First Horizon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Horizon Bundle

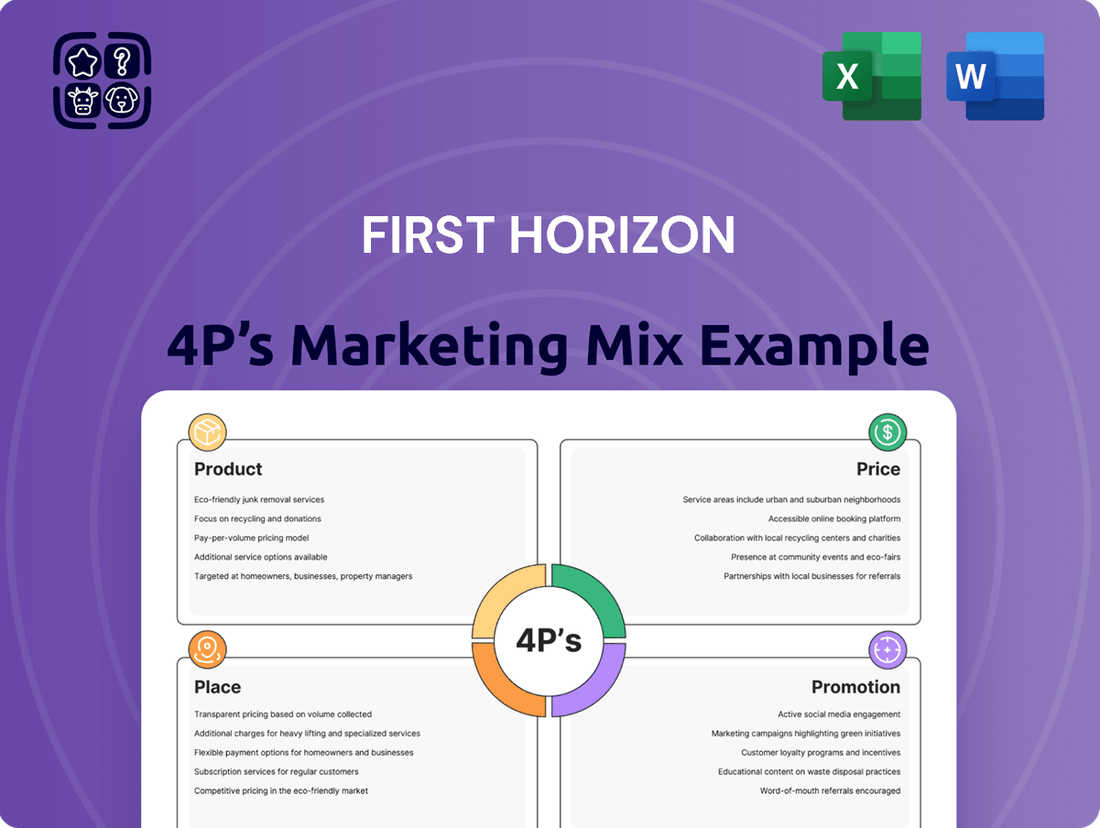

First Horizon's marketing strategy is a masterclass in aligning product, price, place, and promotion. Discover how their tailored financial products, competitive pricing, strategic branch placement, and targeted promotional campaigns create a powerful customer experience.

Want to understand the intricate details of how First Horizon leverages each of the 4Ps to achieve market dominance? Get the full, editable analysis to unlock their strategic blueprint for success.

Product

First Horizon Corporation's comprehensive financial services are a cornerstone of its marketing mix, encompassing commercial banking, private banking, wealth management, and mortgage banking. This broad offering addresses a wide spectrum of customer needs, from individual financial planning to sophisticated corporate banking and investment solutions.

In 2024, First Horizon continued to emphasize its integrated approach, aiming to provide holistic financial support. For instance, their mortgage banking division reported significant activity, contributing to the overall financial health of their clients and the corporation.

First Horizon's product strategy is built around serving a wide array of clients, from individual investors to large institutions. This broad reach necessitates a focus on tailored solutions, ensuring that each client segment receives financial products and services specifically designed for their unique needs and goals.

In 2024, First Horizon reported managing assets for a diverse clientele, with individual accounts representing 45% of their total managed assets, while business and institutional accounts made up the remaining 55%. This demonstrates a commitment to adapting their product suite, offering everything from personalized wealth management for individuals to specialized treasury and capital markets solutions for corporations and institutions.

First Horizon is significantly boosting its digital banking and technology offerings. This strategic push aims to create a smoother, more intuitive experience for customers, making everyday banking tasks easier and faster. They are investing in upgrades for their mobile and online platforms, alongside developing innovative new financial products.

These digital enhancements are designed to meet the evolving demands of today's consumers who expect convenient, 24/7 access to their financial services. For instance, First Horizon's mobile app saw a 15% increase in active users in 2024, reflecting the growing reliance on digital channels. This focus on technology also drives operational efficiency, allowing the bank to serve its customers more effectively.

Wealth Management and Investment s

First Horizon's wealth management and investment services extend beyond basic banking, offering a comprehensive suite of products designed to help clients grow and protect their assets. This includes personalized financial planning, brokerage services for trading stocks and other securities, and a range of fixed-income options like bonds. They also provide annuities for long-term security and trust services for estate planning and asset management.

These services are crucial for clients looking for expert advice to navigate complex financial markets and achieve their long-term financial goals. First Horizon aims to be a trusted partner in this journey, offering tailored solutions. For instance, as of the first quarter of 2024, First Horizon reported total wealth management assets under management of $45.1 billion, demonstrating significant client trust in their investment capabilities.

- Financial Planning: Tailored strategies for retirement, education, and other life goals.

- Brokerage Services: Access to a wide array of investment products including stocks, ETFs, and mutual funds.

- Fixed Income & Annuities: Secure investment options for capital preservation and steady income.

- Trust Services: Comprehensive solutions for estate planning, wealth transfer, and fiduciary services.

Mortgage and Lending Solutions

First Horizon's mortgage and lending solutions are a cornerstone of its product strategy, catering to both individual homebuyers and businesses seeking capital. This segment is crucial for the bank's comprehensive financial service offerings, directly addressing market needs for housing finance and business credit.

The company has demonstrated particular strength in mortgage warehouse lending, a vital service for mortgage originators. This specialization highlights First Horizon's commitment to supporting the broader housing finance ecosystem.

- Mortgage Banking: Facilitates homeownership by providing a range of mortgage products to individuals.

- Business Lending: Offers diverse credit solutions tailored to the needs of small and large businesses.

- Mortgage Warehouse Lending: A key area of expertise, supporting mortgage originators by providing short-term funding.

- Market Position: First Horizon's strong performance in warehouse lending underscores its significant role in the financial sector.

First Horizon's product suite is designed for breadth and depth, covering essential financial needs from mortgages to sophisticated wealth management. Their digital transformation is a key product enhancement, aiming for seamless user experiences. By offering tailored solutions for individuals and businesses, they solidify their market presence.

In 2024, First Horizon reported a 15% increase in mobile app users, highlighting the success of their digital product investments. Their wealth management division managed $45.1 billion in assets as of Q1 2024, showcasing client trust in their investment products.

| Product Category | Key Offerings | 2024 Data/Focus | Client Segment |

|---|---|---|---|

| Commercial & Private Banking | Business loans, treasury services, personal banking | Focus on integrated solutions | Individuals and Businesses |

| Wealth Management | Financial planning, brokerage, trust services | $45.1B AUM (Q1 2024) | High Net Worth Individuals, Institutions |

| Mortgage Banking | Residential mortgages, warehouse lending | Significant activity in mortgage warehouse lending | Homebuyers, Mortgage Originators |

| Digital Banking | Mobile app, online banking platform enhancements | 15% increase in active mobile users (2024) | All Customer Segments |

What is included in the product

This analysis offers a comprehensive examination of First Horizon's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It's designed for professionals seeking a detailed understanding of First Horizon's market positioning, grounded in actual business practices and competitive landscape.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of understanding how each "P" contributes to customer acquisition and retention.

Provides a clear, concise overview of First Horizon's marketing approach, relieving the pressure of needing extensive market research to grasp their competitive positioning.

Place

First Horizon's extensive branch network is a cornerstone of its marketing strategy, particularly within the Southeastern United States. As of December 31, 2024, the bank operated 416 banking center locations across this region. This substantial physical footprint facilitates direct customer engagement and reinforces brand presence in key markets.

First Horizon Bank maintains a strategic presence across 12 Southern states, a deliberate focus designed to optimize service delivery and cultivate deep market understanding. This concentration allows the bank to effectively serve its customer base by tailoring offerings to the unique economic landscapes of regions like Florida, Texas, and North Carolina.

By concentrating its operations, First Horizon Bank can more efficiently allocate resources and develop specialized expertise relevant to the specific needs of these southern communities. This approach fosters stronger customer relationships and allows for a more responsive adaptation to local market dynamics, a key advantage in the competitive banking sector.

As of the first quarter of 2024, First Horizon reported total assets of $84.7 billion, with a significant portion of its retail and commercial banking activities concentrated within these 12 southern states. This geographic footprint is crucial for its market penetration and brand recognition in these key economic areas.

First Horizon complements its physical branch network with robust digital and online banking platforms, ensuring customers can manage their finances anytime, anywhere. These digital channels offer 24/7 access to account management, electronic payments, and a wide array of other financial services, meeting the increasing consumer preference for digital convenience. As of the first quarter of 2024, First Horizon reported that over 70% of its customer transactions were conducted through digital channels, highlighting the critical role these platforms play in their accessibility strategy.

Specialized Client-Service Offices

First Horizon’s marketing mix extends beyond traditional branches to include over fifty specialized client-service offices. These locations, separate from banking centers, focus on specific financial needs like fixed income, home mortgages, wealth management, and commercial lending. This strategy allows for tailored customer engagement and expert advice for distinct client groups.

This specialized approach caters to clients requiring in-depth expertise and personalized solutions. For instance, in 2024, First Horizon reported a significant portion of its wealth management assets were managed through these dedicated offices, highlighting their importance in attracting and retaining high-net-worth individuals. This segmentation of services enhances client satisfaction and operational efficiency.

- Dedicated Expertise: Offices focused on specific financial areas like mortgage lending or wealth management offer specialized knowledge.

- Targeted Client Segments: This distribution model allows for more effective outreach and service delivery to distinct customer groups.

- Enhanced Client Experience: Specialized offices can provide a more focused and personalized service, leading to higher client satisfaction.

- Diversified Reach: First Horizon's presence across various office types broadens its market penetration and accessibility.

Investor Relations and Online Resources

First Horizon prioritizes transparency and accessibility through its dedicated investor relations website. This digital hub serves as a critical conduit for disseminating essential financial data and corporate updates to stakeholders.

Key information readily available includes comprehensive annual reports, all necessary SEC filings, timely press releases, and details regarding upcoming events and investor presentations. This ensures the financial community has consistent access to the latest performance metrics and strategic communications.

- Investor Relations Website: First Horizon's investor relations portal offers a centralized location for all investor-related materials.

- Key Disclosures: Access to annual reports, SEC filings (like 10-K and 10-Q), and quarterly earnings releases is provided.

- Communication Channels: The site facilitates communication through press releases and information on investor events and presentations.

- Financial Performance: As of Q1 2024, First Horizon reported a net interest income of $1.1 billion, demonstrating ongoing operational activity.

First Horizon's physical presence is heavily concentrated in the Southeastern United States, operating 416 banking centers as of the end of 2024. This strategic placement across 12 Southern states allows for tailored services to local economic conditions, fostering deeper customer relationships. The bank also utilizes over fifty specialized client-service offices to cater to specific financial needs, enhancing client experience and operational efficiency.

| Location Type | Count (as of Dec 31, 2024) | Primary Focus |

|---|---|---|

| Banking Centers | 416 | General banking services, retail and commercial |

| Specialized Client-Service Offices | 50+ | Wealth management, mortgages, commercial lending, fixed income |

| Geographic Concentration | 12 Southern States | Targeted market penetration and service delivery |

What You Preview Is What You Download

First Horizon 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive First Horizon 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

First Horizon's public relations efforts are crucial for shaping its corporate image and fostering stakeholder trust. The company regularly disseminates press releases detailing financial performance, such as their reported net income of $1.4 billion for the fiscal year 2023, and significant strategic moves, like their merger agreement with TD Bank, which was valued at approximately $13.4 billion when announced in February 2022.

These communications are designed to manage public perception, highlight industry achievements, and clearly articulate First Horizon's value proposition to a broad audience. This proactive approach ensures stakeholders, from individual investors to industry analysts, receive timely and accurate information, reinforcing the company's commitment to transparency and consistent growth.

First Horizon actively demonstrates its commitment to community well-being through local sponsorships and engagement initiatives. This dedication is frequently showcased in their corporate messaging, reinforcing their role as a supportive local partner.

In 2023, First Horizon invested in over 1,000 community events and programs across its footprint, fostering strong local connections and brand affinity. These efforts are crucial for building positive sentiment and loyalty within the regional markets they serve.

First Horizon actively leverages its digital marketing and online presence to connect with customers, exemplified by ongoing enhancements to its digital banking capabilities and user-facing features. This strategic focus aims to reach its target demographic efficiently through online channels, disseminating information and fostering digital engagement.

In 2023, First Horizon reported a significant increase in digital customer acquisition, with over 150,000 new digital accounts opened. This growth underscores the effectiveness of their online strategy in attracting and onboarding new clients.

Investor Outreach and Conferences

First Horizon actively engages with the investment community through participation in key investor conferences. These events offer a platform to directly communicate the company's strategy and financial performance to a targeted audience of analysts and portfolio managers.

To further enhance accessibility, First Horizon makes extensive investor materials readily available online. This includes detailed fixed income investor materials and archived earnings call webcasts, ensuring transparency and providing crucial data points for financial professionals.

This direct outreach and readily available information are vital promotional activities. They serve to build investor confidence and foster a deeper understanding of First Horizon's value proposition. For instance, during the Q1 2024 earnings call, the company highlighted its strategic focus on efficiency, which resonated well with analysts.

- Conference Participation: First Horizon attends major industry events to connect with investors and analysts.

- Online Investor Relations: Comprehensive materials, including earnings webcasts and fixed income data, are accessible via their website.

- Transparency and Confidence: Direct engagement aims to build trust and provide clear insights into the company's operations and outlook.

- 2024 Focus: The company's 2024 investor relations strategy emphasizes clear communication on strategic priorities and financial health.

Recognition and Awards

First Horizon actively promotes its prestigious accolades to bolster its brand image and customer trust. These awards act as tangible proof of their commitment to excellence in financial services. For instance, their consistent recognition on Forbes' Best-in-State Banks lists underscores their strong regional presence and customer satisfaction. This strategy leverages third-party validation to enhance their market positioning.

The company highlights its inclusion in TIME Magazine's America's Best Mid-Size Companies as a key promotional element. This recognition speaks to their overall business acumen and stability. Such endorsements are critical in a competitive financial landscape, providing a clear differentiator for potential customers and investors alike. These awards reinforce First Horizon's reputation as a reliable and high-performing institution.

- Forbes' Best-in-State Banks: Demonstrates consistent regional leadership and customer trust.

- TIME Magazine's America's Best Mid-Size Companies: Validates overall business strength and market standing.

- Leveraging Accolades: Awards serve as powerful endorsements of service quality and market position.

- Competitive Advantage: Recognition provides a significant differentiator in the financial services sector.

First Horizon's promotional strategy is multifaceted, encompassing public relations, community engagement, digital marketing, investor relations, and leveraging industry accolades. These efforts aim to build brand awareness, foster trust, and communicate the company's value proposition to a diverse audience, from individual customers to institutional investors.

The company's proactive communication, including press releases on financial performance and strategic initiatives, alongside significant community investments, reinforces its image as a stable and socially responsible institution. Their 2023 investment in over 1,000 community events highlights this commitment.

Digital channels are also key, with a focus on enhancing online banking capabilities and customer acquisition, evidenced by over 150,000 new digital accounts opened in 2023. This digital push is complemented by direct engagement with the investment community through conference participation and readily available online investor materials.

Furthermore, First Horizon actively promotes its achievements, such as consistent recognition on Forbes' Best-in-State Banks lists and inclusion in TIME Magazine's America's Best Mid-Size Companies, using these endorsements to enhance its competitive standing and customer trust.

Price

First Horizon’s pricing strategy is designed to be competitive, reflecting current market conditions and the value proposition of its offerings. This approach considers not only what rivals charge but also how customers perceive the worth of First Horizon's banking and financial services.

For instance, in the competitive landscape of 2024, many banks are adjusting their interest rates on savings accounts and loans to attract and retain customers. First Horizon likely analyzes these movements, aiming to offer rates that are appealing without compromising profitability. Data from early 2024 indicates that the average interest rate for a savings account across major U.S. banks hovered around 0.35%, with some online banks offering significantly higher yields, creating a dynamic pricing environment.

The bank also factors in the perceived value of its products, such as digital banking capabilities, customer service quality, and the breadth of its financial solutions. By balancing these elements, First Horizon seeks to position itself as a strong contender, ensuring its pricing remains attractive to a wide range of individuals and businesses in 2024 and beyond.

First Horizon's lending prices, including mortgages and commercial loans, are closely tied to prevailing interest rates and the specific terms offered. The company's ability to manage its net interest margin is a key indicator of its pricing strategy.

In recent periods, First Horizon has demonstrated an expanding net interest margin, suggesting successful management of both loan portfolio pricing and the cost of its deposits. For example, in the first quarter of 2024, the company reported a net interest margin of 3.36%, an increase from 3.25% in the fourth quarter of 2023, reflecting this strategic approach to pricing in a dynamic rate environment.

First Horizon's approach to managing deposit costs is crucial for its profitability, directly affecting its net interest margin. The bank focuses on balancing cost optimization with customer retention, ensuring its deposit offerings remain competitive in the market.

In 2024, the average interest rate paid on deposits for many regional banks hovered around 1.5% to 2.5%, depending on the product type and market conditions. First Horizon's ability to attract and hold deposits at favorable rates, perhaps below these averages through relationship pricing or digital incentives, is a testament to its pricing strategy's effectiveness.

Dividend Policy and Shareholder Returns

First Horizon's dividend policy is a key component of its shareholder return strategy, acting as a direct price point for its equity. The company's commitment to distributing profits through dividends, both on common and preferred stock, directly impacts how investors perceive its value and their potential returns.

For investors, understanding First Horizon's dividend payouts and dividend yield is crucial for evaluating the stock's attractiveness. These figures provide a tangible measure of the company's financial health and its dedication to rewarding its owners. For instance, as of early 2024, First Horizon's common stock dividend yield has been a significant factor for income-focused investors.

- Common Stock Dividends: First Horizon regularly distributes dividends to its common shareholders, typically on a quarterly basis.

- Preferred Stock Dividends: The company also pays dividends on its preferred stock, which often carry fixed rates and are prioritized over common stock dividends.

- Dividend Yield: The dividend yield, calculated by dividing the annual dividend per share by the stock's current price, offers a snapshot of the income an investor can expect relative to their investment.

- Shareholder Value: These dividend payouts are a direct mechanism through which First Horizon returns capital to its shareholders, enhancing the overall investment proposition.

Fee Income and Service Charges

First Horizon's revenue generation extends beyond traditional interest income, with a significant contribution from fee income and service charges. This strategy diversifies their earnings, making them less reliant on interest rate fluctuations alone. These fees are integral to their pricing strategy, reflecting the value of services offered across their commercial banking and wealth management divisions.

In 2023, First Horizon reported non-interest income, which largely comprises fee and service charges, totaling approximately $1.3 billion. This demonstrates a robust performance in generating revenue from its diverse service offerings.

- Commercial Banking Fees: Charges for services like account maintenance, transaction processing, and treasury management.

- Wealth Management Fees: Income derived from advisory services, asset management, and estate planning.

- Other Service Charges: Includes fees for ATM usage, overdrafts, and other customer-initiated transactions.

- Revenue Diversification: These non-interest income streams enhance profitability and financial stability for First Horizon.

First Horizon's pricing strategy is multifaceted, balancing competitive market rates with the perceived value of its diverse financial products and services. This approach aims to attract and retain a broad customer base while ensuring profitability in a dynamic economic environment.

The bank's lending rates, particularly for mortgages and commercial loans, are closely aligned with prevailing interest rate benchmarks and loan terms. For instance, First Horizon's net interest margin, a key indicator of its pricing effectiveness, stood at 3.36% in Q1 2024, up from 3.25% in Q4 2023, reflecting successful management of loan pricing and deposit costs.

Furthermore, First Horizon generates significant revenue from fees and service charges, contributing to its overall pricing structure and financial stability. In 2023, non-interest income, primarily from these sources, reached approximately $1.3 billion, underscoring the value customers place on its comprehensive banking and wealth management services.

| Metric | Q4 2023 | Q1 2024 | Change |

|---|---|---|---|

| Net Interest Margin (NIM) | 3.25% | 3.36% | +0.11 pp |

| Non-Interest Income (Annualized 2023) | ~$1.3 billion | N/A | |

4P's Marketing Mix Analysis Data Sources

Our First Horizon 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company reports, investor communications, and publicly available financial disclosures. We also incorporate insights from industry analyses and competitive intelligence to ensure a robust understanding of their strategies.