First Horizon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Horizon Bundle

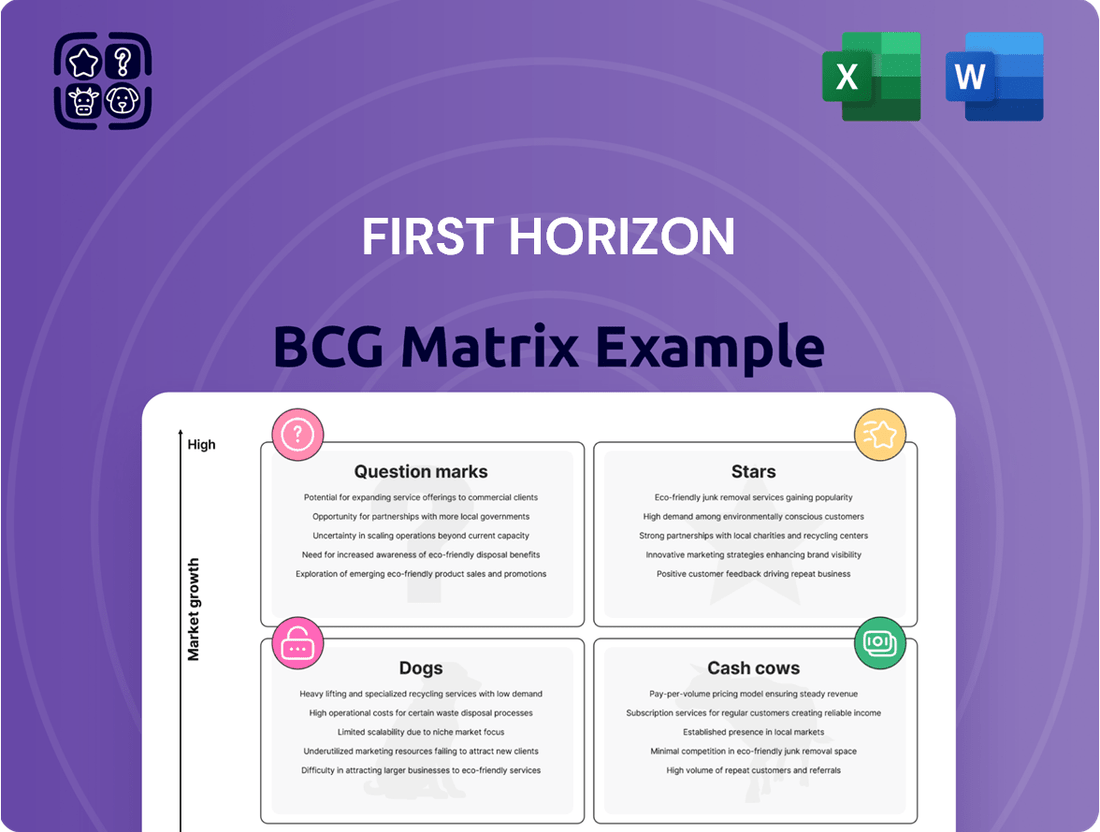

This glimpse into First Horizon's BCG Matrix highlights key product positioning, but the full report unlocks a comprehensive strategic roadmap. Understand exactly which products are your Stars, Cash Cows, Dogs, and Question Marks to make informed decisions about resource allocation and future growth.

Don't stop at the overview; invest in the complete First Horizon BCG Matrix to gain actionable insights and data-driven recommendations. This detailed analysis will empower you to optimize your portfolio and drive sustainable success in today's competitive landscape.

Stars

First Horizon's commercial banking arm is strategically situated to benefit from the booming Southeastern U.S. economy. This region's rapid population influx and expanding economic base present a fertile ground for commercial lending opportunities.

Data from the Sixth District, encompassing much of the Southeast, showed loan growth that not only held steady in late 2024 but consistently outperformed national trends. This resilience underscores the vibrant commercial lending landscape First Horizon operates within.

First Horizon's wealth and trust management services are designed for high-net-worth individuals and institutions, a segment known for its profitability and increasing need for advanced financial guidance. While precise market share figures for this specific service are not publicly available, the company's robust suite of offerings and dedication to client relationships highlight its strategic focus on this high-margin sector.

This segment is poised for growth, especially as regional wealth continues to accumulate, making it a key area for First Horizon's future revenue generation. For instance, the U.S. wealth management industry saw significant inflows in 2023, with many firms reporting substantial growth in assets under management for their affluent client segments.

First Horizon is strategically allocating $100 million across three years for technology and digital upgrades. These investments are designed to significantly enhance customer experience and streamline operations, crucial for capturing new clients and staying ahead in the dynamic financial sector.

This robust investment in digital capabilities, particularly in a market experiencing substantial growth in digital banking services, positions these areas as strong contenders for future leadership within the industry.

'DeliverExcellence Retail' Initiative

The 'DeliverExcellence Retail' initiative, launched in early 2024, has been a key driver for First Horizon's retail banking operations. This program is designed to elevate both the client and associate experience, directly impacting customer acquisition and retention efforts.

Early results from 'DeliverExcellence Retail' are promising, with a notable 5-point increase in client satisfaction scores observed. Furthermore, the initiative has successfully generated a significant volume of teller referrals, indicating enhanced engagement and service quality.

- Client Satisfaction: A 5-point increase observed since the initiative's inception in early 2024.

- Referral Generation: Significant increase in teller-driven customer referrals.

- Strategic Focus: Enhancing client and associate experience to drive acquisition and retention.

- Market Potential: Positioned to capture increased market share in the growing regional consumer banking sector.

Fixed Income Business Operations

First Horizon's fixed income operations have demonstrated robust performance, largely driven by market volatility. This segment is anticipated to sustain its strong trajectory, mirroring the success seen in 2024.

As a key component of their capital markets division, the fixed income business navigates a dynamic landscape. Success here hinges on specialized knowledge and swift adaptation to market shifts, directly impacting revenue generation.

The segment's capacity to flourish amidst fluctuating market conditions underscores a solid market standing.

- Strong 2024 Performance: First Horizon's fixed income business capitalized on market volatility, achieving significant gains.

- Continued Momentum: Projections indicate a sustained strong performance for the fixed income segment, building on 2024's success.

- Capital Markets Synergy: This segment is integral to First Horizon's capital markets offerings, benefiting from cross-divisional strengths.

- Market Responsiveness: Expertise and agility in a dynamic market are critical for revenue growth in fixed income operations.

First Horizon's commercial banking and wealth management services are positioned as Stars within the BCG Matrix. The commercial banking arm benefits from the robust economic growth in the Southeastern U.S., a region that saw loan growth outperforming national trends in late 2024. Similarly, wealth and trust management is a high-growth area, as evidenced by the U.S. wealth management industry's significant inflows in 2023, particularly within affluent client segments.

| Business Unit | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Commercial Banking (Southeast) | High | Strong (Outperforming national trends) | Star |

| Wealth & Trust Management | High (Growing affluent segment) | Strong (Focus on high-margin sector) | Star |

What is included in the product

First Horizon's BCG Matrix offers a strategic overview of its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

Visualize your business portfolio to identify underperforming units and reallocate resources effectively.

Cash Cows

First Horizon's established consumer banking operations, featuring checking and savings accounts, are a cornerstone in its mature Southeastern U.S. markets. These services are a reliable source of deposits and revenue, benefiting from a loyal customer base. In 2023, First Horizon reported total deposits of $73.6 billion, showcasing the significant scale of these foundational operations.

First Horizon's mortgage banking segment acts as a significant cash cow, generating substantial revenue and cash flow from origination, servicing, and sales, despite its sensitivity to interest rate fluctuations.

This segment benefits from an established infrastructure and client base, allowing it to produce considerable cash without needing significant new market development. For instance, in Q1 2024, First Horizon reported mortgage banking revenue of $103 million, showcasing its consistent contribution.

The company's diversified loan portfolio, which includes loans to mortgage companies, further strengthens this segment by providing a buffer against stresses on pre-provision net revenue.

First Horizon's efficient expense management and a robust net interest margin (NIM) position it favorably within the BCG matrix. In Q1 2025, the company reported a strong NIM of 3.42%, demonstrating its ability to effectively price its loans and manage its funding costs.

This operational efficiency, coupled with a consistent focus on controlling expenditures, directly fuels high profit margins and substantial cash generation from its core banking operations. The ongoing efforts to streamline costs are anticipated to create positive operating leverage, further enhancing its cash-generating capabilities.

Disciplined Credit Performance and Underwriting

First Horizon's disciplined approach to credit and underwriting has been a significant driver of its stable cash flows. In 2024, the bank reported a loan portfolio stressed loss rate that was notably lower than the industry average, a testament to its rigorous risk assessment processes.

This strong credit quality translates directly into reduced potential losses and lower provisions for credit losses. For instance, in the first quarter of 2024, First Horizon's provision for credit losses as a percentage of average loans stood at 0.32%, below the average of several comparable regional banks.

The direct impact of this prudent risk management is more stable and predictable earnings from its loan portfolios. This enhanced reliability of earnings from its core lending activities solidifies its position as a Cash Cow within the BCG Matrix.

- Lower Stressed Loss Rate: First Horizon's loan portfolio exhibited a stressed loss rate below peer averages in 2024, indicating superior credit quality.

- Reduced Provisions: Strong underwriting practices lead to lower provisions for credit losses, improving net interest income.

- Stable Cash Flows: The predictable earnings from high-quality loans contribute significantly to the bank's consistent cash generation.

- Enhanced Earnings Reliability: Prudent risk management bolsters the dependability of income derived from its lending operations.

Consistent Shareholder Returns via Repurchases and Dividends

First Horizon demonstrates a strong commitment to shareholder returns, actively deploying capital through both share repurchases and dividends. This consistent capital allocation signals robust cash generation that exceeds the company's reinvestment requirements, a hallmark of a healthy Cash Cow.

The company's proactive approach to capital returns is further underscored by recent actions. Notably, First Horizon secured approval for a substantial $1 billion in repurchase authority in late 2024. This was followed by the repurchase of approximately $360 million in shares during the first quarter of 2025, reflecting significant free cash flow and a clear dedication to enhancing shareholder value.

- Consistent Capital Allocation: First Horizon regularly returns capital to shareholders via dividends and share buybacks.

- Strong Free Cash Flow: The company's ability to repurchase shares indicates healthy cash generation beyond operational needs.

- Shareholder Value Focus: Approved $1 billion in repurchase authority in late 2024.

- Q1 2025 Repurchases: Executed $360 million in share repurchases in the first quarter of 2025.

First Horizon's established consumer banking operations, particularly in its core Southeastern markets, serve as significant cash cows. These operations reliably generate substantial deposits and revenue, supported by a loyal customer base. By the end of 2023, the bank had amassed $73.6 billion in total deposits, underscoring the scale and stability of these foundational business lines.

The mortgage banking segment is another key cash cow, consistently producing strong revenue and cash flow from origination and servicing activities. Despite interest rate sensitivity, this segment leverages an established infrastructure and client relationships to generate significant cash without requiring extensive new market investment. In the first quarter of 2024 alone, mortgage banking revenue reached $103 million, highlighting its ongoing contribution.

First Horizon's disciplined credit management and efficient operations, including a robust net interest margin (NIM), further solidify its cash cow status. A strong NIM of 3.42% was reported in Q1 2025, demonstrating effective pricing and funding cost management. This operational efficiency, combined with prudent risk assessment, leads to stable, predictable earnings and substantial cash generation from its core lending activities.

| Key Cash Cow Segments | 2023 Deposits | Q1 2024 Mortgage Revenue | Q1 2025 NIM | Shareholder Returns (Q1 2025) |

| Consumer Banking | $73.6 billion | N/A | N/A | N/A |

| Mortgage Banking | N/A | $103 million | N/A | N/A |

| Core Lending Operations | N/A | N/A | 3.42% | $360 million (share repurchases) |

Preview = Final Product

First Horizon BCG Matrix

The First Horizon BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after your purchase. This means you're seeing the complete, analysis-ready report, free from any watermarks or demo content, ensuring you get exactly what you need for strategic decision-making.

Dogs

Less Digitally Integrated Legacy Services represent areas within First Horizon that haven't fully embraced digital advancements. Think of services like manual check processing or in-branch-only account management that haven't been streamlined with online or mobile capabilities. These are the banking equivalents of a dial-up modem in the age of fiber optics.

These older services often face challenges in attracting younger, digitally savvy customers. For instance, while the overall banking industry saw digital account openings surge, legacy services might lag significantly. This can lead to a shrinking customer base and increased operational costs per transaction as they require more manual effort to maintain compared to their digital counterparts.

In 2024, many financial institutions are actively working to either digitize these legacy services or phase them out. For First Horizon, this means evaluating which of these services still hold value and can be modernized, and which are simply draining resources without generating sufficient returns. The cost of maintaining these less efficient systems can be substantial, impacting overall profitability.

Niche loan portfolios in stagnant sub-markets are the Dogs of the First Horizon BCG Matrix. These are highly localized portfolios within economically sluggish or declining areas. For instance, a portfolio concentrated in small business loans for a manufacturing town experiencing factory closures would fit this description.

These segments often face limited demand for new lending and carry elevated credit risks. In 2024, regions with high industrial decline might see commercial loan delinquency rates exceeding 5%, compared to a national average closer to 2%. This ties up capital without generating significant new revenue or expanding market share, potentially not aligning with the company's broader growth objectives.

While First Horizon's overall performance is generally robust, certain business segments may lag behind competitors. These underperforming areas, characterized by lower revenue growth compared to industry benchmarks or direct rivals, represent potential 'Dogs' in the BCG matrix. For instance, if a specific loan product or regional branch consistently shows weaker growth than comparable offerings from other financial institutions, it falls into this category.

In Q1 2025, First Horizon's overall revenue growth was modest when compared to its peers in the banking sector. This broader trend suggests that while the company is not in decline, it may not be capturing market share as effectively as some competitors. This situation amplifies the importance of identifying and addressing any specific business lines that are disproportionately underperforming within this already moderate growth environment.

High-Cost, Low-Traffic Physical Branch Locations

Certain physical branch locations, particularly those in areas experiencing demographic shifts or declining foot traffic, can become costly liabilities if not strategically repurposed. These branches often carry significant operational expenses like rent, staffing, and utilities, yet fail to generate enough revenue or new business to offset these costs, effectively acting as cash traps.

First Horizon, like many financial institutions, must continuously evaluate its physical footprint. In 2024, the trend of digital banking adoption continued to impact branch traffic. For instance, a study by J.D. Power in early 2024 indicated that while branches remain important for certain services, the frequency of in-person visits for routine transactions has declined significantly over the past decade.

Optimizing the branch network is therefore a critical strategic imperative for efficiency and profitability. This involves identifying underperforming locations and making informed decisions about their future, which might include consolidation, relocation, or repurposing into advisory-focused centers.

- High operational costs: Branches in low-traffic areas incur ongoing expenses without commensurate revenue generation.

- Declining foot traffic: Demographic shifts and increased digital banking usage reduce the necessity for physical presence in some locations.

- Cash trap potential: These branches can drain resources, hindering investment in more profitable areas of the business.

- Strategic optimization: Evaluating and potentially closing or repurposing underperforming branches is key to improving overall financial health.

Non-Core, Unscaled Acquired Business Lines

Non-core, unscaled acquired business lines within First Horizon, often stemming from past mergers, represent areas that haven't achieved critical mass or significant market traction. These segments can become a drain on resources and management focus, potentially hindering growth in more promising areas. For instance, if a small regional insurance brokerage was acquired and failed to integrate effectively or scale its operations, it might fall into this category. By July 2025, First Horizon will likely have evaluated such units for their strategic contribution.

These underperforming assets may not align with the bank's core strategic objectives or demonstrate a clear path to profitability. Consider a scenario where an acquired fintech solution, despite initial promise, failed to attract a substantial user base or generate meaningful revenue. In 2024, banks like First Horizon are increasingly scrutinizing their portfolios for efficiency. A report from S&P Global Market Intelligence in Q1 2024 indicated that many regional banks were reviewing their non-strategic assets to streamline operations.

- Diverting Resources: Smaller, unscaled acquired businesses can consume valuable management time and capital that could be better allocated to core, high-growth areas.

- Lack of Integration: Failure to fully integrate acquired product lines or services into the main business can lead to operational inefficiencies and missed synergies.

- Underperformance: These segments often exhibit lagging revenue growth and profitability compared to the bank's primary offerings, impacting overall financial performance.

- Divestiture Consideration: As a strategic option, First Horizon may consider divesting these non-core, unscaled business lines to unlock capital and refocus on its core strengths.

Dogs within First Horizon's portfolio represent business segments with low market share and low growth potential. These are areas that consume resources without generating significant returns, often due to declining demand or intense competition. For example, niche loan portfolios in economically stagnant regions or underperforming physical branches would fit this description.

In 2024, many financial institutions are focusing on optimizing their operations by identifying and addressing these underperforming assets. For First Horizon, this means a strategic evaluation of segments that may be draining capital and management attention, potentially hindering investment in more promising areas.

The challenge lies in efficiently managing or divesting these 'Dog' segments. By doing so, First Horizon can reallocate resources to areas with higher growth prospects, thereby improving overall profitability and competitive positioning.

Identifying and addressing these 'Dog' segments is crucial for First Horizon's strategic efficiency. These areas, characterized by low growth and low market share, often represent a drag on resources. For instance, a specific loan product in a declining industry might exhibit significantly lower origination volumes compared to market trends, as seen in some regional manufacturing hubs throughout 2024.

| Segment Example | Market Share | Growth Rate | First Horizon Relevance |

| Niche Loan Portfolios (Stagnant Markets) | Low | Low | Resource drain, potential credit risk |

| Underperforming Branches | Low (local) | Low/Declining | High operational costs, low revenue |

| Non-Core Acquired Businesses | Low | Low | Diverts resources, lacks scale |

Question Marks

First Horizon's ongoing investments in new digital banking products and platforms represent a classic 'Question Mark' in the BCG Matrix. These initiatives aim to attract new customer segments and expand reach, but their market share is initially low, and they require substantial investment for development and marketing. For instance, in 2024, the bank allocated a significant portion of its technology budget towards enhancing its mobile app and introducing new features like AI-powered financial advice, reflecting this strategic focus.

First Horizon's expansion into new Southeastern metropolitan areas represents a classic Stars or Question Marks scenario in the BCG Matrix. These markets, such as Raleigh, North Carolina, or Charleston, South Carolina, exhibit robust economic growth and increasing populations, indicating high market potential.

However, First Horizon's current market share in these burgeoning areas is relatively low. For instance, in the Southeast, while the overall banking market is substantial, First Horizon's penetration in these specific new metro areas might be in the single digits. This necessitates significant investment in marketing, branch networks, and digital capabilities to build brand recognition and attract customers, mirroring the resource demands of a Question Mark.

First Horizon is strategically positioning itself to capture growth in emerging sectors by developing specialized banking solutions. These offerings are designed for high-potential industries, though currently, they represent a smaller portion of the bank's overall market share as First Horizon cultivates expertise and client bases in these new territories.

Significant investment in specialized talent and tailored product development is crucial for these nascent solutions to ascend the BCG matrix. For instance, by mid-2024, First Horizon reported a 15% increase in dedicated teams focused on fintech and renewable energy sectors, signaling a commitment to building the necessary infrastructure for these emerging areas.

Initiatives to Grow Fee-Based Businesses

First Horizon's strategic focus on growing its fee-based businesses, particularly in areas like capital markets advisory and new wealth management products, aligns with a "question mark" position in the BCG matrix. These initiatives represent high-growth potential avenues, but they necessitate significant upfront investment to compete effectively and build market share against entrenched players.

Diversifying revenue streams is a key objective, acknowledging that initial returns in these nascent fee-based services might be modest. For instance, in 2024, First Horizon continued to invest in its digital wealth platform, aiming to attract a younger demographic and capture a larger share of the growing independent advisor market.

- Capital Markets Advisory Expansion: Investing in talent and technology to offer more sophisticated M&A and strategic consulting services, targeting middle-market companies.

- New Wealth Management Products: Launching innovative investment solutions, such as ESG-focused funds and alternative investment platforms, to attract and retain a broader client base.

- Digital Platform Enhancement: Bolstering the user experience and functionality of its online and mobile banking platforms to support the growth of fee-generating digital services.

- Partnership Development: Forging strategic alliances with fintech firms and other financial institutions to co-create and distribute new fee-based products.

Targeted Customer Acquisition Campaigns in Competitive Markets

First Horizon's efforts to acquire new customers in highly competitive markets, where it's not the dominant player, are crucial for growth. These targeted campaigns require substantial investment in marketing and operations to peel away market share from established rivals.

Success hinges on presenting unique value propositions and executing flawlessly to transform new clients into long-term, loyal customers.

- Differentiated Offerings: First Horizon focuses on unique product features or superior customer service that competitors lack.

- Targeted Digital Marketing: Campaigns leverage data analytics to reach specific customer segments most likely to switch, with digital ad spend in the financial services sector projected to grow significantly. For instance, in 2024, financial institutions are increasing their digital marketing budgets to reach younger demographics.

- Partnerships and Alliances: Collaborating with complementary businesses to offer bundled services can attract new customer bases.

- Customer Onboarding and Retention: Streamlined onboarding processes and loyalty programs are key to converting acquisition into lasting relationships.

These initiatives represent potential future revenue streams but currently demand considerable capital with uncertain returns. First Horizon's investment in these areas, such as expanding its digital wealth management offerings, reflects a strategic bet on market trends and evolving customer needs.

The bank’s push into new geographic markets, like the rapidly growing Sun Belt region, also fits the Question Mark profile. While these areas offer high growth potential, First Horizon's market share is still nascent, requiring substantial investment to gain traction against established competitors.

First Horizon's focus on developing specialized banking solutions for emerging industries, such as fintech and sustainable finance, also falls under the Question Mark category. These ventures require significant upfront investment in expertise and product development to build market share in rapidly evolving sectors.

The bank's strategic expansion of its fee-based income streams, including capital markets advisory and new wealth management products, are classic Question Marks. These areas offer significant growth potential but require substantial investment to build scale and compete effectively.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive data, including First Horizon's financial reports, market share data, and industry growth forecasts, ensuring a robust strategic overview.