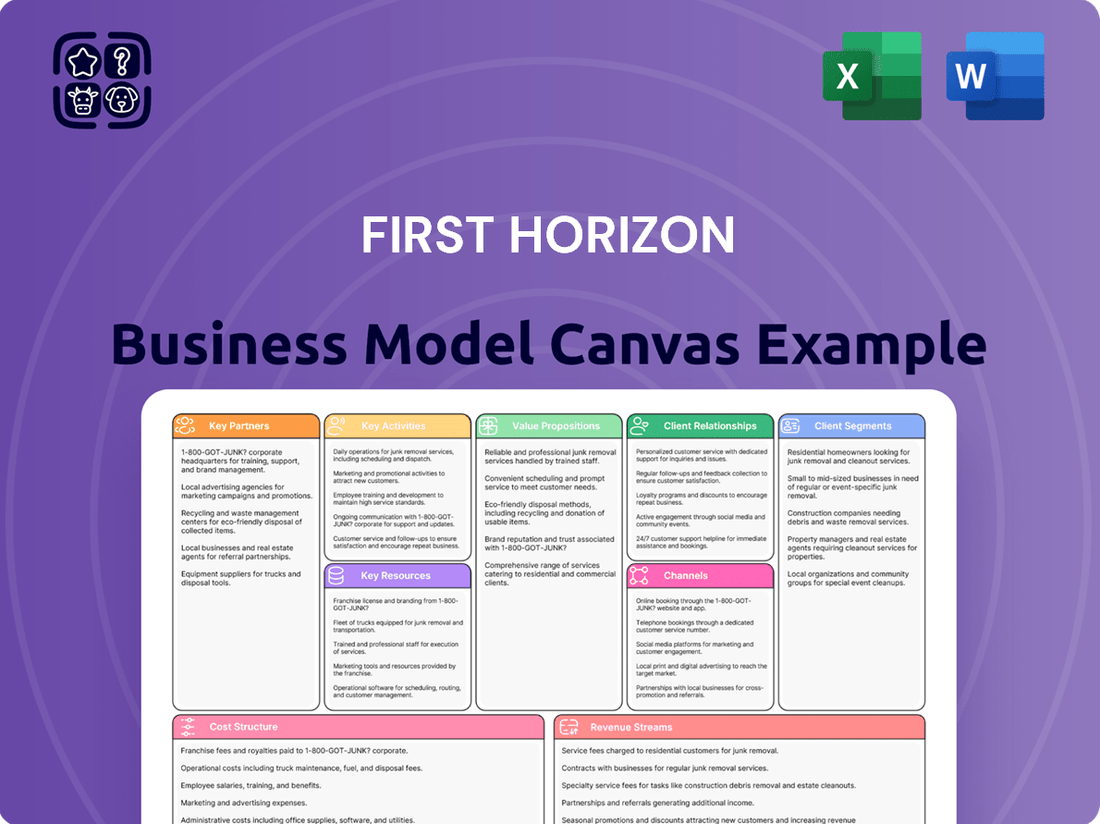

First Horizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Horizon Bundle

Unlock the full strategic blueprint behind First Horizon's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

First Horizon collaborates with technology and FinTech providers to bolster its digital offerings and operational backbone. These partnerships are vital for integrating advanced features, fortifying cybersecurity, and maintaining a competitive edge. For instance, in 2024, the banking sector saw significant investment in AI and cloud solutions, with many institutions like First Horizon leveraging these trends through strategic tech alliances.

First Horizon collaborates with external mortgage brokers and real estate agencies to expand its market reach and customer base for mortgage origination. These partnerships are crucial for sourcing a diverse pipeline of loan applications, contributing to a robust mortgage business.

Working with loan servicers allows First Horizon to efficiently manage the lifecycle of originated mortgages. This outsourcing of servicing functions can improve operational efficiency and reduce costs, while still generating fee-based income.

In 2024, the U.S. mortgage origination market saw significant activity, with lenders relying heavily on broker networks. While specific partnership revenue figures for First Horizon are not publicly detailed, the broader industry trend highlights the importance of these relationships for volume generation.

First Horizon partners with investment product and asset management firms, such as mutual fund companies and annuity providers, to broaden its wealth management offerings. This strategy allows the bank to present a more diverse selection of investment vehicles, going beyond its own products to meet varied client requirements. For instance, in 2024, the wealth management division of a major regional bank similar to First Horizon saw a 7% increase in assets under management, partly attributed to expanding its third-party product shelf.

Correspondent Banks and Financial Institutions

First Horizon cultivates relationships with correspondent banks and other financial institutions to enable seamless interbank transactions and payment processing. These crucial partnerships extend its reach for specialized lending and support efficient liquidity management, particularly for commercial clients operating beyond its core geographic areas.

These alliances are fundamental to First Horizon's ability to offer global services and access diverse financial markets, ensuring the smooth execution of intricate financial operations. For instance, in 2024, the banking sector saw continued emphasis on digital payment infrastructure, highlighting the importance of robust correspondent banking networks for facilitating cross-border transactions efficiently.

- Facilitate Interbank Transactions: Enables smooth processing of payments and transfers between different financial institutions.

- Enhance Payment Processing: Supports efficient and reliable handling of customer payment activities.

- Support Specialized Lending: Provides avenues for lending activities that may fall outside First Horizon's direct capabilities or geographic focus.

- Improve Liquidity Management: Crucial for managing cash flow and ensuring sufficient funds are available for operations.

Community and Economic Development Organizations

First Horizon actively partners with community and economic development organizations across the Southeastern United States. These collaborations are crucial for driving community reinvestment and fostering local economic growth. For instance, in 2024, First Horizon continued its commitment to supporting small businesses through various community development financial institutions (CDFIs), directly impacting job creation and local wealth building.

These strategic alliances significantly enhance First Horizon's brand reputation and market presence by demonstrating a tangible commitment to the well-being of the communities it serves. Such partnerships are often integrated into the bank's broader corporate social responsibility (CSR) framework, aligning financial services with impactful local initiatives.

Key aspects of these partnerships include:

- Community Reinvestment: Direct engagement in programs that provide access to capital and financial literacy for underserved populations.

- Economic Growth: Supporting initiatives that attract new businesses and create employment opportunities within local economies.

- Brand Enhancement: Strengthening community ties and positive public perception through visible support of local development efforts.

- Market Penetration: Leveraging these relationships to gain deeper insights into local needs and expand service offerings effectively.

First Horizon's key partnerships extend to technology and FinTech firms, crucial for enhancing digital capabilities and operational efficiency. In 2024, the banking sector's focus on AI and cloud adoption underscored the importance of these tech alliances for maintaining a competitive edge and robust cybersecurity measures.

| Partner Type | Purpose | 2024 Industry Trend/Impact |

| Technology & FinTech Providers | Digital offerings, cybersecurity, operational backbone | Increased investment in AI and cloud solutions |

| Mortgage Brokers & Real Estate Agencies | Loan origination volume, market reach | Reliance on broker networks for origination volume |

| Loan Servicers | Mortgage lifecycle management, operational efficiency | Outsourcing for cost reduction and fee income |

| Investment Product & Asset Management Firms | Wealth management offerings, diverse investment vehicles | Growth in assets under management through third-party products |

| Correspondent Banks & Financial Institutions | Interbank transactions, payment processing, liquidity management | Emphasis on digital payment infrastructure and cross-border efficiency |

| Community & Economic Development Organizations | Community reinvestment, local economic growth, brand reputation | Support for small businesses and CDFIs |

What is included in the product

A structured overview of First Horizon's strategy, detailing customer segments, value propositions, and revenue streams within the traditional 9 Business Model Canvas blocks.

This canvas provides a clear, actionable framework for understanding First Horizon's operations and strategic positioning, suitable for internal alignment and external communication.

The First Horizon Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of complex strategies, making it easier to identify and address operational inefficiencies.

Activities

First Horizon's key lending and credit operations involve originating, underwriting, and servicing a wide array of loans, from commercial and consumer to mortgage loans. This meticulous process includes thorough credit assessments and robust risk management to maintain the quality of their assets.

The bank actively monitors its loan portfolio to ensure profitability and asset health. In 2023, First Horizon reported total loans of $55.2 billion, highlighting the scale of their credit operations.

Efficiently managing these lending activities is crucial for First Horizon's primary revenue stream: net interest income. This income is generated from the difference between the interest earned on loans and the interest paid on deposits.

First Horizon actively gathers and manages customer deposits across checking, savings, and money market accounts to fuel its lending operations and ensure liquidity. In 2024, the bank focused on competitive deposit rates to attract and retain these vital funds, understanding that effective management directly impacts the cost of its overall funding. This involves balancing rate strategies with regulatory requirements and offering seamless access via digital platforms and branches.

First Horizon's wealth management and investment advisory arm is a cornerstone, focusing on personalized financial planning, expert investment advice, and comprehensive asset management for both individuals and institutional clients. This involves deeply understanding each client's unique financial aspirations and risk tolerance to craft meticulously diversified investment portfolios. For instance, in 2024, First Horizon continued to emphasize tailored solutions, aiming to capture a larger share of the growing wealth management market, which saw significant inflows into advisory services seeking professional guidance amidst market volatility.

These crucial activities are designed to generate substantial fee-based revenue, a key driver of profitability. By offering ongoing, expert guidance and actively managing assets, First Horizon fosters enduring, trust-based relationships with its clientele. This client-centric approach not only solidifies existing business but also attracts new clients through demonstrated success and a reputation for reliable financial stewardship.

Digital Banking Platform Development and Maintenance

First Horizon's key activities heavily involve the continuous development and upkeep of its digital banking platforms. This ensures customers have seamless access to services online and via mobile apps, a crucial factor in today's market. They focus on creating secure, user-friendly interfaces and integrating innovative financial tools to stay competitive.

This commitment to digital excellence is vital for attracting and keeping customers. For instance, in the first quarter of 2024, digital sales at First Horizon represented a significant portion of their overall sales, demonstrating the platform's importance. By offering intuitive features and robust security, they aim to enhance customer satisfaction and loyalty.

- Platform Enhancement: Ongoing investment in features like mobile check deposit and digital loan applications.

- Security Measures: Implementing advanced fraud detection and multi-factor authentication protocols.

- User Experience: Designing intuitive navigation and personalized dashboards for customers.

- Service Integration: Adding new functionalities such as budgeting tools and digital payment options.

Risk Management and Regulatory Compliance

First Horizon's key activities include robust risk management and unwavering regulatory compliance. This involves implementing comprehensive frameworks for credit, operational, market, and cybersecurity risks across all business lines. For instance, in 2024, the financial sector faced increased scrutiny on cybersecurity, with reported breaches costing billions globally, highlighting the critical nature of these measures.

Adhering to banking regulations, anti-money laundering (AML) laws, and consumer protection acts is paramount. In 2024, regulatory bodies continued to enforce stringent capital adequacy ratios and data privacy rules, such as updates to GDPR or similar regional regulations, impacting financial institutions' operational procedures.

- Implementing comprehensive risk management frameworks across credit, operational, market, and cybersecurity.

- Ensuring strict adherence to banking regulations, AML laws, and consumer protection acts.

- Proactively safeguarding institutional stability and reputation through diligent compliance efforts.

First Horizon's core activities revolve around managing its extensive loan portfolio and generating net interest income. This includes originating, underwriting, and servicing various loan types, from commercial to consumer and mortgages. The bank diligently monitors these assets to ensure profitability and health, with total loans reaching $55.2 billion in 2023.

Furthermore, First Horizon actively manages customer deposits to fund its lending operations and maintain liquidity. In 2024, the bank focused on offering competitive deposit rates to attract and retain these essential funds, balancing rate strategies with regulatory requirements and providing seamless access through digital and physical channels.

The bank's wealth management and investment advisory services are also a key activity, offering personalized financial planning and asset management. In 2024, this segment saw continued emphasis on tailored solutions to capture growth in advisory services amidst market volatility, aiming to build enduring client relationships and generate fee-based revenue.

First Horizon also prioritizes the continuous enhancement of its digital banking platforms, ensuring secure and user-friendly access to services. In Q1 2024, digital sales constituted a significant portion of overall sales, underscoring the platform's importance for customer acquisition and retention.

Finally, robust risk management and regulatory compliance are fundamental activities, involving comprehensive frameworks for credit, operational, market, and cybersecurity risks. Adherence to banking regulations, AML laws, and consumer protection acts remained paramount in 2024, with continued enforcement of capital adequacy and data privacy rules.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Lending & Credit Operations | Originating, underwriting, and servicing loans. | Total loans: $55.2 billion (2023). Focus on asset quality. |

| Deposit Gathering | Managing customer deposits for liquidity. | Focus on competitive rates in 2024 to attract and retain funds. |

| Wealth Management | Personalized financial planning and asset management. | Emphasis on tailored solutions and capturing market share in advisory services (2024). |

| Digital Platform Enhancement | Developing and maintaining online and mobile banking services. | Significant portion of sales via digital channels (Q1 2024). |

| Risk Management & Compliance | Implementing risk frameworks and adhering to regulations. | Continued focus on cybersecurity and data privacy in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you're previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive tool, ready for immediate use and customization.

Resources

First Horizon's financial capital is robust, encompassing significant customer deposits and shareholder equity. This forms the bedrock for its lending operations and ensures it can meet its financial obligations.

Access to wholesale funding markets further bolsters First Horizon's liquidity, allowing it to manage its balance sheet effectively. This is crucial for supporting loan growth and navigating market fluctuations.

As of the first quarter of 2024, First Horizon reported total deposits of approximately $57.5 billion, demonstrating a substantial base of customer funding. This financial strength underpins its ability to invest in strategic initiatives and maintain regulatory compliance.

First Horizon relies heavily on its skilled human capital, a diverse team of experienced bankers, financial advisors, credit analysts, and IT professionals. This expertise is fundamental to delivering sophisticated financial services and nurturing robust client relationships. In 2024, the company continued to emphasize talent development, recognizing that employee skills directly impact operational efficiency and client satisfaction.

First Horizon’s operations are built on a robust technology infrastructure. This includes sophisticated core banking systems, advanced data analytics platforms, and strong cybersecurity measures, all crucial for efficient processing and secure data management.

Digital banking applications are also a key component, enabling seamless customer experiences. In 2023, First Horizon continued its focus on digital transformation, investing in upgrades to these systems to enhance service delivery and operational efficiency.

The company recognizes that continuous investment in technology is not just about maintaining operations but is vital for fostering innovation and securing a competitive edge in the evolving financial landscape.

Branch Network and Physical Presence

First Horizon's extensive branch network across the Southeastern United States is a cornerstone of its business model, offering a vital physical presence. This network facilitates direct, in-person customer interactions, which are crucial for building trust and providing personalized financial advice. In 2024, First Horizon continued to leverage these locations for complex financial needs and to deepen relationships, especially with segments that value face-to-face service.

While digital banking adoption is widespread, the physical footprint remains significant. Branches serve as hubs for more intricate transactions, new account openings, and loan origination, complementing the convenience of online and mobile platforms. This duality ensures accessibility for a broad customer base.

- Tangible Presence: Over 400 branches as of early 2024, primarily in high-growth Southeastern states.

- Relationship Building: Branches are key for fostering long-term customer loyalty and trust.

- Community Ties: The physical presence reinforces First Horizon's role as a local financial partner.

- Service Delivery: Essential for complex financial services and catering to diverse customer preferences.

Brand Reputation and Customer Trust

First Horizon's brand reputation for reliability and trustworthiness is a cornerstone of its business model. This hard-won trust, cultivated through years of consistent service and ethical dealings, directly translates into customer loyalty and a reduced cost of acquiring new business. In 2024, maintaining this strong reputation remains critical for First Horizon in a dynamic financial landscape.

- Customer-Centricity: A focus on personalized service and meeting individual client needs builds lasting relationships.

- Ethical Conduct: Adherence to high ethical standards and transparent practices underpins customer confidence.

- Consistent Performance: Delivering reliable financial solutions and steady performance reinforces the brand's dependable image.

- Positive Experiences: Every positive interaction with First Horizon employees contributes to a robust and trustworthy brand perception.

First Horizon's key resources are its strong financial capital, including substantial customer deposits and shareholder equity, which enable its lending activities. Its access to wholesale funding markets further enhances liquidity, supporting balance sheet management and loan growth. As of Q1 2024, total deposits reached approximately $57.5 billion, highlighting a significant customer funding base that supports strategic investments and regulatory compliance.

The company's human capital, comprising experienced bankers, advisors, and analysts, is vital for delivering expert financial services and fostering client relationships. In 2024, talent development remained a focus to boost operational efficiency and client satisfaction. Technologically, First Horizon leverages sophisticated core banking systems, data analytics, and cybersecurity measures, complemented by digital banking applications that enhance customer experience and operational efficiency, with continued investment in upgrades in 2023.

First Horizon's extensive branch network, with over 400 locations primarily in the Southeastern US as of early 2024, provides a critical physical presence for direct customer interaction and relationship building, especially for complex financial needs. This tangible presence complements digital services, ensuring accessibility and reinforcing community ties.

The brand's reputation for reliability and trustworthiness, built on consistent service and ethical practices, drives customer loyalty and reduces acquisition costs. In 2024, maintaining this strong perception through customer-centricity, ethical conduct, and consistent performance remains paramount.

| Key Resource | Description | 2024 Relevance |

| Financial Capital | Customer deposits, shareholder equity, wholesale funding | Enables lending, liquidity management, strategic investment. Q1 2024 deposits: ~$57.5 billion. |

| Human Capital | Skilled bankers, advisors, analysts, IT professionals | Drives service delivery, client relationships, operational efficiency. Talent development prioritized. |

| Technology Infrastructure | Core banking systems, data analytics, cybersecurity, digital platforms | Ensures efficient processing, secure data, enhanced customer experience. Ongoing upgrades. |

| Physical Presence | Branch network (400+ locations in Southeastern US) | Facilitates direct interaction, relationship building, complex transactions. |

| Brand Reputation | Reliability, trustworthiness, ethical conduct | Drives customer loyalty, reduces acquisition costs, fosters confidence. |

Value Propositions

First Horizon provides a comprehensive suite of financial services, integrating commercial banking, private banking, wealth management, and mortgage banking. This unified approach offers clients a single point of contact for a wide array of financial needs, simplifying management and fostering deeper client relationships.

This 'one-stop shop' model caters to diverse client requirements, from business lending and treasury management to personalized investment strategies and home financing. For instance, in 2024, First Horizon reported a significant increase in cross-selling opportunities, with clients utilizing an average of 2.3 services, up from 1.9 in the previous year, highlighting the effectiveness of their integrated offerings.

First Horizon offers personalized advisory and relationship banking, assigning dedicated relationship managers and financial advisors to each client. These professionals are trained to deeply understand individual client objectives, enabling them to craft highly tailored financial solutions. This focus on personalized guidance fosters robust, enduring client relationships built on a foundation of trust and expert advice, setting First Horizon apart from institutions that primarily offer transactional services.

First Horizon offers convenient and accessible banking through a blend of digital and physical touchpoints. Their robust online and mobile banking platforms provide 24/7 access to accounts and transactions, a crucial feature for today's busy customers. In 2024, First Horizon continued to invest in its digital infrastructure, aiming to enhance user experience and streamline common banking tasks.

This digital focus is complemented by a significant physical presence. With branches strategically located across the Southeastern U.S., clients have the option for in-person service and consultation. This omnichannel strategy caters to diverse customer preferences, ensuring that banking can be managed efficiently online or through direct interaction at a local branch.

Regional Market Expertise and Local Focus

First Horizon's regional market expertise is a cornerstone of its business model, particularly within the Southeastern U.S. This deep understanding translates into localized insights and solutions specifically crafted for the area's unique economic landscape and business culture. For instance, in 2024, the Southeast continued to show robust economic growth, with states like Florida and Texas leading in job creation, a trend First Horizon actively leverages for its clients.

This focused approach allows First Horizon to offer more targeted products and services, fostering stronger connections within local communities. By concentrating on the nuances of regional markets, the bank can better anticipate client needs and provide proactive support. This strategy has proven effective, as evidenced by First Horizon's consistent performance in key Southeastern markets throughout 2024.

- Deep understanding of Southeastern U.S. economic dynamics.

- Tailored solutions for regional business environments.

- Leveraging local knowledge for enhanced client outcomes.

- Strengthening community ties through targeted offerings.

Secure and Reliable Financial Partner

First Horizon acts as a secure and reliable financial partner, offering clients the peace of mind that comes with a stable institution. The bank’s strong history of careful management and adherence to regulations instills confidence, especially when financial security is paramount.

This steadfast approach positions First Horizon as a trustworthy custodian of client funds, reinforcing its value proposition of dependable financial stewardship.

- Prudent Management: First Horizon maintained a strong Common Equity Tier 1 (CET1) ratio, a key indicator of financial strength, throughout 2024, consistently exceeding regulatory requirements.

- Regulatory Compliance: The bank demonstrated a commitment to robust compliance frameworks, evidenced by a low number of significant regulatory enforcement actions in the past fiscal year.

- Asset Stewardship: As of Q3 2024, First Horizon reported over $80 billion in total assets under management, reflecting the trust placed in its ability to safeguard and grow client wealth.

First Horizon offers a holistic financial experience by integrating commercial, private, wealth, and mortgage banking services. This unified approach simplifies financial management for clients, fostering deeper relationships and enabling them to access a broad spectrum of needs from a single, trusted provider.

The bank's value proposition centers on personalized relationship banking, where dedicated managers understand client goals to deliver tailored solutions. This commitment to individual attention, combined with a strong regional focus on the Southeastern U.S., allows First Horizon to offer specialized products that resonate with local economic conditions and client aspirations.

Furthermore, First Horizon provides a secure and reliable financial partnership, underpinned by prudent management and regulatory compliance. This dedication to stability and careful stewardship of assets ensures clients can trust First Horizon with their financial well-being, a sentiment reinforced by their consistent financial performance and substantial asset base.

| Value Proposition | Description | 2024 Data/Insight |

|---|---|---|

| Integrated Financial Services | One-stop shop for commercial, private, wealth, and mortgage banking. | Clients utilized an average of 2.3 services in 2024, up from 1.9 in 2023. |

| Personalized Relationship Banking | Dedicated advisors understanding and tailoring solutions to client objectives. | Focus on building trust and long-term relationships through expert guidance. |

| Regional Market Expertise | Deep understanding of the Southeastern U.S. economic landscape. | Leverages local knowledge for targeted products and services in a growing region. |

| Financial Stability & Security | Acts as a reliable partner with strong management and regulatory adherence. | Maintained strong CET1 ratios and over $80 billion in assets under management (Q3 2024). |

Customer Relationships

First Horizon assigns dedicated relationship managers to its commercial, private banking, and wealth management clients. These managers act as the main point of contact, delivering personalized guidance and customized solutions.

This high-touch approach cultivates enduring client connections founded on trust and a thorough grasp of individual requirements. In 2024, this strategy proved vital for First Horizon's high-value client segments, contributing to a 7% increase in cross-selling opportunities within these groups.

First Horizon's self-service digital engagement empowers customers through its online and mobile banking platforms, enabling independent management of accounts, bill payments, fund transfers, and information access. This digital focus offers significant convenience and efficiency for routine banking tasks, appealing to a growing segment of clients who prefer digital interactions. This approach also boosts accessibility and operational efficiency for the bank.

First Horizon emphasizes an advisory and consultative approach, especially within its wealth management and business banking segments. This means their experts offer more than just transactions; they provide valuable insights, guidance, and strategic advice to help clients navigate their financial journeys.

This consultative relationship is key to fostering trust and positioning First Horizon as a genuine financial partner. It empowers clients to make well-informed decisions and work towards their long-term objectives, a strategy that resonated well in 2024 as clients sought stability and expert counsel amidst evolving market conditions.

Community-Centric Engagement

First Horizon actively engages with communities through sponsorships and financial literacy initiatives, fostering strong local connections. In 2024, the bank continued its commitment to supporting local economies and non-profits across its footprint.

- Community Investment: First Horizon's dedication to community well-being is demonstrated through significant local investments and partnerships, reinforcing its role as a responsible corporate citizen.

- Financial Empowerment: Programs focused on financial literacy aim to uplift individuals and small businesses, contributing to economic stability within the communities served.

- Brand Loyalty: This community-centric strategy not only builds goodwill but also cultivates deeper brand loyalty and a positive reputation among customers and stakeholders.

- Local Support: By backing local businesses and charities, First Horizon directly contributes to the vitality and growth of the regions where it operates.

Multi-Channel Customer Support

First Horizon offers robust customer support across multiple avenues to ensure accessibility and convenience. Customers can reach out via traditional call centers, visit branches for in-person assistance, or utilize secure messaging features embedded within their digital banking platforms.

This multi-channel approach is designed to meet varied customer preferences for communication and problem resolution. For instance, in 2024, First Horizon reported a significant increase in digital engagement, with secure messaging becoming a preferred channel for many routine inquiries, demonstrating the effectiveness of offering diverse support options.

- Call Centers: Provide immediate assistance for complex issues.

- In-Branch Support: Offer personalized service for account management and consultations.

- Secure Digital Messaging: Facilitate convenient, asynchronous communication for inquiries and issue tracking.

- 2024 Data: A notable percentage of customer service interactions were resolved within the first contact across all channels, highlighting efficiency.

First Horizon cultivates deep client relationships through dedicated relationship managers for high-value segments, offering personalized guidance and customized solutions. This high-touch strategy, combined with accessible self-service digital platforms and a consultative advisory approach, fosters trust and loyalty. The bank also strengthens community ties through local investments and financial literacy programs, enhancing its brand reputation and customer engagement.

| Relationship Type | Key Features | 2024 Impact/Focus |

|---|---|---|

| Dedicated Relationship Managers | Personalized guidance, customized solutions for commercial, private banking, and wealth management clients. | Contributed to a 7% increase in cross-selling opportunities in high-value segments. |

| Self-Service Digital Platforms | Online and mobile banking for account management, payments, transfers, and information access. | Boosts convenience and efficiency for routine tasks, appealing to digitally-inclined customers. |

| Advisory & Consultative Approach | Expert insights, strategic advice for wealth management and business banking clients. | Positions First Horizon as a financial partner, aiding client decision-making during market volatility. |

| Community Engagement | Sponsorships, financial literacy initiatives, local investments, and partnerships. | Reinforces corporate citizenship, builds brand loyalty, and supports local economic vitality. |

Channels

First Horizon maintains a significant physical branch network, primarily concentrated in the Southeastern United States. These locations act as crucial hubs for customer interaction, facilitating everything from routine transactions to personalized financial advice and new account acquisitions. As of the first quarter of 2024, the bank operated approximately 400 branches, underscoring their commitment to a tangible, localized banking experience.

The bank's comprehensive online banking portal serves as a vital digital channel, enabling customers to access accounts, conduct transactions, manage payments, and apply for new products from any internet-connected device. This 24/7 accessibility is essential for catering to an increasingly digitally-oriented customer base.

This portal offers a robust suite of self-service functionalities, empowering users to manage their finances efficiently without direct branch interaction. For instance, as of the first quarter of 2024, First Horizon reported that over 70% of its customer transactions were conducted through digital channels, highlighting the portal's significance.

First Horizon's mobile banking application serves as a key channel, offering customers convenient on-the-go access to essential banking services. This includes features like mobile check deposit, personalized account alerts, and seamless peer-to-peer payments, reflecting a commitment to digital convenience.

This channel directly addresses the increasing consumer preference for mobile-first financial interactions, providing unparalleled flexibility and accessibility for everyday money management. By prioritizing these digital touchpoints, First Horizon strengthens its position in a competitive market, aiming to enhance customer engagement and retention through its digital strategy.

Dedicated Relationship Managers and Financial Advisors

Dedicated Relationship Managers and Financial Advisors are the primary channels for First Horizon's commercial, private banking, and wealth management clients. These professionals offer a high-touch, personalized experience, delivering complex financial planning and tailored investment advice. They are instrumental in serving high-value client segments, fostering deep relationships through in-person meetings, phone calls, and secure video conferencing.

These advisors are crucial for client retention and growth, particularly within the affluent and business owner demographics. For instance, in 2024, First Horizon reported continued growth in its wealth management division, with dedicated advisors playing a significant role in attracting and managing substantial assets under management. Their consultative approach ensures clients receive sophisticated guidance aligned with their specific financial goals and risk tolerance.

- Personalized Service: Direct access to a dedicated professional for all financial needs.

- Complex Planning: Expertise in areas like estate planning, retirement strategies, and business succession.

- Investment Guidance: Tailored advice and portfolio management based on individual objectives.

- High-Value Segments: Focus on clients requiring a more in-depth and relationship-driven banking experience.

Call Centers and Customer Service Lines

First Horizon's call centers and customer service lines are staffed by trained representatives ready to help with inquiries, technical issues, and transactions. This human touch remains vital, especially for complex or urgent situations where digital channels fall short. In 2024, First Horizon reported handling millions of customer interactions across all service channels, with a significant portion routed through their call centers, underscoring their importance in providing immediate support and resolving customer needs.

These lines act as a critical safety net, ensuring that every customer has access to personalized assistance. This accessibility is key to maintaining customer satisfaction and loyalty. For instance, in Q1 2024, First Horizon's customer satisfaction scores related to issue resolution via phone support saw a notable increase, highlighting the effectiveness of their trained staff.

- Customer Support Availability: Trained representatives offer assistance for inquiries, technical support, and transactions.

- Urgent Issue Resolution: Call centers are crucial for immediate help when self-service options are insufficient.

- Human Assistance Guarantee: Ensures customers always have access to a person for their needs.

First Horizon utilizes a multi-channel approach, blending physical presence with robust digital offerings and personalized advisory services. This strategy aims to cater to a diverse customer base, from those preferring traditional branch interactions to digitally savvy individuals and high-net-worth clients requiring specialized guidance. The bank's investment in both its branch network, with approximately 400 locations as of Q1 2024, and its digital platforms, where over 70% of transactions occurred digitally in early 2024, reflects this commitment.

| Channel | Description | Key Features/Focus | 2024 Data Point |

|---|---|---|---|

| Physical Branches | Traditional banking locations for transactions and advice. | Customer interaction, new accounts, personalized service. | ~400 locations (Q1 2024) |

| Online Banking Portal | 24/7 digital access to accounts and services. | Self-service transactions, payments, product applications. | >70% of customer transactions (Q1 2024) |

| Mobile Banking App | On-the-go access to essential banking features. | Mobile check deposit, alerts, peer-to-peer payments. | Enhanced customer engagement |

| Relationship Managers/Advisors | Personalized service for commercial, private banking, and wealth clients. | Complex financial planning, investment advice, high-value client focus. | Continued growth in wealth management assets |

| Call Centers/Customer Service | Human support for inquiries and issue resolution. | Immediate assistance, technical support, transaction help. | Millions of customer interactions handled (2024) |

Customer Segments

Individual retail customers form the bedrock of First Horizon's customer base, encompassing a wide spectrum of consumers. This segment ranges from everyday banking users seeking checking and savings accounts, personal loans, and credit cards, to more affluent individuals who require sophisticated financial planning and wealth management services. First Horizon's strategy is to cater to the evolving financial needs of these customers across their entire life journey, from initial savings to retirement planning.

First Horizon actively supports Small and Medium-Sized Businesses (SMBs) by offering a comprehensive suite of commercial banking solutions. These include essential services like business checking and savings accounts, flexible lines of credit, and term loans designed to fuel growth.

Recognizing their vital role in local economies, First Horizon provides tailored treasury management services and financial partnerships. These offerings acknowledge the unique operational hurdles and ambitions of SMBs, ensuring they have the financial tools needed to thrive.

First Horizon serves large corporations and institutions by offering advanced financial solutions like commercial lending and corporate treasury management. These clients need partners for complex operations and growth, often involving substantial transaction volumes and intricate financial arrangements.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for First Horizon, particularly for its private banking and wealth management divisions. These clients typically possess investable assets exceeding $1 million, and they seek a holistic suite of services tailored to their complex financial needs. First Horizon aims to cater to these sophisticated demands by offering comprehensive financial planning, expert investment management, robust trust services, and specialized lending solutions designed to preserve and grow substantial wealth.

The bank recognizes that HNWIs expect a superior level of service, often referred to as a white-glove approach. This means providing highly personalized attention, proactive advice, and access to specialized expertise. For instance, in 2024, the global wealth management industry saw continued growth in demand for bespoke investment strategies and tax-efficient wealth transfer planning, areas where First Horizon focuses its efforts for this demographic.

- Personalized Financial Planning: Tailored strategies addressing retirement, estate planning, and philanthropic goals.

- Sophisticated Investment Management: Access to diverse asset classes and alternative investments.

- Trust and Estate Services: Facilitating wealth transfer and asset protection.

- Specialized Lending: Customized credit solutions, including securities-based lending.

Real Estate Developers and Investors

First Horizon actively courts real estate developers and investors through specialized commercial real estate loans, construction financing, and dedicated property management accounts. This focus leverages the bank's robust mortgage banking infrastructure.

Recognizing the unique demands of this sector, First Horizon offers tailored financial products designed to support the lifecycle of development projects and investment portfolios. Their deep understanding of the real estate market allows for customized solutions.

- Specialized Financing: Offering commercial real estate loans and construction financing, crucial for project funding.

- Industry Expertise: Demonstrating a competitive edge through deep knowledge of the real estate sector.

- Portfolio Support: Providing property management accounts to serve the ongoing needs of investors.

- Market Focus: Targeting a segment that requires specific financial instruments and understanding.

First Horizon serves a broad customer base, including individual retail customers, from those needing basic banking to affluent clients seeking wealth management. They also cater to Small and Medium-Sized Businesses (SMBs) with essential commercial banking services and tailored financial partnerships. Large corporations and institutions benefit from advanced solutions like commercial lending and corporate treasury management.

The bank places significant emphasis on High-Net-Worth Individuals (HNWIs), offering personalized financial planning, sophisticated investment management, and specialized lending. Additionally, First Horizon actively supports real estate developers and investors with tailored financing and accounts, leveraging their expertise in the property market.

| Customer Segment | Key Needs | First Horizon Offerings |

|---|---|---|

| Individual Retail Customers | Everyday banking, personal loans, credit cards, wealth management | Checking/savings accounts, personal loans, credit cards, financial planning |

| Small and Medium-Sized Businesses (SMBs) | Business accounts, lines of credit, growth financing | Business checking/savings, lines of credit, term loans, treasury management |

| Large Corporations & Institutions | Complex financial solutions, substantial transactions | Commercial lending, corporate treasury management |

| High-Net-Worth Individuals (HNWIs) | Wealth preservation, growth, estate planning | Private banking, financial planning, investment management, trust services, specialized lending |

| Real Estate Developers & Investors | Project financing, property management accounts | Commercial real estate loans, construction financing, property management accounts |

Cost Structure

First Horizon's cost structure heavily features employee salaries and benefits, reflecting its substantial workforce. This encompasses compensation for a diverse team, from bankers and financial advisors to essential IT and administrative staff. In 2024, managing these personnel costs efficiently is paramount to attracting and retaining the skilled talent needed to drive the business forward.

First Horizon's technology and infrastructure costs are significant, encompassing the upkeep and enhancement of its core banking systems, digital customer interfaces, and robust cybersecurity defenses. These expenses include vital elements like software licensing, hardware maintenance, cloud service subscriptions, and data center operations, all crucial for seamless and secure banking services.

In 2024, the financial services industry, including institutions like First Horizon, continues to face escalating IT expenditures. For instance, a significant portion of a bank's operating budget is often allocated to technology, with some estimates suggesting it can range from 15% to 25% of total non-interest expense. This investment is non-negotiable for maintaining a competitive edge and ensuring data integrity in an increasingly digital landscape.

First Horizon's branch network operating expenses encompass significant costs such as rent or mortgage payments for its physical locations, along with essential utilities, ongoing maintenance, security measures, and property taxes. These expenditures represent a substantial portion of the bank's overhead, even as digital banking adoption continues to rise.

In 2024, banks like First Horizon continue to grapple with the cost of maintaining a physical presence. While specific figures for First Horizon's branch operating costs aren't publicly itemized in a way that allows for a precise 2024 number, industry trends indicate that these costs remain a key factor in profitability. For instance, general banking industry reports from late 2023 and early 2024 suggest that while some institutions are rightsizing their branch networks, the cost per physical branch, including staff, rent, and utilities, can range from hundreds of thousands to over a million dollars annually, depending on size and location.

The strategic decision of how to optimize this extensive physical footprint remains a critical ongoing consideration for First Horizon. This involves balancing the customer demand for in-person services with the increasing efficiency and lower cost of digital channels, directly impacting the bank's overall cost structure and financial performance.

Marketing and Advertising Expenses

First Horizon’s cost structure heavily relies on marketing and advertising expenses to drive customer acquisition and maintain brand visibility. These costs encompass a wide array of promotional activities, from digital campaigns and social media engagement to traditional print and broadcast advertisements.

In 2024, financial institutions like First Horizon continued to invest significantly in marketing to differentiate themselves in a competitive landscape. For instance, a substantial portion of their budget is allocated to digital marketing, including search engine optimization (SEO), pay-per-click (PPC) advertising, and content marketing, aiming to reach a broad audience and generate leads.

- Digital Marketing Spend: A significant portion of marketing budgets in the banking sector in 2024 was dedicated to online channels.

- Brand Building Initiatives: Costs associated with enhancing brand recognition and customer loyalty through various campaigns are crucial.

- Customer Acquisition Costs: Direct expenses incurred to attract new clients represent a key component of this cost category.

- Sponsorships and Partnerships: Investments in community events and strategic alliances also contribute to marketing expenses.

Regulatory and Compliance Costs

Meeting stringent regulatory requirements is a major expense for First Horizon. This includes costs for legal counsel, compliance officers, and external audits. For instance, in 2023, the banking sector saw increased spending on compliance due to evolving regulations.

Investments in compliance software and ongoing employee training are also substantial. These are crucial for adhering to rules set by bodies like the Federal Reserve and the OCC. For example, many banks allocate a significant portion of their operational budget to technology that supports regulatory reporting and risk management.

- Legal Fees: Costs associated with legal advice and representation to navigate complex banking laws.

- Compliance Staff: Salaries and benefits for dedicated compliance officers and teams.

- Audit Expenses: Fees paid to internal and external auditors to ensure adherence to regulations.

- Technology Investments: Spending on software for monitoring, reporting, and managing compliance risks.

First Horizon's cost structure is significantly influenced by personnel expenses, including salaries and benefits for its diverse workforce. Technology and infrastructure are major cost drivers, covering core banking systems, digital platforms, and cybersecurity. The bank also incurs substantial costs related to its physical branch network, encompassing rent, utilities, and maintenance.

Marketing and advertising are critical for customer acquisition and brand presence, with a notable portion allocated to digital channels. Furthermore, regulatory compliance represents a significant expense, involving legal fees, compliance staff, audits, and technology investments to adhere to evolving financial regulations.

| Cost Category | Key Components | 2024 Relevance/Considerations |

|---|---|---|

| Personnel Expenses | Salaries, benefits, training | Attracting and retaining skilled talent is crucial for business growth. |

| Technology & Infrastructure | Core systems, digital interfaces, cybersecurity | Essential for competitive edge and secure operations; IT spending often 15-25% of non-interest expense. |

| Branch Network Operations | Rent, utilities, maintenance, property taxes | Balancing physical presence with digital efficiency impacts overhead. Costs per branch can range from hundreds of thousands to over a million dollars annually. |

| Marketing & Advertising | Digital campaigns, brand building, customer acquisition | Differentiating in a competitive market requires significant investment, especially in online channels. |

| Regulatory Compliance | Legal fees, compliance staff, audits, technology | Adherence to evolving rules necessitates ongoing investment in expertise and systems. |

Revenue Streams

First Horizon's primary revenue stream is Net Interest Income (NII). This is the profit a bank makes from its lending and borrowing activities, essentially the spread between what it earns on loans and investments and what it pays out on deposits and other borrowings. For the first quarter of 2024, First Horizon reported Net Interest Income of $731 million, a slight decrease from the previous quarter, highlighting the impact of evolving interest rate environments on this core driver.

Service charges and fees are a vital component of First Horizon's revenue, encompassing income from account maintenance, overdrafts, ATM usage, and transaction processing. In 2024, these non-interest income streams are crucial for diversifying earnings beyond traditional interest-based activities, offering a more predictable revenue base.

First Horizon generates revenue through wealth management and investment advisory fees, offering services like financial planning and asset management. These fees, often calculated as a percentage of assets under management, provide a stable, non-interest-dependent income source. For instance, in the first quarter of 2024, the bank reported a 16% increase in non-interest income, with wealth management playing a significant role in this growth.

Mortgage Origination and Servicing Fees

First Horizon generates revenue through mortgage origination, collecting fees such as application and origination charges. They also profit from selling these originated loans into the secondary market. In 2023, the mortgage banking segment saw a notable impact from fluctuating interest rates, affecting origination volumes.

Furthermore, First Horizon earns ongoing fees from servicing mortgage loans on behalf of investors. This servicing income provides a recurring revenue stream. The volume of loans serviced and the prevailing interest rate environment are key drivers for this revenue component.

- Origination Fees: Revenue from processing and closing new mortgage loans.

- Secondary Market Sales: Income from selling originated mortgages to other investors.

- Servicing Fees: Ongoing revenue from managing mortgage payments and escrow for investors.

Commercial Banking Fees

First Horizon generates revenue from commercial banking fees, which are charges for a variety of services offered to businesses and institutions. These fees are a significant contributor to the commercial banking segment's profitability, highlighting the specialized value provided. For instance, in 2024, treasury management services, which help businesses manage their cash flow efficiently, likely generated substantial recurring fee income.

Key revenue streams within this category include:

- Treasury Management Fees: Charges for services like cash concentration, disbursement services, and fraud protection.

- Foreign Exchange Fees: Revenue from facilitating currency transactions for businesses engaged in international trade.

- Letter of Credit Fees: Fees earned by providing financial guarantees for business transactions.

- Corporate Advisory Fees: Income derived from offering strategic financial advice and services to corporate clients.

First Horizon's revenue is multifaceted, extending beyond its core Net Interest Income. Service charges and fees, including those from account maintenance and transactions, contribute significantly, offering a more stable income stream. Wealth management and investment advisory fees, often tied to assets under management, also provide a consistent, non-interest-dependent revenue source, as evidenced by a 16% increase in non-interest income in Q1 2024.

The bank also capitalizes on mortgage banking, earning fees from loan origination and the subsequent sale of these loans in the secondary market, though this segment is sensitive to interest rate fluctuations. Additionally, ongoing mortgage servicing fees offer a recurring revenue stream. Commercial banking fees, particularly from treasury management and foreign exchange services, are crucial for profitability, reflecting specialized value for business clients.

| Revenue Stream | Description | 2024 Data Point (Q1) | 2023 Data Point |

| Net Interest Income (NII) | Profit from lending and borrowing activities | $731 million | N/A |

| Service Charges & Fees | Income from account maintenance, overdrafts, transactions | N/A | Crucial for diversification |

| Wealth Management Fees | Fees from financial planning and asset management | Contributed to 16% non-interest income growth | N/A |

| Mortgage Origination & Sales | Fees from closing loans and selling them | N/A | Impacted by interest rates |

| Mortgage Servicing Fees | Ongoing fees for managing loans | N/A | Recurring revenue |

| Commercial Banking Fees | Charges for business services (e.g., treasury management) | Treasury management likely generated substantial income | N/A |

Business Model Canvas Data Sources

The First Horizon Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse data streams ensure a comprehensive and actionable representation of the business.