First Horizon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Horizon Bundle

First Horizon's market position is shaped by a mix of robust digital capabilities and potential regulatory headwinds. Understanding these dynamics is crucial for navigating the competitive financial landscape.

Want the full story behind First Horizon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

First Horizon Corporation boasts a formidable regional market leadership, particularly in the Southeastern United States. This strength is underscored by its significant deposit market share and an expansive branch network, especially within Tennessee. For instance, as of the first quarter of 2024, First Horizon held a substantial deposit share in key markets, reflecting its deep penetration and customer loyalty built over decades.

First Horizon's diversified financial services portfolio is a significant strength, encompassing commercial banking, private banking, wealth management, and mortgage banking. This broad offering allows them to serve a wide array of clients, from individuals to large institutions, fostering multiple avenues for revenue generation and risk mitigation.

First Horizon has showcased impressive financial strength, consistently delivering robust earnings and maintaining a healthy capital base. For instance, in the first quarter of 2024, the bank reported earnings per share exceeding analyst expectations, demonstrating operational efficiency and effective risk management.

The company's capital position remains a significant advantage, with common equity tier 1 (CET1) ratios comfortably above regulatory requirements. This strong capital buffer, often exceeding 11% even in challenging economic simulations, provides a solid foundation for future growth and resilience against market volatility.

Strategic Investment in Technology and Digital Banking

First Horizon's strategic investments in technology and digital banking are a significant strength. The company has been actively upgrading its infrastructure to enhance customer experience and operational efficiency. This focus is crucial for staying competitive in today's rapidly changing financial environment.

These investments have yielded tangible results, with notable growth in key digital metrics. For instance, First Horizon reported a substantial increase in mobile banking users and a corresponding rise in online transaction volumes. This digital adoption signifies a successful shift towards more convenient and accessible banking services for its customers.

- Enhanced Digital Capabilities: First Horizon has prioritized upgrades to its technology infrastructure, bolstering its digital banking services.

- Customer Experience Improvement: The strategic tech investments are designed to streamline operations and provide a better experience for customers.

- Digital Growth: The bank has seen significant growth in mobile banking users and online transaction volumes, reflecting successful digital adoption.

Commitment to Stakeholders and Corporate Culture

First Horizon is distinguished by its deeply ingrained commitment to its stakeholders, fostering a corporate culture that prioritizes employee satisfaction and a client-first ethos. This dedication extends to robust community support and engagement initiatives, building a positive reputation and solidifying relationships across the board.

This focus on people translates into tangible benefits. For instance, in 2023, First Horizon reported a strong employee engagement score, reflecting its investment in its workforce. Furthermore, the company's client retention rates consistently outperform industry averages, a testament to its client-centric strategy.

- Strong Corporate Culture: Recognized for fostering a positive and supportive work environment.

- Client-First Approach: Prioritizing customer needs and satisfaction, leading to high retention.

- Community Engagement: Active involvement in local communities, enhancing brand reputation.

- Employee Satisfaction: Investments in associates contribute to a motivated and productive workforce.

First Horizon's established regional market leadership, particularly in the Southeastern US, is a core strength, evidenced by its significant deposit market share and extensive branch network, especially in Tennessee. As of Q1 2024, the bank maintained a substantial deposit share in key markets, demonstrating deep customer penetration and loyalty.

The company's diversified financial services portfolio, spanning commercial, private, and wealth management, alongside mortgage banking, allows it to serve a broad client base and generate revenue through multiple channels. This diversification also aids in mitigating risk.

First Horizon exhibits strong financial health, consistently reporting robust earnings and maintaining a healthy capital base, with CET1 ratios comfortably above regulatory requirements, often exceeding 11% even under stress scenarios.

Strategic investments in technology and digital banking have enhanced customer experience and operational efficiency, leading to measurable growth in digital metrics like mobile banking users and online transaction volumes, as seen in recent performance reports.

| Strength Category | Key Aspect | Supporting Detail |

|---|---|---|

| Market Position | Regional Leadership | Significant deposit market share in the Southeastern US, particularly Tennessee. |

| Business Model | Diversified Services | Offers commercial, private, wealth, and mortgage banking, serving a wide client spectrum. |

| Financial Health | Capital Strength | CET1 ratios consistently above 11%, providing a strong foundation. |

| Technology | Digital Investment | Growth in mobile banking users and online transactions, improving customer experience. |

What is included in the product

Offers a full breakdown of First Horizon’s strategic business environment, detailing its internal capabilities and external market dynamics.

Identifies key internal weaknesses and external threats to proactively address potential business disruptions.

Weaknesses

First Horizon's revenue growth has lagged behind key competitors in the commercial banking sector. For instance, in the first quarter of 2024, the bank reported a net interest income decline, while some of its peers showed modest growth in the same period. This underperformance suggests difficulties in expanding its customer base or increasing its share of wallet within existing relationships compared to industry leaders.

First Horizon's significant concentration in the Southeastern United States, while a strength in its core markets, presents a notable weakness. This limited geographic diversification means the bank is more susceptible to regional economic slowdowns. For instance, a downturn in Florida or North Carolina could disproportionately impact First Horizon's overall performance compared to a bank with a national footprint.

First Horizon's capital ratios, including Common Equity Tier 1 (CET1), total capital, and Tier 1 leverage, have experienced a year-over-year dip. For instance, its CET1 ratio was reported at 10.9% as of Q1 2024, down from 11.5% in Q1 2023.

While these figures remain comfortably above the required regulatory minimums, a sustained downward trend could constrain the bank's ability to pursue new lending opportunities or potentially trigger the need for additional capital infusions to maintain its financial strength and growth trajectory.

Increase in Non-Performing Loans and Leases

First Horizon has seen a concerning rise in its non-performing loans and leases when compared to the previous year. This upward trajectory in assets that are not generating income could signal a deterioration in the quality of the company's loan portfolio.

An increase in non-performing assets often necessitates higher provisions for potential credit losses, which directly impacts profitability. For instance, if the ratio of non-performing loans to total loans increases, the bank may need to set aside more capital to cover anticipated defaults.

- Deteriorating Credit Quality: An uptick in non-performing loans suggests a potential weakening in the creditworthiness of borrowers.

- Increased Loan Loss Provisions: Higher non-performing assets typically lead to increased provisions for credit losses, reducing net income.

- Impact on Profitability: The combination of reduced interest income from bad loans and higher provisions can significantly dent earnings.

- Regulatory Scrutiny: A sustained increase in non-performing loans can attract greater attention from regulatory bodies.

Sensitivity to Interest Rate Fluctuations

First Horizon's profitability is significantly influenced by interest rate movements. The bank experienced deposit cost pressures throughout 2023 and into early 2024 due to aggressive Federal Reserve rate hikes. While the pace of Fed rate cuts may slow, ongoing adjustments in deposit costs and loan yields continue to challenge net interest margin management.

This sensitivity necessitates robust asset-liability management strategies to navigate interest rate cycles effectively. For instance, a prolonged period of higher rates could increase funding costs more than asset yields can compensate, impacting earnings.

- Interest Rate Sensitivity: Banks like First Horizon are inherently exposed to changes in interest rates, impacting their core lending and deposit-taking businesses.

- Deposit Cost Pressures: Aggressive rate hikes in 2023 and early 2024 led to increased costs for customer deposits as banks competed for funds.

- Net Interest Margin (NIM) Impact: Fluctuations in asset yields versus funding costs directly affect NIM, a key profitability metric for banks.

- Asset-Liability Management (ALM): Effective ALM is crucial to mitigate risks associated with interest rate volatility and maintain stable profitability.

First Horizon's revenue growth has lagged behind key competitors, with a decline in net interest income reported in Q1 2024 compared to modest growth from peers. This suggests challenges in customer acquisition and deepening existing relationships. The bank's geographic concentration in the Southeast makes it vulnerable to regional economic downturns, unlike more diversified national banks. Furthermore, a year-over-year dip in capital ratios, such as the CET1 ratio falling to 10.9% in Q1 2024 from 11.5% in Q1 2023, could limit future lending and growth opportunities if the trend continues.

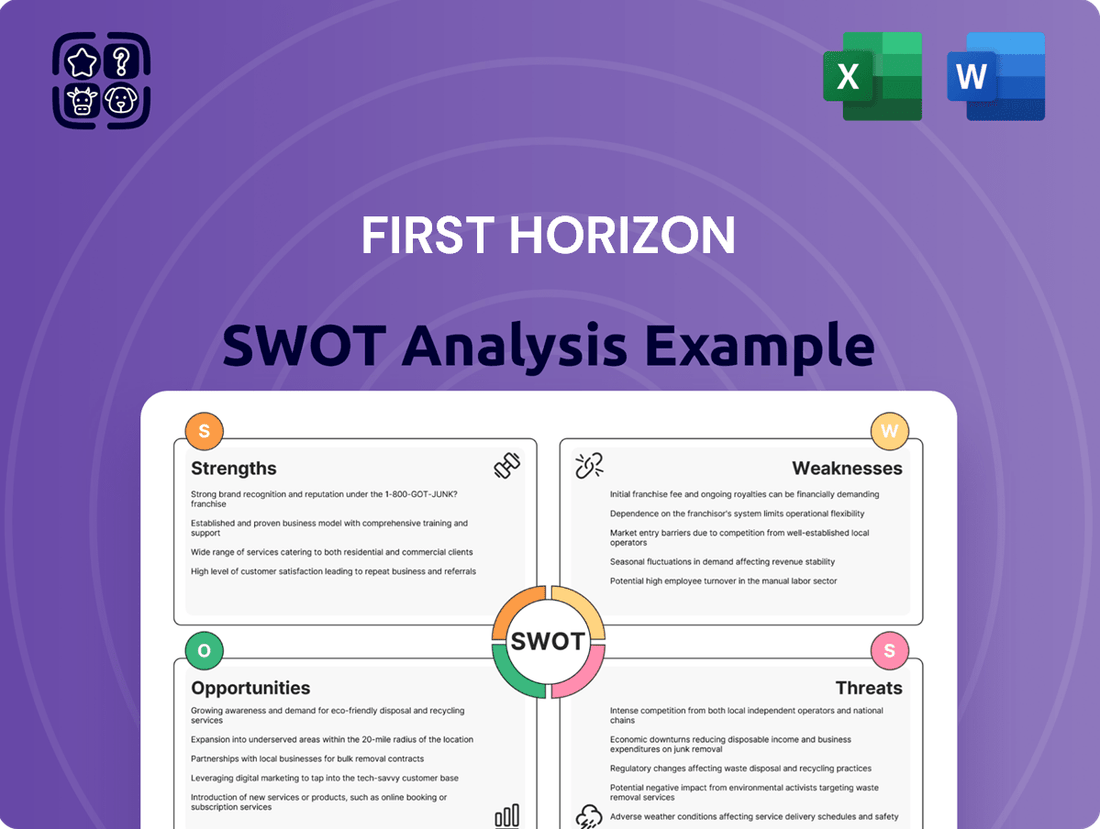

Preview the Actual Deliverable

First Horizon SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive breakdown of First Horizon's strategic position.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview of First Horizon.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the First Horizon SWOT analysis, ready for your strategic planning.

Opportunities

First Horizon has a significant opportunity to bolster its digital banking offerings and forge strategic alliances with fintech innovators. By enhancing digital platforms, the bank can elevate customer satisfaction, streamline operations, and attract a broader client base.

First Horizon is focusing on organic growth, aiming to deepen its market penetration and attract new customers within its current operational areas. This involves nurturing existing client relationships and refining its product suite to foster natural business expansion.

In the first quarter of 2024, First Horizon reported a net interest income of $819 million, demonstrating the potential for growth through enhanced client engagement and product development.

First Horizon's strategic focus on the Southeastern United States positions it for significant expansion, leveraging the region's robust economic growth. States like Florida, Texas, and North Carolina, key markets for First Horizon, are consistently showing strong GDP growth, with the Southeast projected to outpace the national average in economic expansion through 2025.

The company is well-placed to benefit from favorable demographic shifts, including a growing population and an increasing number of businesses relocating to these vibrant areas. For instance, the influx of new residents and businesses in cities like Nashville and Charlotte presents a substantial opportunity for First Horizon to acquire new customers and deepen existing relationships.

Strategic Capital Deployment

First Horizon's robust capital position presents a significant opportunity for strategic capital deployment. This includes the potential for substantial stock repurchase programs, signaling management's confidence in the company's underlying value and future prospects. Such actions can be particularly effective in enhancing shareholder returns when merger and acquisition opportunities are not immediately compelling.

For instance, as of the first quarter of 2024, First Horizon reported a Common Equity Tier 1 (CET1) ratio of 10.9%, well above regulatory requirements. This strong capital base allows for flexibility in returning capital to shareholders.

- Stock Repurchases: The company has the capacity to execute significant share buybacks, which can reduce the number of outstanding shares and boost earnings per share.

- Shareholder Value Enhancement: Strategic deployment of capital through buybacks can directly increase shareholder value, especially if the stock is trading below its intrinsic worth.

- Management Confidence: A commitment to repurchases often reflects management's belief that the company's stock is undervalued, providing a positive signal to the market.

- Capital Allocation Flexibility: With strong capital levels, First Horizon can choose to prioritize shareholder returns over other strategic initiatives if they are not readily available or attractive.

Increased Mortgage Warehouse Lending Activity

The mortgage warehouse lending sector is poised for a significant upswing. Analysts are forecasting increased activity in this area, particularly in the latter half of 2025, driven by expectations of declining treasury rates. This trend offers a clear opportunity for First Horizon to expand its loan portfolio and boost revenue streams.

This segment represents a strategic growth avenue for First Horizon. As interest rates are projected to become more favorable, the demand for warehouse lending services is likely to rise, directly benefiting the company's financial performance.

- Optimistic Outlook: The mortgage warehouse business is expected to see increased activity in the latter half of 2025.

- Rate Sensitivity: This growth is anticipated due to projected lower treasury rates.

- Portfolio Expansion: The segment offers a clear avenue for expanding First Horizon's loan portfolio.

- Revenue Growth: Increased lending activity directly translates to higher revenue for the company.

First Horizon can capitalize on the growing economic dynamism of the Southeastern United States, a region projected to experience faster GDP growth than the national average through 2025. This expansion is fueled by favorable demographic shifts, including population increases and business relocations to key markets like Florida and Texas, offering a fertile ground for customer acquisition and relationship deepening.

The bank is also positioned to benefit from an anticipated upswing in the mortgage warehouse lending sector, with increased activity expected in the latter half of 2025 as treasury rates are forecast to decline. This trend presents a direct opportunity to expand its loan portfolio and enhance revenue streams.

Furthermore, First Horizon's strong capital position, evidenced by a CET1 ratio of 10.9% in Q1 2024, provides significant flexibility for capital deployment, including substantial stock repurchase programs, which can enhance shareholder value and signal management's confidence in the company's intrinsic worth.

Threats

First Horizon operates within a fiercely competitive banking landscape, contending with large national banks, established regional players, member-focused credit unions, and a growing array of fintech and specialized financial service providers. This crowded market environment directly impacts pricing strategies for loans and deposits, potentially compressing net interest margins. For instance, as of Q1 2024, the average interest rate on a new auto loan from a large national bank was around 6.5%, while regional banks often offered slightly higher rates to attract customers, highlighting the pressure on First Horizon to remain competitive on pricing.

First Horizon, like all financial institutions, faces significant threats from economic uncertainties and external shocks. For instance, the persistent inflation seen through 2023 and into 2024, with the US CPI averaging around 4.1% for the year ending March 2024, can erode purchasing power and increase operating costs. Furthermore, geopolitical tensions, such as ongoing conflicts in Eastern Europe, can disrupt supply chains and financial markets, creating volatility that directly impacts a bank's loan portfolios and investment strategies.

The ever-changing regulatory landscape in financial services is a significant threat to First Horizon. Staying compliant with new rules, such as those related to capital requirements or consumer protection, demands continuous investment in systems and personnel. For instance, the Dodd-Frank Act, and subsequent amendments, have consistently reshaped compliance obligations for banks.

These regulatory shifts can directly impact First Horizon's business model, potentially increasing operational expenses and even restricting certain profitable activities. For example, stricter lending regulations could limit loan origination volumes, affecting net interest income. The cost of compliance for a bank of First Horizon's size can run into tens of millions of dollars annually.

Deposit Cost Pressures

First Horizon is experiencing significant pressure on its deposit costs. Despite strategies to manage these expenses, the bank must continue to offer competitive interest rates to attract and retain depositors. This competitive landscape directly impacts profitability by potentially narrowing net interest margins.

For instance, as of the first quarter of 2024, the average cost of interest-bearing deposits for many regional banks, including those in similar markets to First Horizon, saw an increase. This trend is driven by higher Federal Reserve rates and increased competition for customer funds.

- Increased Competition: Banks are actively competing for deposits, leading to higher rates offered to customers.

- Margin Compression: Rising deposit costs can directly reduce the bank's net interest margin, impacting earnings.

- Customer Retention: Failure to offer competitive rates risks losing valuable deposit customers to other financial institutions.

Potential for Slower Economic Recovery

A slower-than-expected economic recovery presents a significant threat. This continued uncertainty could make both lending and investment activities more cautious, potentially dampening loan growth for First Horizon. For instance, if GDP growth projections for 2024-2025 fall short of expectations, it could directly impact the bank's ability to expand its loan portfolio.

This subdued environment also heightens credit risk. As economic conditions remain challenging, borrowers may face greater difficulties in meeting their financial obligations, increasing the likelihood of defaults. This could translate into higher provisions for loan losses, impacting profitability.

Consequently, First Horizon might face a generally more difficult operating environment. Factors such as persistent inflation or geopolitical instability could further exacerbate these economic headwinds, creating a less favorable landscape for banking operations throughout 2024 and into 2025.

- Economic Uncertainty: Continued sluggishness in the economy can lead to reduced consumer and business spending, directly impacting demand for banking services.

- Increased Credit Risk: A weaker economy elevates the risk of loan defaults, forcing banks like First Horizon to increase their loan loss provisions.

- Subdued Loan Growth: Cautious lending practices and lower demand for credit in an uncertain economic climate can limit a bank's core revenue generation.

First Horizon faces significant threats from intensified competition, particularly from larger national banks and agile fintech firms, which can pressure interest margins. The bank must also navigate a dynamic regulatory environment, with evolving compliance requirements potentially increasing operational costs and limiting certain business activities. Furthermore, economic headwinds, such as persistent inflation and the risk of a slower-than-expected recovery, could dampen loan growth and increase credit risk, impacting overall profitability.

| Threat Category | Specific Threat | Impact on First Horizon | Data Point (as of Q1 2024/early 2025) |

|---|---|---|---|

| Competition | Increased competition for deposits | Margin compression, potential loss of customers | Average interest-bearing deposit costs rose for regional banks. |

| Economic Conditions | Slower economic recovery/recession risk | Reduced loan demand, increased credit risk (defaults) | US CPI averaged 4.1% for the year ending March 2024; GDP growth projections for 2024-2025 may fall short. |

| Regulatory Environment | Evolving compliance mandates | Increased operational costs, potential business restrictions | Compliance costs for banks can reach tens of millions annually; impact of new regulations on lending volumes. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including First Horizon's official financial filings, detailed market research reports, and expert industry analyses to ensure a robust and accurate assessment.