Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstService Bundle

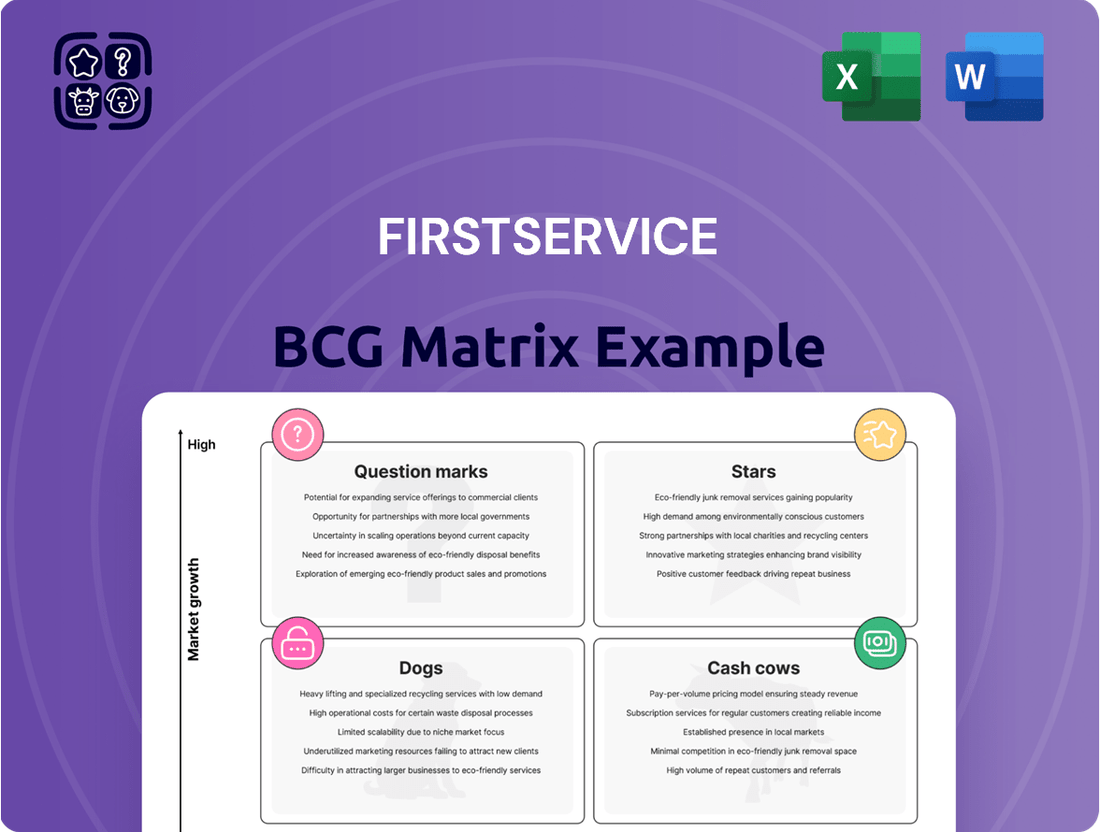

This glimpse into the FirstService BCG Matrix highlights its strategic product portfolio, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understand the full picture of market share and growth to make informed decisions.

Unlock the complete FirstService BCG Matrix for a comprehensive analysis of each product's position. Get detailed insights and actionable strategies to optimize your investments and drive future success.

Don't miss out on the full FirstService BCG Matrix report, which provides a clear roadmap for product management and resource allocation. Purchase today to gain a competitive edge.

Stars

Century Fire Protection stands out as a star performer within FirstService Brands, exhibiting robust growth and a commanding presence in its market. In the second quarter of 2025, this segment achieved revenue growth exceeding 15%, fueled by strong double-digit organic expansion.

This impressive financial performance underscores Century Fire Protection's significant market share in the burgeoning fire protection industry. The company's strategic focus on expanding its geographic reach for this brand further solidifies its position as a key growth engine and a leader poised for sustained success.

Roofing Corp of America (RCA), acquired in December 2023, is FirstService's newest growth platform. RCA is projected to achieve mid-to-high single-digit organic growth in 2024. It significantly boosted FirstService Brands' revenue in Q4 2024, positioning it as a Star despite a temporary Q2 2025 organic revenue dip caused by project postponements.

First Onsite is a shining example of a Star in the BCG matrix for FirstService. In 2024, the company achieved an impressive 5% organic growth, and when you account for fewer widespread events, that figure jumps to over 10%.

This isn't a flash in the pan; First Onsite has consistently delivered around 10% organic growth for the past five years. This sustained performance highlights its robust market presence and capacity for expansion.

The brand's ability to weather various market conditions and its success in landing new national accounts further cement its status as a Star performer within FirstService's restoration portfolio.

Paul Davis Restoration

Paul Davis Restoration, much like First Onsite, is a significant player within FirstService's strong restoration division. In 2024, this brand played a role in the restoration services' overall 5% organic growth, which climbed to over 10% when factoring out the impact of weather-related events.

The company's strategic approach, which includes making key acquisitions and concentrating on increasing its share of business from current clients, highlights its substantial market presence and ongoing expansion. This positions Paul Davis Restoration as a Star in the BCG matrix.

- Market Share: Paul Davis Restoration benefits from a high market share within the restoration industry.

- Growth Drivers: Strategic acquisitions and a focus on wallet share expansion are key to its continued growth.

- 2024 Performance: Contributed to the restoration segment's 5% organic growth, exceeding 10% when adjusted for weather events.

Strategic Tuck-Under Acquisitions in High-Growth Verticals

FirstService actively seeks strategic tuck-under acquisitions to enhance its presence in high-growth sectors like fire protection and restoration. These acquisitions are crucial for expanding geographic reach and service offerings, allowing for rapid market share gains in burgeoning industries.

For instance, Century Fire Protection and various restoration brands within the FirstService portfolio have been instrumental in this strategy. These integrations are designed to bolster market share, enabling FirstService to quickly ascend in competitive, expanding markets.

- Geographic Expansion: Tuck-under acquisitions allow FirstService to enter new territories efficiently, complementing existing operations.

- Service Line Enhancement: These acquisitions strengthen specific service offerings, particularly in high-demand areas like fire safety and disaster recovery.

- Market Share Growth: By integrating smaller, targeted businesses, FirstService aims to consolidate market position and capitalize on industry growth.

- Synergy Realization: The goal is to achieve operational efficiencies and leverage cross-selling opportunities across the expanded service network.

Stars in the FirstService BCG Matrix represent businesses with high market share and high growth potential. Century Fire Protection, for example, saw revenue growth over 15% in Q2 2025, driven by strong organic expansion. First Onsite demonstrated consistent ~10% organic growth over five years, and Paul Davis Restoration contributed significantly to the restoration segment's growth, exceeding 10% adjusted for weather events in 2024. These brands are key growth engines for FirstService, bolstered by strategic acquisitions and geographic expansion.

| Brand | 2024 Organic Growth (Adjusted) | Key Growth Drivers | Market Position |

|---|---|---|---|

| Century Fire Protection | Double-digit | Geographic expansion, strong industry demand | Market leader |

| First Onsite | Over 10% | Consistent performance, national accounts | Strong restoration presence |

| Paul Davis Restoration | Over 10% | Strategic acquisitions, client retention | Significant market share |

What is included in the product

The FirstService BCG Matrix assesses business units by market share and growth, guiding investment decisions.

The FirstService BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis by instantly placing each business unit into its appropriate quadrant.

Cash Cows

FirstService Residential stands as a dominant force in North America, managing over 9,000 residential communities. This segment is the bedrock of FirstService's financial strength, representing a significant 59% of its revenue and 63% of its EBITDA in 2024. Its established market leadership and consistent growth, evidenced by a 6% revenue increase in Q1 2025, highlight its mature position and capacity to generate substantial, reliable cash flow.

FirstService Residential's core community association management services are a prime example of a cash cow within the BCG framework. Their established position in the market, coupled with exceptional contract retention rates, which have consistently exceeded 95%, translates into a predictable and robust revenue stream.

This high client loyalty significantly reduces the capital expenditure required for marketing and sales to acquire new customers. Consequently, these mature services generate substantial and consistent cash flow that can be reinvested into other business segments or distributed to shareholders.

FirstService Financial and Energy Programs, offered through FirstService Residential, are prime examples of Cash Cows within the FirstService BCG Matrix. These programs effectively tap into the company's substantial existing client base, providing valuable ancillary services.

By leveraging this established network, FirstService can cross-sell these financial and energy solutions, generating significant supplementary revenue. For instance, in 2023, FirstService Residential reported robust growth in its ancillary services segment, contributing to overall profitability.

Once these programs are in place, they require minimal additional investment to sustain, allowing them to operate as highly efficient revenue generators. This low investment, high return model is characteristic of a Cash Cow, supporting the broader portfolio.

Standardized Property Management Operations

FirstService Residential's dedication to operational efficiencies and a culture of continuous improvement allows for consistent cost realization without compromising customer experience. This focus on optimizing processes is a key driver for their strong performance.

The standardized delivery model for property management services is designed for high profit margins and a steady, reliable cash flow. This efficiency in core operations directly contributes to the segment's robust cash-generating ability.

- Standardized Processes: FirstService Residential implements uniform procedures across its operations, leading to predictable outcomes and cost control.

- Operational Efficiencies: A commitment to continuous improvement ensures that processes are constantly refined for maximum effectiveness and minimal waste.

- High Profit Margins: The streamlined nature of their service delivery allows for attractive profit margins within the property management sector.

- Steady Cash Flow: Optimized operations translate into a consistent and reliable generation of cash, a hallmark of a cash cow.

Canadian Residential Property Management

Canadian Residential Property Management, as part of FirstService's portfolio, functions as a cash cow. In 2024, these Canadian operations accounted for a solid 12% of FirstService's total revenue, demonstrating their significant contribution.

While precise growth rates for the Canadian segment weren't explicitly stated, its position as a North American leader implies a mature market. This maturity, coupled with a high market share, translates into a predictable and consistent cash flow, a hallmark of a cash cow business.

- Stable Revenue Contribution: Canadian operations generated 12% of FirstService's total revenue in 2024.

- Mature Market Presence: Established leadership in North America suggests a stable, albeit potentially slower-growing, market.

- Consistent Cash Flow: High market share in a mature segment provides reliable and predictable earnings.

- Low Growth, High Share: This characteristic aligns with the typical profile of a cash cow in the BCG matrix.

FirstService Residential's ancillary services, such as financial and energy programs, are classic cash cows. These offerings leverage the company's extensive existing client base, requiring minimal new investment to generate consistent revenue. Their high profitability and low capital needs allow them to be a significant source of stable cash flow for FirstService.

| Ancillary Service Type | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Financial Programs | Cash Cow | Leverages existing client base, low investment, high margins | Contributed to robust growth in ancillary services segment (2023) |

| Energy Programs | Cash Cow | Cross-selling opportunity, minimal ongoing investment, predictable returns | Supplements core property management revenue |

Delivered as Shown

FirstService BCG Matrix

The FirstService BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic tool. You can confidently use this preview as a direct representation of the comprehensive analysis and clear visual presentation you will obtain. This ensures transparency and guarantees that the purchased BCG Matrix report is precisely what you need for your business planning and decision-making processes.

Dogs

The home improvement sector within FirstService Brands experienced a tepid environment in 2024, marked by flat year-over-year organic growth. This stagnation suggests that some individual brands or franchises within this segment may be underperforming.

While not officially designated as dogs, certain California Closets or CertaPro Painters franchises operating in economically challenged regions or those with consistently low organic growth could be considered cash traps. These units may be consuming capital without yielding substantial returns, hindering overall portfolio efficiency.

Within FirstService's diverse offerings, some legacy service lines might lack distinct features, making it tough to stand out in crowded markets. These services, without significant innovation or unique selling points, could face dwindling market share and minimal growth prospects.

For instance, if a particular home services division, established decades ago, relies on traditional methods and hasn't adopted new technologies or service models, it could fall behind more agile competitors. In 2023, the home services market saw significant digital adoption, with companies leveraging AI for scheduling and customer service, a trend that older, less differentiated services might struggle to match.

Attempting to revitalize these service lines often demands substantial investment in turnaround strategies. However, these efforts may not always deliver the desired returns, especially if the core offering remains fundamentally undifferentiated. This situation can lead to a drain on resources that could be better allocated to more promising growth areas within the company.

Even with a solid acquisition track record, smaller, poorly integrated tuck-under acquisitions can turn into dogs. These might be units that don't mesh well with the parent company or fail to hit their growth projections. For example, if a company like FirstService, known for its strategic acquisitions, were to acquire a small local property management firm and struggle to integrate its systems or culture, that new entity could become a drain.

These underperforming acquisitions might continue to require resources for integration and ongoing support, yet they don't deliver the anticipated boost in market share or profitability. This is a significant risk for any company pursuing an aggressive acquisition strategy. In 2024, for instance, the average cost of integrating a new acquisition can range from 10% to 30% of the deal value, a figure that balloons for poorly executed integrations.

Services Highly Sensitive to Discretionary Spending

Services highly sensitive to discretionary spending, often found in the home improvement segment, can struggle during economic slowdowns. These aren't the essential repairs that keep a property functional, but rather upgrades or aesthetic enhancements. When household budgets tighten, these are typically the first expenditures to be cut.

For instance, a company offering high-end landscaping or custom interior redesigns might see demand plummet when consumers prioritize necessities. This can lead to them becoming break-even operations or even cash traps, as revenue fails to cover costs and investment. In 2024, consumer spending on home improvement projects that were not essential for structural integrity or safety saw a noticeable dip compared to previous years, with some analysts reporting a 5-7% decrease in discretionary renovation spending.

- Low Demand: Services like non-essential renovations or luxury landscaping face reduced consumer appetite during economic uncertainty.

- Economic Sensitivity: These offerings are directly tied to consumer confidence and disposable income, making them vulnerable to market downturns.

- Cash Trap Potential: Without consistent demand, these services can become costly to maintain without generating sufficient profit, draining resources.

- Market Share Challenges: During recessions, companies focusing solely on discretionary services may find it difficult to maintain or grow their market share against more essential service providers.

Geographic Markets with Intense Local Competition

In property services, some local markets are incredibly fragmented. This means many small players are vying for business, creating intense competition. When these local operations can't stand out or grow, and the overall market isn't expanding much, they can become what we call 'dogs' in the BCG matrix. They're stuck in a tough spot, finding it hard to gain a meaningful share or become profitable.

FirstService is focused on expanding its reach across different areas. However, it's natural that not every single local market will be a star performer. Some might be characterized by this intense local rivalry and sluggish growth. For instance, in 2024, while the overall property management sector saw steady demand, specific hyper-local markets in mature urban areas might have experienced slower growth rates, perhaps in the low single digits, making it challenging for any single provider to dominate.

- Intense Local Competition: In highly fragmented property service markets, operations may struggle to gain significant market share due to numerous local competitors.

- Low Market Growth: When these competitive markets also exhibit low overall growth, operations within them are categorized as 'dogs'.

- Challenges in Differentiation: 'Dogs' find it difficult to differentiate themselves and achieve profitable expansion in such environments.

- Strategic Footprint Expansion: FirstService's goal to build its geographic footprint acknowledges that not all local markets will be equally strong performers.

Dogs within FirstService's portfolio represent business units or franchises with low market share in low-growth markets. These segments often require significant investment to maintain but offer minimal returns, acting as a drag on overall company performance. Identifying and managing these 'dogs' is crucial for optimizing resource allocation and driving strategic growth.

For example, some legacy home services that haven't adapted to digital trends or offer unique value propositions may fall into this category. Similarly, poorly integrated acquisitions or services heavily reliant on discretionary consumer spending during economic downturns can become dogs. In 2024, the home improvement sector experienced a slowdown in non-essential projects, highlighting the vulnerability of such offerings.

In highly fragmented local property service markets, intense competition combined with sluggish growth can also create 'dog' situations. These units struggle to differentiate and achieve profitability, despite efforts to expand the company's geographic footprint. Managing these underperforming assets is key to enhancing the efficiency of FirstService's diverse business segments.

| BCG Category | Market Share | Market Growth | FirstService Examples | 2024 Context |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy home services, non-essential renovations, poorly integrated acquisitions, hyper-local fragmented property services | Slowdown in discretionary spending, increased digital adoption impacting older service models |

Question Marks

FirstService Residential's investment in AI-powered proptech like HODA (Homeowner Digital Assistant) positions them to capitalize on a high-growth sector. While the specific market share for these emerging solutions is likely small currently, the strategic importance of streamlining operations and improving resident experience is undeniable.

The substantial investment needed for development, implementation, and driving widespread adoption suggests these AI solutions are in the early stages of their lifecycle, characteristic of a question mark in the BCG matrix. For instance, the global proptech market was valued at over $23 billion in 2023 and is projected to grow significantly, indicating the potential for these innovations to become future market leaders.

When established brands like FirstService's Century Fire Protection enter new geographic markets, such as the Western U.S., their initial market share will naturally be low. This is typical for any new market entry, regardless of brand strength.

Despite the low initial share, these new territories represent a growing market for fire protection services. In 2024, the U.S. fire protection market was valued at approximately $75 billion, with projections indicating continued expansion. This growth potential is a key driver for such strategic moves.

The established brand reputation of Century Fire Protection provides a significant advantage, translating into high growth prospects in these virgin markets. Capturing this potential requires substantial investment in marketing, sales, and local infrastructure, positioning these entries as potential future stars in the FirstService portfolio.

FirstService's recent acquisitions of smaller franchised operations, like certain Paul Davis Restoration locations, position them as potential stars in the BCG matrix. These moves, often into specific metropolitan areas, mean they start with a smaller slice of the pie in those new markets.

Despite a current low market share, these acquired businesses are targeted for rapid growth. This requires substantial capital and dedicated operational focus to truly expand and dominate their local territories, mirroring the characteristics of a question mark needing investment to become a star.

The Amenity Collective

The Amenity Collective, a specialized arm of FirstService, focuses on managing amenity spaces within residential properties. This niche service caters to a growing demand for enhanced community living, though its market share within the broader FirstService portfolio might still be developing. The sector is experiencing significant growth, with the global property management market projected to reach over $2.3 trillion by 2027, indicating substantial potential for specialized services like amenity management.

As a potential question mark in the BCG Matrix, The Amenity Collective operates in a high-growth industry but may have a relatively low market share currently. This positioning suggests a need for strategic investment to scale operations and capitalize on the increasing trend of residents valuing well-managed amenity offerings. For instance, the demand for smart home technology integration in amenities is a key growth driver.

- Niche Focus: Manages amenity spaces, a growing segment of property management.

- Growth Potential: Operates in a high-growth market with increasing resident demand for amenities.

- Market Share: Likely has a smaller market share compared to FirstService's broader property management services.

- Investment Need: Requires continued investment to scale and capture more of this niche market.

Sustainability and ESG Initiatives

FirstService's commitment to sustainability and ESG initiatives, including climate change action and community engagement, positions it as a socially responsible entity. While these efforts are not direct revenue drivers, they tap into a burgeoning market of corporate and consumer interest. This focus can attract new clients and bolster brand image, though their immediate financial impact or market share gains may be modest, serving more as a long-term strategic advantage.

The company's ESG strategy aligns with growing investor demand for sustainable practices. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, according to the Global Sustainable Investment Alliance. This trend suggests that companies prioritizing ESG can indeed see benefits in client acquisition and brand perception.

- Focus on Climate Action: FirstService is actively addressing climate change through its operations and strategy.

- Community Engagement: The company emphasizes its role in and contribution to the communities it serves.

- Ethical Business Practices: Maintaining high ethical standards is a cornerstone of FirstService's social responsibility.

- Strategic Investment: ESG initiatives are viewed as investments in future competitive advantage and client attraction.

FirstService's AI-powered solutions like HODA are positioned in a rapidly expanding proptech market, valued at over $23 billion in 2023. While current market share for these specific AI tools is likely nascent, their strategic importance for operational efficiency and resident experience is significant. These investments represent a classic question mark, requiring substantial capital for development and adoption to potentially become future market leaders.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.