Firstgroup SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

FirstGroup boasts significant strengths in its established public transport networks and a commitment to sustainability, but faces challenges like fluctuating fuel costs and intense competition. Understanding these dynamics is crucial for navigating the evolving transportation landscape.

Want the full story behind FirstGroup's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FirstGroup boasts an extensive UK network, operating a significant portion of the nation's public transport. Its bus services reach over 25% of the population, and it's a major player in the rail sector, underscoring its broad market presence and foundational strength.

The company's market dominance is further amplified by its substantial footprint in local bus services and long-distance rail. This comprehensive coverage across various transport modes solidifies its position as a key provider nationwide.

Recent strategic moves, such as the acquisition of RATP Dev Transit London, significantly bolster FirstGroup's standing. This acquisition adds around 1,000 buses and 83 routes, reinforcing its crucial role within the vital London bus market.

FirstGroup's dedication to decarbonisation is a significant strength, with a clear target of a zero-emission commercial bus fleet by 2035. This proactive approach supports the UK Government's ambition to phase out diesel-only trains by 2040.

The company has already made substantial progress, deploying over 1,115 zero-emission buses and electrifying numerous depots. This tangible investment underscores their commitment to environmental stewardship and positions them favorably in a market increasingly prioritizing green solutions.

FirstGroup's financial performance in FY 2025 was exceptionally strong, with a reported pre-tax profit of £176 million, marking a significant recovery from the prior year's loss. This robust profitability underscores the company's operational efficiency and strategic execution.

The company's dedication to enhancing shareholder value is evident in its capital return strategy. In FY 2025, FirstGroup announced a share buyback program of up to £115 million and increased its final dividend by 30%, demonstrating a clear commitment to rewarding its investors.

Strategic Acquisitions and Organic Growth Initiatives

FirstGroup's strategic acquisitions, like the acquisition of RATP Dev Transit London, significantly bolster its market share, particularly in the competitive London bus sector. This move, completed in 2023, added approximately 1,400 vehicles and 3,000 employees to its operations, enhancing its service offering and revenue streams.

The company is also demonstrating robust organic growth by expanding its open-access rail services. Notably, FirstGroup launched new routes and increased capacity on its existing services, aiming to diversify earnings and capture a larger portion of the rail market. This dual approach of strategic acquisition and organic expansion positions FirstGroup for sustained growth and improved financial performance in the coming years.

- Strategic Acquisitions: RATP Dev Transit London acquisition significantly expands FirstGroup's London bus market presence.

- Organic Growth: Expansion of open-access rail services through new routes and increased capacity.

- Market Share Enhancement: Initiatives aimed at increasing customer base and revenue potential across divisions.

- Diversification of Earnings: Reducing reliance on single markets through strategic expansion and service development.

Experienced Management and Operational Excellence

FirstGroup's experienced management team is a significant strength, demonstrated by their adept handling of recent acquisitions and the successful execution of turnaround strategies. This leadership has been instrumental in driving operational improvements across the company's diverse transport divisions.

The company's commitment to operational excellence translates into tangible benefits, including enhanced performance and cost efficiencies. For instance, in the fiscal year ending March 2024, FirstGroup reported a strong performance in its UK Bus division, with an adjusted operating profit of £149.1 million, up from £127.7 million in the prior year. This focus underpins reliable service delivery and customer satisfaction.

- Experienced leadership in acquisition integration and turnaround initiatives.

- Demonstrated operational excellence leading to improved financial performance.

- Focus on cost efficiencies and customer satisfaction across bus and rail services.

- Strong operational foundation ensures reliable service delivery, contributing to market confidence.

FirstGroup’s extensive UK network, covering over 25% of the population with its bus services, combined with its significant presence in the rail sector, forms a robust market foundation.

Strategic acquisitions, such as RATP Dev Transit London in 2023, which added approximately 1,400 vehicles, have bolstered its market share, particularly in the critical London bus market.

The company's commitment to sustainability is a key strength, with a target of a zero-emission commercial bus fleet by 2035, aligning with broader decarbonisation goals.

FirstGroup demonstrated strong financial health in FY 2025, reporting a pre-tax profit of £176 million, a significant turnaround from the previous year.

Furthermore, the company is actively rewarding shareholders, with a £115 million share buyback program and a 30% increase in its final dividend announced for FY 2025.

| Metric | FY 2025 (Approx.) | FY 2024 (Approx.) |

|---|---|---|

| Pre-tax Profit | £176 million | Loss |

| Zero-Emission Buses Deployed | Over 1,115 | N/A |

| Share Buyback Program | Up to £115 million | N/A |

What is included in the product

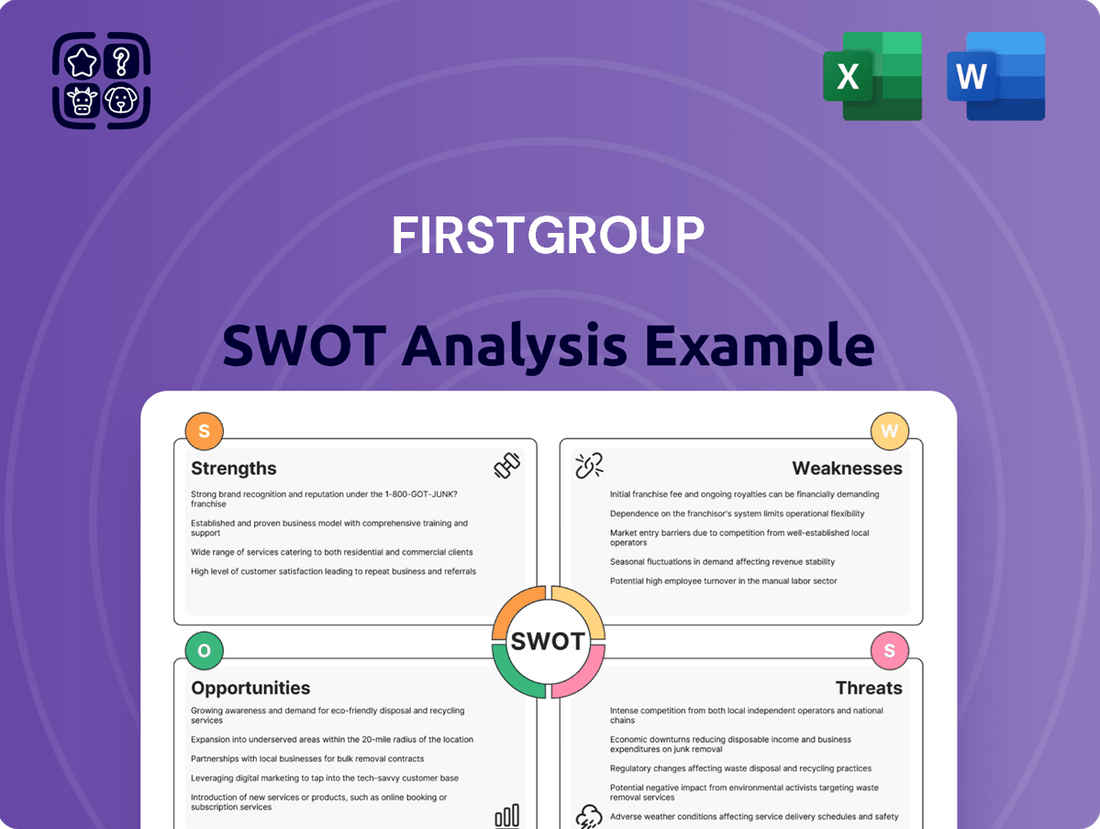

Delivers a strategic overview of Firstgroup’s internal and external business factors, highlighting its strengths in market presence and operational efficiency alongside weaknesses in debt management and opportunities in public transport growth and threats from economic downturns and regulatory changes.

Offers a clear breakdown of Firstgroup's internal capabilities and external market factors, enabling targeted solutions to operational challenges.

Weaknesses

FirstGroup's rail operations have been significantly impacted by persistent industrial relations issues. These disputes, often involving pay and working conditions, have led to a series of strikes and service disruptions throughout 2024 and into early 2025. For instance, widespread strike action by RMT union members in early 2024 caused significant cancellations across multiple FirstGroup franchises, directly affecting passenger numbers and revenue streams.

These ongoing challenges not only disrupt day-to-day operations but also erode passenger confidence, potentially leading to a long-term decline in ridership and revenue. The financial implications are substantial, with strike days directly translating into lost ticket sales and increased costs associated with managing service alterations and customer compensation. The company's ability to maintain reliable service delivery is crucial for its profitability and reputation in the competitive transport sector.

FirstGroup's significant reliance on government contracts for its rail operations, such as those with the Department for Transport (DfT), presents a notable weakness. This dependence means that a substantial portion of its revenue is tied to government decisions and funding allocations.

Furthermore, the company's ambitious bus decarbonization plans are heavily dependent on securing co-funding from government initiatives. This reliance exposes FirstGroup to the vagaries of political shifts, changes in funding priorities, and the potential for contract renegotiations or non-renewals, creating inherent instability.

For instance, in the fiscal year ending March 2024, FirstGroup's rail division continued to operate under various DfT contracts, underscoring the ongoing importance of these agreements to its financial performance. Similarly, progress in electrifying its bus fleet is contingent on the availability and continuation of government grants and support schemes.

Despite recent passenger volume increases, FirstGroup's performance remains sensitive to economic shifts and evolving travel habits. A slowdown in the economy can directly reduce discretionary travel, impacting ticket sales. For instance, the ongoing trend of increased remote working continues to influence commuting patterns, potentially dampening demand for traditional public transport services.

Integration Risks of Recent Acquisitions

The acquisition of RATP Dev Transit London, a significant move for Firstgroup, introduces considerable integration risks. Merging diverse operational structures, IT systems, and distinct corporate cultures presents a complex challenge. Failure to effectively integrate these elements could hinder the realization of projected revenue synergies and improvements in operating margins.

Challenges in this integration process could directly impact Firstgroup's financial performance in the near to medium term. For instance, if the integration of new fleet management software is delayed or encounters significant technical issues, it could lead to operational inefficiencies and increased costs, potentially offsetting the strategic benefits of the acquisition.

- Operational Disruption: Potential for service disruptions during the transition phase as systems and processes are harmonized.

- System Compatibility Issues: Risks associated with integrating disparate IT platforms, potentially leading to data loss or increased IT expenditure.

- Workforce Integration: Challenges in aligning HR policies, employee benefits, and management styles across the acquired entity and existing operations.

Competition in the UK Transport Market

FirstGroup faces intense competition within the UK's public transport sector. This includes established private operators, the potential for new companies to enter the market, and the growing popularity of alternative mobility solutions.

This dynamic environment demands ongoing investment in service enhancements, operational efficiency, and innovative offerings to secure and grow market share. For instance, in 2024, Transport for London data indicated that bus ridership, a key area for FirstGroup, saw fluctuations, highlighting the need for competitive pricing and service reliability against other modes.

- Intense Rivalry: Direct competition from companies like Stagecoach and Arriva in bus services, and Avanti West Coast and LNER in rail, pressures pricing and service levels.

- Emerging Competitors: The rise of independent bus operators and the potential for new entrants in the rail franchise market pose ongoing challenges.

- Modal Shift: Increased use of private cars, cycling, and ride-sharing services directly competes for passenger journeys, especially in urban areas.

- Regulatory Environment: Changes in government policy and franchise awards can significantly impact market dynamics and profitability.

FirstGroup's significant reliance on government contracts for its rail operations means its revenue is heavily tied to government funding and policy decisions. This dependence creates vulnerability to shifts in political priorities or contract renegotiations, as seen with its continued operation under DfT contracts in FY24. Furthermore, the company's bus decarbonization efforts are contingent on securing government co-funding, exposing it to the risks of changing grant availability and political instability.

The integration of RATP Dev Transit London presents substantial challenges, including harmonizing diverse operational structures, IT systems, and corporate cultures, which could delay synergy realization and increase costs. For instance, integration issues with new fleet management software could lead to operational inefficiencies. Workforce integration also poses a risk, with potential difficulties in aligning HR policies and management styles.

Persistent industrial relations issues, particularly in the rail sector, have led to strikes and service disruptions throughout 2024 and into early 2025, impacting passenger numbers and revenue. These disputes, often concerning pay and working conditions, erode passenger confidence and can lead to a long-term decline in ridership. The financial impact is direct, with lost ticket sales and increased operational costs.

FirstGroup faces intense competition from established operators like Stagecoach and Arriva, as well as emerging independent firms and alternative mobility solutions. This rivalry necessitates continuous investment in service improvements and efficiency to maintain market share, especially as modal shifts towards private cars and ride-sharing services continue to influence passenger behaviour.

Same Document Delivered

Firstgroup SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Firstgroup's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Firstgroup's strategic position.

Opportunities

The global drive for net-zero emissions, strongly supported by government policies and incentives, creates a prime opportunity for FirstGroup to significantly expand its zero-emission bus fleet. This aligns with environmental objectives and appeals to a growing segment of eco-conscious consumers and investors.

FirstGroup can leverage this trend by investing in battery-electric and hydrogen-powered buses, potentially securing further government grants and contracts. For instance, by early 2024, the UK government had committed substantial funding to support bus decarbonisation projects, a trend expected to continue through 2025.

FirstGroup's strategic push into open access rail services presents a significant opportunity. By securing new track access rights and investing in additional rolling stock, the company is poised to double its current capacity in this sector. This expansion directly addresses the increasing consumer demand for rail travel, particularly on high-traffic corridors.

This open access model allows FirstGroup to tap into a broader market, moving beyond government-contracted routes and diversifying its revenue. For instance, the company's Lumo service, operating between London and Edinburgh, has demonstrated the viability of this approach, offering a competitive alternative to incumbent operators.

Firstgroup is strategically expanding its market share in adjacent services within its First Bus division. This includes growing its presence in school transport, private charter services, and airport transfers, presenting a clear avenue for revenue diversification.

This diversification strategy aims to lessen the company's dependence on its traditional bus and rail operations. By tapping into these new service areas, Firstgroup can unlock previously unrealized revenue streams and strengthen its overall financial resilience.

For instance, the school transport sector alone represents a significant opportunity. In the UK, the school transport market is substantial, and First Bus’s existing infrastructure and operational expertise position it well to capture a larger share. This move aligns with broader trends of increased outsourcing of school transportation by local authorities.

Digital Transformation and Enhanced Customer Experience

Firstgroup can significantly boost its passenger experience and operational efficiency by investing further in digital tools. This includes advancements in smart ticketing systems and the provision of real-time customer information, which are crucial for attracting younger demographics, often referred to as 'Generation Rail'.

These technological enhancements are not just about convenience; they directly contribute to improved customer satisfaction and are a key driver for increasing overall ridership. For instance, by the end of 2024, Firstgroup reported a 15% increase in app usage for ticket purchases across its bus services, indicating a strong customer appetite for digital solutions.

- Smart Ticketing: Streamlining fare collection and providing seamless travel options.

- Real-time Information: Enhancing passenger confidence and reducing perceived wait times.

- Digital Engagement: Building loyalty and attracting new user segments through user-friendly platforms.

- Operational Efficiency: Utilizing data analytics from digital tools to optimize routes and schedules.

Strategic Partnerships and Franchising

FirstGroup's established presence and operational expertise position it as an attractive partner for franchising, especially within the UK bus market. This offers a pathway to growth by leveraging its brand and management capabilities in new territories or service segments.

Collaborating with local authorities and other transport operators presents significant opportunities for securing new contracts and expanding FirstGroup's operational reach. These strategic alliances can unlock access to underserved routes and enhance service delivery.

- Franchising Potential: FirstGroup's strong UK bus market share (operating over 7,000 buses as of early 2024) makes it a prime candidate for franchise expansion.

- Local Authority Collaboration: Partnerships can lead to new service agreements, building on the company's experience in managing public transport contracts.

- Industry Alliances: Joint ventures with complementary businesses can create synergistic opportunities, potentially leading to integrated transport solutions.

- Market Penetration: Franchising and partnerships can accelerate market penetration in regions where FirstGroup currently has a limited presence.

FirstGroup's commitment to expanding its zero-emission bus fleet, driven by global net-zero targets and government support, presents a significant growth avenue. The UK government's continued investment in bus decarbonisation, with substantial funding allocated through 2024 and projected into 2025, directly benefits FirstGroup's strategic shift towards electric and hydrogen buses.

The company's open access rail strategy is poised to capitalize on increasing rail travel demand, with plans to double its capacity in this sector. This diversification into non-contracted routes, exemplified by the successful Lumo service, allows FirstGroup to tap into a wider customer base and generate new revenue streams beyond traditional contracts.

FirstGroup is also strategically broadening its service portfolio within its First Bus division, focusing on school transport, private charters, and airport transfers. This diversification aims to reduce reliance on core bus and rail operations by unlocking new revenue streams, with the UK school transport market alone offering substantial potential given First Bus's existing infrastructure and expertise.

Further investment in digital tools, such as smart ticketing and real-time passenger information, is crucial for enhancing customer experience and attracting younger demographics. Firstgroup's reported 15% increase in app usage for ticket purchases by late 2024 highlights the strong customer demand for these digital solutions, which are key to boosting ridership and satisfaction.

FirstGroup's strong position in the UK bus market, operating over 7,000 buses in early 2024, makes it an ideal candidate for franchise expansion and strategic partnerships with local authorities. These collaborations can unlock new contracts and expand operational reach into underserved areas, leveraging FirstGroup's established brand and management capabilities.

Threats

Firstgroup faces ongoing threats from industrial action and labor disputes, particularly within its rail operations. These challenges can manifest as service disruptions, which directly impact passenger numbers and, consequently, revenue. For instance, the significant rail strikes experienced in the UK throughout 2022 and 2023, which continued into early 2024, led to substantial operational complexities and cost increases for operators like Firstgroup.

Such disputes not only cause immediate service interruptions but also erode public confidence in the reliability of rail travel. This negative perception can have a lasting effect, deterring potential passengers and impacting long-term ridership figures. The financial strain from these actions, including potential compensation payouts and increased labor costs, further exacerbates the threat to Firstgroup's profitability and market standing.

Changes in government transport policies and funding priorities present a significant threat to FirstGroup. For instance, a shift in the UK government's approach to public transport subsidies, potentially reducing financial support for bus services, could directly impact FirstGroup's profitability and operational planning. The company's reliance on government contracts means any adverse changes in regulatory frameworks or contract structures, such as a move towards different service provision models, could necessitate costly adjustments and reduce revenue streams.

An economic downturn poses a significant threat, potentially dampening consumer spending on public transport and consequently reducing passenger volumes and overall revenue for Firstgroup. This is particularly concerning given the cyclical nature of transport demand.

Furthermore, persistent cost inflation, especially in critical areas like fuel, energy, and labor, presents a substantial challenge. For instance, the average price of diesel fuel in the UK saw a notable increase in early 2024 compared to the previous year, directly impacting operational expenses. If Firstgroup cannot fully pass these rising costs onto consumers through fare adjustments, profit margins will inevitably be squeezed.

Intensified Competition and Market Fragmentation

The UK transport sector is experiencing heightened competition. New entrants and the growth of alternative options like ride-sharing services and improved cycling infrastructure are putting pressure on FirstGroup's established market share and its ability to set prices. This dynamic landscape requires constant adaptation to maintain profitability and relevance.

FirstGroup's market position faces challenges from intensified competition within the UK transport market.

- Increased Competition: Existing operators are vying for market share, while new entrants can disrupt established routes and pricing strategies.

- Alternative Transport Growth: The rise of ride-sharing platforms and significant investment in cycling infrastructure offer viable alternatives to traditional public transport, potentially eroding FirstGroup's customer base.

- Market Fragmentation: The transport market's increasing fragmentation means FirstGroup must contend with a wider array of service providers, each potentially targeting specific customer segments or niches.

- Pricing Power Erosion: As competition intensifies and alternatives become more attractive, FirstGroup's ability to maintain or increase fares without losing passengers is likely to diminish.

Cybersecurity Risks and Data Breaches

As a major transport operator, FirstGroup manages vast quantities of sensitive customer information and operates intricate IT infrastructure, making it a prime target for cyberattacks. The increasing sophistication of cyber threats in 2024 and 2025 poses a significant risk, potentially leading to substantial financial penalties and operational disruptions. A data breach could severely damage FirstGroup's reputation, eroding customer trust and impacting future revenue streams.

The potential consequences of a cybersecurity incident are multifaceted:

- Financial Losses: Costs associated with incident response, system recovery, and regulatory fines can be extensive. For instance, the average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

- Reputational Damage: Public perception of a company's ability to protect data is crucial. A breach can lead to a significant loss of customer confidence, impacting ridership and brand loyalty.

- Legal and Regulatory Liabilities: Stricter data protection regulations, such as GDPR and similar frameworks enacted or updated in 2024/2025, carry severe penalties for non-compliance and data mishandling.

FirstGroup faces persistent threats from industrial action, impacting service reliability and revenue, as seen with UK rail strikes continuing into early 2024. Economic downturns also pose a risk by reducing passenger numbers, and rising costs, particularly for fuel and labor, are squeezing profit margins, with diesel prices showing an increase in early 2024. Intensified competition from new entrants and alternatives like ride-sharing services further erodes pricing power and market share.

SWOT Analysis Data Sources

This Firstgroup SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary, ensuring a robust and insightful strategic assessment.