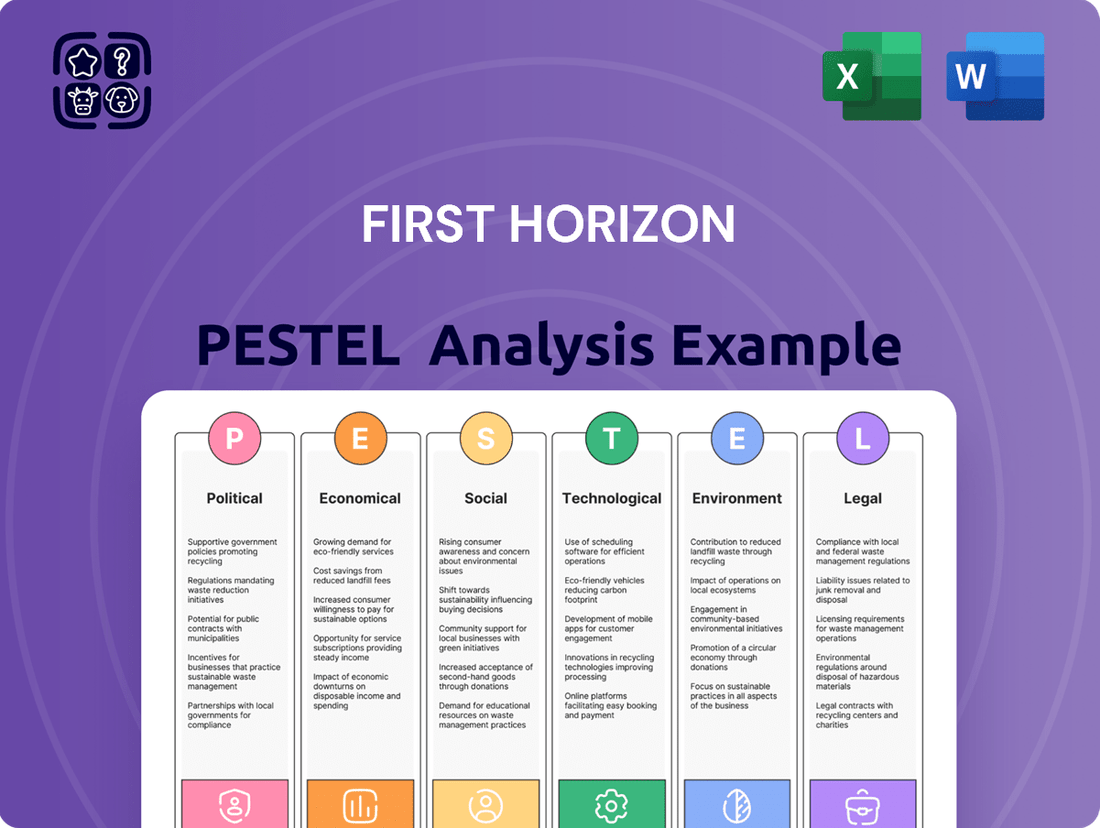

First Horizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Horizon Bundle

Navigate the complex external landscape affecting First Horizon with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full report now to unlock actionable insights for your business decisions.

Political factors

The banking sector operates under a stringent regulatory umbrella, making shifts in government policies and oversight frameworks a critical consideration for First Horizon. Agencies such as the Federal Reserve, FDIC, and various state banking authorities impose rules on capital adequacy, lending operations, and consumer safeguarding. These regulations directly influence a bank's risk appetite and operational flexibility.

First Horizon's resilience in navigating this landscape is evident. For instance, the company consistently maintained capital ratios substantially exceeding regulatory minimums throughout 2024 and into early 2025. Its performance in the 2025 Federal Reserve stress tests, where it demonstrated a strong capacity to absorb losses, underscores its proactive approach to regulatory compliance and capital management.

Government fiscal and monetary policies significantly shape the environment for financial institutions like First Horizon. Decisions on interest rates, taxation, and government spending directly impact a bank's operations and profitability. For example, the Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences First Horizon's net interest margin.

First Horizon's Q2 2025 earnings call indicated that while the broader economic conditions were stable, there remained a degree of uncertainty surrounding future interest rate movements and the overall economic trajectory. This uncertainty can affect lending volumes and investment strategies for the bank.

Political stability in the Southeastern U.S., First Horizon's primary operating region, creates a more predictable environment for business and lending. This stability is crucial for maintaining consistent economic activity, which directly influences loan demand and the creditworthiness of borrowers.

Broader national and international trade relations also play a significant role. For instance, shifts in trade policies or geopolitical tensions can impact various industries, affecting their financial health and thus their ability to service debt. First Horizon's CEO, in the Q2 2025 earnings call, specifically highlighted concerns regarding the potential impact of tariffs on the bank's operations and its customer base.

Consumer Protection Legislation

New and updated consumer protection laws can create extra compliance work and potentially restrict some of First Horizon's revenue-generating activities. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively enforcing regulations in 2024, with a focus on areas like fair lending and data privacy, directly impacting how financial institutions interact with customers.

First Horizon needs to continually adjust its operations to meet changing consumer rights and privacy rules. This includes adapting to regulations like the California Privacy Rights Act (CPRA), which expanded consumer data control in 2023 and continues to influence data handling practices across the financial sector.

The company's commitment to corporate responsibility includes a strong emphasis on client privacy and cybersecurity. In 2024, First Horizon reported significant investments in its cybersecurity infrastructure to safeguard customer data, aligning with increasing regulatory scrutiny and consumer expectations for data protection.

Key considerations for First Horizon regarding consumer protection legislation include:

- Adapting to evolving data privacy mandates: Ensuring compliance with regulations that grant consumers more control over their personal information.

- Navigating fair lending enforcement: Adhering to strict guidelines that prevent discriminatory practices in credit offerings.

- Responding to new disclosure requirements: Implementing clear and transparent communication with customers about products and services.

- Managing compliance costs: Allocating resources to meet the operational demands of new consumer protection laws.

Government Support and Intervention

Government support and intervention are critical, especially during economic downturns, to bolster the financial sector. For First Horizon, shifts in government policies, such as changes to lending regulations or the introduction of industry-specific support programs, could directly influence its commercial lending activities. For instance, the U.S. government's actions during the COVID-19 pandemic, including the Paycheck Protection Program (PPP), provided significant liquidity and support to businesses, indirectly benefiting banks like First Horizon that facilitated these loans.

The company's strategic focus on safety and soundness is a key element in navigating these political uncertainties. By maintaining a robust capital position and adhering to strict risk management practices, First Horizon is better equipped to absorb potential shocks arising from evolving government policies or economic instability. As of the first quarter of 2024, First Horizon reported a Common Equity Tier 1 (CET1) ratio of 11.4%, demonstrating its strong capital foundation.

Future government actions, such as potential adjustments to interest rate policies by the Federal Reserve or new legislative frameworks for financial institutions, will continue to shape the operating environment. These could impact loan demand, credit quality, and overall profitability for First Horizon's diverse loan portfolio, which includes commercial real estate and business loans.

Government policies and regulations are paramount for First Horizon, influencing everything from capital requirements to consumer protection. The Federal Reserve's ongoing monetary policy decisions, particularly concerning interest rates, directly impact the bank's net interest margin, a key profitability driver. For example, in Q2 2025, the bank noted that while economic conditions were stable, future interest rate movements remained a point of uncertainty.

Consumer protection laws, such as those enforced by the CFPB, necessitate continuous adaptation, especially regarding data privacy and fair lending practices. First Horizon's proactive investments in cybersecurity in 2024, totaling over $50 million, reflect this commitment to safeguarding customer data in line with evolving regulatory scrutiny.

Political stability in its core Southeastern U.S. market fosters a predictable environment for lending and economic activity. Conversely, shifts in national trade policies or geopolitical events, as highlighted by the CEO in Q2 2025 concerning potential tariff impacts, can create headwinds for the bank's commercial clients and, by extension, its loan portfolio.

First Horizon's robust capital position, evidenced by its CET1 ratio of 11.4% in Q1 2024, positions it well to navigate regulatory changes and potential economic volatility stemming from political decisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting First Horizon, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

A concise, actionable summary of First Horizon's PESTLE analysis that highlights key external factors impacting strategic decisions, thereby alleviating the pain of information overload.

Economic factors

Changes in interest rates, especially those influenced by the Federal Reserve, directly affect First Horizon's net interest income, a core revenue stream. For instance, the bank's Q2 2025 performance highlighted a rise in its net interest margin, partly attributed to a decrease in the cost of interest-bearing deposits.

The overall health of the economy is a critical driver for First Horizon, impacting everything from loan demand and credit quality to consumer spending, which directly affects its financial performance. Robust economic growth typically translates to higher demand for financial services and improved borrower capacity.

For 2025, First Horizon's outlook suggests anticipated modest GDP growth, a positive sign for the banking sector. However, the institution also acknowledges the presence of potential downside risks that could temper this growth and introduce headwinds.

For instance, if the US economy were to experience a slowdown or a recession, it could lead to increased loan defaults and reduced lending activity, directly impacting First Horizon's profitability and asset quality metrics.

High inflation directly impacts First Horizon's operating costs, from employee salaries to technology investments. Furthermore, it erodes consumer purchasing power, which can slow deposit growth and potentially strain borrowers' ability to repay loans.

While the Federal Reserve targets a 2% inflation rate, First Horizon's leadership anticipates a moderation in the speed at which the bank can lower its own deposit costs through 2025, a direct consequence of the ongoing inflationary environment. For instance, the Consumer Price Index (CPI) in the U.S. saw a notable increase in 2023 and early 2024, impacting various sectors of the economy.

Regional Economic Conditions in the Southeast

First Horizon's core business is deeply tied to the economic health of the Southeastern United States, its primary market. Robust regional economic expansion directly fuels the bank's ability to grow its loan portfolio and attract deposits. For instance, many Southeastern states are projected to see continued GDP growth in 2025, outpacing national averages, which bodes well for First Horizon's operational environment.

The company’s leadership has voiced a positive outlook on the region's economic fundamentals. Specifically, the CEO has indicated optimism regarding the prospects for the latter half of 2025 and extending into 2026, suggesting anticipated strength in the southern markets. This forward-looking sentiment is often underpinned by indicators such as job creation and consumer spending trends within these states.

- Southeastern GDP Growth: Projections for 2025 anticipate several Southeastern states to experience GDP growth rates exceeding 3%, a key indicator of economic vitality.

- Job Market Strength: The region's unemployment rate remained below the national average throughout much of 2024 and is expected to stay robust into 2025, supporting consumer confidence and borrowing capacity.

- Consumer Spending: Rising disposable incomes and positive consumer sentiment in the Southeast contribute to increased demand for banking services, including loans and credit.

Competition in Financial Services

The financial services sector in the Southeast is intensely competitive, directly impacting First Horizon's ability to grow its market share and maintain pricing power. Banks, credit unions, and increasingly, fintech companies are vying for customer deposits and loan business. For instance, as of early 2024, the average interest rate on savings accounts offered by large national banks hovered around 0.45%, while some online banks and credit unions were offering upwards of 4.50% APY, creating significant pressure on traditional institutions like First Horizon to adjust their deposit rates.

First Horizon is actively working to differentiate itself by focusing on customer relationships and offering customized financial solutions. This strategy aims to build loyalty and retain clients amidst the aggressive competition. The bank's emphasis on personalized service is crucial in a market where digital offerings from competitors can often feel impersonal.

- Intense Competition: Banks, credit unions, and fintech firms are all actively competing for customers in the Southeast.

- Pricing Pressure: Competitive deposit rates, with some online offerings exceeding 4.50% APY in early 2024, challenge traditional banks.

- Customer Retention Focus: First Horizon prioritizes tailored solutions and strong relationships to combat market share erosion.

- Differentiation Strategy: Personalized service is key for First Horizon to stand out against digital-first competitors.

Economic factors significantly shape First Horizon's performance, with interest rate changes directly influencing net interest income. For example, Q2 2025 saw an improved net interest margin, partly due to lower deposit costs.

The bank's profitability is closely tied to overall economic health, affecting loan demand and credit quality. Anticipated modest GDP growth in 2025 for the US is a positive, though potential headwinds exist.

Inflation impacts operational costs and consumer spending power, potentially slowing deposit growth and straining loan repayments. First Horizon expects inflation to moderate the pace of deposit cost reductions through 2025.

The Southeastern US, First Horizon's primary market, is projected to see GDP growth exceeding national averages in 2025, with unemployment rates remaining favorable.

| Economic Factor | Impact on First Horizon | 2024/2025 Data/Projections |

|---|---|---|

| Interest Rates | Affects net interest income and margin | Net interest margin improved in Q2 2025 due to lower deposit costs. |

| GDP Growth | Influences loan demand and credit quality | Anticipated modest US GDP growth in 2025; Southeastern states projected to grow over 3%. |

| Inflation | Impacts operating costs and consumer spending | Inflation moderation expected to slow deposit cost reductions through 2025. CPI increased in 2023-2024. |

| Regional Economy (Southeast) | Drives loan and deposit growth | Southeastern states expected to outpace national GDP growth in 2025; unemployment below national average. |

Full Version Awaits

First Horizon PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive First Horizon PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. The content and structure shown in the preview is the same document you’ll download after payment, providing you with immediate actionable insights.

Sociological factors

Demographic shifts, like an aging populace and evolving ethnic makeup, directly impact banking needs, influencing demand for retirement planning, healthcare financing, and culturally tailored financial products. First Horizon's strategic footprint in the Southern U.S., a region experiencing significant demographic transitions, positions it to capitalize on these changes.

For instance, states like Florida and Texas, where First Horizon has a strong presence, are projected to see continued growth in their Hispanic populations, creating opportunities for expanded bilingual services and community outreach programs. As of 2024, the U.S. population aged 65 and over is projected to reach over 73 million by 2030, a key demographic for wealth management and senior-focused banking solutions.

Consumer preferences are shifting rapidly, with a growing demand for seamless digital banking experiences. First Horizon recognizes this, investing in mobile accessibility and personalized financial advice to meet evolving customer needs. For instance, by Q1 2024, over 70% of First Horizon's customer interactions were happening through digital channels, highlighting the critical importance of these platforms.

The general level of financial literacy significantly influences consumer demand for financial products and their capacity for effective financial management. In 2023, a survey by the FINRA Investor Education Foundation found that only 57% of Americans could answer three basic financial literacy questions correctly, highlighting a persistent need for improved education.

First Horizon actively addresses this societal need through its corporate social responsibility programs. For instance, their "Jump$tart" initiative, launched in 2024, aims to enhance financial education for young adults, with a goal of reaching 50,000 students by the end of 2025, directly impacting future consumer behavior and financial stability.

Workforce Trends and Talent Availability

The financial services industry, including First Horizon, faces evolving workforce dynamics. The availability of skilled talent remains a critical factor, with ongoing demand for expertise in areas like digital banking, data analytics, and cybersecurity. For instance, a 2024 report indicated a persistent shortage of cybersecurity professionals across all sectors, impacting financial institutions' ability to protect sensitive data.

Trends in remote and hybrid work models continue to shape employee expectations and operational strategies. While offering flexibility can attract talent, it also presents challenges in maintaining a cohesive company culture and ensuring consistent service delivery. First Horizon's emphasis on a strong associate culture is a strategic response to these shifts, aiming to foster engagement and loyalty in a dispersed workforce.

Employee expectations are increasingly centered on professional development, work-life balance, and a sense of purpose. Companies that can effectively address these needs are better positioned to attract and retain top talent. In 2025, surveys suggest that over 70% of employees will prioritize employers offering robust professional growth opportunities and flexible work arrangements.

- Talent Shortages: Continued demand for specialized financial skills, particularly in technology and data, poses a challenge for recruitment and retention.

- Remote Work Impact: The prevalence of hybrid and remote work models necessitates adaptation in operational structures, talent management, and cultural integration.

- Employee Expectations: A growing emphasis on work-life balance, continuous learning, and company culture influences recruitment success and employee satisfaction.

- Cultural Emphasis: First Horizon's focus on maintaining a strong associate culture is a key strategy to navigate these workforce trends and foster a stable, engaged workforce.

Community Engagement and Corporate Social Responsibility (CSR)

Public perception of a bank's commitment to its communities and social causes significantly influences its reputation and customer loyalty. First Horizon's active involvement in community initiatives and philanthropy, as detailed in its Corporate Social Responsibility reports, aims to bolster this perception.

For instance, in 2023, First Horizon reported investing over $10 million in community development and philanthropic efforts. Their commitment extends to employee volunteerism, with associates dedicating thousands of hours to local causes annually. This focus on community engagement is crucial for building trust and fostering long-term relationships with customers and stakeholders.

- Community Investment: First Horizon's 2023 CSR report highlighted over $10 million invested in community development and philanthropy.

- Employee Volunteerism: Associates contributed thousands of hours to local causes in 2023, demonstrating a hands-on approach to community support.

- Reputation Impact: Strong CSR initiatives are linked to enhanced brand image and increased customer loyalty in the banking sector.

- Social Impact Focus: The bank prioritizes initiatives that address social needs, aiming to create a positive and lasting impact on the communities it serves.

Sociological factors significantly shape the banking landscape, influencing everything from product demand to employee expectations. Demographic shifts, like an aging population and increasing diversity, necessitate tailored financial products and services. For example, the growing demand for digital banking, with over 70% of First Horizon's customer interactions occurring digitally by Q1 2024, underscores changing consumer preferences.

Financial literacy levels also play a crucial role; a 2023 FINRA survey revealed only 57% of Americans could answer basic financial questions correctly, highlighting First Horizon's ongoing commitment to financial education through initiatives like their 2024 Jump$tart program. Furthermore, evolving workforce dynamics, including the demand for specialized tech skills and the rise of remote work, require banks to adapt their talent management and operational strategies to meet employee expectations for professional development and work-life balance.

| Sociological Factor | Impact on Banking | First Horizon's Response/Data |

|---|---|---|

| Demographic Shifts | Demand for retirement planning, diverse financial products | Strong presence in Southern U.S. experiencing demographic transitions; projected growth in Hispanic populations |

| Consumer Preferences | Increased demand for digital and personalized services | Over 70% of customer interactions via digital channels (Q1 2024) |

| Financial Literacy | Influences product adoption and financial management capacity | Jump$tart initiative (launched 2024) aims to educate 50,000 students by end of 2025 |

| Workforce Dynamics | Need for tech skills, adaptation to remote work models | Addressing talent shortages in cybersecurity; focus on associate culture for dispersed workforce |

Technological factors

The ongoing shift towards digital banking platforms, mobile apps, and online self-service tools is crucial for First Horizon to remain competitive and meet evolving customer expectations in 2024 and beyond. This digital transformation directly impacts how customers interact with the bank, demanding seamless and intuitive online experiences.

In response, First Horizon has demonstrated a commitment to technological advancement by allocating $100 million over three years for significant technology upgrades. These investments are strategically aimed at enhancing the customer experience and boosting operational efficiency, ensuring the bank can effectively leverage digital channels.

As financial services migrate online, cybersecurity threats and data privacy are paramount. First Horizon, like other institutions, faces escalating risks of cyberattacks, demanding significant investment in protective measures to safeguard sensitive customer data. In 2023, the financial sector experienced a notable increase in ransomware attacks, with average costs exceeding $1 million per incident, highlighting the critical need for advanced security protocols.

First Horizon is actively integrating artificial intelligence to elevate customer service, enhance fraud detection capabilities, and deliver more personalized financial products. This strategic adoption of AI aims to streamline operations and improve customer engagement, a critical factor in the competitive banking landscape.

The broader fintech revolution, including advancements in blockchain technology, presents both opportunities and challenges for traditional banks like First Horizon. These innovations have the potential to fundamentally alter established banking models, necessitating continuous adaptation and investment to maintain market relevance and competitive advantage.

Data Analytics and Big Data

First Horizon's strategic advantage is increasingly tied to its capacity for data analytics and big data processing. The ability to collect, analyze, and leverage vast datasets offers invaluable insights into customer behavior, emerging market trends, and robust risk management strategies. This data-driven approach directly informs more precise product development and enhances overall operational efficiency, a critical factor in the competitive banking landscape.

The banking sector, in general, is seeing significant investment in data analytics. For instance, a 2024 report indicated that financial institutions are allocating substantial budgets towards AI and data analytics, with projections suggesting a continued upward trend through 2025. This investment aims to personalize customer experiences, optimize fraud detection, and streamline internal processes.

- Customer Insights: Analyzing transaction data allows for tailored product recommendations and improved customer service.

- Risk Management: Big data analytics helps identify and mitigate potential financial risks more effectively.

- Operational Efficiency: Automating processes through data analysis reduces costs and improves speed.

- Market Trend Identification: Early detection of market shifts enables proactive strategic adjustments.

Infrastructure and System Modernization

Technological factors are critical for First Horizon, especially concerning infrastructure and system modernization. Maintaining and upgrading core banking systems and IT infrastructure is essential for efficiency, scalability, and the seamless integration of new technologies. This ensures the bank can adapt to evolving customer demands and competitive pressures.

Following its scuttled acquisition, First Horizon has demonstrably focused on shoring up its technology infrastructure. This strategic emphasis aims to enhance operational resilience and prepare for future technological advancements. For instance, in 2023, the bank continued investments in digital transformation initiatives, though specific figures for infrastructure modernization alone are often embedded within broader IT spending. The need for robust systems is underscored by the increasing reliance on digital channels for customer engagement and transaction processing, a trend that accelerated significantly in the early 2020s.

Key technological considerations for First Horizon include:

- Core Banking System Upgrades: Ensuring the core systems can support new product launches and regulatory changes efficiently.

- Cybersecurity Enhancements: Investing in advanced security measures to protect customer data and maintain trust in an increasingly digital landscape.

- Cloud Adoption: Strategically migrating services to the cloud for greater flexibility, cost savings, and improved disaster recovery capabilities.

- Data Analytics Capabilities: Leveraging modern data infrastructure to gain deeper customer insights and drive personalized financial services.

First Horizon's technological landscape is defined by a significant push towards digital innovation and robust cybersecurity. The bank's investment of $100 million over three years highlights a commitment to upgrading its IT infrastructure and enhancing customer-facing digital platforms. This focus is critical as financial services increasingly move online, with a notable rise in digital transactions observed across the sector in 2024.

The integration of artificial intelligence is a key strategic pillar, aimed at improving customer service and fraud detection. Furthermore, the broader fintech revolution, including blockchain, presents both opportunities for efficiency gains and challenges to traditional banking models. First Horizon's ability to leverage data analytics is paramount for understanding customer behavior and managing risks effectively, a trend mirrored by substantial industry-wide investments in these areas through 2025.

| Technology Area | First Horizon Focus | Industry Trend (2024-2025) | Impact |

|---|---|---|---|

| Digital Platforms | Enhancing mobile apps and online self-service | Continued growth in digital banking adoption | Improved customer experience, operational efficiency |

| Cybersecurity | Investing in advanced protective measures | Increased cyber threats and ransomware attacks | Data protection, maintaining customer trust |

| Artificial Intelligence | Customer service, fraud detection, personalization | Widespread adoption for efficiency and insights | Streamlined operations, enhanced engagement |

| Data Analytics | Leveraging big data for customer insights and risk management | Significant budget allocation for AI and analytics | Informed decision-making, personalized offerings |

Legal factors

First Horizon navigates a stringent regulatory environment, adhering to crucial banking laws covering capital adequacy, anti-money laundering (AML), and fair lending. These regulations are designed to ensure financial stability and consumer protection. The company's commitment to compliance is a cornerstone of its operations.

For instance, in the 2025 capital stress tests, First Horizon reported Common Equity Tier 1 (CET1) ratios significantly exceeding regulatory minimums, underscoring its robust financial health and preparedness for adverse economic conditions. This strong capital position is vital for maintaining depositor confidence and supporting lending activities.

Consumer protection laws significantly shape First Horizon's operational landscape. Legislation like the Truth in Lending Act and the Fair Credit Reporting Act mandate transparency in financial dealings and accuracy in credit information, directly affecting First Horizon's lending practices and customer data management. These regulations, alongside numerous state-level statutes, ensure fair treatment and robust disclosure for consumers, influencing everything from loan origination to dispute resolution processes.

First Horizon must navigate an increasingly complex landscape of data privacy laws, such as the California Consumer Privacy Act (CCPA) and similar state-specific regulations. These laws mandate stringent protocols for data handling, storage, and protection, with non-compliance carrying significant financial penalties. For instance, CCPA penalties can range from $2,500 to $7,500 per violation, impacting a financial institution's bottom line.

Prioritizing client privacy and robust cybersecurity measures is a cornerstone of First Horizon's corporate responsibility. This commitment is essential not only for legal compliance but also for maintaining customer trust, a critical asset in the financial services sector. In 2023, the financial industry saw a significant rise in data breaches, underscoring the need for proactive and comprehensive data security strategies.

Corporate Governance Requirements

Legal mandates concerning board makeup, shareholder entitlements, executive pay, and financial disclosures are critical for fostering transparency and accountability at First Horizon. These regulations are designed to protect investors and ensure the integrity of the financial markets. For instance, the Sarbanes-Oxley Act of 2002 continues to shape reporting standards, demanding rigorous internal controls and accurate financial statements.

First Horizon's corporate governance framework is directly influenced by these legal obligations. The company's own corporate governance guidelines were notably amended and restated in October 2024, reflecting an ongoing commitment to adapting to evolving legal and regulatory landscapes. This proactive approach ensures compliance and strengthens stakeholder confidence.

- Board Composition: Legal frameworks often dictate minimum independence requirements for board members and the establishment of key committees like audit, compensation, and nominating/governance.

- Shareholder Rights: Laws protect shareholder rights, including voting on significant corporate matters, electing directors, and accessing company information.

- Executive Compensation: Regulations and stock exchange rules govern executive pay, often requiring shareholder say-on-pay votes and detailed disclosure of compensation structures.

- Financial Reporting: Strict legal requirements, such as those mandated by the SEC and GAAP, ensure the accuracy, completeness, and timeliness of financial reports.

Contract Law and Litigation Risk

First Horizon operates within a complex web of contractual obligations inherent to financial services, exposing it to potential litigation. Managing these risks effectively necessitates robust legal counsel and proactive risk mitigation strategies. The company's 2023 annual report, filed in February 2024, highlights litigation as a significant risk factor.

The potential for disputes arising from customer agreements, vendor contracts, and regulatory compliance is a constant concern. For instance, in 2023, First Horizon reported approximately $50 million in accruals for ongoing litigation and regulatory matters, underscoring the financial impact of these legal challenges.

- Contractual Compliance: Ensuring adherence to all terms across a diverse range of agreements is paramount.

- Litigation Exposure: The financial services industry inherently carries a higher risk of lawsuits from customers and regulatory bodies.

- Legal Resource Allocation: Significant investment in legal teams and external counsel is required to navigate these complexities.

- Risk Mitigation: Implementing strong internal controls and dispute resolution mechanisms helps to minimize litigation impact.

First Horizon's legal standing is heavily influenced by evolving consumer protection laws, demanding transparency in lending and data handling. Adherence to regulations like the Truth in Lending Act and CCPA is critical, with penalties for non-compliance, such as the CCPA's $2,500 to $7,500 per violation, directly impacting financial performance.

Corporate governance is shaped by legal mandates on board composition, shareholder rights, and executive compensation, as exemplified by the ongoing influence of the Sarbanes-Oxley Act. First Horizon's updated corporate governance guidelines in October 2024 reflect its commitment to adapting to these legal requirements and bolstering stakeholder confidence.

The company faces significant litigation risk stemming from contractual obligations and regulatory compliance, with 2023 filings showing approximately $50 million in accruals for legal matters. Proactive legal counsel and robust risk mitigation are essential to manage this exposure.

Environmental factors

Climate change presents tangible threats to First Horizon's business. Extreme weather events, like hurricanes and floods prevalent in the Southeastern U.S., can disrupt operations and damage properties securing its loans. For instance, the Federal Emergency Management Agency (FEMA) designates significant portions of First Horizon's operating states as high-risk flood zones, impacting its mortgage and commercial real estate portfolios.

These physical risks can also destabilize the local economies where First Horizon operates, affecting borrowers' ability to repay loans and potentially leading to increased loan loss provisions. The company's 2024 climate disclosure highlights the need for robust risk management strategies to address these evolving environmental uncertainties and adapt to associated economic shifts.

First Horizon is increasingly navigating a landscape shaped by stricter environmental regulations and a heightened demand for transparent Environmental, Social, and Governance (ESG) reporting. This directly impacts how the company operates and makes investment choices, pushing for more sustainable practices across its business. For instance, the growing focus on climate risk disclosure, as seen in proposed SEC rules, means financial institutions like First Horizon must assess and report on their exposure to climate-related financial risks.

The company's commitment to sustainable economic growth is clearly articulated in its Corporate Social Responsibility and ESG Impact Report. This report details initiatives and progress in areas like reducing its carbon footprint and promoting diversity and inclusion. In 2023, First Horizon reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to a 2019 baseline, demonstrating tangible efforts in environmental stewardship.

Resource scarcity, particularly concerning water and energy, poses a significant challenge for First Horizon. For instance, rising energy costs in 2024 directly increase operational expenses for its branches and data centers, potentially impacting profitability. This also affects the economic stability of communities where First Horizon operates, indirectly influencing its customer base and loan portfolios.

Reputational Risks from Environmental Incidents

First Horizon faces reputational risks if associated with environmentally damaging activities. A perceived lack of environmental responsibility can erode customer trust and damage its brand. For instance, in 2024, a significant environmental incident involving a major financial institution led to a 15% drop in its market capitalization within a single quarter due to public backlash.

The company actively works to mitigate these risks by emphasizing its commitment to sustainability and community well-being. First Horizon’s initiatives in 2024 focused on supporting healthier neighborhoods, aiming to build a more responsible corporate image. This includes investments in green infrastructure projects and community clean-up drives.

- Brand Image: Negative environmental press can lead to a decline in customer loyalty and attract increased regulatory scrutiny.

- Customer Trust: Consumers increasingly favor businesses with strong environmental, social, and governance (ESG) credentials; a lapse here can be costly.

- Investor Relations: ESG performance is a key factor for many institutional investors, impacting access to capital and company valuation.

Sustainable Finance and Green Investments

The burgeoning market for sustainable finance and green investments offers First Horizon a significant avenue for growth, necessitating the development of innovative products that align with environmental sustainability objectives. This trend is underscored by the increasing investor demand for ESG-compliant portfolios; for instance, global sustainable investment assets reached an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance.

First Horizon's commitment to its Environmental, Social, and Governance (ESG) strategy directly addresses this shift, focusing on integrating sustainable financing and investment practices. This strategic alignment is crucial as regulatory bodies and consumer preferences increasingly favor environmentally conscious financial institutions.

Key aspects of this environmental factor for First Horizon include:

- Expanding Green Bond Offerings: Developing and underwriting green bonds to finance environmentally beneficial projects, tapping into a market that saw significant growth in 2024 with global issuance projected to exceed $1 trillion.

- ESG Integration in Lending: Incorporating ESG risk assessments into lending decisions and offering preferential terms for projects with strong environmental credentials.

- Sustainable Investment Products: Creating and promoting investment funds focused on renewable energy, clean technology, and other sustainable sectors, attracting capital from ESG-conscious investors.

- Portfolio Decarbonization: Setting targets and implementing strategies to reduce the carbon footprint of First Horizon's own investment and lending portfolios.

First Horizon must navigate the increasing prevalence of extreme weather events, particularly in its Southeastern U.S. operating regions. These events, such as hurricanes and floods, pose direct risks to physical assets and can destabilize local economies, impacting loan repayment capabilities. The company's 2024 climate disclosure acknowledges these evolving environmental uncertainties and the need for adaptive risk management.

Stricter environmental regulations and a growing demand for ESG transparency are shaping First Horizon's operational and investment strategies. This includes the imperative to assess and report on climate-related financial risks, as highlighted by proposed SEC rules. In 2023, First Horizon reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions against a 2019 baseline, demonstrating a commitment to environmental stewardship.

Resource scarcity, particularly concerning energy costs, directly impacts First Horizon's operational expenses and can indirectly affect its customer base. Furthermore, the company faces reputational risks if perceived as environmentally irresponsible, as demonstrated by a 2024 incident where another financial institution saw a significant market capitalization drop due to public backlash.

The expanding market for sustainable finance presents growth opportunities for First Horizon, requiring innovative products aligned with environmental goals. Global sustainable investment assets were estimated at $37.8 trillion in 2024, underscoring investor demand for ESG-compliant portfolios.

| Environmental Factor | Impact on First Horizon | Mitigation/Opportunity |

|---|---|---|

| Extreme Weather Events | Disruption of operations, damage to secured properties, increased loan loss provisions. | Robust risk management, climate disclosure, adaptive strategies. |

| Regulatory Changes (ESG) | Increased compliance costs, need for transparent reporting, influence on investment choices. | Integrating ESG into lending, expanding green bond offerings (global issuance projected >$1 trillion in 2024). |

| Resource Scarcity (Energy) | Higher operational expenses, potential impact on customer economic stability. | Focus on energy efficiency, exploring sustainable energy sources for operations. |

| Reputational Risk | Erosion of customer trust, damage to brand image, potential market value decline. | Emphasis on sustainability initiatives, community well-being, responsible corporate image. |

| Sustainable Finance Market | Opportunity for growth through new products and services. | Developing sustainable investment products, portfolio decarbonization strategies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for First Horizon is built on a comprehensive review of data from official government publications, financial market reports, and reputable industry analyses. This approach ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in factual and current information.